Defining Balance Sheet Rules

This section provides an overview of balance sheet rules and discusses how to:

Set up ledger accounts detail.

Assign products and positions detail.

Pages Used to Define Balance Sheet Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Ledger Accounts |

FI_BSR_DEFN |

|

Define the relationship between the PF Ledger account and the product detail (instrument) or treasury position account. Also assign FSI application rules to the PF Ledger account or treasury position account. In addition, use this page for reconciliation purposes. |

|

Products/Positions |

FI_BSR_PROD_SEQ |

|

Assign an FSI application rule to a position, and define the relationship between PF Ledger accounts and their corresponding product detail or treasury positions. |

|

Balance Sheet Rules - Notes |

FI_BSR_DESCRLONG |

|

Enter notes. |

Understanding Balance Sheet Rules

Balance sheet rules define the hierarchy for the reconciliation of products and position balances to their respective ledger accounts. For that reason, it is important to take into account the reconciliation process when assigning balance sheet rules.

The balance sheet rules are also used to assign the FSI application rules to PF ledger accounts or to treasury position accounts. (You assign rules for products on the Financial Calculation Rules page).

The Balance Sheet Rules pages have two primary functions:

They identify the relationships between balance sheet accounts in the PF Ledger and the product detail or treasury positions.

The pages are set up so that you can create an ID for the appropriate level on the ledger account tree, and then identify product details or treasury positions that are associated with that set of ledger accounts. Through the use of constraints, you can define as simple or complex a set of mappings between ledger accounts and products or positions as needed. For each ID you can elect to have the reconciliation process compare the ledger account balances with the associated product or position balances, and optionally post the difference to a ledger (suspense) account.

They enable you to assign an analytic application rule to a PF Ledger account or treasury position.

You can also use constraints to narrow the range of ledger accounts, or positions to which the analytic application rule (for PeopleSoft Risk-Weighted Capital, or PeopleSoft Funds Transfer Pricing) should be applied.

This section discusses:

Balance types.

Balance sheet rules processing sequence.

Balance Types

The PF Ledger table (PF_LEDGER_F00) stores current, end-of-period balances. The ADB Ledger table (PF_LED_ADB_F00) stores average daily balances. The financial analytic applications enable you to choose either PF Ledger or ADB Ledger type balances for processing. The balance sheet rules for FTP, RWC, and reconciliation processing can be set up to use either of these ledger types to establish a basis for account balance selection.

PF Ledger is the master table that contains the master list of account information, and it is the sole basis for selection of rows for processing. The ADB Ledger is treated as a subordinate table to the PF Ledger table. When a business rule is defined so that it processes balances from the ADB Ledger, the processing logic is:

The subset of accounts selected for processing are from the PF Ledger table.

For each row that is selected in step one, rows with the same key field values are selected from the ADB Ledger.

The balance amounts that are used are from the ADB Ledger for the rows that are identified in step two.

Regardless of which data source is used, PF Ledger or ADB Ledger, once a balance sheet rule processes an account row, it does not process it again. The reason for this is to prevent any possibility of double-counting a balance that may be included in more than one basis ID. Likewise, a balance sheet rule can process a ledger row as either an ADB or a PF Ledger type of balance, but never both.

Balance Sheet Rules Processing Sequence

The applications process balance sheet rules in a sequence based on the hierarchical structure of the tree for the product, position, or account tree; the processing sequence is from the most specific nodes in the tree to the more general nodes. This processing sequence must be taken into account when assigning balance sheet rules.

For example, assume that you have a high level ledger node representing all cash accounts, and child nodes underneath for cash on hand, personal checks, and travelers checks. Also assume that you want to assign slightly different rules for the cash on hand and the checks, due to different operational risks.

You have two options for setting up balance sheet rules, and both achieve the same result:

You could set up two rules, one rule for the parent node, cash, and a specific rule for the cash on hand child node.

You could set up three specific rules, one for each of the child nodes: cash on hand, travelers checks, and personal checks.

If, from a performance measurement standpoint, you consider all checks the same, you may choose the first option, which enables you to group all three of the cash nodes together, but still process the cash on hand balances differently than the check balances.

Ledger Accounts Page

Use the Ledger Accounts page (FI_BSR_DEFN) to define the relationship between the PF Ledger account and the product detail (instrument) or treasury position account.

Also assign FSI application rules to the PF Ledger account or treasury position account. In addition, use this page for reconciliation purposes.

