Common Element Used in this Chapter

Common Element Used in this ChapterThis chapter discusses how to:

Set up loan participants for CRC.

Set up loan types for CRC.

Set up loan validation edits for CRC.

Select equations for the hold and release process for CRC.

Create loan destinations for CRC.

Specify loan processes for CRC.

Set up loan origination for CRC.

Set up process demographic data for CRC.

Set up certification requests for CRC.

Review loan action codes for CRC.

Common Element Used in this Chapter

Common Element Used in this Chapter|

OPEID (office of postsecondary education identifier) |

An identifier assigned to a school by the Department of Education. |

Setting Up Loan Participants for CRC

Setting Up Loan Participants for CRC

To set up loan participants for CRC, use the Create CRC Loan Participants component (SFA_CRC_DEST_ID).

Participants in the loan process include lenders, guarantors, and loan servicers. To streamline the loan process, identify all loan participants and understand their electronic loan processing requirements and agreements with your institution. The loan participants tables are not institution or aid year specific.

This section discusses how to set up guarantors, lenders, and servicers.

Pages Used to Set Up Loan Participants

Pages Used to Set Up Loan Participants|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRC_DEST_ID |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Participants, CRC Loan Servicers |

View, update, or add guarantor, lender, or servicer information that process loan certification request records with your institution. |

|

|

EO_ADDR_USA_SEC |

Click the Edit Address link on the CRC Loan Servicers page. |

Edit or view guarantor, lender, or servicer address information. |

|

|

SFA_CRC_DESTCT_SEC |

Click the Contact Address link on the CRC Loan Servicers page. |

Edit or view the country, mailing address, and email address. |

Setting Up Guarantors, Lenders, and Servicers for CRC

Setting Up Guarantors, Lenders, and Servicers for CRC

Access the CRC Loan Servicers page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Participants, CRC Loan Servicers).

Use this page to add your guarantors, lenders, and servicers.

|

OPEID (office of postsecondary education identifier) |

Displays an eight-digit alphanumeric identifier assigned to a federal student aid participant by the Department of Education. |

|

OPEID Type (office of postsecondary education identifier) |

Displays the type of lending participant (guarantor, lender, or servicer) for which you are adding information. |

|

Select Servicer |

Indicates whether the loan servicer is selected to be an active business partner with the school. Select Yes or No. |

|

Preferred Lender |

Select this check box to make this lender available for self-service lender selection by the student. |

|

Certification RQST Participant (certification request participant) |

Select if the lender or loan servicer agrees to process loans using certification request. |

|

Edit Address |

Click to access the Edit Address page to review or update address information. |

|

Contact Address |

Click to review or update contact information. |

Setting Up Loan Types for CRC

Setting Up Loan Types for CRC

To set up loan types for CRC, use the Create Loan Types component (LOAN_TYPE).

This section discusses how to:

Define loan types.

Link CommonLine loan types to NSLDS loan history information.

Assign checklists.

Pages Used to Set Up Loan Types

Pages Used to Set Up Loan Types|

Page Name |

Definition Name |

Navigation |

Usage |

|

LOAN_TYPE_TABLE |

Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, Loan Type Table |

Define the types of loans your institution uses in the loan origination process. |

|

|

LOAN_TYPE_TABLE2 |

Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, CommonLine/NSLDS Xref |

Link federal loan types defined for CommonLine processing with the borrower's loans reported by the NSLDS. |

|

|

LOAN_TYPE_DOCUMENT |

Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, Checklist Setup |

Associate a checklist to be generated when a loan is originated. |

Defining Loan Types

Defining Loan Types

Access the Loan Type Table page (Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, Loan Type Table).

When you set up a loan financial aid item type, you include specific conditions for processing the loan. You must complete the Loan Type Table page to complete the setup. Loan types are used for both CL 4 and CRC.

Processing

|

Loan Category |

Select from Alt Loan (alternative loan), PLUS, Sub/Unsub (subsidized/unsubsidized), Subsidized, and Unsubsidized. If you select PLUS, a Graduate PLUS Indicator check box displays. Select the check box for Grad PLUS loans. |

|

Loan Program |

Select from Alternative,Direct, FFELP, Health, Perkins, State, and University. For example, to set up Stafford loans processed through CommonLine, the loan category is Sub/Unsub and the loan program is FFELP. To set up an alternative loan program processed through CommonLine, the loan category is Alt Loan (alternative loan), and the loan program is Alternative. |

|

Loan Refund Indicator |

Select from: Borrower: Select to have the borrower of the loan receive any refunds or overage. For example, the borrower could be a parent or guardian for a PLUS loan. Student: Select to have the student to receive any refunds from the loan. You can override this field at the loan application level. Designating the student as the recipient for PLUS refunds requires additional setup in PeopleSoft Student Financials. |

Requirements

The system enforces the selected requirements during loan origination and validation.

|

Loan References Required |

Enter reference information on the CommonLine Promissory Note PLUS/Alt and Originate Loans components. Enter the number of references required in the Nbr Ref Rq (number of references required) field. |

|

Nbr Ref Rq (number of references required) |

Enter the number of references required if you selected the Loan References Required check box. |

|

Credit Check Required |

Select to require a credit check. |

|

Loan Cosigner Required |

If you select this check box, enter the number of cosigners required in the Nbr Csg Rq (number cosigners required) field. |

|

Nbr Csg Rq (number cosigners required) |

Enter the number of cosigners required if you selected the Cosigner Required Amount check box. |

|

Cosigner Required Amount |

Enter the minimum loan amount requiring a cosigner. Enter cosigner information on the CommonLine Promissory Note PLUS/Alt and Originate Loans components. This setting is enforced by the loan servicer. |

|

Loan Fee Rate |

Enter the loan fee rate to print on the promissory note for this loan type. Ensure that the loan fee rate matches the loan fee setup for the item type that you associate with this loan type. |

|

Max Nbr Disbs (maximum number disbursements) |

Indicates the maximum amount of disbursements. |

|

Min Loan Amt (minimum loan amount) |

Indicates the smallest amount for which a loan can be originated. |

Loan Item Types

Select a setID and an item type. You can have multiple item types associated with the same loan type. You cannot share item types across multiple loan types. For example, to define FFELP Stafford loans where the loan category is Sub/Unsub, enter the subsidized and unsubsidized item types.

Note. Based on the business processes defined by your institution, you may need to create multiple loan types for the same loan program.

The system displays the type loan fee, loan fee amount, fee type, and loan fee percent for the item type selected. These values are associated with the item type when you set up the financial aid item type on the Loan Fee Table page.

See Also

Linking CommonLine Loan Types to NSLDS Loan History Information

Linking CommonLine Loan Types to NSLDS Loan History Information

Access the CommonLine/NSLDS Xref page (Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, CommonLine/NSLDS Xref).

When you originate a CommonLine loan, the system uses the information set up on this page to search for similar loans in the borrower's NSLDS history. If a prior loan is found, the system uses the prior loan information to derive the new loan's destination. This optional feature can be set up in the Loan Institution setup page.

|

Alternative Loan Type Cd (alternative loan type code) |

Indicates a code to notify loan agencies the type of alternative loan. Alternative loan codes are assigned by NCHELP. |

|

NSLDS Loan Type |

Select a loan type to translate the NSLDS loan type that's defined in the NSLDS tables. |

See Also

www.nchelp.org

Assigning Checklists

Assigning Checklists

Access the Checklist Setup page (Set Up SACR, Product Related, Financial Aid, Loans, Create Loan Types, Checklist Setup).

The values of the Loan Type, Loan Program, and Loan Ctgry (loan category) fields are based on the aid year and academic institution that you selected to access the page.

|

Checklist |

Select a checklist to be created when a loan is originated. Note. For Direct Loan, the system does not generate an assigned checklist during loan origination. It generates an assigned checklist when you run the print promissory note process. |

Setting Up Loan Validation Edits for CRC

Setting Up Loan Validation Edits for CRC

To set up loan validation edits for CRC, use the Maintain CRC Loan Edits component (SFA_CRC_EDITS) and Create Loan Edit Sets component (SFA_CRC_EDITDFT).

This section provides an overview on loan validation edits and discusses how to:

Define validation edit messages.

Create loan validation edit sets.

See Also

Equation Engine Programmer's Guide

Understanding Loan Validation Edits

Understanding Loan Validation EditsLoan edits verify that the loan origination data is valid for transmission to the receiving loan agency. All CommonLine loan validation edits must be defined in the Loan Edits/Message Table page. Financial Aid delivers a core set of edits to be used during loan validation. All CommonLine loan edits are equations written using the Equation Engine. Separate edits are created for both CRC and CL 4 loans. You can use the Equation Engine to create or modify equations to support loan agencies that are not defined as a CommonLine standard.

Pages Used to Set Up Loan Validation Edits

Pages Used to Set Up Loan Validation Edits|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRC_EDITS |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Maintain CRC Loan Edits, Load Edits/Messages |

View delivered edits and error messages used in loan validation. You must correct all loan errors before loan data can be selected for outbound processing. You can modify the message text. |

|

|

SFA_CRC_EDITDFT |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Edit Sets, Loan Edit Defaults |

Create loan validation edit sets that are used when constructing loan destination profile records. Loan edit default sets are logical sets of edits that can be executed based on loan program, loan category and process level. After they are added to a loan destination, you can further modify the edit sets to function according to the loan destination's business rules. |

Defining Validation Edit Messages

Defining Validation Edit Messages

Access the Loan Edits/Messages page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Maintain CRC Loan Edits, Load Edits/Messages).

This page is delivered preloaded. Review and update edit error messages as needed. New loan edits created with the Equation Engine must be added to this page for the loan validation process to use them. Use the Equation field to select an Equation Engine equation.

The Loan Orig Edit Errors (loan origination edit errors) page in the Maintain Originated Loans component (SFA_CRC_ORIG) displays any edit errors encountered during the loan origination process.

