Matched Maturity Marginal Funds Transfer Pricing

PeopleSoft Funds Transfer Pricing supports the matched maturity marginal funds transfer pricing methodology, which is based on the concept that a centralized unit, the treasury, serves as a conduit for all of the institution's funds using current market marginal funds costs. Under this system, each business unit sells its liabilities at appropriate transfer prices to the treasury, and each business unit buys the funds required to support its assets at appropriate transfer prices from the treasury. In effect, each business unit is treated like a fully matched book: assets receive a transfer price charge that reflects their maturity and liquidity characteristics (cash flows, repricing, origination date, maturity), while liabilities receive a transfer price credit that reflects the market value of funds with those same characteristics.

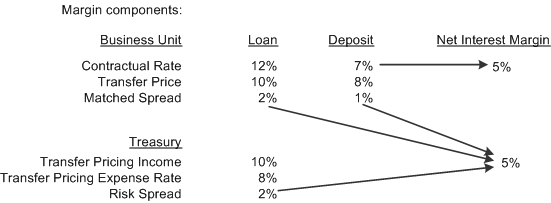

One of the primary benefits of this methodology is that each component of the net interest margin can be measured independently:

Asset or lending spread is the difference between the actual yield on assets and their matched cost for purchased funds from the treasury.

This spread measures the economic return on assets, independent of actual funding sources.

Liability or funding spread is the difference between the actual cost of deposits and the credit for sale of funds to the treasury.

This spread measures the opportunity value of deposit funds independent of their use.

Image: Funds Transfer Pricing Margin Components

To illustrate, assume that the bank has issued a short-term time deposit costing 7% and funded a long term loan yielding 12%. The deposit costs 100 basis points (bps) less than purchased funds with a similar maturity, and the loan has a yield 200 bps higher than the bank would pay for funds of the same maturity. This graphic illustrates the margin components:

The end result is that the spreads reported on assets and liabilities are more stable, reflecting the true economic contributions of these products, while the income variability resulting from changing interest rates is isolated in the treasury, where it can be best managed on a consolidated basis.