11g Release 5 (11.1.5)

Part Number E20384-05

Contents

Contact

Us

|

Oracle® Fusion

Applications Project Management Implementation Guide 11g Release 5 (11.1.5) Part Number E20384-05 |

Contents |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Allocation Basis Methods: Critical Choices

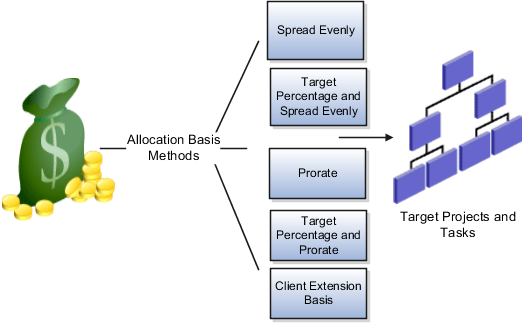

When you define an allocation rule, you specify a basis method. The basis method defines how the amounts in the source pool are to be divided among the target lines. Each target line identifies projects and tasks. The following is a list of basis methods used in allocations:

Spread Evenly

Target Percentage and Spread Evenly

Prorate

Target Percentage and Prorate

Use Client Extension Basis

The image shows the various basis methods used in allocations.

The allocation rule divides the source pool amount equally among all the chargeable target tasks included in the rule. This is the most simple and direct basis method.

Specify the percentage of the source pool that is required to allocate to each target line. The total specified target percentage must always equal 100 percent. The allocation rule calculates the amount to allocate to the target line, and then spreads the results evenly among the chargeable tasks.

The allocation generation uses the attributes defined in the allocation rule to derive the rate at which the source pool amount is apportioned among the target projects and tasks. For this basis method, the allocation rule uses the basis attributes to apportion the source amount among all the tasks defined by the rule.

The allocation rule first uses the target percentage to calculate the amount to allocate to the line, and then apportions the results among all the tasks.

Note

Both the Prorate and Target Percentage and Prorate basis methods provide precise control over how the rule distributes the source pool.

Another way to define percentages and a basis is to use the Allocation Basis extension. This extension enables you to define your own allocation basis to determine the basis amount for each target project and task.

When you define an allocation rule, you specify the allocation method, which determines how amounts are allocated to projects and tasks during generation. The full and incremental allocations distribute all the amounts accumulated during the generation period. Following are the two types of allocation methods:

Full Allocation

Incremental Allocation

The full allocation method always distributes the entire source pool amount to target projects and tasks and generates allocation transactions for the entire amount each time in a period. This method is suitable to process an allocation rule only once within the same accounting or project accounting period.

Warning

If you generate allocation transactions using a full allocation rule twice for the same period, then the complete source pool amount is allocated twice to target projects and tasks in the same period. If this is done inadvertently, then you can reverse the duplicate allocation.

This example explains how the source amounts are allocated using the full allocation method.

|

Allocation Number |

Source Pool Amount |

Total Allocated Amount to Targets |

Previous Allocated Amount to Targets |

Current Allocated Amount to Targets |

|---|---|---|---|---|

|

1 |

1050.00 |

1050.00 |

0.00 |

1050.00 |

Incremental allocations create expenditure items based on the difference between the transactions processed in the previous and current allocation generation. This method is suitable if you want to use the allocation rule to generate allocations several times in a single period. The application keeps track of the results of previous incremental allocation generations. Therefore, you can process an incremental allocation multiple times within the same period creating additional transactions to incrementally increase or decrease the amount allocated to each target project and task based on changes to the available source pool amount and basis logic from the previous incremental generation. You can review and delete draft allocations until you are satisfied with the results.

Note

For incremental allocations the application calculates the amounts allocated in the previous allocation generation.

The following example explains how the source amounts are allocated using the incremental allocation methods: The amount type used in this allocation rule is period-to-date and allocation is generated for the June 2010 period. The following table shows how costs are allocated incrementally to target projects and tasks throughout this period:

|

Allocation Number |

Source Pool Amount |

Total Allocated Amount to Targets |

Previous Allocated Amount to Targets |

Current Allocated Amount to Targets |

|---|---|---|---|---|

|

1 |

1000.00 |

1000.00 |

0 |

1000.00 |

|

2 |

1100.00 |

1100.00 |

1000.00 |

100.00 |

|

3 |

1050.00 |

1050.00 |

1100.00 |

<50.00> |

At the end of the period, the total amount allocated to targets is 1050.00. This is made up of sets of incremental allocation transactions. Incremental transactions can be positive or negative, based on changes to the source pool, eligible targets, and basis calculations.

