Defining Processing Parameters for Credit Risk

This section presents an overview of credit risk processing and discusses how to:

Define the credit conversion factor.

Define the credit risk parameters.

Define credit risk functions.

Pages Used to Define Credit Risk Processing Parameters

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Credit Conversion Factor |

FI_KFACTOR_F00 |

|

Define the ratio at which the available credit will be used for a particular product type, should the counterparty default. |

|

Credit Risk Parameters |

FI_RWCPRP_TBL |

|

Define runtime parameters for a credit risk processing scenario. |

|

Credit Risk Functions |

FI_RWCCN_TBL |

|

Define functions for processing credit risk. |

|

Notes |

FI_RWCCN_NOTES |

On the Functions page, select the Notes tab. |

Enter miscellaneous notes relating to the function. |

|

RWC Function Params Sec Panel |

FI_RWCCN_PRM |

On the Functions page, click the Parameters link. |

View and modify the function parameter values. |

Understanding Credit Risk Processing

This section discusses:

Assumptions underlying credit risk calculations.

Retail exposure handling.

Credit risk functions.

Reviewing credit risk output.

Assumptions Underlying Credit Risk Calculations

The credit risk engine processes based on the following assumptions.

Standard methodology:

Credit Conversion Factor (CCF):

20% for short term self-liquidating letters of credit.

0% for cancellable exposures.

20% for maturities < 1 year.

50% for maturities > 1 year.

100% for securitizations and repos.

Risk Weight:

100% for not rated or not calculated.

Credit Risk Mitigation (CRM):

Simple: Pledge collateral for the life of the exposure. Substitute the risk weighting of the collateral for the risk weighting of the counterparty, subject to 20% floor, 10% for repos, and 0% floor for core market.

Comprehensive: Reduce the exposure amount by the collateral amount. Must apply maturity mismatch.

Maturity Mismatch: If the CRM maturity is < 1 year, the CRM amount = 0. Mismatch formula is P * t/T.

Netting: Currency mismatch applies.

Guarantees: If a facility exposure is protected, the program applies the risk weight of the guarantor; if a facility exposure is unprotected, the program applies the risk weight of the counterparty.

Pools of types of collateral: The bank is required to subdivide the exposure into portions covered by each type of CRM. The risk-weighted assets of each portion must be calculated separately.

Credit risk functions are required by the engine to complete the final risk-weighted asset or regulatory capital calculation.

Interest rate based (IRB) methodologies:

Probability of Default (PD):

.03 % minimum; default = 100%.

Loss Given Default (LGD):

Senior: unsecured 45%.

Subordinated: unsecured 75%.

Secured: financial collateral LGD = 0%; receivables = 0-35%, 125% threshold; Real Estate (RE) = 30-35%, 140% threshold; other = 30-40%, 140% threshold.

The part of the exposure that is collateralized receives the LGD that is associated with the type of collateral, else the 45% or 75%.

Guarantees: If the facility is protected, apply the risk weight of CRM; if the facility is unprotected, apply the risk weight of the counterparty.

Advanced: Bank has the option to adopt the treatment under the foundation approach or to make an adjustment to its LGD estimate of the exposure to reflect the presence of the guarantee or credit derivative.

Credit Conversion Factor (CCF):

75% for non-short-term liquid letters of credit.

0% for cancellable exposures.

20% for short-term liquid letters of credit.

Foundation versus advanced method:

With the foundation method, you can set the credit risk engine parameters to override the risk rating driven PD factor. Do so by using the credit risk function, which is discussed later. With the advanced method, you can set the credit risk engine parameters to override both the PD and LGD factors. You are required by the processing engine, when using the advanced method, to provide initial facility level LGD values. These values must be loaded into the FI_LGD_AD_TBL using the provided ETL maps.

Multi-currency processing:

When processing multiple currencies, the credit risk engine assumes that all currencies have been converted to the appropriate base currency equivalent prior to processing. The results are in the standardized base currency equivalent fields. The Enterprise Performance Management currency conversion process performs this task just prior to running the Credit Risk Application Engine (FI_RWC_CR). Alternatively, you can perform the currency conversion as part of the Extract, Transform, and Load (ETL) process.

