11g Release 6 (11.1.6)

Part Number E20379-06

Home

Contents

Book

List

Contact

Us

|

Oracle® Fusion

Applications Workforce Deployment Implementation Guide 11g Release 6 (11.1.6) Part Number E20379-06 |

Home |

Contents |

Book List |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Payroll Relationships: Explained

Define Payroll Business Definitions

Define Earning and Deduction Definitions

Manage Payroll Process Configuration

A payroll relationship exists between a person and a payroll statutory unit, which is the legal entity responsible for employee payment. Payroll relationships group person records based on payroll regulatory and statutory calculation and reporting requirements. This grouping enables the aggregation of balances across multiple employment terms and assignment records.

Important aspects of payroll relationships include:

Creation of payroll relationship records

Multilevel aggregation for payroll calculation

Payroll employment model

When an HR administrator processes a new hire, the application automatically creates a payroll relationship record for that person. As an administrator adds employment terms or assignments for that person, the application uses several factors, such as system person type, payroll statutory unit, and country-specific relationship mapping rules, to determine whether to create a new payroll relationship record. Predefined mapping rules for payroll relationships also define the payroll relationship types that indicate whether payroll processing can occur. These predefined rules can vary by localization. For example, in the US, the Employee person type maps to the payroll relationship type that is defined to be processed in payroll runs, whereas the Contingent Worker person type maps to a payroll relationship type that is not be processed in payroll runs.

Note

There is no direct association between payroll relationships and work relationships.

Payroll relationships represent the association between a person and the payroll statutory unit, which provides the highest level of aggregation for payroll calculation purposes. Payroll processing occurs at the payroll relationship level. This means that to access the results of any payroll process, such as calculation or payment distribution, you start by selecting a payroll relationship record.

Note

Although a person may have multiple payroll relationships, payroll balances for that person cannot span payroll relationships.

The payroll relationship structure provides the capability to have employment terms and assignments that can be linked together for calculations based on the payroll statutory unit. Therefore, information must be stored at the various levels of the payroll relationship model. This information is used by the various payroll processes.

Your enterprise might be defined to use two-tier and three-tier employment models. The three payroll employment levels are:

Payroll relationship

The payroll relationship is the highest level for which to accumulate balances. Elements assigned at the payroll relationship level are processed in every payroll run. Payroll relationship elements are typically deduction elements, such as tax, pension, social insurance, or court orders.

Payroll relationships are also used outside of Oracle Fusion Global Payroll to facilitate the extraction of data from HCM that is sent to a third-party payroll provider for payroll processing. For example, payroll coordinators use Oracle Fusion Global Payroll Interface to extract benefits data from HCM and send that data through payroll relationships, along with payroll-related data.

Employment terms (three-tier model only)

Employment terms are commonly used as a middle layer in the payroll employment model to help manage multiple assignments and to satisfy tax and reporting requirements at a lower level than the payroll statutory unit. Elements assigned at the employment terms level are typically salary, pension, or social insurance elements that vary based upon the employment terms.

Note

Employees with multiple terms or assignments that are paid on payrolls using different frequencies, such as Monthly and Semimonthly, must have different employment terms or assignments for each payroll. In a two-tier configuration, payrolls can be assigned to the assignment record; in a three-tier configuration, payrolls can be assigned to the terms record.

Assignment

Because the assignment is the lowest level of the payroll employment model, elements assigned at this usually level vary from one assignment to another or are specifically for a single assignment. Assignment elements are typically used for monetary terms and conditions, such as overtime rules, rates, or bonuses.

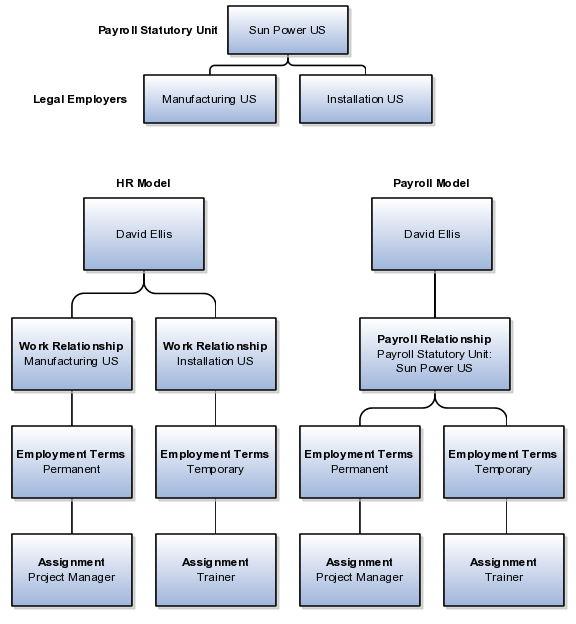

The following figure illustrates the comparison between the HR employment model and the payroll employment model in a US example with two legal employers belonging to one payroll statutory unit. In this example, David Ellis has two different employment terms and assignments, and therefore has two work relationships in the HR employment model and one payroll relationship in the payroll employment model.

You can use profile options to specify the values you want to display for each level of the payroll employment hierarchy. The hierarchy appears in View Person Process Results pages. It can display information for up to three levels, depending on the employment model used in your enterprise:

Payroll relationship

Employment terms

Assignments

You can specify up to three values at each level to help identify the record. For example, you might select legal employer name and job name to identify employment terms records, and assignment name and number to identify assignment records.

The following table lists the profile option codes, available profile values, and default values at the site level for each level of the payroll employment hierarchy.

|

Level |

Profile Option Codes |

Profile Values |

|---|---|---|

|

Payroll relationship |

PAY_EMP_HIERARCHY_REL_DESC_1 PAY_EMP_HIERARCHY_REL_DESC_2 PAY_EMP_HIERARCHY_REL_DESC_3 |

Payroll Relationship Number Payroll Statutory Unit Name Payroll Relationship Type |

|

Employment terms |

PAY_EMP_HIERARCHY_TERM_DESC_1 PAY_EMP_HIERARCHY_TERM_DESC_2 PAY_EMP_HIERARCHY_TERM_DESC_3 |

Employment Category Legal Employer Name Grade Name Job Name Position Name Payroll Name Location Name |

|

Assignment |

PAY_EMP_HIERARCHY_ASG_DESC_1 PAY_EMP_HIERARCHY_ASG_DESC_2 PAY_EMP_HIERARCHY_ASG_DESC_3 |

Assignment Name Assignment Number Employment Category Grade Name Job Name Legal Employer Name Location Name Position Name |

You can override site-level values at the user level. For example, you might use position as the default value and override it with job for the payroll administrator who manages records for a group of workers who are not assigned to positions.

Pay frequency components together provide the flexibility to implement complex time-related objects used in payroll definitions, payroll processes, and payroll tasks that use start and end dates.

It is important to understand how the following pay frequency components work together to provide payroll functionality for your organization. Each may require its own setup and implementation.

Consolidation Groups

Payroll Definitions

Time Definitions

Run Types

Use consolidation groups to process the results from more than one payroll run in a single action or process the results for one payroll in separate actions. With consolidation groups, you produce one set of results per payment method for several payrolls, one set of reports, and one set of costing results. For example, you may submit a regular payroll run and a supplementary payroll run for the same payroll period. If both the regular and supplementary run belong to the same consolidation group, then you use a single consolidation group to process all the results for the post-run processing. Optionally, you can enter a different consolidation group for the supplementary payroll and use it to process the results of the post-run processing for the supplementary payroll separately from the regular payroll.

