Understanding XML-Based Integration Using Integration Broker

Understanding XML-Based Integration Using Integration Broker

This chapter provides an overview of credit card integration using Integration Broker and discusses how to:

Set up credit card integration for Integration Broker.

Set up credit card interface elements.

See Also

PeopleTools: PeopleSoft Integration Broker PeopleBook

Understanding XML-Based Integration Using Integration Broker

Understanding XML-Based Integration Using Integration Broker

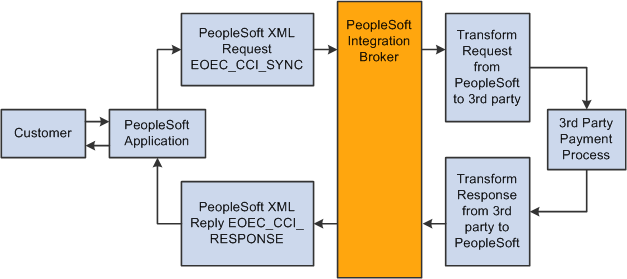

You can use PeopleSoft Integration Broker to process your PeopleSoft credit card transactions with the third-party credit card processing vendor of your choice. Oracle delivers messages and a synchronous service for you to use to set up a synchronous connection with your third-party vendor. Because each third-party vendor requires a different format for communication, PeopleSoft applications do not deliver transformations to your third-party vendor. This is because each third-party vendor has different requirements for inputs and outputs to their services. Therefore, part of setting up an integration involves writing your own transformation programs for the request and response message. The transformation programs are a mapping between the fields in the PeopleSoft system and the fields in your third-party vendor’s service. You also need to set up a node in the PeopleSoft application to process the response from your third-party vendor.

Oracle delivers XML messages for use with XML-based credit card processing vendors. You must build your own XML message transformation into the format that the vendor is expecting.

You can use PeopleSoft Application Engine to perform your transformations. You use the delivered EOEC_CCI_SYNC message for the request transaction and the delivered EOEC_CCI_RESPONSE message for the response transaction. The messages are detailed later in this section.

Note. If you have upgraded from a PeopleTools 8.47 or earlier release, the upgrade program creates service operations for these messages. The service operation names and message names are the same.

The diagram shows the process flow for integration with a third-party credit processing vendor.

EOEC_CCI_SYNC and EOEC_CCI_RESPONSE is used to integrate with a third-party credit processing vendor

EOEC_CCI_Sync Message

The EOEC_CCI_SYNC message is a synchronous request that the credit card interface sends to the third-party vendor. The request can be for an authorize, bill, authorize and bill, credit transaction, or authorization reversal. The PeopleCode that supports this message is located in App Package EOEC_CCI. The following tables describe the request fields and how they are populated by the PeopleSoft system.

Level 0 Record: EOEC_CCI_XMLPAY:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_UNIQUE_ID |

UNIQUEID |

Unique ID generated for each transaction. |

Level 1 Record: EOEC_CCI_RQST:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_MERCHANT |

VENDOR |

Populated from the merchant ID set up on the Credit Card Interface Installation page. |

|

EOEC_CCI_PARTNER |

PARTNER |

Hardcoded to “PeopleSoft”. |

Level 2 Record: EOEC_CCI_TRANS:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TRANSID |

TRANSACTION_ID |

Either blank or contains the request ID of a previous transaction (such as a prior authorization transaction). |

|

EOEC_CCI_MERCH_REF |

TRANSACTION_CUSTREF |

Contains a reference to the transaction such as an order or invoice number. |

|

EOEC_CCI_RQSTTOKEN |

N/A |

Either blank or contains the request token of a previous transaction (such as a prior authorization transaction). |

Level 3 Record: EOEC_CCI_TRNTYP:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TRANSACT |

TRANSTYPE |

The service to be performed:

|

Level 4 Record: EOEC_CCI_PAYDAT:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TRANSACT |

N/A |

N/A |

Level 5 Record: EOEC_CCI_INV:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_INV_NUM |

