Setting Up Match Funding

This section discusses how to:

Set up match funding rates.

Set up break funding rules.

Pages Used to Set Up Match Funding

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Match Funding Rates |

FI_IMFUND_TBL |

|

Defines funds transfer rate and rule for a match-funded instrument. |

|

Break Funding Rule |

FI_IMFUND_BFSEQ |

|

Defines a break funding rule for a match-funded instrument. |

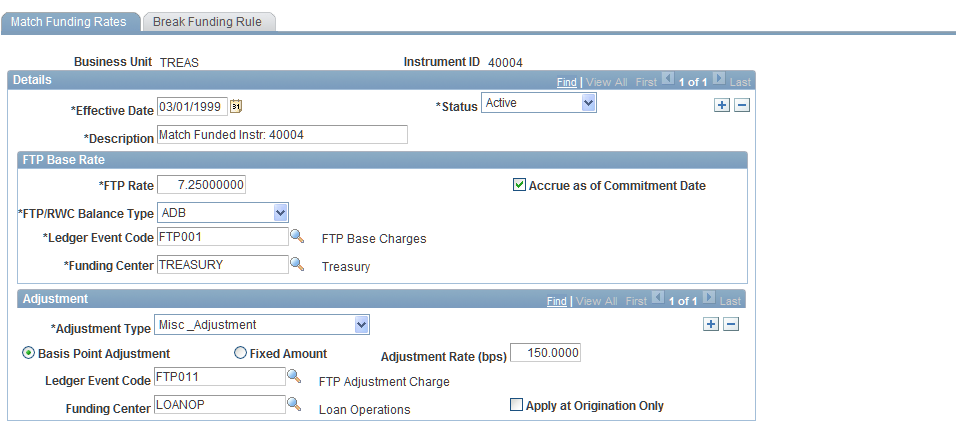

Match Funding Rates Page

Use the Match Funding Rates page (FI_IMFUND_TBL) to defines funds transfer rate and rule for a match-funded instrument.

Image: Match Funding Rates page

This example illustrates the fields and controls on the Match Funding Rates page. You can find definitions for the fields and controls later on this page.

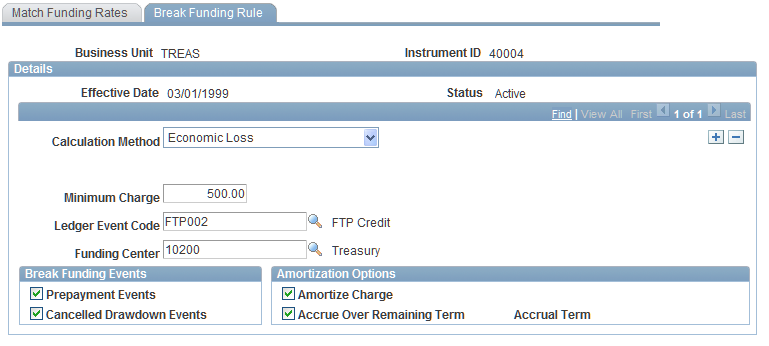

Break Funding Rule Page

Use the Break Funding Rule page (FI_IMFUND_BFSEQ) to defines a break funding rule for a match-funded instrument.

Image: Break Funding Rule page

This example illustrates the fields and controls on the Break Funding Rule page. You can find definitions for the fields and controls later on this page.

Specify a calculation method. Your choices are Amount,Economic Loss,Fixed Rate, Fixed Rate,orRecalibrate FTP Rate. Depending upon your selection, the following fields appear:

Next specify when you want to calculate a break fund charge. Your can choose between: payoff events or cancelled drawdown events.

Finally, specify whether you want to amortize the break fund charges, and if so, how to amortize them. Depending on your selection, the following fields appear: