Entering Financial Instrument Data

This section discusses how to:

Describe financial instruments.

Enter data for instruments with variable rates.

Enter detailed instrument data.

Enter status information about instruments.

Enter option information about instruments.

Enter the remaining instrument data.

Pages Used to Enter Instrument Data

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Instrument |

FI_INSTRUMENT |

|

Describe the instrument, including its term, payment, and interest calculation information. |

|

Variable Rate Data |

FI_INSTR_VAR |

|

Enter the interest rate and reprice data for instruments with variable rates. The data that you enter writes to the FI_ISTR_F00 table. |

|

Instrument Detail |

FI_INSTR_MISC |

|

Enter detailed data, such as rate locks and teaser rate data about the instrument. The data that you enter writes to the FI_ISTR_F00 table. |

|

Status |

FI_ISTATUS_PNL |

|

Enter current status information about the instrument. |

|

Balances |

FI_IBAL_PNL |

|

Enter information about the instrument balance. |

|

CF Events |

FI_IEVENT_PNL |

|

Enter information about the instrument's cash flow events. |

|

Option |

FI_IOPTION_PNL |

|

Enter option information for the instrument. |

|

Reprice Events |

FI_IRATE_PNL |

|

Enter repricing events (when the interest rate is reset). |

|

Demographics |

FI_IDEMOG_PNL |

|

Enter demographic data about this instrument. |

|

History |

FI_ITRNHST_PNL |

|

Enter transaction information such as payments. |

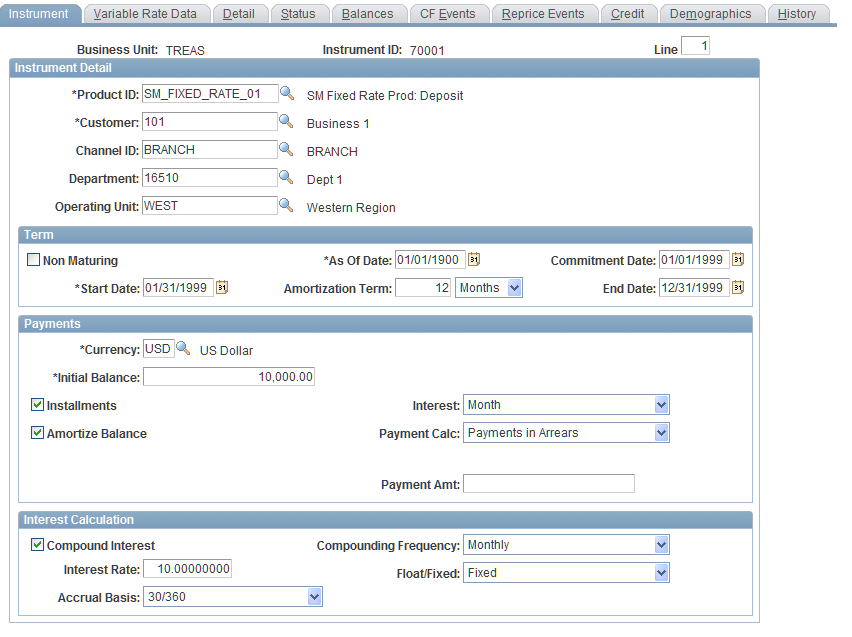

Instrument Page

Use the Instrument page (FI_INSTRUMENT) to describe the instrument, including its term, payment, and interest calculation information.

Image: Instrument page

This example illustrates the fields and controls on the Instrument page. You can find definitions for the fields and controls later on this page.

To describe an instrument:

Enter general instrument detail information.

Set up general term information.

Set up payments information.

Select the currency and enter an initial balance and payment amount. If you want the payments to be made in installments, select the frequency for the payments. Indicate whether you want to amortize the balance and whether you want to amortize the balance negatively. Select the payment calculation method.

Use the Interest Calculation group box to set up how you want to calculate the interest.

Select the Compound Interest option if you want to compound the interest. If so, specify a compounding frequency. Enter the interest rate (if this is a fixed loan) and select how the rates are to be determined in theFloat/Fixed field. Values are:

Enter a value for the accrual basis.

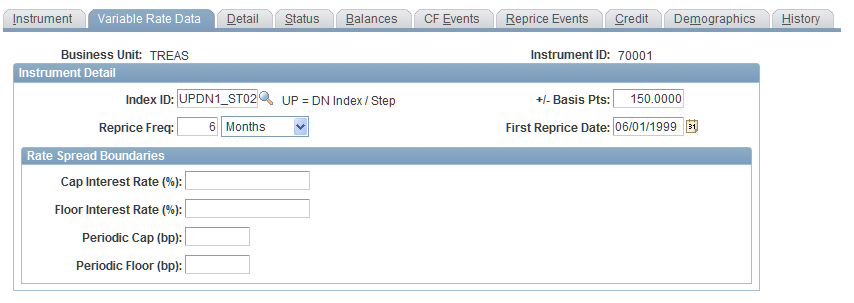

Variable Rate Data Page

Use the Variable Rate Data page (FI_INSTR_VAR) to enter the interest rate and reprice data for instruments with variable rates.

