Total Compensation Output

Total Compensation Output

This chapter provides overviews of the Total Compensation output, the Compensation Tree, compensation IDs (comp IDs) and their sources, and time periods, and discusses how to prevent double accounting.

Total Compensation Output

Total Compensation Output

Total Compensation enables you to generate the following output:

Reports

Employee Benefits statement: A listing of all compensation for each worker, designed for distribution to workers.

Employee Compensation report: Detailed information about each compensation type for each individual within a group that you specify.

Group Compensation report: Aggregated information for each worker within a group that you specify.

Inquiries

Inquiries are on-screen displays of the total compensation, human resources, and payroll amounts for one worker or for a group of workers.

Spreadsheet

Retrieves total compensation data and display it in Microsoft Excel.

OLAP Analysis Models (Cubes)

PeopleSoft HCM integrates with online analytical processing (OLAP) tools, so that you can analyze these cubes.

The OLAP structure is formed in a cube. With these cubes, you view and store multiple models of compensation for your organization and process cubes to analyze data.

This document assumes you are familiar with OLAP concepts and terminology.

Total Compensation Process

Total Compensation Process

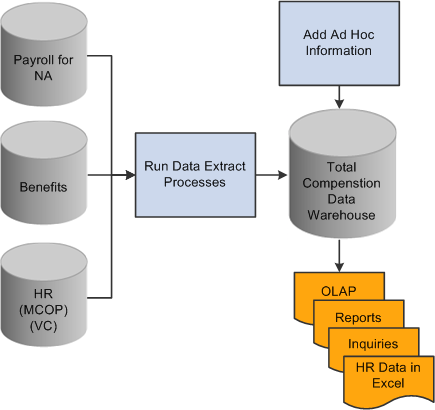

This illustration provides an overview of the Total Compensation process and how the system integrates with PeopleSoft Payroll for North America, Benefits and HR:

Total Compensation process showing integrations with PeopleSoft Payroll for North America, Benefits and HR

Processing Sequence

Processing Sequence

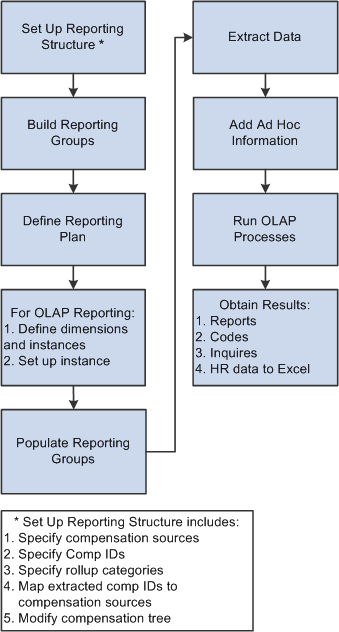

The reporting structure that you set up determines how the reporting results appear. PeopleSoft provides predefined values for most of the reporting structure components. You might want to alter a few predefined attributes.

This flowchart illustrates how the steps work together to define results. You generally set up a reporting structure once and change it occasionally. You perform the other steps as needed.

Processing sequence that illustrates how the reporting structure that you set determines how the reporting results appear

Compensation Trees

Compensation Trees

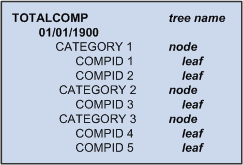

The structure of the Compensation Tree determines how the data warehouse stores the information that it collects. PeopleSoft provides a Compensation Tree that you alter as needed. Change the tree structure before you begin data collection.

For the Total Compensation business process, you can define the leaves and nodes of the tree before you define the tree. The trees in the business process use a dedicated tree structure. The tree nodes are called rollup categories, and the tree leaves are called compensation IDs (comp IDs). You define both of these when you build the tree.

Compensation Tree structure with leaves and nodes, representing compensation IDs and rollup categories respectively

Note. All predefined Total Compensation components, such as trees, queries, and cube dimensions, begin with TC_ (for example, the dimension TC_Company).

Compensation IDs and Their Sources

Compensation IDs and Their Sources

Compensation IDs are the elementary pieces of the reporting process. Each comp ID represents a figure reported in the results. Comp IDs are the leaves on the Compensation Tree. By using comp IDs, Total Compensation can gather data in the same way for any type of result.

PeopleSoft HR supplies predefined comp IDs; you add comp IDs mostly for ad hoc awards.

Comp IDs are the elements of compensation, such as components of pay, variable compensation awards, and benefit amounts. Each comp ID is mapped to the appropriate compensation source so that the extraction processes can retrieve the data and place it in the warehouse. You can have as many comp IDs as you need, and each comp ID can have one or more sources.

The most extreme case is to have just one comp ID containing components from all the possible sources. You would map that comp ID to each source so that the business process would gather all the data that you want. This scenario is highly unlikely because the results would include just one figure.

Possible sources for comp IDs are Payroll for North America and HR (including the Manage Base Benefits business process). HR includes base pay (regular pay comprised of multiple components of pay stored in the Job and Compensation records), and incentives and ad hoc payments from the Variable Compensation business process.

Time Periods

Time Periods

You define a time period for the information you want to report, using the standard From and Thru Date fields. You also specify the period frequency. This indicates the number of times within the period that you want to calculate total compensation amounts: monthly, quarterly, or annually. You define all the time periods when you set up the Total Compensation reporting plans.

For example, if you specify quarterly as the period frequency, the from date January 1, 2004, and the through date December 31, 2004, the system extracts data four times for 2004: March 1, 2004, June 1, 2004, September 1, 2004, and December 1, 2004. If you specify quarterly as the period frequency, the from date January 1, 2004, and the through date December 31, 2005, the system extracts data eight times.

Note. Report data is more accurate when you extract data more often. For example, within a one-year period, a monthly extraction (12 times) is more accurate than an annual extraction (once). Because generating such accurate reports requires processing time, you should explore the processing capacity of your hardware.

The system ensures that the period frequency is compatible with a plan's from and through dates.

You can have one reporting plan with several from and through dates. When you run the extraction process, you can specify a subset of the plan's dates. For example, plan number seven is set up with a two-year time period. When running the extraction process, you can specify a one-year period.

For OLAP users, this value also indicates the level of navigation into a cube.

Preventing Double Accounting

Preventing Double Accounting

Safeguards in HCM greatly reduce the possibility of double accounting. However, there are two instances when the system can theoretically count compensation values more than once:

If a worker is in more than one reporting group, his or her total compensation is counted each time the business process encounters him or her in a group.

Run the Group Overlapping report to prevent this type of double accounting.

Compensation amounts are extracted from the HR and Benefits Administration applications.

Payroll amounts are extracted from Payroll for North America. To prevent the possibility of double accounting, specify whether a comp ID is a compensation amount or a payroll amount. The system uses this attribute to store compensation and payroll amounts separately in the data warehouse and as separate measures in OLAP. This ensures that compensation data coming from HR or Benefits Administration is not aggregated with payroll data.

See Also