Payroll definitions are essential to your payroll implementation because they indicate the payment frequency and processing schedule, and through the payroll relationship, they link the employees with the payroll run.

Time definitions can be static periods of unusual length based on a given static date, or they can create dates based on dynamic variables that you specify for either a time span, a retrieval date, or a more complex definition type to use with a user-defined date. They are used in many areas, including payroll periods, payroll employment management, balance dimensions, retroactive and proration events, element start and end dates, and overtime periods.

Run types control the elements and payment types to process in a payroll run. Two predefined run types, Regular and Supplemental, group the other run types and determine the sequence in which they are processed. The Regular run type includes Regular Normal, Process Separately, and Separate Payment. The Supplemental run type includes Process Separately, Separate Payment, and Supplemental Normal.

For each of the component run types, you can specify payment methods that override the default payment methods for the payroll definition. You can also select the element classifications to be processed by runs of this type, and exclude specific elements from these classifications.

You create consolidation groups by selecting the Manage Consolidation Groups task from the Payroll Calculation work area. The following scenarios provide examples of how you can use consolidation groups.

Consolidation groups facilitate separating payroll run results for supplemental processing. For most payroll post-run processing, you can use the consolidation group as an input parameter. You may want the results of a supplemental payroll run to be kept separately from those of the regular payroll process that was already performed. To use a consolidation group to keep supplemental run results separate from the regular payroll run, you would perform these steps:

Create a new consolidation group used to label the supplemental payroll run.

Initiate the supplemental payroll run, specifying the new consolidation group as an input parameter.

Using multiple consolidation groups you can control processing. For example, you want to process and pay a particular set of employees separately within a single payroll to keep separate records of payment and costing. To process employees separately, you would perform these steps:

Create a new consolidation group to specify when running the Calculate Payroll process.

Create a payroll relationship groups to separate the employees.

You can use rules to identify them dynamically or you can specify the employees by their payroll relationship numbers.

Run the Calculate Payroll process for each payroll relationship group separately, once specifying the original consolidation and once for the new consolidation group.

You may want a supplemental payroll run for a special circumstance. For example, you have a main payroll run and three QuickPay runs. Because one of the QuickPay runs is for a termination, it needs to be processed prior to the others. To process the QuickPay for this special circumstance, you would perform these steps:

Create a new consolidation group to specify when you process the QuickPay for the termination.

Submit a QuickPay process, specifying the new consolidation group.

Process the other three payroll runs using their default consolidation groups.

Payroll definitions contain calendar and offset information, which determines when payments are calculated and costed. Using payroll definitions, you can specify payment frequency, processing schedule, and other parameters for a particular payroll. Payroll period types, such as weekly or monthly, determine the interval at which you pay employees.

Each payroll definition can use only one payroll period type, and you must set up at least one payroll definition for each payroll period type that you use to pay employees. For example, to pay employees semimonthly, create a payroll definition using the semimonthly payroll period type, ensuring that tax calculations and other calculations will produce correct results for those employees.

When you create a payroll definition, the complete payroll schedule is automatically generated, based on the payroll period type, any offsets or calendar adjustments, and the number of years that you specify. Once you have saved a payroll definition, you can assign employees to it on the Manage Payroll Relationships page.

A common scenario for modifying an existing payroll definition is to increase the number of years and generate more payroll time periods to extend the payroll calendar. A common scenario for creating a payroll definition is to replace one that is expired or end-dated.

Each payroll must belong to a consolidation group, which is required by the application for processing purposes. Before you can create a payroll definition, the legislative data group and the consolidation group to use for it must already be defined.

When you create or modify payroll definitions, the application automatically generates a calendar of payroll periods based on your selections. The choices you make for the following values determine exactly how the schedule of payroll periods is generated:

Effective start date

First period end date

Number of years

Offsets

Changes to specific dates

The effective start date is the first date that the payroll definition can be used for employee data. The start date must be on or before the earliest date of any historical data you want to load. For example if you want a payroll to be in use starting on 1/1/2013, and you have 5 years of historical payroll data to load, then the start date of the payroll definition must be on or before 1/1/2008.

The effective start date does not affect the generated calendar of payroll periods. The start date for the first payroll period is based on the first period end date.

The first period end date is the end date of the first payroll period that the application generates for a payroll definition. It is typically based on the date of implementation, tax year, benefits enrollments, or a particular payment cycle. For example, if your weekly payroll work week is Saturday through Friday, and your first payment date is planned to be on 1/6/12, you could use 12/30/11 as your first period end date.

The number of years you enter represents how many years of time periods to generate starting from the beginning of the first payroll period. For example, a payroll definition with an effective start date of 1/1/1985, a payroll period type of semimonthly, a first period end date of 6/15/2012, and the number of years as 5 would generate a calendar of payroll time periods from 6/1/2012 through 5/31/2017. Once you save a payroll definition, you can later only increase but not reduce its number of years because a calendar of time periods for the payroll has already been generated.

Depending on the payroll period type, you can elect for your payroll cycle events to occur on specific dates or be based on offsets from period start or end dates.

This table describes the predefined payroll cycle events that you can offset.

|

Date |

Meaning |

|---|---|

|

Cutoff Date |

Final date that payroll information can be entered for the payroll period. |

|

Payslip Availability Date |

Date on which the payslip is available for viewing. |

|

Payroll Run Date |

Date scheduled for the regular run of this payroll. |

|

Date Earned |

Date on which element entries are added to the payroll run. |

|

Date Paid |

Date the employee is marked as paid. For check payments, this is the date that the check can be cashed or deposited. For electronic funds transfer (EFT) payments, it is the transfer date. |

When creating a payroll definition, you can use dynamic offsets for payroll cycle events. All of the predefined payroll time periods you can use support dynamically generated dates for offsets. Using dynamic offsets, you have the option to offset each payroll cycle event by a specified number of calendar or work days before or after the start date or the end date of the payroll period. For example, you might want to set the payroll run date three work days before the payroll end date, which accommodates differences in the number of days in the payroll period and also accounts for weekends and holidays.

The predefined Monthly (Calendar) payroll time period supports using both dynamic offsets and fixed-date offsets. Using fixed dates, you can adjust the exact date of each of the payroll cycle events for the first payroll period and any adjustments that you make will be reflected in the payroll calendar for subsequent payroll time periods. For example, you might set the cutoff date as the 25th of the month and the payroll run date as the 26th of the month, then all payroll periods in the calendar will have those offsets.

Once you have generated the payroll time periods, you can further adjust any specific calendar dates, as desired. For example, if you know of a particular bank holiday that falls on a payroll run date or a payment date, you might want to adjust the dates manually on the payroll calendar's time period. You can make these adjustments when creating a payroll definition or any time after then, as long as the time period is in the future.

This example demonstrates how to create two payroll definitions for different payment frequencies that are associated with one consolidation group and one legislative data group.

The following table summarizes the key decisions for this scenario.

|

Decisions to Consider |

In This Example |

|---|---|

|

Which consolidation group should be used? |

User-defined consolidation group: InFusion US Emp Group |

|

What is the legislative data group for the consolidation group? |

User-defined legislative group: InFusion US LDG |

|

What are the payroll periods to use? |

Predefined payroll period types: Semimonthly Monthly (Calendar) |

|

What are the names of the new payroll definitions? |

InFusion US Emp Semimonthly InFusion US Emp Monthly |

|

What is the name of the organization payment method to use for all employees? |

User-defined payment methods: InFusion US Emp Check Infusion US Emp EFT |

In this example, the InFusion US company is creating payrolls for its employees. There are two sets of employees, permanent employees who are paid a set amount on a semimonthly basis, and temporary employees that are paid using time card data on a monthly basis.

