2. Direct Debits

A direct debit is a financial transaction initiated by the creditor via its bank (the creditor bank) to collect funds from a debtor's account with a debtor bank, as agreed between the debtor and creditor. This instruction to make a payment results in an agreement/mandate as agreed between the debtor and creditor and signed by the debtor. Direct debit transfers include consumer payments on insurance premiums, mortgage loans, and other kinds of bills.

Direct debit life-cycle process includes the following:

- Maintain direct debit mandates

- Customer to bank direct debit instructions

- Interbank direct debit instructions

This chapter contains the following sections:

- Direct Debit Maintenances

- Direct Debit Transactions

2.1 Direct Debit Maintenances

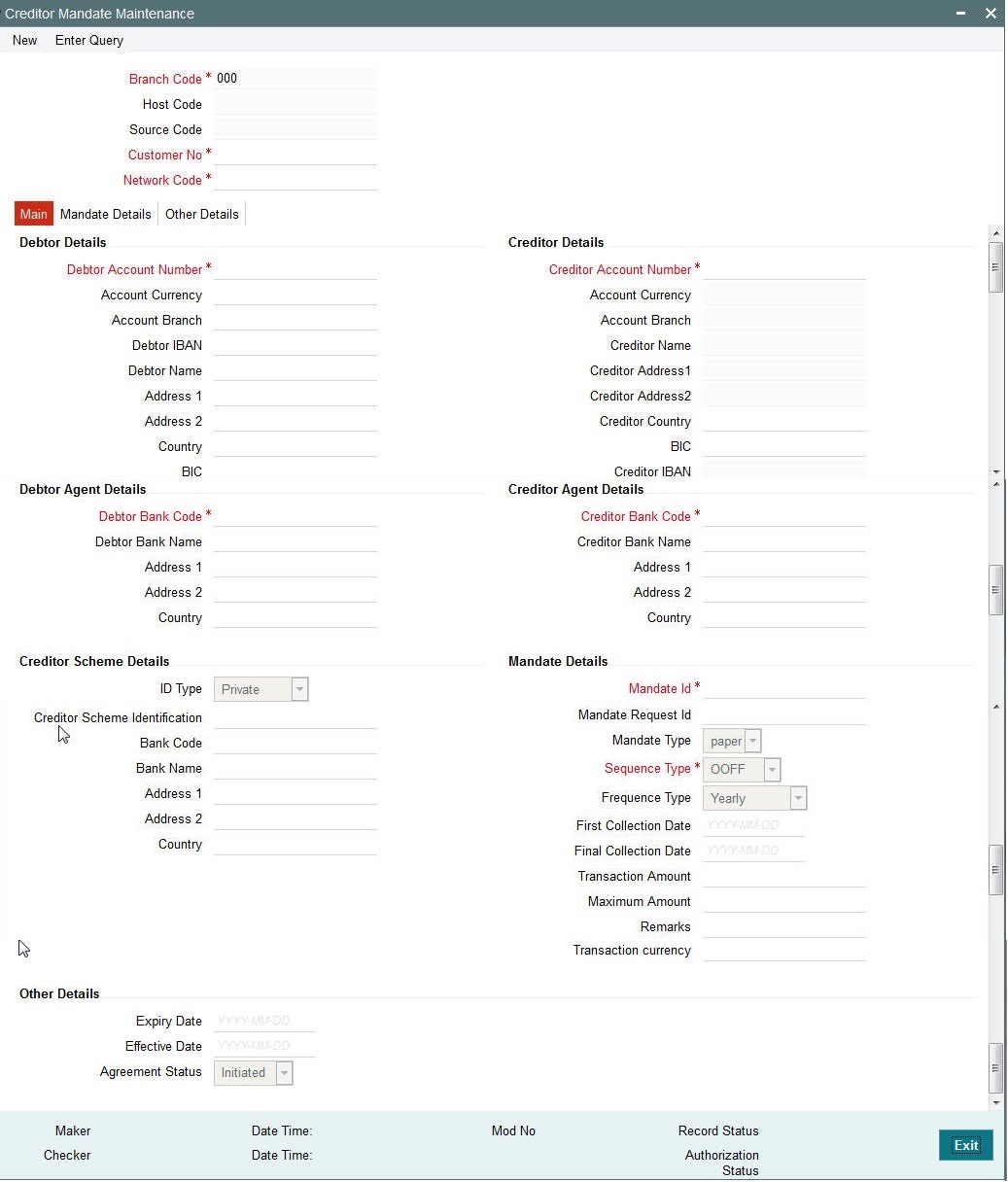

2.1.1 Creditor Mandate Maintenance

You can invoke the ‘Creditor Mandate Maintenance’ screen by typing ‘PCDCRAGT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can specify the following fields:

Branch Code

Specify the branch code for which the Creditor agreement is maintained.

Source Code

Specify the source code through which the agreement is maintained.

Host Code

Displays the host code of the specified branch code.

Customer Number

Select the Creditor customer number for which the mandate is maintained.

Network Code

Select the Creditor customer number for which the mandate is maintained.

2.1.1.1 Main tab

You can specify the following fields in the Main tab of the screen:

Debtor Details

Debtor Account Number

Specifies the Debtor account for which the mandate is maintained.

Debtor Account Currency

Specifies the Currency of the Account.

Debtor Account Branch

Specifies the branch of the Account.

Debtor IBAN

Specifies the IBAN of the Debtor account.

Debtor Name

Specifies the name of the Debtor account.

Address 1

Specifies the Address of the Debtor.

Address 2

Specifies the Address of the Debtor.

Country

Select the country to which the party belongs.

BIC

Specifies the BIC of the Debtor.

Debtor Agent Details

Debtor Bank Code

Specifies the bank code of the Debtor bank.

Debtor Bank Name

Specifies the name of the Debtor bank.

Address 1

Specifies the address of the Debtor bank.

Address 2

Specifies the address of the Debtor bank.

Country

Specifies the country to which the Debtor bank belongs.

Creditor Details

Account Number

Specifies the Creditor account for which the mandate is maintained.

Account Currency

Specifies the Currency of the Account.

Account Branch

Specifies the branch of the account.

Debtor Name

Specifies the name of the Debtor account.

Address 1

Specifies the Address of the Debtor.

Address 2

Specifies the Address of the Debtor.

Creditor Country

Select the country to which the party belongs.

BIC

Specifies the BIC of the Debtor.

Creditor IBAN

Specifies the IBAN of the Creditor account.

Creditor Agent Details

Creditor Bank Code

Specifies the bank code of the Creditor bank.

Debtor Bank Name

Specifies the name of the Creditor bank.

Debtor Account Branch

Specifies the branch of the account.

Address 1

Specifies the Address of the Creditor bank.

Address 2

Specifies the Address of the Creditor bank.

Country

Select the country to which the Creditor bank belongs to.

Creditor Bank Code

Select the bank code of the Creditor bank.

Mandate Details

Mandate ID

Specifies the unique identification assigned by the creditor to identify the mandate.

Mandate Request ID

Specify Mandate Request ID.

Mandate Type

Select the type of mandate maintained (paper form/electronic).

Sequence Type

Select the sequence type of the transaction. Allowed sequence types are OOFF (One off) and Recursive.

Frequency Type

Select the frequency type of the transaction Valid Values are Yearly, Monthly, Quarterly, Half-yearly, Weekly, Daily, Adhoc, Intraday & Fort-nightly.

Valid from Date

Select the date from which the mandate is valid.

Valid To Date

Select the date till which the mandate is valid.

First Collection Date

Select the date of the first collection of a DD as per mandate.

Transaction Amount

Specify a fixed amount to be collected from debtor account for every DD transaction if applicable.

Transaction Currency

Select the currency of the transaction.

Maximum Amount

Specify the maximum amount that can be collected from debtor account for every DD transaction.

Mandate Status

The system displays the status of the Mandate.

The following status are applicable for a creditor mandate

- Not effective – Mandate is not effective till the Effective date is reached. Mandate cannot be used during Non-effective status.

- Effective – Mandate becomes ‘Effective’ from the Effective date and is valid to use.

- Active – Mandate becomes ‘Active’ when the first or subsequent direct debit requests are processed using the mandate. Mandate is allowed to use with ‘Active’ status.

- Expired – Mandate becomes ‘Expired’ when the validity period is completed. Mandate with ‘Expired’ status cannot be used further for a transaction.

- Used – Mandate becomes ‘Used’ when the final or one-off transaction is received for the mandate. Mandate with ‘Used’ status cannot be used further.

- Cancelled – Mandate will be updated to ‘Cancelled’ status when the mandate has not been used for a period of inactive days maintained in the system (or) when the mandate record is either cancelled manually in Creditor/Debtor Mandate Maintenance screen.

Remarks

Specify remarks, if any for the mandate.

Creditor Scheme Details

Identification Type

Select the identification type of the credit Party that signs the mandate.

Creditor Scheme ID

Select the Identification number of the credit party that signs the mandate.

Bank Code

Select the bank code of the credit party that signs the mandate..

Name

Specify the name of the credit party that signs the mandate.

Address 1

Specify the address of the credit party that signs the mandate.

Address 2

Specify the address of the credit party that signs the mandate.

Country

Select the country code of the credit party that signs the mandate.

Other Details

Expiry Date

Specifies the date from when the mandate gets expired.

Effective Date

Specifies the date from when the mandate becomes effective.

2.1.1.2 Mandate Details

Click the Mandate Details tab from the ‘Creditor Mandate Maintenance’ screen.

You can specify the following fields:

Additional Details

Service Level Code

Specify the service level code for the mandate. Valid value is SEPA.

Service Level Value

Specify the service level value for the mandate.

Local Instrument Code

Specify the local instrument code. Valid values are COR/B2B.

Local Instrument Value

Specify the local instrument value.

Referred Document Details

Referred Document Code

Select the underlying documents associated with the mandate.

Referred Document Value

Specify the details to identify the underlying documents associated with the mandate.

Document Number

Specify the Unique and unambiguous identification of the referred document.

Related Date

Specify the Date associated with referred document.

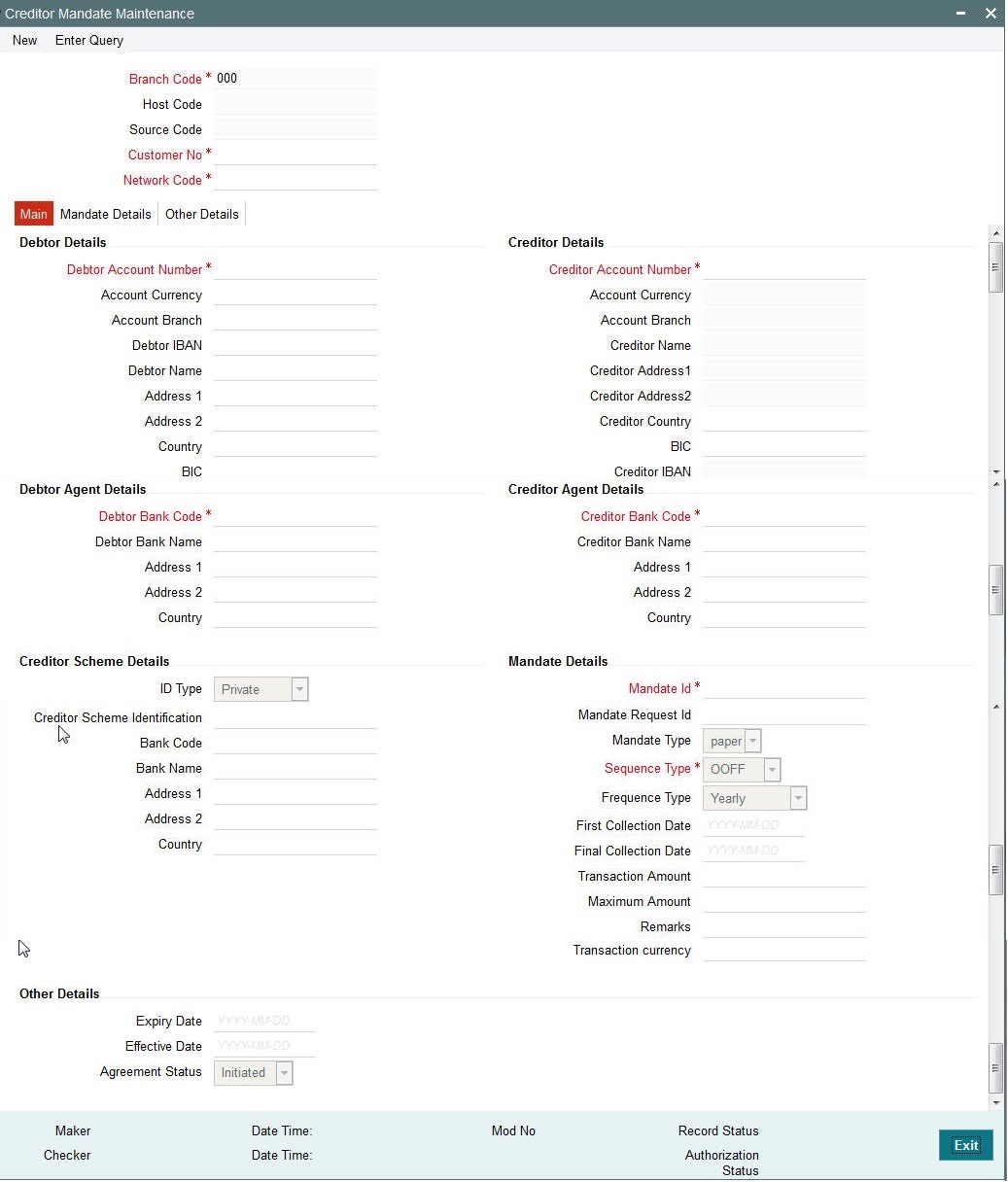

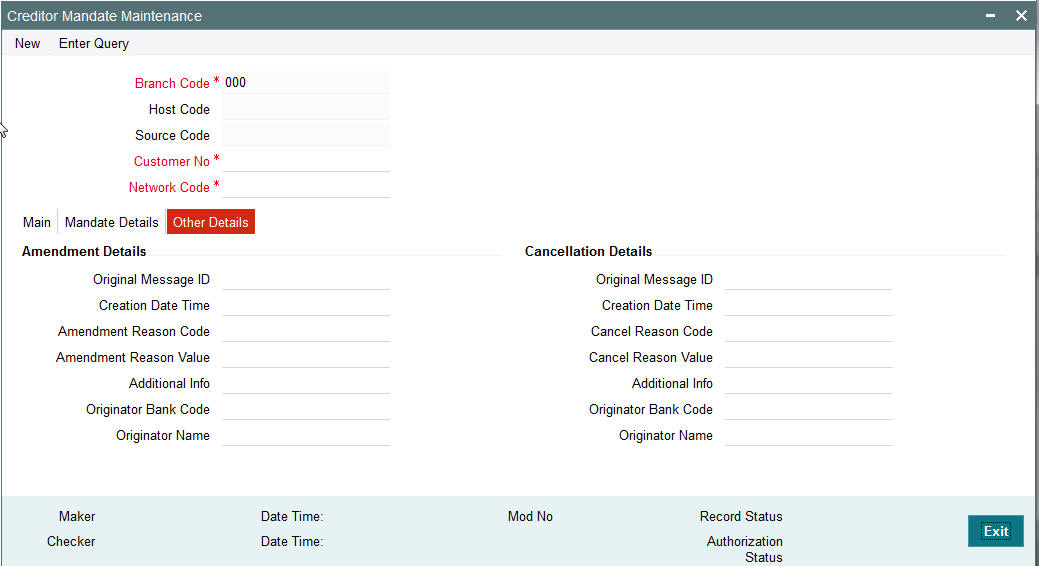

2.1.1.3 Other Details

Click the Other Details tab from the ‘Creditor Mandate Maintenance’ screen.

You can specify the following fields:

Other Details

Original Message Id

Specify the original message id of the mandate.

Creation Date Time

Specify the date and time of the amendment request received.

Amendment Reason Code

Specify the reason code for amendment. Allows valid set of codes only.

Amendment Reason Value

Specify the reason for the amendment.

Additional Info

Specify if any additional information is required.

Originator Bank Code

Select the originator details who has issued the amendment.

Originator Name

Specify the originator details who has issued the amendment.

Originator Name

Specify the originator details who has issued the amendment.

Cancellation Details

Original Message Id

Specify the original message id of the mandate.

Creation Date Time

Specify the date and time of the cancellation request received.

Cancel Reason Code

Specify the reason code for cancellation. Allows valid set of codes only.

Cancel Reason Value

Specify the reason for the cancellation.

Additional Info

Specify if any additional information is required.

Originator Name

Specify if any additional information is required.