INVNUM |

Either blank or contains the request ID of a pervious transaction (such as a prior authorization transaction). Oracle recommends that you use TRANSACTION_ID instead of INVNUM in transformation programs because the field is only 20. |

|

EOEC_DATE |

N/A |

|

|

DESCR254 |

DESCRIPTION |

Hardcoded to “Description”. |

|

EOEC_CCI_DISC_AMT |

DISCOUNTAMT |

N/A |

|

EOEC_CCI_SHIP_AMT |

SHIPAMT |

N/A |

|

EOEC_CCI_DUTY_AMT |

DUTYAMT |

N/A |

|

EOEC_CCI_TAX_AMT |

TAXAMT |

N/A |

|

EOEC_CCI_TAX_INCL |

NATIONALTAXINCL |

N/A |

|

EOEC_CCI_TOTAL_AMT |

TOTALAMT |

The total amount of the transaction. |

|

EOEC_CCI_COMMENT |

COMMENT |

N/A |

|

CURRENCY_CD |

N/A |

N/A |

Level 6 Record: EOEC_CCI_BILLFM:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_FULLNAME |

NAME |

N/A |

|

EOEC_EMAIL_ADDR |

|

N/A |

|

PHONE |

N/A |

N/A |

|

FAX |

N/A |

N/A |

|

URL |

N/A |

N/A |

Level 7 Record: EOEC_CCI_ADDR1:

|

Message field |

Alias |

Populated with |

|

ADDRESS1 |

STREET |

N/A |

|

ADDRESS2 |

N/A |

N/A |

|

ADDRESS3 |

N/A |

N/A |

|

ADDRESS4 |

N/A |

N/A |

|

CITY |

N/A |

N/A |

|

STATE |

N/A |

N/A |

|

POSTAL |

ZIP |

N/A |

|

COUNTRY |

N/A |

N/A |

Level 6 Record: EOEC_CCI_BILLTO:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_CUSTID |

CUSTOMERID |

N/A |

|

EOEC_CCI_FULLNAME |

NAME |

N/A |

|

EOEC_EMAIL_ADDR |

|

Email address of the consumer. |

|

PHONE |

N/A |

Telephone number of the consumer. |

|

FAX |

N/A |

N/A |

|

EOEC_CCI_CUSTCODE |

CUSTCODE |

N/A |

|

EOEC_CCI_PO_NUM |

PONUM |

N/A |

|

EOEC_CCI_TAXEXEMPT |

TAXEXEMPT |

N/A |

Level 7 Record: EOEC_CCI_ADDR2:

|

Message field |

Alias |

Populated with |

|

ADDRESS1 |

STREET |

Street address of the consumer. |

|

ADDRESS2 |

N/A |

N/A |

|

ADDRESS3 |

N/A |

N/A |

|

ADDRESS4 |

N/A |

N/A |

|

CITY |

N/A |

City address of the consumer. |

|

STATE |

N/A |

State address of the consumer. |

|

POSTAL |

ZIP |

Postal address of the consumer. |

|

COUNTRY |

N/A |

Country address of the consumer. |

Level 6 Record: EOEC_CCI_SHIPFM:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_FULLNAME |

NAME |

N/A |

|

EOEC_EMAIL_ADDR |

|

N/A |

|

PHONE |

N/A |

N/A |

|

FAX |

N/A |

N/A |

Level 7 Record: EOEC_CCI_ADDR3:

|

Message field |

Alias |

Populated with |

|

ADDRESS1 |

STREET |

N/A |

|

ADDRESS2 |

N/A |

N/A |

|

ADDRESS3 |

N/A |

N/A |

|

ADDRESS4 |

N/A |

N/A |

|

CITY |

N/A |

N/A |

|

STATE |

N/A |

N/A |

|

POSTAL |

ZIP |

N/A |

|

COUNTRY |

N/A |

N/A |

Level 6 Record: EOEC_CCI_SHIPTO:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_FULLNAME |

