Specifying Asset Budgeting Defaults

You must define the asset budgeting defaults that are used for the planning model. The default settings determine the level of autonomy that budget preparers have as they plan for new assets. Preparers can enter only the accounts specified on the setup pages in asset budgeting. The override check boxes control the preparers' ability to modify information as they add assets.

This section discusses how to:

Define asset budgeting defaults.

Select asset accounts.

Select depreciation accounts.

Specify asset catalog items.

Define capital acquisition plans.

Pages Used to Specify Asset Budgeting Defaults

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Asset Budgeting Defaults |

BP_ASSET_OPTIONS |

|

Establish defaults used when working with assets, enable override capability for CAP and cash account information, and specify cash accounts. |

|

Asset Budgeting Defaults - Asset Accounts |

BP_ASSET_ACCOUNT |

Click the Asset Accounts link on the Asset Budgeting Defaults or Asset Budgeting Defaults - Depreciation Accounts pages. |

Define the asset accounts through which preparers perform asset budgeting. |

|

Asset Budgeting Defaults - Depreciation Accounts |

BP_DEPR_ACCOUNT |

Click the Depreciation Accounts link on the Asset Budgeting Defaults or Asset Budgeting Defaults - Asset Accounts pages. |

Specify depreciation accounts or enable override capability for useful life, salvage value, and the depreciation method associated with assets. |

|

Asset Catalog |

BP_ASSET_CATALOG |

|

Set up asset profiles that comprise an asset catalog. Profiles include default accounts, cost, depreciation method, useful life, salvage value, and currency code. |

|

Capital Acquisition Planning Details |

BP_CAP_DETAILS |

|

Add new or view existing CAPs that you can use in the planning model. |

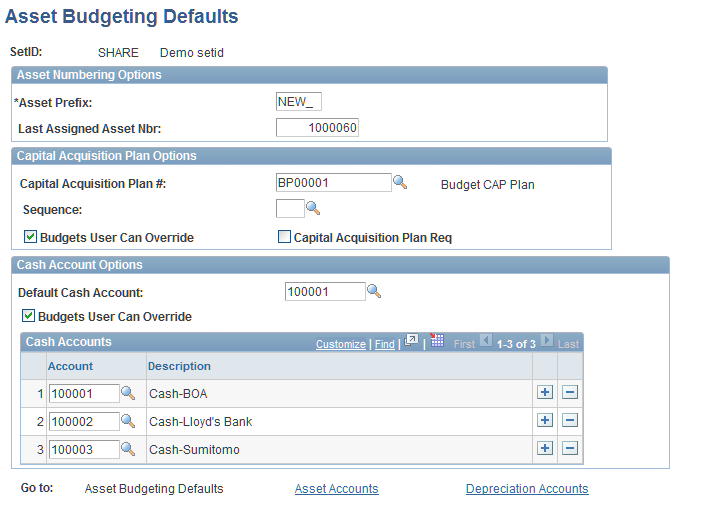

Asset Budgeting Defaults Page

Use the Asset Budgeting Defaults page (BP_ASSET_OPTIONS) to establish defaults used when working with assets, enable override capability for CAP and cash account information, and specify cash accounts.

Image: Asset Budgeting Defaults page

This example illustrates the fields and controls on the Asset Budgeting Defaults page. You can find definitions for the fields and controls later on this page.

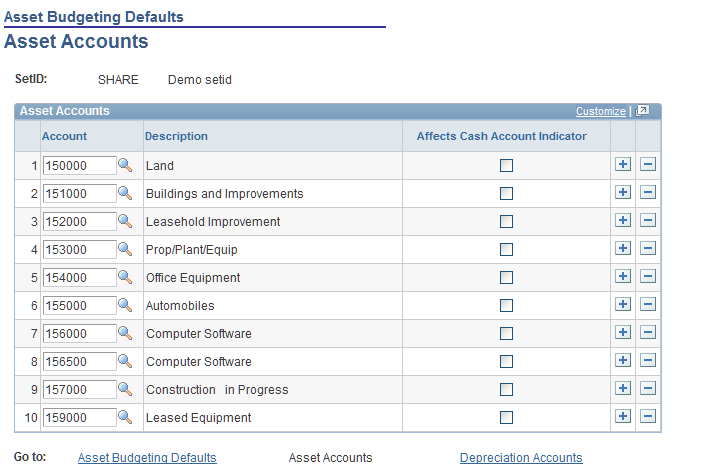

Asset Budgeting Defaults - Asset Accounts Page

Use the Asset Budgeting Defaults - Asset Accounts page (BP_ASSET_ACCOUNT) to define the asset accounts through which preparers perform asset budgeting.

Click the Asset Accounts link on the Asset Budgeting Defaults or Asset Budgeting Defaults - Depreciation Accounts pages.

Image: Asset Budgeting Defaults - Asset Accounts page

This example illustrates the fields and controls on the Asset Budgeting Defaults - Asset Accounts page. You can find definitions for the fields and controls later on this page.