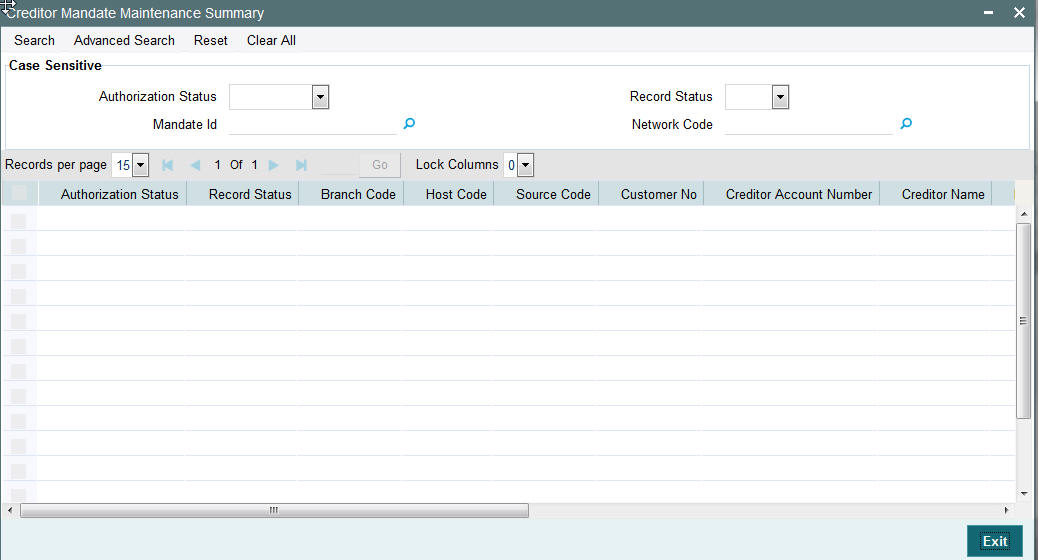

2.1.1.4 Creditor Mandate Maintenance Summary

You can invoke the ‘Creditor Mandate Maintenance Summary’ screen by typing ‘PCSCRAGT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Mandate Id

- Network Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Creditor Mandate maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

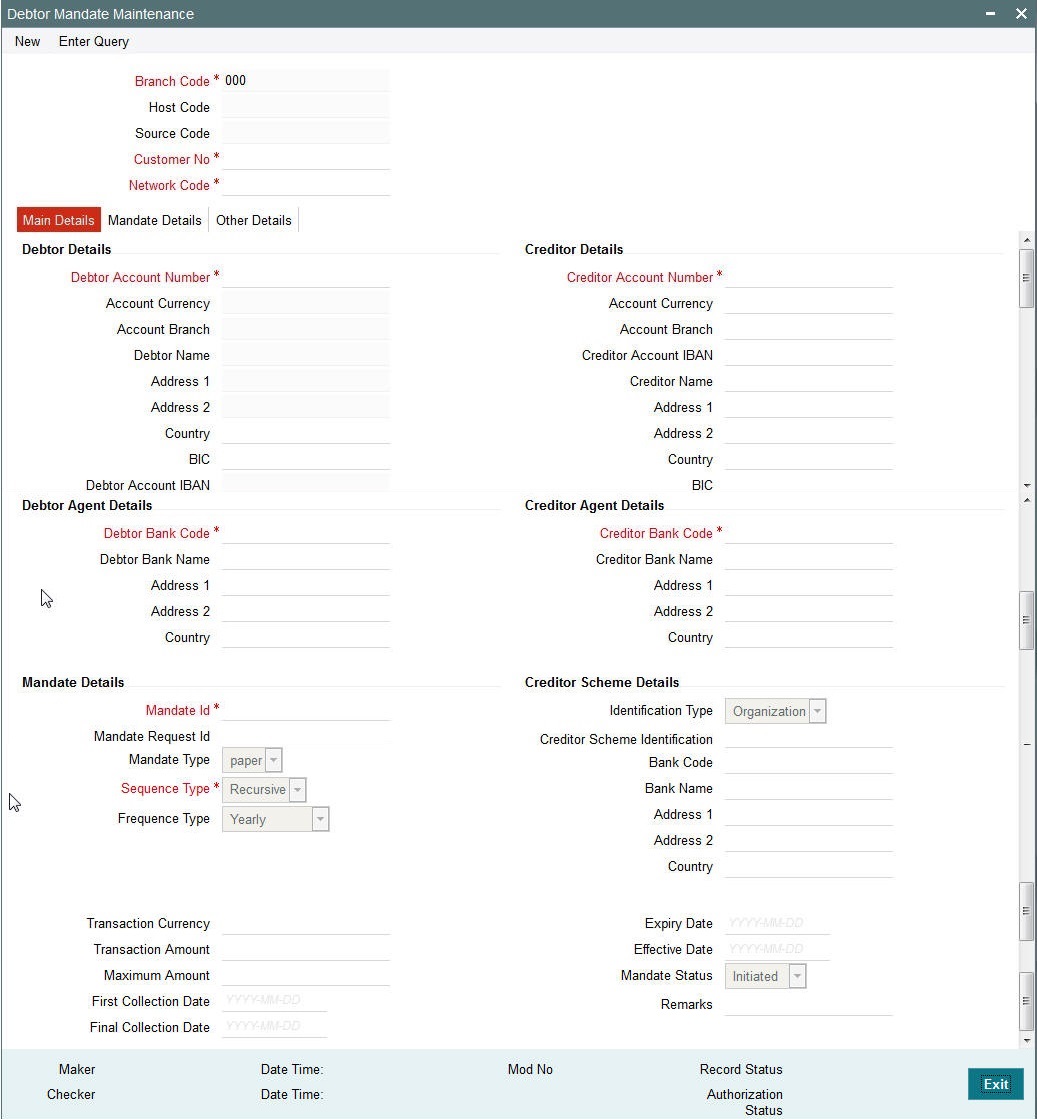

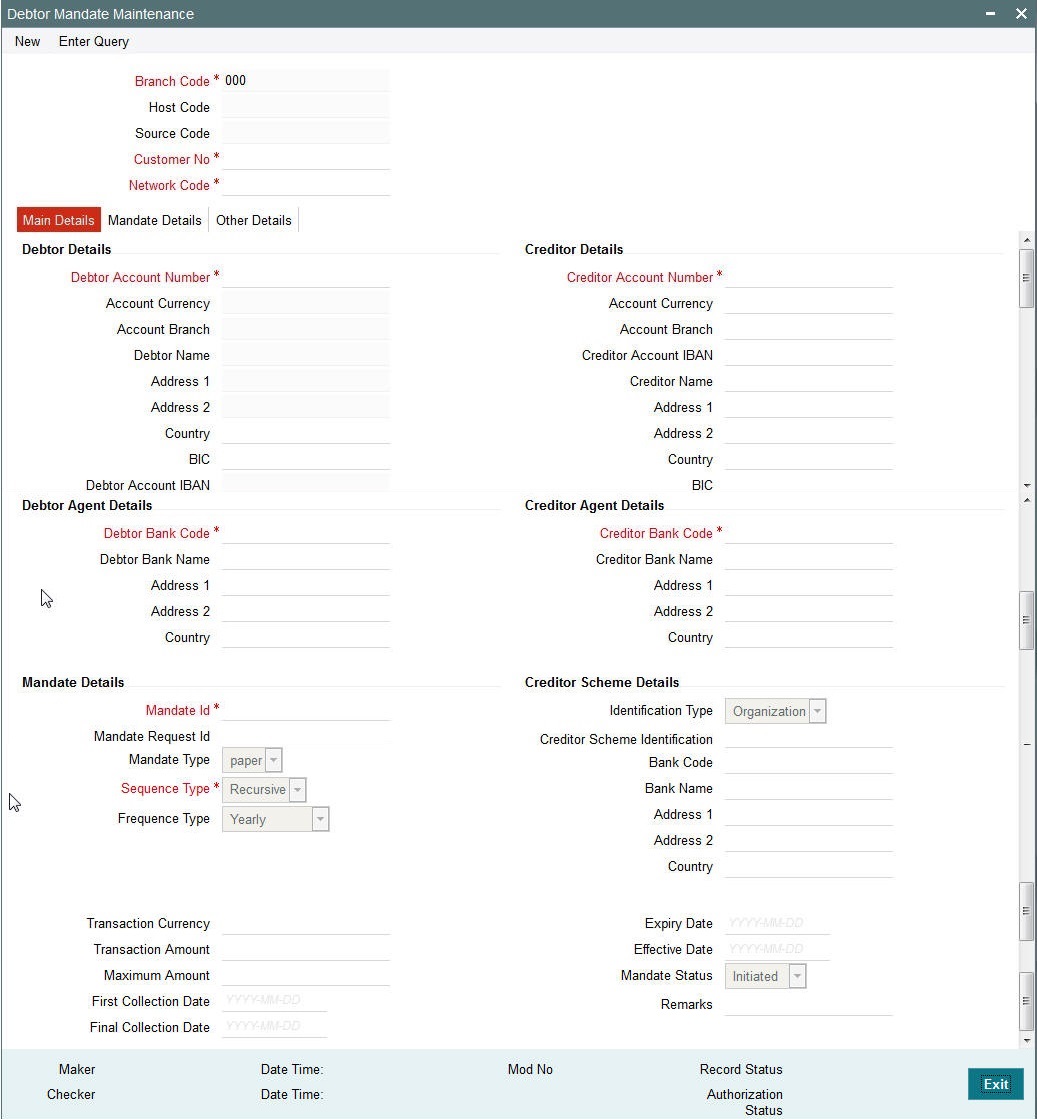

2.1.2 Debtor Mandate Maintenance

You can invoke the ‘Debtor Mandate Maintenance’ screen by typing ‘PCDDRAGT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can specify the following fields:

Branch Code

Specify the branch code for which the Debtor agreement is maintained.

Source Code

Specify the source code through which the agreement is maintained.

Host Code

Displays the host code of the specified branch code.

Customer Number

Specify the Debtor customer number for which the mandate is maintained.

Network Code

Select the Network Code for which the mandate is being created.

2.1.2.1 Main tab

Click the Main tab from the ‘Debtor Mandate Maintenance’ screen.

You can specify the following fields:

Debtor Details

Account Number

Specify the debtor account for which the mandate is maintained.

Account Currency

Specify the Currency of the Account.

Account Branch

Specify the branch of the account.

Creditor Name

Specify the name of the Debtor.

Creditor Address 1

Specify the Address of the Debtor.

Creditor Address 2

Specify the Address of the Debtor.

Creditor Country

Specify the country to which the party belongs.

BIC

Specify the BIC of the Debtor.

Debtor Agent Details

Creditor Bank Code

Specify the bank code of the Debtor bank.

Creditor Bank Name

Specify the name of the Debtor bank.

Address 1

Specify the address of the Debtor bank.

Address 2

Specify the address of the Debtor bank.

Country

Select the country to which the Debtor bank belongs.

Creditor Details

Creditor Account Number

Specify the Creditor account for which the mandate is maintained.

Creditor Account Currency

Specify the Currency of the Account.

Creditor Account Branch

Specify the branch of the account.

Creditor Name

Specify the name of the Creditor account.

Address 1

Specify the Address of the Creditor.

Address 2

Specify the Address of the Creditor.

Country

Specify the country to which the party belongs.

BIC

Specify the BIC of the Creditor.

Creditor Agent Details

Creditor Bank Code

Specify the bank code of the Creditor bank.

Creditor Bank Name

Specify the name of the Creditor bank.

Address 1

Specify the Address of the Creditor bank.

Address 2

Specify the Address of the Creditor bank.

Country

Specify the country to which the Creditor bank belongs to.

Mandate Details

Mandate ID

Specify the unique identification assigned by the creditor to identify the mandate.

Mandate Request ID

Specify the mandate.

Mandate Type

Select the type of mandate maintained (paper form/electronic).

Sequence Type

Select the sequence type of the transaction. Allowed sequence types are OOFF (One off) and Recursive

Frequency Type

Select the frequency type of the transaction. Valid Values are Yearly, Monthly, Quarterly, Half-yearly, Weekly, Daily, Adhoc, Intraday & Fort-nightly

Valid from Date

Select the date from which the mandate is valid.

Valid To Date

Select the date till which the mandate is valid.

First Collection Date

Select the date of the first collection of a DD as per mandate.

Transaction Amount

Specify a fixed amount to be collected from debtor account for every DD transaction, if applicable.

Maximum Amount

Specify the maximum amount that can be collected from debtor account for every DD transaction.

Mandate Status

The system displays the status of the Mandate.

Remarks

Specify any remarks of the mandate.

Creditor Scheme Details

Identification Type

Select the identification type of the credit Party that signs the mandate.

Creditor Scheme ID

Select the Identification number of the credit party that signs the mandate.

Bank Code

Select the bank code of the credit party that signs the mandate..

Bank Name

Specify the name of the credit party that signs the mandate.

Address 1

Specify the address of the credit party that signs the mandate.

Address 2

Specify the address of the credit party that signs the mandate.

Country

Specify the country code of the credit party that signs the mandate.

Expiry Date

Specify the date from when the mandate gets expired.

Effective Date

Specify the date from when the mandate becomes effective.

2.1.2.2 Mandate Details

Click the Mandate Details tab from the ‘Debtor Mandate Maintenance’ screen.

You can specify the following fields:

Additional Details

Service Level Code

Specify the service level code for the mandate. Valid value is SEPA.

Service Level Value

Specify the service level value for the mandate.

Local Instrument Code

Specify the local instrument code. Valid values are COR/B2B.

Local Instrument Value

Specify the local instrument value.

Referred Document Details

Referred Document Code

Specify the underlying documents associated with the mandate. The list displays valid Referred Document Type codes.

Referred Document Value

Specify the details to identify the underlying documents associated with the mandate.

Document Number

Specify the Unique and unambiguous identification of the referred document.

Related Date

Specify the Date associated with referred document.

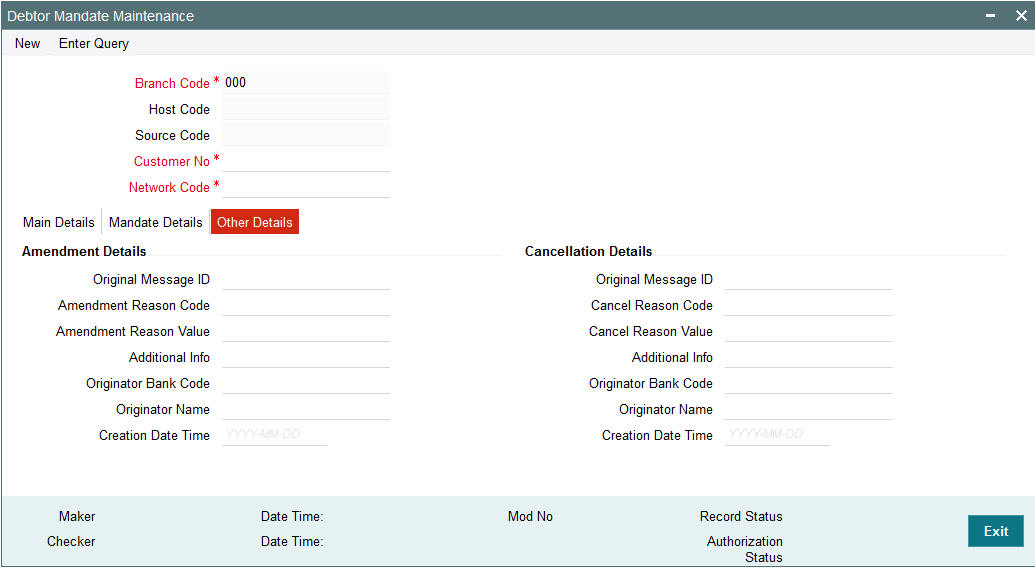

2.1.2.3 Other Details

Click the Other Details tab from the ‘Debtor Mandate Maintenance’ screen.

You can specify the following fields:

Other Details

Amendment Details

Original Message Id

Specify the original message id of the mandate.

Creation Date Time

Specify the date and time of the amendment request received.

Amendment Reason Code

Specify the reason code for amendment. Allows valid set of codes only.

Amendment Reason Value

Specify the reason for the amendment.

Additional Info

Specify if any additional information is required.

Originator Bank Code

Specify the originator details who has issued the amendment.

Originator Name

Specify the originator details who has issued the amendment.

Originator Name

Specify the originator details who has issued the amendment.

Cancellation Details

Original Message Id

Select the original message id of the mandate.

Creation Date Time

Specifies the date and time of the cancellation request received.

Cancel Reason Code

Specifies the reason code for cancellation. Allows valid set of codes only.

Cancel Reason Value

Specifies the reason for the cancellation.

Additional Info

Specifies if any additional information is required.

Originator Name

Specifies if any additional information is required.

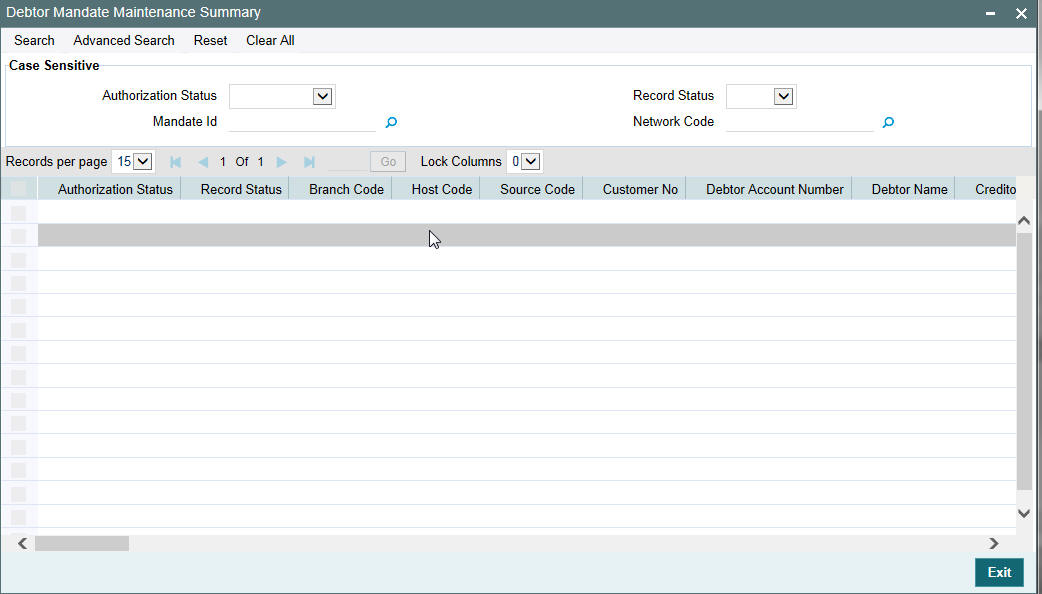

2.1.2.4 Debtor Mandate Maintenance Summary

You can invoke the ‘Debtor Mandate Maintenance Summary’ screen by typing ‘PCSDRAGT’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Mandate Id

- Network Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Debtor Mandate maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

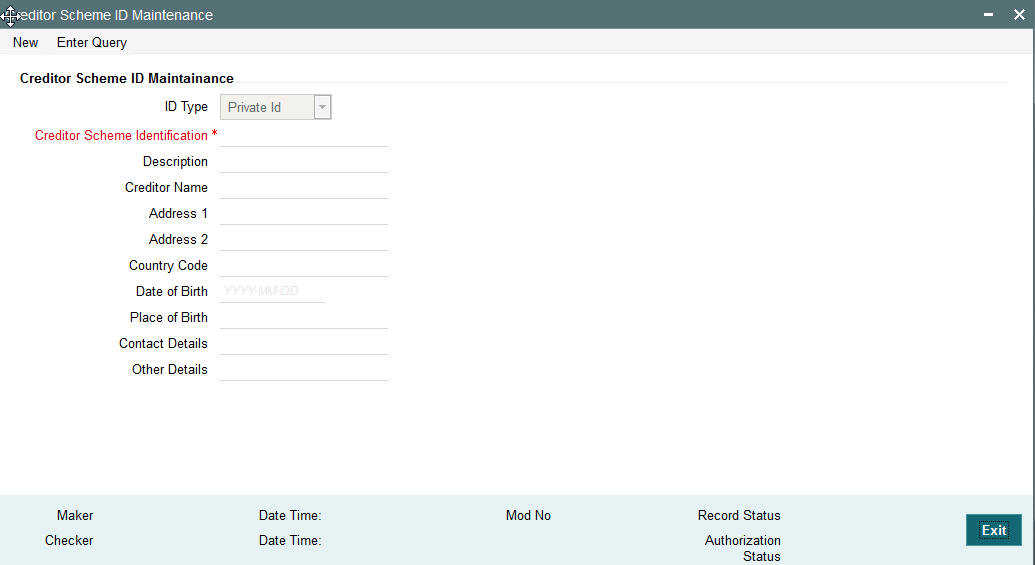

2.1.3 Creditor Scheme Id Maintenance

You can invoke the ‘Creditor Scheme Id Maintenance’ screen by typing ‘PCDCSCHM’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can specify the following fields:

Creditor Scheme ID Maintenance

ID Type

Specify the identification type of the Credit Party that signs the mandate.