Predefined errors are described in this table:

|

Equation |

Description |

Cause |

Resolution |

|

FACRADDR01 |

Permanent address missing. |

Used for alternative/PLUS loans. A valid permanent address cannot be found for the student. The address type is based on the FA Process Demographic Use page permanent address usage setting. |

Add a valid address that can be used as the permanent address on the Addresses page or modify the permanent address usage setting to select one of the student's existing addresses. |

|

FACRADDR02 |

Mailing address missing. |

Used for alternative/PLUS loans. A valid mailing address cannot be found for the student. The address type is based on the FA Process Demographic Use page mail address usage setting. |

Add a valid address that can be used as the mailing address on the Addresses page or modify the mailing address usage setting to select one of the student's existing addresses. |

|

FACRADDR03 |

Borrower perm address missing. |

A valid permanent address cannot be found for the borrower. The address type is based on the FA Process Demographic Use page permanent address usage setting. |

Add a valid address to the borrow ID that can be used as the permanent address on the Addresses page or modify the permanent address usage setting to select one of the student's existing addresses. |

|

FACRADDR04 |

Borrower mail address missing. |

A valid mailing address cannot be found. The address type is based on the FA Process Demographic Use page mail address usage setting. |

Add a valid address that can be used as the mailing address on the Addresses page or modify the mailing address usage setting to select one of the student's existing addresses. |

|

FACRBORROW01 |

Loan borrower not defined. |

Used for PLUS loans. The Borrower ID field in the Maintain Originated Loans component is blank. |

Enter the correct ID on the Loan Origination 1 page. Parent borrowers must already be defined in PeopleSoft Campus Community Fundamentals. |

|

FACRCHNG01 |

Loan increase with undisbursed check. |

Used for change transactions. A post disbursement change transaction is generated and an undisbursed check exists for the loan. |

Disburse the funds to the student account or return the funds to the lender. |

|

FACRCOSIGN01 |

No cosigners - cosigners required. |

Used for alternative loans. If cosigners are required for the loan type, the edit verifies that the required number of cosigners are not defined in the Relationships page for the student and are also assigned to the loan. |

Add the missing cosigners in the Relationships page and Maintain Originated Loans component. |

|

FACRCOSIGN02 |

Cosigner signature required. |

Used primarily for alternative loans. Cosigner signatures have not been entered in the Enter Alt Loan Prom Notes page. |

Fix the data on the Alt Loan Prom Notes page. |

|

FACRDEBT01 |

Total student loan debt required. |

Used for alternative loans. The total loan debt on the Maintain Originated Loans component is 0, and NSLDS loan history exists. |

Update the total loan debt in the Maintain Originated Loan component using the Loan Demographic Data page. |

|

FACRDEPSTAT1 |

Dependency Status missing. |

The student's federal dependency status was missing when the loan was originated. |

Use the Loan Demographic Data page to update the dependency status in the Maintain Originated Loan component. |

|

FACRDEST01 |

Loan destination is zero missing. |

The loan destination is not assigned after the loan has been originated. This edit is always executed by the loan validation process and cannot be deactivated. |

Assign a loan destination in the Loan Origination 1 page. |

|

FACRDISBDT01 |

Disbursement more than 90 days after loan period end. |

A disbursement date is set for greater than 90 days beyond the loan period end date. |

Change the date on the Loan Origination 2 page. |

|

FACRDISBDT02 |

Disbursement date earlier than 13 days of loan period start. |

The first disbursement precedes the loan period begin date by more than 13 days. |

Fix the disbursement date or loan period start date in the Loan Origination 2 page. |

|

FACRDISBDT03 |

Disbursement dates must be in chronological order. |

Disbursement dates are not in order. |

Fix disbursement dates in the Maintain Originated Loan component, Loan Origination 2 page. |

|

FACRDRVLIC01 |

Borr DL Number or state missing. |

The borrower's drivers license information was incomplete when the loan was originated. |

Update the driver's license data in the Driver's License page and then use the Loan Demographic Data page to update this information in the Originate Loan component. |

|

FACRGRADDT01 |

Grad date before loan end date. |

The graduation date viewed in the Maintain Originated Loans component is before the end of the loan period. |

Update the FA Term graduation date (if required) and then use the Loan Demographic Data page to update this graduation date in the Maintain Originated Loans component. |

|

FACRHOLDFED1 |

Disbursement hold on federal aid. |

A disbursement hold on federal aid has been placed on the student. |

Remove the federal aid disbursement hold on the student in the Packaging Status Summary page. |

|

FACRNAME01 |

Student Name missing. |

A valid name type cannot be found. The name type should be based on the FA Process Demographic Use page name usage setting. |

Add a valid name type that can be used as the student's name on the Names page or modify the name usage setting to select one of the student's existing names. |

|

FACRNAME02 |

Borrower name missing. |

A valid name type cannot be found. The name type should be based on the FA Process Demographic Use page name usage setting. |

Add a valid name type that can be used as the borrower's name on the Names page or modify the name usage setting to select one of the borrower's existing names. |

|

FACRPER01 |

Loan period greater than 1 year. |

The loan period defined in the Loan Origination 2 page is more than one year. |

Change the loan period dates so that the loan period is less than a year. |

|

FACRPLUS01 |

PLUS borrower and student SSN are the same. |

A PLUS borrower cannot be the student. |

Correct possible invalid relationship defined for the student. Assign a new borrower for the PLUS loan. |

|

FACRPLUS02 |

No PLUS for grad students allowed. |

The student has a graduate NSLDS level in the FA Term record when the loan is originated. |

