11g Release 7 (11.1.7)

Part Number E20375-08

Home

Contents

Book

List

Contact

Us

|

Oracle® Fusion Applications

Financials Implementation Guide 11g Release 7 (11.1.7) Part Number E20375-08 |

Home |

Contents |

Book List |

Contact Us |

|

Previous |

Next |

This chapter contains the following:

Accounting Configuration Offerings: Overview

Ledgers and Subledgers: Explained

Financial Ledgers: How They Fit Together

Creating Primary Ledgers: Example

Specifying Ledger Options: Worked Example

Assigning Legal Entities and Balancing Segments: Examples

Data Access Set Security: Examples

Data Access Set Security: Overview

Define General Ledger Security: Explained

Segment Value Security: Examples

Define Ledgers: Review and Submit Accounting Configuration

Manage Chart of Accounts Mapping

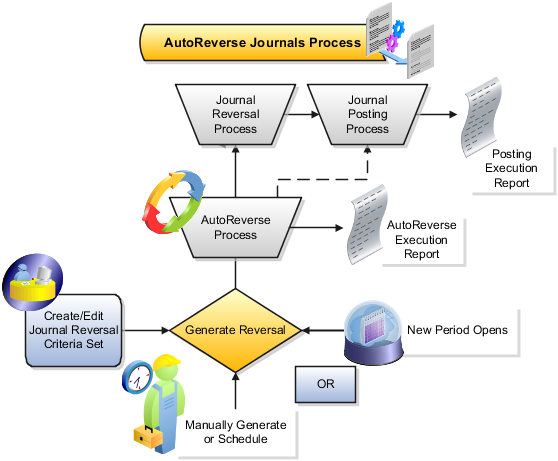

Manage Journal Reversal Criteria Sets

Manage Allocations and Periodic Entries

The Setup and Maintenance work area in the Oracle Fusion Applications is used to manage the configuration of legal entities, ledgers, and reporting currencies that comprise your accounting configuration. To create a new legal entity or ledger, your implementation consultant or system administrator must create an implementation project. This implementation project can be populated by either adding a financials related offering or one or more task lists.

Note

Setup tasks that are not related to the ledger or legal entity specific setup tasks can be invoked from either an implementation project or launched directly from the Setup and Maintenance work area.

There are two offerings predefined for financial implementations.

The Oracle Fusion Accounting Hub offering is used to add the Oracle Fusion General Ledger and Oracle Fusion Subledger Accounting application features to an existing enterprise resource planning (ERP) system to enhance the current reporting and analysis.

The Oracle Fusion Financials offering, which includes the Oracle Fusion General Ledger and Oracle Fusion Subledger Accounting application features, as well as at least one of the subledger financial applications.

When adding an offering to an implementation project, implementation consultants can customize the tasks displayed by adding additional tasks to the implementation project.

Oracle Fusion Applications reflect the traditional segregation between the general ledger and associated subledgers. Detailed transactional information is captured in the subledgers and periodically imported and posted in summary or detail to the ledger.

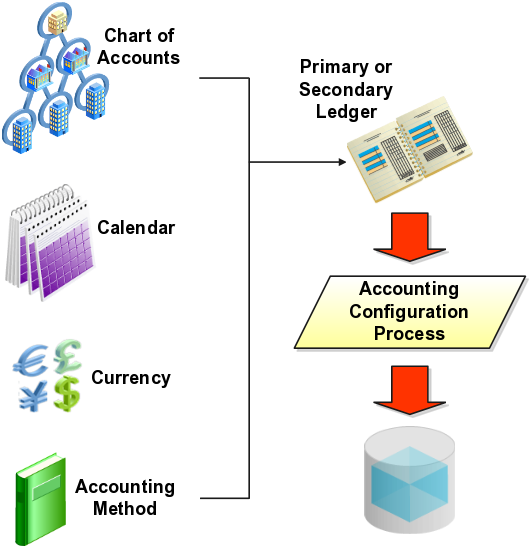

A ledger determines the currency, chart of accounts, accounting calendar, ledger processing options, and accounting method for its associated subledgers. Each accounting setup requires a primary ledger and optionally, one or more secondary ledgers and reporting currencies. Reporting currencies are associated with either a primary of secondary ledger.

The number of ledgers and subledgers is unlimited and determined by your business structure and reporting requirements.

If your subsidiaries all share the same ledger with the parent company or they share the same chart of accounts and calendar, and all reside on the same applications instance, you can consolidate financial results in Oracle Fusion General Ledger in a single ledger. Use Oracle Fusion Financial Reporting functionality to produce individual entity reports by balancing segments. General Ledger has three balancing segments that can be combined to provide detailed reporting for each legal entity and then rolled up to provide consolidated financial statements.

Accounting operations using multiple ledgers can include single or multiple applications instances. You need multiple ledgers if one of the following is true:

You have companies that require different account structures to record information about transactions and balances. For example, one company may require a six-segment account, while another needs only a three-segment account structure.

You have companies that use different accounting calendars. For example, although companies may share fiscal year calendars, your retail operations require a weekly calendar, and a monthly calendar is required for your corporate headquarters.

You have companies that require different functional currencies. Consider the business activities and reporting requirements of each company. If you must present financial statements in another country and currency, consider the accounting principles to which you must adhere.

Oracle Fusion Subledgers capture detailed transactional information, such as supplier invoices, customer payments, and asset acquisitions. Oracle Fusion Subledger Accounting is an open and flexible application that defines the accounting rules, generates detailed journal entries for these subledger transactions, and posts these entries to the general ledger with flexible summarization options to provide a clear audit trail.

Companies account for themselves in primary ledgers, and, if necessary, secondary ledgers and reporting currencies. Your transactions from your subledgers are posted to your primary ledgers and possibly, secondary ledgers or reporting currencies. Local and corporate compliance can be achieved through an optional secondary ledger, providing an alternate accounting method, or in some cases, a different chart of accounts. Your subsidiary's primary and secondary ledgers can both be maintained in your local currency, and you can convert your local currency to your parent's ledger currency to report your consolidated financial results using reporting currencies or translation.

A primary ledger is the main record-keeping ledger. Like any other ledger, a primary ledger records transactional balances by using a chart of accounts with a consistent calendar and currency, and accounting rules implemented in an accounting method. The primary ledger is closely associated with the subledger transactions and provides context and accounting for them.

To determine the number of primary ledgers, your enterprise structure analysis must begin with your financial, legal, and management reporting requirements. For example, if your company has separate subsidiaries in several countries worldwide, enable reporting for each country's legal authorities by creating multiple primary ledgers that represent each country with the local currency, chart of accounts, calendar, and accounting method. Use reporting currencies linked to your country specific primary ledgers to report to your parent company from your foreign subsidiaries. Other considerations, such as corporate year end, ownership percentages, and local government regulations and taxation, also affect the number of primary ledgers required.

A secondary ledger is an optional ledger linked to a primary ledger for the purpose of tracking alternative accounting. A secondary ledger can differ from its primary ledger by using a different accounting method, chart of accounts, accounting calendar, currency, or processing options. All or some of the journal entries processed in the primary ledger are transferred to the secondary ledger, based on your configuration options. The transfers are completed based on the conversion level selected. There are four conversion levels:

Balance: Only Oracle Fusion General Ledger balances are transferred to the secondary ledger.

Journal: General Ledger journal posting process transfers the journal entries to the secondary ledger.

Subledger: Oracle Fusion Subledger Accounting creates subledger journals to subledger level secondary ledgers as well as reporting currencies.

Adjustments Only: Incomplete accounting representation that only holds adjustments. The adjustments can be manual or detailed adjustments from Subledger Accounting. This type of ledger must share the same chart of accounts, accounting calendar, and period type combination, and currency as the associated primary ledger.

