Defining Credit Facilities for Basel II Compliance

Use the following pages to define credit exposures and their associated products and customers. Credit facilities are a primary source of input for the Basel II credit risk engine.

Pages Used to Define Credit Facilities

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Credit Facility |

FI_CREDIT_FACILITY |

|

Define a credit facility or exposure. |

|

Limits and Sub Limits |

FI_FAC_SUB_LIMITS |

|

Define credit limits, sub-limits and sub-sub-limit amounts associated with a facility. Sub-limits follow a hierarchical setup pattern and are an optional setup component. |

|

Sub Products and Customers |

FI_FAC_SUB_PC |

|

Define all products and customers associated with a sub-facility. |

|

Sub-Sub Limits |

FI_FAC_SSUB_LIMITS |

|

Define the sub-sub-limit amounts for the facility. A sub-sub-limit is the lowest level in the credit limit hierarchy and is optional. |

|

SubSub Products and Customers |

FI_FAC_SSUB_PC |

|

Define the combination of products and customers associated with the sub-sub-limit amount. |

|

Notes |

FI_CR_FAC_NOTES |

Select the Notes tab. |

Enter miscellaneous text concerning the facility. |

|

Counterparty |

FI_CNTRPRTY_TBL |

|

Define the participants in a contractual financial relationship with the institution. The primary setup key is based on the general warehouse customer ID, but definition as a counterparty for Basel II purposes enables you to track additional attributes, such as risk rating. |

|

Collateral Code |

FI_COLLATERAL_TBL |

|

Define attributes of credit risk mitigants, such as financial or physical collateral or guarantees. |

|

Collateral |

FI_COLLATERAL |

|

Define attributes of a piece of collateral. |

|

Collateral Amts |

FI_COLLATERAL_AMTS |

|

Define amounts associated with collateral, such as recovery value. |

|

Notes |

FI_COLLATRL_NOTES |

|

Enter miscellaneous text concerning the collateral. |

|

Customer Group |

FI_CUSTOMER_GROUP |

|

Define the counterparties or customers who are part of a customer group. |

|

Product Group |

FI_PRODUCT_GROUP |

|

Define a list of products associated with a credit facility product group. |

|

Risk Rating |

FI_RISK_RATING |

|

Define the risk rating, rating scope, and probability of default that can be associated with a counterparty or customer. |

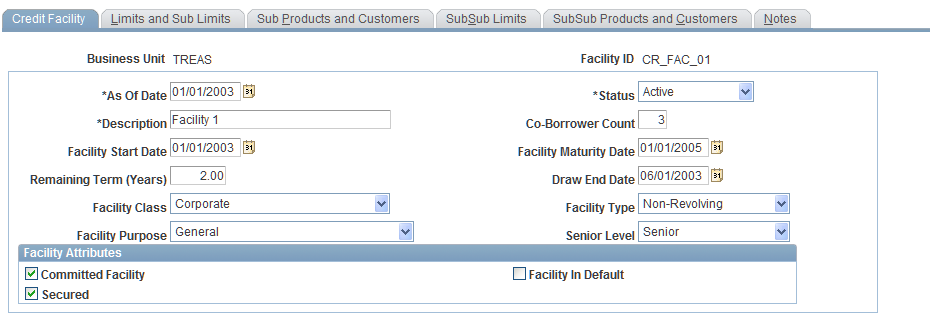

Credit Facility Page

Use the Credit Facility page (FI_CREDIT_FACILITY) to define a credit facility or exposure.

Image: Credit Facility page

This example illustrates the fields and controls on the Credit Facility page. You can find definitions for the fields and controls later on this page.

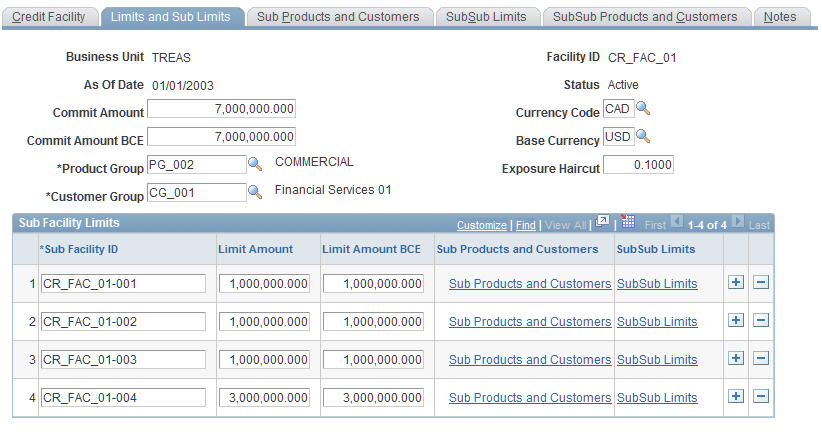

Limits and Sub Limits Page

Use the Limits and Sub Limits page (FI_FAC_SUB_LIMITS) to define credit limits, sub-limits and sub-sub-limit amounts associated with a facility.

Sub-limits follow a hierarchical setup pattern and are an optional setup component.

Image: Limits and Sub Limits page

This example illustrates the fields and controls on the Limits and Sub Limits page. You can find definitions for the fields and controls later on this page.

Sub Facility Limits

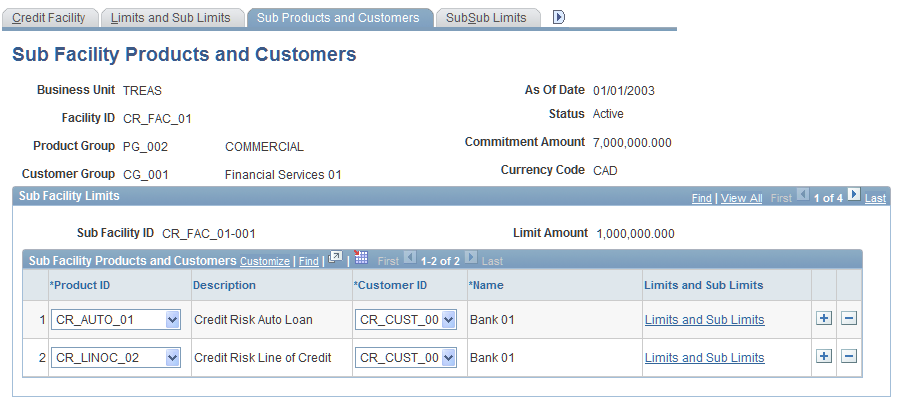

Sub Products and Customers Page

Use the Sub Products and Customers page (FI_FAC_SUB_PC) to define all products and customers associated with a sub-facility.

Image: Sub Products and Customers page

This example illustrates the fields and controls on the Sub Products and Customers page. You can find definitions for the fields and controls later on this page.

The list of sub-products and customers associated with a sub-facility define all possible combinations of product and customers associated with a sub-facility limit amount. For example, if product 1, product 2, and product 3 are defined in the same sub-limit level with customer 1 and customer 2, the processing logic assumes that customer 2 can draw against the facility using any of the three products, up to the total of the sub-limit amount.

| Product ID |

Enter each product associated with the sub-facility by selecting one of the products that you defined on the Product Group page. |

| Customer ID |

Enter each customer associated with the sub-facility by selecting one of the customers that you defined on the Customer Group page. |

| Limits and Sub Limits |

Click the link to access the Limits and Sub Limits page, where you can define the limit for the sub-facility. |

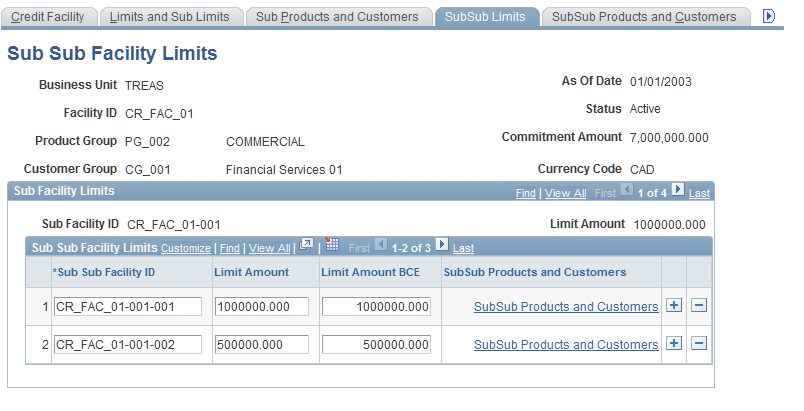

Sub Sub Limits Page

Use the Sub Sub Limits page (FI_FAC_SSUB_LIMITS) to define the sub-sub-limit amounts for the facility.

