Understanding the Minimum Wage Ordinance

Understanding the Minimum Wage OrdinanceThis chapter provides an understanding section on the minimum wage ordinance and discusses how to implement the minimum wage ordinance.

Understanding the Minimum Wage Ordinance

Understanding the Minimum Wage OrdinanceThe Minimum Wage Ordinance (MWO) aims to establish a Statutory Minimum Wage (SMW) regime which strikes an appropriate balance between forestalling excessively low wages and minimizing the loss of low-paid jobs while sustaining Hong Kong’s economic growth and competitiveness.

The SMW rate becomes effective the first of May 2011. The initial SMW rate has been set at 28 HKD per hour.

PeopleSoft HCM Global Payroll for Hong Kong is providing the resolution to comply with MWO.

Implementing the Minimum Wage Ordinance

Implementing the Minimum Wage OrdinanceThis section discusses how to:

Define applicable payees and pay groups.

Count total hours worked.

Define wages payable to employees.

Calculate minimum wage.

Pay additional remuneration.

Export the total hours of work.

Note. The pages shown is this chapter are documented in the PeopleSoft Global Payroll 9.1 PeopleBook.

Defining Applicable Payees and Pay Groups

Defining Applicable Payees and Pay GroupsThis section discusses how to:

Track the applicable attribution on the payee or pay group level.

Exclude the whole pay group from the SMW calculation.

Override the value on the payee level.

Tracking the Applicable Attribution on the Payee or Pay Group Level

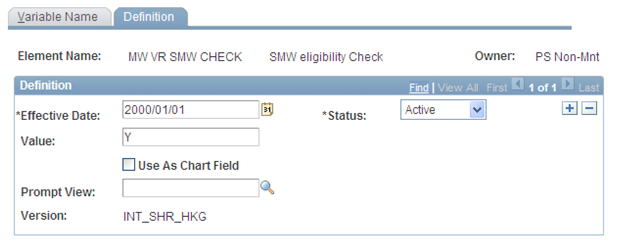

PeopleSoft delivers a variable element (MW VR SMW CHECK). To track the applicable attribution on the payee level or the pay group level. access the Variable Name page (Set Up HRMS, Product Related, Global Payroll & Absence Management, Elements, Supporting Elements, Variables, Definition).

Definition page showing the definition for the SMW Eligibility Check element

The system sets the default for the Value field to Y for MW VR SMW CHECK.

Excluding the Whole Pay Group from the SMW Calculation

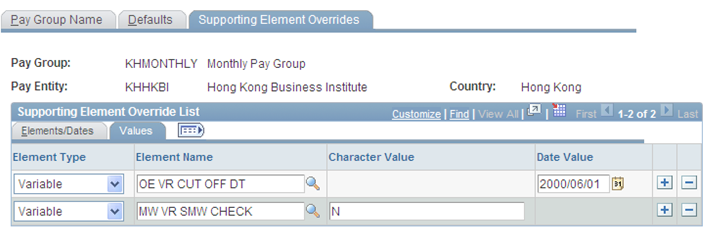

To exclude the whole pay group from the SMW calculation on the pay group level, access the Supporting Element Overrides page (Set Up HRMS, Product Related, Global Payroll & Absence Management, Framework, Organizational, Pay Groups, Supporting Element Overrides).

Supporting Element Overrides page showing an override for the MW VR SMW CHECK element

Enter N in the Character Value field for MW VR SMW CHECK element.

Overriding the Value on the Payee Level

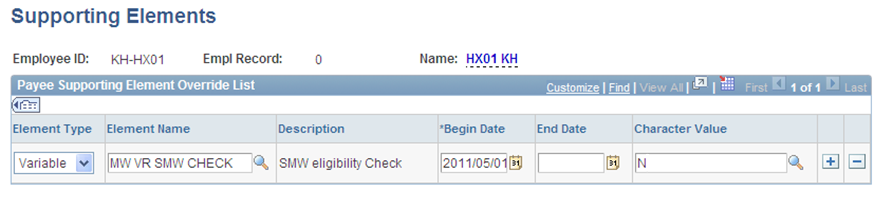

To override the value for the MW VR SMW CHECK element on the payee level, access the Supporting Elements page (Global Payroll & Absence Management, Payee Data, Create Overrides, Supporting Elements).

Supporting Elements page showing the override for an employee

Enter N in the Character Valuefield for the MW VR SMW CHECK element on the payee level.

Counting Total Hours Worked

Counting Total Hours WorkedThe system counts the total hours worked based on the schedule. The system automatically counts rest days and excludes these hours from the total hours worked. The system also counts off schedule and public holidays, but these hours are not counted for HKG statutory holidays.