NAME |

N/A |

|

EOEC_EMAIL_ADDR |

|

N/A |

|

PHONE |

N/A |

N/A |

|

FAX |

N/A |

N/A |

Level 7 Record: EOEC_CCI_ADDR4:

|

Message field |

Alias |

Populated with |

|

ADDRESS1 |

STREET |

N/A |

|

ADDRESS2 |

N/A |

N/A |

|

ADDRESS3 |

N/A |

N/A |

|

ADDRESS4 |

N/A |

N/A |

|

CITY |

N/A |

N/A |

|

STATE |

N/A |

N/A |

|

POSTAL |

ZIP |

N/A |

|

COUNTRY |

N/A |

N/A |

Level 6 Record: EOEC_CCI_ITEM:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_ITEM NUM |

ITEM_NUMBER |

N/A |

|

EOEC_CCI_SKU |

SKU |

N/A |

|

EOEC_CCI_UPC |

UPC |

N/A |

|

DESCR254 |

DESCRIPTION |

N/A |

|

EOEC_CCI_QTY AMT TOTALAMT |

QUANTITY |

N/A |

|

EOEC_CCI_UOM |

UNITOFMEASURE |

N/A |

|

EOEC_CCI_UNITPRICE |

UNITPRICE |

N/A |

|

EOEC__CCI_EXTAMT |

EXTAMT |

N/A |

|

EOEC_CCI_DISC_AMT |

DISCOUNTAMT |

N/A |

|

EOEC_CCI_TAX_AMT |

TAXAMT _ |

N/A |

|

EOEC_CCI_TOTAL |

TOTALAMT |

N/A |

Level 4 Record: EOEC_CCI_TENDER:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TRANSACT |

N/A |

N/A |

Level 5 Record: EOEC_CCI_CARD:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TYPE |

CARDTYPE |

Two-character code for the type of card used in the transaction.

|

|

EOEC_CCI_NUMBER |

CARDNUM |

Credit card number used in the transaction. |

|

EOEC_CCI_EXPYR |

EXPYR |

Expiration year of the card. |

|

EOEC_CCI_EXPMO |

EXPMO |

Expiration month of the card. |

|

EOEC_CCI_CVNUM |

CVNUM |

Card verification number. |

|

EOEC_CCI_MAGDATA |

MAGDATA |

N/A |

|

EOEC_CCI_FULLNAME |

NAMEONCARD |

First and last name of the consumer. |

|

EOEC_CCI_FNAME |

FIRSTNAME |

First name of the consumer. |

|

EOEC_CCI_LNAME |

LASTNAME |

Last name of the consumer. |

Level 5 Record: EOEC_CCI_STATUS:

|

Message field |

Alias |

Populated with |

|

EOEC_CCI_TRANS_REF |

PNREF |

N/A |

Note. When writing your transformation program, use the alias name to reference the fields. When you view the “Request — Original” text of the message, the alias name is displayed.

EOEC_CCI_RESPONSE Message

The EOEC_CCI_RESPONSE message is a response to the request that the credit card interface receives from the third-party vendor. Your transformation should populate the response message fields as shown in the tables.

Level 0 Record: EOEC_CCI_XMLRSP:

|

Message field |

Alias |

Populate with |

|

EOEC_CCI_UNIQUE_ID |

UNIQUEID |

N/A |

Level 1 Record: EOEC_CCI_RSPNS:

|

Message field |

Alias |

Populate with |

|

EOEC_CCI_MERCHANT |

VENDOR |

N/A |

|

EOEC_CCI_PARTNER |

PARTNER |

N/A |

Level 2 Record: EOEC_CCI_TRRSLT:

|

Message field |

Alias |

Populate with |

|

EOEC_CCI_TRANSID |

TRANSACTIONID |

The request ID or identifier returned from the third-party vendor. |

|

EOEC_CCI_RESULT |

RESULT |

Map the appropriate return code for the transmission result in the following way:

