Setting Up Function Definitions

You may want to use functions when assigning risk weights to certain products. This section provides an overview of function definitions and discusses how to:

Set up function definitions.

Define function rules.

Define functions.

Pages Used to Set Up Function Definitions

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Function Definitions |

PF_FN_DEFN_PNL |

|

Set up function definitions to model risk weights. |

|

Risk Function Rules - Definition |

RWC_FUNC_DEFN |

|

Define risk weights for products or forecasted balances according to risk type to calculate the risk or normalized loss weight. |

|

Risk Function Rules - Functions |

RWC_FUNC_SEQ |

|

Assign risk functions for risk weighted capital rules. |

|

Risk Function Rules - Notes |

RWC_FUNC_NOTES |

|

Enter notes about a risk function rule. |

|

RWC Function Params Sec Panel |

RWC_FUNC_RW_PARAMS |

Click the Parameters button for a risk-weighted capital function in the Default Rules box on the Functions page. |

View and enter parameters for the default rule risk-weighted capital function. |

|

RWC Function Params Sec Panel |

RWC_FUNC_NL_PARAMS |

Click the Parameters button for a loss function in the Default Rules box on the Functions page. |

View and enter parameters for the default rule loss function. |

|

RWC Function Params Sec Panel |

RWC_FSEQ_RW_PARAMS |

Click the Parameters button for a risk-weighted capital function in the Constraint Defined Rules box on the Functions page. |

View and enter parameters for the constraint defined rule for a risk-weighted capital function. |

|

RWC Seq Norm Loss Params |

RWC_FSEQ_NL_PARAMS |

Click the Parameters button for a loss function in the Constraint Defined Rules box on the Functions page. |

View and enter parameters for the constraint defined loss function. |

Understanding Function Definitions

For some risk types, you may want to allocate capital or normalized loss amounts by using defined functions or algorithms. For example, you may base your credit risk allocations on a proprietary function that takes into account the potential severity of loss, expected workout costs, and probability of loss.

Function definitions enable you to apply a function that you've created, and to vary a constant or coefficient value in that function, based on user defined criteria.

When defining functions, you may want to use dataset elements that contain values at the product level. The Product Ratings page enables you to assign values that pertain to credit risk evaluation at the product level.

Note: You can create risk function rules for products or forecasted pool data sources only. Ledger accounts and treasury positions must use risk weight rules to evaluate capital needs.

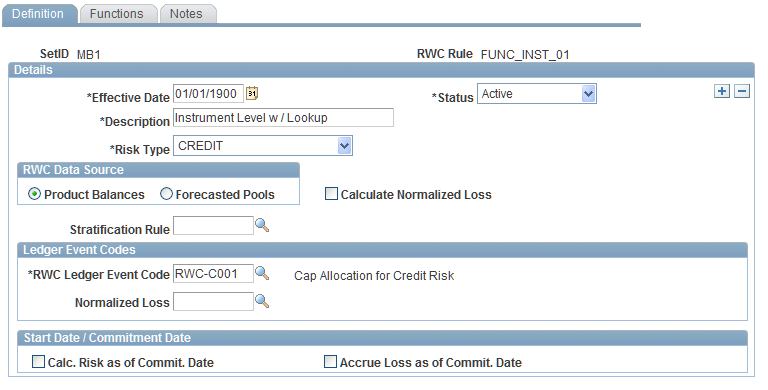

Risk Function Rules - Definition Page

Use the Risk Function Rules - Definition page (RWC_FUNC_DEFN) to define risk weights for products or forecasted balances according to risk type to calculate the risk or normalized loss weight.

Image: Risk Function Rules - Definition page

This example illustrates the fields and controls on the Risk Function Rules - Definition page. You can find definitions for the fields and controls later on this page.

Start Date / Commitment Date

In the Start Date / Commitment Date group box, you can elect to calculate the risk-weighted capital as of the commitment date—Calc. Risk as of Commit. Date (calculate risk as of commitment date)—and the normalized loss amount as of the commitment date—Accrue Loss as of Commit. Date (accrue loss as of commitment date). If you do not select one of these check boxes, the system bases the calculations on theAs of Date of the instrument or forecasted pool.

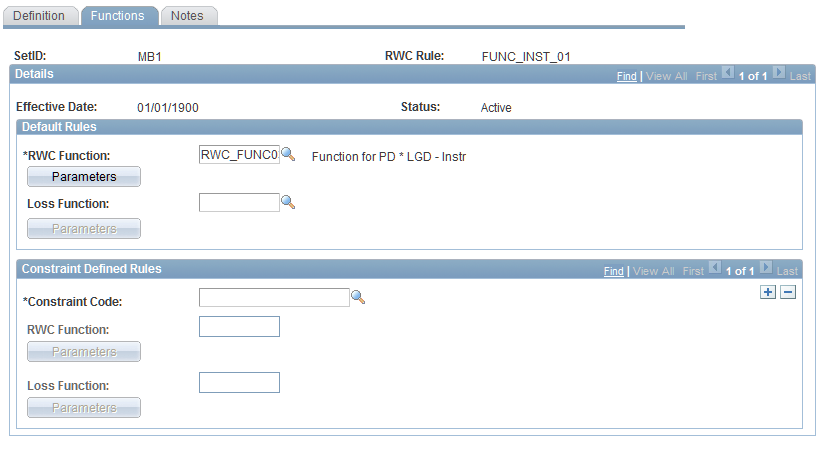

Risk Function Rules - Functions Page

Use the Risk Function Rules - Functions page (RWC_FUNC_SEQ) to assign risk functions for risk weighted capital rules.

Image: Risk Function Rules - Functions page

This example illustrates the fields and controls on the Risk Function Rules - Functions page. You can find definitions for the fields and controls later on this page.

Fields vary depending on the options that you selected on the Risk Function Rules - Definition page.

Constraint Defined Rules

Specify the functions and parameter values to use for the subset of instruments or forecasted pools that satisfy the constraint code criteria. If you are stratifying, then select the constraint code to apply to the pool of instruments. The constraint code that you enter here must be built on the pooled instrument table (FI_POOLINST_F00). If you are not stratifying, then ensure that the constraint code is built on an instrument table. Specify the RWC Function to calculate the allocated capital, then clickParameters to view and assign values. Specify theLoss Function to calculate the normalized loss if applicable, then clickParameters to view and assign values.