Financial Performance Measures Process

One of the primary business processes for PeopleSoft Risk Weighted Capital and PeopleSoft Funds Transfer Pricing is the Financial Performance Measures process (FPM). Running this process enables the financial rules and calculations to be processed so that PeopleSoft Risk Weighted Capital and PeopleSoft Funds Transfer Pricing can use this data. The FPM process uses the Stratification engine (FI_SE) and Cash Flow Generator (FI_CASHFLOW) in a specific sequence to process and retrieve additional data.

All business processes are invoked using a jobstream. The following lists the basic process flow:

The FPM jobstream enables you to invoke the Stratification engine for aggregating instruments into pools.

The FPM process instructs the Cash Flow Generator to calculate the expected future cash flows for the instruments in the pool and to calculate the financial measures for the pool.

The FPM process makes an online call to the Yield Curve Generator process for any products or instruments needing an interest rate during processing.

The Pricing Index Model generates the interest rates and pricing indexes for the cash flows scheduled based on the interest rate reprice dates.

The behavioral models calculate the effects on cash flows resulting from such events as prepayments, exercised rate lock options, and charge-offs.

The Curve Evaluator generates discount rates for cash flows.

It also creates a cash flow schedule based on the interest payment schedule and interest rate reprice schedule created in the Product Definitions module.

The Cash Flow Generator accesses the beginning principal balance for each payment period from the Instrument Balance table (FI_IBAL_R00) or from the Instrument Pool Balance table (FI_POOLBAL_R00).

Using all these engines, the FPM process calculates financial measures, such as net present value, convexity, measures of duration, interpolation of interest rates, cash flows, calculation of net interest margin, and reconciliation of ledger account balances to their corresponding instrument or treasury position balances.

For added flexibility, you also have the option to run the Stratification application engine and Cash Flow Generator application engine separately. Run the Stratification application engine to aggregate instrument data into pool tables. You can then run the Cash Flow Generator application engine separately, using as input the instrument pools aggregated by the stratification application engine. Or, run the Cash Flow Generator application engine and the FPM process without prior stratification of instrument data into pools.

Note: The Cash Flow Generator can project cash flows both for instruments currently in the portfolio, as well as instruments forecasted to be originated at some future date. Cash flow calculations for nonforecasted data are based on data available in the FI_INSTR_F00 table and its child tables. Cash flow calculations for forecasted data are based on the rules from the Financial Products page. These rules describe the cash flow characteristics of the instruments, including type of balance, par amount, term, interest calculations, and interest dates.

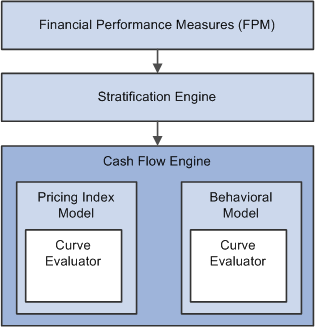

Image: Basic FPM process flow

The following diagram provides a graphical representation of the basic FPM process flow, beginning with the FPM process, then the Stratification engine, and the Cash Flow engine: