Setting Up Risk Weights

Risk weight rules define the risk weights that you assign to ledger balances, forecasted balances, product balances, and position balances, to calculate risk-weighted capital and normalized loss.

This section provides an overview of risk weights and discusses how to:

Define risk weights.

Define risk weight rules.

Define operating risk weight overrides for Basel II.

Pages Used to Set Up Risk Weights

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Risk Weight Rules - Definition |

RWC_CALC_DEFN |

|

Define specific risk weights for ledger accounts, forecasted balances, positions, and products, according to risk type. |

|

Risk Weights |

RWC_CALC_SEQ |

|

Define risk weight rules by assigning specific default risk weights and incremental risk weights. |

|

Notes |

RWC_CALC_NOTES |

|

Enter text related to the defined Risk-Weighted Capital rule code. |

|

RWC Operating Risk |

FI_RWC_OR_DEFN |

|

Define operating risk factors for Basel II (PE, LGE). |

Understanding Risk Weights

To establish a risk weight, you begin with a default risk weight based on instrument or ledger attributes, and then define additional risk weights such as interest rate risk based on instrument or ledger attributes. Risk weight rules are processed by the general PeopleSoft Risk-Weighted Capital processing engines (RWC_RATE, RWC_ACCT), rather than by the credit risk engine (FI_RWC_CR).

For example, suppose that you have a default credit risk weight of six percent for auto loans. The exception to this rule is that auto loans in California that are less than one year old and held by borrowers with a poor credit rating have a credit risk weight of 10 percent. You have two options for setting up risk weight rules:

Create a constraint that covers the exception (loans in California, less than one year old, with a poor credit rating), and assign it a risk weight of four percent.

Create narrowly defined constraints (one for loans in California, one for loans less than one year old, and one for poor credit ratings) and assign incremental risk weights to each constraint, so that they total four percent.

Four percent plus the default six percent equals the desired 10 percent for the exception auto loans described previously.

You may set up risk-weighted capital rules using a set of additive weights that can be applied based on user-defined criteria—that is, use constraints to identify the set of instruments, accounts, or positions for which the specific weight should be applied.

You may also choose to override the default risk weights by applying the predefined Risk-Weighted Capital operating risk factors for Basel II processing and other requirements.

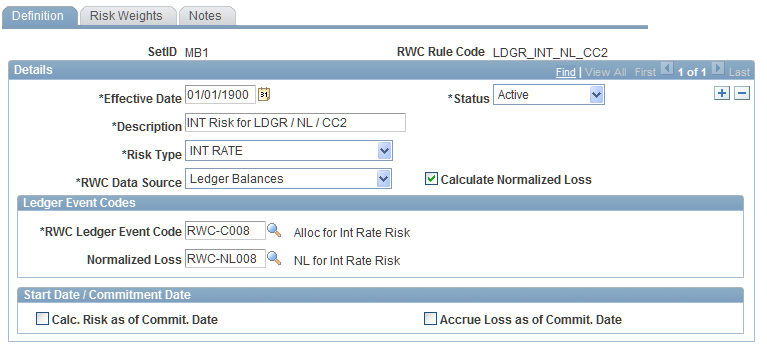

Risk Weight Rules - Definition Page

Use the Risk Weight Rules - Definition page (RWC_CALC_DEFN) to define specific risk weights for ledger accounts, forecasted balances, positions, and products, according to risk type.

Image: Risk Weight Rules - Definition page

This example illustrates the fields and controls on the Risk Weight Rules - Definition page. You can find definitions for the fields and controls later on this page.

Ledger Event Codes

Start Date / Commitment Date

If you select Product Balances or Forecasted Pools in theRWC Data Source field, then you must select one of the check boxes that appear in this group box.

| Calc. Risk as of Commit. Date (calculate risk as of commitment date) |

Select this option to calculate the risk-weighted capital as of the commitment date. |

| Accrue Loss as of Commit. Date |

Select this option to accrue the normalized loss amount as of the commitment date. |

If you do not select one of these check boxes, the system performs the calculations as of the start date of the instrument or forecasted pool.