Note

A full accounting representation of your primary ledger is maintained in any subledger level secondary ledger.

Secondary ledgers provide functional benefits, but produce large volumes of additional journal entry and balance data, resulting in additional performance and memory costs. When adding a secondary ledger, consider your needs for secondary ledgers or reporting currencies, and select the least costly data conversion level that meets your requirements. For secondary ledgers, the least costly level is the adjustment data conversion level because it produces the smallest amount of additional data. The balance data conversion level is also relatively inexpensive, depending upon how often the balances are transferred from the primary to the secondary ledger. The journal and subledger data conversion levels are much more expensive, requiring duplication of most general ledger and subledger journal entries, as well as general ledger balances.

For example, you maintain a secondary ledger for your International Financial Reporting Standards (IFRS) accounting requirements, while your primary ledger uses US Generally Accepted Accounting Principles (GAAP). You decided to select the subledger level for your IFRS secondary ledger. However, since most of the accounting is identical between US GAAP and IFRS, a better solution is to use the adjustment only level for your secondary ledger. The subledger level secondary ledger requires duplication of most subledger journal entries, general ledger journal entries, and general ledger balances. With the adjustment only level, your secondary ledger contains only the adjustment journal entries and balances necessary to convert your US GAAP accounting to the IFRS accounting, which uses a fraction of the resources that are required by full subledger level secondary ledger.

Following are scenarios that may require different combinations of primary and secondary ledgers:

The primary and secondary ledgers use different charts of accounts to meet varying accounting standards or methods. A chart of accounts mapping is required to instruct the application how to propagate balances from the source (primary) chart of accounts to the target (secondary) chart of accounts.

The primary and secondary ledgers use different accounting calendars to comply with separate industry and corporate standards.

Note

Use the same currency for primary and secondary ledgers to avoid difficult reconciliations, if you have the resources to support the extra posting time and data storage. Use reporting currencies or translations to generate the different currency views needed to comply with internal reporting needs and consolidations.

Reporting currencies maintain and report accounting transactions in additional currencies. Each primary and secondary ledger is defined with a ledger currency that is used to record your business transactions and accounting data for that ledger. It is advisable to maintain the ledger in the currency in which the majority of its transactions are denominated. For example, create, record, and close a transaction in the same currency to save processing and reconciliation time. Compliance, such as paying local transaction taxes, is also easier using a local currency. Many countries require that your accounting records be kept in their national currency.

If you need to maintain and report accounting records in different currencies, you do this by defining one or more reporting currencies for the ledger. There are three conversion levels for reporting currencies:

Balance: Only General Ledger balances are converted into the reporting currency using translation.

Journal: General Ledger journal entries are converted to the reporting currency during posting.

Subledger: Subledger Accounting creates subledger reporting currency journals along with primary ledger journals.

Note

A full accounting representation of your primary ledger is maintained in any subledger level reporting currency. Secondary ledgers cannot use subledger level reporting currencies.

Of the three data conversion levels available, the balance data conversion level is typically the least expensive, requiring duplication of only the balance level information. The journal and subledger data conversion levels are more expensive, requiring duplication of most general ledger and subledger journal entries, as well as general ledger balances.

Do not use journal or subledger level reporting currencies if your organization has only an infrequent need to translate your financial statements to your parent company's currency for consolidation purposes. Standard translation functionality meets this need. Consider using journal or subledger level reporting currencies when any of the following conditions exist.

You operate in a country whose unstable currency makes it unsuitable for managing your business. As a consequence, you need to manage your business in a more stable currency while retaining the ability to report in the unstable local currency.

You operate in a country that is part of the European Economic and Monetary Union (EMU), and you choose to account and report in both the European Union currency and your National Currency Unit (NCU).

Note

The second option is rare since most companies have moved beyond the initial conversion to the EMU currency. However, future decisions could add other countries to the EMU, and then, this option would again be used during the conversion stage.

Oracle Fusion Applications is an integrated suite of business applications that connects and automates the entire flow of the business process across both front and back office operations and addresses the needs of a global enterprise. The process of designing the enterprise structure, including the accounting configuration, is the starting point for an implementation. This process often includes determining financial, legal, and management reporting requirements, setting up primary and secondary ledgers, making currency choices, and examining consolidation considerations.

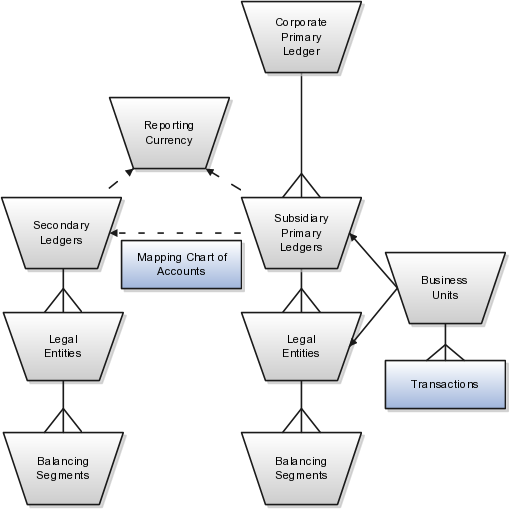

This figure shows the enterprise structure components and their relationships to each other. Primary ledgers are connected to reporting currencies and secondary ledgers to provide complete reporting options. Legal entities are assigned to ledgers, both primary and secondary, and balancing segments are assigned to legal entities. Business units must be connected to both a primary ledger and a default legal entity. Business units can record transactions across legal entities.

A primary ledger is the main record-keeping ledger. Create a primary ledger by combining a chart of accounts, accounting calendar, ledger currency, and accounting method. To determine the number of primary ledgers, your enterprise structure analysis must begin with determining financial, legal, and management reporting requirements. For example, if your company has separate subsidiaries in several countries worldwide, create multiple primary ledgers representing each country with the local currency, chart of accounts, calendar, and accounting method to enable reporting to each country's legal authorities.

If your company just has sales in different countries, with all results being managed by the corporate headquarters, create one primary ledger with multiple balancing segment values to represent each legal entity. Use secondary ledgers or reporting currencies to meet your local reporting requirements, as needed. Limiting the number of primary ledgers simplifies reporting because consolidation is not required. Other consideration such as corporate year end, ownership considerations, and local government regulations, also affect the number of primary ledgers required.

A secondary ledger is an optional ledger linked to a primary ledger. A secondary ledger can differ from its related primary ledger in chart of accounts, accounting calendar, currency, accounting method, or ledger processing options. Reporting requirements, for example, that require a different accounting representation to comply with international or country-specific regulations, create the need for a secondary ledger.

Below are scenarios and required action for different components in primary and secondary ledgers:

If the primary and secondary ledgers use different charts of accounts, the chart of accounts mapping is required to instruct the system how to propagate journals from the source chart of accounts to the target chart of accounts.

If the primary and secondary ledgers use different accounting calendars, the accounting date and the general ledger date mapping table will be used to determine the corresponding non-adjusting period in the secondary ledger. The date mapping table also provides the correlation between dates and non-adjusting periods for each accounting calendar.

If the primary ledger and secondary ledger use different ledger currencies, currency conversion rules are required to instruct the system on how to convert the transactions, journals, or balances from the source representation to the secondary ledger.

Note: Journal conversion rules, based on the journal source and category, are required to provide instructions on how to propagate journals and types of journals from the source ledger to the secondary ledger.

Reporting currencies are the currency you use for financial, legal, and management reporting. If your reporting currency is not the same as your ledger currency, you can use the foreign currency translation process or reporting currencies functionality to convert your ledger account balances in your reporting currency. Currency conversion rules are required to instruct the system on how to convert the transactions, journals, or balances from the source representation to the reporting currency.