Cancel the loan if appropriate, or change the student's grade level to an undergraduate in the correct FA Term record. If you change the student's grade level, then you also need to use the Loan Demographic Data page to update it in the Originate Loan component. |

|

FACRPLUSMPN |

Serial PLUS MPN check. |

For PLUS loans. Confirms a prior PLUS loan with the same EmplID, borrower EmplID, and lender in the CommonLine MPN Usage page with the current PLUS loan. |

To process serially, modify the loan record by changing the borrower or loan destination so that the borrower and lender match the information in the CommonLine MPN Use page. If the loan should be processed as a new MPN, set the Serial Loan Code field on the Loan Origination 3 page from S to N. |

|

FACRREFS01 |

References missing. |

The required number of references have not been defined for the student in the Relationships page and have not been assigned to the loan. |

Add the missing references in the Relationships page and Maintain Originated Loans component. |

|

FACRSRVCIN01 |

Service indicator exists. |

An active negative service indicator is assigned to the student. |

Remove the service indicator. |

|

FACRSSN01 |

Borrower SSN is blank. |

For PLUS and Alternative loans. When the loan was originated, either the borrower was not assigned, or the borrower ID did not have a valid Social Security Number (SSN). A valid SSN has the appropriate country code and a NID type of PR. |

Verify that the borrower is assigned in the Maintain Originated Loans component. If appropriate, fix the SSN on the Biographical Details page component and then pull the SSN into the originated loan record using the Loan Demographic Data page. |

|

FACRSSN02 |

Student SSN is blank. |

When the loan was originated, the student did not have a valid SSN. A valid SSN has the appropriate country code and a NID type of PR. |

Fix the SSN on the Biographical Details page and then pull the SSN into the originated loan record using the Loan Demographic Data page. |

Creating Loan Validation Edit Sets

Creating Loan Validation Edit Sets

Access the Loan Edits Defaults page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Edit Sets, Loan Edit Defaults).

Create logical sets of loan validation edits based on the loan program, loan category, and processing level. When creating loan destination profiles, the system uses these edit sets to automatically populate the loan destination edits page for the loan destination, simplifying your setup.

|

Loan Program |

Values are: Alternative, FFELP, Direct Lending, Health Professions, State, and University. |

|

Loan Category |

Values are: Alt Loan (alternative loan), PLUS, Sub/Unsub (subsidized/unsubsidized), Subsidized, and Unsubsidized. |

|

Processing Level |

Values are: Direct (not applicable), Guarantee and Print Appl (guarantee and print application), Print and Guarantee, Guarantee Only, School Cert Request (school certification request), and Manual. |

Default Profile Edits

Define loan edits to use during validation for the selected loan program, category, and destination processing level. In addition to creating new edit sets, you can also add or delete edits, or activate or deactivate existing edits.

|

Equation |

Select a predefined equation. Edit equations are set up on the CRC Loan Edits/Messages page. |

|

Loan Requirement Status |

For each section, indicate one of the following: Optional: The selected section is not a requirement for the loan. Recommended: The selected section is not a requirement for the loan. Required: The selected section is a requirement for the loan. Note. The field value does not drive current loan functionality, but is intended to support future business processes. |

|

Loan Edit Activated |

Select to activate an edit. |

Selecting Equations for the Hold and Release Process for CRC

Selecting Equations for the Hold and Release Process for CRC

To set up equations for the hold and release process for CommonLine loans, use the Hold and Release Equations component (LN_CLHR_EQ_NAME).

This section discusses how to select equations for the CommonLine disbursement hold and release process. This process is used for both CommonLine 4 and Common Record CommonLine loans.

Page Used to Set Equations for Hold and Release

Page Used to Set Equations for Hold and Release|

Page Name |

Definition Name |

Navigation |

Usage |

|

LN_HR_EQ_NAME_PNL |

Set Up SACR, Product Related, Financial Aid, Loans, Hold and Release Equations, Hold/Release Equations |

Select the equations that you require the hold and release process to execute. |

Selecting Equations for Hold and Release

Selecting Equations for Hold and Release

Access the Hold/Release Equations page (Set Up SACR, Product Related, Financial Aid, Loans, Hold and Release Equations, Hold/Release Equations).

The equations that you select on this page form an equation set unique to the specified process name.

|

Description |

Displays the process for which you are selecting equations. |

|

Equation Name |

Select an equation. The list contains all equations created for the selected institution; select only those equations created specifically for hold and release processing. |

If you use the hold and release process at your institution without modifications, create at least one hold/release equation set with the two provided hold and release equations: FAHDLOADLVL (Load Level edit) and FAHDSAPSTAT (Satisfactory Academic Progress check).

Note. If you create your own equations, follow the naming conventions described in the Equation Engine documentation to prevent the accidental deletion of custom equations during application upgrades.

Creating Loan Destinations for CRC

Creating Loan Destinations for CRC

To set up loan destinations for CRC, use the Create CRC Loan Destinations component (SFA_CRC_DEST_PROF).

