Understanding Family Allowances

Understanding Family AllowancesThis chapter provides an overview of family allowances and discusses how to define and enter family allowances.

Understanding Family Allowances

Understanding Family AllowancesGlobal Payroll for Switzerland enables you to define and manage data for an employee's dependents and family as well as process available family allowances for each payee.

Viewing Delivered Elements

Viewing Delivered ElementsThe PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Switzerland. Instructions for running the query are provided in the PeopleSoft Global Payroll PeopleBook.

See Also

Understanding How to View Delivered Elements

Defining and Entering Family Allowances

Defining and Entering Family Allowances

This section discusses how to:

Enter dependent data in PeopleSoft HCM.

Set up family allowance data.

Set up child allowance data.

Enter family allowance payment data.

The steps above are included in the family allowance process in Global Payroll for Switzerland.

Note. Since January 1, 2009 the setup parameters on the Family Allowance Data page are no longer supported. The values on the Child Allowance Data page are still used, although the Adoption Allowance Amount and Birth Allowance % Method fields are no longer supported.

Pages Used to Define and Enter Family Allowances

Pages Used to Define and Enter Family Allowances

Entering Dependent Data in PeopleSoft HCM

Entering Dependent Data in PeopleSoft HCM

Enter dependent's name, address, and personal information on the Dependents Data component in PeopleSoft HCM.

See Also

Tracking Dependent and Beneficiary Data

Setting Up Family Allowance Data

Setting Up Family Allowance Data

Access the Family Allowance Data page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Addl Rates, Ceilings, Values, Family Allowance Rates CHE, Family Allowance Data).

Note. The Family Allowance Data and Child Allowance Data pages reflect rules that are designed to protect child and education allowances. These rules vary from canton to canton. Consequently, they are not irrevocably installed in Global Payroll and can be defined dynamically.

|

Household Amount - Canton Jura |

Displays the household allowance amount for Jura. The canton of Jura is unique in that a household allowance is payable if there is at least one child eligible. This field displays a value of zero for all other cantons. |

Full Time, Part-Time, and Single Parent Part-Time Rule

In granting family allowances, the cantons distinguish between full-time employment, part-time employment, and part-time employment for single-parent families. Different sets of rules are applied accordingly. You can view the appropriate rule for the applicable fields Full Time Rule, Part Time Rule, and Single Parent Part Time Rule.

Fields beneath the Part Time Rule apply to employees who are not specified as single parents. Fields beneath the Single Parent Part Time Rule apply to employees who are specified as single parents. You can identify a person as a single parent on the Family Allowance page.

|

Minimum Hours Limit |

The lower limit or minimum number of hours allowed to qualify for receiving the family allowance. |

|

Maximum Limit/Factor |

For information only. The hourly rate or divisor determines the upper limit. |

|

Hourly Rate or Divisor |

For part-time employees, the allowance is calculated as follows: Allowance * STD HOURS * 4.3333 / Divisor. For hourly paid employees, the calculation is: Allowance * ACTUAL HOURS / Divisor. |

Setting Up Child Allowance Data

Setting Up Child Allowance DataAccess the Child Allowance Data page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Addl Rates, Ceilings, Values, Family Allowance Rates CHE, Child Allowance Data).

Statutory Family Allowance Data

|

Birth Allowance Amount |

The amount granted at the birth of a child. |

|

Adoption Allowance Amount |

Not supported. |

|

Birth Allowance % Method (birth allowance percent method) |

Not supported. |

|

CA Age Maximum 1 (child allowance age maximum 1) |

Enter the age until which the amount in Child Allowance 1 is paid. For example, in Zurich 170 CHF is paid until the age of 12. PeopleSoft maintains this amount. |

|

CA Age Maximum 2 (child allowance age maximum 2) |

Enter the age until which the amount in Child Allowance 2 is paid. For example, in Zurich 195 CHF is paid until the age of 16. PeopleSoft maintains this amount. |