The business requires that a single monthly costing process be run against results from different payroll runs by using the consolidation group name as an input parameter in the costing run. This example creates two payroll definitions with different payment periods, but the same consolidation group. Both definitions are effective starting on 1/1/11 and will generate payroll time periods covering 5 years.

Create two payroll definitions:

One for permanent employees that are paid a flat amount by electronic funds transfer (EFT) on a semimonthly basis. This payroll definition includes dynamically generated offset dates.

One for temporary employees that are paid by check using time card data on a monthly calendar basis.

Perform the following steps twice, first using the semimonthly values and then using the monthly values.

In this example, all employees that will use this payroll definition are hired after 1/1/11, so there is no issue with loading historical employee data.

|

Field |

Semimonthly Value |

Monthly Value |

|---|---|---|

|

Name |

InFusion US Emp Semimonthly |

InFusion US Emp Monthly |

|

Consolidation Group |

InFusion US Emp Group |

InFusion US Emp Group |

|

Period Type |

Semimonthly |

Monthly (Calendar) |

|

First Period End Date |

6/15/12 |

6/30/12 |

|

Default Payment Method |

InFusion US Emp EFT |

InFusion US Emp Check |

|

Field |

Falls Value |

Day Type Value |

Offset Value |

Base Date Value |

|---|---|---|---|---|

|

Cutoff Date |

5 |

Work Days |

Before |

Period End Date |

|

Payroll Run Date |

3 |

Work Days |

Before |

Period End Date |

|

Field |

Value |

|---|---|

|

Fixed Date |

Yes |

|

Cutoff Date |

6/25/12 |

|

Date Earned |

6/30/12 |

|

Payroll Run Date |

6/27/12 |

|

Date Paid |

6/30/12 |

|

Column |

Semimonthly Value |

Monthly Value |

|---|---|---|

|

Payroll Run Date |

Old Value: 11/28/13 New Value: 11/27/13 |

Old Value: 5/27/13 New Value: 5/28/13 |

Closing a payroll period can interfere with changes to recurring entries. Payroll periods are not like General Ledger periods. You do not need to close payroll periods.

There are two reasons why you might not be able to view and select the payment method you are looking for. Either the start date of the payroll definition is before the start date of the organization payment method or the organization payment method has no associated payment source.

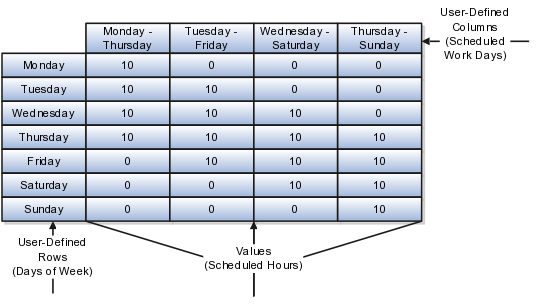

This example illustrates how to create a user-defined table to store values for workers schedules.

Your organization works on a 10 hour a day, four day a week rotating schedule. The employees work for four consecutive days, 10 hours a day.

The main components of the user-defined table are the definition, columns, rows, and values.

In this example, you will construct a user-defined table containing the schedules available in your organization.

This figure illustrates the user-defined table containing the various schedules that your organization offers.

This user-defined table definition consists of the following:

The name of the table is Scheduled_Hours.

The table is used to match to a specific day of the week.

The row title is Days of the Week.

The unit of measure is text since the row values are days of the week.

The user-defined columns are named the days of the week that the employee works. The data type for each column is number. The date type reflects the data type of the values that will be entered in each column.

There are seven user-defined rows containing the exact value of a day of the week.

The values are the scheduled hours for each day of the week. Since the employees only work four consecutive days of ten hours each, there can only be four different schedules. Each column contains the scheduled hours for each day of the week represented in the row.

This example illustrates how to create a user-defined table to store values for stock option allocations.

Each year, your organization offers stock options to its employees. The amount of options depends on years of service and job category of the employee receiving them.

The main components of the user-defined table are the definition, columns, rows, and values.

In this example, you will construct a user-defined table containing stock option allocations by job category and years of service.

This figure illustrates the user-defined table containing the stock option allocation that your organization offers.

This user-defined table definition consists of the following:

The name of the table is Stock_Options.

The table rows consist of a range of numbers that represent years of service.

The row title is Years of Service.

The unit of measure must be number when you are looking at a range of values.

The user-defined columns are named for each job category. The data type for each column is number. The date type reflects the data type of the values in each column.

There are seven user-defined rows containing the range of years of service allotting the same amount of stock options.

The values are the number of stock options. There are only four job categories, in this example. Each column contains the stock option allocation for each job category based on the range of service years.

Fast formulas are generic expressions of calculations or comparisons that you want to repeat with different input variables.

You can use fast formulas to:

Calculate payrolls

Define the rules for paid time off accrual plans

Define custom calculations for benefits administration

Validate element inputs or user-defined tables

Edit the rules for object group population for elements or people

Calculate absence duration

Define custom configuration for compensation

Write payroll calculations and skip rules for elements that you define to represent earnings and deductions. Associate more than one formula with each element to perform different processing for employee assignments with different statuses. You can define elements and formulas for earnings and deductions with highly complex calculations requiring a number of different calls to the database.

Edit the delivered accrual type formulas or write your own. Each accrual plan needs two formulas: one to calculate the gross accrual and the other to return information to the PTO carry-over process.

Configure your plan design to the requirements of your enterprise. Formulas provide a flexible alternative to the delivered business rules for such purposes as:

Date calculations, such as enrollment start and end dates, rate or coverage start and end dates, waiting periods and enrollment periods, or action item due dates

Calculations of rate and coverage amount, minimum and maximum, or upper and lower limits

Certification requirements

Partial month and proration calculations

Eligibility and participation evaluation

For example, you can write a formula to calculate benefits eligibility for those cases where the provided eligibility criteria does not accommodate your particular requirements.

For more information, see Benefits Fast Formula Reference Guide (1456985.1) on My Oracle Support at https://support.oracle.com.

Validate user entries into element input values using lookups or maximum and minimum values. However, for more complex validations write a formula to check the entry. Also, use a formula to validate entries in user tables.

Define criteria to dynamically populate a payroll relationship group or work relationship group. When you create a formula of type Payroll Relationship Group or Work Relationship Group, the Create Fast Formula page provides an expression editor to help you build the selection criteria.

Calculate the duration of an absence from the start and end dates.

Extend the existing flexibility of compensation plan configuration by writing formulas to customize:

Start and end dates for compensation allocations under individual compensation plans

Person selection, hierarchy determination, column default values, and currency selection for workforce compensation plans

The source of items displayed in total compensation statements

This example demonstrates, using the text editor, how to create a fast formula that returns the range of scheduled hours for managers and a different range for other workers.

The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In This Example |

|---|---|

|

Is the formula for a specific legislative data group? |

No, this is a global formula that can be used by any legislative data group. |

|

What is the formula type for this formula? |

Range of Scheduled Hours |

|

Are there any contexts used in this formula? |

No |

|

Are there any database item defaults? |

Yes, ASG_JOB |

|

Are there any input value defaults? |

No |

|

What are the return values? |

MIN_HOURS, MAX_HOURS, FREQUENCY |

|

Field |

Value |

|---|---|

|

Formula Name |

Manager Range of Scheduled Hours |

|

Formula Type |

Range of Scheduled Hours |

|

Description |

Manager's Range of Hours |

|

Effective Start Date |

1-Jan-2010 |

/* DATABASE ITEM DEFAULTS BEGIN */

DEFAULT FOR asg_job IS ' '

/* DATABASE ITEM DEFAULTS END */

JOB_1 = ASG_JOB

IF JOB_1 = 'Manager' then

(MIN_HOURS = 25

MAX_HOURS = 40

FREQUENCY = 'H')

else

(MIN_HOURS = 20

MAX_HOURS = 35

FREQUENCY = 'H')

return MIN_HOURS, MAX_HOURS, FREQUENCY

This example demonstrates how to create a fast formula that groups executive workers for reporting and processing. All executive workers are in department EXECT_10000. Once the formula is created it will be added as object group parameters so that only those workers in department EXECT_10000 are used in processing.

The following table summarizes key decisions for this scenario:

|

Decisions to Consider |

In This Example |

|---|---|

|

Is the formula for a specific legislative data group? |

Yes, InVision |

|

What is the formula type for this formula? |

Payroll Relationship Group |

|

Field |

Value |

|---|---|

|

Formula Name |

Executive Payroll Relationship Group |

|

Type |

Payroll Relationship Group |

|

Description |

Executive Workers |

|

Legislative Data Group |

Vision LDG |

|

Effective As-of Date |

1-Jan-2010 |

|

Conjunction |

Database Item Name |

Data Type |

Operand |

Literal Value |

|---|---|---|---|---|

|

IF |

DEPARTMENT |

Character |

= |

'EXECT_10000' |

|

Then |

SELECT_EMP |

Character |

= |

'YES' |

|

ELSE |

SELECT_EMP |

Character |

= |

'NO' |

Compilation errors display in the Manage Fast Formulas page when you compile the formula. The formula compiler returns line numbers starting at 1 from the beginning of a formula, and character positions starting at 1 from the beginning of a line in its error messages. The compiler aborts compilation when an error is encountered.

This table lists the type and description of several common formula compilation errors.

|

Formula Error |

Description |

|---|---|

|

Syntax Error |

The formula text violates the grammatical rules for

the formula language. An example is using |

|

Incorrect Statement Order |

|

|

Misuse of |

Occurs when any of these conditions occurs:

|

|

Misuse of |

An |

|

Missing |

A database item with defaulting specified must have

a |

|

Misuse of |

A DEFAULT statement is specified for a variable other than an input or database item. |

|

Uninitialized Variable |

The compiler detects that a variable is uninitialized when used. The compiler cannot do this in all cases. This error often occurs when you want to use a database item, but a database item is not available in the formula. |

|

Missing Function Call |

A function call is not recognized. The combination of return type, function name, and parameter types does not match any available function. |

|

Incorrect Operator Usage |

An instance of a formula operator use does not match the permitted uses of that operator. For example, the + operator has two permitted uses.

The operands are both of data type |

|

Inconsistent Data Type Usage |

A formula variable is being used as if it is of more than one data type. Or a database item or context is being used with the wrong data type. For example, Variable A is assigned a |

|

|

A condition that eventually becomes false, or an |

|

Misuse of Context |

A variable is used as a context, or a context is used as a variable. For example, |

Fast formula execution errors occur when a problem arises while a formula is running. The usual cause is a data problem, either in the formula or in the application database. These errors contain the formula line number where the error occurs.

This table lists the type and description of each formula execution error.

|

Formula Error |

Description |

|---|---|

|

Uninitialized Variable |

Where the formula compiler cannot fully determine if a variable or context is initialized when it is used, it generates code to test if the variable is initialized. When the formula executes and the variable or context is not initialized an error is raised. |

|

Divide by Zero |

Raised when a numeric value is divided by zero. |

|

No Data Found |

Raised when a non-array type database item unexpectedly fails to return any data. If the database item can return no data then it should allow defaulting. This error is also raised from within a formula function. The cause is an error in the formula function code. |

|

Too Many Rows |

Raised when a non-array type database item unexpectedly returns more than a single row of data. The cause is an incorrect assumption made about the data being accessed. This error can also be raised from within a formula function. The cause is an error in the formula function code. |

|

|

Raised when a database item unexpectedly returns a |

|

Value Exceeded Allowable Range |

Raised for a variety of reasons, such as exceeding the maximum allowable length of a string. |

|

Invalid Number |

Raised when an attempt is made to convert a non numeric string to a number. |

|

User Defined Function Error |

Raised from within a formula function. The error message text is output as part of the formula error message. |

|

External Function Call Error |

A formula function returned an error, but did not provide any additional information to the formula code. The function might have output error information to the logging destination for the executing code. |

|

Function Returned |

A formula function returned a |

|

Too Many Iterations |

A single |

|

Array Data Value Not Set |

The formula attempted to access an array index that has no data value. This is an error in the formula code. |

|

Invalid Type Parameter for |

An invalid data type was specified in the |

|

Incorrect Data Type For Stored Item |

When retrieving an item using |

|

Called Formula Not Found |

The called formula could not be resolved when attempting to call a formula from a formula. This could be due to an error in the calling formula, or because of installation issues. |

|

Recursive Formula Call |

An attempt was made to call a formula from itself. The call could be directly or indirectly via another called formula. Recursive formula calling is not permitted. |

|

Input Has Different Types In Called and Calling Formulas |

When calling a formula from a formula, the actual formula input data type within the called formula does not match the data type specified from the calling formula. |

|

Output Has Different Types In Called and Calling Formulas |

When calling a formula from a formula, the actual formula output data type within the called formula does not match the data type specified from the calling formula. |

|

Too Many Formula Calls |

There are two many formula from formula calls. This is due to a problem with the formulas. |

If you need to compile many fast formulas at the same time, you can run the Compile Formula process on the Submit a Process or Report page. Also, if you make any changes to a function after you have compiled a formula that uses it, you need to recompile the formula for the changes to take effect.

Compilation errors occur in the Manage Fast Formulas page when you compile the formula. An error message explains the nature of the error. Common compilation errors are syntax errors resulting from typing mistakes.

Execution errors occur when a problem arises while a formula is running. The usual cause is a data problem, either in the formula or in the application database.

Payroll balances show the accumulation of values over a period of time. The values can be currency, hours, or any other numeric value. You manage balance definitions from the Payroll Calculation work area. Most of the balances you require are predefined and additional balances are created automatically when you create elements. You can edit the definition of these generated balances, or create additional balances for calculations or reporting.

When you create a balance definition, you select the balance category and a unit of measure. Each balance definition is grouped in a predefined balance category for quicker processing. Balance categories are legislation-specific and cannot be modified. The predefined units of measure available for selection are Day, Hour (with different combinations of minutes and seconds), Integer, Money, and Number.

Important aspects of balance definitions are:

Balance Dimensions

Balance Feeds

Generated Balances and Database Items

Base Balances

Remuneration

Each balance can have multiple dimensions, which define the specific value to be retrieved. Balance dimensions are predefined and typically combine these components:

Time span, such as run, period to date, or fiscal year to date

Employment relationship level, either assignment, terms, or payroll relationship

Context, required for some balances only, such as tax reporting unit, element, or payroll

For example, if you select the dimension Core Assignment Tax Unit Year to Date for the balance Gross Earnings, you create the defined balance GROSS_EARNINGS_ASG_TU_YTD, which accumulates gross earnings for an assignment in a specific tax reporting unit from the beginning of the calendar year to date.

You can define balance feeds by element input values or by balance classification run results.

