Calculating Cross, Triangulated, and Reciprocal Rates

This section discusses how to run the EOP_RATECALC Application Engine process to calculate cross, triangulated, and reciprocal rates.

Page Used to Run the EOP_RATECALC Process

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Calculate Cross/Reciprocal Rate - Parameters |

RUN_EO9030 |

|

Set run control parameters and run the EOP_RATECALC Application Engine process that calculates cross, triangulated, and reciprocal rates. |

Understanding the EOP_RATECALC Process

Run the EOP_RATECALC process to calculate rates and update the market rates table.

The process performs three functions:

Generates cross rates for non-triangulated currency pairs.

For example, an organization subscribes to a rate service that provides all rates respective to USD. Starting with a USD to Canadian dollar rate and a USD to Mexican peso rate, the system can calculate a new Canadian dollar to Mexican peso cross rate.

Generates triangulated rates for triangulated currency pairs.

For example, the EUR to an EPC (euro participating currency) fixed rate has been established on the market rate table and a new EUR to USD rate has just been entered. Using this information, the process can create a new USD to EPC triangulated rate. The difference between triangulated rates and cross rates affects how the data is stored in the database. When calculating a cross rate, you actually create a new rate. When calculating a triangulated rate, the individual components of the source rates are stored on the target.

Generates reciprocal rates for those currency pairs that are not automatically reciprocated.

For example, using a USD to CAD rate as the source, the process calculates the CAD to USD reciprocal. If currency quote methods are in place, the visual rate remains the same and there is a difference in how the data is stored in the database (RATE_MULT and RATE_DIV are inverse). If currency quote methods are not used, the process actually calculates an inverse rate, meaning that the visual rates will differ.

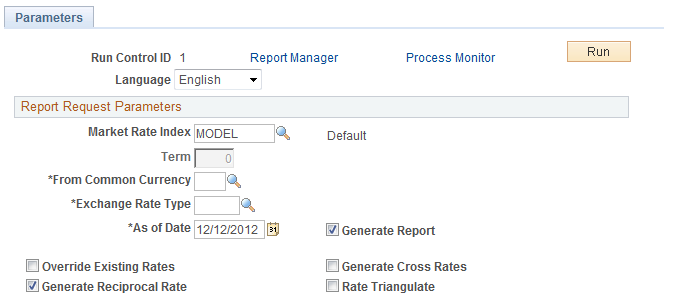

Calculate Cross/Reciprocal Rate - Parameters Page

Use the Calculate Cross/Reciprocal Rate - Parameters page (RUN_EO9030) to set run control parameters and run the EOP_RATECALC Application Engine process that calculates cross, triangulated, and reciprocal rates.

Image: Cross/Reciprocal Rate - Parameters page

This example illustrates the fields and controls on the Cross/Reciprocal Rate - Parameters page. You can find definitions for the fields and controls later on this page.

Oracle supports the use of Oracle Business Intelligent Publisher (BI Publisher or BIP) to generate the Cross/Reciprocal Rate Calc (EO9030) report.

Important! This calculation process includes two SQR reports - Cross/Reciprocal Rate Calc (EO9030) and Update History Rates (EO9031). Select to run EO9030 if you do not implement Application Integration Architecture (AIA) in your system. Select to run EO9031 if you are an AIA customer and wish to update history rates via this process.