|

|

EOEC_CCI_AVS |

AVS |

N/A |

|

EOEC_CCI_CVRESULT |

CVRESULT |

N/A |

|

EOEC_CCI_RET_MSG |

MESSAGE |

Populate this with a text response from the vendor or this can be populated with text that explains to the user why a transaction was not successful. |

|

EOEC_CCI_TRANS_REF |

PNREF |

N/A |

|

EOEC_RET_AUTHCD |

AUTHCODE |

This should be populated with the authorization code returned from the vendor. |

|

EOEC_CCI_HOSTCODE |

HOSTCODE |

N/A |

|

EOEC_CCI_HOST_URL |

HOSTURL |

N/A |

|

EOEC_CCI_ORIGRSLT |

ORIGRESULT |

N/A |

|

EOEC_RET_STATUS |

TRSTATUS |

N/A |

|

EOEC_RET_STATUSMSG |

N/A |

N/A |

|

EOEC_RET_AUTHDTTM |

N/A |

N/A |

|

EOEC_CCI_RQSTTOKEN |

N/A |

N/A |

Level 3 Record: EOEC_CCI_AVRSLT

|

Message field |

Alias |

Populate with |

|

EOEC_MATCH_STREET |

STREETMATCH |

N/A |

|

EOEC_MATCH_ZIP |

ZIPMATCH |

N/A |

When writing the transformation program, use the alias name to reference the fields.

Note. The alias name is shown in the “Response — Original” message from within the Service Operations Monitor.

Agents can then process credit cards using their application-specific credit card transaction page to submit the transaction to the vendor for authorization, billing, authorization and billing, or credit. You can choose which types of transactions to permit.

See Also

PeopleTools: PeopleSoft Integration Broker PeopleBook

PeopleTools: Security Administration PeopleBook, “Setting up Digital Certificates and Single Signon”

PeopleTools: PeopleTools Portal Technologies PeopleBook

Setting Up Credit Card Integration for Integration Broker

Setting Up Credit Card Integration for Integration BrokerThis section discusses how to configure integration for Integration Broker.

Configuring Integration for Integration Broker

Configuring Integration for Integration BrokerTo set up Integration Broker for credit card processing:

Define the Integration Broker Gateway if it's not already done.

Activate the delivered service (EOEC_CCI_SYNC) that is used for the credit card integration.

Set up an external node to use when using the XML-based interface to which the XML messages should be sent and to indicate where the processor is located.

Also specify the authentication option that you arranged with the credit card processor.

Set up routings.

Use the Routings tab in the Node component to add the EOEC_CCI_SYNC service to the node. To see the XML data before and after transformations, set the log detail to Header & Detail. This is helpful when troubleshooting your new integration.

Test the integration.

You can use the test component described below.

If you receive error messages when using Integration Broker, see the Troubleshooting the Integration Broker Setup section below:

Troubleshooting the Integration Broker Setup

Several sources of information are available when the setup is not successful. These include but are not limited to:

Error messages stored on the message instance (view with the message monitor).

IB gateway error log (http://<GatewayMachine>:<Port>/PSIGW/errorLog.html).

IB gateway message log (http://<GatewayMachine>:<Port>/PSIGW/msgLog.html).

Application server log for the active IB domain server on the database.

Web server logs.

You can also do the following:

Increase the log fence on the gateway properties file. This file is located in the following directory: PS_CFG_HOME\webserv\<web-server>\applications\peoplesfoft\PSIGW

If you set the log fence to five in the integration Gateway properties, you will receive more details in the error and message logs.

Check the Service Operations Monitor to view the XML messages before and after the transformations (PeopleTools, Integration Broker, Monitor, Service Operations, Synchronous Services).

Check the Header and Detail logs on the Synchronous Detail page (PeopleTools, Integration Broker, Service Operations Monitor, Monitor, Synchronous Details).

Problems are usually due to incorrect transformations between the two systems. Use these logs to ensure that your transformations are correct.

