Understanding Delivered Absence Rules

Understanding Delivered Absence Rules

This chapter provides an overview of delivered absence rules and discusses how to:

Set up absences for Germany.

Modify take elements.

Calculate entitlement for paid vacation.

Define absence entitlement plans.

Issue advance payment for vacations.

Enter maternity and educational leave data.

Note. This chapter supplements the absence documentation provided in the PeopleSoft Global Payroll PeopleBook. Before you begin reading about German absence functionality, read "Understanding Absences" to familiarize yourself with how Global Payroll handles absence processing.

See Also

Understanding Absence Setup and Management Tasks

Understanding Delivered Absence Rules

Understanding Delivered Absence Rules

This section discusses:

Absence take elements.

Delivered entitlement elements.

Viewing delivered elements.

Absence Take Elements

Absence Take ElementsThis PeopleSoft application delivers predefined rules for processing absences, and these rules comply with German laws and tariffs. You can modify some of the absence rules and create new ones to reflect your company policies, the specific requirements of tariff contracts, work agreements, and employment contracts.

This table lists the absence take elements PeopleSoft delivers with Global Payroll for Germany and identifies the units (hours or days) in which the absence take is calculated.

The Earnings Units Paid and Earnings Units Unpaid columns identify the formulas that populate the units paid and units unpaid values used by the earnings calculation. The columns show only the suffix of the formula name. The full name of each formula is DE_AB_COUNT followed by the unique suffix.

If a count formula appears in the Earnings Units Unpaid column but not in the Earnings Units Paid column, then the absence is always unpaid. If a formula appears in both columns, then the absence is unpaid only when the entitlement balance is zero or less.

The Priority column shows the relative priority of the absence when a payee has more than one absence event for the same date.

|

Absence Reason |

Take Element |

Units |

Earnings Units Paid |

Earnings Units Unpaid |

Priority |

|

Vacation |

DE_AB_M60 |

D2 |

D2B |

D2U |

300 |

|

Vacation unpaid |

DE_AB_M30 |

|

|

D1 |

300 |

|

Sick |

DE_AB_M10 |

D3 |

H2B |

H2U |

100 KUG |

|

Curing |

DE_AB_M15 |

D3 |

D1 |

|

100 KUG |

|

Sick unpaid |

DE_AB_M11 |

|

|

H2 |

100 |

|

Paid absence |

DE_AB_M55 |

|

H2 |

|

400 |

|

Educational leave |

DE_AB_M78 |

|

|

D1 |

100 |

|

Military service < 3 days |

DE_AB_M70 |

D1 |

D1 |

|

200 |

|

Military training |

DE_AB_M75 |

|

|

D1 |

200 |

|

Military service |

DE_AB_M76 |

|

|

D1 |

200 |

|

Instead of military service |

DE_AB_M77 |

|

|

D1 |

200 |

|

Not excused unpaid |

DE_AB_M50 |

|

|

H1 |

150 |

|

Unpaid |

DE_AB_M56 |

|

|

H1 |

150 |

|

Training leave |

DE_AB_M69 |

D1 |

H1 |

|

500 |

|

Maternity |

DE_AB_M79 |

|

|

D1 |

100 |

|

Legal strike |

DE_AB_M20 |

|

|

H1 |

300 |

|

Work accident |

DE_AB_M16 |

D3 |

H1B |

H1U |

100 |

|

Work accident unpaid |

DE_AB_M17 |

|

|

H1 |

100 |

|

Travel accident |

DE_AB_M18 |

D3 |

H1B |

H1U |

100 |

|

Travel accident unpaid |

DE_AB_M19 |

|

|

H1 |

100 |

|

Bummelei unpaid |

DE_AB_M40 |

|

|

H1 |

200 |

|

KUG normal |

DE_AB_M90 |

|

H2 |

|

100 |

|

KUG sick |

DE_AB_M91 |

|

H2 |

|

100 |

|

Sick (incl. Spplmntry Sck Py) |

DE_AB_M101 |

D3 |

H2B |

H2U |

100 KUG |

|

Marriage |

DE_AB_MB001 |

|

D2 |

|

700 |

|

Marriage of the children |

DE_AB_MB002 |

|

D2 |

|

700 |

|

Golden anniversary of parents |

DE_AB_MB003 |

|

D2 |

|

700 |

|

Childbirth of wife |

DE_AB_MB004 |

|

D2 |

|

700 |

|

Death of spouse |

DE_AB_MB005 |

|

D2 |

|

700 |

|

Death of parents, children, and other relatives |

DE_AB_MB006 |

|

D2 |

|

700 |

|

Moval active job |

DE_AB_MB007 |

|

D2 |

|

700 |

|

Moval because of job |

DE_AB_MB008 |

|

D2 |

|

700 |

|

Job anniversary 25, 40, 50 |

DE_AB_MB009 |

|

D2 |

|

700 |

|

Childcare |

DE_AB_MB020 |

|

D2 |

|

700 |

Delivered Entitlement Elements

Delivered Entitlement Elements

Global Payroll for Germany delivers four entitlement elements:

DE_AB_VACA: vacation

DE_AB_SICK: sick time

DE_AB_WACC: work accident

DE_AB_TACC: travel accident

Entitlement for vacations is frequency based; entitlement for sickness and accidents is defined per absence.

See Also

Defining Absence Take Elements

Viewing Delivered Elements

Viewing Delivered ElementsThe PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Germany. Instructions for running the query are provided in the PeopleSoft Global Payroll PeopleBook.

See Also

Understanding How to View Delivered Elements

Setting Up Absences for Germany

Setting Up Absences for Germany

Before you can enter and process absences, you must complete various setup steps. We describe the general setup steps under Absence Set Up and Management Tasks in the PeopleSoft Global Payroll PeopleBook. Following are the specific steps applicable to Global Payroll for Germany.

To prepare Global Payroll for Germany for absence processing:

Define work schedules and assign a schedule to each payee.

Instructions for creating and assigning work schedules are in the Using Schedules section of the PeopleSoft Global Payroll PeopleBook.

Define holiday schedules.

Instructions for creating and assigning holiday schedules are in the Using Schedules section of the PeopleSoft Global Payroll PeopleBook.

Define or modify entitlement and take elements.

Use the predefined absence entitlement and absence take elements delivered with Global Payroll for Germany, modify some attributes of these elements, or create your own absence elements. In this chapter, we list the delivered absence elements and describe the attributes you can change.

Create entitlement plans.

Entitlement plans provide a convenient way to define the amount of paid time off to which employees are entitled for vacation, sickness, accidents, or other reasons that you define. You can base entitlement on weekly work days, age, length of service, or other factors. When you run the Absence process, the system retrieves the entitlement plan associated with the payee to determine the entitlement that is appropriate for the absence that is being processed.

Assign entitlement plans to payees.

After you define your entitlement plans, associate them with pay entity, pay group, or payees using supporting element override.

Assign absence elements to payees and process lists.

As with all primary elements, you must assign absence entitlement and take elements to payees and include them in the process lists that you use when you run the absence processes. (This step is not necessary for per absence entitlement elements.)

This PeopleSoft application delivers predefined sections and process lists for absence processing. Use these, modify them, or create your own.

Modifying Take Elements

Modifying Take Elements

This section discusses:

Delivered take elements.

Changing count formulas.

Example of count formula DE_AB_COUNT_H1B (scheduled hours paid).

Viewing delivered elements.

Delivered Take Elements

Delivered Take ElementsYou can modify the take elements delivered with Global Payroll for Germany and most count formulas and earnings elements that these take elements use, with the exception of the PeopleSoft-maintained elements described below.

The following earnings codes and count formulas affect social insurance, tax, and DEUEV calculations; you cannot change them.

|

Earnings Code |

Formulas Related to Earnings Code |

|

DE_SI_0012_RE (social insurance reduction days) |

DE_AB_SIRED_1DAY reduces with the first unpaid day. DE_AB_SIRED_1MON reduces after one month unpaid. For unpaid absences, these formulas calculate the number of social insurance (SI) reduction days. Payroll also considers SI reduction days for new hires and terminations within a month. Depending on the absence take, SI days must be reduced with the first unpaid day or after a waiting period of 30 days. |

|

DE_TX_NOI (work interruptions) |

DE_AB_UDAYS_COUNT Counts the number of at least five consecutive days a payee is absent without pay (referred to as a work interruption). |

|

DE_AB_DEU_AB* (DEUEV stop reason) |

DE_AB_DEUEV_GEN DEUEV Beginning of work interruption. |

|

DE_AB_DEU_AN* (DEUEV start reason) |

DE_AB_DEUEV_GEN1 DEUEV End of work interruption. |

Note. The Take Config 1 field associated with the absence take element stores the reason code for a DEUEV interruption. The count formulas assign the DEUEV reason to the units of the earnings code.

Changing Count Formulas

Changing Count FormulasThe take elements delivered with Global Payroll for Germany use predefined formulas to calculate the day count and to calculate the number of units the system uses to generate positive input for earnings. You can select a different formula for the day count or for the calculation of positive input.

The suffix for each absence count formula is unique and can provide information about the count formula; for example, it can tell you how the formula interprets absences that are less than one day, as explained in this table:

|

Suffix Description |

Meaning |

Examples |

|

B or U included in suffix B = paid (bezahlt) U = unpaid (unbezahlt) |

These count formulas can be used only when an entitlement element is associated with the take element (for example, work accidents). If the entitlement balance covers only part of a day's absence, the system generates the correct number of units for paid earnings and unpaid earnings for the same day. |

DE_AB_COUNT_D1B or DE_AB_COUNT_D1U |

|

BAL |

Use these formulas as day count formulas. The formula DE_AB_COUNT_HOLRED is used by these count formulas to reduce units for public holidays. |

DE_AB_COUNT_BAL or DE_AB_COUNT_D3BAL |

This table lists the delivered count formulas. An X in the Day Count column indicates that the formula is an appropriate selection for the Day Count field on the Day Formula page of a take element. An X in the Earnings Units column indicates that the formula is appropriate for the Element Name - Unit field in the Units tab of the Day Formula page. Use the Formula View page to view a formula.

|

Description |

Day Count |

Earnings Units |

Formula Name |

|

Count workdays: Counts scheduled days, including holidays. |

X |

X |

DE_AB_COUNT_D1 |

|

Count workdays paid: Counts scheduled days including holidays. Can be used if earnings code is for a paid absence. Considers system element PIN DAY COUNT PD. |

|

X |

DE_AB_COUNT_D1B |

|

Balance count schedule days: Counts scheduled days, including holidays, and then uses the formula DE_AB_COUNT_HOLRED to reduce units for public holidays. |

X |

|

DE_AB_COUNT_D1BAL |

|

Count workdays unpaid: Counts scheduled days including holidays. Can be used if earnings code is for an unpaid absence. Considers system element PIN DAY COUNT UNP. |

|

X |

DE_AB_COUNT_D1U |

|

Count work days without public holiday: Counts scheduled days excluding holidays. (Counts holiday if Holiday Type = space.) |

X |

X |

DE_AB_COUNT_D2 |

|

Count work days without public holiday paid: Counts scheduled days excluding holidays. (Counts holiday if Holiday Type = space.) Can be used if earnings code is for a paid absence. Considers system element PIN DAY COUNT UNP. |

|

X |

DE_AB_COUNT_D2B |

|

Count work days without public holiday unpaid: Scheduled days without holidays (counts if holiday type = space). Can be used if earnings code is for an unpaid absence. Considers system element PIN DAY COUNT UNP. |

|

X |

DE_AB_COUNT_D2U |

|

Calendar days |

X |

X |

DE_AB_COUNT_D3 |

|

Count paid Calendar Days |

X |

X |

DE_AB_COUNT_D3B |

|

Calendar days + reduction of holiday: Calendar days reduced by the units for public holiday with formula DE_AB_COUNT_HOLRED. |

X |

|

DE_AB_COUNT_D3BAL |

|

Count unpaid Calendar Days |

X |

X |

DE_AB_COUNT_D3U |

|

Scheduled hours: Scheduled hours with holiday (ignores holiday type). |

X |

X |

DE_AB_COUNT_H1 |

|

Scheduled hours + reduction of holiday: Scheduled hours with holiday (ignores holiday type) reduced by the units for public holiday with formula DE_AB_COUNT_HOLRED. |

X |

|

DE_AB_COUNT_H1BAL |

|

Scheduled hours paid: Scheduled hours with holiday (ignores holiday type). Can be used if earnings code is for a paid absence. |

|

X |

DE_AB_COUNT_H1B |

|

Scheduled hours unpaid: Scheduled hours with holiday (ignores holiday type). Can be used if earnings code is for an unpaid absence. |

|

X |

DE_AB_COUNT_H1U |

|

Scheduled hours without public holiday: Scheduled hours without holiday (counts if holiday type = space). |

