Understanding Securities

Understanding Securities

This chapter provides an overview of securities and discusses how to:

Define securities.

Import security definitions and market values.

Process securities mark-to-market values.

Note. This component is designed to provide support for

managing interest-bearing securities that trade in the marketplace. Suitable

securities for this component include Treasury securities (T-Bills, T-Notes,

Treasury bonds), corporate bonds, municipal bonds ("munis"), agency securities

(Fannie Mae, Freddie Mac), and commercial papers. For managing debt instruments

that your firm will issue, however, such as commercial paper and line-of-credit

facilities, see the "Managing Facilities in Deal Management" chapter.

For managing stocks, see the "Managing Equity Deals" chapter.

See Also

Managing Facilities in Deal Management

Understanding Securities

Understanding Securities

Deal Management provides securities functionality for use in creating deals. You can attach a specified security to a deal on the Security Header page.

This functionality enables you to:

Record general information for a security.

Search and record multiple lines of security, market-value information.

Download security information and current market values.

Note. Many of the fields that are mentioned in this chapter are described in more detail in the "Capturing Deals and Trade Tickets" chapter.

See Also

Capturing Deals and Trade Tickets

Prerequisite

PrerequisiteBefore creating and processing securities, you must set up deal instrument types.

See Also

Defining Instrument Types and Instrument Templates

Defining Securities

Defining Securities

This section discusses how to:

Enter security header information manually.

Enter security market value information.

Pages Used to Define Securities

Pages Used to Define Securities|

Page Name |

Definition Name |

Navigation |

Usage |

|

Security Header |

TRX_SECURITY_HDR |

Deal Management, Administer Deals, Securities |

Enter and view general information about a security. |

|

Security Market Value |

TRX_SEC_MKTVAL |

Deal Management, Administer Deals, Securities, Security Market Value |

View the currency information and market value of a security as of a specified date. The market values can be entered here manually or viewed after being imported using the Securities Market Values Import page. You can record more than one market price. |

Entering Security Header Information Manually

Entering Security Header Information Manually

Access the Security Header page (Deal Management, Administer Deals, Securities).

|

Security Type |

Select the agency that issues the identifier for the security. Options include CINS, CUSIP, EPIC, ISID, ISIN, QUICK, RIC, SEDOL, SICOVAM, and Valoren. |

|

Security ID |

Displays the identifier that you assigned. |

|

Issue Number |

Enter the identifier that is assigned to this security according to the identification system that is selected in the Security Type field. Note. The CUSIP/CINS identifier entered here is validated using check-digit validation logic if a check digit exists for the security. If the security does not have a check digit appended to it, one is derived by the system and appended to the existing CUSIP/CINS identifier. |

|

Coupon at Issue |

Enter the applicable interest rate in decimal format. |

|

Created By and Last Changed By |

User ID and date/time stamp information that enable you to track changes to the security. |

Entering Security Market Value Information

Entering Security Market Value Information

Access the Security Market Value page (Deal Management, Administer Deals, Securities, Security Market Value).

Specify your search criteria and click the Search button; leaving this field blank returns all possible results.

|

Seq (sequence) |

Enter a number for each added row of market source information to determine processing order of the valuation. |

|

Market Price |

Enter the price of the security relative to the par value. |

|

Purchased Interest |

Displays the interest calculated from the interest-period, start date to the settlement date. This value is important for securities purchased in a secondary market. For example, bonds usually pay interest every six months, but, interest is accrued by the bondholders on a day-to-day basis. When a bond is sold, the buyer pays the seller the market price plus the accrued interest, for which the buyer will be reimbursed when the issuer next pays interest. |

Importing Security Definitions and Market Values

Importing Security Definitions and Market ValuesThis section provides an overview of the securities data import process and discusses how to:

Import security definitions.

Import the current market values of securities.

PeopleSoft provides a way to import general information about a security into the system based on its CUSIP or CINS identifier. A variation of this process can be used to import current market values of the securities. Once a security definition is downloaded into the system, investment deals can be created using the security. When the latest market value for the security is downloaded into the system, the value of the security deal is updated and the gain or loss for the deal is booked in Treasury accounting.

Understanding the Securities Data Import Infrastructure

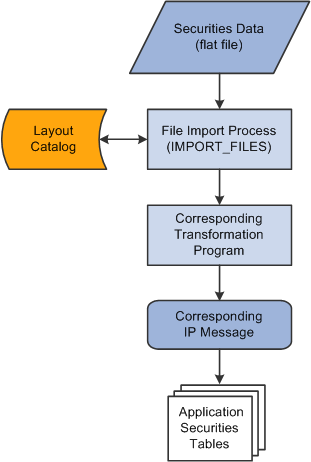

Understanding the Securities Data Import InfrastructureThis diagram illustrates the securities data import process.

Securities data import process

The securities data import process involves the following steps:

An administrator enters information pertaining to a securities data file in comma-separated value (.csv), flat-file format.