Your Response-Transformed message structure should look similar to this:

<?xml version="1.0"?> <EOEC_CCI_RESPONSE xmlns:c="yourcompany.com"> <FieldTypes> <EOEC_CCI_XMLRSP class="R"/> <EOEC_CCI_TRRSLT class="R"> <RESULT type="NUMBER"/> </EOEC_CCI_TRRSLT> <EOEC_CCI_AVRSLT class="R"/> <EOEC_CCI_RSPNS class="R"/> <PSCAMA class="R"/> </FieldTypes> <MsgData> <Transaction> <EOEC_CCI_XMLRSP class="R"> <UNIQUEID/> <EOEC_CCI_RSPNS class="R"> <VENDOR/> <PARTNER/> <EOEC_CCI_TRRSLT class="R"> <TRANSACTIONID>177</TRANSACTIONID> <RESULT>0</RESULT> <AVS/> <CVRESULT/> <MESSAGE/> <AUTHCODE>123456</AUTHCODE> <HOSTCODE/> <HOSTURL/> <ORIGRESULT/> <TRSTATUS/> <EOEC_RET_STATUSMSG/> <EOEC_RET_AUTHDTTM/> <EOEC_CCI_AVRSLT class="R"> <STREETMATCH/> </EOEC_CCI_AVRSLT> </EOEC_CCI_TRRSLT> </EOEC_CCI_RSPNS> </EOEC_CCI_XMLRSP> </Transaction> </MsgData> </EOEC_CCI_RESPONSE>

See Also

PeopleTools: PeopleSoft Integration Broker PeopleBook

PeopleTools: PeopleSoft Integration Broker Administration PeopleBook

PeopleTools: Security Administration PeopleBook, “Setting up Digital Certificates and Single Signon”

PeopleTools: PeopleTools Portal Technologies PeopleBook

Setting Up Credit Card Interface Elements

Setting Up Credit Card Interface Elements

This section discusses how to:

Define connection parameters.

Define accepted credit card types.

Test the credit card interface.

Test credit card transactions.

Note. The information is this section is used for credit card integration using Integration Broker, or any manual processing that you have set up for credit card processing vendors.

Pages Used to Set Up Credit Card Interface Elements

Pages Used to Set Up Credit Card Interface Elements|

Page Name |

Definition Name |

Navigation |

Usage |

|

EOEC_CCI_INSTAL |

Enterprise Components, Component Configurations, Credit Card Interface, Setup |

Define connection parameters for credit card processing calls to a third-party vendor. Before you set up credit card processing options, establish your merchant account with a third-party vendor. |

|

|

EOEC_CCI_CARDTYPE |

Enterprise Components, Component Configurations, Credit Card Interface, Credit Card Types |

Define the types of credit cards you accept for credit card processing. |

|

|

EOEC_CCI_TEST |

Enterprise Components, Component Configurations, Credit Card Interface, Test Credit Card Interface, Card Entry/Display |

Enter test credit card information that you can submit to verify that your credit card processing is functioning properly. |

|

|

EOEC_CCI_TRANSACT |

Enterprise Components, Component Configurations, Credit Card Interface, Test Credit Card Interface, Transaction |

Enter test credit card transaction information that you can submit to verify that your credit card processing is functioning properly. |

Defining Connection Parameters

Defining Connection Parameters

Access the Credit Card Interface Installation page (Enterprise Components, Component Configurations, Credit Card Interface, Setup).

Use the Credit Card Interface Installation (EOEC_CCI_INSTAL) page to set up connection parameters for credit card processing calls to a third-party vendor.

Note. Before you set up credit card processing options, establish your merchant account with a third-party vendor.

Note. Check the installation documentation for the product you are installing for specific details on setting up credit card interfaces.