Creditor Scheme Identification

Specify the Identification number of the credit party that signs the mandate.

Description

Specify the description of the Creditor Scheme ID.

Creditor Name

Specify the name of the credit party that signs the mandate.

Address 1

Specify the address of the credit party that signs the mandate.

Address 2

Specify the address of the credit party that signs the mandate.

Country Code

Specify the country code of the credit party that signs the mandate.

Date of Birth

Specify the date of birth of the creditor

Place of Birth

Specify the place of birth of the creditor

Contact Details

Specify the contact details of the creditor.

Other Details

Specify the remarks of the creditor.

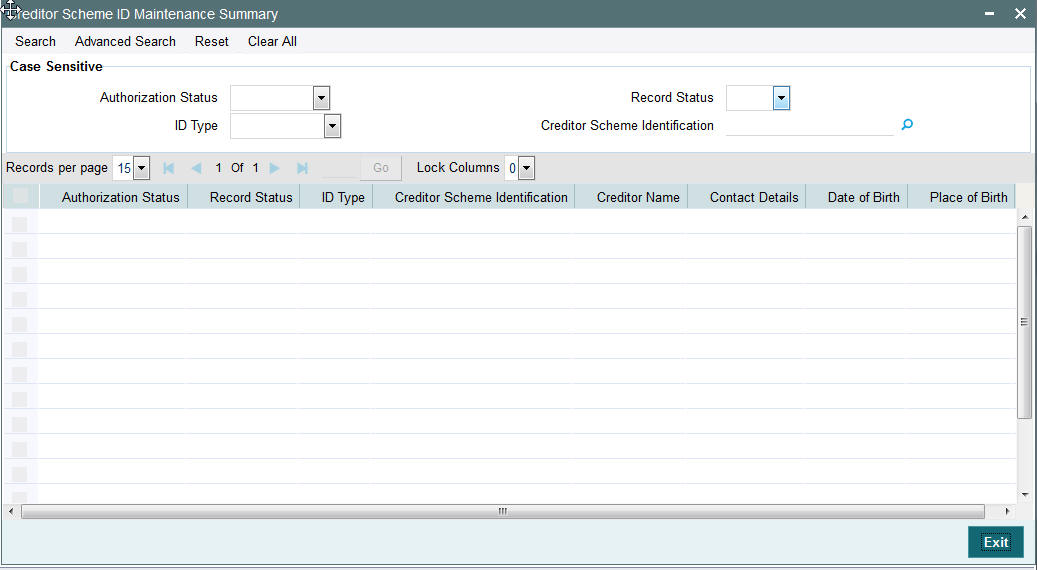

2.1.3.1 Creditor Scheme Id Maintenance Summary

You can invoke the ‘Creditor Scheme Id Maintenance Summary’ screen by typing ‘PCSCSCHM’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button..

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Id Type

- Creditor Scheme Identification

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

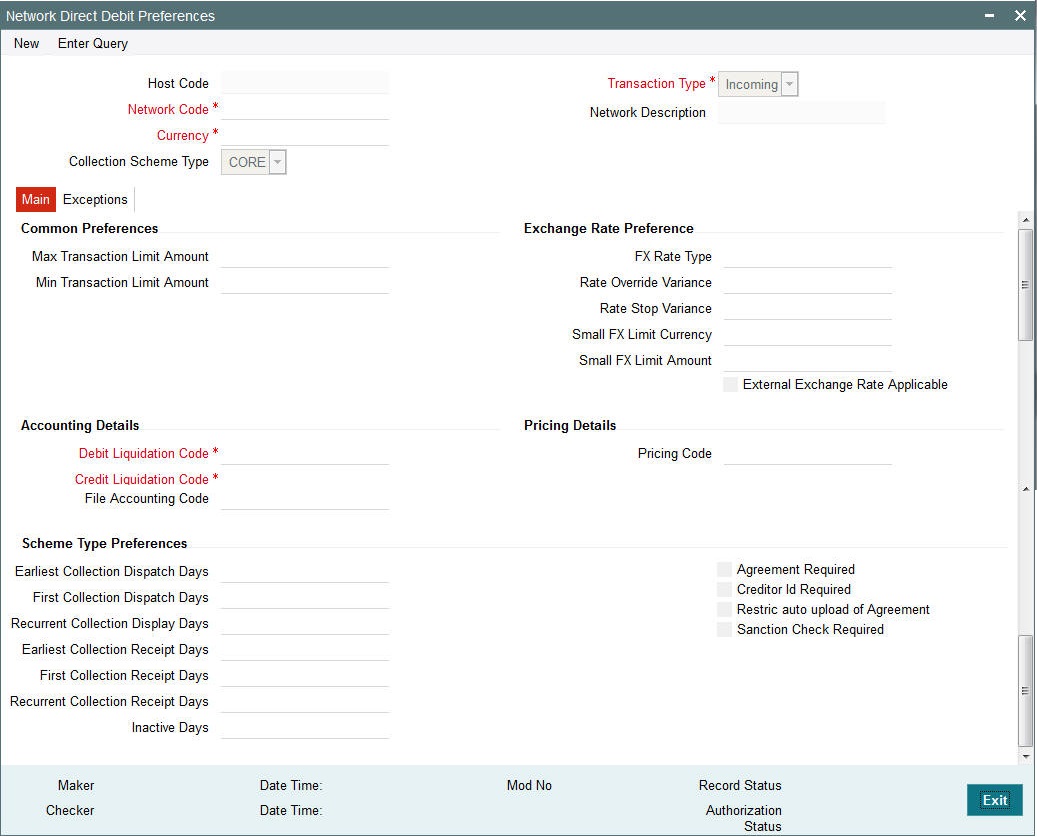

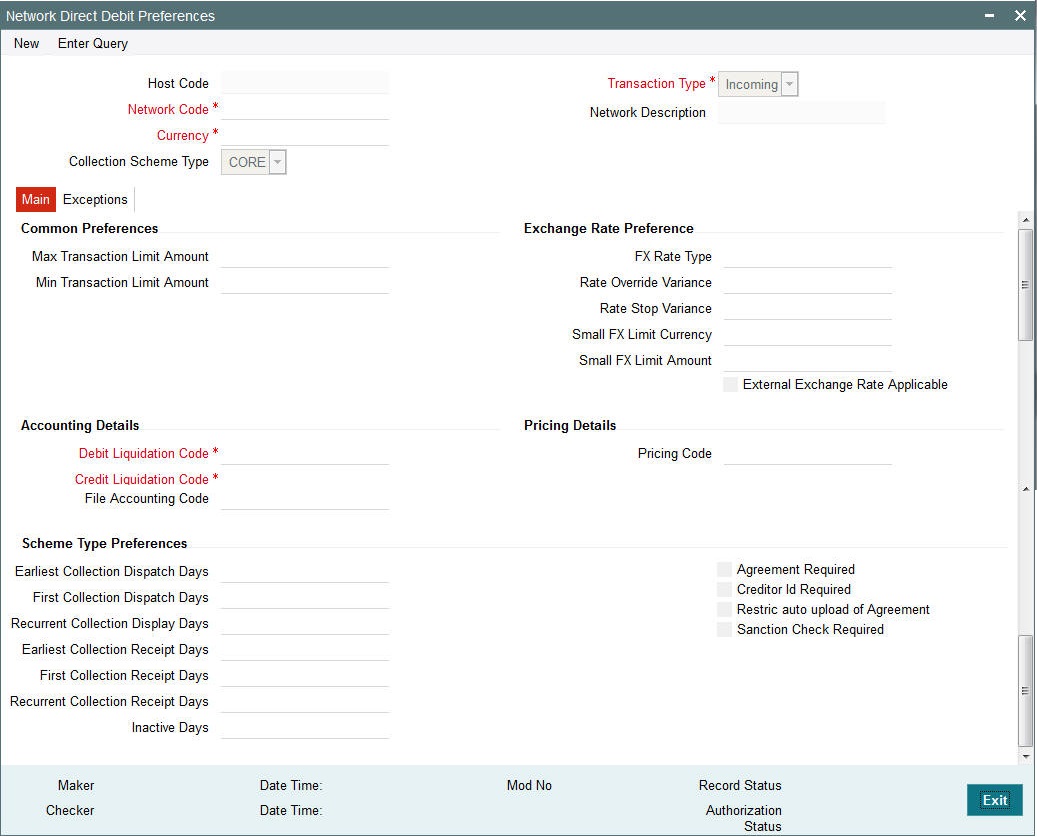

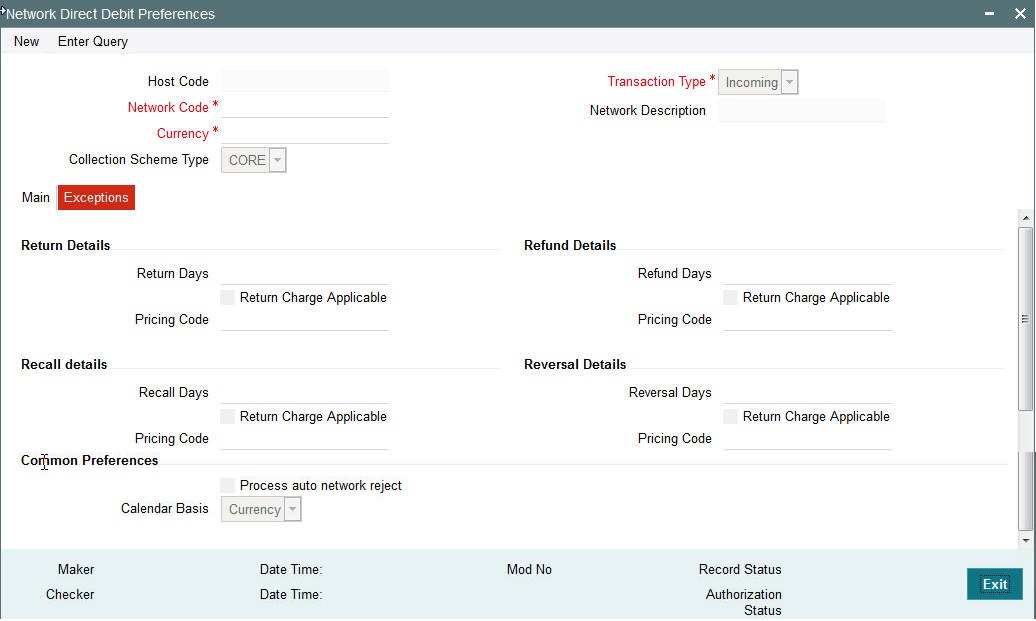

2.1.4 Network Direct Debit Preferences Maintenance

You can invoke the ‘Network Direct Debit Preferences Maintenance’ screen by typing ‘PCDNWDDP’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can specify the following fields:

Network Code

Specify the network code for which the direct debit preferences are to be maintained

Network Description

The system displays the description of the network code selected.

Host Code

The system displays the logged in branch's host code.

Collection Scheme Type

Specify the scheme type of the mandate. The values allowed for this field are Core and B2B.

Transaction Type

Specify the transaction type for which the DD preferences are to be maintained for a specific network.

Transaction type can be Incoming or outgoing.

2.1.4.1 Main tab

Click the Main tab from the ‘Network Direct Debit Preferences’ screen.

You can specify the following fields:

Limit Details

Maximum Transaction Amount

Specify the maximum transaction amount allowed for the network.

Minimum Transaction Amount

Specify the minimum transaction amount allowed for the network.

Exchange Rate Preferences

Note

Cross currency transactions are currently not allowed in Direct Debits.

Scheme Type Preferences

Agreement Required

Check this box if the Agreement is required to be validated during DD transaction processing.

Creditor ID Required

Check this box if Creditor Scheme ID must be provided during DD transaction processing.

Earliest Collection Dispatch Days

Specify the number of days, based on the calendar basis that will be subtracted from the transaction activation date to arrive at the earliest collection dispatch date.

Earliest Collection Receipt Days

Specify the number of days, based on the calendar basis that will be subtracted from the transaction activation date to arrive at the earliest collection receipt date.

First Collection Dispatch Days

Specify the number of days, based on the calendar basis that will be subtracted from the transaction activation date to arrive at the first collection dispatch date.

First Collection Receipt Days

Specify the number of days, based on the calendar basis that will be subtracted from the transaction activation date to arrive at the first collection receipt date.

Recurrent Collection Receipt Days

Specify the number of days, based on the calendar basis that will be subtracted from the transaction activation date to arrive at the recurrent collection receipt date.

Accounting Details

Debit Liquidation Code

Specify the accounting code for debit liquidation.

Credit Liquidation Code

Specify the accounting code for credit liquidation.

File Liquidation Code

Specify the accounting code for file dispatch/receipt accounting.

Pricing Details

Pricing Code

Specify the accounting code for pricing.

2.1.4.2 Exception tab

Click the Exception tab from the ‘Network Direct Debit Preferences’ screen.

You can specify the following fields:

Scheme Type

Specify the Scheme type for which the exceptional handling to be defined.

Return Days

Specify the number of days within which Return will be allowed on the DD transaction.

Refund Days

Specify the number of days within which Refund will be allowed on the DD transaction.

Recall Days

Specify the number of days within which Recall will be allowed on the DD transaction.

Reversal Days

Specify the number of days within which Reversal will be allowed on the DD transaction.

Calendar Basis

Specify the Calendar basis to derive the refund, recall and reversal days.

Process Auto Network Reject

Check this box if the auto processing of network reject transaction is done by the system.

Pricing Applicable

Check this box if pricing is applicable for the Exceptional transactions.

Return

Check this box if pricing is applicable for the Exceptional transactions.

Refund

Check this box if pricing applicable for a refund of DD transaction.

Recall

Check this box if pricing is applicable for a recall of DD transaction.

Reversal

Check this box if pricing is applicable for a reversal of DD transaction.