Legal entities are discrete business units characterized by the legal environment in which they operate. The legal environment dictates how the legal entity should perform its financial, legal, and management reporting. Legal entities generally have the right to own property and the obligation to comply with labor laws for their country. They also have the responsibility to account for themselves and present financial statements and reports to company regulators, taxation authorities, and other stakeholders according to rules specified in the relevant legislation and applicable accounting standards. During setup, legal entities are assigned to the accounting configuration, which includes all ledgers, primary and secondary.

You assign primary balancing segment values to all legal entities before assigning values to the ledger. Then, assign specific primary balancing segment values to the primary and secondary ledgers to represent nonlegal entity related transactions such as adjustments. You can assign any primary balancing segment value that has not already been assigned to a legal entity. You are allowed to assign the same primary balancing segment values to more than one ledger. The assignment of primary balancing segment values to legal entities and ledgers is performed within the context of a single accounting setup. The Balancing Segment Value Assignments report is available to show all primary balancing segment values assigned to legal entities and ledgers across accounting setups to ensure the completeness and accuracy of their assignments. This report allows you to quickly identify these errors and view any unassigned values.

A business unit is a unit of an enterprise that performs one or many business functions that can be rolled up in a management hierarchy. When a business function produces financial transactions, a business unit must be assigned a primary ledger, and a default legal entity. Each business unit can post transactions to a single primary ledger, but it can process transactions for many legal entities. Normally, it will have a manager, strategic objectives, a level of autonomy, and responsibility for its profit and loss. You define business units as separate task generally done after the accounting setups steps.

The business unit model:

Allows for flexible implementation

Provides a consistent entity for controlling and reporting on transactions

Enables sharing of sets of reference data across applications

For example, if your company requires business unit managers to be responsible for managing all aspects of their part of the business, then consider using two balancing segments, company and business unit to enable the production of business unit level balance sheets and income statements.

Transactions are exclusive to business units. In other words, you can use business unit as a securing mechanism for transactions. For example, if you have an export business that you run differently from your domestic business, use business units to secure members of the export business from seeing the transactions of the domestic business.

Create a primary ledger as your main record-keeping ledger. Like any other ledger, a primary ledger records transactional balances by using a chart of accounts with a calendar, currency, and accounting rules implemented in an accounting method. The primary ledger is closely associated with the subledger transactions and provides context and accounting for them.

Your company, InFusion Corporation is implementing Oracle Fusion Applications. You have been assigned the task of creating a primary ledger for your InFusion America entity.

Navigate to the Define Accounting Configurations task list and open Manage Primary Ledgers from within your implementation project. Click the Go to Task.

Click the Create icon.

Enter the following values:

|

Field |

Value |

|---|---|

|

Name |

InFusion America |

|

Description |

InFusion America primary ledger for recording transactions. |

|

Chart of Accounts |

InFusion America Chart of Accounts |

|

Accounting Calendar |

Standard Monthly |

|

Currency |

USD |

|

Accounting Method |

Standard Accrual |

Click Save and Edit Task List to navigate back to the accounting configuration task list.

Note

You cannot change the chart of accounts, accounting calendar, or currency for your ledger after you save your ledger.

This example demonstrates specifying the ledger options for your primary ledger. Your company, InFusion Corporation, is a multinational conglomerate that operates in the United States (US) and the United Kingdom (UK). InFusion has purchased an Oracle Fusion enterprise resource planning (ERP) solution including Oracle Fusion General Ledger and all of the Oracle Fusion subledgers.

After completing your InFusion America Primary Ledger, select Specify Ledger Options under the Define Accounting Configuration task list on the Functional Setup Manager page.

Note

Both primary and secondary ledgers are created in the same way and use the same user interface to enable their specific ledger options.

Important: Select a period after the first defined period in the ledger calendar to enable running translation. You cannot run translation in the first defined period of a ledger calendar. In this example, your calendar began with Jan-2010.

Any value between 0 and 999 periods can be specified to permit entering journals but not posting them in future periods. Minimize the number of open and future periods to prevent entry in the wrong period.

This account is required for the General Ledger to perform the movement of revenue and expense account balances to this account at the end of the accounting year.

Note: The Cumulative Translation Adjustment (CTA) account is required for ledgers running translation.

The values entered here are used as the default for balance level reporting currency processing. InFusion America Primary Ledger is using the subledger level reporting currency processing.

|

Option |

Setting |

|---|---|

|

Enable Suspense |

General Ledger |

|

Default Expense Account |

101-00-98199999-0000-000-0000-0000 |

|

Rounding Account |

101-10-98189999-0000-000-0000-0000 |

|

Entered Currency Balancing Account |

101-10-98179999-0000-000-0000-0000 |

|

Balancing Threshold Percent |

10 |

|

Option |

Description |

|---|---|

|

Enable journal approval |

Click to enable journal approval functionality. Approval rules must be created in the Oracle Fusion Approvals Management (AMX). |

|

Notify when prior period journal |

Notify the user when a prior period date is selected on a journal entry. |

|

Allow mixed and statistical journals |

Enter both monetary and statistical amounts on the same line in a journal entry. |

|

Validate reference date |

Requires a reference date in an open or future enterable period. |

Note: To complete the intercompany accounting functionality, you must define intercompany rules.

Optionally, assign legal entities and balancing segments to your accounting configuration.

Assign one or more legal entities to your configuration by following these steps:

Navigate to the Assign Legal Entities task. Click the Go to Task.

Click the Select and Add icon.

Click Search. Select your legal entities.

Click Apply. Click Done.

Click Save and Close.

Assign balancing segment values to your legal entities by following these steps:

Navigate to the Assign Balancing Segment Values to Legal Entities task. Click the Go to Task.

Click the Create icon.

Select the balancing segment value. Optionally, add a Start Date.

Click Save and Close to close the create page.

Click Save and Close.

Assign balancing segment values directly to your ledger by following these steps:

Navigate to the Assign Balancing Segment Value to Ledger task. Click the Go to Task.

Select the balancing segment value.

Optionally enter a start date.

Click Save and Close.

Note

The balancing segment values that are assigned to the ledger represent nonlegal entity transactions, such as adjustments. If you use legal entities, you must assign balancing segment values to all legal entities before assigning values to the ledger. The only available balancing segment values that can be assigned to ledgers are those not assigned to legal entities.

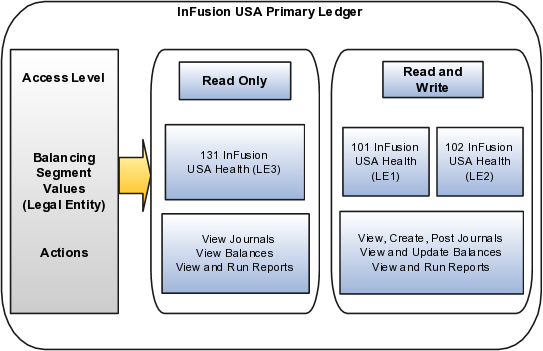

This example shows two data access sets that secure access by using primary balancing segment values that correspond to legal entities.

The figure shows the actions enabled when an access level is assigned to a balancing segment representing legal entities (LE) for one of the two access levels:

Read Only

Read and Write

InFusion USA Primary Ledger, is assigned to this Data Access Set.

Read only access has been assigned to balancing segment value 131 that represents the InFusion USA Health LE3.

Read and write access has been assigned to the other two primary balancing segment values 101 and 102 that represent InFusion USA Health LE1 and LE2.

In summary, you can:

Create a Journal Batch: In ledgers or with primary balancing segment values if you have write access.

Modify a Journal Batch: If you have write access to all ledgers or primary balancing segment values that are used in the batch.

View a Journal Batch: If you have read only or write access to the ledger or primary balancing segment values.

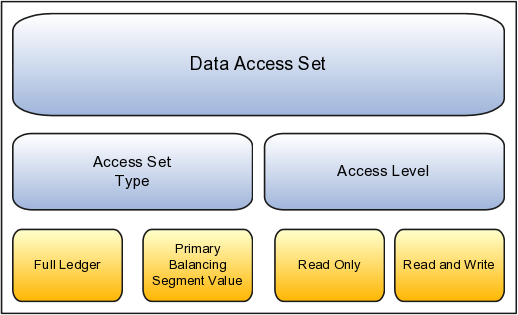

Data Access Sets secure access to ledgers, ledger sets, and portions of ledgers using primary balancing segment values. If you have primary balancing segment values assigned to a legal entity, then you can use this feature to secure access to specific legal entities.

Secures parent or detail primary balancing segment values.

Secures the specified parent value as well as all its descendents, including midlevel parents and detail values.

Requires all ledgers assigned to the data access set to share chart of accounts and accounting calendar.

When a ledger is created, a data access set for that ledger is automatically created; giving full read and write access to that ledger. Data access sets are automatically created when you create a new ledger set as well. You can also manually create your data access sets to give read only access or partial access to select balancing segment values in the ledger.

You can combine ledger and ledger set assignments to a single data access set you create as long as the ledgers all share a common chart of accounts and calendar. When a data access set is created, data roles are automatically created for that data access set. Five data roles are generated for each data access set, one for each of the Oracle Fusion General Ledger roles:

Chief Financial Officer

Controller

General Accounting Manager

General Accountant

Financial Analyst

The data roles then must to be assigned to your users before they can use the data access set.

Full Ledger Access: Access to the entire ledger or ledger sets. For example, this could mean read only access to the entire ledger or both read and write access.

Primary Balancing Segment Value: Access one or more primary balancing segment values for that ledger. You can specify read only, read and write access, or a combination of the two for different primary balancing segment values for different ledgers and ledger sets.

Note

Security by management segment consistent with the primary balancing segment as used above is not available in V1.

Data Access Set Security: Grants access to a ledger, ledger set, or specific primary balancing segment values associated with a ledger. Create and edit data access set security on the Manage Data Access Sets page from the Setup and Maintenance work area or from your implementation project.

Segment Value Security: Controls access to value set values associated with any segment in your chart of accounts. Create and edit segment value security on the Define Chart of Accounts page from the Setup and Maintenance work area or your implementation project.

Function and Data Security: Secures features and data with privileges that are mapped to roles.

Access through the Define Security task list on the Setup and Maintenance work area or your implementation project.

Use Oracle Identity Manager (OIM) to manage user and user-role assignments.

Use Authorization Policy Manager (APM) to manage data roles and duty roles.

Set up segment value security rules against your value sets to control access to parent or detail segment values.

Securing a value set denies access to all values by default. Create conditions and assign them to specific data roles to control access to your value set values.

Restrict data entry, online inquiry, and reporting to specific values by using segment value security rules.

General Points About Segment Value Security:

Used with flexfield segments.

Specifies that data security be applied to segment values that use the value set. Based on the roles provisioned to users, data security policies determine which values of the segment end users can view or modify.

Applies at the value set level. If a value set is secured, every usage of the value set in the chart of accounts structure is secured. For example, if the same value set is used for the legal entity and intercompany segments of the chart of accounts, the same security is applied to both segments.

Applies only to independent value sets.

Applies mainly when data is being created or updated, and to account combination tables for query purposes.

Controls access to parent or detail segment values.

Note

A distinction between setup and transactions user interfaces is that segment value security prevents you from seeing certain account values in transaction user interfaces but you can still see the account combinations with the secured values in setup user interfaces.

If you try to update the field in the setup user interface, you cannot use those secured values. For transaction, balance, and query activity type user interfaces, the segment value security prevents both the viewing and using of the secured values. Segment value security control is both for Read and Write access control.

Segment value security is enforced in Oracle Fusion Applications where ever the chart of accounts values are used.

When entering a journal for a ledger with a secured chart of accounts, you can only use account values for which the access is granted using segment security rules.

When running reports against a ledger with a secured chart of accounts, you can only view balances for accounts for which the access is granted using segment security rules.

When viewing ledger options in an accounting configuration, if the accounts specified include references to an account with values you have not been granted access to, you can see the account but not be able to enter that secured value if you select to modify the setup.

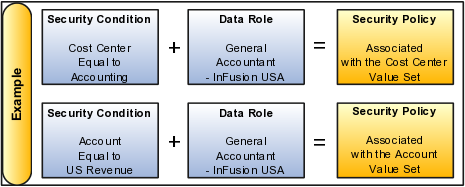

Example

Create conditions and assign them to specific data roles to control access to your segment values. For example:

Enable security on both the cost center and account value sets that are associated with your chart of accounts.

Assign the General Accountant - InFusion USA data role to have access to cost center Accounting and account US Revenue.

Deny all other users access to the specified cost center and account values.

Segment Value Security Operators

Use any of the following operators in your conditions to secure your segment values:

|

Operator |

Usage |

|---|---|

|

Equal to |

Secures a detail specific value. You cannot use this operator to secure a parent value. |

|

Not equal to |

Secures all detail values except the one that you specify. You cannot use this operator to secure a parent value. |

|

Between |

Secures a detail range of values. |

|

Is descendent of |

Secures the parent value itself and all of its descendents including mid level parents and detail values. |

|

Is last descendent of |

Secures the last descendents, for example the detail values of a parent value. |

Tip:

For Is descendent of and Is last descendent of:

Specify an account hierarchy (tree) and a tree version to use this operator.

Understand that the security rule applies across all the tree versions of the specified hierarchy, as well as all hierarchies associated with the value set.

A balances cube is an online analytical application (OLAP) database that maintains financial balances in a multidimensional database. In Oracle Fusion General Ledger a new balances cube is created when an accounting configuration is submitted for a primary or secondary ledger that uses to a new unique combination of chart of accounts and calendar.

A new balances cube is also created when a secondary ledger is added to an existing accounting configuration and uses a new unique combination of chart of accounts and calendar. The balances cubes are named after the chart of accounts they contain.

A balances cube:

Stores your financial balances in a multidimensional enable real time, interactive financial reporting and analysis.

Preaggregates your balances at every possible point of summarization, thus ensuring immediate access to financial data and eliminating the need for an external data warehouse for financial reporting.

Is uniquely identified by the combination of a chart of accounts and an accounting calendar. Average balances are tracked in a separate balances cube.

Is automatically synchronized by the following general ledger processes: posting, open period, and translation.

Consists of a set of defining business entities called dimensions. Dimensions in a cube determine how data is accumulated for reporting and analytical purposes

Are referred to as an application or database connection in the user interfaces for:

Financial Reports

Smart View

Calculation Manager

Note

Account balances were maintained in relational tables in Oracle E-Business Suite General Ledger, The Oracle Fusion General Ledger updates balances in real time to the relational tables and the General Ledger Balances cubes. Most inquiry and reporting are now performed from the General Ledger Balances cubes and not from the relational tables.

