Setting Up Behavioral Models

This section provides an overview of behavioral models and discusses how to define them.

Pages Used to Set Up Behavioral Models

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Behavioral Model |

FI_BEHV_MDL_PNL |

|

Define a behavioral model for interest rate sensitivity. |

|

Behavioral Models - Notes |

FI_BEHV_NOTES_PNL |

|

Enter any descriptive text relating to the behavior model that you are defining. |

Understanding Behavioral Models

Behavioral models describe how a customer holding a particular type of product for a certain length of time might behave relative to changes in market interest rates, taking into account such factors as geography, credit rating, age of the instrument, and time of year. For example, customers can react to changing interest rates by prepaying their mortgages or withdrawing their deposits.

When projecting cash flows for these products, the Cash Flow Generator application engine takes into account the results from the behavioral models that you define, when projecting cash flows for these products.

You can assign several models to one product. For example, you can assign "Model X" to loans in Georgia that are more than five years old and have poor credit ratings and assign "Model Y" to loans in Arizona that are less than five years old with excellent credit ratings. By doing so, you create a model for each subset that you want to treat differently from the total population of that product.

Almost all of the behavioral models are evaluated only on the instrument's payment date. The only exception is the Rate Lock behavioral model, which is evaluated on the dates of the rate lock options.

This section discusses:

Modeling criteria.

Types of behavioral models.

Modeling Criteria

To model behavior, enter values for one or more of the following criteria:

Weighted Average Coupon rate (WAC).

Age (always in months).

Rate delta.

An algorithm takes those values and processes the data according to the following parameters:

|

If |

The System Selects |

|---|---|

|

On an instrument's payment date, the value (interest rate) of that instrument as defined by the Price Index Model falls between your defined WAC values. |

The minimum of all the WACS that are greater than or equal to the instrument value that the Price Index Model defines. |

|

You have defined age as a factor and the instrument's age falls between your defined ages. |

The maximum of all the ages that you have defined, which are less than or equal to the age of the instrument. |

|

You have defined rate delta and the instrument's rate delta (the Product Pricing Index minus the current WAC) falls between your defined rate deltas. |

The maximum of all the rate deltas that you have defined, which are less than or equal to the rate delta of the instrument. |

For processing to occur, ensure that you have defined at least one of the following:

WAC value that is large enough to establish the upper bound, so that all possible WACs returned by the Product Pricing model will fall below the upper bound.

Age value that is small enough to establish the lower bound, so that all possible ages will fall above the lower bound.

Rate delta that is small enough to establish the lower bound, so that all possible rate deltas (returned by the Product Pricing Index minus the current WAC) will fall above the lower bound.

Types of Behavioral Models

Using the Behavioral Models page, create or modify behavioral models according to model type. The page varies according to the model type that you select. This table lists the six model types:

|

Model Type |

Used for Modeling |

|---|---|

|

Charge Off |

Loss or charge-off rate on loans and lines of credit. The Cash Flow Generator application engine uses this model to estimate projected losses on loans and lines of credit. Charge-off models can be applied only to products with these instrument base types: Loans or Lines Of Credit. |

|

Credit Draw-Down |

Rate at which funds are drawn against a line of credit or a credit card. Credit draw-downs can be used only for Lines Of Credit. |

|

Deposit Growth |

Rate at which deposits are to grow. Deposit growth models can be used only for products with an instrument base type of Deposit (that is nonmaturing). |

|

Deposit Runoff |

Rate at which deposits are to decrease relative to their age. Deposit runoff models can be used only for products with an instrument base type of Deposit (that is maturing). |

|

Prepayment Model |

Rate at which a loan is to prepay, in reaction to changes in market interest rates and in relation to the loan's age. Prepayment models can be applied only to products with these instrument base types: Bonds, Loans, or Lines of Credit. Prepayment model types are explicitly specified. Note: For this type, you must also set up the seasonality groups. |

|

Rate Lock |

When the rate lock occurs for variable loans with rate lock options. Rate locks can be applied only to products that have a rate lock model defined in the product definition page. |

Behavioral Model Page

Use the Behavioral Model page (FI_BEHV_MDL_PNL) to define a behavioral model for interest rate sensitivity.

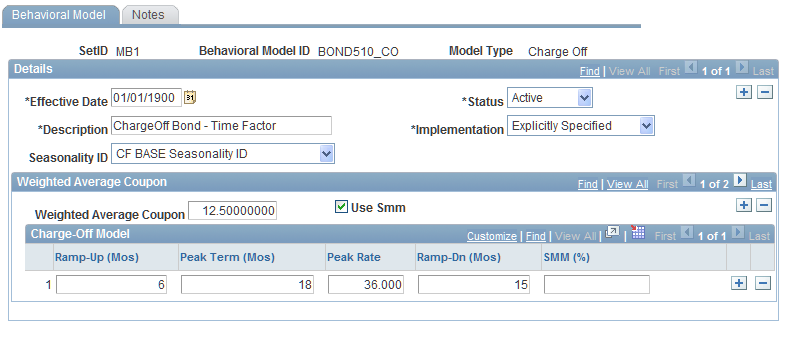

Image: Behavioral Model page

This example illustrates the fields and controls on the Behavioral Model page. You can find definitions for the fields and controls later on this page.

Note: This is a dynamic page. The options that you choose in the fields may activate or deactivate additional fields.

To define behavioral models:

Select, on the access page, the type of behavioral model that you want to create: Charge Off, Credit Draw-Down, Deposit Growth, Deposit Runoff, Prepayment, orRate Lock.

The Implementation field enables you to select the type of parameters that you can set up for your model.

For all models, select Explicitly Specified. This is the default value.

Select the predefined seasonality ID.

The options that appear here were created on the Seasonality Groups page. This enables you to factor an adjustment for cyclical (seasonal) patterns into the modeling. The seasonality factor is applied as a multiplier to the results that are returned by the behavioral model.

Enter the weighted average interest rate for this pool in the Weighted Average Coupon field.

You can define as many rows as necessary for each model that has different coupon rates.

Select the SMM (single monthly mortality) option if you are using this method.

Enter the number of months (starting from origination when rates are increasing) in the Ramp-Up (Mos) field.

Enter the number of months during which the rate peaks do not increase or decrease in the Peak Term (Mos) field.

Enter the percentage rate at which a rate peaks in the Peak Rate field.

Enter the number of months during which charge-off rates are decreasing, eventually reaching a constant (seasoned) rate in the Ramp-Dn (Mos) field.

Enter the rate when it becomes seasoned in the Constant _ Rate field.

This column varies slightly according to the model that you create. For example, this column appears as Constant Charge-Off Rate for the Charge-Off model.

Select the Use Age check box to enable the system to factor the age of the instrument, deposit, or loan into the modeling.

Enter the difference between rates in the Rate Delta (bps) field.

If this is for the Rate Lock model, this is the difference in rates that the borrower would require to be incited to pursue the rate lock rate option and accept the rate being offered by the institution as the new rate (that is, excise option). For example, suppose that the current coupon rate is three percent, then a rate difference of one percent might be appropriate for the borrower to accept the new rate as a fixed rate, trading off the variable rate option previously on the product.

Enter the average age of the deposit, instrument, or loan in the Age (Months) field.

Enter the constant prepayment rate (CPR).

This is the annualized percentage prepayment rate.

Enter the percent of Public Securities Administration (PSA) that corresponds to the CPR that you entered.

Enter the single monthly mortality rate (SMM), which is based on the CPR rate that you entered.

The SMM is calculated as SMM = 1 – (1 – CPR)*1/12.