This section provides an overview on loan destinations for CRC and discusses how to:

Define loan destination profiles for CRC.

Define loan processing levels for CRC.

Define loan destination validation edits for CRC.

Understanding Creating Loan Destinations for CRC

Understanding Creating Loan Destinations for CRCConsolidate the loan participants—the lender, guarantor, and servicer—into one entity, the loan destination. The loan destination defines the business characteristics and protocols between a lender, guarantor, and servicer which enables them to process loans for the school. You must create a loan destination profile for each lender/guarantor/servicer relationship in the FFELP loan program and alternative loan program, and for the Direct Lending servicer for direct loans.

Note. If you continue to process loans under the CommonLine 4 protocol, you should not create active CRC loan destination profiles for the same CommonLine 4 destinations until you are ready to use them.

Page Used to Create Loan Destinations

Page Used to Create Loan Destinations|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRC_DEST_PROF |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Loan Dest Profile |

Define participants that your institution uses to exchange loan application data. |

|

|

SFA_CRC_DEST_PROF2 |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Process Levels |

Define the valid loan processing levels for the loan destination. |

|

|

SFA_CRC_DEST_EDITS |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Validation Edits |

Define the validation edits to be used for loans originated for the loan destination. |

Defining Loan Destination Profiles for CRC

Defining Loan Destination Profiles for CRCAccess the Loan Dest Profile page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Loan Dest Profile).

Loan Destination Profile

|

Loan Destination Nbr (loan destination number) |

Indicates the loan destination number. |

|

Effective Date |

Enter the date for which this destination is valid and active. |

|

Status |

Indicates the effective status. Select Active or Inactive for the effective-dated row set. |

Destination Components

|

Guarantor OPEID, Lender OPEID, Servicer OPEID (office of postsecondary education identifier) |

Indicates the numeric identifier assigned by the Department of Education. |

|

Lender Branch ID |

Indicates the lender branch ID. This field is required if a Lender OPEID value exists. |

|

Servicer Branch Code |

Indicates the servicer branch code. This field is required if a Servicer OPEID value exists. |

File Routing Control

|

Application |

Indicates the recipient of the CRC application file. The system displays the recipient name and OPEID used on the XML document record. |

|

Pre Disb Changes (pre disbursement changes) |

Indicates the recipient of the CRC change file. The system displays the recipient name and OPEID used on the XML document record. |

|

Post Disb Changes (post disbursement changes) |

Indicates the recipient of the CRC change file. The system displays the recipient name and OPEID used on the XML document record. |

|

File Path |

Indicates the physical location in your production environment where the CRC XML files are to be created. Note. The correct syntax of the path statement is dependent on the schools operating systems. The path must end in a closing character (a back slash or forward slash). |

|

Accept Change Records |

Select this check box to indicate that the loan destination accepts change records. The Pre Disb Changes and Post Disb Changes fields are not be accessible if the loan destination does not accept changes. |

Build Options

|

CRC Version |

Select CRC to indicate the CommonLine protocol the loan destination supports. |

|

Stafford MPN Process Default |

Select New MPN or Serial MPN to indicate the default serial MPN indicator to assign during origination. |

|

PLUS MPN Process Default |

Select New MPN or Serial MPN to indicate the default serial MPN indicator to assign during origination. |

|

Prom Note Delivery Default (promissory note delivery default) |

Select Email,Paper, or Web to establish the default method for delivering promissory notes to the lender. |

|

Disb Hold/Release Default (disbursement hold/release default) |

Select Hold, No Support, or Release to establish the disbursement hold/release status to assign during origination. |

|

Funds Return Method Code |

Select Borr Check, EFT, Master Chk,or Netting to establish the method for which funds are returned by the school to the lender or disbursing agent. |

Defining Loan Processing Levels for CRC

Defining Loan Processing Levels for CRC

Access the Process Levels page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Process Levels).

Define the valid process levels the loan destination supports. The loan origination process uses these setting to determine the correct process level to assign during the loan origination process.

|

Loan Category |

Select from: Alt Loan (alternative loan), PLUS, Sub/Unsub (subsidized/unsubsidized), Subsidized, and Unsubsidized. The values to use are dependent on the loan categories used to define the loan types at the school. |

|

Originated with Prom Note |

Select the check box to indicate that the corresponding process level be used during origination. The loan origination process determines the process level based on whether a promissory note exists at the school for a student. |

|

Processing Level |

Select the loan processing level that the loan destination performs for the corresponding loan category. Select from: Cert Req (certification request), Direct (Direct Lending. This is not a valid selection), Guar Only (guarantee only), Guar/Print (guarantee and print), Manual (loan is not transmitted electronically), and Print/Guar (print and guarantee). |

Defining Loan Destination Validation Edits for CRC

Defining Loan Destination Validation Edits for CRC

Access the Validation Edits page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Create CRC Loan Destinations, Validation Edits).

