Setting Up the Basic Structure

This section discusses how to:

Define risk type.

Copy a Risk-Weighted Capital rule.

Use risk functions.

View risk events.

Pages Used to Set Up the Basic Structure

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Risk Type Definition |

RWC_RISK_TYPE |

|

Define the types of risk for your business. |

|

Notes |

RWC_RISKTYPE_NOTES |

|

Enter short descriptive text for the risk type. |

|

Copy an RWC Rule |

PF_RULE_COPY |

|

Copy an existing Risk-Weighted Capital rule. |

|

Risk Function Lookup Table |

FI_RWC_ILKUP |

|

View and modify instrument-level risk-related statistics. |

|

Risk Events |

FI_RISK_EVENTS |

|

View and modify risk events related to historic credit, operational, or market risk. |

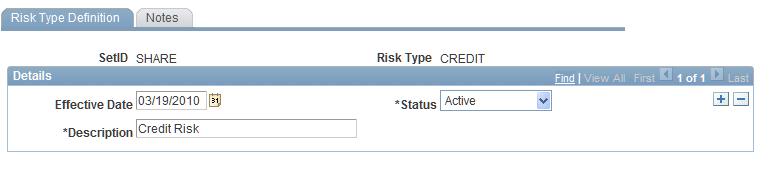

Risk Type Definition Page

Use the Risk Type Definition page (RWC_RISK_TYPE) to define the types of risk for your business.

Image: Risk Type Definition page

This example illustrates the fields and controls on the Risk Type Definition page. You can find definitions for the fields and controls later on this page.

Some of the common risk types are:

Catastrophic Loss: The risk to earnings or capital arising from a catastrophe.

Credit: The risk to earnings or capital arising from an obligor's failure to meet the terms of any contract with the bank or failure to perform otherwise as agreed, including during settlement.

In practice, credit risk receives more capital than all other types of risk.

Deposit Runoff: The risk to earnings or capital arising from having to replace relatively low-cost deposits with purchased higher-cost funds, due to secular changes in interest rates.

Diversification Adj: A way to classify risk factors for areas or lines of business where the risk factors are offset, if you want to reduce your risk calculations accordingly.

Foreign Exchange: The risk to earnings and capital arising from working with foreign exchange rates.

Interest Rate: The risk to earnings or capital arising from movements in interest rates.

This type exists primarily for firms that are not active in asset and liability management.

Legal: The risk to earnings or capital arising from violations of, or nonconformance with, laws, rules, regulations, prescribed practices, or ethical standards.

Market: The risk to earnings or capital as a result of an adverse movement in the financial market price.

Operational: The risk to earnings or capital arising from problems with service or product delivery.

This risk is a function of internal controls, information systems, employee integrity, and operating processes.

Regulatory: The risk to earnings or capital arising from changes in regulatory statutes or other governing bodies.

Reputation: The risk to earnings or capital arising from negative public opinion.

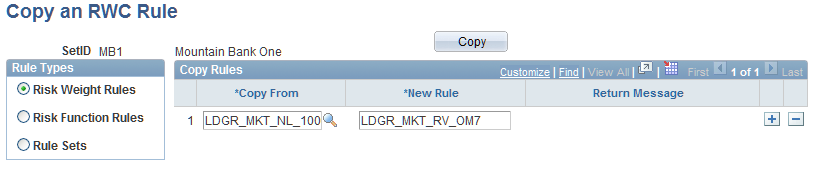

Copy an RWC Rule Page

Use the Copy an RWC Rule page (PF_RULE_COPY) to copy an existing Risk-Weighted Capital rule.

Image: Copy an RWC Rule page

This example illustrates the fields and controls on the Copy an RWC Rule page. You can find definitions for the fields and controls later on this page.

To make implementation easier, use the Copy an RWC Rule page to copy existing rules and make modifications to them.

In the Rule Types group box, selectRisk Weight Rules, Risk Function Rules, orRule Sets. Select the rule that you want to copy in theCopy From column, and then enter the new name in theNew Rule column. Click theCopy button. The system displays the results of the copy in theReturn Messagecolumn. If necessary, modify the new rule on the appropriate rule page.

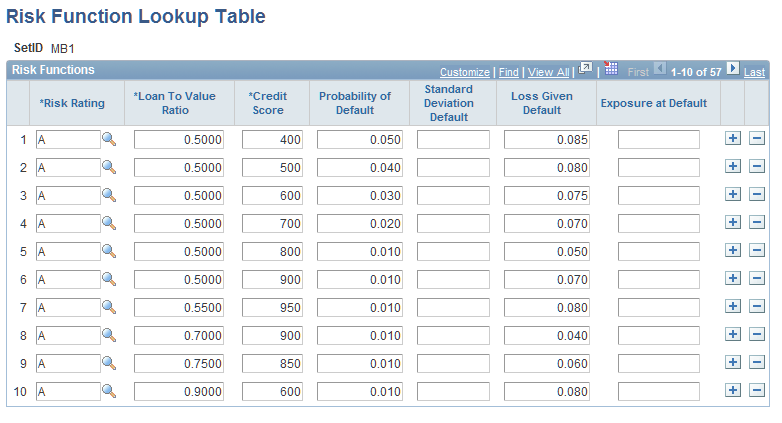

Risk Function Lookup Table Page

Use the Risk Function Lookup Table page (FI_RWC_ILKUP) to view and modify instrument-level risk-related statistics.

Image: Risk Function Lookup Table page

This example illustrates the fields and controls on the Risk Function Lookup Table page. You can find definitions for the fields and controls later on this page.

The Risk Function Lookup Table page provides a delivered model for how you can create and populate the multi-factor input table, FI_RWC_ILKUP, to generate instrument level lookup capital amounts. It provides an example of using a combination of Risk Rating, Loan to Value ratio, andCredit Score values to assign values to groups of instruments forProbability of Default (PD),Loss Given Default (LGD), andExposure at Default (EAD).

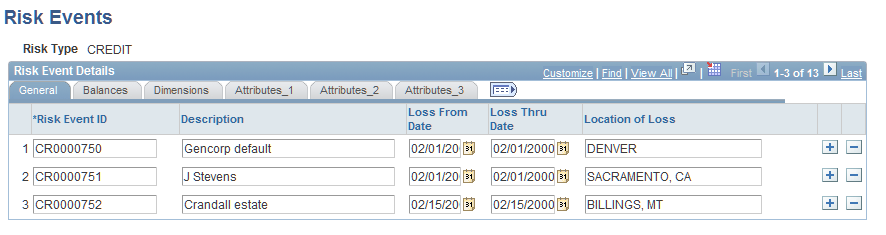

Risk Events Page

Use the Risk Events page (FI_RISK_EVENTS) to view and modify risk events related to historic credit, operational, or market risk.

Image: Risk Events page

This example illustrates the fields and controls on the Risk Events page. You can find definitions for the fields and controls later on this page.

The Risk Events page displays the historic credit, operational, or market risk events that are populated in a single denormalized table (FI_RISK_EVENTS), that is better optimized for ad/hoc analytics.