A sub-sub-limit is the lowest level in the credit limit hierarchy and is optional.

Image: Sub Sub Limits page

This example illustrates the fields and controls on the Sub Sub Limits page. You can find definitions for the fields and controls later on this page.

Define the facility credit limits for product and customer combinations. Sub-facilities are not valid for retail credit facilities.

Warning! When a facility purpose is changed to Retail, the system automatically deletes all sub-facility setup data.

For each customer ID and product ID that is associated with the non-retail facility, complete the following fields.

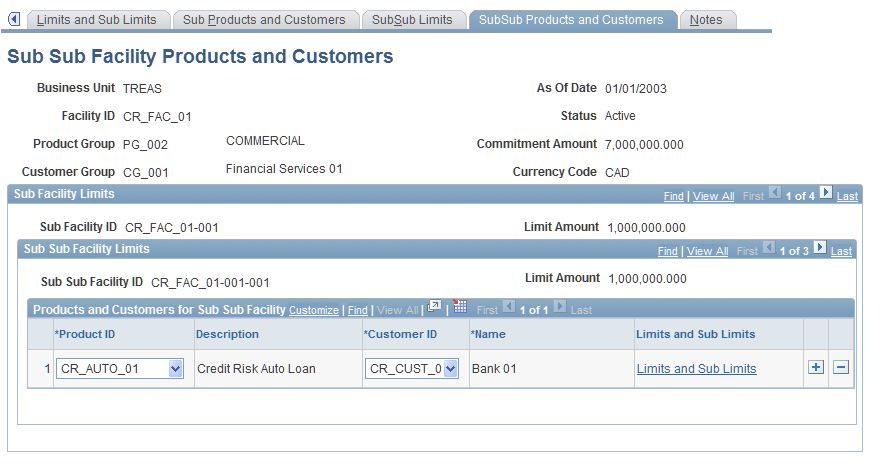

Sub Sub Products and Customers Page

Use the Sub Sub Products and Customers page (FI_FAC_SSUB_PC) to define the combination of products and customers associated with the sub-sub-limit amount.

Image: Sub Sub Products and Customers page

This example illustrates the fields and controls on the Sub Sub Products and Customers page. You can find definitions for the fields and controls later on this page.

For each sub-sub-facility, identify the products and customers that are associated with it. Click the Limits and Sub Limits link to access the Limits and Sub Limits page, where you can view and define the limits for the total facility and each sub-facility.

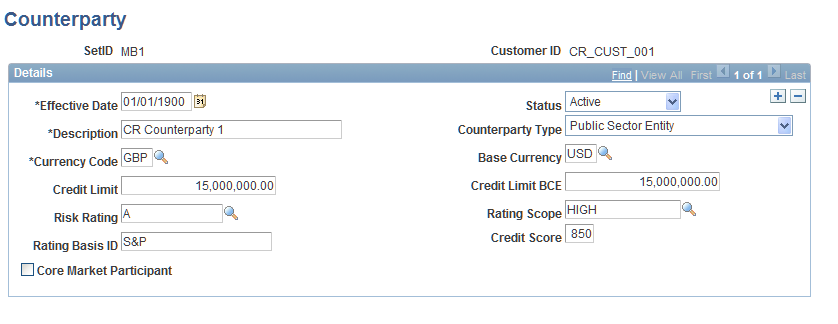

Counterparty Page

Use the Counterparty page (FI_CNTRPRTY_TBL) to define the participants in a contractual financial relationship with the institution.

The primary setup key is based on the general warehouse customer ID, but definition as a counterparty for Basel II purposes enables you to track additional attributes, such as risk rating.