A balances cube consists of a set of defining business entities called dimensions. This table details the dimensions that are available for creating financial reports, Smart View queries, and allocations using multidimensional cubes.

|

Dimension |

Description |

Example |

|---|---|---|

|

Accounting Period |

Based upon the calendar of the ledger or ledger set. Report on years, quarters, or periods. |

|

|

Ledger or Ledger Set |

Used to select a ledger for the reporting. Multiple ledgers may be in the same cube if they share a common chart of accounts. |

|

|

Chart of Accounts Segments |

Uses a separate dimension for each of the segments from the charts of accounts. Organized by hierarchy. A default hierarchy is provided that includes all detail segment values. Hierarchies published in the Publish Account Hierarchies user interface are included. |

|

|

Scenario |

Indicates if the balances represented are actual or budget amounts. Allocation related dimensions are seeded members and required for allocation solutions. Allocation dimension are not used directly by end users. Budget scenario dimension members are user defined in the Oracle Fusion Applications value set called Accounting Scenario and appear in the cube after running the Create Scenario Dimension Members process. |

|

|

Balance Amount |

Indicates if the value is the beginning balance, period activity, or ending balance. Debit, Credit, and Net amounts are available for reporting. |

|

|

Amount Type |

Indicates whether the amounts represent Base, Period to Date, Quarter to Date, or Year to Date. |

|

|

Currency |

Used to select the desired currency for the balances. |

|

|

Currency Type |

Used to select the currency type of the balances. |

|

Note

Dimensions are seeded and new ones cannot be added.

There are two types of Oracle Fusion General Ledger Balances cubes: Standard Balances cubes and Average Balances cubes.

A new standard balances cube is created whenever an accounting configuration is submitted for a ledger, either primary or secondary, that uses a new unique combination of chart of accounts and accounting calendar. Cubes are named after the chart of accounts.

For example, the chart of accounts, InFusion US Chart of Accounts has a related cube entitled, InFusion US Chart of Accounts. If a chart of accounts is used by multiple ledgers with different calendars, the cube names are distinguished by appending a number to their names.

For example, if InFusion US Chart of Accounts is used by two different ledgers, each of which has a different accounting calendar, one with a standard calendar year ending December 31st and the other with a fiscal year ending May 31st, two cubes are created. The cubes are named InFusion US Chart of Accounts and InFusion US Chart of Accounts 2.

Average balances cubes use different dimensions than the standard balances cubes therefore require their results be stored in separate cubes. If the average balances option is enabled for a ledger, a second average balances cube is automatically created based upon the same criteria of a unique combination of chart of accounts and accounting calendar. Average balances cubes are named with ADB (average daily balances) plus the name of the associated chart of accounts.

For example, for a chart of accounts, InFusion US Chart of Accounts, the average balances cube name is ADB InFusion US Chart of Accounts. Numbers are appended to the name when more than one calendar is used by the same chart of accounts. The numbering is determined and shared with the related standard balances cubes. The standard cube called InFusion US Chart of Accounts 3 has a corresponding average balance cube entitled ADB InFusion US Chart of Accounts 3.

In creating your cube, take in to consideration the dimensions that are you, the customer, define and those that are partially or completely predefined by Oracle Fusion Applications.

Two dimensions, Chart of Accounts and Scenario, have customer specific dimension values and require user procedures to populate the cube

Accounting Period, Currency, and Ledger dimensions are customer specific, but are automatically created in the cubes from the changes made in the applicable user interfaces.

Other dimensions, such as Amount Type and Balance Amount, have only predefined members.

The following are points to consider in setting up and populating cubes for the Chart of Accounts and Scenario dimension members.

Account hierarchies for your chart of account dimensions are created in the Manage Account Hierarchies page or the Manage Trees and Trees Versions page after setting up your value sets, chart of accounts, and values.

Create account hierarchies (trees) to identify managerial, legal, or geographical relationships between your value set values.

Define date-effective tree versions to reflect organizational changes within each hierarchy over time.

The tree version must be in an active or inactive status to be published. Draft versions cannot be published.

Note

From your implementation project, Navigate > Define Common Applications Configuration > Define Enterprise Structures > Define Financial Reporting Structures > Define Chart of Accounts > Manage Account Hierarchies > Go to Task.

Next, after defining the tree versions, publish account hierarchies (tree versions) to the cube. Before publishing, set the following profile option: Display Only Segment Value Description in the Cube Alias. Consider the following points when setting the profile option.

The member alias displayed in the Oracle Fusion General Ledger balances cubes.

Yes displays only the segment value description, for example: Cash.

No displays value plus the segment value description, for example: 1110 Cash.

Default value is No.

No is necessary when there are duplicate segment value descriptions across all dimensions. The descriptions are stored in the Alias in the cube. Aliases must be unique across all dimensions in the cube. For example, if the description West existed in the Cost Center value set and the Location value set, the entire cube creation process fails.

If duplicate segment value descriptions exist, the cube can be created with the profile set to No. At anytime the value of the profile can be changed to Yes after the duplicates are removed. At that time, the account hierarchies (tree versions) must be published or republished to the cube.

If you set the profile value to Yes, and rebuild a cube from a process run in Enterprise Scheduler or create a cube by submitting an accounting configuration and duplicate descriptions exist, the create cubes process errors. You have two options at that point:

Set profile value to No and run the Create Cubes process or if you have a new ledger with a new chart of accounts and accounting calendar combination, submit the accounting configuration.

Remove the duplicates across all dimensions, not just a single segment. Then run the Create Cubes or resubmit the accounting configuration.

From your implementation project, Navigate > Define Common Applications Configuration > Define Enterprise Structures > Define Financial Reporting Structures > Define Chart of Accounts > Publish Account Hierarchies > Go to Task. Use the Publish Account Hierarchies page to search and publish account hierarchies.

Select the Publish check box. This is indicator of what to include in balances cube by selecting the check box or what you don't want to include in balances cube by removing the check from the check box.

Select the rows. Functionality allows for select multiple rows to be selected.

Select the Publish button to update the balances cubes. A process is generated.

Navigator > Tools > Scheduled Processes to monitor the process.

Note

Use Smart View to verify that the account hierarchies were correctly published.

The customer specific Scenario dimension members are defined in the Manage Value Sets and Manage Values pages in the value set called Accounting Scenario. Any customer specific Scenario dimension is included in all balances cubes.

Best practice is to setup the customer specific Scenario members in this value set before you create your first ledger and run the Accounting Configuration process. The Accounting Configuration process generates your balances cubes.

If the cubes already existed, you can run the Create Scenario Dimension Members process to update the balances cubes for the new members.

Note

If you are on a release before the Create Scenario Dimension Members process is available, you have to rebuild the cubes with the Create Cubes process to add the Scenario dimension in the cube. Follow the guidelines for creating cubes before running process.

For Standard Balances Cube dimensions, there are default values that if used in Smart View and on financial reports created in Financial Reporting Studio cause #MISSING to appear when balances are returned on a report output. If #MISSING appears, check that all dimensions are properly set. Particularly, check the Accounting Period, Ledger, Scenario, and Currency dimensions, which all must have a value selected other than the default top level value called Gen1.

The following table lists the available and default dimension values as well as providing guidance on selecting the correct dimensions.

|

Dimension |

Possible Values |

Default Value |

Additional Information |

|---|---|---|---|

|

Accounting Period |

Years, quarters, and period |

Accounting Period = Accounting Period (Gen1) |

You must always select an accounting period for each financial report including User Point of View, Smart View query, or allocation including Point of View. If you do not specify a valid Accounting Period, the financial reports, Smart View queries, and Account Inspector displays #MISSING. |

|

Ledger |

Includes ledgers and ledger sets |

Ledger = Ledger (Gen1) |

If you do not specify a specific Ledger or Ledger Set, the financial reports, Smart View queries, and Account Inspector queries display #MISSING |

|

Chart of accounts dimensions |

|

Highest level (Gen1) |

There is a separate dimension for each segment of the chart of accounts used by the cube. Each segment has a default account hierarchy that includes all the detail values for the segment but not parent values. Only account hierarchies (tree versions) published from the Publish Account Hierarchies user interface are available in the cube. |

|

Scenario |

|

Scenario = Scenario represents the sum of all values: Actual + Allocated + Total for Allocations + Budget + Forecast. Select a value for this dimension. Note Must always select a Scenario dimension. |

Seeded values are Actual, Allocated, and Total for Allocated. Additional scenario values for Budget, Forecast Q1, and Forecast Q2 may be available if they have been added to the Accounting Scenario value set. These additional values will be published to every cube. |

|

Balance Amount |

|

Balance Amount = Balance Amount (Gen1) which is the equivalent of Ending Balance. |

|

|

Amount Type |

Base, PTD, QTD, YTD |

Amount Type = Amount Type (Gen1) which is the equivalent of Base. |

Base is necessary because this is the value used to store from posting all balances at the lowest level. PTD, QTD, and YTD are calculated values. |

|

Currency |

All ISO currencies (250+). |

Highest level (Gen1) |

Similar to Accounting Period and Ledger, there may not be an appropriate default for Currency since different Ledgers have different ledger currencies. If you don't specify a valid currency in a financial report, Smart View query, or allocation, you will get a result = #MISSING. |

|

Currency Type |

Total, Entered, and Converted from for each ISO currency = each ISO currency. |

Currency Type = Currency Type (Gen1), which is the equivalent of Total. |

|

The following dimensions are included in the average balances cube in this order. Most comments from standard cube are applicable below unless stated.

Accounting Period: Valid values are years, quarters, accounting period and day, which is equivalent to accounting date.

Ledger

Separate dimension for each Chart of accounts segment

Scenario

Amount Type valid values are: PATD, QATD, and YATD

Currency

Currency Type

Levels and generations are cube terminology used to describe hierarchies in Oracle Fusion General Ledger balances cubes.

Levels are used to describe hierarchy levels. Levels are numbered from the lowest hierarchy level. For example, the detail chart of accounts segment values are Level 0. The immediate parent is Level 1; the next parent is Level 2.

Generations (Gen) describe hierarchy levels starting with the top of the hierarchy and moving down through the generations of the same.

An example for generations is as follows:

Accounting Period = Accounting Period is Gen 0

Year is Gen 1

Qtr is Gen 2

Period is Gen 3

Ledger = Ledger is Gen 1

All Ledgers is Gen 2

VF USA is Gen 3

Ledger Set (any ledger set) is Gen 2

Company = Company is Gen 1

All Company Values, for example detail values, is Gen 2

11010 is Gen 3

Tree 1 V1 is Gen 2

[Tree 1 V1].[10000] is Gen 3

[Tree 1 V1].[10000].[11000] is Gen 4

Tree 2 V1 is Gen 2

[Tree 2 V1].[10000] is Gen 3

[Tree 1 V1].[10000].[11000] is Gen 4

Note

Similar levels and generations apply to the other dimension, including chart of accounts dimensions and those that are not chart of accounts dimensions.

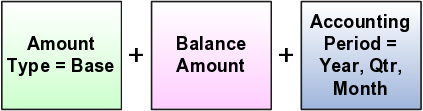

By using various combinations of selections for the Accounting Period, Balance Amount, and Amount Type dimensions, you can derive different amounts to meet financial reporting requirements. In some cases, more than one combination of query values can return the desired information.

There is some duplication in the calculations for the balances cube to ensure complete reporting requirements.

Many reporting needs can be completed using the Balance Amount dimension, Amount Type equal to Base, and specifying the Accounting Period equal to Year, Quarter, or Month.

However, the Amount Type dimension is still required for the following reasons:

To get the complete QTD (Quarter to Date) reporting requirements for the first and second month in a quarter can only be achieved using QTD and Accounting Period = Month.

PTD (Period to Date) and YTD (Year to Date) are also available to ensure more consistency reporting with the E-Business Suite Release 12.

This example shows how to obtain quarter information.

QTD for the first and second months of a quarter can only be achieved using Amount Type dimension equal to QTD.

The end of quarter information can be derived from the Accounting Period dimension equal to Quarter or with the Amount Type equal QTD.

This example shows how to obtain end of year information.

Accounting Period equal to Year and Balance Amount equal to Ending Balance and Amount Type equal to Base or YTD.

Accounting Period equal to a specific month and Balance Amount equal to Period Activity and Amount Type equal to YTD.

When the Balance Amount equals the Balance Amount or the Balance Amount equals the Ending Balance, this results in an Ending Balance.

Note

Ending Balance is always the ending balance regardless of Amount Type member setting or Accounting Period member setting (period, quarter or year).

You have loaded your Oracle E-Business Suite Release 12 balances into your new Oracle Fusion Standard Balances Cube. Now you want to query the results to verify that the data was loaded correctly.

The following two tables show the amounts loaded into the balances cube from your R12 balances and the calculated balances for ending balance, year to date (YTD), and quarter to date (QTD). The first table is the balance sheet based balances and the second table is for income statement based balances.

Balance Sheet Balances

|

Month |

Beginning Balance Loaded to Cube |

Activity Loaded to Cube |

Ending Balance |

Calculate YTD |

QTD |

|---|---|---|---|---|---|

|

Jan |

200 |

20 |

220 |

20 |

20 |

|

Feb |

220 |

30 |

250 |

50 |

50 |

|

Mar |

250 |

25 |

275 |

75 |

75 |

|

Apr |

275 |

50 |

325 |

125 |

50 |

|

May |

325 |

40 |

365 |

165 |

90 |

|

Jun |

365 |

45 |

410 |

210 |

135 |

|

Jul |

410 |

100 |

510 |

310 |

100 |

|

Aug |

510 |

200 |

710 |

510 |

300 |

|

Sep |

710 |

140 |

850 |

650 |

440 |

|

Oct |

850 |

150 |

1000 |

800 |

150 |

|

Nov |

1000 |

100 |

1100 |

900 |

250 |

|

Dec |

1100 |

400 |

1500 |

1300 |

650 |

Income Statement Balances

|

Month |

Beginning Balance Loaded to Cube |

Activity Loaded to Cube |

Ending Balance |

Calculate YTD |

QTD |

|---|---|---|---|---|---|

|

Jan |

0 |

70 |

70 |

70 |

70 |

|

Feb |

70 |

20 |

90 |

90 |

90 |

|

Mar |

90 |

30 |

120 |

120 |

120 |

|

Apr |

120 |

100 |

220 |

220 |

100 |

|

May |

220 |

200 |

420 |

420 |

300 |

|

Jun |

420 |

250 |

670 |

670 |

550 |

|

Jul |

670 |

50 |

720 |

720 |

50 |

|

Aug |

720 |

300 |

1020 |

1020 |

350 |

|

Sep |

1020 |

130 |

1150 |

1150 |

480 |

|

Oct |

1150 |

110 |

1260 |

1260 |

110 |

|

Nov |

1260 |

200 |

1460 |

1460 |

310 |

|

Dec |

1460 |

500 |

1960 |

1960 |

810 |

The following two tables show the results available from Oracle Fusion General Ledger from your R12 loaded and aggregated balances in the balances cube. The first table is the balance sheet based balances and the second table is for income statement based balances.