X |

X |

DE_AB_COUNT_H2 |

|

Scheduled hours without public holiday paid: Scheduled hours without holiday (counts if holiday type = space). Can be used if earnings code is for a paid absence. |

|

X |

DE_AB_COUNT_H2B |

|

Scheduled hours without public holiday unpaid: Scheduled hours without holiday (counts if holiday type = space). Can be used if earnings code is for an unpaid absence. |

|

X |

DE_AB_COUNT_H2U |

|

Count for supplementary Sick Calculate Supplementary Sick Days for Absences with Entitlement . |

X |

X |

DE_AB_COUNT_SP_SCK |

Two conditions can cause a formula to count an absence as a half day: Select the Half Day check box when you enter the absence on the Absence Entry page or enter a number of hours that is less than the payee's scheduled hours.

Example of Count Formula DE_AB_COUNT_H1B (Scheduled Hours Paid)

Example of Count Formula DE_AB_COUNT_H1B (Scheduled Hours Paid)Following is an example of the count formula DE_AB_COUNT_H1B (Scheduled Hours Paid):

IF SCHED HRS > 0 THEN IF PARTIAL HOURS > 0 THEN PARTIAL HOURS * (DAY COUNT PD / DAY COUNT) to formula ELSE SCHED HRS * (DAY COUNT PD / DAY COUNT) to formula ENDIF ENDIF

Viewing Delivered Elements

Viewing Delivered ElementsThe PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Germany. Instructions for running the query are provided in the PeopleSoft Global Payroll PeopleBook.

See Also

Understanding How to View Delivered Elements

Calculating Entitlement for Paid Vacation

Calculating Entitlement for Paid Vacation

PeopleSoft delivers the formula DE_AB_VAC_ENTCALC1, which you can use to calculate entitlement for paid vacation. The formula calculates entitlement monthly and prorates entitlement when a payee works less than a full month. It automatically increases entitlement for new hires and grants entitlement annually for existing employees.

The formula does the following:

Calculates entitlement for the current month, taking calendar segmentation into account. It prorates entitlement based on calendar days and stores the result in the month-to-date accumulator DE_AB_VAC_ENTMONTH.

Calculates entitlement for the remaining months of the calendar year and stores the result in the variable element DE_AB_TEMP2.

For the last slice or segment in the calendar, the formula does the following:

Calculates the new annual entitlement by taking the entitlement for the current month (DE_AB_VAC_ENTMONTH) and adding to it the entitlement for the previous month (stored in the year-to-date accumulator DE_AB_MONSUM) and entitlement for the remaining months of the year, until year-end or the payee's termination date (DE_AB_TEMP2).

Determines whether the calculated annual entitlement represents a new entitlement (January or a new hire) or an adjustment to the previous month's calculation.

Defining Absence Entitlement Plans

Defining Absence Entitlement Plans

Use the Absence Entitlement Plans DEU (GPDE_AB_ENTITLEMNT) component to define absence entitlement plans.

This section provides an overview of entitlement plans and discusses how to:

Enter entitlement plan names and effective dates.

Specify the number of vacation days.

Understanding Entitlement Plans

Understanding Entitlement PlansAn entitlement plan specifies the number of paid absence units to which payees are entitled for a variety of absence reasons, such as vacation time, sickness, and accidents. For each entitlement reason, you can enter the number of entitlement units that should be granted based on the number of workdays per week, the payee's age, years of service, and/or job function. Absence entitlement plans provide a convenient method of grouping a set of entitlement rules into a single plan.

Assigning Entitlement Plans to Payees

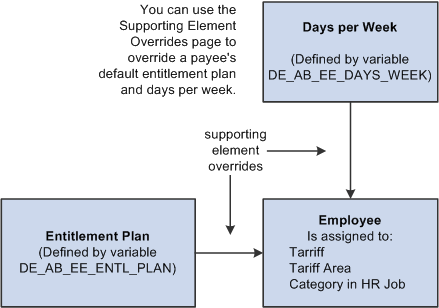

Assign an entitlement plan on the pay entity, pay group, or payee level using the Supporting Overrides page.

If you do not associate an entitlement plan with a payee (through use of the Supporting Element Overrides page), vacation entitlement for the payee is automatically set to 25 (as calculated by the formula DE_AB_VAC_ENTFORM). Entitlement for sickness, work, and travel accident is automatically set to 44.44 (as calculated by the per absence entitlement formula DE_AB_ENTFORM_PA).

This diagram illustrates how supporting element overrides can be to define a payee's entitlement plan and days per week.

Defining a payee's entitlement plan and days per week

Note. When you assign an entitlement plan to a payee, you must still associate the individual entitlement elements that are within the plan to payees. The entitlement plan simply specifies the number of entitlement units to which the payee is entitled. It does not specify that the payee is eligible to receive the entitlement.

To override a payee's default entitlement plan:

Access the Payee Supporting Element Overrides page for the payee.

On the Elements/Dates tab, complete the Element Type and Element Name fields.

In the Element Type field, select Variable. In the Element Name field, select DE_AB_EE_ENTL_PLAN.

On the Values tab, enter the name of the entitlement plan that you want to assign to the payee.

Adjusting an Employee's Number of Workdays per Week

The system refers to the payee's number of workdays per week to retrieve the correct row from the entitlement plan table.

The number of workdays per week comes from the Tariff Factor Table. You can use the variable element DE_AB_EE_DAYS_WEEK to override this number for individual employees. Use the Supporting Element Overrides page to enter the override amount for the variable.

Pages Used to Define Absence Entitlement Plans

Pages Used to Define Absence Entitlement Plans|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPDE_AB_ENTITLEMNT |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Absence Entitlement Plans DEU, General Data |

Enter the name of the entitlement plan and the effective date of the plan. |

|

|

GPDE_AB_ENTITLEDE |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Absence Entitlement Plans DEU, Detail Data |

Specify the number of vacation days to award to employees based on their age, length of service, or other vacation entitlement. First define the entitlement elements and formula elements that calculate entitlement for the plan. |

|

|

Absence Event - Absence Event Detail Input |

GP_ABS_EVENT_SEC |

Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Absence Event, Absence Event Input Detail Select Vacations from the Search menu accessed from the Absence Take Elements field, and then click the Details link. |

Enter detailed information for an absence, including the reason, processing action, manager approval, user-defined data, entitlement adjustment, and partial hours. |

Entering Entitlement Plan Names and Effective Dates

Entering Entitlement Plan Names and Effective Dates

Access the Absence Entitlement Plans DEU - General Data page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Absence Entitlement Plans DEU, General Data).

|

Entitlement |

The entitlement plan name that you entered to access this page. |

Specifying the Number of Vacation Days

Specifying the Number of Vacation Days

Access the Absence Entitlement Plans DEU - Detail Data page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Absence Elements, Absence Entitlement Plans DEU, Detail Data).

Element

|

Entitlement |

Select the entitlement element that you want to associate with this entitlement plan. |

|

Formula |

Select the formula element that calculates entitlement for the element named in the Entitlement field. To calculate entitlement for paid vacation, use the formula element named DE_AB_VAC_ENTCALC1 delivered with Global Payroll for Germany. The formula automatically prorates entitlement for payees who leave or join the company mid-period. If the entitlement element is resolved per absence (for example, sickness, travel or work accident), leave the field blank. |

Absence Entitlement Details

|

Days/Week |

Enter the number of workdays per week that corresponds to the entitlement amount. For example: Five days/week results in vacation entitlement of 30 days/year. Four days/week results in vacation entitlement of 24 days/year. |

|

Between Age |

If entitlement in your plan varies according to age, enter the age from which an employee is eligible. When calculating entitlement, the system uses the end of the calendar year to determine a payee's age. For example, assume the pay period is January 2000 and you are paying an employee who was born December 31, 1950. The system considers the age of this employee to be 50 years, not 49 years. |

|

and Age |

If entitlement in your plan varies according to age, enter the age until which an employee is eligible. The age you enter in this field represents the payee's age as of December 31 of the current year. |

|

Between Service Years |

If entitlement in your plan varies according to length of service, enter the minimum number of years of service required for this entitlement. The number of years you enter in this field represents years of service as of December 31 of the current year. |

|

and Service Years |

If entitlement in your plan varies according to the length of service, enter the maximum number of years of service allowed for this entitlement. The number of years you enter in this field represents years of service as of 31 December of the current year. |

|

Job Function Code |

Enter the job function code to which the plan applies. (Job function code is not used by the delivered lookup formulas.) |

|

Entitlement |

Enter the number of units of entitlement that you want to grant to the payee. |

|

Additional Entitlement |

Enter an additional entitlement amount in this field. (Additional entitlement is not considered by the delivered formulas, such as DE_AB_VAC_ENTCALC1 for paid vacation or DE_AB_ENTFORM_PA for sickness, work accident, and travel accident.) |

See Also

Calculating Entitlement for Paid Vacation

Entering German Nation DEUEV Codes

Issuing Advance Payment for Vacations

Issuing Advance Payment for Vacations

Access the Absence Event - Absence Event Input Detail page (Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Absence Event, Absence Event Input Detail).