Image: Counterparty page

This example illustrates the fields and controls on the Counterparty page. You can find definitions for the fields and controls later on this page.

Define the participants (or counterparties) in a financial contract with the institution. The counterparties are the financial institution's customers. The counterparty attributes that you define here provide some of the key parameters for Basel II processing.

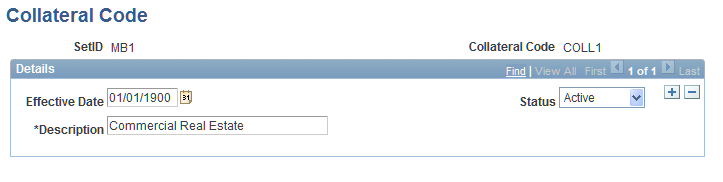

Collateral Code Page

Use the Collateral Code page (FI_COLLATERAL_TBL) to define attributes of credit risk mitigants, such as financial or physical collateral or guarantees.

Image: Collateral Code page

This example illustrates the fields and controls on the Collateral Code page. You can find definitions for the fields and controls later on this page.

Define collateral codes for Basel II processing requirements.

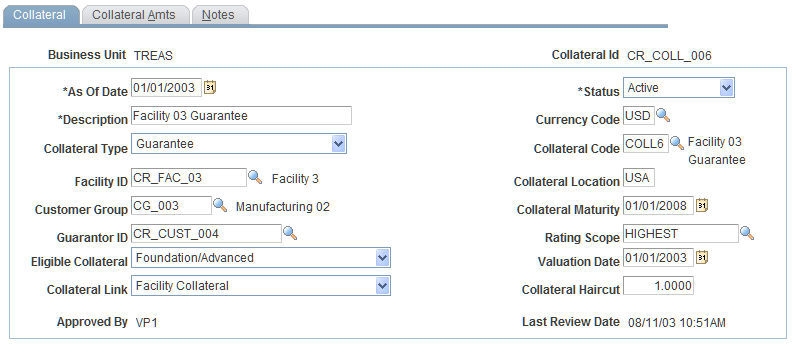

Collateral Page

Use the Collateral page (FI_COLLATERAL) to define attributes of a piece of collateral.

Image: Collateral page

This example illustrates the fields and controls on the Collateral page. You can find definitions for the fields and controls later on this page.

Define the parameters that are associated with a piece of collateral.

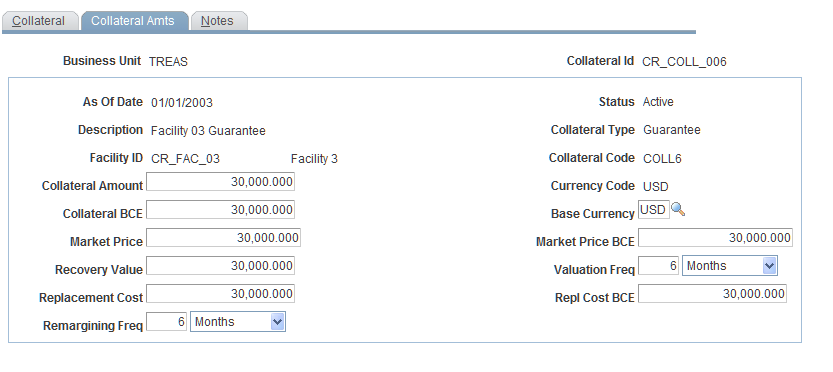

Collateral Amts Page

Use the Collateral Amts page (FI_COLLATERAL_AMTS) to define amounts associated with collateral, such as recovery value.

