Setting Up Break Funding Rules

This section provides an overview of break funding and explains how to establish break funding rules.

Pages Used to Set Up Break Funding Rules

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Break Funding |

FTP_BFND_RULE |

|

Enter break funding charges for an instrument. |

|

Break Funding - Notes |

FTP_BFND_NOTES |

|

Enter notes about the break fund rule. |

Understanding Break Funding

Break funding charges are typically assessed for loans that are paid off before maturity and represent the cost of having to reinvest the funds at a lower return. The assumption is that the institution is raising term funds to match the term of the loan. Break fund charges are usually assessed on large loans, and their calculations are specific to the underlying instrument.

You can calculate break fund charges not only on payoffs, but on a cancelled drawdown as well. You can choose to accrue break fund charges over the remaining term of the instrument, or you can assess a onetime charge.

Break funding can be calculated:

As a fixed amount.

As a percentage or rate of the payoff or cancelled drawdown amount.

By calculating the economic loss to the funding center, resulting from reinvestment of the funds under adverse interest rate conditions.

Treatment of Payoffs and Draw-Downs

The Instrument Transaction History table (FI_ITRNHST_R00) can be used to record payoffs received or the cancelled drawdown on financial assets that can trigger break funding events. These payoff events are used solely by PeopleSoft Funds Transfer Pricing for identifying and calculating break funding charges.

For instruments with a break funding rule, PeopleSoft Funds Transfer Pricing scans the Instrument Transaction History table (FI_ITRNHST_R00) for any payoff or cancelled drawdown event that occurred during the processing period. PeopleSoft Funds Transfer Pricing then calculates a break funding charge by using the amount of the payoff or cancelled drawdown as a starting balance, and projecting cash flows that would have resulted had the payoff not occurred, or had the drawdown occurred as originally planned.

The FTP_BFND process scans the FI_ITRNHST_R00 table for payoffs (on assets) or a cancelled drawdown event that has occurred during the processing period. When a break funding event has occurred, the program uses the break funding rule (that was assigned in the FTP Rate process) to calculate the appropriate charge.

Break funding events are stored in the FI_ITRNHST_R00 table that is populated as part of the migration process. Payoff events are identified with a transaction code of 090, while cancelled drawdowns have a transaction code of 080.

When an instrument is recalibrated.

A new funds transfer pricing rate is calculated for recalibrated instruments similar to new instrument calibration. The Break Fund Calculations (FTP_BFND) process automatically scans the FI_ITRNHST_R00 table looking for funds transfer pricing reset events with the transaction codes of 095 and resets the funds transfer pricing base and adjustment rates for all those instruments

The transaction codes listed above are as follows:

020: Renegotiation w/Blend & Extend

025: Renegotiation W/O Blend & Ext

030: Fixed Rate Renewal

040: Fixed Rate Add Loan

050: Fixed Rate Blend & Extend

FTP recalibration is a process where you assign current markets rates to additional funding for acquisition or surplus funding for redeployment as a result of changed product balance behavior forecast and blend with previously locked-in funding cost based on a previous forecast to produce a recalibrated FTP rate. This rate reflects the funding cost locked-in according to the current balance behavior forecast for the synthetic instrument it is assigned to and replaces the previously assigned FTP rate to calculate actual and forecasted interested expenses for that synthetic instrument.

Reforecasting of FTP rates can occur multiple times during the life of a synthetic instrument. Lines of Business (LOBs) product management and account management requires reevaluation of initial assumptions and a reforecast of the future balance behavior of existing accounts. As a result, the FTP rate is recalibrated so that the balance deviations from the previously forecasted balance behavior are funded at current market rates and the newly projected balances are used as a comparison point for future breakage calculations. When reforecast occurs, the new FTP rate and projected balances need to be available to determine breakage events for the following accounting periods. If at least one reforecast happens, the breakage charges/credits due to reforecast are calculated as an FTP recalibration breakage or as a onetime Net Present Value (NPV) charge/credit. These two methods are mutually exclusive. If FTP recalibration breakage is chosen to be posted, then the recalibrated FTP rate is applied to actual balances to calculate total interest expenses for the accounting period. The FTP recalibration breakage is posted as the difference between the total interest expense amount using the recalibrated FTP rate and the base interest expenses using a base line FTP rate. The base line FTP rate can be the original proforma pricing FTP rate for this synthetic instrument, the FTP rate from a budget, or some other user defined rate. If the one time NPV breakage is selected, then the calculated amount is posted to the current account period only. The breakage due to reforecast, whether it is the FTP recalibration breakage, or the one time NPV, is combined with the monthly one-off breakage and each total amount is posted separately to the "Breakage" line under "Total Interest Expenses" in the P&L.

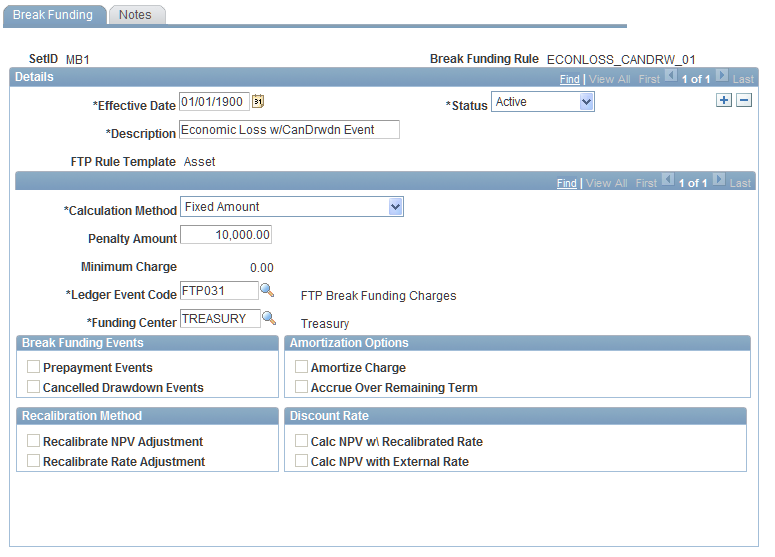

Break Funding Page

Use the Break Funding page (FTP_BFND_RULE) to enter break funding charges for an instrument.

Image: Break Funding page

This example illustrates the fields and controls on the Break Funding page. You can find definitions for the fields and controls later on this page.

The fields in the page vary according to the selected option.

Set up general rule information, and then specify a calculation method.

The following fields will vary according to the option that you selected for the calculation method:

Break Funding Events

The events for which break funding occurs are set by default for prepayments and cancelled draw-downs. Deselect these fields if you do not want break funding to occur for these events.

Amortization Options

Set up your amortization options. Specify whether you want to amortize the break fund charges, and if so, over what period of time to amortize them.

Recalibration Method

Discount Rate