Balance Feeds by Element

Balance feeds by element indicate one or more element input values to add or subtract from a balance. For each balance feed, all elements must be of the same data type. For example, you would not mix money and hours in the same balance feed.

If a balance is fed by a single element, it is called a primary balance.

Balance Feeds by Classification

Balance feeds defined by primary or secondary element classification are always payroll run result values.

If you add a primary classification as a balance feed, you cannot add the children of this classification from the secondary or subclassifications. For example, if you use the Supplemental Earnings primary classification as a balance feed, you cannot also use any secondary or subclassification that are children of Supplemental Earnings. Also, you cannot use both secondary classifications and subclassifications in the same balance feed.

For any balance that you need to initialize, regardless of whether it is fed by elements or classifications during normal processing, you can select elements to feed it for balance initialization purposes only. Select one element for each level of the employment hierarchy associated with a dimension that you want to initialize.

When you create elements, balances and balance feeds are created automatically as determined by the element template. A database item is generated automatically for each balance dimension. You can use the database items in your formulas to check the value of a balance.

You can specify a base balance when there is a relationship between balances that can be relied on when processing and reporting. For example, Loan Repayment could be the base balance for Loan Repayment Arrears.

One balance in a legislation is predefined as the remuneration balance, which is used to generate payments for employees. For example, the remuneration balance might be Net Pay, which is a calculated balance that is the sum of standard earnings and supplemental earnings minus all the deductions calculated for the run.

Important

Setting the Use for Remuneration option to Yes means the balance will be defined as the remuneration balance. Only one balance in a legislation can be the remuneration balance.

Setting initial balances values is an essential task when you migrate payroll data from another system. First you load balance values into batch views then submit the Load Initial Balances process from the Payroll Calculation work area. The process validates then processes the batch.

For each balance to be initialized, you must create elements in the Balance Initialization classification and add them to the balance as balance feeds. You can create up to three elements: one to initialize assignment level balances, one for employment terms level, and one for payroll relationship level.

Each balance initialization element must:

Be nonrecurring and for balance adjustments only.

Be processable in the payroll run.

Have an input value to feed the balance and an input value for each context required by the balance. If you need to set initial values for a large number of balances you can define multiple input values for a single element with each input value feeding a different balance.

Populate the batch views with the balance values for the initialization date. You can use the Batch Loader spreadsheet, or populate the batch directly using the API in the PAY_BALANCE_BATCH_LINES_PKG API package. You can download the Batch Loader spreadsheet in the Payroll Administration work area.

The views are:

PAY_BALANCE_BATCH_HEADER

PAY_BALANCE_BATCH_LINES

Important

The PAY_BALANCE_BATCH_LINES view has a complex definition and cannot be directly inserted into. You must use the Batch Loader spreadsheet or API.

When you create the batch header and lines, consider the following points:

Divide your employees into separate batches to limit the size of each batch.

Within a batch, ensure that you include batch lines for every balance to be initialized for a person. You cannot split lines for a person across multiple batches.

The date you specify on the batch header applies to all lines unless you enter an override date at the line level. The date at line level must be on or before the date on the header.

You cannot initialize balances once you have run any payroll processes.

The Load Initial Balances process validates then processes the initial balance values you load into batch views. It creates balance adjustments to set the required values.

The data you load into the batch views determines which defined balances are initialized and the values used. Typically, you group employees into batches to manage the initialization of their balances.

The Load Initial Balances process validates that the entities referenced in the batch data exist, including balances, balance dimensions, tax reporting units, payrolls, payroll relationships, employment terms, and assignments. It checks that values are available for the contexts used by each balance dimension. It does not check, for example, that an employee is assigned to a specified organization. It sets the status of valid batch lines to V.

The process creates balance adjustments. For all the batch lines it successfully processes, the process sets the status to T and updates the PAYROLL_REL_ACTION_ID to point to the balance adjustment.

The following table shows a simple three-line batch loaded on 18 June.

|

Defined Balance |

Value |

|---|---|

|

Total_Earnings_PTD |

100 |

|

Total_Earnings_QTD |

250 |

|

Total_Earnings_YTD |

500 |

For this batch, the process creates an adjustment on the first day of the time period relevant to each dimension, as shown in the following table:

|

Adjustment Date |

Adjustment Value |

Balances Adjusted |

|---|---|---|

|

1 June |

100 |

Total_Earnings_PTD Total_Earnings_QTD Total_Earnings_YTD |

|

1 April |

150 |

Total_Earnings_QTD Total_Earnings_YTD |

|

1 Jan |

250 |

Total_Earnings_YTD |

The PAY_BALANCE_BATCH_HEADER and PAY_BALANCE_BATCH_LINES views hold the data used by the Load Initial Balances process to initialize balance values.

You must load data into these views using the Batch Loader spreadsheet or API in the PAY_BALANCE_BATCH_LINES_PKG PL/SQL package. Create each batch line with a BATCH_LINE_STATUS of U (unprocessed) and leave the PAYROLL_REL_ACTION_ID column blank. The batch upload process updates these two columns.

Note

You can view the full column listing by querying the view in the Oracle Enterprise Repository at https://fusionappsoer.oracle.com/oer/.

In PAY_BALANCE_BATCH_LINES, the columns shown in the following table are required. Where there is both an ID column and a name column for the same entity, for example, PAYROLL_ASSIGNMENT_ID and ASSIGNMENT_NUMBER, you can populate either column, but you must populate at least one. If the ID column is left blank, the batch upload process uses the name column value to derive the ID value.

|

Column |

Comments |

|---|---|

|

PAYROLL_RELATIONSHIP_ID + PAYROLL_RELATIONSHIP_NUMBER |

Identify the payroll relationship for this balance value. |

|

BALANCE_TYPE_ID + BALANCE_NAME |

Identify the balance for this balance value. |

|

BALANCE_DIMENSION_ID + DIMENSION_NAME |

Identify the balance dimension for this balance value. DIMENSION_NAME should be populated with the localization's dimension usage dimension name rather than the core DIMENSION_NAME held on PAY_BALANCE_DIMENSIONS. |

|

VALUE |

Identify the numerical value of the balance on the upload date. |

|

UPLOAD_DATE |

Identify the date of the balance value. This date must be on or before the upload date for the batch header. |

|

PAYROLL_ID + PAYROLL_NAME |

Identify the context required for evaluating a balance value, even though it may not be a context for the dimension. |

The core contexts shown in the following table must be populated if the balance dimension expects a value for this context.

|

Column |

Comment |

|---|---|

|

PAYROLL_TERM_ID + TERM_NUMBER |

Identify the payroll term for this balance value, if required. Where there is both an ID column and a number column for the same entity, you can populate either column, but you must populate at least one. |

|

PAYROLL_ASSIGNMENT_ID + ASSIGNMENT_NUMBER |

Identify the payroll assignment for this balance value, if required. |

|

LEGAL_EMPLOYER_ID + LEGAL_EMPLOYER_NAME |

|

|

TAX_UNIT_ID + TAX_UNIT_NAME |

|

|

AREA1 + AREA2 + AREA3 + AREA4 |

Identify state and country code information. In Oracle E-Business Suite these items were STATE_CODE, COUNTY_CODE and so on. |

|

THIRD_PARTY_PAYEE_ID + THIRD_PARTY_PAYEE_NAME |

|

|

TIME_DEFINITION_ID + TIME_DEFINITION_NAME |

|

|

RUN_TYPE_NAME + RUN_TYPE_ID |

|

|

ELEMENT_ENTRY_ID |

|

|

BALANCE_DATE |

|

|

CALC_BREAKDOWN_ID |

Identify the ID associated with payroll term. |

There are six legislative or user-defined contexts, which must be populated if the balance dimension expects a value for these contexts. For each context, there is a context ID, name, and value. For example:

CONTEXT1_ID + CONTEXT1_NAME

CONTEXT1_VALUE if CONTEXT1 is used by the balance dimensions

Note

The values of the core contexts are the IDs themselves, while the values of the legislative contexts are separate from the ID of the context.