2.1.4.3 Network Direct Debit Preferences Maintenance Summary

You can invoke the ‘Network Direct Debit Preferences Maintenance Summary’ screen by typing ‘PCSNWDDP’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Network Code

- Transaction Type

- Currency

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

2.2 Direct Debit Transactions

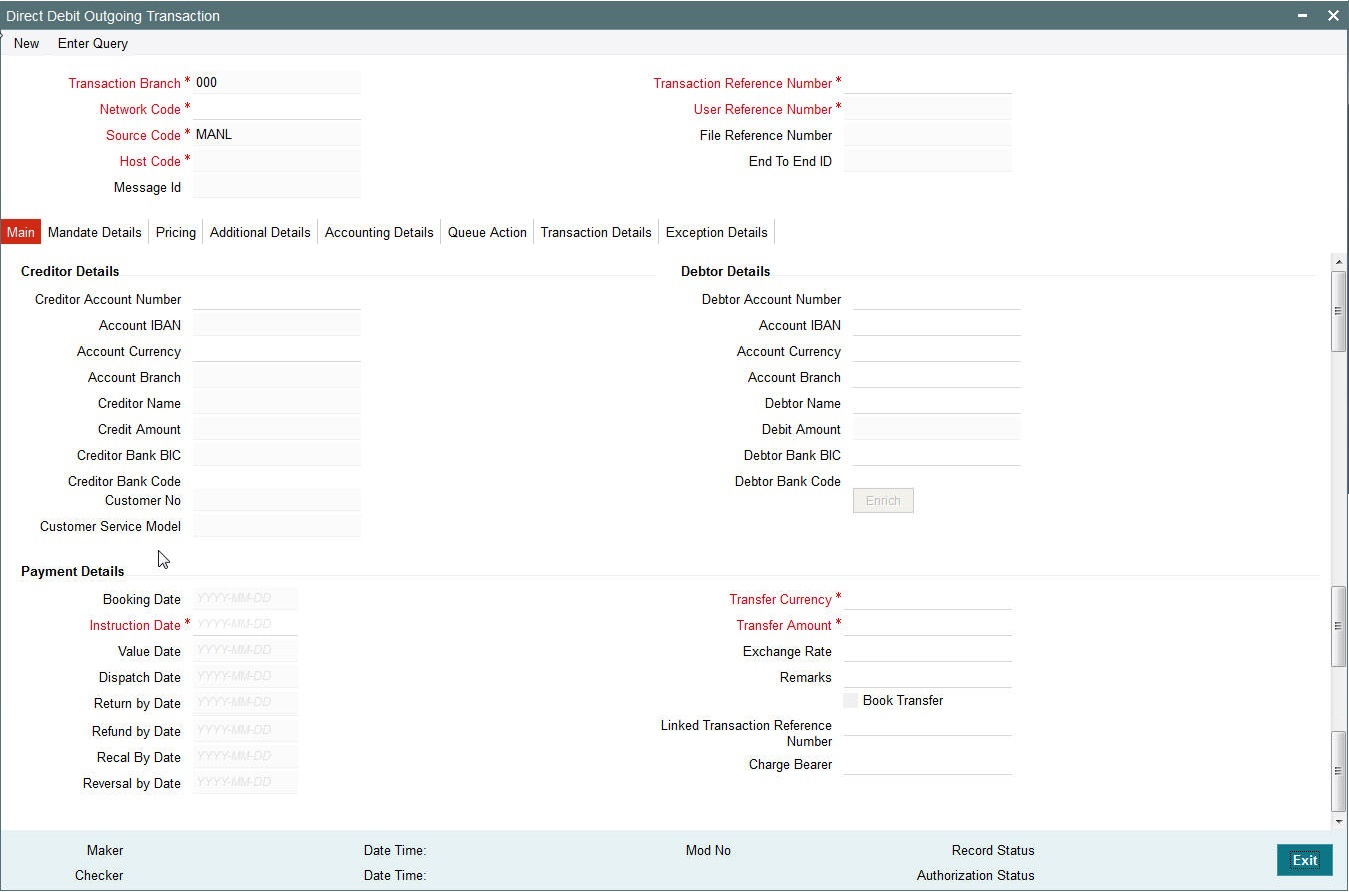

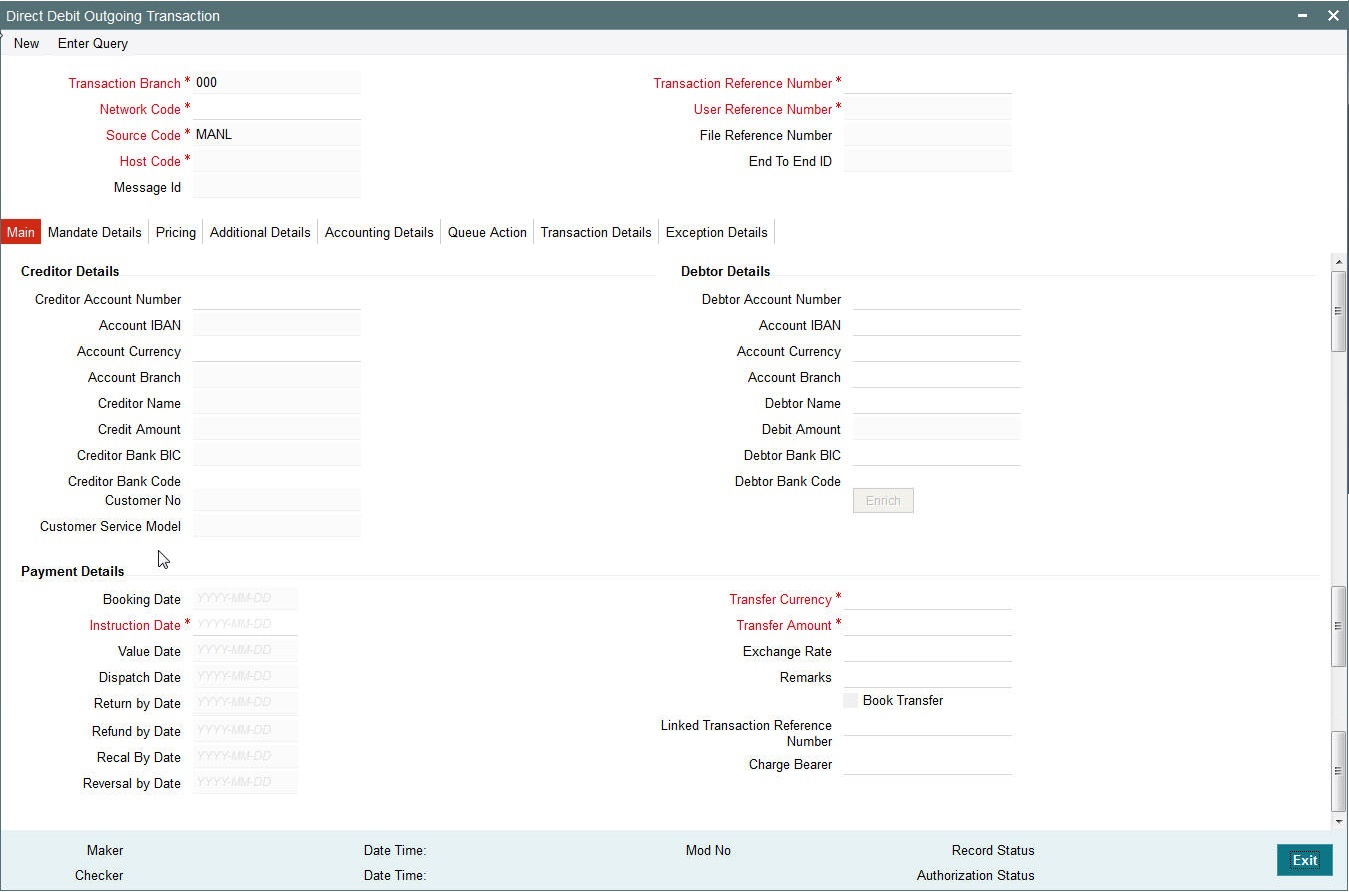

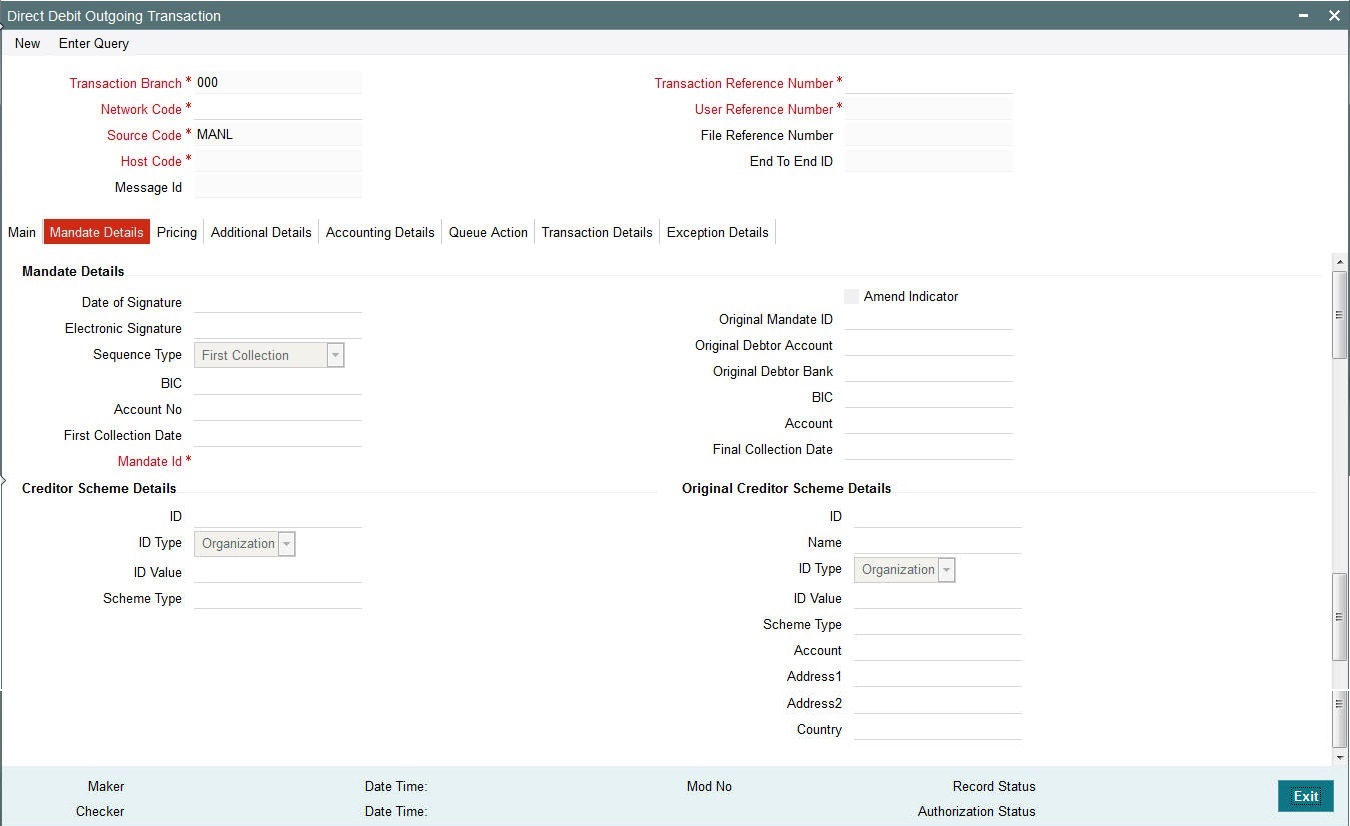

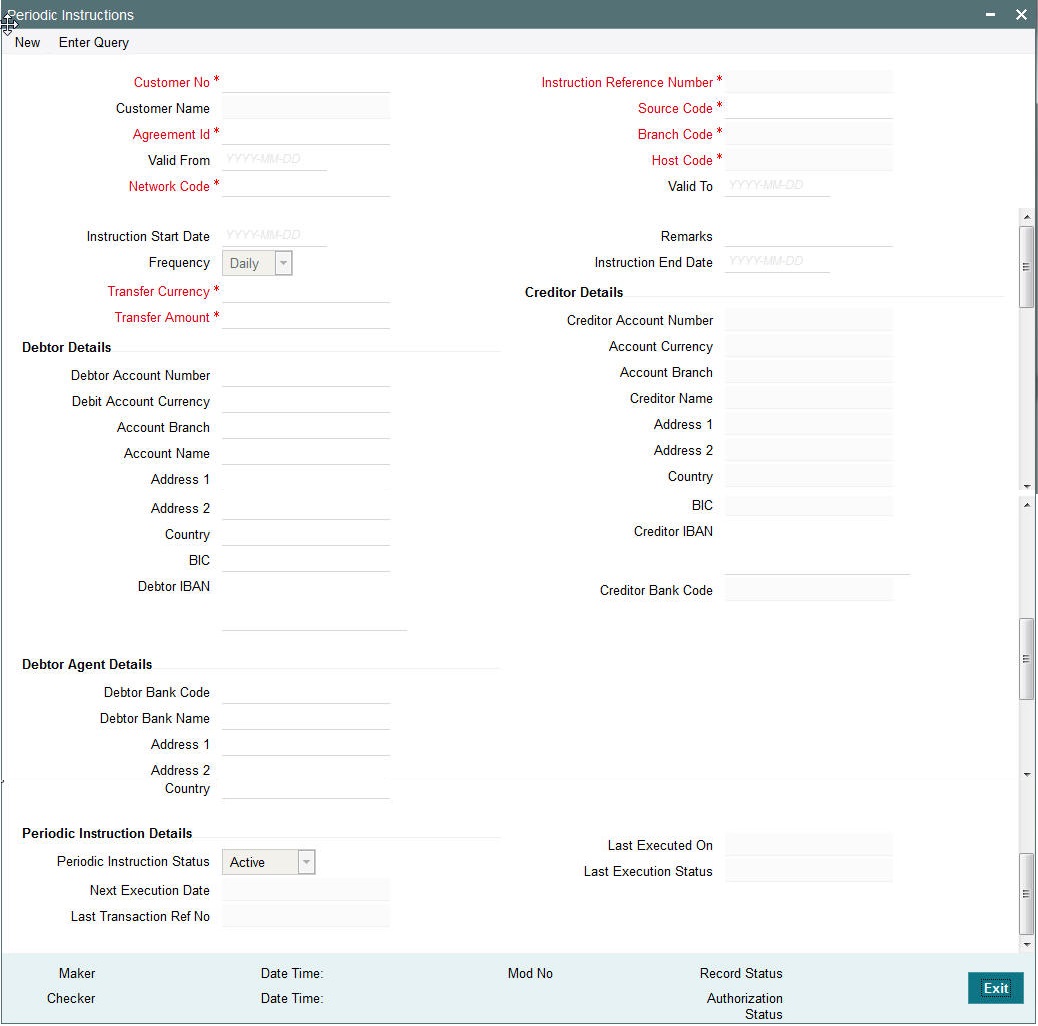

2.2.1 Direct Debit Outgoing Transaction

An outgoing Direct debit transaction screen is used to initiate an outgoing DD transaction and to view the Outgoing direct debit transaction created through upload.

You can invoke ‘Direct Debit Outgoing Transaction Input’ screen by typing ‘PCDAOTXN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Transaction Branch

Indicates the branch from which the customer is logged in.

Host Code

Indicates the host code that is linked to the transaction branch of the customer

Network Code

Select the network code.

Source Code

This is defaulted to ‘MANL’ and it is non-editable for manually initiated transactions.

Transaction Reference Number

Indicates a unique identifier of the Direct Debit transaction and it is auto-generated.

User Reference Number

This field will default the Transaction Ref Number field and you can modify the reference,if required.

End to end Id

Specifies the end to end transaction identification.

2.2.1.1 Main Tab

You can specify the following fields in the Main tab:

Creditor Details

Creditor Account Number

Select the creditor account for which the transaction is executed. Valid accounts maintained in the External Account maintenance are allowed to be selected.

Account IBAN

Account IBAN for which the transaction is displayed for the Creditor account number chosen.

Account Currency

Account currency is displayed.

Account Branch

Account Branch is displayed.

Creditor Name

Account name is displayed.

Credit Amount

Specify the amount specified for the credit transaction.

Creditor Bank BIC

Specify the BIC of the Creditor Bank.

Creditor Bank Code

Specify the bank code of the Creditor Bank.

Customer Number

Creditor customer number is displayed based on the account selected.

Customer Service Model

If Service model is linked to the customer number, the same is displayed.

Debtor Details

Debtor Account Number

Specify the debtor account for the transaction is initiated.

Account IBAN

Specify the Account IBAN for which the transaction is initiated.

Account Currency

The currency of the account.

Account Branch

Specify the branch of the debtor account.

Debtor Name

Specify the name of the debtor.

Debit Amount

Specify the amount to be debited.

Debtor Bank BIC

Select the BIC of the Debtor Bank.

Debtor Bank Code

Select the code of the Debtor Bank.

Payment Details

Booking Date

Specify the booking date of the direct debit transaction.

Instruction Date

Specify the instruction date of the transaction. This field identifies the original value date that was provided by the creditor during the instruction.

Value Date

Specify the value date of the transaction. This fields identifies the date on which the transfer to be made.

Dispatch Date

Specify the dispatch date of the direct debit transaction. This field denotes the date on which the message to be dispatched. Dispatch date will be derived based on the sequence type specified in the transaction.

- If the Sequence type is of ‘OOFF’ or ‘FRST’, then dispatch date is derived as the value date minus the no of days specified in First collection dispatch days.

- If the Sequence type is of ‘RCUR’, then dispatch date is derived as the value date minus the no of days specified in Recurrent collection dispatch days.

Return by Date

This field denotes the date by which the Return request to be received for an outgoing DD transaction. This date is derived by value date plus the return days based on the calendar basis.

Refund by Date

This field denotes the date by which the refund request to be received for an outgoing DD transaction. This date is derived by value date plus refund days based on the calendar basis.

Recall by Date

This field denotes the date by which the Recall to be initiated for an outgoing DD transaction. This date is derived by value date minus the recall days based on the calendar basis.

Reversal by Date

This field denotes the date by which the reversal request to be initiated for an outgoing DD transaction. This date is derived by value date plus reversal days based on the calendar basis.

Transfer Currency

Specify the currency in which the transfer is initiated.

Transfer Amount

Specify the amount to be transferred.

Remarks

Specify any remarks, if any.

Book Transfer

This flag identifies if the corresponding DD transaction is a book transfer transaction, if both Debtor account & Creditor account holds account with the current processing branch bank code.

Linked Transaction Reference Number

In case of book transfers, incoming DD transaction booked as part of outgoing will be strored in Linked Transaction Reference Number field.