This page defines the loan validation edits for the loan destination. The edits are pre-populated from the Loan Edits Defaults page when process level rows are created on the Process Levels page. Insert additional edits or remove invalid edits that are specific to the loan destination.

|

Equation |

Select a predefined edit statement. |

|

Activate |

Select to activate an edit. |

Specifying Loan Processes for CRC

Specifying Loan Processes for CRC

To set up loan processes for CRC, use the Define Loan Institutions component (LOAN_INST_TABLE).

This section discusses how to define loan processes for CRC.

Pages Used to Set Up Loan Processes

Pages Used to Set Up Loan Processes|

Page Name |

Definition Name |

Navigation |

Usage |

|

LOAN_INST_TABLE |

Set Up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions, Loan Institution Table |

Define how your school processes loans for the academic year. You can define loan processes for each academic career of your institution. |

|

|

LN_INST_ADDR_SEC |

Click the Institution Address link on the Loan Institution Table page. |

Enter address information for each loan institution. |

|

|

LN_INST_CNTCT_SEC |

Click the Loan Institution Contact link on the Loan Institution Table page. |

Update the address, mailbox type, and mailbox identification. |

Defining Loan Processes for CRC

Defining Loan Processes for CRC

Access the Loan Institution Table page (Set Up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions, Loan Institution Table).

Set up your institution for loan processing by specifying the valid loan processes and contact information

|

FFELP/Direct Participant |

Select if the loan institution can originate FFELP or direct loans, or both. Values are: All Loans, Direct, and FFELP. |

|

DL Disclosure Print (direct lending disclosure print) |

For direct lending. |

|

DL SchCd (direct lending school code) |

If your institution processes direct loans, enter your direct lending school code. This field is hidden if your school does not participate in the direct lending program. |

|

SSN Source (social security number source) |

For direct loans. Select the source of the student's Social Security Number, such as from Campus Community. |

|

COD Full Participant |

Select if your institution is a full COD participant. |

|

DL Serial MPN Activation (direct loan serial master promissory note activation) |

Select if the loan institution that you are defining uses the direct loan serial master promissory note. This field is hidden if your school does not participate in the direct lending program. |

|

EDE Special School (electronic data express special school) |

For direct loans. Select to set an identification trigger on the origination file. This is for schools approved by the Department of Education for special consideration for direct loan processing by the Loan Origination Center (LOC). Usually the default rate for the school must be lower than 10%. |

|

Cntact Nbr (contact number) |

Enter contact information for each financial aid administrator in charge of loan processing. Assign a contact number for each entry. |

|

Institution Address |

Click to access the Loan Institution Address Information page. |

|

Loan Institution Contact |

Click to access the Loan Institution Contact Information page and update the address, mailbox type, and mailbox identification. |

Setting Up Loan Origination for CRC

Setting Up Loan Origination for CRC

To set up loan origination for CRC, use the Reassign Loan Agencies component (LN_AGENCY_DFLT) and Define Loan Institutions component (LOAN_INST_TABLE).

This section provides an overview of loan origination and discusses how to:

Specify a default loan agency for CRC.

Set up loan destination defaults for CRC.

Understanding Loan Origination for CRC

Understanding Loan Origination for CRC

Because CommonLine 4 process levels only require a guarantor to originate a loan, the loan destination that you use to originate the loan might not be the same loan destination that you use to guarantee the loan.

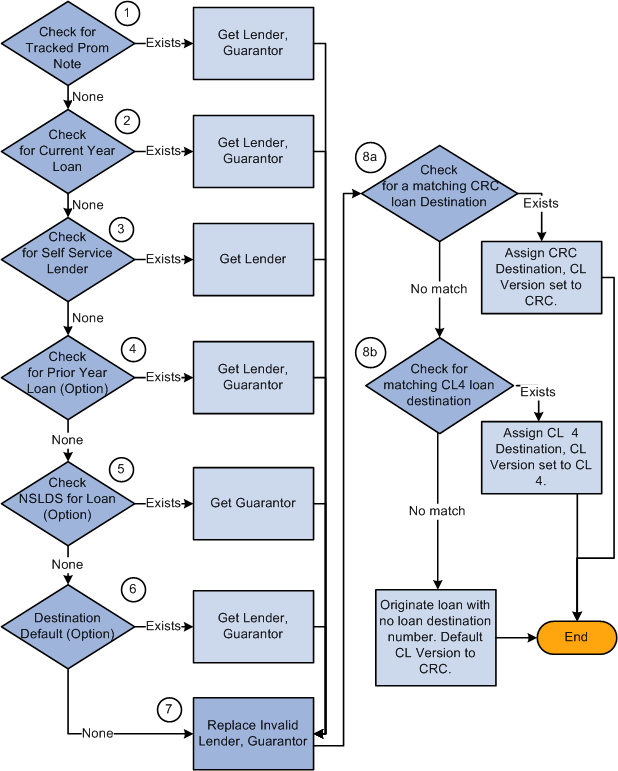

Loan origination follows a seven-step process to determine the lender and guarantor and then determine the loan destination. You determine which steps to follow when you set destination defaults.

|

Step |

What Happens |

Possible Information Selected |

|

Step 1 – This step is always performed. |

If an active unused promissory note is tracked, the designated lender and guarantor are selected from the form used for origination. Steps 2 through 6 are skipped. |

Lender Only Guarantor Only Lender and Guarantor No Information |

|

Step 2 – This step is always performed. |

If a matching loan is originated and guaranteed in the current aid year for the borrower, the lender and guarantor are used from the earlier origination record. Steps 3 through 6 are skipped. |

Lender and Guarantor No Information |

|

Step 3 – Optional |

If the student has selected a lender on a self-service page, the process uses the selected lender and skips steps 4 through 6. |

Lender No information |

|

Step 4 – Optional |

The origination process looks back one year for a prior year originated loan of the same loan type. If a prior loan is found, steps 5 and 6 are skipped. |

Lender and Guarantor No Information |

|

Step 5 – Optional |

The origination process looks at the current NSLDS history to find a previously originated loan of the same loan type. A new NSLDS loan type cross reference section is available in the Loan Type Table component to facilitate this step. If a prior loan is found, step 6 is skipped. Note. Only the guarantor is used from the NSLDS loan history. |

Guarantor Only No Information |

|

Step 6 – Optional |

A default destination is assigned. User can assign a default CL 4 or CRC destination number. |

Lender Only Guarantor Only Lender and Guarantor No Information |

|

Step 7 – This step is always performed. |

Checks the validity of the selected lender and guarantor values and reassigns lender and guarantor IDs as defined in the Agency Default page. |

Lender Only Guarantor Only Lender and Guarantor No Information |

|

Step 8 |

Based on the lender, guarantor, and servicer information selected in the prior six steps, the loan origination process searches for a matching CRC loan destination profile record. If one is not found, the CL 4 loan destination profile records are checked for a matching record. If one is not found, the loan is still originated, but it cannot be transmitted until a loan destination is assigned. |

Loan Destination No Destination |

The following chart illustrates the process:

Process flow to determine loan destination

Pages Used to Set Up Loan Origination for CRC

Pages Used to Set Up Loan Origination for CRC|

Page Name |

Definition Name |

Navigation |

Usage |

|

LN_AGENCY_DFLT |

Set Up SACR, Product Related, Financial Aid, Loans, Reassign Loan Agencies, Agency Default Setup |

Identify a default agency if the borrower does not select a lender, guarantor, or servicer. Identify lenders, guarantors, or servicers that are no longer in service and have them replaced automatically with a new agency when a loan is originated. Note. Schools that have defined loan agency default records for CL 4 loan processing for the aid years that are still active must update the records using the new CRC fields. The CL 4 setting is ignored by the loan origination process. |

|

|

LOAN_INST_TABLE2 |

Set Up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions, Loan Destination Default |

Set up loan destination default parameters. |

Specifying a Default Loan Agency for CRC

Specifying a Default Loan Agency for CRC

Access the Agency Default Setup page (Set Up SACR, Product Related, Financial Aid, Loans, Reassign Loan Agencies, Agency Default Setup).

|

Agency Type |

Select from Guar/Ins (guarantor/insurer), Lender, or Servicer. |

|

OPEID (office of postsecondary education identifier) |

Select the identifier of the loan agency that to be reassigned or leave blank if you are setting a default agency. |

|

Branch ID |

Select the branch identification of the OPEID. |

|

New OPEID (office of postsecondary education identifier) |

Select the identifier assigned to your school by the Department of Education. |

|

New Branch ID |

Select the branch identification of the new OPEID. |

Note. Customers who have upgraded from a previous release of Campus Solutions see their original CL 4 loan agency default settings.

|

CL4 Agency ID |

Indicates the lender or guarantor ID of previously stored agency default data. The system displays the name and OPEID of the agency if not blank. This field appears only if you have recently upgraded from Release 8.0 SP1. |

|

CL4 New Agency |

Indicates the lender or guarantor ID of previously stored agency default data. The system displays the name and OPEID of the agency if not blank. This field appears only if you have recently upgraded from Release 8.0 SP1. |

Setting Up Loan Destination Defaults for CRC

Setting Up Loan Destination Defaults for CRC

Access the Loan Destination Default page (Set Up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions, Loan Destination Default).

The order the loan origination process uses to choose the loan destination for the student is as follows: Current Promissory Note, Current Year Originations, Check Prior Year Originations, Check NSLDS for Guarantor, and then Default Destination.

|

Loan Program |

Select from: Alternative, Direct, FFELP, Health, Perkins, State, and University. |

|

Current Prom Note (current promissory note), Current Year Originations, and Student Selected Lender |

The loan origination process always performs these steps. |

|

Check Prior Year Originations and Check NSLDS for Guarantor |

Select to have the system perform these steps. |

|

Default Destination |

If nothing results from the first four search methods, the system uses this default destination. |

|

Use CRC Destination |

Select to control the searching of the default loan destination profile. If not selected, the system only searches CL 4 destinations. If selected, the system only searches CRC loan destinations. Note. Choosing a CL 4 or CRC loan destination does not guarantee that the originated loan uses the same CommonLine version—the system continues to perform the loan origination logic. |

Setting Up Process Demographic Data for CRC

Setting Up Process Demographic Data for CRC

To set up process demographic data for CRC, use the Define Demographic Data Use component (FA_PRCSDEMO_TBL). The loan origination process extracts borrowers' demographic information from Campus Community.