Populate CONTEXT[1-6]_NAME with the name of the context usage for that legislative or user-defined context, and CONTEXT[1-6]_VALUE with the actual value of that context.

Elements are grouped into primary classifications, such as Earnings and Voluntary Deductions. In a human resources department, you can use the primary classifications to identify groups of elements for information and analysis purposes. In a payroll department, the classifications control processing, including the sequence in which elements are processed and the balances they feed.

Oracle Fusion provides you with these primary classifications and some balances, mainly to reflect tax legislation. They are designed to meet the legislative requirements of your country, so you cannot change them. You can create additional balances to be fed by any of the primary classifications.

Secondary classifications are subsets of the primary classifications. Use them to manage wage basis rules for deductions and taxes. Many legislations have predefined secondary classifications, and a few allow you to create your own. As with primary classifications, you cannot remove or change any predefined secondary classifications.

Subclassifications provide a way to feed balances. Elements can have only one primary and secondary classification, but multiple subclassifications. You can create subclassifications or use predefined ones. Once a subclassification is associated with a classification it cannot be associated with another classification. A subclassification name can be reused under different primary classifications, but you will have to create separate balance feeds for each subclassification with the same name.

If the classification is set to allow costing, you can select any costing option for element eligibility records. You can create distribution groups with elements that have a primary classification that allows distribution. For example, you can create a distribution with all of the earnings elements and prorate tax expenses proportionately over the cost centers in which the wages were earned. The primary classification also determines whether a positive amount is costed as a debit or a credit.

Use frequency rules on an element that is not scheduled to process each period. For example, the rules for a weekly payroll could indicate that the element entries for that element would only be processed on the first and third payroll periods of each month. The default frequency rule is always each period.

Payroll runs process elements in a predefined sequence, which you can determine.

An element's primary classification defines a default processing priority for the element in payroll runs. Lower priority numbers process first

Most classifications also have a priority range. When you define an element in these classifications, you can overwrite its default processing priority with another number from the range. This is useful if you need to establish the order in which the element processes with respect to other elements in the classification

Sometimes you must prioritize the processing of certain element entries for an individual person. For example, you may need to determine the precise order in which deductions taken for wage attachments process for a person. You can enter a subpriority number for element entries.

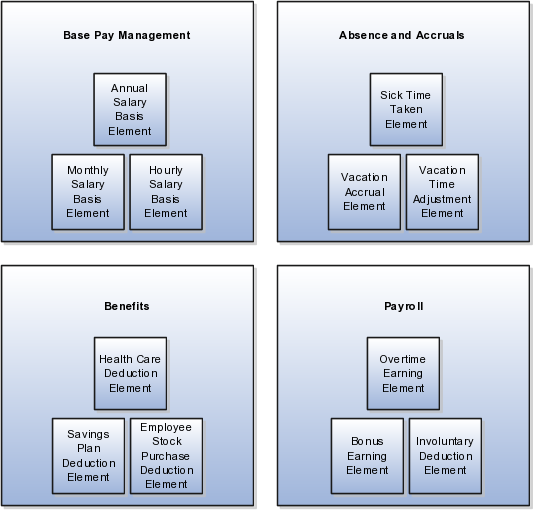

Elements are building blocks that help determine the payment of base pay, benefits, absences, and other earnings and deductions. The components of elements are set up differently based on how the element is to be used.

To manage base pay, you attach a single earning element to each salary basis to hold base pay earnings, and assign a salary basis to each worker. When a manager or compensation specialist enters a base pay amount for a worker, the amount is written to the payroll element input value associated with the worker's salary basis and used in payroll processing to generate payment amounts.

You can manage employee absences and leave time. To facilitate reporting and analysis of employee absences, you can distinguish between absence categories, absence types, and absence reasons. You can associate an absence type with an element to maintain an absence balance for an employee. You can associate absence types and other elements with accrual plans to determine the net accrual of an employee.

Attach elements at various levels in the benefits object hierarchy to create deductions and earnings that can be processed in a payroll run to calculate net pay.

For Oracle Fusion Global Payroll, you define earning and deduction elements, such as bonus and overtime earnings and involuntary deductions. These elements incorporate all the components required for payroll processing, including formulas, balances, and formula result rules.

Elements are the building blocks of payroll and benefits. There is no limit to the number of elements you can define. You define the policies or business rules that govern the allocation of these elements to your workers.

Elements can represent:

Earnings, such as salary, wages, and bonuses

Compensation, such as employee stock purchase and insurance plans

Absences from work

Tangible items distributed to persons, such as tools, uniforms, mobile phones, or computers

Statutory deductions, such as taxes, voluntary deductions, such as contributions to charities or savings plans, and involuntary deductions, such as court orders, as well as pretax deductions

Employer taxes and other employer liabilities

Oracle Fusion supplies many predefined elements while additional elements are generated when you define certain types of compensation and payroll elements through templates.

The predefined elements are specific to your localization. They typically include deductions for tax and wage attachments. You cannot make any changes to these predefined elements.

You can create many earnings and deductions from element templates. The templates include the elements, balances, balance feeds, and formulas required for payroll processing. You can configure any of these definitions to match your specific business requirements.

The components of an element's definition are available for entry based on the primary and secondary classification you select, for example a standard earning. This diagram illustrates element definition components and what is defined in each component.

For example, you can define an element called Wage, for hourly paid workers. You classify the element in the predefined classification Earnings, which determines when it is processed in the payroll run and what payroll balances it feeds.

You must specify at least one input value, in this case Hours Worked, which must be entered in each payroll period. If required, you can define multiple input values with fixed values, defaults, or validation.

You associate a formula with the element, to calculate the wage for the payroll period. A simple formula might be hours worked, from the input value, multiplied by an hourly rate, from compensation information on the employment record. You define who is eligible for the element by assigning eligibility criteria to various components in the persons employment record, such as grade, payroll, salary basis, or organization. In this example, the wage element is available to all persons on the weekly payroll.

An element's input values defines the entry values available on each entry of this element. Each input value has a unit of measure defined, and can have validations and conditions defined to control the data entry of the element entry assigned to a person. For example, an earnings element may have an input value for hours worked, which is defined as required and has a unit of measure of number.

When you create an element, some input values are created automatically if you use Oracle Fusion Global Payroll or Oracle Fusion Global Payroll Interface. For Global Payroll Interface, this applies to earnings elements only. You can create additional input values for any element, as needed.

