Setting Up Model Definitions

This section discusses how to:

Create model definitions.

Define engine settings for model definitions.

Pages Used to Create Model Definitions

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Model Definition |

FI_CONFIG_TBL |

|

Specify the product and account trees for this model ID, the accrual basis, and whether the behavioral model and risk-weighted capital results should be factored into the processing. |

|

Engine Settings |

FI_CONFIG_SEQ |

|

Specify any risk-weighted capital allocations that require transfer pricing and the dimensions that you want to use to group calculations when reconciling ledger balances with product detail balances. |

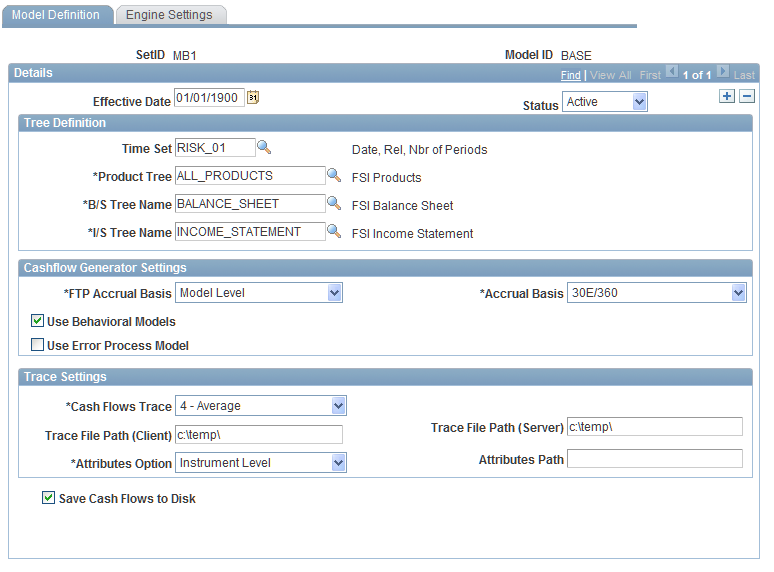

Model Definition Page

Use the Model Definition page (FI_CONFIG_TBL) to specify the product and account trees for this model ID, the accrual basis, and whether the behavioral model and risk-weighted capital results should be factored into the processing.

Image: Model Definition Page

This example illustrates the fields and controls on the Model Definition Page. You can find definitions for the fields and controls later on this page.

To set up model ID definitions:

Set up tree definitions.

Select a time set code to indicate the time buckets that help create the reprice or maturity buckets for stratified pooled data.

Select a product, balance sheet, and income statement tree.

These trees are used to process rules for products, the balance sheet, and the income statement (respectively) according to the tree levels that you define in the warehouse.

Set up the cashflow characteristics in the Cashflow Generator Settings group box.

Define the level of FTP accrual basis.

Options are: Model Level, Instrument Level, orProduct Level.

Then define an accrual basis for FTP cashflows. Options are: 30/360, 30E/360, 30N/360, Actual/360, Actual/365, and Actual/Actual.

If you want to include estimated prepayments (from the behavioral model) in the cash flow calculations, select the Use Behavioral Models check box.

This check box enables all behavioral models and the service fee model.

Similarly, select the Use Error Process Model check box to use error process models.

In the Trace Settings group box, control the amount of cash flow detail information (if any) that is written to log files in theCash Flows Trace field.

Valid values range from 0-No Trace (for production use) to8-Complete (for debugging purposes) with increasing detail.

Note: Specifying a Trace Settings field value of8-Complete could compromise performance capability significantly while processing cash flows.

Specify the path where the cash flow trace files is created.

Do this for client or server paths. This is a required field to set up when you specify any option other than No Trace in theCash Flows Trace field. Otherwise, processing cannot commence.

In the Attributes Option field, set the pricing index type for the model.

Pricing indexes drive the new interest rates generated by processes that use the Cash Flow engine, such as the Financial Performance Measures (FPM) engine. PeopleSoft Funds Transfer Pricing also makes extensive use of this functionality. The option that you select here determines whether the Cash Flow engine generates pricing indexes for pricing events on the product or instrument level. Depending on the selection, pricing indexes for pricing events are set up on the Financial Product Definition component or the Financial Instruments Entry component. Your selection applies to processing of both historic and forecast scenarios.

Note: A pricing event is any time a pricing index is used to provide an interest rate to an instrument or product. Pricing events include pricing, repricing, teasers, and rate locks. These events are usually based on a pricing index.

Options are:

If in the Attribute Options field you selectedAttributes Files, specify in theAttributes Path field the location of cash flow attributes configuration filecfattributes.ini.

Select the Save Cash Flows To Disk check box to save cash flow information to disk.

Processing functions only when running the Cash Flow engine.

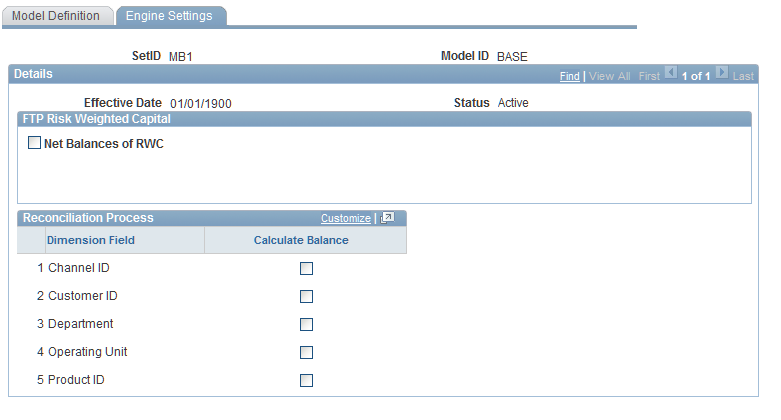

Engine Settings Page

Use the Engine Settings page (FI_CONFIG_SEQ) to specify any risk-weighted capital allocations that require transfer pricing and the dimensions that you want to use to group calculations when reconciling ledger balances with product detail balances.

Image: Engine Settings Page

This example illustrates the fields and controls on the Engine Settings Page. You can find definitions for the fields and controls later on this page.

To specify engine settings for the model ID:

The FTP Risk-Weighted Capital group box is used to give instructions to the PeopleSoft Funds Transfer Pricing (FTP) application on transfer pricing risk-weighted capital.

Set up the fields in this group box:

When the Net Balances of RWC field is selected, this check box tells the FTP processes (FTP_INST, FTP_ACCT, FTP_TRPS, and FTP_FPOOL) to net allocated capital from the balances that it is processing.

It also activates the remaining fields in the group box.

Select a Cost of Funds Table.

This specifies that FTP calculates an FTP charge for the allocated capital amount, based on this cost of funds rate. The resulting cost of allocated capital is stored in a standard output table, with an FTP_SEQ_TYPE code of RWC.

Indicate the point on the yield curve when calculating the cost of allocated capital rate in the Term of Capital field.

Define to which PF (Performance) ledger account the funds transfer charge is posted in the Ledger Event Code field.

In the Reconciliation Process group box, indicate whether you want to group the calculations across dimensions when reconciling ledger balances with product detail balances.

To do this, select the Calculate Balance check box for the appropriate dimensions:Channel ID, Customer ID, Department, Operating Unit, orProduct ID. The FI_RECON and FI_RCN_BS engines use these dimensions during reconciliation.