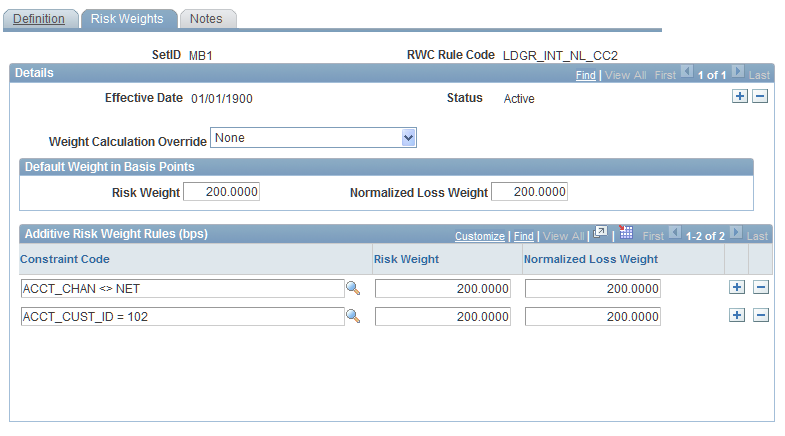

Risk Weights Page

Use the Risk Weights page (RWC_CALC_SEQ) to define risk weight rules by assigning specific default risk weights and incremental risk weights.

Image: Risk Weights page

This example illustrates the fields and controls on the Risk Weights page. You can find definitions for the fields and controls later on this page.

Terms on this page vary depending on your selections on the Risk Weight Rules - Definition page.

Default Weight in Basis Points

If you are not using the Weight Calculation Override option, enter the default risk weight and the normalized loss weight in basis points.

Additive Risk Weight Rules (bps)

You can adjust the risk and normalized loss weights by specifying the basis points that you want to add to the default weights. This adjusted weight applies only to the balance amounts that satisfy the conditions in the corresponding constraint codes. To decrease the default basis weight, precede the entry with a negative sign.

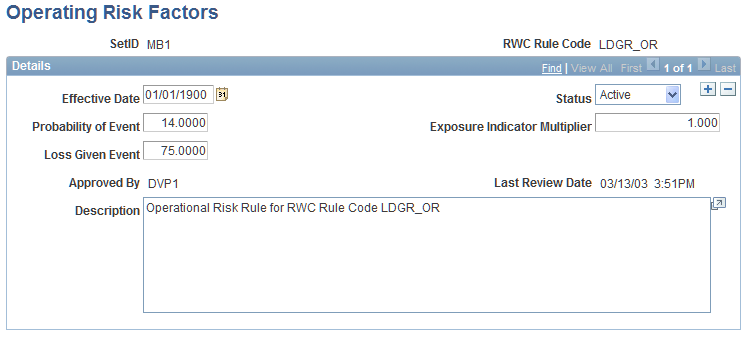

RWC Operating Risk Page

Use the RWC Operating Risk page (FI_RWC_OR_DEFN) to define operating risk factors for Basel II (PE, LGE).

Image: RWC Operating Risk page

This example illustrates the fields and controls on the RWC Operating Risk page. You can find definitions for the fields and controls later on this page.

To override a risk weight, you must first define the override factors on this page. Enter operating risk definitions that match risk rules that you have already established on the Risk Weight Rules pages, and ensure that the calculations are defined as calculation override rules on the Risk Weights page.

Enter values between 0 and1 for the three factors:

The system stores these factors in the operating risk factor table, FI_RWC_OR_DEFN, which is keyed by RWC_RULE_ID. The application matches the rule ID that it is processing with the same rule ID in FI_RWC_OR_DEFN, and uses these factors to compute the weight in basis points. The formula is: PE × LGE × M, where PE is the probability of the event, LGE is the loss given event, and M is the user-defined multiplier, which can be used for any purpose.