For each input value created you can modify these attributes:

|

Field |

Purpose |

|---|---|

|

Display Sequence |

Control the order in which the entry value is displayed on element entries. |

|

Special Purpose |

Identify how an input value is used, irrespective of the name given to it. For example, it identifies if the input value holds a percentage value, a rate, or third-party payee details. It basically assists with processing the input value based on what type of information it holds. |

|

Unit of Measure |

Select the value that describes the type of value the entry value can hold, such as number or character. |

|

Displayed |

Select to display the input value on the element entry. |

|

Allow User Entry |

Select to enter values on element entries. |

|

Required |

Select to make the input value a required entry value on the element entry. If you select Required, you must also select Displayed and Allow User Entry. |

|

Create a Database Item |

Select to have a database item created for the input value to make the values available for formulas or system extract. |

|

Default |

Enter a value that appears as the default value for this entry value in element entries, if needed. |

|

Apply default at runtime |

Select to have the default set on the element entry when the payroll process is run. Changes to the default value are reflected in the next processing after the effective date of the change. You can replace the default at runtime functionality by manually providing an entry value on the element entry. |

|

Minimum |

Enter a minimum value for the element, if needed. |

|

Maximum |

Enter a maximum value for the element, if needed. |

|

Validation Formula |

Enter a formula that validates the entry value entered on element entries, if needed. |

|

Validation Source |

Use with the other input value options to select the valid validation method, such as lookups or formulas. |

|

Lookup Type |

Specify a lookup type to provide a list of values for an element entry value. |

|

Warning or Error |

Use when you are validating the input value or entering a minimum or maximum value. It specifies whether a warning or an error displays if the entry fails the validation condition or does not meet the minimum or maximum value indicated. |

|

Reference |

Use to associate a balance context with the run result. For example, if you want to associate a context, such as jurisdiction, with an element; create an input value for jurisdiction and select the jurisdiction context in the reference field. Then the run result value of the input value will work as context value when updating the balance. If you select a reference then the lookup type and validation source values should be automatically set to the reference context. You need to provide the reference field first for the validation source value to be automatically populated. |

Note

Once an element is processed, you cannot update certain input value attributes, such as unit of measure. This ensures that changing certain attributes will not invalidate prior results.

After you have defined and used an element, updates to the element are limited to ensure the integrity of the element for retroactive processing and the balances of the input values. You cannot remove existing input values or add new ones if you have created entries for the element. You must add an input value to an element before you create any element entries, or set the element entries effective date to the element's start date.

You can make the following changes to an element that has been previously processed:

Change a required input value to be optional.

Alter the sequence in which input values appear in the Element Entries flow.

Change the input value validation rules for minimum, maximum, lookup, or formula.

Change your specification of which input values create database items.

You can select rules for the element's entry value to define how you can update the element entries. The options are:

Automatic entry

Allow multiple entries in same period

Additional entry

Entry values can be automatically added in element entries in three ways.

Elements can be defined to default an input value at creation. The user defining the element can specify the entry value to be defaulted when an element entry is created. Users can override or change the default at any time. Changes to this type of a default value on the element do not affect existing element entries.

Elements can be defined to default an input value at run time. When this is selected, the element will automatically default the element entry value. `This value can be updated if needed. A change to the default value for an input value set to default at run time will automatically change the value to be applied at run time for everybody with an entry for that element.

Some entry values are automatically created by a service or process used with compensation, benefits, or formula results.

Important

An element with automatic entry allowed cannot allow multiple entries in the same period.

This option allows you to give a person more than one entry of the element in the same pay period. For example, if you enter overtime hours on a weekly basis for monthly-paid persons, you might need to give a person five entries of an overtime element in each period.

If you are creating a net-to-gross element, you must select Allow multiple entries in same period.

This option allows you to add an occasional one time entry for recurring elements. This additional entry can override or add to the normal entry amount.

At minimum, an element needs one standard processing rule. This identifies the formula the payroll run uses to process the element for persons with an active employment record. It is also the default formula for other assignment statuses. However, you can define additional processing rules if you need to use different formulas for assignments at other statuses. For example, you could have two rules for a Wages element: Standard Wages and Paid Training Leave.

You can add one or more of the following optional results rules to an element:

Direct result

Indirect result

Message

Order indirect

Stop

Target indirect

For all formula result types except Direct Result or Message, select the target element name to which you want to pass the formula result. This element must have a processing priority causing it to process after the element sending the result.

For the formula result types Direct Result, Indirect Result, and Target Indirect, select the target input value to update.

This is the element's run result, or a direct result updating one of the element's input values.

This result passes as an element entry to another nonrecurring element not yet processed.

The formula issues messages under certain conditions. For example, a formula can check a loan repayment balance and, if the balance is zero, issue the message "Loan is repaid."

There are three severity levels for a message rule:

Error

This causes the run to roll back all processing for the employment record.

Warning

This does not affect payroll processing but warns you of a possible problem.

Information

This does not affect payroll processing.

This result updates the subpriority of the element you select in the Target Element Name field.

This formula result uses the Date Earned of the payroll run to put an end date on a recurring entry of this or another element (which must be defined with Allow Multiple Entries not selected).

This result updates recurring entries of this or another element on the effective date of the payroll run. The receiving element must be defined with Allow Multiple Entries not selected unless you are passing a recurring element's entries to itself, that is updating another entry of the same element. With this result rule, any future-dated changes to the entry will be overwritten by the results of the current payroll run.

An element's latest entry date determines how element entries process after a person is terminated or transferred to another payroll. The options are:

Final close

Last standard earning date

Last standard process date

Note

These are the predefined options, you can create others that fit your business needs.

This option allows the element to stay open for entries beyond a persons last day worked. For example, you want the element to stay open to pay a severance package to a terminated person.

This option stops all element entries on the date the person leaves. It is recommended to use this option for recurring entries such as salary.

Note

When you select the Last Standard Earning Date, also select proration for the element. This ensures the element is processed for proration purposes, even if it is not active at the end of a payroll period.

The last standard process date defaults to the last day of the pay period in which the person is terminated, but you can set it to a later period when you terminate a person. It enables all element entries to stop on the last standard process date or on the date the assignment ends, if this is earlier.

Note

This option is only available for Oracle Fusion Global Payroll users.

Element eligibility determines which people are eligible for an element. To determine eligibility, you assign element eligibility criteria to the components that persons must have to receive entries of the element. While some elements may represent compensation, deductions, and equipment available to all persons, many elements are available only to certain groups of persons. For example, your enterprise might provide company cars only to persons in the Sales Department. Eligibility criteria rule out the possibility of persons getting element entries by mistake. For example, you might want to give a production bonus only to those persons who work full time in Production and are on the weekly payroll. To do this you would define eligibility criteria for the element Production Bonus and the combination of the Production organization, the Full-Time assignment category, and the Weekly payroll.

Element eligibility can be assigned by many different criteria.

All payrolls or for specific payrolls

Payroll statutory unit

Legal employer

Payroll relationship type

Department in which the person works

Location of person's office

Job, for example, Associate Professor or Secretary

Grade

Groups to which the person belongs. You set up all the groups that are appropriate for your enterprise. For example, you could decide to group persons by company within a multi-company enterprise, and by union membership.

Position, which is a class of job performed in a particular organization, for example, Associate Professor of Chemistry, or Finance Department Secretary.

Note

In order to enter an element for a worker, you must define element eligibility for every element. This must be done for predefined elements and those you define. If you want the element to be available to all workers, you can save the element eligibility record with no criteria selected. This is the usual practice for compensation and benefit elements where you determine eligibility using eligibility profiles.

You can define more than one eligibility criteria for each element but there must be no overlap between them. For example, you could create one criteria for the combination of grade A and the job Accountant. However, you could not create one criteria for grade A and a second for the job Accountant. This would imply that an accountant on grade A is eligible for the same element twice. If you have more than one criteria for an element, you can enter different default values, qualifying conditions, and costing information for each eligibility group.

Element eligibility rules always control element entries.

After you have used an element you can make the following changes to the eligibility rules:

Change the input value default values and validation.