This initiates the File Import Application Engine process (IMPORT_FILES), which functions as an interface or shell to define the necessary commands for the system to import the securities data files.

The File Import Application Engine reads the file's layout definition data (which is stored in the Layout Catalog ) and calls the corresponding transformation process.

The layout for importing securities definition data is SECURITY and the corresponding transformation process called is TRX_SECD_XFM. For importing security market value, the SEC_MARKET layout is used with the TRX_SECM_XFM transformation process.

The transformation Application Engine loads the data into the securities application tables using the TRX_SEC_HDR IP message for securities definition data or the TRX_SEC_MKTVAL IP message for security market values.

See Also

Understanding Electronic Banking

Pages Used to Import Security Definitions and Market Values

Pages Used to Import Security Definitions and Market Values|

Page Name |

Definition Name |

Navigation |

Usage |

|

Security Definition Import |

BSP_IMPORT |

Deal Management, Administer Deals, Security Definition Import, Security Definition Import |

Import security definition data based on the security's identifier. |

|

Security Market Values Import |

BSP_IMPORT |

Deal Management, Process Deals, Security Market Values Import |

Import current security market values data. |

Importing Securities Data

Importing Securities DataAccess the Security Definition Import page (Deal Management, Administer Deals, Security Definition Import) or the Security Market Values Import page (Deal Management, Process Deals, Security Market Values Import).

Note. The field descriptions provided here are the same for both the Security Definition Import page and Security Market Values Import page.

|

Import Type |

Select the method to import the bank statement data. Options are:

|

|

Integration Node |

Enter the integration node to use to transfer the data. This field appears only if FTP or HTTP is selected in the Import Type field. See PeopleTools PeopleBook: PeopleSoft Integration Broker, "Building Message Schemas." See PeopleTools PeopleBook: PeopleSoft Integration Broker Administration, "Using Listening Connectors and Target Connectors," Working With the AS2 Connectors. See Defining Integration Broker Settings for Bank Statements and Payment Acknowledgments. |

|

View Integration Node Details |

Click to access the Integration Node Details page and review property details of the selected node. This link appears only if FTP or HTTP is selected in the Import Type field. |

|

File Path |

Enter the complete file path location. To select files by using the Select File button, the file path must have a trailing backslash (\). You can also search for files of a specific type by entering an asterisk and the file type extension. For example, to search all files with an .XML extension enter:

|

|

File Selection Help |

Click to view help information about specifying file paths and file names. |

|

File Name |

Enter the specific file to import or click the Select File button to search for a file. If you want to import multiple files based on extension, leave this field blank. |

|

Layout |

Select the file layout for the type of security data being imported.

|

Advanced Options

|

Encryption Profile |

Select an encryption profile to decrypt bank statements. Encryption profiles contain both encryption and decryption information. |

|

Use Integration Broker |

Select to lay out the files and publish the formatted document to PeopleSoft Integration Broker. Integration Broker then processes the formatted file accordingly. You select this option if you want to use the financial sanctions information as a trigger to Integration Broker to perform other processes, or to integrate with other systems. |

|

Post Process File Action |

Select what action, if any, to perform on the bank statement files after the data has been processed. The options are:

|

|

Post Process File Directory |

Enter a file path to the directory to which the file will be moved or copied if either option is selected as the post process file action. |

Layout Properties

|

Value |

Property codes and values appear by default from values that are defined on the selected layout ID. If you configure unique code mappings for a layout (on the Code Mappings page), you need to modify the displayed CODE_MAP_GROUP value with the appropriate unique map value. See Defining Code Mappings for Bank Statements, Payments, and Payment Acknowledgments. |

Processing Security Mark-to-Market Values

Processing Security Mark-to-Market Values

After capturing deals involving securities, use the Security Mark-to-Market Application Engine process (TR_SEC_MTM) periodically to update security market rates. You should import current market values first, using the Security Market Values Import page, to ensure that the deals are updated with the latest market rates and values.

The Securities process provides a table (Security Mark Value) for the security in which current market prices can be stored. The Security Mark-to-Market Application Engine process (TR_SEC_MTM) uses these stored prices to calculate the current market value as of a certain date (for example, January 31, February 28). A corresponding book value is also calculated where appropriate. The new book value calculations incorporates any unamortized fee amounts associated with the deal. These calculations and their storage provide for an accurate unrealized gain/loss calculation in the automated accounting process. The existing MTM Gain/Loss (09) calculation type is used to determine the Unrealized Gain/Loss.

Page Used to Process Security Mark to Market

Page Used to Process Security Mark to Market|

Page Name |

Definition Name |

Navigation |

Usage |

|

Security Mark to Market |

TR_SEC_MTM_RUNCNTL |

Deal Management, Process Deals, Security Mark to Market |

Run the Security Mark-to-Market Application Engine process (TR_SEC_MTM) to generate reevaluated rates and update the current market value and book value of securities involved in your current deals. |