Verify connection requirements with your vendor.

|

Credit Card Merchant ID |

Enter the merchant ID supplied by your vendor. |

|

Credit Card Hist. Backup Days (credit card history backup days) |

If you create a process that archives history records, specify the number of days that you retain credit card authorization history records. |

|

Credit Card Tracing |

This field is currently not used. |

|

On-line Transmission Retries |

Enter a value from 0 through 9 to specify how many times the system should attempt to retransmit transactions in the event of transmission failure. |

|

Address Verification Flag |

Credit card transmissions can fail authorization if the address that you send doesn't exactly match the billing address for the credit card. Select from: Add Vf ON (address verification on): Transactions fail when the address that you send does not match the credit card billing address. This is the default value. Add Vf OFF (address verification off): Transactions do not fail when the address that you send does not match the billing address on the credit card. |

|

Type of Interface |

Select to use Integration Broker as the interface type. |

Allowed Transaction Types

|

Credit Card Transaction Type |

Select the types of transactions that your agents are allowed to submit. Disallowed transaction types are not available on the application-specific credit card transaction page. Select from: Authorization Reversal: Your vendor can cancel the transaction after authorization and before payment is received. This makes the funds available if the transaction is cancelled. Authorize Only: Your vendor verifies that the card is valid for the charge. For example, the customer has enough credit to pay for the order, the card is not stolen, and so forth. The vendor does not bill the credit card. Bill Only: Your vendor bills the card without first verifying that the card is valid for the charge. Select this option if you have preauthorized the transaction and you want to submit the transaction for billing only. Authorize and Bill: Your vendor performs both authorization and billing during the same transaction. The vendor charges the customer’s credit card on receiving authorization. Credit Only: Your vendor credits the customer’s credit card. |

|

Process Credits |

Select to permit agents to submit credit transactions as well as billing transactions. This option is available only if you selected either Authorize and Bill or Bill Only in the Credit Card Transaction Types field. |

Connection Parameters

The third-party vendor that you integrate with will provide you with information to connect with their systems. Enter that information to enable your PeopleSoft system to make the connection when you submit a transaction for processing.

Defining Accepted Credit Card Types

Defining Accepted Credit Card Types

Access the Card Type page (Enterprise Components, Component Configurations, Credit Card Interface, Credit Card Types).

Use this page to define the types of credit cards that you accept for credit card processing.

Oracle delivers data for most popular credit card types. You can modify existing definitions and add new ones.

|

Credit Card Type |

Enter a value for the credit card. |

|

Credit Card Name |

Enter a credit card name such as Visa or MasterCard. The name should match the credit card type so that you can identify the card without memorizing the credit card type codes. |

|

Credit Card Number Length |

Enter the card's standard credit card number length. Before transmitting a request to your vendor, the system validates the length of the credit card number against this number. |

|

Credit Card Status |

Select Active if you accept this type of credit card. Select Inactive if you don’t accept this type of credit card. Inactive credit card types do not appear on the application-specific credit card transaction page or in the Test Credit Card Interface component. The default value for this field is Inactive. |

|

Credit Card Valid Prefixes |

Enter all valid prefixes for this type of credit card. Enter multiple prefixes in comma-separated format with no spaces in between. The system removes any characters other than numbers and commas when you move to another field. Before transmitting a request to your vendor, the system validates that the credit card number starts with a valid prefix. |

|

Use Check Digit Algorithm |

Select Y (yes) to use the modulus (MOD) 10 check digit algorithm to validate credit card numbers before transmitting requests to your vendor. The MOD 10 check digit algorithm verifies whether card numbers you enter into the system are legitimate. The default value for this field is N. |

|

Credit Card Expiration Days |

Enter a four digit numerical expiration value. |

Testing the Credit Card Interface

Testing the Credit Card Interface

Access the Test Credit Card Interface - Card Entry/Display page (Enterprise Components, Component Configurations, Credit Card Interface, Test Credit Card Interface, Card Entry/Display).

Use this page to enter test credit card information that you can submit to verify that your credit card processing is functioning properly.

The test that you can run on this page:

Verifies that the card number you enter meets the requirements defined in the Credit Card Valid Prefixes field for the associated card type on the Card Type page.

If you have set the Use Check Digit Algorithm field value to Y, verifies that the card number is valid based on the MOD 10 check digit algorithm.