This section discusses how to set up process demographic data for CRC.

Pages Used to Set Up Demographic Data for CRC

Pages Used to Set Up Demographic Data for CRC|

Page Name |

Definition Name |

Navigation |

Usage |

|

FA_PRCSDEMO_TBL |

Set Up SACR, Product Related, Financial Aid, Define Demographic Data Use, FA Process Demographic Use |

Indicates how to retrieve the student demographic information for loan processing. The loan origination process extracts borrowers' demographic information from Campus Community. |

|

|

ADDR_USAGE_TABLE |

|

Define hierarchies of address types to search for and use in a specific usage. The FA Process Demographic Use page selects the appropriate constructs defined in this page to determine the addresses to use in loan processing. |

|

|

NAME_USAGE_TABLE |

|

Define hierarchies of name types to search for and use in a specific usage. The FA Process Demographic Use page selects the appropriate constructs defined in this page to determine the names to use in loan processing. |

|

|

PHONE_USAGE_TABLE |

|

Define phone usages to specify the hierarchies of telephone types to search for and use in a specific usage. |

Setting Up Process Demographic Data for CRC

Setting Up Process Demographic Data for CRC

Access the FA Process Demographic Data page (Set Up SACR, Product Related, Financial Aid, Define Demographic Data Use, FA Process Demographic Use).

The system displays settings defined by Campus Community components.

|

Address Usage |

Used to select the address used by the associated process. Not used for loans. |

|

Perm Addr Usage (permanent address usage) |

Used to select the permanent address for loan processing. |

|

Mail Addr Usage (mail address usage) |

Used to select the temporary address for loan processing. |

|

Name Usage |

Used to select the name for use by the associated process. For loans, this selects the name for the student and borrower. |

|

Phone Usage |

. Used to select the phone number for use by the associated process. |

|

Email Usage |

Indicates the type of email address, such as home, business, dorm, or campus. Used to select email usage table settings defined in Campus Community setup. |

|

Address Usage Table |

Click to access the Address Usage page to define or review address usages. |

|

Name Usage Table |

Click to access the Name Usage page to define or review name usages. |

|

Phone Usage Table |

Click to access the Phone Usage page to define or review phone usages. |

See Also

Page Used to Establish Address Usages

Setting Up Certification Requests for CRC

Setting Up Certification Requests for CRC

This section discusses how to define search match criteria for CRC.

Page Used to Set Up Certification Requests

Page Used to Set Up Certification Requests|

Page Name |

Definition Name |

Navigation |

Usage |

|

SFA_CRC_SRCHMCH |

Set Up SACR, Product Related, Financial aid, Loans, CR CommonLine, Create CRC Search Match Setup, CRC Search/Match Parameters |

Define search match criteria for the CRC Inbound process. |

Defining Search Match Criteria for CRC

Defining Search Match Criteria for CRCAccess the Create CRC Search/Match Parameters page (Set Up SACR, Product Related, Financial aid, Loans, CR CommonLine, Create CRC Search Match Setup, CRC Search/Match Parameters).

You must first define the search parameters and rules that the Search Match process uses for the certification request process. The available fields in the certification request record that Search Match can use are national ID (SSN), last name, first name, middle initial, and birthdate.

|

Add |

Indicates that if the system does not find an EmplID, then it should create one. The system only offers this to the parent for PLUS loans. |

|

Assign ID |

Indicates that the system use the EmplID found during the search match. The option is not available for No Match if the system does not find an EmplID to assign. The Assign ID can represent either a student or a parent. |

Note. The No Match - Only for PLUS loans group box only applies when the search match process cannot find an EmplID for the parent. The system uses the Match(es) Found section criteria for both student and parents when search match is called.

See Also

Reviewing Loan Action Codes for CRC

Reviewing Loan Action Codes for CRC

To set up these codes for CRC, use the Maintain CRC Loan Action Codes component (SFA_CRC_ACTION_CD).

While most of the CommonLine action codes are shared between CL4 and CRC, CRC specific codes exist which must be maintained separately.

This section discusses how to review loan action codes.

Page Used to Review Loan Action Codes

Page Used to Review Loan Action Codes|

Page Name |

Definition Name |

Navigation |

Usage |

|

CRC Loan Action Codes |

SFA_CRC_ACTION_CD |

Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Maintain CRC Loan Action Codes, Loan Action Code Table |

View CRC specific status codes and descriptions. |

Reviewing Loan Action Codes

Reviewing Loan Action Codes

Access the Loan Action Code Table page (Set Up SACR, Product Related, Financial Aid, Loans, CR CommonLine, Maintain CRC Loan Action Codes, Loan Action Code Table).

CRC specific status codes are stored in this component. You should not have to add or delete loan action codes, but you can modify the descriptions. Four loan action types are available: Guarantor, Lender, PNote (Promissory Note), and Credit. Loan action codes that are common to both CL 4 and CRC loans are stored in the CL 4 action code table.

|

Loan Action Category |

The values are: Accept, Reject, and Status. |