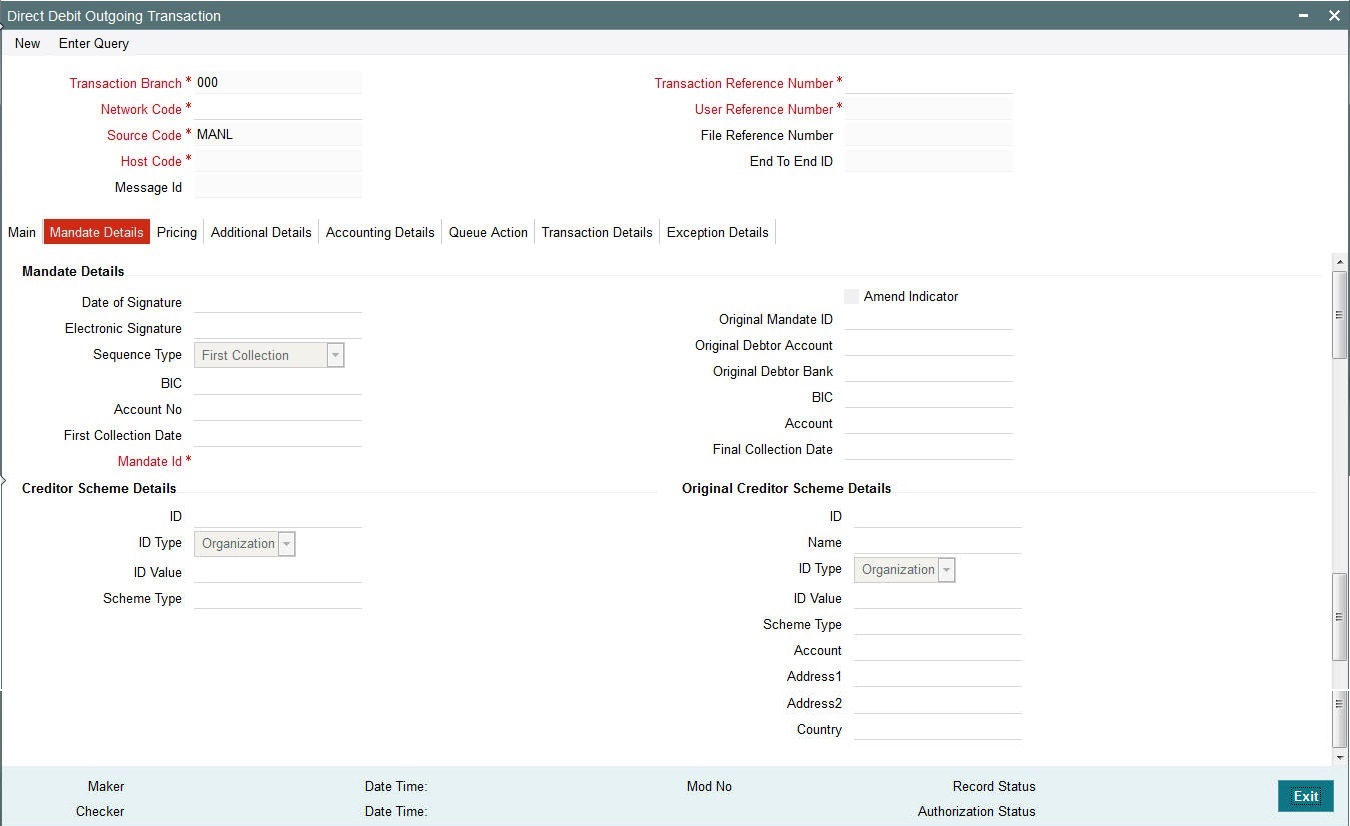

2.2.1.2 Mandate Details Tab

Click Mandate Details tab from the Direct Debit Outgoing Transaction screen.:

You can specify the following fields:

Mandate Details

Date of Signature

Indicates the date on which the mandate was signed by debtor. This is defaulted based on the mandate ID selected.

Sequence Type

Select the required sequence type. Valid values are:

- First Collection

- Final Collection

- One Off Transaction

- Recurring Transaction

Original Mandate Id

Specify the identification of the original mandate. This field indicates the original mandate ID as assigned by the creditor, to identify the original mandate maintained. This field is mandatory if changes occur in ‘Mandate Identification’, otherwise not to be used.

Original Debtor Bank

Specify the details of the Original Debtor Bank.

Final Collection Date

Specify the final collection date.

Original Debtor Agent Account Number

Specify the account number of the Original Debtor Agent.

Original Debtor Account Number

Specify the account number of the Original Debtor.

Amend Indicator

This Indicator is for notifying whether the underlying mandate is amended or not. Check this box if amendment is applicable.

Electronic Signature

Specify the electronic signature details.

Mandate Id

Specify the identification of the mandate.

Original Debtor Account

Specify the account details of the Original Debtor.

First Collection Date

Specify the date of first collection.

Original Debtor Agent Bank BIC

Specify the BIC of the original Debtor Agent Bank.

Original Debtor Bank BIC

Specify the BIC of the original Debtor Agent Bank.

Original Final Collection Date

Specify the date of the Original Final Collection Date.

Creditor Scheme Details

Scheme Id

Specify the identification of the creditor scheme.

Scheme Id Type

Specify the type of Scheme identification.

Scheme Type

Specify the type of scheme.

Scheme Value

Specify the value of the creditor scheme.

Original Creditor Scheme Details

Original Creditor Scheme details are required if changes occur in ‘Creditor Scheme ID or Name', otherwise not to be used

Scheme Name

Specify the name of the Original Creditor Scheme.

Original Creditor Agent BIC

Specify the BIC of the Original Creditor Agent.

Original Creditor Agent Account

Specify the account details of the Original Creditor Agent.

Scheme Id

Specify the identification of the Original Creditor Scheme.

Scheme Id Type

Specify the type of Scheme identification.

Original Creditor Scheme Type

Specify the type of Original Creditor Scheme.

Scheme Value

Specify the value of the Original Creditor Scheme.

Address 1

Specify the first line of the address of the Original Creditor.

Address 2

Specify the second line of the address of the Original Creditor.

Country

Specify the country of the Original Creditor.

2.2.1.3 Pricing Tab

Click the Pricing tab from the Direct Debit Incoming Transaction screen.:

You can view the charge/tax details derived for the transaction in Pricing tab.You can amend the price values/waiver flag, if required.

Pricing Component

This field indicates the pricing component derived for the DD transaction.

Pricing Currency

Indicates the pricing currency of the component.

Pricing Amount

Specifies the fixed or calculated charge amount using the Pricing Value Maintenance. You can edit this field to a non-zero value.

Waiver

Check this box to select the charge component to waive the associated charges.

Debit Currency

Indicates the currency of the debit account.

Debit Amount

Indicates the amount debited to the selected debit amount.

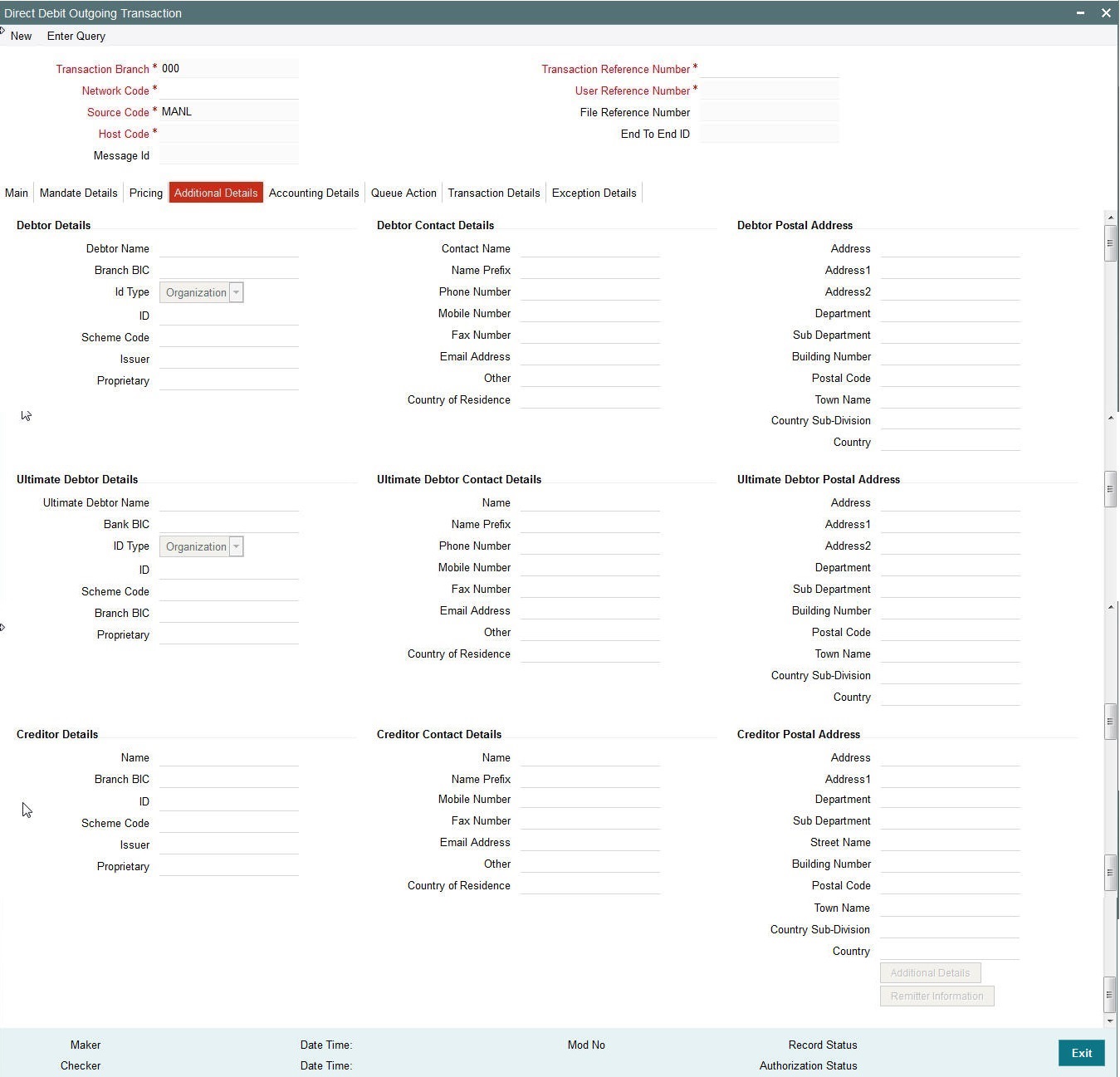

2.2.1.4 Additional Details Tab

Specify the additional details in this screen. Click on the ‘Additional Details’ to invoke this screen.

Debtor Details

Debtor Name

Specify the name of the debtor.

Branch BIC

Specify the Branch BIC of the debtor.

Id Type

Specify the type of identification.

ID

Specify the identification of the Debtor.

Scheme Code

Specify the Scheme Code of the Debtor.

Issuer

Specify the Issuer of the Debtor.

Proprietary

Specify the Proprietary details of the Debtor.

Debtor Contact Details

Contact Name

Specify the Contact Name of the Debtor.

Name Prefix

Specify the prefix name of the Debtor.

Phone Number

Specify the phone number of the Debtor.

Mobile Number

Specify the mobile number of the Debtor.

Fax Number

Specify the fax number of the Debtor.

Email Address

Specify the mailing address of the Debtor.

Other

Specify any other details of the Debtor.

Country of Residence

Specify the country of residence of the Debtor.

Debtor Postal Details

Address

Select the address of the Debtor.

Address 1 through to Address 2

Select the address of the Debtor in the two lines provided.

Department

Specify the department of the Debtor.

Sub Department

Specify the sub department of the Debtor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the debtor.

Ultimate Debtor Details

Ultimate Debtor Name

Specify the name of the Ultimate Debtor.

Bank BIC

Specify the Bank BIC.

ID Type

Specify the type of identification.

ID

Specify the identification.

Scheme Code

Specify the scheme code details.

Branch BIC

Specify the Branch BIC.

Proprietary

Specify the Ultimate Debtor proprietary information.

Ultimate Debtor Contact Details

Contact Name

Specify the Contact Name of the Ultimate Debtor.

Name Prefix

Specify the prefix name of the Ultimate Debtor.

Phone Number

Specify the phone number of the Ultimate Debtor.

Mobile Number

Specify the mobile number of the Ultimate Debtor.

Fax Number

Specify the fax number of the Ultimate Debtor.

Email Address

Specify the mailing address of the Ultimate Debtor.

Other

Specify any other details of the Ultimate Debtor.

Country of Residence

Specify the country of Residence of the Ultimate Debtor.

Ultimate Debtor Postal Details

Address

Select the address of the Ultimate Debtor.

Address 1 through to Address 2

Select the address of the Ultimate Debtor in the two lines provided.

Department

Specify the department of the Ultimate Debtor.

Sub Department

Specify the sub department of the Ultimate Debtor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the Creditor.

Creditor Details

Creditor Name

Specify the name of the Creditor.

Branch BIC

Specify the Branch BIC of the Creditor.

Id Type

Specify the type of identification.

ID

Specify the identification of the Creditor.

Scheme Code

Specify the Scheme Code of the Creditor.

Issuer

Specify the Issuer of the Creditor.

Proprietary

Specify the Proprietary details of the Creditor.

Creditor Contact Details

Contact Name

Specify the Contact Name of the Creditor.

Name Prefix

Specify the prefix name of the Creditor.

Phone Number

Specify the phone number of the Creditor.

Mobile Number

Specify the mobile number of the Creditor.

Fax Number

Specify the fax number of the Creditor.

Email Address

Specify the mailing address of the Creditor.

Other

Specify any other details of the Creditor.

Country of Residence

Specify the country of residence of the Creditor.

Creditor Postal Details

Address

Select the address of the Creditor.

Address 1 through to Address 2

Select the address of the Creditor in the two lines provided.

Department

Specify the department of the Creditor.

Sub Department

Specify the sub department of the Creditor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the Creditor.

2.2.1.5 Accounting Details

Click the Accounting Details tab in the Direct Debit Outgoing Transaction screen.:

If accounting entries are posted for a transaction you can view the details from the Accounting Details tab.

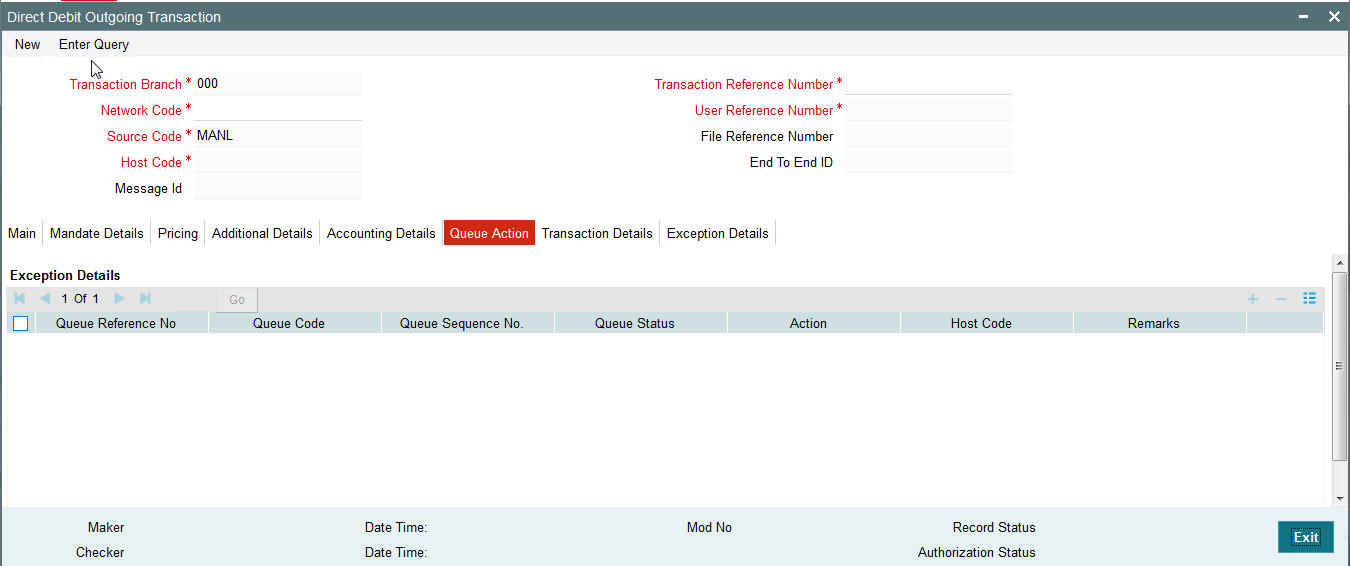

2.2.1.6 Queue Action Details

Click the Queue Action tab in the Direct Debit Outgoing Transaction screen.:

Queue actions done for a transaction can be viewed from Queue Action tab.

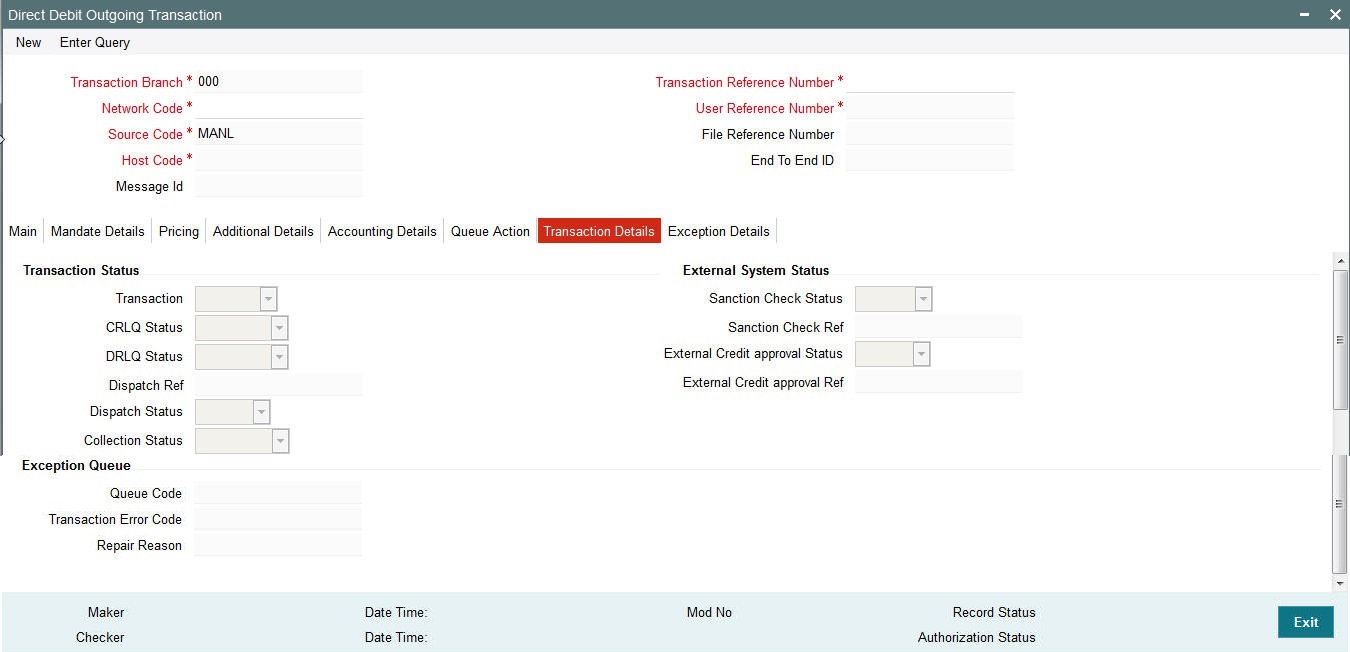

2.2.1.7 Transaction Details

Click the Transaction Details tab in the Direct Debit Outgoing Transaction screen.:

You can view the below status for a Direct Debit transaction from Transaction Details tab:

- Transaction status

- CRLQ status - indicates the credit accounting liquidation status

- DRLQ status – indicates the debit accounting liquidation status

- Dispatch status

- Collection status

Status of External system checks will be available for sanction check and external credit approval with related reference numbers.