Verifies that you have entered values in the Exp. Month, Expiration Year, First Name and Last Name fields on this page.

You can use the following credit card sample data in your test transactions:

|

Credit Card Type |

Credit Card Number |

|

American Express |

378282246310005 |

|

Diners Club/Carte Blanche |

38000000000006 |

|

Discover |

6011111111111117 |

|

MasterCard |

5555555555554444 |

|

Visa |

4111111111111111 |

|

Card Type |

Select a card type to test. Available values are defined on the Credit Card Types page. |

|

Credit Card Number |

Enter the credit card number to test. |

|

Exp. Month (expiration month), Expiration Year, Card Verification Number, First Name and Last Name |

Enter card information to test. Card verification number is optional in running credit card tests. |

|

Toggle Display |

Click to switch between display-only and editable modes. |

|

Test |

Click to begin the test. |

|

Test Results |

The results of the test appear in this text box. If the card number is valid, the message VALID CARD NUMBER appears. If the card number is not valid, an explanatory message appears; the card number is incorrect or the card is expired, for example. |

Testing Credit Card Transactions

Testing Credit Card Transactions

Access the Credit Card Transaction Test page (Enterprise Components, Component Configurations, Credit Card Interface, Test Credit Card Interface, Transaction).

Use this page to enter test credit card transaction information that you can submit to verify that your credit card processing is functioning properly.

The test that you can run on this page verifies that your environment is set up correctly to process online credit card transactions using XML Compliant integration.

Note. This does not test the environment that is set up for batch credit card transactions.

|

Sequence and Request ID |

Display a combination of numbers that distinguishes the transaction from other transactions. The combination of numbers are similar to a run control or job number. |

|

Amount |

Enter a transaction amount and click the Look up button to select a transaction currency. |

|

Token |

The token is a response value that is returned from the Credit Card processing service. It is another validation that can be referenced in regards to a specific transaction. |

|

Trans. Type (transaction type) |

Choose a transaction type to test: Auth/Bill (Authorization/Bill): Perform both authorization and billing during the same transaction. AuthRev (Authorization Reversal): Cancel the transaction after authorization and before payment is received. Authorize: (default value) Verify that the card is valid for the charge. Bill: Bill the card without first verifying that the card is valid for the charge. Credit: Credit the customer’s credit card. |

|

Class ID |

Select TestTransaction (the default) or one of the following interface types that has been specified on the Credit Card Interface Installation page. ProcessBrokerTransaction: Select if you want to test your XML-based interface. InterlinkTransaction: Select if you want to test your Business Interlink interface. |

|

Process |

Click to process the test transaction. |

|

Return Code |

Enter a return code to test whether proper error messages and results are returned. Available codes and their descriptions are discussed in the Return Codes section subsequently. |

|

Test Results |

The results of the transaction test appear in this text box. Test result interpretations are discussed in the following sections. |

You can enter any of the following return codes and click Process to view the corresponding description and error message in the Test Results area. These return codes and their corresponding error messages can appear in multiple areas. For example, when you are using the Test Credit Card Interface component, they appear on this test page. In an application, they appear as appropriate for that application's method of interacting with the credit card interface.

|

Return Code |

Description |

|

-3 |

Error Opening Trace File |

|

-4 |

Vendor Error − ICS_INIT failed |

|

-5 |

Unsupported Service |

|

-6 |

Credit card number is invalid |

|

-7 |

Phone number is too long |

|

-8 |

State field length is invalid |

|

-9 |

Zip Code field is too long |

|

-10 |

Amount must be greater than zero |

|

-11 |

Vendor Error − ICS_SEND failed |

|

-12 |

Decryption Failed |

|

-15 |

Request ID is required |

|

-16 |

Currency is required |

|

-17 |

Phone is required |

|

-18 |

Email ID is required |

|

-19 |

Zip Code is required |

|

-20 |

City is required |

|

-21 |

Country code is required |

|

-23 |

Address 1 is required |

|

-99 |

Trace Run Only |