Retail Exposure Handling

Retail exposures have special processing requirements and options for customers using any of the defined methods (standardized simple, comprehensive, foundation, or advanced). The Credit Risk Application Engine supports these requirements in the following manner.

Instrument detail is mapped into the instrument table (FI_INSTR_F00), the balance table (FI_IBALANCE_R00), and the credit table (FI_ICREDIT_R00). Drawn amounts are stored in FI_IBALANCE_R00. Undrawn or commitment amounts are mapped into the facility table (FI_FACILITY_F00) in the same way that other exposures are treated.

See Understanding Financial Calculation Rules.

One important difference in the treatment of retail exposures is that customers are often given flexibility in defining risk weights, Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD), based on the evaluation of these parameters within their own portfolio. To support this activity, use the Stratification Application Engine (FI_STRATIFY) to aggregate or pool the previously loaded instrument detail in like pools, according to defined criteria (for example, credit score, loan-to-value ratio). Stratification rules for the stratification process are associated with product and model level rules for financial calculation, rather than with a particular risk rule.

The system stores stratified results in a set of result tables, such as FI_POOLHDR_R00, FI_POOLINST_F00, and FI_POOLBAL_R00, which are associated with the scenario that the stratification rules process.

If you select the Pool for Retail option on the parameter page, the system displays thePool Scenario field, which enables you to use the results of a special stratification run in a different scenario for credit risk processing.

You need to manually establish credit facility records for each unique combination of retail facility attributes in your portfolio. In the simplest case, a single credit facility defined as a retail exposure could be associated with thousands of pools.

Pools that are created by the stratification process are mapped to these facilities by assignment of each instrument to a facility ID using one of the following techniques:

Using ETL, establish a valid retail facility ID.

Ensure that the facility ID is identified as a discrete stratification attribute.

By the stratification rules for retail products, add a retail facility ID to the rule.

The results of either of these methods are retail products with valid retail facility IDs for the Credit Risk Application Engine to use for proper processing.

When processing with the Pool for Retail option selected, the engine:

Examines all facilities that are categorized as retail (the facility purpose is Retail Residential Secured,Retail Revolving,Retail Others, orRetail Purchased Receivables).

Selects stratified data that matches the Scenario ID from the pool output tables and loads the data into temporary tables for specialized retail processing.

In processing retail exposures, it parallels the process for non-retail facilities by matching pool draws from the Instrument Pool Cash Balance table (FI_POOLBAL_R00) record and commitment amounts (from the commitment balance (FI_COMMITMENT_AMT) field in the FI_POOLFCST_TBL table) to facilities.

Represents pooled data as sub-limit level data in the credit risk result table (FI_RWC_CR_F00).

The system places the pool ID in the Sub Facility ID field (FI_SUB_FAC_ID) for retail records when the Pool for Retail option is selected.

Uses defaults for certain output fields (such as RW = 100%), and uses commitment amounts to calculate headroom at this level.

Calculates headroom, but does not process collateral at this level similar to other retail processing.

Credit risk functions are commonly employed to continue the processing of these pools, but are not required. Certain functions that use detailed pool attributes require the use of specific datamaps that join sub-facility IDs to pool IDs. Other functions can derive attribute data from a datamap that is joined to the facility. For example, you can assign unsecured retail facilities (as defined by the facility level flag) a risk weight of 30, and secured facilities a risk weight of 10.

If the Pool for Retail option is not selected, the system processes retail facilities, but draws exposure directly from the Financial Instrument table (FI_INSTR_F00), Instrument Balance table (FI_IBALANCE_R00), and the Instrument Status table (FI_ICREDIT_R00) attributes. The system nets drawn amounts against the collateral amount (FI_COLLATERAL_AMT) that is stored in the Instrument Status table (FI_ICREDIT_R00), unlike pooled input. The system passes results to the output table at a facility ID level only (unlike pooled data, which creates sub-facility IDs that correspond to the pool IDs).