Exception queue code and Error code details are available under Exception Queue status.

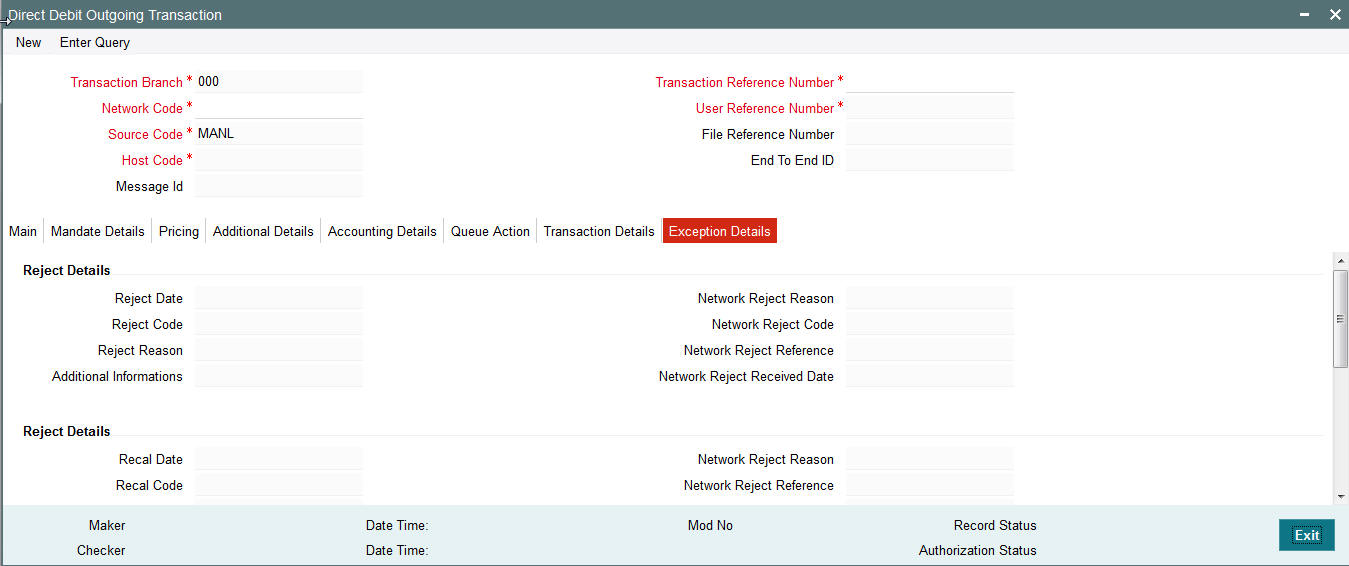

2.2.1.8 Exception Details

Click the Exception Details tab in the Direct Debit Outgoing Transaction screen.:

Exception transactions are not currently supported.

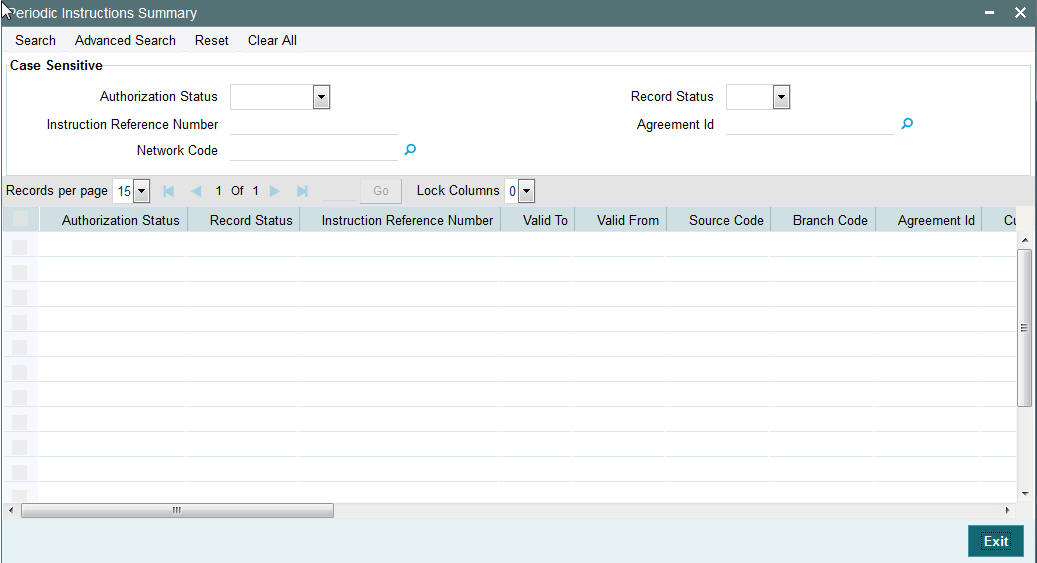

2.2.1.9 Direct Debit Outgoing Transaction Summary

You can invoke the ‘Direct Debit Outgoing Transaction Summary’ screen by typing ‘PCSAOTXN’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Transaction Reference Number

- Host Code

- Transaction

- Collection Status

- Source Code

- Transaction Branch

- Transfer Currency

- Transfer Amount

- Value Date

- Instruction Date

- Booking Date

- Network Code

- File Reference Number

- DRLQ Status

- CRLQ Status

- Debtor Account IBAN

- Creditor Account IBAN

- Debtor Account Number

- Creditor Account Number

- Queue Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Periodic Instruction maintenance screen. You can also export the details of selected records to a file using ‘Export’ button.

2.2.2 Saving of an Outgoing Direct Debit Transaction

The system performs the following mandatory field checks and the referential checks during the enrich/ save of outgoing direct debit transaction.

- Bank Redirection

- System validates if there are any redirection bank code maintained for the Debtor Bank Code, Indirect participant bank code and if there is, system replaces the original bank code with redirected bank code

- Any exception during this is logged into Transaction Repair Queue.

- Applicable only for upload and webservices.

- Account Redirection

- System validates if there is any redirection account maintained for the Creditor account specified for an Outgoing DD transaction initiated from current processing branch. If there is, system replaces the original creditor account with redirected account number.

- Any exception during this is logged into Transaction Repair Queue.

- Applicable only for upload and webservices

- Verify Book Transfer (Y/N)

- System marks the Book Transfer flag as ‘Y’ if both the Creditor agent bank code and Debtor agent bank code are same as the current processing branch bank code (or) if both creditor account and debtor account are held with current processing branch bank code. Else this flag is not marked.

- Transactional Validations

- Verify if Instruction date/Collection date" minus current system date is greater than or equal to First Collection receipt days (maintained in Network DD preferences) in case of FRST/OOFF & Recurrent collection receipt days in case of RCUR/FNAL. Else transaction is prompted with appropriate error message and is not booked.

- For an outgoing DD transaction, the debit account currency and credit account currency is the same as Transfer currency.

- Creditor account field is verified to check if it is valid and existing with appropriate status.

- Debtor bank code, Creditor bank code, Direct Participant bank code fields are validated based on the Local bank code clearing maintenance.

- Field Transfer Amount & Value Date should not be null and Field Transfer amount specified in the transaction should be within the limit amount provided in Network DD Preferences.

- If the ‘Value Date’ falls on a Network Holiday, then Value date is moved to next working date and the date instructed in the direct debit request is stored under ‘Original Value Date’.

- Processing Dates Resolution

- Activation date is derived based on the value date specified in the transaction. If Value date falls on a holiday, system derives the next network working day as the Activation date.

- Dispatch date is derived based on the sequence type specified in the transaction.

- Debit/Credit Account Resolution

- Debit account and Credit account details is derived based on the liquidation accounting codes maintained in Network DD Preferences. If the current processing branch bank code is an indirect participant of the network, then debit account is derived from the Indirect Participant Account Maintenance for the specified indirect participant bank code.

- If an outgoing DD transaction is amended on behalf of an indirect participant bank code (i.e, pass through DD transaction), then system derives the credit account from the Indirect Participant Account Maintenance for the specified indirect participant bank code.

- If an outgoing DD transaction is identified as a Book transfer, then the debit account and credit account details are fetched from the pre-defined network ‘BOOK’ maintained in the Network DD preferences.

If any of the below validation fails, then the transaction is rejected with an error code.

Following fields are mandatory for requesting Outgoing Direct Debit transaction:

- Host Code

- Network Code

- Creditor Bank Code

- Creditor Account (or Creditor IBAN,if IBAN is mandatory for the Network)

- Debtor Bank Code

- Debtor Account (or Debtor IBAN,if IBAN is mandatory for the Network)

- Debtor Name

- Transfer Currency

- Transfer Amount

- Value Date

- Mandate Id

If the source code is not MANL, then it is mandatory to specify the Source reference number.

Customer/Account status validation is done based on the status details available in External Customer maintenance/External Account maintenance.

Holiday check for instruction date is done based on the local branch holidays maintained.

Any validation failure from user interface screen throws error on transaction saving. You can check the error details from the respective error message displayed and can take remedial action before re-submitting.

2.2.3 Authorization of an Outgoing Direct Debit Transaction

The transaction authorization process involves the following steps:

- Mandate Check – System will validate the Mandate ID details provided in the Outgoing DD transaction with Mandate ID maintained in Creditor Mandate provided in the DD outgoing contract. In case of any exceptions, the transaction is moved to Business Override Queue.

- Network related validations

- Debtor/ creditor/Bank/Additional details entered for a payment transaction is validated against valid characters allowed for the network. SEPA character validations are currently supported.

- If fields contain any invalid SEPA character, then the transaction is moved to Repair queue with error details.

- IBAN check

- If ‘IBAN validation required’ flag is checked for the network, then IBAN verification for Debtor IBAN, Creditor IBAN & creditor BIC is done against the IBAN format maintained for the respective country.

- IBAN is validated based on IBAN Information maintenance (ISDESBAN) available for the country for the following parameters:

● IBAN Length

● Check digit of the IBAN

● National ID of the IBAN

- If IBAN check fails transaction is moved to Repair Queue.

- Duplicate check

- Duplicate checks are done during transaction processing.

- This involves identification of duplicate transactions done for a period as maintained in Host Code level for a network and transaction type combination.

- If there are any matching transactions with the fields identical with the transaction being processed, the original transaction is identified and linked to this transaction.

- The transaction is moved to Business Override Queue for further investigation In case of a duplicate transaction.

- Duplicate transactions are listed as part of the override message for duplicate check. The override details can be viewed from BO queue.

- Transaction cutoff time check

- System validates the cut-off time, defined in the cut-off maintenance based on the wild card sequence.

- In case of transactions breaching the cut off time, system moves the activation date and value date.

- Sanction check

- Sanction check for an outgoing DD transaction is done only on activation date in synchronous mode.

- System verifies whether sanction check system is applicable in Host Code Preferences Maintenance, for outgoing transaction type and initiates sanction check validation.

- Out queue name for sending the sanction check relevant transaction details and In queue name for the response is fetched from ‘Sanction Check System’ maintenance.

- Sanction Check system provides a response for the request. This response updates contract’s sanction check status of the payment and the response date in the sanction check master details.

- If the sanction check response status for a outgoing DD transaction is ‘Approved’, then further processing continues.

- If the contract’s sanction check response status is ’Override’ or ’Rejected’ or ‘Timed Out’, then transaction is logged in ‘Sanction Check Exception Queue. Processing of the transaction is stopped at this stage.

- If sanction check is not required at Network preferences, then the payment’s sanction check status remains as Null and no information is placed in the sanction check queue.

- Computation of Charge and Tax

- Charge and tax for outgoing DD transaction is calculated based on the Pricing Code linked to Network DD preferences.

Note

Charge computation at this stage is applicable for transaction received from SOAP/REST web services. Charges for transactions entered from UI screen is computed during enrichment/save.

- Pricing components applicable to the price code and the attributes like whether the component is a charge or tax, Pricing currency and the exchange rate type are derived from Pricing Code maintenance (PPDCDMNT).

- System derives the debit customer from ECA-CIF Account Mapping maintenance.

- Customer service model linked to the customer is obtained from Service model

- Customer Linkage maintenance (PMDCSMLK).

- Charge components are processed prior to tax components involved.

- Tax amount is computed based on component value which is linked as basis element in price code. Tax rate is applied on the charge amount calculated. If charge currency and tax currency are different, then charge amount which is the basis for tax is converted in tax currency using mid rate of the exchange rate type linked to the tax component.

- If waiver flag is checked for a charge component, component charge amount is still calculated. This amount is further awaited and cannot be recovered from debit account.

- If a charge component is waived, the related tax gets calculated. Application of this tax is based on the waiver flag at tax component level.

- Customer debit amount for charge/ tax is computed based on the credit account currency involved. If charge/tax currency is different from credit account currency, then currency conversion is done using mid-rate of the exchange rate type linked to the component.

- Component wise charge/tax currency, amount, debit currency, debit amount and waiver flag value is stored for the transaction.

- Dispatch

- Once processed, system logs the Outgoing DD transaction data in the message table for pacs.003 generation.

- Support is available for bulk dispatch of pacs.003 message in EBA IDF file format to an Direct participant bank code (if processing branch is an indirect participant) or to CSM directly (if the processing bank is a direct SEPA participant).

- Once the message is dispatched, the corresponding transactions in the file is updated with Contract status as ‘Active’ and Collection status as ‘Outstanding’

- Consolidated credit amount is computed based on the transactions sent in same dispatch file.

- System create multiple bulks based on the Instruction date (Interbank settlement date) in a single IDF file.

- Dispatch accounting entries is triggered based on every message id and dispatch reference no combination with dispatch accounting code.

- Notifications

- Following notifications will be supported for Outgoing DD transactions:

Notification Code Tag Details Text PM_DD_CR_1 -Credit Notification for outgoing DD individual requests-On Credit Liquidation Credit Account Account <Credit Account>is credited for <Credit Currency >,<Credit Amount> on <Credit Liquidation Date> for Payment Reference Number<Transaction Reference Number>. Charge or Tax component amount deducted details are <Charge Currency> <Charge Amount> Credit currency Credit Amount Credit liquidation date Transaction Reference number Charge/Tax debit amount Charge/Tax debit currency Account <Credit Account>is credited for <Credit Currency >,<Credit Amount> on <Credit Liquidation Date> for Payment Reference Number<Transaction Reference Number>. Charge or Tax component amount deducteddetails are <Charge Currency> <Charge Amount> Transfer Currency Payment initiation request received for <Transfer currency> <Transfer Amount> to debit <Debtor Account><Debtor Name> with<Debtor Bank Name> on <Booking Date>with <Value Date>Payment reference number is <Transaction reference number> Transfer Amount Debtor Account Debtor Name Debtor Bank Name Booking Date Value Date Transaction Reference Number PM_DD_DS_1 -Notification for outgoing direct debit individual requests dispatched Transfer Currency <Network Description> Payment for <Transfer currency> <Transfer Amount> to debit <Debtor Account><Debtor Name> with<Debtor Bank Name> is sent on <Dispatch Date> with <Value Date>Payment reference number is <Transaction reference number> Transfer Amount Debtor Account Debtor Name Debtor Bank Name Booking Date Value Date Transaction Reference Number Network Description PM_DD_CL_1 For Creditor on auto/manual cancellation of DD request on SC rejection Transaction number, transfer currency, transfer amount Payment Transaction No.<> for <Transfer currency> <Transfer Amount> is cancelled as sanction check failed - Debit /Credit Accounting

- BOD batch job of DD picks all the outgoing DD transactions with Collection status as ‘Pending’ and Value date as current application date and post the debit/credit liquidation entries.

- Accounting details are handed off to accounting system with debit/credit liquidation accounting code linked at Network DD preferences.

- Additionally, charge/tax details is handed off along with the credit liquidation details.

- Once debit/credit liquidation is processed for an outgoing DD transaction, system updates the Contract status as ‘Success’ and Collection Status as ‘Approved’

2.2.4 Direct Debit Incoming Transaction

Direct debit Incoming transactions can be created based on the upload of incoming DNF file received from Clearing Network or using Direct Debit Incoming Transaction screen.

The UI screen will be used to capture the details of incoming DD request received from creditor bank, if STP processing fails during Incoming contract creation.