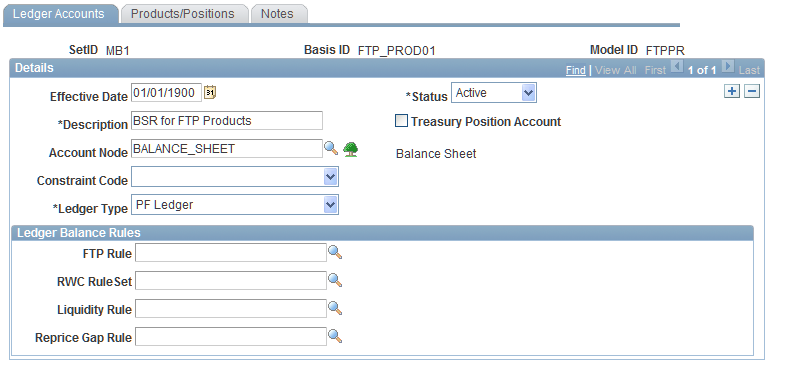

Image: Ledger Accounts page

This example illustrates the fields and controls on the Ledger Accounts page. You can find definitions for the fields and controls later on this page.

To set up ledger accounts detail for balance sheet rules:

Enter a description of the ledger account for which you want to establish rules.

Select the Treasury Position Account check box to define a rule for treasury position balance.

This check box determines some of the fields that appear on the Products/Positions page.

Specify in the Account Node field the PF Ledger tree node that contains the PF Ledger accounts that are related to this rule.

Click the Tree button to view the tree for this account node.

Select a constraint code and ledger type (either PF Ledger orADB Ledger).

Set up the ledger balance rules for the FSI applications.

Select the FTP rule code, RWC ruleset, liquidity, and reprice gap rules that you want to apply to the ledger balance during processing.

Warning! Ensure that all PF Ledger accounts are accounted for in the balance sheet rules by assigning every account node in the PF Ledger to a balance sheet rule.

Products/Positions Page

Use the Products/Positions page (FI_BSR_PROD_SEQ) to assign an FSI application rule to a position, and define the relationship between PF Ledger accounts and their corresponding product detail or treasury positions.

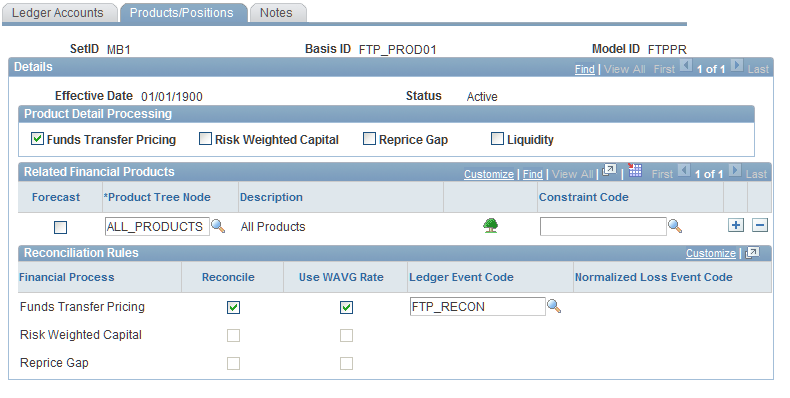

Image: Products/Positions page

This example illustrates the fields and controls on the Products/Positions page. You can find definitions for the fields and controls later on this page.

Note: The Treasury Position Account check box on the previous page affects the fields that are activated on this page. All possible fields are detailed in the following text.

To assign products and positions detail to balance sheet rules:

Indicate if you want to apply this basis ID to the processing for PeopleSoft Funds Transfer Pricing and Risk-Weighted Capital, Reprice Gap, and Liquidity.

Both PeopleSoft Funds Transfer Pricing and PeopleSoft Risk-Weighted Capital applications evaluate the check boxes in the Product Detail Processing section.

If you select the product detail flags, the Funds Transfer Pricing and Risk-Weighted Capital engines process at a product detail-level (pools, instrument balances, or positions) rather than at a ledger-level. RWC_ACCT and FTP_ACCT engines do not perform ledge-level processing for the accounts that are associated with this basis ID. In addition, selecting the flag activates the Reconcile check box in theReconciliation Rules group box below. A cleared product detail flag indicates that you want to perform ledger-level processing only.

Set up the related positions for treasury or financial products (depending on whether or not you select the Treasury Position check box on the previous page).

For treasury positions, select the position source ID, constraint code, funds transfer pricing, and risk-weighted capital rules that you want to assign to this basis ID. For financial products, select the Forecast check box if you want to process forecasted balances and select a product tree node and constraint code to filter the instruments in that node. (Click theTree button to view the product tree hierarchy).

The Reconciliation Rules group box applies only to application-level reconciliation.

To perform application-level reconciliation, set up the reconciliation rules for the balance sheet rule.

Note: You can define a one-to-many relationship between the ledger account (specified on the Ledger Accounts page) and multiple product nodes, or multiple treasury position IDs on this page, by using the constraint codes.