Balance Sheet Balances

|

Accounting Period |

Balance Amount |

Amount Type |

Value |

Comments |

R12 Amount Type Equivalent |

|---|---|---|---|---|---|

|

May |

Beginning Balance |

YTD |

200 |

Jan Beginning Balance |

|

|

May |

Period Activity |

YTD |

165 |

Jan to May Activity |

YTD-Actual as of May |

|

May |

Ending Balance |

YTD |

365 |

May Ending Balance |

YTD-Actual as of May |

|

May |

Beginning Balance |

QTD |

275 |

Apr Beginning Balance |

|

|

May |

Period Activity |

QTD |

90 |

Apr-May Activity |

QTD-Actual as of May |

|

May |

Ending Balance |

QTD |

365 |

May Ending Balance |

QTD-Actual as of May |

|

May |

Beginning Balance |

PTD |

325 |

May Beginning Balance |

|

|

May |

Period Activity |

PTD |

40 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

PTD |

365 |

May Ending Balance |

PTD-Actual as of May |

|

May |

Beginning Balance |

Base |

325 |

May Beginning Balance |

|

|

May |

Period Activity |

Base |

40 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

Base |

365 |

May Ending Balance |

YTD-Actual as of May |

|

Q2 |

Beginning Balance |

QTD |

275 |

April Beginning Balance |

|

|

Q2 |

Period Activity |

QTD |

135 |

Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

QTD |

410 |

Ending Balance always as of Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

YTD |

410 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Q2 |

Beginning Balance |

Base |

275 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

Base |

135 |

Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

Base |

410 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Year |

Beginning Balance |

YTD |

200 |

Jan Beginning Balance |

|

|

Year |

Period Activity |

YTD |

1300 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

YTD |

1500 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

|

Year |

Beginning Balance |

Base |

200 |

Jan Beginning Balance |

|

|

Year |

Period Activity |

Base |

1300 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

Base |

1500 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

Income Statement Balances

|

Accounting Period |

Balance Amount |

Amount Type |

Value |

Comments |

R12 Amount Type Equivalent |

|---|---|---|---|---|---|

|

May |

Beginning Balance |

YTD |

0 |

Jan Beginning Balance |

|

|

May |

Period Activity |

YTD |

420 |

Jan to May Activity |

YTD-Actual as of May |

|

May |

Ending Balance |

YTD |

420 |

May Ending Balance |

YTD-Actual as of May |

|

May |

Beginning Balance |

QTD |

120 |

Apr Beginning Balance |

|

|

May |

Period Activity |

QTD |

300 |

Apr-May Activity |

QTD-Actual as of May |

|

May |

Ending Balance |

QTD |

420 |

May Ending Balance |

QTD-Actual as of May |

|

May |

Beginning Balance |

PTD |

220 |

May Beginning Balance |

|

|

May |

Period Activity |

PTD |

200 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

PTD |

420 |

May Ending Balance |

PTD-Actual as of May |

|

May |

Beginning Balance |

Base |

220 |

May Beginning Balance |

|

|

May |

Period Activity |

Base |

200 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

Base |

420 |

May Ending Balance |

YTD-Actual as of May |

|

Q2 |

Beginning Balance |

QTD |

120 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

QTD |

550 |

Period Activity Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

QTD |

670 |

Ending Balance always as of Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

YTD |

670 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Q2 |

Beginning Balance |

Base |

120 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

Base |

550 |

Period Activity always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

Base |

670 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Year |

Beginning Balance |

YTD |

0 |

Jan Beginning Balance (always zero for Income Statement) |

|

|

Year |

Period Activity |

YTD |

1960 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

YTD |

1960 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

|

Year |

Beginning Balance |

Base |

0 |

Jan Beginning Balance (always zero for Income Statement) |

|

|

Year |

Period Activity |

Base |

1960 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

Base |

1960 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

By using various combinations of selections for the Accounting Period, Balance Amount, and Amount Type dimensions, you can derive different amounts to meet financial reporting requirements combinations.

Balances cubes do not return data for these combinations:

|

Accounting Period |

Balance Amount |

Amount Type |

|---|---|---|

|

Year |

Beginning Balance |

QTD |

|

Year |

Period Activity |

QTD |

|

Year |

Ending Balance |

QTD |

|

Year |

Beginning Balance |

PTD |

|

Year |

Period Activity |

PTD |

|

Year |

Ending Balance |

PTD |

|

Q2 |

Beginning Balance |

YTD |

|

Q2 |

Period Activity |

YTD |

|

Q2 |

Beginning Balance |

PTD |

|

Q2 |

Period Activity |

PTD |

|

Q2 |

Ending Balance |

PTD |

You have loaded your Oracle E-Business Suite Release 12 balances into your new Oracle Fusion Standard Balances Cube. Now you want to query the results to verify that the data was loaded correctly.

The following two tables show the amounts loaded into the balances cube from your R12 balances and the calculated balances for ending balance, year to date (YTD), and quarter to date (QTD). The first table is the balance sheet based balances and the second table is for income statement based balances.

Balance Sheet Balances

|

Month |

Beginning Balance Loaded to Cube |

Activity Loaded to Cube |

Ending Balance |

Calculate YTD |

QTD |

|---|---|---|---|---|---|

|

Jan |

200 |

20 |

220 |

20 |

20 |

|

Feb |

220 |

30 |

250 |

50 |

50 |

|

Mar |

250 |

25 |

275 |

75 |

75 |

|

Apr |

275 |

50 |

325 |

125 |

50 |

|

May |

325 |

40 |

365 |

165 |

90 |

|

Jun |

365 |

45 |

410 |

210 |

135 |

|

Jul |

410 |

100 |

510 |

310 |

100 |

|

Aug |

510 |

200 |

710 |

510 |

300 |

|

Sep |

710 |

140 |

850 |

650 |

440 |

|

Oct |

850 |

150 |

1000 |

800 |

150 |

|

Nov |

1000 |

100 |

1100 |

900 |

250 |

|

Dec |

1100 |

400 |

1500 |

1300 |

650 |

Income Statement Balances

|

Month |

Beginning Balance Loaded to Cube |

Activity Loaded to Cube |

Ending Balance |

Calculate YTD |

QTD |

|---|---|---|---|---|---|

|

Jan |

0 |

70 |

70 |

70 |

70 |

|

Feb |

70 |

20 |

90 |

90 |

90 |

|

Mar |

90 |

30 |

120 |

120 |

120 |

|

Apr |

120 |

100 |

220 |

220 |

100 |

|

May |

220 |

200 |

420 |

420 |

300 |

|

Jun |

420 |

250 |

670 |

670 |

550 |

|

Jul |

670 |

50 |

720 |

720 |

50 |

|

Aug |

720 |

300 |

1020 |

1020 |

350 |

|

Sep |

1020 |

130 |

1150 |

1150 |

480 |

|

Oct |

1150 |

110 |

1260 |

1260 |

110 |

|

Nov |

1260 |

200 |

1460 |

1460 |

310 |

|

Dec |

1460 |

500 |

1960 |

1960 |

810 |

The following two tables show the results available from Oracle Fusion General Ledger from your R12 loaded and aggregated balances in the balances cube. The first table is the balance sheet based balances and the second table is for income statement based balances.