These changes affect all new entries. Changes to run time defaults affect existing entries. The system also uses the new validation rules to check any updates you make to existing entries.

Date-effectively end all of the rules that apply to an element and define a new set of rules, which are effective from a later date. For example, suppose you have defined eligibility for a company car based on grade. Following a change of policy you must now define eligibility based on job.

You will not be allowed to end the element eligibility if any nonrecurring entries exist at the date you want to end the rule. You must delete existing entries before you end the element's eligibility.

You can end the element eligibility if recurring entries exist. Any existing entries will be ended automatically when you end the element's eligibility.

Change the qualifying conditions of age and length of service that persons must meet to be eligible for the element.

Proration is the calculation of proportionate element amounts whenever payroll-relevant data is changed during a payroll period. For example, a person joining or leaving the company or a change of pay grade, mid-payroll period, could trigger proration. You add a proration formula to the element and add the element to a proration event group.

The proration formula determines how to prorate the element. For example, you can prorate based on hours in a pay period or days in a pay period. You can either use a payroll formula that handles proration, or create a separate proration formula that runs after the main payroll formula only in payroll periods in which a proration event occurs.

You must assign an event group to an element to prorate it. When you define the event group, you select the events that activate proration calculation, such as hiring a person or terminating employment.

Gross-up functionality enables you to calculate the gross earnings required to generate a specified net pay for a given earning, if you need to pay a person a guaranteed take home pay (net) per payroll period, or to pay a specified bonus of a set amount (net amount). You define which taxes and other deductions the employer is willing to pay by selecting the balances that can be used in the net-to-gross processing.

Follow these steps to set up elements for gross-up processing.

On the Standard Rules section of the earning element, define the element with the following criteria:

Nonrecurring entry

Allow multiple entries in same period

Enter a skip rule to process once per pay period

On the Duration Rules section define

the Latest Entry Date to be Final Close.

On the Advanced Rules section, define the element with the following criteria:

Gross-up during calculation

Pay separately from other elements

Select Yes to enable iterative calculation

Enter an iterative order.

Note

Iterative order must be in the reverse sequence of the processing priority numbers. The element with the lowest iterative priority number is reduced first.

Enter an iterative formula.

Chose the following input values for the element:

|

Input Value Name |

Purpose of Entry |

|---|---|

|

Pay Value |

The gross pay is returned to this input value when it has completed the gross-up calculations. |

|

Amount |

The amount gives the iterative formula the desired net pay. |

|

Low Gross |

The low gross is used by the iterative formula to hold the lower gross pay guess, to feed into the next iteration of the formula. |

|

High Gross |

Used by the iterative formula to hold the higher gross pay guess, to feed into the next iteration of the formula. |

|

Remainder |

The amount by which the additional pay to be paid by the employer (gross minus desired net) differs from the total of the balances that are eligible for gross-up processing. Returned by the iterative formula. |

|

To Within |

The amount by which actual net can differ from desired net after normal processing. Must not be zero but can be a nominal amount such as 0.01. |

|

Method |

The method of iterative calculation: binary or interpolation. This determines which function the iterative formula calls. Use the lookup type ITERATIVE_METHOD and select the default interpolation, since this is usually the more efficient method. |

|

Additional Amount |

The amount to add to desired net to calculate gross pay. Returned by the iterative formula. |

Define element eligibility rules.

On the Processing Rule section, enter the following formulas:

Add a gross-up formula in the standard processing formula name

Create a formula result rule to feed the payment amount result as a direct result to the element's pay value.

On the Balance Feeds section, confirm which balances feed your gross-up element.

On the Gross Balance Exclusions section, select the deductions to be paid by the employer.

The formulas for Net-to-Gross processing do the following:

The iterative formula takes as input the desired net amount (Amount input value), the amount by which net can differ from the desired amount (To Within input value), and the method of calculation (Method input value).

In the first run the formula sets the lower gross limit to the desired net amount, and the higher gross limit to twice the desired amount. Then it runs a function to provide the first guess of the gross. The formula returns three values to the element's input values: low gross, high gross, and additional amount.

The element's payroll formula runs. It adds the additional amount to the desired amount to create the gross amount and returns this value to the element's pay value for the payroll run to process.

In the next iteration, the iterative formula compares the additional amount to the total value of the balances that are available for gross-up for this element entry. The additional amount must not differ from this balance total by more than the amount you specified in To Within field.

If the additional amount equals the balance total, then the iterative processing ends.

If the additional amount is above or below the balance total by an acceptable margin, then the processing ends and the formula returns the remainder (additional amount - balance) to the element's Remainder input value.

Otherwise, the formula runs the function to generate a better estimate for gross, using the remainder to determine by how much to change the guess. The formula checks the results in another iteration.

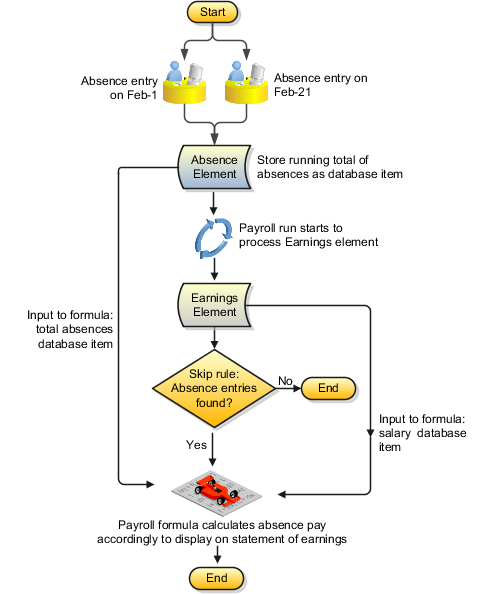

When you create an absence element for an absence type, your choice of element classification determines how absence entries display on the statement of earnings. You must use one of the following classifications:

Information classification or Absence classification

Standard Earnings classification

Use either of these classifications if you want to:

Process absences in a single calculation.

Prevent absence entries from appearing on the statement of earnings that the payroll run generates.

Note

Although both the Information classification and Absence classification work in the same way, you can select either classification depending on your reporting requirement.

Since payroll runs do not process elements in the Information or Absence classifications, you can use an Earnings element to manage the calculation and payment of absences. For example, you can define a skip rule for an Earnings element that triggers processing when it finds an entry for the absence element. The payroll formula associated with the Earnings element uses the database item of the absence element to retrieve the total number of absences. Then the formula uses another database item to retrieve the salary or hourly rate to calculate the total absence pay for the period and, if necessary, reduce the regular earnings.

The following figure depicts the relation between the Absence element, Earnings element, skip rules, and the payroll formula associated with the Earnings element:

Use this classification if you want to:

Process absences individually in each payroll period.

Treat absence entries as earnings.

This approach creates a one-line entry on the statement of earnings for each absence type. For example, you can use this classification if your employees submit timecards, and you want absences taken by these employees to show on the statement of earnings.

When you set up an absence type, you can determine how absences are processed in payroll runs. Choose the type of element to associate with the absence type:

Use a nonrecurring absence element.

Use a recurring absence element (only if you use Oracle Fusion Global Payroll and enable proration).

Nonrecurring absence elements are valid for the payroll period in which the absence starts. The application creates the entry only when you enter the absence end date. The element entry records the full value of the absence duration even if the end date falls beyond the payroll period.

For example, if you enter an absence that starts on May 24 and ends on June 5 for someone on a monthly payroll, the element entry is dated May 1 to May 31 and records the full value of the absence duration (13 days).