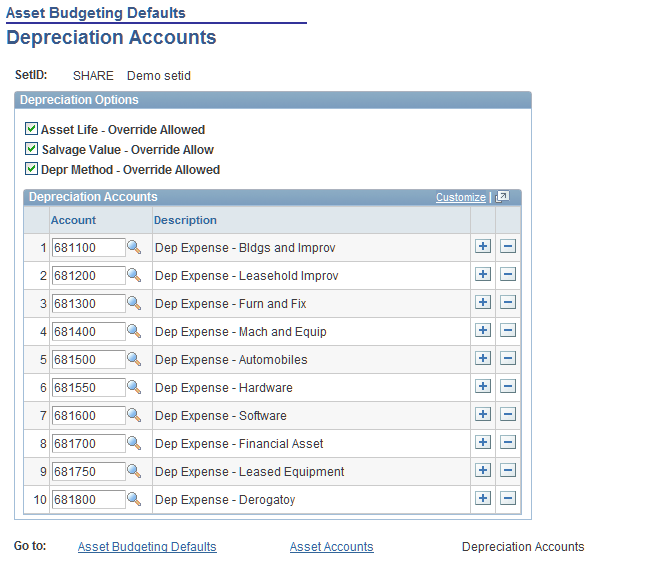

Asset Budgeting Defaults - Depreciation Accounts Page

Use the Asset Budgeting Defaults - Depreciation Accounts page (BP_DEPR_ACCOUNT) to specify depreciation accounts or enable override capability for useful life, salvage value, and the depreciation method associated with assets.

Click the Depreciation Accounts link on the Asset Budgeting Defaults or Asset Budgeting Defaults - Asset Accounts pages.

Image: Asset Budgeting Defaults - Depreciation Accounts page

This example illustrates the fields and controls on the Asset Budgeting Defaults - Depreciation Accounts page. You can find definitions for the fields and controls later on this page.

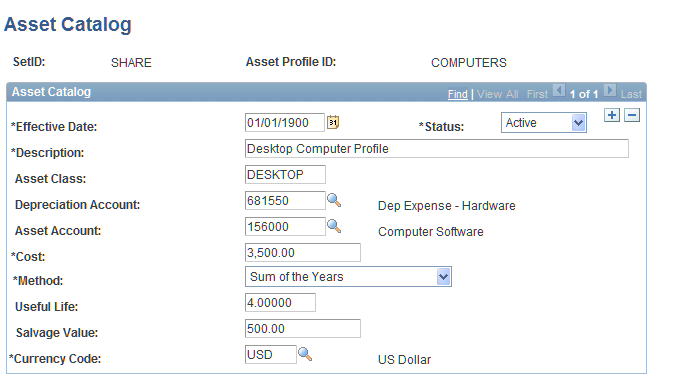

Asset Catalog Page

Use the Asset Catalog page (BP_ASSET_CATALOG) to set up asset profiles that comprise an asset catalog.

Profiles include default accounts, cost, depreciation method, useful life, salvage value, and currency code.

Image: Asset Catalog page

This example illustrates the fields and controls on the Asset Catalog page. You can find definitions for the fields and controls later on this page.

Defaults that you define for an Asset Profile ID using this page appear on the Asset Data page when you select an asset catalog item.

Note: If you use Asset Management and import asset catalog data into Planning and Budgeting, most of the fields on this page display the asset profile data from Asset Management. However, some information, such as depreciation account, asset account, and cost is required for budgeting purposes and unavailable in Asset Management.

If you are not using asset data from Asset Management, use this page to define a catalog item (Asset Profile ID) for each type of asset that you want to enter in Planning and Budgeting.

Note: Since these account default rules represent the dimension members for the asset activities in your planning model, make sure that all values exist on the same level of an account tree you use in your activity group. You want all the accounts used for asset budgeting to be consistent with the account tree, dimension leveling, and parent line item activity, within the scenario of your business unit's planning model. Users may not be able to add assets or run reports when the accounts used are at varying levels of an account tree. This applies for all the above listed pages which use account defaults, namely: Asset Budgeting Defaults, Asset Budgeting Defaults - Asset Accounts, Asset Budgeting Defaults - Depreciation Accounts, and Asset Catalog pages.

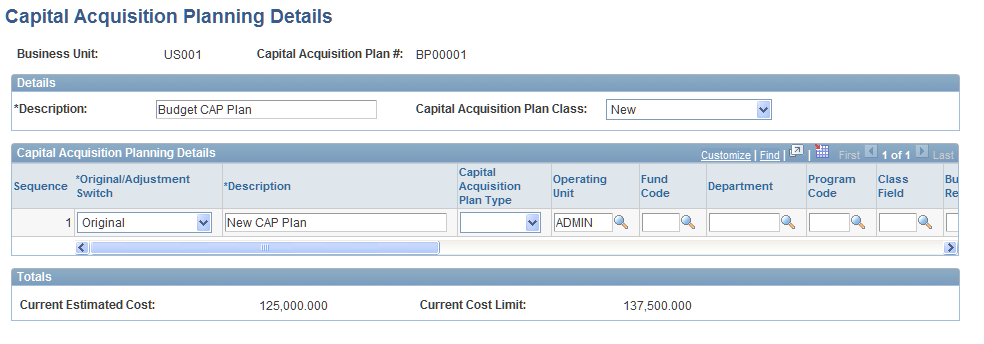

Capital Acquisition Planning Details Page

Use the Capital Acquisition Planning Details page (BP_CAP_DETAILS) to add new or view existing CAPs that you can use in the planning model.

Image: Capital Acquisition Planning Details page

This example illustrates the fields and controls on the Capital Acquisition Planning Details page. You can find definitions for the fields and controls later on this page.

The Details group box displays details about the CAP. When you add an asset, you can select a combination of CAP number and CAP sequence number to further identify the plan row to which the asset is associated. For example, if the CAP is for a new building, sequence 1 could have a description of Office Space, sequence 2 could be Cafeteria, and sequence 3 could be Conference Rooms.