Enter the absence begin and end dates. Enter the date for which you want to generate positive input in the Date field in the first row. Enter the payment amount in the Monetary field and select the currency code.

Note. If the vacation falls within more than one pay period, for example, July 31 to August 5, then the date you enter determines the pay period in which the advance payment is processed. For example, a date of July 31 causes the positive input to be generated for July; a date of August 5 causes the positive input to be generated during the August payroll.

See Entering Absences.

Entering Maternity or Educational Leave Data

Entering Maternity or Educational Leave Data

This section discusses how to enter maternity or educational leave data and the batch processing.

Page Used to Enter Maternity and Educational Leave Data

Page Used to Enter Maternity and Educational Leave Data|

Page Name |

Definition Name |

Navigation |

Usage |

|

GPDE_AB_EE_MATERN |

Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Maternity Leave DEU, Maternity Leave |

Enter data for a maternity or educational leave. |

Entering Maternity or Educational Leave Data

Entering Maternity or Educational Leave Data

Access the Maternity Leave page (Global Payroll & Absence Mgmt, Payee Data, Maintain Absences, Maternity Leave DEU, Maternity Leave).

Women are entitled to maternity leave six weeks before and three weeks after the birth of a child (the protection period). A woman or man can take an extended leave of absence (educational leave) of up to three years following the maternity leave. The employer must send a letter to the employee to ask how long the educational leave will be.

|

Expected Date of Birth |

Enter the child's expected birth date. |

|

Date of Birth |

Enter the child's date of birth. When you enter this date, the system recalculates the end date of the protection period. |

Absence Take Maternity

|

From |

Enter the begin date of the maternity leave. |

|

To |

Enter the end date of the maternity leave. |

|

Absence Take |

Enter the take element for the maternity leave. |

Absence Take Educational Leave

|

From |

Enter the begin date of the educational leave. |

|

To |

Enter the end date of the educational leave. |

|

Absence Take |

Enter the take element for the educational leave. |

Letter Details

|

Letter Code |

Select the code for the letter you want to send to the employee. |

|

Date Letter Printed |

Enter the date on which you want to print the letter. |

Batch Processing

Batch Processing

At the beginning of the Absence process, the system retrieves the following information:

Tariff, tariff area, and employee category for the payee.

Entitlement plan and workdays associated with Tariff tables.

Entitlement plan and workdays for payee, if different from Tariff table.

Disability data.

Entitlement from entitlement plan.

Absence Process List and Sections

Use the absence process list (DE AB ABSENCE ) delivered with Global Payroll for Germany, modify this process list, or build your own.

The sections within DE AB ABSENCE are:

DE_ABS_INIT: Initializes section. Executes multiple counts in preparation for absence calculations. For example, counts scheduled days, scheduled hours, and public holidays (days and hours).

DE_ABS_ENTITLEMENT: Calculates entitlement.

DE_ABS_TAKE: Calculates take.

DE_ABS_TERM_SECT: Calculates vacation pay-off for terminated payees.

DE_ABS_GEN_PI: Generates positive input for earnings and deductions.

Note. This PeopleSoft application delivers a separate process list, DE MT PRCLST, for maternity leave.

Managing Supplementary Sick Payments

Managing Supplementary Sick Payments

After continuous sick payments by an employer has ended, an employee can claim additional payments if Tariff contracts or Employer/Works council agreements exist.

This section provides an overview of supplementary sick payment processing and discusses how to:

Set up the supplementary sick payment bracket.

Set up the Pay Entity override elements.

Set up Payee override elements.

View delivered supplementary sick pay elements.

Understanding Supplementary Sick Payment Processing

Understanding Supplementary Sick Payment ProcessingYou process supplementary sick payments as follows:

Add the necessary section to the Payroll Process. The section should be processed immediately following the initialization of SI-Data to ensure that all necessary base data is loaded.

Change Absence elements.

Enter the Supplementary Sick Pay entitlement. The system calculates the supplementary sick payment based on the company seniority date. The entitlement is stored in the bracket DE_AB_SUPP_SICK_PY.

Create an override for the pay entity to determine the calculation method for the net payment.

Create an override for the pay entity to determine the proration method for the net payment.

Create an override for the pay entity to determine the up-grossing of the supplementary sick payment.

Create an override for the payee to enter the Daily Sick Payment By Health Insurance Provider amount.

Create an override for the payee to enter the Net for Social Benefit amount.

Pages Used to Set Up Supplementary Sick Payments

Pages Used to Set Up Supplementary Sick Payments|

Page Name |

Definition Name |

Navigation |

Usage |

|

GP_BRACKET1 |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Brackets, Lookup Rules |

Verify company seniority lookup rule parameters. |

|

|

GP_PYENT_SOVR |

Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Supporting Element Overrides |

Set override variables for pay entities. |

|

|

GP_PAYEE_SOVR |

Global Payroll & Absence Mgmt, Payee Data, Create Overrides, Supporting Elements, Supporting Elements |

Set override variables for individual employees. |

Setting Up the Supplementary Sick Payment Bracket

Setting Up the Supplementary Sick Payment Bracket

Access the Lookup Rules page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Supporting Elements, Brackets, Lookup Rules).

Use this page to determine if the entitlement applies to employees with seniority less then or greater than the number of years entered in the bracket.

In the sample setup, the system uses the last entered row if an employee's years of seniority are more than his or her stored years, and it always uses the next lower value.

Setting Up the Pay Entity Override Elements

Setting Up the Pay Entity Override Elements

Access the Supporting Element Overrides page (Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Framework, Organizational, Pay Entities, Supporting Element Overrides).

Supporting Element Override List

|

Element Name |

Select from the following values: DE_SK_USE_ACTL: Determines calculation method. Enter this variable to indicate whether the calculation of the base net per employee will use the actual month, or the month prior to the absence begin date. Set the value of this variable to Y to initiate the calculation of the payment using the actual month. To use the previous month, no entry is necessary. DE_SK_USE_CALDY: Determines proration method for the calculation of the supplementary sick payment amount per day. Enter this variable to indicate whether the proration of the base net per employee is performed using the number of calendar days in the month, or a flat 30 days. Set the value of this variable to Y to prorate the payments using calendar days. To prorate using a flat 30 days, no entry is necessary. DE_SK_NG_CALC: Determines the up-grossing of the supplementary sick payment. Enter this variable to indicate whether the paid supplementary sick payment must be increased by the applicable taxes, which are paid by the employee, or if it should be paid as a gross amount with the employer paying the taxes. Set the value of this variable to Y to increase the supplementary sick payment. For payouts without the increase, no entry is necessary. |

Setting Up Payee Override Elements

Setting Up Payee Override Elements

Access the Supporting Elements page (Global Payroll & Absence Mgmt, Payee Data, Create Overrides, Supporting Elements, Supporting Elements).

Payee Supporting Element Override List

|

Element Name |

Select from the following values: DE_SK_DY_SICK_PY: To calculate the supplementary sick payment for each payee, enter the daily sick payment amount from the health insurance provider. DE_SK_SL_NET: To calculate the SI-exemption in case of supplementary sick payments, enter the net amount of the social benefit paid by the SI provider. The amount should be the payment made per month of the payee's sickness period (typically the daily sick payment by health insurance provider multiplied by 30). |

Viewing Delivered Supplementary Sick Pay Elements

Viewing Delivered Supplementary Sick Pay Elements

To calculate the supplementary sick payment, new elements need to be added to the payroll process globally and at the pay entity and payee levels.

This section lists:

Delivered sections.

Delivered earnings.

Delivered formulas.

Delivered variables.

Delivered accumulators.