Warning! Sub-facilities are not valid for retail credit facilities. When you change a facility purpose to Retail, the system automatically deletes all sub-facility setup data.

Credit Risk Functions

Credit risk functions are a specialized form of risk weight functions for exclusive use with the credit risk engine. A credit risk function can be used to address the following business requirements:

Perform a factor lookup from an external table to update the Probability of Default (PD), Loss Given Default (LGD), or Exposure at Default (EAD) fields in the FI_RWC_CR_F00 record.

This approach relies on having common fields in the lookup table.

Perform a credit risk-specific function formula as the final step in the job to calculate risk weighted assets (RWA) or regulatory capital requirements (RC).

Some convenient predefined Interest Rate Based (IRB) functions exist for this purpose, including:

RWC_BCR1 (Capital requirement K with maturity adjustment).

RWC_BCR2 (Capital requirement K with firm-size adjustment).

RWC_BCR3 (Capital requirement K for residential mortgage).

RWC_BCR4 (Capital requirement K for qualifying revolving exposures).

RWC_BCR5 (Capital requirement K for other retail exposures).

Assign a simple user defined risk weight times a balance for use in approaches such as standardized.

You can define weights as parameters.

Create an end user defined function that is subject to engine limitations.

The overall framework relies on customers using PeopleSoft Enterprise Performance Management metadata to define facility, pool, or instrument level constraints. These constraints (selection criteria) identify which rows of data the risk function processes. Credit risk functions can only be used to update the FI_RWC_CR_F00 output table.

Credit risk functions are executed as the final step of the Credit Risk application engine. Values that are updated through functions override any previously calculated (or default) values in the target fields. Rules are run in the sequence that they are input into the credit risk rule page.

Note: There are dependencies and limitations to the use of credit risk functions:

Customers are required to use datamaps that include the FI_RWC_CR_F00 table.

Customers are required to use delivered datamaps or create datamaps that maintain a one-to-one relationship between FI_RWC_CR_F00 rows and the joined tables (such as FI_FACILITY_F00 and FI_COLLATERAL_F00).

If these rules are maintained, customers can create their own datamaps to meet specialized requirements.

Reviewing Credit Risk Output

PeopleSoft delivers three query templates to provide you with various views of the Credit Risk application engine output:

Output Detail (FI_RWC_CR1).

Provides the full detail of the calculated output from the credit risk engine (no summarization). It prompts for business unit and processing scenario, and returns output at the facility, sub-facility and sub-sub-facility (if applicable) levels.

Facility Summary (FI_RWC_CR2).

Provides the same data as the output detail, but summarizes all measure fields to a facility level.

Unit / Scenario Summary (FI_RWC_CR3).

Summarizes output detail at the highest level of business unit, as of date, and scenario ID combination.

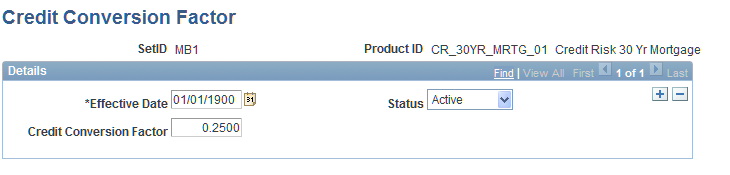

Credit Conversion Factor Page

Use the Credit Conversion Factor page (FI_KFACTOR_F00) to define the ratio at which the available credit will be used for a particular product type, should the counterparty default.

Image: Credit Conversion Factor page

This example illustrates the fields and controls on the Credit Conversion Factor page. You can find definitions for the fields and controls later on this page.

Define the credit conversion factor for a specific product. This is the rate for available credit should the counterparty default. This rate is commonly referred to as the burn rate. Enter a percentage in theCredit Conversion Factor field.