Image: Collateral Amts

This example illustrates the fields and controls on the Collateral Amts. You can find definitions for the fields and controls later on this page.

| Collateral Amount |

Enter the nominal value of the collateral in the denominated currency. |

| Collateral BCE (base currency equivalent) andBase Currency |

Enter the collateral amount in the base currency equivalent. |

| Market Price andMarket Price BCE (base currency equivalent) |

Enter the open market value for the collateral and the market price restated in the base currency equivalent. |

| Recovery Value |

Enter the value of the collateral net of haircuts that could be realized to satisfy the requirements of the collateralized exposure. |

| Valuation Frequency |

Enter the collateral valuation frequency. |

| Replacement Cost andReplacement BCE (base currency equivalent) |

Enter the replacement cost of the collateral in the denominated currency and its base currency equivalent. |

| Remargining Freq |

Enter the frequency of margin adjustments for the security. This value generally pertains to capital markets instruments. |

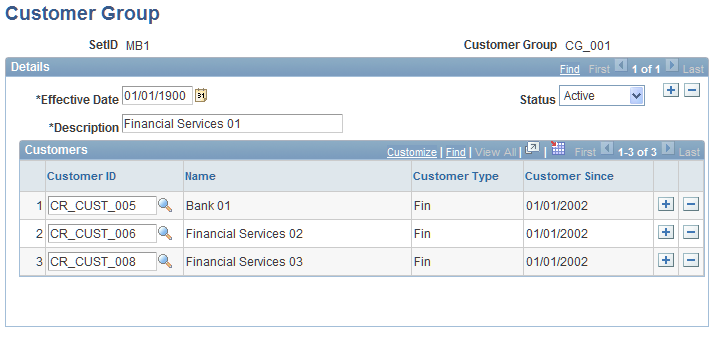

Customer Group Page

Use the Customer Group page (FI_CUSTOMER_GROUP) to define the counterparties or customers who are part of a customer group.

Image: Customer Group page

This example illustrates the fields and controls on the Customer Group page. You can find definitions for the fields and controls later on this page.

Define the customers or counterparties that constitute a customer group. Customer groups are an integral part of defining credit facilities and customer group level collateral.

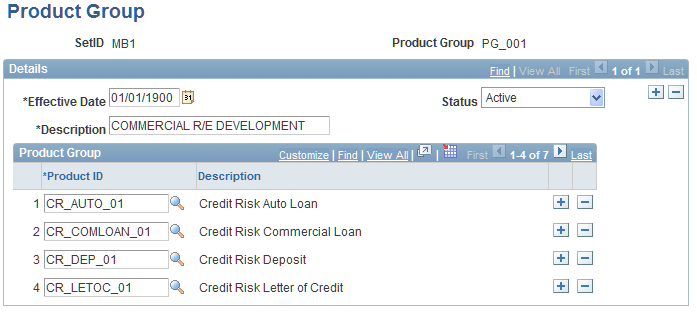

Product Group Page

Use the Product Group page (FI_PRODUCT_GROUP) to define a list of products associated with a credit facility product group.

Image: Product Group page

This example illustrates the fields and controls on the Product Group page. You can find definitions for the fields and controls later on this page.

Define the products that constitute a product group. Product groups are an integral part of facility level credit risk processing.

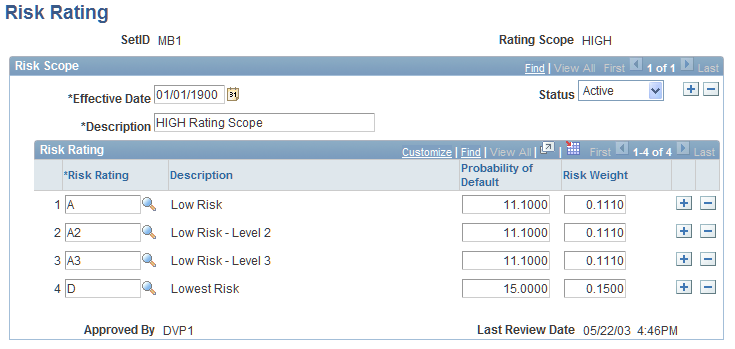

Risk Rating Page

Use the Risk Rating page (FI_RISK_RATING) to define the risk rating, rating scope, and probability of default that can be associated with a counterparty or customer.

Image: Risk Rating page

This example illustrates the fields and controls on the Risk Rating page. You can find definitions for the fields and controls later on this page.

Define risk ratings associated with a particular rating scope. Risk rating and scope are then associated with a customer or counterparty as part of counterparty setup. The associated probability of default and risk weights are then available to the credit risk engine for processing.