Defining the Schedule ID for a Pay Group

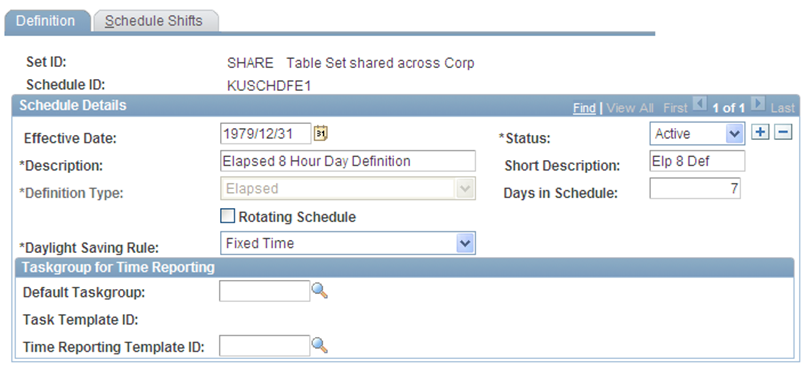

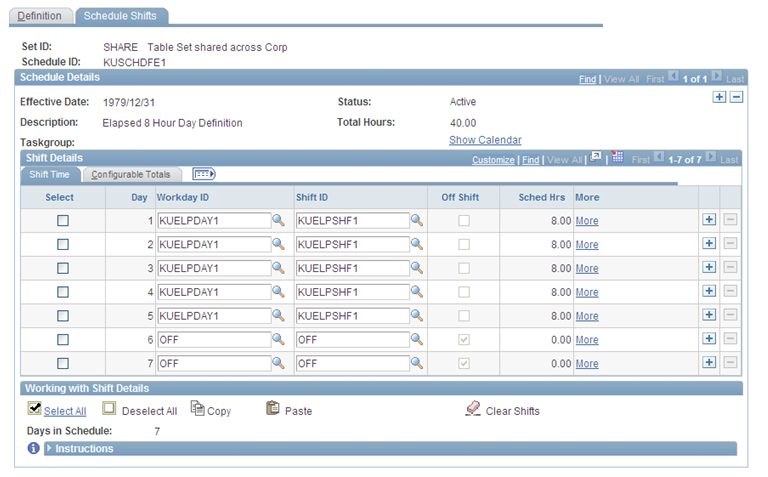

To define the schedule ID for a pay group, access the Definition and Schedule Shifts pages (Set Up HRMS, Product Related, Global Payroll & Absence Management, Schedules, Definitions).

Definition page showing an Elapsed 8 Hour Day Definition schedule

Schedule Shifts page showing the shift details for the Elapsed 8 Hour Day Definition schedule

Use these pages to define the schedule ID for a pay group. Payees in the pay group can have the default schedule. You can use this schedule to capture the default working hours.

Overriding and Adjusting Hours for Payees

To override or adjust hours:

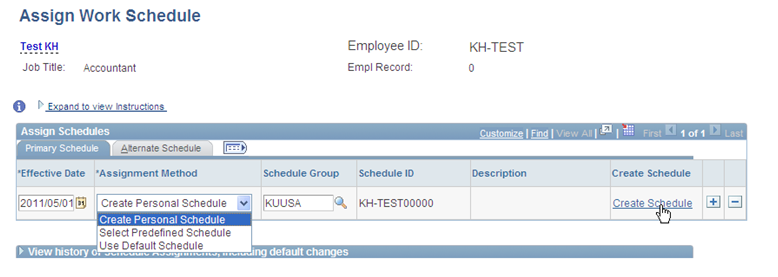

Access the Assign Work Schedule page (Global Payroll & Absence Management, Payee Data, Create Overrides, Assign Work Schedule).

Assign Work Schedule page showing the assigned schedules for an employee

From this page you can:

Update or view non-default and personal schedules in Assign Schedules section.

Assign a schedule group for all schedules.

Create personal schedules using the Create Schedule link.

Access the schedule calendar for each schedule with the Show Schedule link.

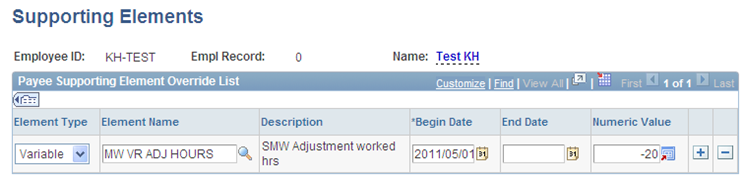

To adjust or override the hours worked on the payee level, access the Supporting Elements page (Global Payroll & Absence Management, Payee Data, Create Overrides, Supporting Elements).

Supporting Elements page showing the SMW Adjustment Worked Hours element

Use the MW VR ADJ HOURS element and the Numeric Value field to adjust working hours.

Use the MW VR TOT HRS element and the Numeric Value field to override or provide the total hours worked from the external Time & Labor system.