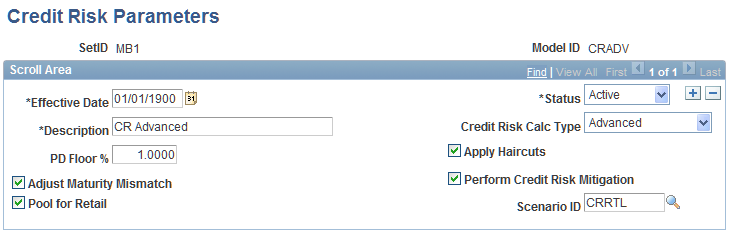

Credit Risk Parameters Page

Use the Credit Risk Parameters page (FI_RWCPRP_TBL) to define runtime parameters for a credit risk processing scenario.

Image: Credit Risk Parameters page

This example illustrates the fields and controls on the Credit Risk Parameters page. You can find definitions for the fields and controls later on this page.

On this page, you define the processing parameters for credit risk exposures.

| Credit Risk Calc Type |

Select from the options: Advanced, Foundation, Standard Comprehensive, orStandard Simple. |

| PD Floor % |

Specify the minimum or floor probability of default percentage assigned to a credit facility exposure. This regulatory floor defaults to .03%, but can be overridden at runtime. |

| Pool for Retail |

Select if you want the engine to process credit risk by using the pools of instrument detail, aggregated according to user defined criteria. |

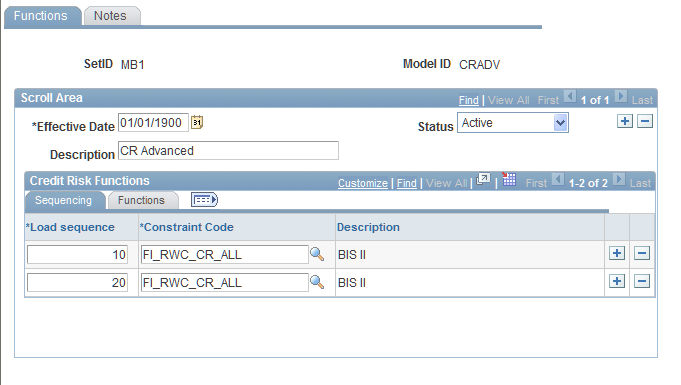

Credit Risk Functions Page

Use the Credit Risk Functions page (FI_RWCCN_TBL) to define functions for processing credit risk.

Image: Credit Risk Functions page (1 of 2)

This example illustrates the fields and controls on the Credit Risk Functions page (1 of 2). You can find definitions for the fields and controls later on this page.

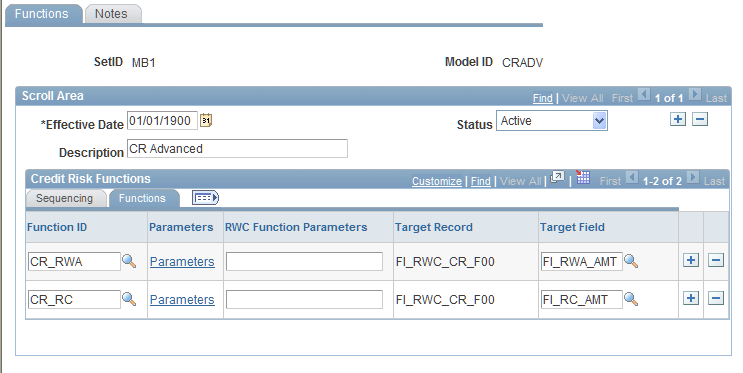

Image: Credit Risk Functions page (2 of 2)

This example illustrates the fields and controls on the Credit Risk Functions page (2 of 2). You can find definitions for the fields and controls later on this page.

| Sequence |

Enter the order in which you want the engine to apply the functions in its calculations. |

| Function ID |

Select one of the predefined functions. |

| Parameters |

Click to access the RWC Function Params Sec page, where you can view and modify the parameter values. |

| RWC Function Parameters |

The system fills in the formula for the function that you have selected. |

| Target Record |

The system default is the Risk-Weighted Capital credit risk table, FI_RWC_CR_F00. All credit risk functions must include this table in their datamap metadata. |

| Target Field |

Select the output field for the results of the function calculation. The risk function sequence replaces existing data in the target field. |