|

Disabled Age Maximum |

Indicates the maximum age for which allowances are paid for disabled children. |

|

Education Age Maximum |

Indicates the maximum age for which education allowances are payable. |

Rates

|

SeqNum (sequence number) |

Shows the sequence of user input of dependent data in the HR pages; for example, spouse = 1, child 1 = 2. |

|

Child Allowance 1 |

The numeric amount to be granted for children with an age <= CA Age Maximum 1. |

|

Child Allowance 2 |

The numeric amount to be granted for children with an age <= CA Age Maximum 2. |

|

Education Allowance |

The numeric amount to be granted as the education allowance. |

|

Currency |

The currency code for the education allowance. Note. The system only supports the CHF currency. |

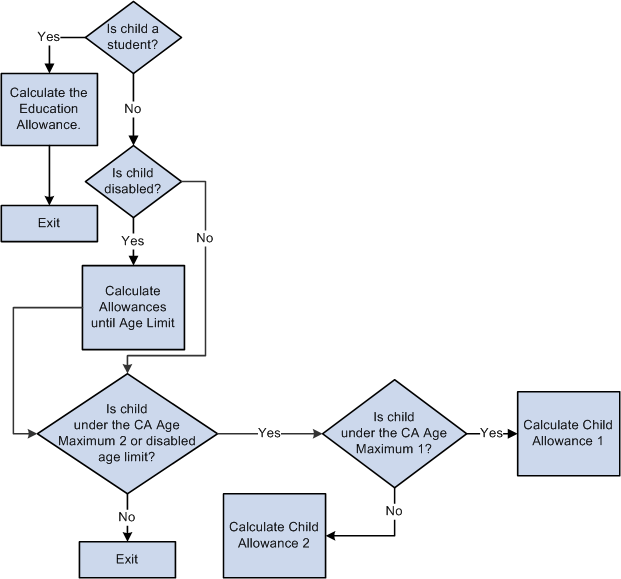

Logical Order of the Child Allowance Process

When processing the child allowance, the system applies the following processing logic involving age, education, and disability considerations:

Logical Order of the Child Allowance Process

Entering Family Allowance Payment Data

Entering Family Allowance Payment Data

Access the Define Family Allow Data CHE page (Global Payroll & Absence Mgmt, Payee Data, Define Family Allow Data CHE, Define Family Allow Data CHE).

Family Allowance Details

|

Canton of Employment |

Displays the canton for the employee. |

|

Override |

Select to override the employee's canton. If the work location is located in a different canton than the canton that pays the allowance. |

|

Single Parent |

Not supported since January 01, 2009. |

|

Reduced HH All (reduced household allowance) |

Not supported since January 01, 2009. |

Children

The employee's dependents or beneficiaries who are already registered appear in this group box.

|

Dep/Benef Name (dependent/beneficiary name) |

The current number (internal) and name of the dependent or beneficiary. |

|

Disabled |

Select if the dependent or beneficiary is disabled. |

|

Student |

Select if the dependent or beneficiary is a student. |

|

Legal End Date |

The date for when benefits are scheduled to end. |

|

Reduced End Date |

The date for when benefits are scheduled to end in individual cases. This entry is required for students. |

|

Non Resident |

Select if the child lives outside of Switzerland in a country for which the allowances of the setup table keyed by CA2 apply. If this check box is selected, the system applies the amount contained in the table keyed by CA2 specified on the Child Allowance Data page. |

|

Birth Allowance Type |

Select the accurate birth allowance type. Possible types are Adoption, Birth, and Voluntary. |

|

Birth Allowance Factor |

The default value is 1. In the case of multiple births (such as twins) enter a factor for each child, according to the rules of the canton. |

|

Eligible |

Select if the dependent or beneficiary has a child allowance. Used only for additional children or rows on this page; otherwise, leave this field deselected. |