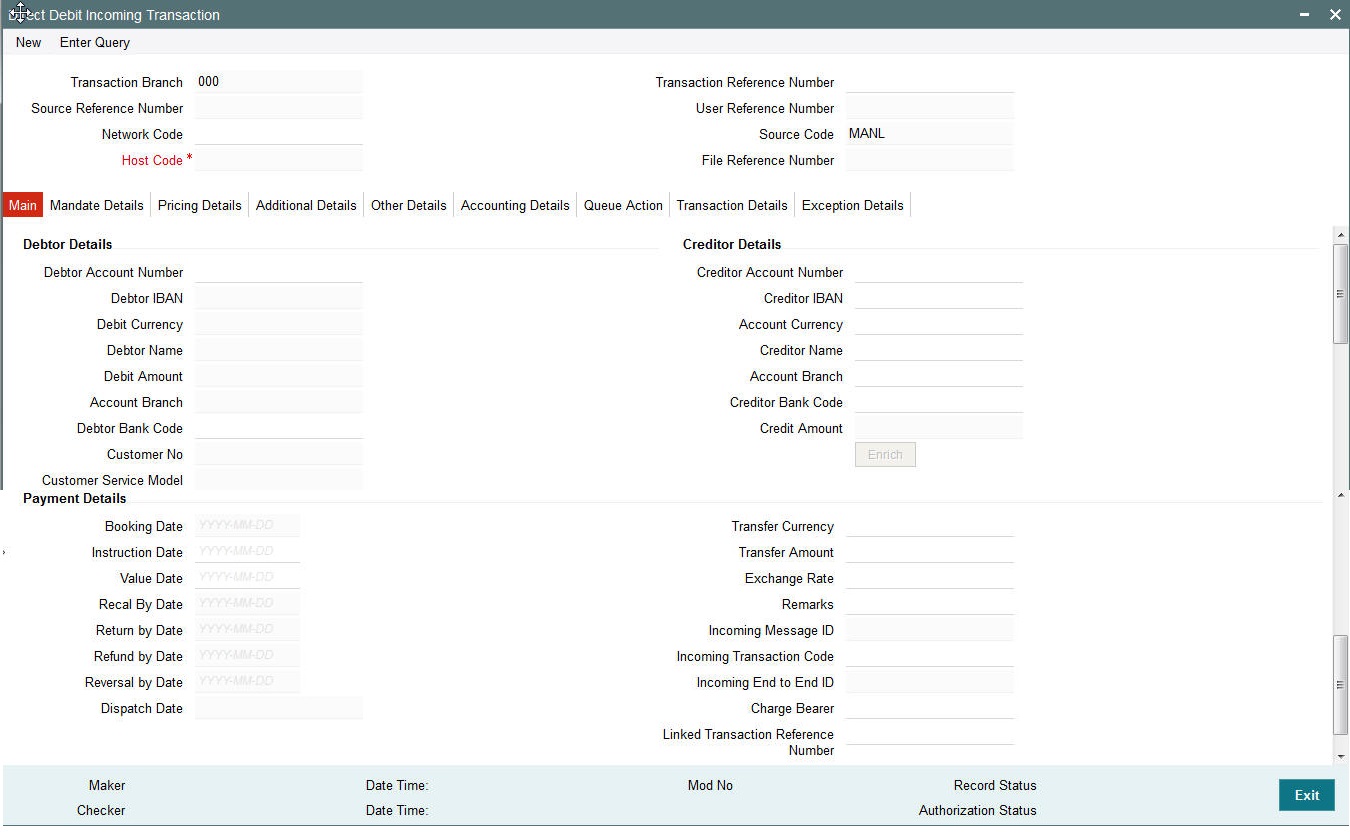

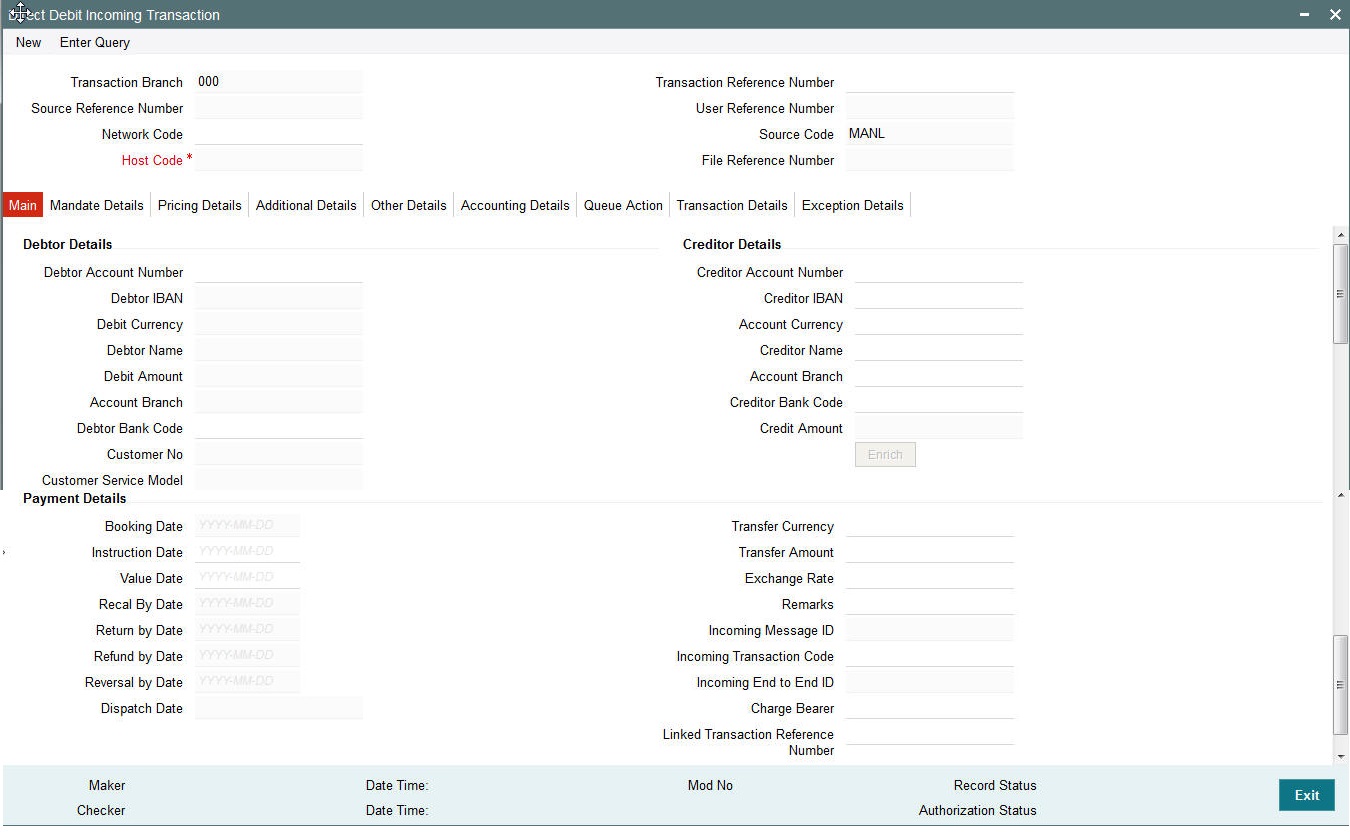

You can invoke ‘Direct Debit Incoming Transaction Input’ screen by typing ‘PCDAITXN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can specify the following fields:

Transaction Branch

This field is defaulted as customer’s logged in branch.

Host Code

Indicates the host code that is linked to the transaction branch of the customer.

Host Description

The system displays the description of the Host code.

Source Code

The system displays the default source code 'MANL' for manually entered transactions.

Network Code

Select an appropriate Network code for the transaction.

Network Description

The system displays the description of the Network code selected.

Transaction Reference Number

Indicates a unique identifier of the Direct Debit transaction and it is auto-generated.

User Reference Number

This field is defaulted as transaction reference number.You can amend the field to specify the user reference number.

File Reference Number

You can enter the incoming file reference number.

2.2.4.1 Main Tab

You can specify the following field details in the Main tab:

Debtor Details

Debtor Account Number

Select the Debtor’s account held with Debtor bank.

Debtor IBAN

Specify the Debtor IBAN No held with Debtor bank.

Account Currency

This field is defaulted as the currency of the Debtor account.

Account Branch

This field is defaulted as the account branch of the debit account selected.

Debtor Name

Debtor name is defaulted based on the debit account selected.

Debtor Bank Code

Specify the bank code of the Debtor bank.

Creditor Details

Creditor Account Number

Specify the Creditor’s Account held with Creditor bank.

Creditor Name

The system displays the Account Name based on the selected Creditor Account Number.

Account IBAN

Specify the Creditor Account IBAN maintained with Creditor Bank.

Creditor Bank Code

Specify the bank code of the Creditor Bank.

Account Currency

The currency of the account.

Credit Amount

This field populates the Transfer Amount field. If Creditor account currency is different from the transfer amount currency then, exchange rate is applied.

Debtor Details

Address 1

Specify the information that locates and identifies a specific address, as defined by postal services.

Address 2

Information that locates and identifies a specific address, as defined by postal services.

Country Code

Specify the country code of the Debtor.

Address Type

Specify the nature of the postal address.

Department

Specify the identification of a sub-division of a large organisation or building.

Sub Department

Specify the nature of the postal address.

Street Name

Specifies the name of the street

Building Number

Specify a group of letters and/or numbers that is added to a postal address to assist the sorting of mail.

Post Code

Specifies the postal code.

Town Name

Specifies the name of the town.

Country Subdivision

Indicates how to contact the party.

Contact Details

Specifies the nature of the postal address.

Debtor Id type

Indicates the ID of the Debtor.

Payment Details

Booking Date

This field identifies the date on which the transaction is booked. By default it populates the current application date.

Instruction Date

This field identifies the original value date that was provided by the creditor during the instruction.

Value Date

This fields identifies the date on which the transfer to be made.

Dispatch Date

Specify the dispatch date of the payment.

Return by Date

Specify the date by which the return must be executed.

Refund by Date

Specify the date by which the refund must be executed.

Recal by Date

Specify the date by which the recall must be executed.

Reversal by Date

Specify the date by which the reversal must be executed.

Transfer Currency

Specify the currency in which the transfer is initiated.

Transfer Amount

Specify the amount to be transferred.

Exchange Rate

Specify the exchange rate.

Remarks

Specify any remarks, if any.

Book Transfer

Check this box to initiate a book transfer.

Linked Transaction Reference Number

Specify the reference number of the linked transaction.

Incoming Message Id

Specifies the Point to point reference, as assigned by the instructing party, and sent to the next party in the chain to unambiguously identify the message.

Incoming Transaction Id

Specifies the Unique identification, as assigned by the first instructing agent, to unambiguously identify the transaction that is passed on, unchanged, throughout the entire interbank chain.

Incoming End to End Id

A customer reference that must be passed on in the end-to-end payment chain. In the event that no reference was given, ‘NOTPROVIDED’ must be used.

Charge Bearer

Specify the Charge Bearer details.

2.2.4.2 Mandate Details Tab

Click Mandate Details tab from the Direct Debit Incoming Transaction screen.:

You can specify the following fields:

Mandate Details

Date of Signature

Indicates the date on which the mandate was signed by debtor. This is defaulted based on the mandate ID selected.

Sequence Type

Select the required sequence type. Valid values are:

- First Collection

- Final Collection

- One Off Transaction

- Recurring Transaction

Original Mandate Id

Specify the identification of the original mandate. This field indicates the original mandate ID as assigned by the creditor, to identify the original mandate maintained. This field is mandatory if changes occur in ‘Mandate Identification’, otherwise not to be used.

Original Debtor Bank

Specify the details of the Original Debtor Bank.

Final Collection Date

Specify the final collection date.

Original Debtor Agent Account Number

Specify the account number of the Original Debtor Agent.

Original Debtor Account Number

Specify the account number of the Original Debtor.

Amend Indicator

This Indicator is for notifying whether the underlying mandate is amended or not. Check this box if amendment is applicable.

Electronic Signature

Specify the electronic signature details.

Mandate Id

Specify the identification of the mandate.

Original Debtor Account

Specify the account details of the Original Debtor.

First Collection Date

Specify the date of first collection.

Original Debtor Agent Bank BIC

Specify the BIC of the original Debtor Agent Bank.

Original Debtor Bank BIC

Specify the BIC of the original Debtor Agent Bank.

Original Final Collection Date

Specify the date of the Original Final Collection Date.

Creditor Scheme Details

Scheme Id

Specify the identification of the creditor scheme.

Scheme Id Type

Specify the type of Scheme identification.

Scheme Type

Specify the type of scheme.

Scheme Value

Specify the value of the creditor scheme.

Original Creditor Scheme Details

Original Creditor Scheme details are required if changes occur in ‘Creditor Scheme ID or Name', otherwise not to be used

Scheme Name

Specify the name of the Original Creditor Scheme.

Original Creditor Agent BIC

Specify the BIC of the Original Creditor Agent.

Original Creditor Agent Account

Specify the account details of the Original Creditor Agent.

Scheme Id

Specify the identification of the Original Creditor Scheme.

Scheme Id Type

Specify the type of Scheme identification.

Original Creditor Scheme Type

Specify the type of Original Creditor Scheme.

Scheme Value

Specify the value of the Original Creditor Scheme.

Address 1

Specify the first line of the address of the Original Creditor.

Address 2

Specify the second line of the address of the Original Creditor.

Country

Specify the country of the Original Creditor.

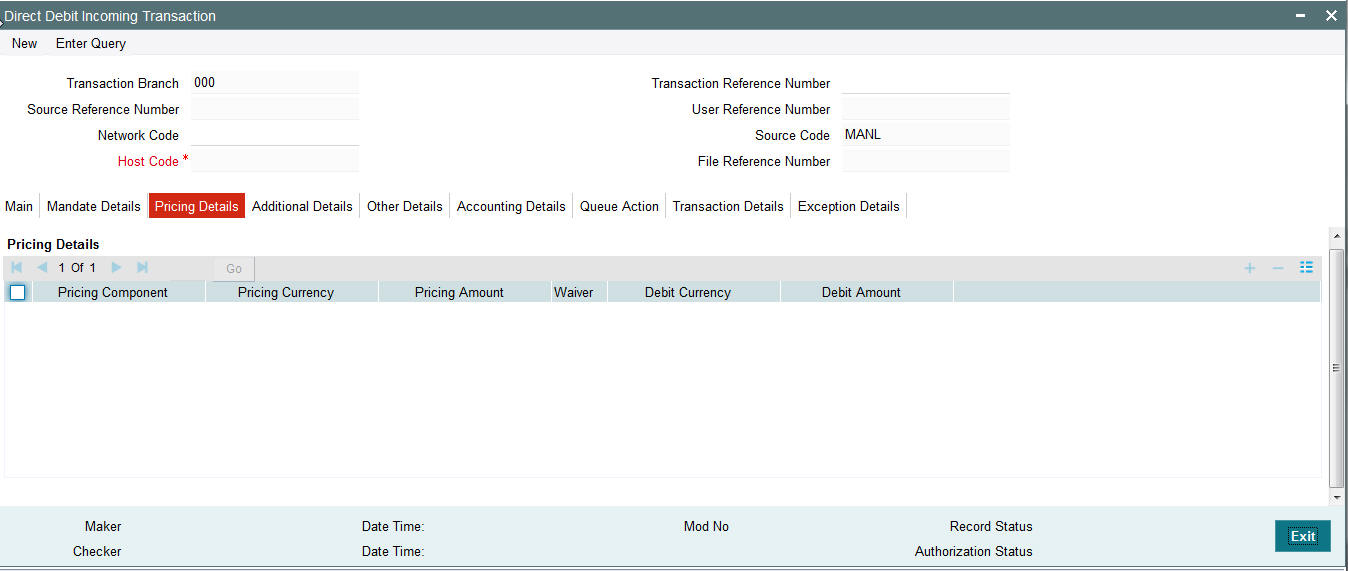

2.2.4.3 Pricing Tab

Click the Pricing tab from the Direct Debit Incoming Transaction screen.:

You can view the charge/tax details derived for the transaction in Pricing tab.You can amend the price values/waiver flag, if required.

Pricing Component

This field indicates the pricing component derived for the DD transaction.

Pricing Currency

Indicates the pricing currency of the component.

Pricing Amount

Specifies the fixed or calculated charge amount using the Pricing Value Maintenance. You can edit this field to a non-zero value.

Waiver

Check this box to select the charge component to waive the associated charges.

Debit Currency

Indicates the currency of the debit account.

Debit Amount

Indicates the amount debited to the selected debit amount.