Defining Wages Payable to Employees

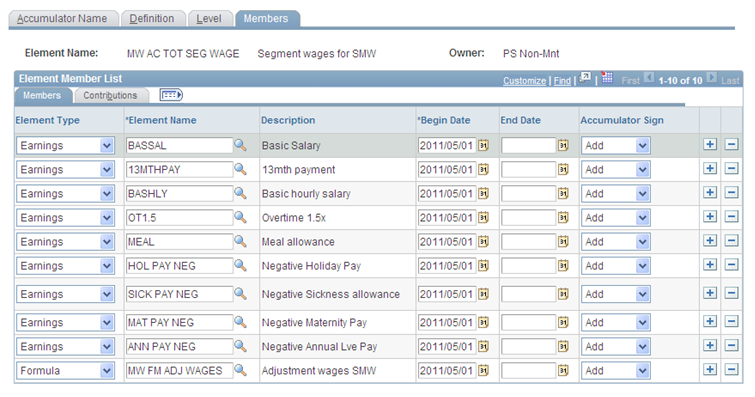

Defining Wages Payable to EmployeesTo track the wages that are used by the system to pay employees, PeopleSoft provides these two accumulators:

MW AC TOT WAGES

MW AC TOT SEG WAGE

Access the Members page (Set Up HRMS, Product Related, Global Payroll & Absence Management, Elements, Supporting Elements, Accumulators, Members).

Members page displaying the members for the Segment Wages for SMW element

PeopleSoft delivers the MW AC TOT WAGES and MW AC TOT SEG WAGE accumulators with some earnings as sample data. You can add or delete any earning elements as needed.

Note. Adjustment for Payment for Rest Days

Some earnings include payment for the rest days. The payment for rest

days has to be excluded from the wage. To exclude the payment for rest days

from the accumulator for Total Wages, use the variable, MW VR ADJ WAGES.

Calculating Minimum Wage

Calculating Minimum WageTo calculate minimum wage, PeopleSoft delivers the MW VR RATE variable element. The initial SMW rate has been set at 28 HKD per hour. This minimum wage rate is expected to be reviewed once every two years.

To change the rate, access the Definition page (Set Up HRMS, Product Related, Global Payroll & Absence Management, Elements, Supporting Elements, Variables, Definition).

Definition page showing the minimum wage set to 28 HKD

Once a new SMW rate is announced, PeopleSoft will not provide any new solutions. You need to insert a new row on the Definition page, then enter the new rate value for the MW VR RATE element.

As of the 1st of May 2011 minimum wage for payees is calculated using this formula:

Minimum Wage = Total Hours Worked * SMW Rate (28 HKD)

Paying Additional Remuneration

Paying Additional RemunerationIn determining whether the wages meet the minimum wage, the system considers the following factors:

Minimum wage

Wages payable

Additional Remuneration

If 2 is NOT less than 1, the minimum wage requirement is met.

If 2 is less than 1, the employer has to pay additional remuneration.

Additional Remuneration = Minimum Wage – Wages Payable,

Note. To implement the minimum wage ordinance, PeopleSoft added a new earning called ADD REMUN (SMW Additional Remuneration). To access the Earnings component go to Set Up HRMS, Product Related, Global Payroll & Absence Mgmt, Elements, Earnings.

Minimum Wage Calculation Example

Assume that the following employment terms exist according to the contract of employment:

Remuneration = 7,000 HKD per month with paid rest days on Sundays.

Working hours = Monday to Saturday 9:00 a.m. to 5:00 p.m. including a 1 hour paid lunch break.

The total number of hours worked in this month is 216 hours. There are 31 days in this month (including 4 Sundays) and the total number of hours worked is 216 hours (27 days from Monday to Saturday * 8 hours per day). In this example, as meal break is regarded as working hours for the employee in accordance with the contract of employment or agreement with the employer, it is included in computing minimum wage.

SMW rate = 28 HKD

Calculation

Minimum wage for the month is 6,048 HKD (216 hours multiplied by 28 HKD)

Wages payable to the employee for this month is 6,097 HKD.

Rest day pay for the month is 903 HKD. Rest day pay is the payment made to the employee for time that is not worked. Rest day pay for 4 Sundays is 7,000 HKD divided by 31 days multiplied by 4 days = 903 HKD.

For illustration purpose, figures are rounded to the nearest integers in these examples. Since 2 is not less than 1, the minimum wage requirement is met.

Retroactive Payments and Segmentations

Here is some additional information for retroactive payments and segmentations:

For SMW calculations, the system considers retroactive payments in the current month.

Example: Employee A’s monthly wage for May was paid 5,000 HKD on May 31st. However, the employer decided to increase A’s salary rate to 5,600 as of May 1st and the delta amount for May is paid in the June payroll as a retroactive payment. Hence, he gets 6,200 HKD in the June payroll (600 is the retroactive payment for May). In this case, the system will use 6,200 HKD to calculate the SMW for June (the retroactive amount 600 HKD is considered in the current month).

In this resolution, the additional remuneration gets resolved in the last active segmentation when period segmentation occurs.

Note. Please modify the rule based on the labor contract and your particular business needs.

Exporting the Total Hours of Work

Exporting the Total Hours of WorkYou can use Query Manager to extract a record of total hours of work for each payee.