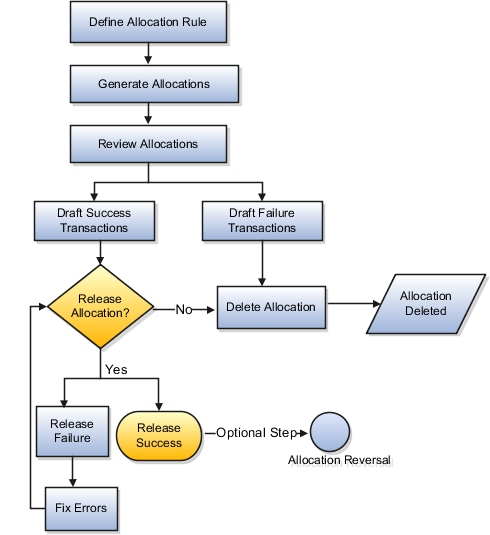

Allocations are processed to distribute various types of costs to distinct sets of target projects and tasks. You identify the amounts to allocate and then define targets, projects and tasks to which you want to allocate the source amounts. Optionally, you offset the allocations with reversing transactions. Oracle Fusion Project Costing gathers source amounts into a source pool and then allocates to the targets using the basis method that you specify in the allocation rule. When the allocation is released, expenditure items are created and processed. The following flowchart shows allocation processing from defining an allocation rule to releasing an allocation transaction.

You create a set of allocation rules to allocate various types of costs to distinct sets of target projects and tasks. Allocation transactions are generated based on the settings in the allocation rules such as:

Allocation or offset transaction attributes

Source amounts to allocate

Target projects and tasks to allocate source amounts

Allocation method

Offset method to reverse and balance allocation transactions

Basis method

Using client extensions

Each allocation rule is associated with a business unit. Source projects and ledger accounts of an allocation must be from the same business unit as the one that is assigned to the allocation rule. During processing, based on the target selection, if the project cross-charge is enabled, costs can be allocated costs to projects across business units. However, offset transactions are charged to projects owned by the same business unit that owns the allocation rule.

When the allocation rule is prepared to generate allocations, costs are collected against the source. For project sources, the actual cost transactions are summarized and for ledger sources, journal entries are posted for the source ledger accounts. If a prorate basis method is used, then ensure that either actual cost or budget amounts are summarized for the target projects, depending on the prorate logic. The allocation is generated either once in an accounting period or incrementally in the accounting period.

The resulting allocation transactions are draft allocations in draft success or draft failure statuses, which are displayed in the Manage Allocations page. The application tracks the source amount, currently and previously allocated amounts so that the user can review if the source amount is allocated appropriately. Based on the type of basis method the allocation rule uses, the application provides the basis percentage and effective percentage. The allocation generation errors are tracked and displayed as exceptions. You can review the issues and fix them as required. If the allocation rule uses an incremental allocation method, then the missing amounts are tracked and you can determine differences from the previous allocation. For example, if a target project that received an allocation transaction during the previous allocation is now closed, then that the amount previously allocated to that project appears as a missing amount. If the draft allocations are as per your expectation, the allocation and offset transactions can get released, which results in the creation of expenditure items. The draft successful transactions can fail during the release of an allocation. For example the released transaction may violate a transaction control. You can fix the errors and then release the allocation.

The draft failure allocations are processed only after reviewing and fixing the issues. For example, you can edit the associated allocation rule or ensure that the actual amounts are summarized for source projects. After fixing the errors, delete the draft allocation and generate the allocation again.

You can use offsets to balance the allocation transactions with the source or other projects. When you define an allocation rule, you select the offset method to determine how offset transactions are created.

After specifying the offset method, you must specify transaction attributes: expenditure organization, expenditure type class, and expenditure type. The attributes do not have to match those used for the allocation transactions.

Note

All offset projects and tasks must be open and chargeable, and in the same business unit that owns the allocation rule. The allocation rule can have an offset method although it may not have source projects.

The allocation rule creates the offset transactions for the offset projects and tasks when you generate the allocation. Offset transactions offset the total amount allocated to target projects, although the total number of offset transactions does not usually equal the total number of allocation transactions. For example with an offset method of Specific Project and Task, if the rule allocates 10,000.00 USD from the allocation sources to 1000 target projects and tasks, then the result is 1000 allocation transactions for a total of 10,000.00 USD and one offset transaction to the specified project and task for a negative amount of 10,000.00 USD.

You can select one of the following offset methods in an allocation rule:

Source Project and Task

Source Project and Client Extension for Task

Use Client Extension for Project and Task

Specific Project and Task

Use this offset method in the allocation rule to create reversing transactions for the specified source projects and tasks in the allocation rule.

Note

If the allocation rule uses ledger sources or a fixed amount source, then the allocation rule cannot use Source Project and Task offset method because a source project does not exist in such cases. Only project sources use this offset method.

Use this offset method to create reversing transactions in specific tasks of the source project. You must specify the logic for determining offsets in the Allocation Offset Tasks client extension.

Use this offset method to create reversing transactions in projects and tasks as specified in the Allocation Offset Projects and Tasks client extension. You can use this method with any one of the sources or a combination of project, ledger, or fixed amount source.

Use this offset method to create reversing transactions in one project and one of its tasks per the specified project and task in the offset method. You can use this method with any one of the sources or a combination of project, ledger, or fixed amount source.

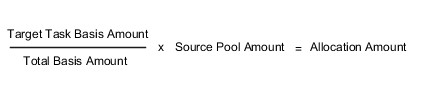

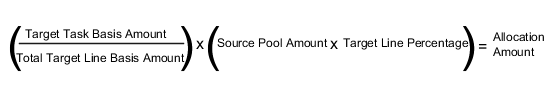

The following example illustrates how allocation generation calculates the basis percentages and prorate amounts using the basis methods:

Prorate

Target Percentage and Prorate

The two prorate basis methods provide precise control over how the rule distributes the source pool. The rule uses the basis attributes defined in the allocation rule to derive the rate at which the source pool amount is apportioned among the target projects and tasks.

The Information Technology department captures its costs such as labor, supplies, and expenses in a shared service IT project. These costs are then allocated to projects that benefit from IT services based on the total labor hours charged to each project.

Using the Prorate basis method, for a source of $1000.00, consider the following target details:

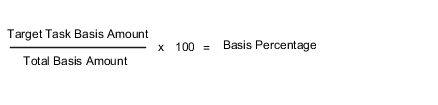

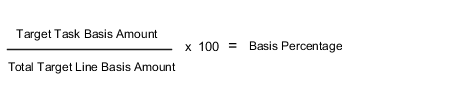

The basis percentage for each target task is equal to the target task basis amount divided by the total basis amount, multiplied by 100. For example, for task 1 on project ABC the application determines the allocation amount by multiplying the basis percentage for each target task by the source pool amount.

|

Project |

Task |

Labor Hours |

Basis Percentage |

Allocation Amount |

|---|---|---|---|---|

|

ABC |

1 |

10 |

10 |

100.00 |

|

ABC |

2 |

20 |

20 |

200.00 |

|

DEF |

1 |

30 |

30 |

300.00 |

|

DEF |

2 |

0 |

0 |

0.00 |

|

GHI |

1 |

40 |

40 |

400.00 |

For the Prorate basis method, the allocation rule prorates the amount specified by the source pool to the targets based on the basis attributes in the allocation rule.

In this example, a subset of projects utilizes the IT services. The allocation rule is configured to allocate a fixed percentage of the source amount to each project and then it spreads across tasks based on the total actual labor hours charged to each task.

Using Target Percentage and Prorate basis method, for a source of $1000.00 allocated to the target line, consider the following details:

Basis percentage for each target task is equal to the target task basis amount divided by the total basis amount the target line from the allocation rule, multiplied by 100. For example, for task 1 on project ABC the application determines the allocation amount by multiplying the basis percentage for each target task by the source pool amount for the target line.

|

Line Number |

Project |

Target Percentage |

Allocation Source Pool Amount |

|---|---|---|---|

|

1 |

ABC |

50 |

500.00 |

|

2 |

DEF |

25 |

250.00 |

|

3 |

GHI |

25 |

250.00 |

|

Target Line Reference |

Project |

Task |

Basis Amount Labor Hours |

Basis Percentage |

Allocation Amount |

Effective Percentage |

|---|---|---|---|---|---|---|

|

1 |

ABC |

1 |

10 |

33.3 |

166.67 |

16.67 |

|

1 |

ABC |

2 |

20 |

66.7 |

333.33 |

33.33 |

|

2 |

DEF |

1 |

30 |

100 |

250.00 |

25 |

|

2 |

DEF |

2 |

0 |

0 |

0.00 |

0 |

|

3 |

GHI |

1 |

40 |

100 |

250.00 |

25 |

For the Target Percentage and Prorate basis method, the rule first uses the target percentage to calculate the amount to allocate to the line, and then apportions the results among all the tasks for that line. In the application, an effective percentage column is also available when reviewing the basis details for an allocation. The effective percentage represents the following:

percentage of the total source pool amount that the target task receives

consolidated percentage of the target percentage and basis percentage calculations.

Note

For simplicity in the above examples, each target line in the allocation rule specifies a project. In real life, the target line can be defined more broadly. For example, a target line could specify a project-owning organization of Services East, so the eligible targets would be all projects owned by Services East.

This example demonstrates how to set up the allocation rules to allocate labor costs from a shared services project. A central contract administration group supports billable projects in the company. Costs that the contract administration group incurs such as labor, expenses, and supplies are charged to a shared services contract administration project. Weekly, the costs are incrementally allocated to all billable projects in the organization. A major project is excluded from the allocation because of the project complexity the project has its own contract administration team and does not use the central contract administration group. Therefore it is explicitly excluded in the targets. Costs are allocated incrementally throughout the year and prorated based on the total actual burdened cost charged.

You are implementing allocation rules for the organization. You want to allocate 100 percent of costs collected in the shared contract services project to all eligible tasks once a week. The costs are spread to all projects for the organization based on the total actual labor hours charged to each project, as more time is worked on the project. The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In this Example |

|---|---|

|

How to allocate the costs? |

Allocate to all time and materials projects within the San Diego organization. |

|

When to allocate costs? |

Allocate labor costs incrementally on a weekly basis. |

|

What costs to allocate? |

Allocate 100 percent of the costs collected in the shared contract services project. |

You define the allocation rule in this scenario to distribute labor cost amounts from shared services project. This allocation rule defines the following:

Source of the amounts to allocate

Target projects and tasks to receive the allocation

Method to generate offset transactions, if required

Method to divide the source amount among the target projects and tasks

Attributes for the allocation and offset transactions, including the expenditure type, expenditure organization, and expenditure type class for the resulting expenditure items

|

Field |

Value |

|---|---|

|

Business Unit |

InVision Services |

|

Name |

Shared Contract Services Allocation |

|

Description |

Rule to allocate shared contract service costs |

|

Allocation Method |

Incremental |

|

Allocation Period Type |

Accounting Period |

|

Targets Selection |

Within business unit |

|

Basis Method |

Prorate |

|

Expenditure Organization |

San Diego |

|

Expenditure Type Class |

Miscellaneous Transactions |

|

Expenditure Type |

Contract Services Allocation |

|

Field |

Value |

|---|---|

|

Allocation Pool Percentage |

100 |

|

Fixed Source Amount |

0 |

|

Amount Class |

Fiscal year-to-date |

|

Amount Type |

Burdened Cost |

|

Project Organization |

San Diego |

|

Project |

Contract Shared Service Center |

|

Field |

Value |

|---|---|

|

Line Number |

1 |

|

Project Organization |

San Diego |

|

Project Type |

Time and Materials |

|

Exclude |

Leave unchecked |

|

Line Number |

2 |

|

Project Organization |

San Diego |

|

Project |

Rudycorp Software Install |

|

Exclude |

Select the check box. |

|

Field |

Value |

|---|---|

|

Offset Method |

Source project and task |

|

Expenditure Organization |

San Diego |

|

Expenditure Type Class |

Miscellaneous Transactions |

|

Expenditure Type |

Service Offset |

|

Field |

Value |

|---|---|

|

Basis Category |

Actual Amounts |

|

Amount Type |

Total Billable Burdened Costs |

|

Amount Class |

Fiscal year-to-date |

|

Relative Period |

0 |

This example demonstrates how to set up the allocation rules to allocate rent costs. Your enterprise has an organization that rents building space, and the finance department wants to allocate rental cost to the projects owned by the organization. The project managers can then use the allocation to bill costs to customers. The Payables department charges rent to a different general ledger account for each organization by cost center. You implement the allocation rule for the organization. Allocate 100 percent of the rental cost collected in the general ledger to all eligible tasks for San Diego organization projects once a month. You can prorate the allocation based on the previous month's total raw cost for each task. Project Rudycorp Software Install is performed completely at the customer location and should not be allocated any rent costs. This project must be excluded from receiving rent allocation.