The data that you enter writes to the FI_ISTR_F00 table.

Image: Variable Rate Data page

This example illustrates the fields and controls on the Variable Rate Data page. You can find definitions for the fields and controls later on this page.

To enter data about instruments with variable rates:

Specify general instrument detail information.

Enter the pricing index to use in the construction of the interest rate in the Index ID field.

Select the number of basis points to add or subtract from the interest rate that is constructed from the pricing index in the +/- Basis Pts (margin in basis points) field.

If you specify as a floating instrument, determine how often an interest rate is repriced or recalculated, enter a number and then select Months, Days, or Years.

Enter the first date during the instrument's life that a new interest rate is calculated in the First Reprice Date field.

Indicate the absolute maximum rate that the instrument can have at any point during its life in the Cap Interest Rate (%) field.

Indicate the absolute minimum rate that the instrument can have at any point during its life in the Floor Interest Rate (%) field.

Enter the maximum increase in basis points that the instrument can have from reprice period to reprice period in the Periodic Cap (bp) field.

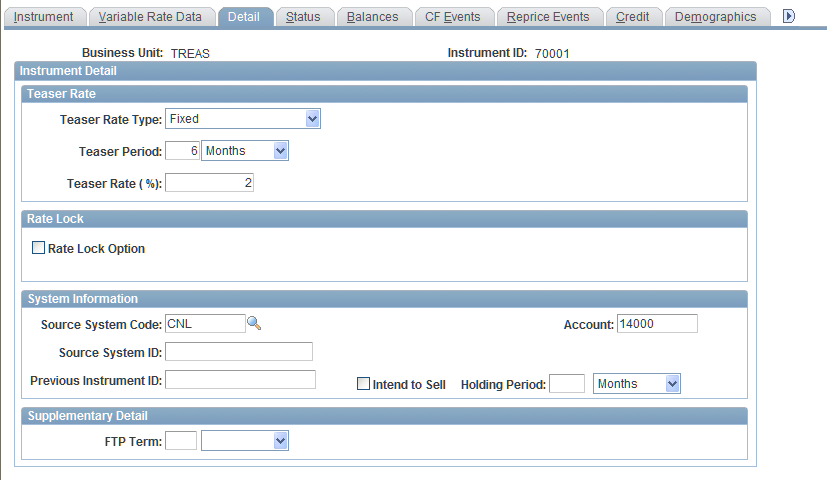

Instrument Detail Page

Use the Instrument Detail page (FI_INSTR_MISC) to enter detailed data, such as rate locks and teaser rate data about the instrument.

The data that you enter writes to the FI_ISTR_F00 table.

Image: Instrument Detail page

This example illustrates the fields and controls on the Instrument Detail page. You can find definitions for the fields and controls later on this page.

Note: The fields on this page may vary depending on how you set up the instrument page.

To enter detailed instrument data:

Select a teaser rate type.

Values are: 0: None,1: Variable Rate, and2: Fixed Rate.

Select the number of days, months, or years in the Teaser Period field.

Specify how often an interest rate reprices or recalculates.

Enter a number in the Teaser Re-Price Freq (teaser reprice frequency) field and then select Months, Days, orYears.

If the teaser rate is variable, enter the price index underlying the teaser rate in the Teaser Index field.

If the teaser rate is variable, use the Teaser Margin (bps) field to enter the number of basis points to add or subtract from the rate that is constructed from the pricing index.

Select the Rate Lock Option check box if the instrument has a rate lock option.

Clear the check box if it does not.

Enter the rate lock frequency in the Rate Lock Freq field.

Values are Months, Days, andYears.

Select the Set Rate Lock From Index check box if this rate lock is based on an index.

Clear the check box if it is not.

Select the One Time Option check box if this is a onetime option.

Clear the check box if it is not.

If the rate lock rate is fixed, enter the rate lock rate (percentage) Rate Lock Rate (%) field.

If applicable, select the index on which the rate lock is based in the Rate Lock Index field.

If the rate lock rate is variable, enter the basis point adjustment to the rate lock index in the Rate Lock Margin (bps) field.

Select the predefined source system code.

Enter an optional general ledger account number with which this instrument is associated in the Account field.

Enter the instrument ID from the source system in the Source System ID field.

Enter the instrument ID prior to its renewal or extension in the Previous Instrument ID field.

Enter the term number used for transfer pricing the instrument balance in the FTP Term field.

Values are Months, Days, andYears.

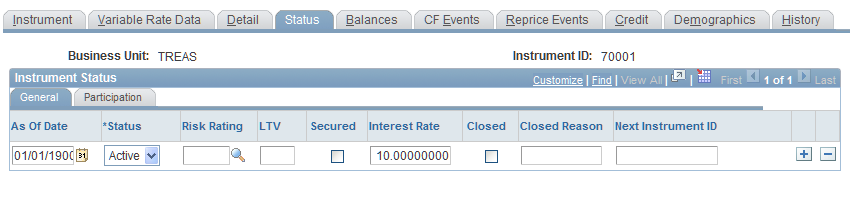

Status Page

Use the Status page (FI_ISTATUS_PNL) to enter current status information about the instrument.

Image: Status page

This example illustrates the fields and controls on the Status page. You can find definitions for the fields and controls later on this page.

To enter current status information about an instrument:

Specify the last date for which the report or process includes data in the As of Date field.

Select the status.

Enter a risk rating and an LTV (loan to value) percentage ratio. Select the Secured check box if there is some underlying collateral that makes the instrument secure.

Specify the interest rate (as a percentage) to apply to instruments with variable interest rates.

Select the Closed check box to indicate that this contract is closed. If so, enter the reason why.

Specify the next instrument ID.

Select the Participation tab.

Select the Sold check box to indicate that the instrument has been sold.

Specify the proportion of the balance retained as a percentage in the Percent Retained field.

Select an optional predefined risk rating code in the Risk Rating field.

Use this option to assign a level of risk (credit or other) associated with the instrument.

Enter the instrument that replaced or superseded this instrument in the Next Instrument ID field.

Option Page

Use the Option page

This page is available only if the product that you are defining has an option leg defined at the product level. Currently, PeopleSoft Financial Services Industry offers two option products, a swaption and a callable bond. At the instrument level, a swaption consists of two instruments that you must define, the fixed pay side of the swap and the floating receive side of the swap. You define a callable bond as a bond. Define the optionality for a swaption or callable bond on the Option page. The system stores the instrument level option information that you enter on this page in the FI_IOPTION_R00 table. Many of the fields in the FI_IOPTION_R00 table are not relevant to creating future cash flows for swaptions and callable bonds and are therefore currently not in use; however, they are important to the data model.

To enter option information about an instrument:

Enter a date for this row of option data in the As of Date field.

Select whether the status of this row is active or inactive in the Status field.

During future cash flow processing, the cash flow engine examines the value of the In/Out field (OPT_CD_VALUE) on the I_OPTION_R00 table to determine how the cash flow engine processes the instrument for each swap leg or for the bond leg.

This field has two possible values:

Note: When you create an instrument on the Instrument Entry component for each swap leg, the system automatically sets the value of the OPT_CD_VALUE field on the I_OPTION_R00 table to OU by default. When the swaption has been exercised, you must manually set the OPT_CD_VALUE field value toIN.

When you create an instrument on the Instrument Entry component for the bond leg, the system automatically sets the value of the OPT_CD_VALUE field on the I_OPTION_R00 table to IN by default. When the callable bond has been exercised, you must manually set the OPT_CD_VALUE field value toOU.

Select the type of option in the Exercise Type field.

Values are:

European: The option can be exercised on one date only.

Bermudan: The option can be exercised on a series of discrete dates.

American: The option can be exercised at any time between two dates.

Enter the rate at which the swap in a swaption contract is invoked or the rate at which a bond is called in the Strike Rate field.

Enter the first possible option exercise date in the Start Date field.

Enter the last possible option exercise date in the End Date field.

If the exercise type is European, this date equals the start date.

Enter the index against the strike rate of the option is to be compared in the Index ID field.

Enter a number that determines how often an option is examined in the Reprice Freq (reprice frequency) field.

If the exercise type of the option is Bermudan, this is the frequency of the discrete dates on which the strike rate of the option is compared to the rate from a curve.

Enter the unit of measure (UOM) for the option frequency in the Reprice UOM field.

Entering the Remaining Instrument Data

Use the remaining pages. These pages have basic setup, which is explained as follows:

Balances page

Enter the type of balance, the as of date, the balance amount and the accrued interest. Then enter the balance in base currency and the accrued interest. These two sets of balance and accrued interest amounts are different only if the balance amount is expressed in a transaction currency that is not the base currency.

CF Events page (cash flow events)

Enter an event code. Values are DrawDown (borrowing against a line of credit),Payment,Margin Adj,orPrepayment. Enter an event date and payment amount.

Reprice Events page

Enter the start date for the reprice event, the variable rate or the interest rate (for a fixed rate instrument). If it is a variable rate instrument, enter the index ID to which the interest rate is tied, and the margin in basis points (adjustment to the index).

Demographics page

Enter the codes for standard industry, country or industry sector, and demographics. Specify the status and enter a demographic value to associate with the demographic code. The system uses this code in conjunction with constraints to more precisely control processing. Enter a demographic date and amount. Finish by entering a location code to represent an additional geographic or location attribute.

History page

Select the transaction date from the calendar (date on which the transaction occurred). Select the transaction code to describe the transaction event. Values are Standard Payment, Standard Deposit, Withdrawal, Drawdown on Commitment, Renegotiation w/Blend & Extend, Renegotiation W/O Blend & Ext, Fixed Rate Renewal, Fixed Rate Add Loan, Fixed Rate Blend & Extend, Reset FTP Rate, Option Conversion, Cancelled Drawdown, Loan Prepayment, FTP Recalibrated Rate, ATM Transaction, Check Processed, Stop Payment Request, Statement Reprint, Balance Inquiry, andStatistical Measure. Statistical measure can be used, for example, to indicate the number of ATM transactions. Enter the currency code. Enter the payment amount twice, expressed in the base currency equivalent, and in the transaction currency.