Calculating Break Fund Economic Loss

When calculating the economic loss to the funding center due to a payoff or a cancelled drawdown, funds transfer pricing applies the theoretical value of the interest rate differential (IRD) against the projected cash flow stream, based on the amount of the payoff or cancelled drawdown. For the remainder of this section, we will refer to both payoff and cancelled drawdown as payoff events.

To calculate the break funding economic loss:

Step 1

Calculate the funds transfer pricing rate for the original instrument.

Create a new synthetic instrument based on all the payment characteristics of the original instrument but with the following fields set to values based on the payoff event:

Commitment date and start date are set to the transaction date of the payoff event.

The amortization term to maturity is calculated as the number of days between the amortization end date of the instrument and the payoff transaction date. The current and initial balance amounts are set equal to the amount of the payoff or cancelled drawdown.

The following formula is used to calculate the funds transfer pricing rate for the original instrument:

((CASHFLOW*ACCRUAL) / (TOTAL(CASHFLOW*ACCRUAL)))*RATE

Step 2

Calculate a new funds transfer pricing rate for the synthetic instrument based on the same funds transfer pricing rule used for the original instrument.

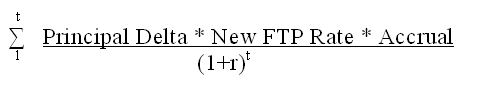

The following formula is used to recalculate the funds transfer pricing rate from the payoff event:

Image: Formula to recalculate the funds transfer pricing rate

This example illustrates the fields and controls on the Formula to recalculate the funds transfer pricing rate. You can find definitions for the fields and controls later on this page.

Step 3

Calculate the IRD as the delta rate between the newly calculated funds transfer pricing rate for the payoff event and the funds transfer pricing rate used for the original instrument (subtract the new FTP rate from the original FTP rate to calculate the IRD).

The following formula is used to calculate the IRD:

Accrual * Change in Principal - (New FTP Rate/100)*Accrual*Change in Principal

Step 4

Determine whether the calculated IRD results in an economic loss to the funding center (calculate the amount of interest lost using the IRD as the interest rate).

For assets, if the IRD is positive, that is the underlying interest rates have gone up, then in theory the funding center can reinvest those funds at a higher rate, so no economic loss amount is calculated. For liabilities, if the IRD is negative, that is the underlying interest rates have gone down, then no economic gain amount is calculated. However, there is a minimum break funding charge value that can be set on the break funding rule, and if it is set, then a break funding charge is always assessed, regardless of the IRD.

The following formula is used to calculate the amount of interest lost:

Prin Delta * IRD/100 * Accrual

Step 5

Generate stream of projected cash flows for the synthetic instrument created based on the payoff event.

The following formula is used to calculate the NPV of the lost interest:

Interest Lost / (1+Discount Rate)^Accrual

Step 6

Calculate the lost or additional income stream to the funding center based on the projected cash flows and use the IRD as the interest rate used to calculate the projected interest payments.

Step 7

Calculate the value of the IRD income stream by calculating the NPV of the income stream using the discount factor based on the yield curve.

The yield curve is based on the Discount Factor table ID, defined on the financial calculation rules.