Understanding Projection Methods

Understanding Projection Methods

This chapter provides an overview of projection methods and discusses how to set up projection methods.

Understanding Projection Methods

Understanding Projection Methods

Consolidation functions produce periodic totals of payroll earnings and hours. Consolidations only use actual earnings and hours, as recorded in PeopleSoft Payroll for North America tables. When you run pension estimates based on future event dates, however, you have to project earnings and hours data up to the future date.

Multiple steps are required to project earnings and hours:

The system looks for the most recent consolidation period with data. This is the base period for the projection.

If the base period is incomplete (for example, if the consolidation period is annual, but you have only processed consolidations through September), the system calculates what the earnings or hours for the entire base period should be. You decide whether the system should project data for the remainder of the period and add this to the actual data, or whether the system should ignore the actual data and simply calculate data for the entire period.

After the system establishes the base period amount, it fills in data for all periods up to the final period.

When projecting hours, the system simply uses the same number of hours for all periods. For earnings, the system applies an annual increase only if the pension administrator enters an assumed increase at calculation time. The system prorates the final period data if the final period (the period containing the event date) is not a full period.

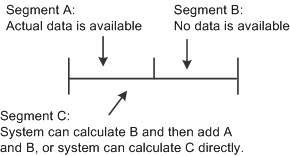

There are several methods for determining the hours or earnings. You choose the method for calculating the hours and earnings. The following diagram shows two options:

Illustration showing how total hours or earnings for the base period are determined

Setting Up Projection Methods

Setting Up Projection Methods

To set up projection methods, use the Projections (PROJECTIONS) component.

This section lists the page used to set up projection methods and discusses how to define projection methods.

Page Used to Set Up Projection Methods

Page Used to Set Up Projection Methods|

Page Name |

Definition Name |

Navigation |

Usage |

|

PA_PROJECTIONS |

Set Up HRMS, Product Related, Pension, Calculation Rules, Projections, Projections |

Set up projection methods. |

Defining Projection Methods

Defining Projection Methods

Access the Projections page (Set Up HRMS, Product Related, Pension, Calculation Rules, Projections, Projections).

Data to Be Projected

|

Hours or Earnings |

Choose whether the projection method will project hours or earnings. If you choose Hours, also complete the information in the Hours for Projection group box. If you choose Earnings, also complete the information in the Earnings for Projection group box. |

Hours for Projection

|

Standard Hours |

Annualizes the standard weekly hours for the employee's job as established in PeopleSoft Human Resources. |

|

Assumed |

Uses an annual hours amount that the pension administrator enter on the calculation page. |

|

Same Rate of Accrual |

Annualizes the actual period-to-date hours. |

Earnings for Projection

|

Compensation Rate |

Uses estimated earnings for the period based on the annual salary as of the first day of the base earnings period. |

|

Assumed |

Uses an amount that the user will have to enter into the calculation page. If you set up a projection method using assumed hours or earnings, you should make the corresponding setup assumptions fields required. These fields are located on the Define Calculation - Main Page, in the Assumptions group box. If you use any other projection method, you should remove the setup assumptions fields from that page to avoid misleading users. |

|

Same Rate of Accrual |

Annualizes the actual period-to-date earnings, as described under "Same Rate Proration Units." |

Same Rate Proration Units

If you select Same Rate of Accrual for either hours or earnings, the system annualizes the actual earnings and hours based on the consolidation "process through" date. When you select this method, under Same Rate Proration Units, select the rate to use when annualizing.

|

Days |

If the system prorates using days, it divides the actual earnings or hours by the number of calendar days in the partial period, then multiplies the result by the number of days in the year. This option always gives you a more precise annualization. Note. If the projection method will be applied to a monthly consolidation, you must annualize using days. |

|

Months |

If the system prorates using months, it divides the actual earnings or hours by the number of complete months in the partial period, then multiplies the result by the twelve. If the system annualizes using days, it divides the total hours by the number of days in the period and multiplies by the number of days in the year. Using months tends to overstate earnings because it drops any partial month, and the result is as though the employee has the same amount of earnings or hours in slightly less time. For example, if you consolidate based on a calendar year, using months to annualize period-to-date earnings of 15,000 USD as of April 15, 2001 yields:

Annualizing the same amount by counting days yields:

|

Current Period Data

When determining the hours or earnings for the base period, use the Current Period Data group box to indicate whether to calculate data for the entire period or just for the remaining portion of the period, which is the portion for which there is no actual data.

Note. When you use the same rate of accrual method, the system always uses the annualized amount for the entire period. There is no sense in annualizing, then prorating. Therefore, this option will be made unavailable.

|

Use |

The system calculates data for the remainder of the period and adds that to the actual period-to-date data. It looks at the partial period fraction in the base consolidation period to determine what portion of the period the existing data covers. If, for example, the partial period fraction for an annual period is .25, the actual data represents 25 percent of the period, or three months. The system then adds this actual data to 75 percent of the annual hours as determined by the compensation rate and standard hours or by the assumed amount of earnings or hours entered on the calculation page. Using this example, if the base consolidation period shows actual earnings of 10,000 USD and a partial period fraction of .25, the system multiplies the annual compensation rate by .75 (the unworked portion of the period) and adds that prorated amount to the original 10,000 USD. |

|

Ignore |

The system uses your chosen method to calculate data for the entire period. |

Final Period Proration Units

The final period is usually an incomplete period. The system prorates the hours or earnings based on the length of the period.

|

Days |

As with the proration units for the Same Rate of Accrual option, the days option gives a more precise proration. |

|

Months |

For monthly consolidation periods, do not prorate using the months option. |