These tables discuss each of the elements delivered to calculate supplementary sick payments:

Delivered Sections

|

Sections |

Description |

|

DE_SK_1000 |

Calculate Supplementary Sick Pay. Calculates the supplementary sick payment. |

|

DE_SK_1100 |

Grosses up the calculated supplementary sick payment to cover applicable taxes. |

Delivered Bracket

|

Bracket |

Description |

|

DE_AB_SUPP_SICK_PY |

Contains the entitlement for Supplementary Sick Payment. |

Delivered Earnings

|

Earnings |

Description |

|

DE_SK_SPSCK |

Supplementary Sick Pay. Calculates the actual supplementary sick payment. |

|

DE_SK_SPSKDY |

Days for Supplementary Sick Pay. Receives the days for which the employee has an entitlement for a supplementary sick payment. |

Delivered Formulas

|

Formulas |

Description |

|

DE_AB_COUNT_SP_SCK |

Counts the Supplementary Sick Payment days and determines if there are days remaining in the balance. Works with absence takes that use entitlements to count down already paid days of absence, for example DE_AB_M10. |

|

DE_AB_CNT_SCKDYS_U |

Counts the Supplementary Sick Payment days and determines if there are days remaining in the balance. Works with absence takes that are treated as unpaid immediately, for example DE_AB_M11. |

|

DE_SK_COND |

Conditional formula for section DE_SK_1000. Verifies that:

This section is not called if these values are not available. |

|

DE_SK_NG_COND |

Conditional formula for section DE_SK_1100. Verifies that:

This section is not called if these values are not available. |

|

DE_SK_SICK_PAY |

Calculates the daily Supplementary Sick Payment based on a given daily sick payment by health insurance and a base net. The net is calculated on actual amounts. After the Supplementary Sick Payment is calculated, the formula calculates the effects on further SI calculations. |

|

DE_SK_NG_INIT |

Provides the data necessary to gross up the Supplementary Sick Payment. |

|

DE_SK_NG_LOOP |

Controls the gross up of the Supplementary Sick Payment and calculates the daily rate. |

|

DE_SK_BSE_NET |

Calculates the employee's net as base for Supplementary Sick Pay/Maternity. Used for calculations and for certificates. |

Delivered Variables

|

Variables |

Description |

|

DE_SK_DLY_SCKSP_PY |

Daily Sick Supplementary Payment. Result for daily supplementary social payment for Sickness. |

|

DE_SK_DYS_PD |

Paid Days for Supplemental Sick Pay . |

|

DE_SK_DY_SICK_PY |

Sick payment from SI Provider per day. |

|

DE_SK_NET |

Net for supplementary Sick pay/Maternity. Stored for retrieval during calculation process and for certificates. |

|

DE_SK_NG_CALC |

Determines if the employer pays the taxes on calculated gross supplementary sick payment: N = Employee pays taxes on supplementary sick payment. Y = Employer pays taxes on supplementary sick payment. |

|

DE_SK_SIEXMPT_SICK |

Covers total SI exemption for Sick Payment. Used to determine SI days calculation. If supplementary Sick Payment plus other recurring payment within the month is higher than the SI Exemption, then all payments qualify for SI. |

|

DE_SK_SIEXMPT_SKMX |

Max SI Exemption for Sick payment. Contains the amount of Sick payment. Used for SI Calculation. |

|

DE_SK_SI_CORR_DYS |

Correction SI-Days due Supplemental Sick Pay. |

|

DE_SK_SL_NET |

Sozialleistungsnetto provided by the SI-Provider in case the employee gets payments. |

|

DE_SK_USE_ACTL |

Uses actual Month to calculate employee's Net. If value = Y, then the employee's net is calculated on basis of actual month. Otherwise, the net from the previous month is used. |

|

DE_SK_USE_CALDY |

Uses Calendar days for additional Sick Pay. If value = Y, the calculation for the supplementary sick pay uses calendar days. Otherwise, the supplementary sick pay is calculated on a base of 30 days. |

Delivered Accumulators

|

Accumulators |

Description |

|

DE_A2_TXBSESCK DE_A2_TXFBSESCK |

Base for Fictitious Net Calculation in case of Additional Sick Payment - Tax-/SI-able. Provided through assigned accumulators, which must contain monthly unprorated values. Customer assigns elements to the attached accumulators. |

|

DE_A2_ERDRSK |

Base for additional payments during sickness by the employer. Used for the calculation of the SI exemption. The content is calculated based on earnings paid during sickness. Provided via assigned accumulators. Customer assigns elements to the attached accumulators. |

|

DE_AB_SCKPAY_BAL |

Contains the supplementary sick days per absence and the original begin date. |

|

DE_AB_SCKSUP_ENT |

Contains stored supplementary sick days entitlement per absence and the original begin date. |

See Also

PeopleTools: PeopleSoft Query PeopleBook