Balance Sheet Balances

|

Accounting Period |

Balance Amount |

Amount Type |

Value |

Comments |

R12 Amount Type Equivalent |

|---|---|---|---|---|---|

|

May |

Beginning Balance |

YTD |

200 |

Jan Beginning Balance |

|

|

May |

Period Activity |

YTD |

165 |

Jan to May Activity |

YTD-Actual as of May |

|

May |

Ending Balance |

YTD |

365 |

May Ending Balance |

YTD-Actual as of May |

|

May |

Beginning Balance |

QTD |

275 |

Apr Beginning Balance |

|

|

May |

Period Activity |

QTD |

90 |

Apr-May Activity |

QTD-Actual as of May |

|

May |

Ending Balance |

QTD |

365 |

May Ending Balance |

QTD-Actual as of May |

|

May |

Beginning Balance |

PTD |

325 |

May Beginning Balance |

|

|

May |

Period Activity |

PTD |

40 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

PTD |

365 |

May Ending Balance |

PTD-Actual as of May |

|

May |

Beginning Balance |

Base |

325 |

May Beginning Balance |

|

|

May |

Period Activity |

Base |

40 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

Base |

365 |

May Ending Balance |

YTD-Actual as of May |

|

Q2 |

Beginning Balance |

QTD |

275 |

April Beginning Balance |

|

|

Q2 |

Period Activity |

QTD |

135 |

Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

QTD |

410 |

Ending Balance always as of Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

YTD |

410 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Q2 |

Beginning Balance |

Base |

275 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

Base |

135 |

Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

Base |

410 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Year |

Beginning Balance |

YTD |

200 |

Jan Beginning Balance |

|

|

Year |

Period Activity |

YTD |

1300 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

YTD |

1500 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

|

Year |

Beginning Balance |

Base |

200 |

Jan Beginning Balance |

|

|

Year |

Period Activity |

Base |

1300 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

Base |

1500 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

Income Statement Balances

|

Accounting Period |

Balance Amount |

Amount Type |

Value |

Comments |

R12 Amount Type Equivalent |

|---|---|---|---|---|---|

|

May |

Beginning Balance |

YTD |

0 |

Jan Beginning Balance |

|

|

May |

Period Activity |

YTD |

420 |

Jan to May Activity |

YTD-Actual as of May |

|

May |

Ending Balance |

YTD |

420 |

May Ending Balance |

YTD-Actual as of May |

|

May |

Beginning Balance |

QTD |

120 |

Apr Beginning Balance |

|

|

May |

Period Activity |

QTD |

300 |

Apr-May Activity |

QTD-Actual as of May |

|

May |

Ending Balance |

QTD |

420 |

May Ending Balance |

QTD-Actual as of May |

|

May |

Beginning Balance |

PTD |

220 |

May Beginning Balance |

|

|

May |

Period Activity |

PTD |

200 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

PTD |

420 |

May Ending Balance |

PTD-Actual as of May |

|

May |

Beginning Balance |

Base |

220 |

May Beginning Balance |

|

|

May |

Period Activity |

Base |

200 |

May Activity |

PTD-Actual as of May |

|

May |

Ending Balance |

Base |

420 |

May Ending Balance |

YTD-Actual as of May |

|

Q2 |

Beginning Balance |

QTD |

120 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

QTD |

550 |

Period Activity Always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

QTD |

670 |

Ending Balance always as of Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

YTD |

670 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Q2 |

Beginning Balance |

Base |

120 |

Apr Beginning Balance |

|

|

Q2 |

Period Activity |

Base |

550 |

Period Activity always Apr-Jun |

QTD-Actual as of Jun |

|

Q2 |

Ending Balance |

Base |

670 |

Ending Balance always as of Jun |

YTD-Actual as of Jun |

|

Year |

Beginning Balance |

YTD |

0 |

Jan Beginning Balance (always zero for Income Statement) |

|

|

Year |

Period Activity |

YTD |

1960 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

YTD |

1960 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

|

Year |

Beginning Balance |

Base |

0 |

Jan Beginning Balance (always zero for Income Statement) |

|

|

Year |

Period Activity |

Base |

1960 |

Jan-Dec Activity |

YTD-Actual as of Dec |

|

Year |

Ending Balance |

Base |

1960 |

Ending Balance always as of Dec |

YTD-Actual as of Dec |

This list describes the processes used to create, rebuild, publish, and maintain Oracle Fusion General Ledger balances cubes, including automatically run child processes.

Create Cube Processes Run in Oracle Enterprise Scheduler Service (ESS)

|

Parent Process |

Child Process |

Description |

Cube Type |

|---|---|---|---|

|

Create Cube |

|

Creates or rebuilds the balances cube based on the combination of chart of accounts and accounting calendar. Automatically runs the child processes below for standard and average daily balance (ADB) cubes, if enabled. |

Standard |

|

Create Cube: Initialize Cube |

Starts the process to import data into the balances cube. |

Standard |

|

Create Cube: Create Calendar Dimension Members and Hierarchies |

Creates the calendar dimension members and hierarchies for a balances cube. |

Standard |

|

Create Cube: Create Ledger Dimension Members |

Creates the ledger dimension members for a balances cube. |

Standard |

|

Create Cube: Publish Chart of Accounts Dimension Members and Hierarchies |

Publishes chart of accounts and hierarchy changes to balances cubes and updates dimension members for any new or changed segment values. |

Standard |

|

Create Average Daily Balance Cube |

Determines the amount needed to manually adjust general ledger account average balances to reflect the differences between the original and revalued customer open items. |

Average Daily Balance (ADB) |

|

Create Cube: Initialize Average Balances Cube |

Begins the process to import average balances into the balances cube. |

ADB |

|

Create Cube: Create Daily Dimension Members and Hierarchies |

Creates the daily calendar dimension members and hierarchies for a balances cube. |

ADB |

|

Create Cube: Create Ledger Dimension Members |

Creates the ledger dimension members for a balances cube. |

ADB |

|

Create Cube: Publish Chart of Accounts Dimension Members and Hierarchies |

Publishes chart of accounts and hierarchy changes to balances cubes and updates dimension members for any new or changed segment values. |

ADB |

|

Create Cube: Transfer General Ledger Balances to Essbase |

Transfer balances to balances cubes. |

Standard and ADB, if enable, in same request |

Publish Cube Processes Run in ESS

|

Parent Process |

Child Process |

Description |

Cube Type |

|---|---|---|---|

|

Publish Chart of Accounts Dimension Members and Hierarchies |

|

Publishes chart of accounts dimension member and hierarchy changes to balances cubes and updates dimension members for any new or changed segment values. |

Standard and ADB, if enable, in same request |

|

Update Chart of Accounts Dimension Members and Hierarchies |

Updates chart of accounts dimension member and hierarchy changes to Essbase. |

Standard and ADB, if enable, in same request |

Transfer Cube Process Run in ESS

|

Parent Process |

Description |

Cube Type |

|---|---|---|

|

Transfer General Ledger Balances to Essbase |

Refreshes standard cube (and average balances cube if enabled) in the General Ledger balances cube. |

Standard and ADB, if enable, in same request |

Other Cube Processes Run in ESS

|

Parent Process |

Descriptions |

Cube Type |

|---|---|---|

|

Create Accounting Period Dimension for Standard Cube |

Creates the accounting period dimension members. |

Standard |

|

Create Ledger Dimension Members |

Creates and updates ledger dimension members including primary ledgers, secondary ledgers, reporting currencies, and ledger sets in the balances cubes. |

Standard and ADB, if enable, in same request |

|

Create Currency Dimension Members |

Creates and updates all currencies in every balances cube. |

Standard and ADB, if enable, in same request |

|

Create Scenario Dimension Members |

Creates and updates all scenario dimension members when new scenarios are created or existing scenarios are changed. |

Standard and ADB, if enable, in same request |

|

Create Accounting Period Dimension for Average Daily Balances Cube |

Creates the accounting period dimension members in the average daily balances cube. |

ADB |

|

Create Rules XML File for BI Extender Automation |

|

Standard and ADB, if enable, in same request |

To run cube process, use the following steps the Scheduled Processes work area from the Navigator menu.

Click the Schedule New Process button

Search on the Process Name.

Enter the desired parameters.

Enter the desired process options and schedule.

Click Submit.

To avoid data corruption, your cumulative adjustment account (CTA) can only be changed if you first perform the following set of steps:

Purge all translated balances

Change the CTA account

Rerun translation

To avoid data corruption, your retained earnings account can only be changed if you first perform the following set of steps:

Enter and post journals to bring the ending balances for your income statement accounts to zero at the end of each accounting year

Purge actual translated balances

Update the retained earnings account