You are implementing allocation rules for the organization. You want to allocate 100 percent of the rental cost collected in the general ledger account for the organization to all eligible tasks once a month. You also want to prorate the allocation based on the previous month's total raw cost for each task. The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In this Example |

|---|---|

|

How to allocate the costs? |

Allocate to all eligible tasks and prorate the allocation by the total actual raw cost accrued for each task during the prior accounting period. |

|

When to allocate costs? |

Allocate rental costs once each accounting period. |

|

What costs to allocate? |

Allocate 100 percent of rental costs collected in the accounting period for the cost center. |

You define the allocation rule in this scenario to distribute amounts between and within projects and tasks in a business unit. This allocation rule defines the following:

Source of the amounts to allocate

Target projects and tasks to receive the allocation

Method to generate offset transactions, if required

Method to divide the source amount among the target projects and tasks

Attributes for the allocation and offset transactions, including the expenditure type, expenditure organization, and expenditure type class for the resulting expenditure items

|

Field |

Value |

|---|---|

|

Business Unit |

InVision Services |

|

Name |

San Diego Rent Allocation |

|

Description |

Rule to allocate San Diego rental costs to projects |

|

Allocation Method |

Full |

|

Allocation Period Type |

Accounting Period |

|

Targets Selection |

Within business unit |

|

Basis Method |

Prorate |

|

Expenditure Organization |

San Diego |

|

Expenditure Type Class |

Miscellaneous Transaction |

|

Expenditure Type |

Rent Allocation |

|

Field |

Value |

|---|---|

|

Allocation Pool Percentage |

100 |

|

Source Amount Class |

Period-to-date |

|

Ledger Sources Account |

01-420-7580-000 |

|

Percentage |

100 |

|

Subtract |

Leave unchecked |

|

Field |

Value |

|---|---|

|

Line Number |

1 |

|

Project Organization |

San Diego |

|

Line Number |

2 |

|

Project |

Rudycorp Software Install |

|

Exclude |

Select the check box. |

|

Field |

Value |

|---|---|

|

Offset Method |

Specific project and task |

|

Project |

Allocation Offset Project |

|

Task |

1.0 |

|

Expenditure Organization |

San Diego |

|

Expenditure Type Class |

Miscellaneous Transaction |

|

Expenditure Type |

Rent Allocation |

|

Field |

Value |

|---|---|

|

Basis Category |

Actual Amounts |

|

Amount Type |

Total Raw Cost |

|

Amount Class |

Period-to-date |

|

Relative Period |

-1 |

When defining an allocation rule, you must specify the expenditure type class for the allocation transaction attributes. Choosing the expenditure type class determines how the allocated amount is created as costs on the expenditure item.

The miscellaneous transaction expenditure type class is used to allocate the source amount as raw cost on the expenditure item.

The burden transactions expenditure type class is used to allocate the source amount as the burden cost for the expenditure item, while expenditure item quantity and raw cost remain zero.

Yes, if the projects are enabled for cross-charge processing and when the target selection in allocation rule is across business units. Allocation transactions are owned by the business unit to which the allocation rule belongs. However, you cannot allocate the source amount to projects in other business units that are enabled for capitalization.

The allocation either results in an error or spreads the amount evenly to all the eligible target projects or tasks based on the Allocation Method for Zero-Basis Amounts profile option settings during implementation.

Both allocation and burdening are related to expenditure item costs. Allocation uses actual amounts from sources such as project sources, ledger sources, and fixed amount source to provide the source pool amount. Allocation generation apportions these source pool amount to target projects and tasks. When you release the allocation, expenditure items are created against each target project.

Burdening uses a set of estimated burden multipliers to increase the total cost amount of expenditure items. This fixed percentage is an estimate of the indirect or burden costs associated with the raw costs for each expenditure item.

Allocations and burdening are not mutually exclusive; you can use both. Whether your company uses allocations, burdening, or both in a particular situation depends on how your company works and how you have implemented Oracle Fusion Project Costing.