Understanding Model Components

Objects—resources, activities, and cost objects—are the basic components of the Activity-Based Management model. So that the model provides you with meaningful information, use ledger-to-resource mappers and drivers to assign costs to resources, activities, and cost objects. By assigning these costs, you define how Activity-Based Management processes the model.

This section discusses:

Primary and secondary resources.

Attributes for resources, activities, and cost objects.

Cost of capital.

Ledger-to-resource mapping.

Ledger Mapper Generator.

Primary and Secondary Resources

Resources are the required economic elements to perform the activities associated with your business and are consumed in the performance of these activities and thus denote operating costs. In Activity-Based Management, resources are typically regarded as the groupings of one or more source ledger accounts. For example, resources in a manufacturing business might include costs for indirect labor, production support, facility maintenance, and all costs outside of production such as sales and marketing. In a service business, however, resources might include salaries, office rentals, and costs of capital such as information systems, depreciation, real estate taxes, and other associated costs.

You can categorize resources in the following two ways:

Primary resources are consumed directly by activities or cost objects.

An employee, a work group, or direct materials are examples of primary resources.

Secondary resources are consumed by other resources before being assigned to activities.

For example, suppose that you have one account—Repair and Maintenance—but that account supports both your manufacturing and operations departments and thus requires that you split the costs between your manufacturing and operations departments. In this case, Repair and Maintenance is a secondary resource assigned to two primary resources—Manufacturing Repair and Maintenance as well as Operations Repair and Maintenance.

Attributes for Resources, Activities, and Cost Objects

You can categorize resources, activities, and cost objects by first defining attributes for them, and then adding the attributes to them. Adding one or more attributes to an object also gives you greater control over the processes and analyses associated with that object. Grouping resources with similar characteristics enhances your ability to extract and analyze report data.

For example, suppose that you print history books. Your cost objects might be Asian history by author X, Asian history by author Y, European history by author Z, European history by author T, and so on. To know about some attribute related to these books (such as their cover type), you can enter those values as attributes so that you can generate reports to track and analyze them.

Cost of Capital

Many advocates of shareholder value analysis, cash flow return on investment, and economic value added encourage the maximization of profits after including the costs of capital employed. To achieve this, include the cost of the employed capital assets — also known as the cost of capital — when you assign operating expenses to activities and cost objects.

Activity-Based Management enables you to determine the cost of capital by correcting the arbitrary allocations of overhead expenses to products as well as the inability to assign indirect costs to activities and the associated profitability dimensions. Activity-Based Management enables you to correct the financial accounting failure of calculating company profits without recognizing the cost of capital as an economic expense. By correcting these areas of potential miscalculation, you can redirect your attention and specific actions to operations where economic losses are incurred. Therefore, you can successfully protect, retain, and expand economically profitable operations.

Traditionally, employed assets and capital are measured at the corporation, division, or business unit level. Using Activity-Based Management, you can measure the cost of capital in more depth (for example, at the activities and cost-objects level).

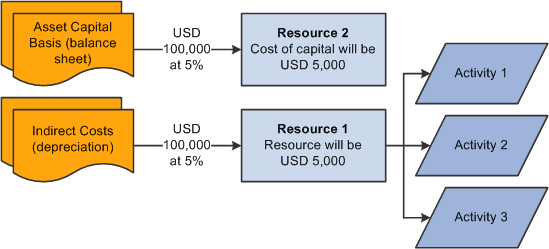

Image: Cost of capital flow chart

The following diagram illustrates how cost of capital is distributed at the activities and cost-objects level.

Ledger-to-Resource Mapping

After you define resources, use the ledger-to-resource mapper to assign actual and budgeted monetary amounts from your source ledger to the resources.

Activity-Based Management source ledger-to-resource mapping populates resources in Activity-Based Management with source ledger account items. It can map multiple source ledger line items to a single resource ID. In addition, you can assign many business units to one PeopleSoft EPM business unit. Activity-Based Management source ledger-to-resource mapping processes two amounts—an actual amount that represents actual costs of the accounting period and a budgeted amount used to calculate budgeted model results and compute capacity rate information.

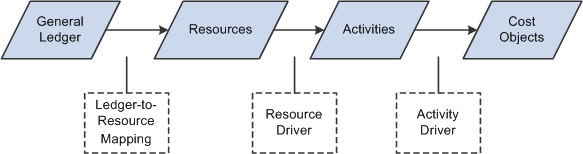

Image: Assigning costs in Activity-Based Management

The following diagram illustrates how Activity-Based Management assigns costs.

Ledger Mapper Generator

The Ledger Mapper Generator engine (AB_LDMPGEN) automatically generates the ledger mapping rules for Activity-Based Management resources.