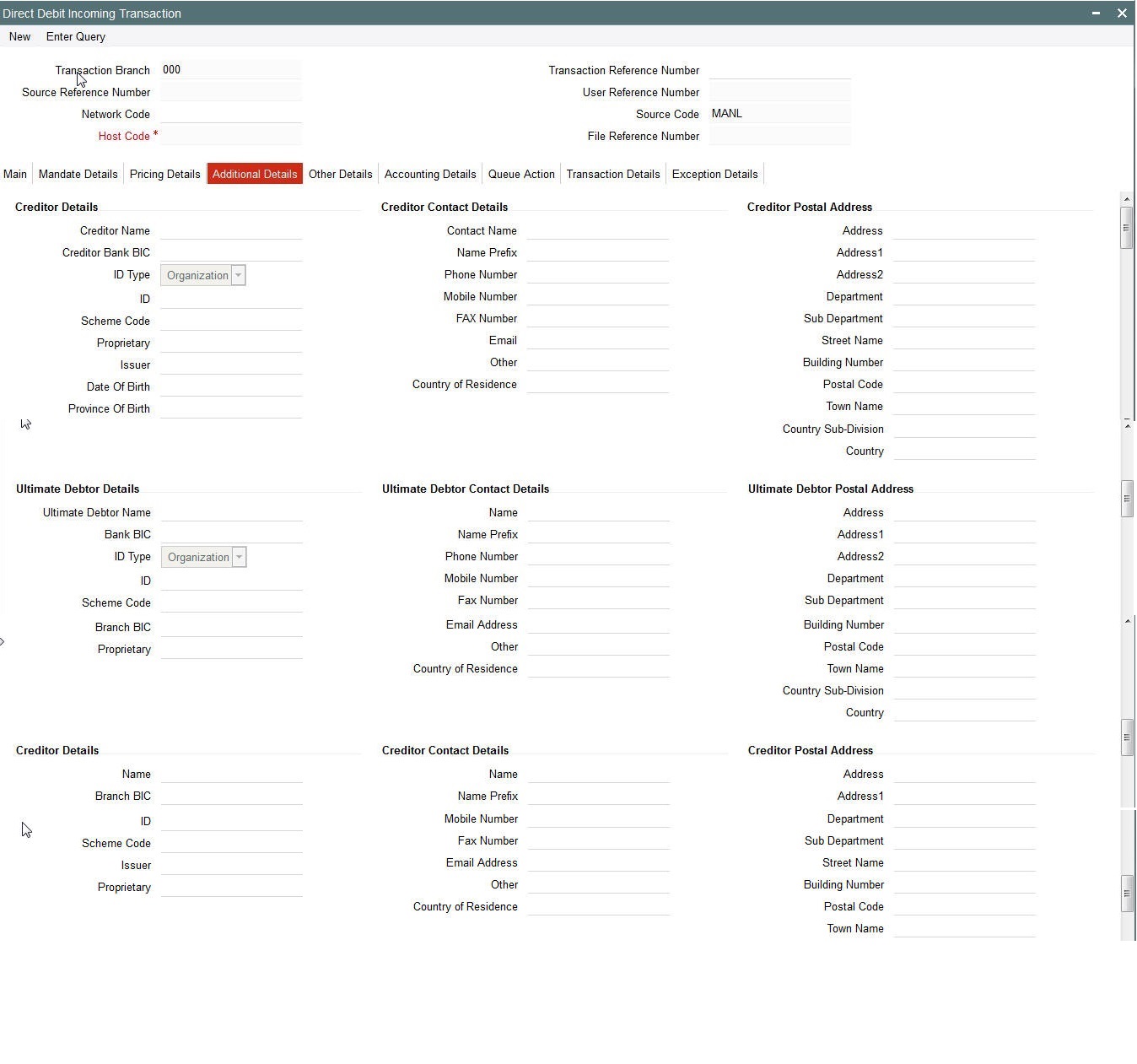

2.2.4.4 Additional Details

Click the Additional Details tab in the Direct Debit Incoming Transaction screen.:

You can specify the following fields:

Debtor Details

Debtor Name

Specify the name of the debtor.

Branch BIC

Specify the Branch BIC of the debtor.

Id Type

Specify the type of identification.

ID

Specify the identification of the Debtor.

Scheme Code

Specify the Scheme Code of the Debtor.

Issuer

Specify the Issuer of the Debtor.

Proprietary

Specify the Proprietary details of the Debtor.

Debtor Contact Details

Contact Name

Specify the Contact Name of the Debtor.

Name Prefix

Specify the prefix name of the Debtor.

Phone Number

Specify the phone number of the Debtor.

Mobile Number

Specify the mobile number of the Debtor.

Fax Number

Specify the fax number of the Debtor.

Email Address

Specify the mailing address of the Debtor.

Other

Specify any other details of the Debtor.

Country of Residence

Specify the country of residence of the Debtor.

Debtor Postal Details

Address

Select the address of the Debtor.

Address 1 through to Address 2

Select the address of the Debtor in the two lines provided.

Department

Specify the department of the Debtor.

Sub Department

Specify the sub department of the Debtor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the debtor.

Ultimate Debtor Details

Ultimate Debtor Name

Specify the name of the Ultimate Debtor.

Bank BIC

Specify the Bank BIC.

ID Type

Specify the type of identification.

ID

Specify the identification.

Scheme Code

Specify the scheme code details.

Branch BIC

Specify the Branch BIC.

Proprietary

Specify the Ultimate Debtor proprietary information.

Ultimate Debtor Contact Details

Contact Name

Specify the Contact Name of the Ultimate Debtor.

Name Prefix

Specify the prefix name of the Ultimate Debtor.

Phone Number

Specify the phone number of the Ultimate Debtor.

Mobile Number

Specify the mobile number of the Ultimate Debtor.

Fax Number

Specify the fax number of the Ultimate Debtor.

Email Address

Specify the mailing address of the Ultimate Debtor.

Other

Specify any other details of the Ultimate Debtor.

Country of Residence

Specify the country of Residence of the Ultimate Debtor.

Ultimate Debtor Postal Details

Address

Select the address of the Ultimate Debtor.

Address 1 through to Address 2

Select the address of the Ultimate Debtor in the two lines provided.

Department

Specify the department of the Ultimate Debtor.

Sub Department

Specify the sub department of the Ultimate Debtor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the Creditor.

Creditor Details

Creditor Name

Specify the name of the Creditor.

Branch BIC

Specify the Branch BIC of the Creditor.

Id Type

Specify the type of identification.

ID

Specify the identification of the Creditor.

Scheme Code

Specify the Scheme Code of the Creditor.

Issuer

Specify the Issuer of the Creditor.

Proprietary

Specify the Proprietary details of the Creditor.

Creditor Contact Details

Contact Name

Specify the Contact Name of the Creditor.

Name Prefix

Specify the prefix name of the Creditor.

Phone Number

Specify the phone number of the Creditor.

Mobile Number

Specify the mobile number of the Creditor.

Fax Number

Specify the fax number of the Creditor.

Email Address

Specify the mailing address of the Creditor.

Other

Specify any other details of the Creditor.

Country of Residence

Specify the country of residence of the Creditor.

Creditor Postal Details

Address

Select the address of the Creditor.

Address 1 through to Address 2

Select the address of the Creditor in the two lines provided.

Department

Specify the department of the Creditor.

Sub Department

Specify the sub department of the Creditor.

Building Number

Specify the building number.

Postal Code

Specify the postal code.

Town Name

Specify the name of the town.

Country Sub-Division

Specify the country sub-division.

Country

Specify the country of the Creditor.

Ultimate Creditor Details

Ultimate Creditor ID Type

Specify the type of Identification

Ultimate Creditor ID

Id of Ultimate party that owes an amount of money to the (ultimate) Debtor.

Address 1

Specify the information that locates and identifies a specific address, as defined by postal services.

Address 2

Information that locates and identifies a specific address, as defined by postal services.

Country Code

Specify the country code of the ultimate debtor.

Ultimate Debtor Details

Ultimate Debtor ID Type

Specify the type of Identification

Ultimate Debtor ID

Id of Ultimate party that owes an amount of money to the (ultimate) creditor.

Name

Name of Ultimate party that owes an amount of money to the (ultimate) creditor..

Address 1

Specify the information that locates and identifies a specific address, as defined by postal services.

Address 2

Information that locates and identifies a specific address, as defined by postal services.

Country

Specify the country code of the ultimate debtor.

Contact Details

Specify the Indicates the details to contact the ultimate debtor.

Other Details Tab

Specify the following fields:

Agent Details

Initiating Party

Specify the Party that initiates the transaction

Instructing Agent BIC

Select the Agent that instructs the next party in the chain to carry out the (set of) instruction(s).Allows you to select a valid bank code BIC from list of values.

Instructed Agent BIC

Select the Agent that is instructed by the previous party in the chain to carry out the (set of) instruction(s). Allows you to select a valid bank code BIC from list of values.

Intermediary Agent1BIC

Select the Agent between the debtor's agent and the creditor's agent.

Allows you to select a valid bank code BIC from list of values If more than one intermediary agent is present, then IntermediaryAgent1 identifies the agent between the Debtor Agent and the IntermediaryAgent2.

Intermediary Agent 1 Account No

Specify the Account no of Intermediary Agent 1 BIC.

Intermediary Agent 2 BIC

Select the agent between the debtor's agent and the creditor's agent.

Allows you to select a valid bank code BIC from list of values If more than two intermediary agents are present, then IntermediaryAgent2 identifies the agent between the IntermediaryAgent1 and the IntermediaryAgent3.

Intermediary Agent 2 Account No

Specify the Account number of Intermediary Agent 2 BIC.

Intermediary Agent 3 BIC

Select the agent between the debtor's agent and the creditor's agent.

Allow to select a valid bank code BIC from list of values If IntermediaryAgent3 is present, then it identifies the agent between the intermediary agent 2 and the debtor agent.

Intermediary Agent 3 Account No

Specify the Account number of Intermediary Agent 3 BIC.

Purpose Details

Purpose Code

Select the underlying reason for the DD transaction using Code.

Purpose Value

Specify the underlying reason for the DD transaction using value.

Local Instrument Code

Displays the local instrument, as published in an external local instrument code list.

Service Level Code

Displays a pre-agreed service or level of service between the parties, as published in an external service level code list.

By default SEPA for SDD transaction is defaulted from the SEPA DD network.

Regulatory Reporting

Specify the Information needed due to regulatory and statutory requirements.

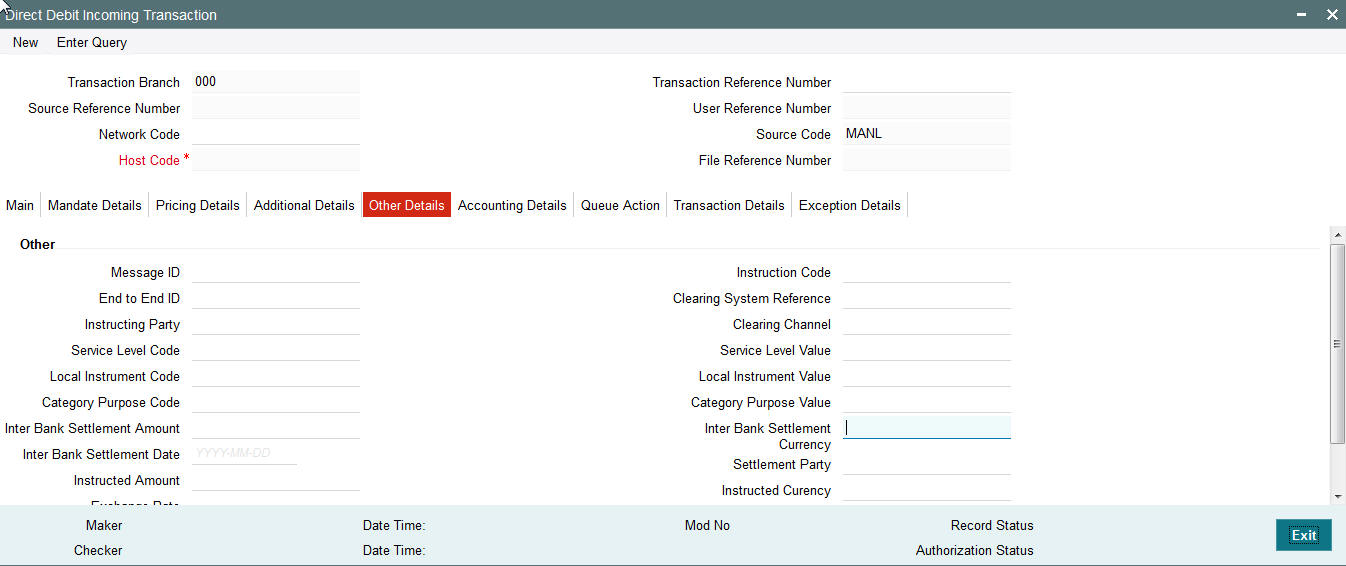

2.2.4.5 Other Details

Click the Other Details tab in the Direct Debit Incoming Transaction screen.:

You can specify the following fields:

Message ID

Specify the message identification.

End to End ID

Specify the end to end identification

Instructing Party

Specify the instructing party details.

Service Level Code

Specify the Service Level Code.

Local Instrument Code

Specify the local instrument code.

Category Purpose Code

Specify the category purpose code.

Inter Bank Settlement Amount

Specify the Inter bank Settlement Amount.

Inter Bank Settlement Date

Specify the Inter Bank Settlement Date.

Instructed Amount

Specify the Instructed Amount

Exchange Rate

Specify the Exchange Rate

Instruction Code

Specify the Instruction Code

Clearing System Reference

Specify the Clearing System Reference.

Clearing Channel

Specify the Clearing Channel.

Service Level Value

Specify the Service Level Value.

Local Instrument Value

Specify the Local Instrument Value.

Category Purpose Value

Specify the Category Purpose Value

Local Instrument Value

Specify the Local Instrument Value.

Inter Bank Settlement Currency

Specify the Inter Bank Settlement Currency.

Settlement Party

Specify the Settlement Party details.

Instructed Currency

Specify the Instructed Currency.

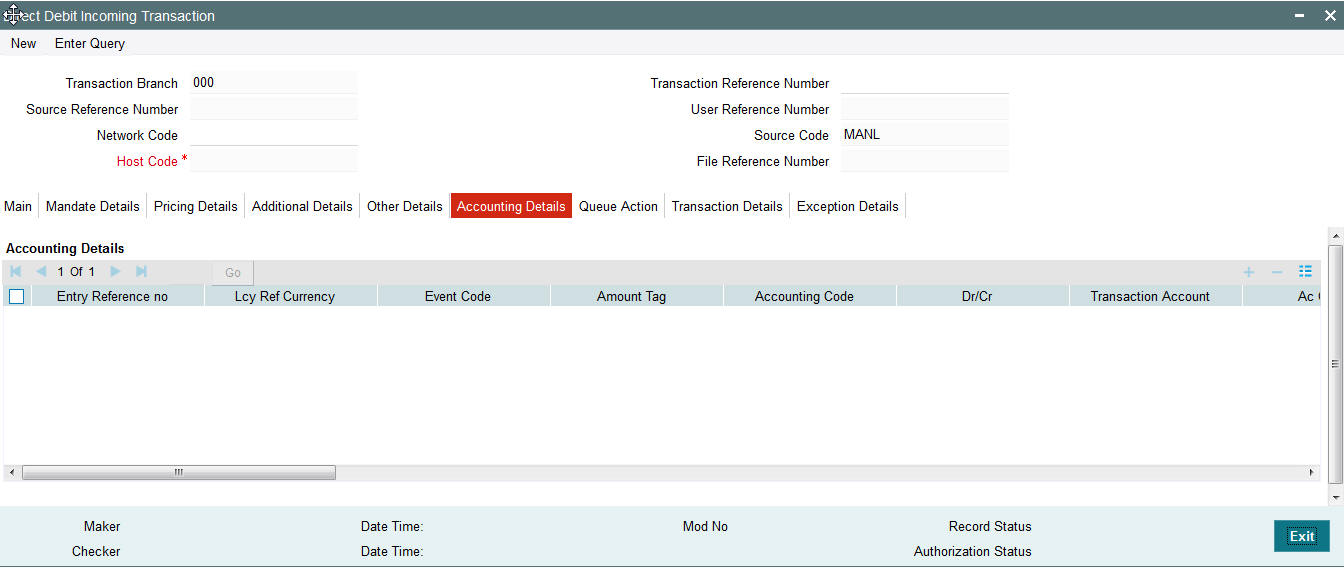

2.2.4.6 Accounting Details

Click the Accounting Details tab in the Direct Debit Incoming Transaction screen.:

If accounting entries are posted for a transaction you can view the details from the Accounting Details tab.

2.2.4.7 Queue Action Details

Click the Queue Action tab in the Direct Debit Incoming Transaction screen.:

Queue actions done for a transaction can be viewed from Queue Action tab.

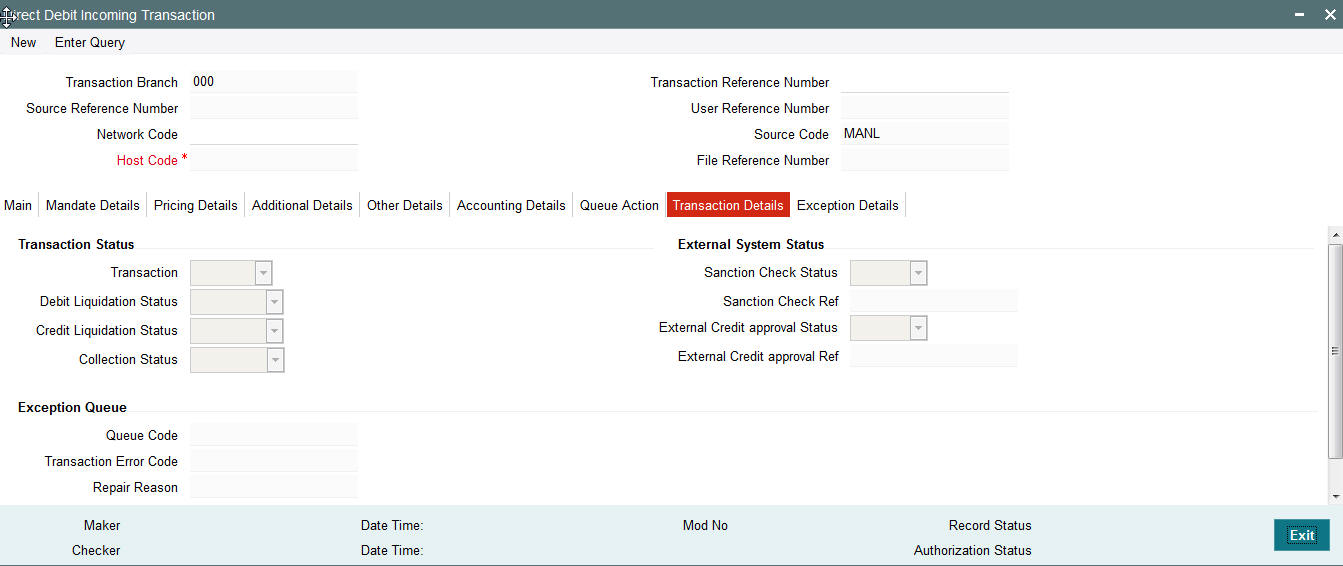

2.2.4.8 Transaction Details

Click the Transaction Details tab in the Direct Debit Incoming Transaction screen.:

You can view the below status for a Direct Debit transaction from Transaction Details tab:

- Transaction status

- CRLQ status - indicates the credit accounting liquidation status

- DRLQ status – indicates the debit accounting liquidation status

- Dispatch status

- Collection status

Status of External system checks will be available for sanction check and external credit approval with related reference numbers.

Exception queue code and Error code details are available under Exception Queue status.

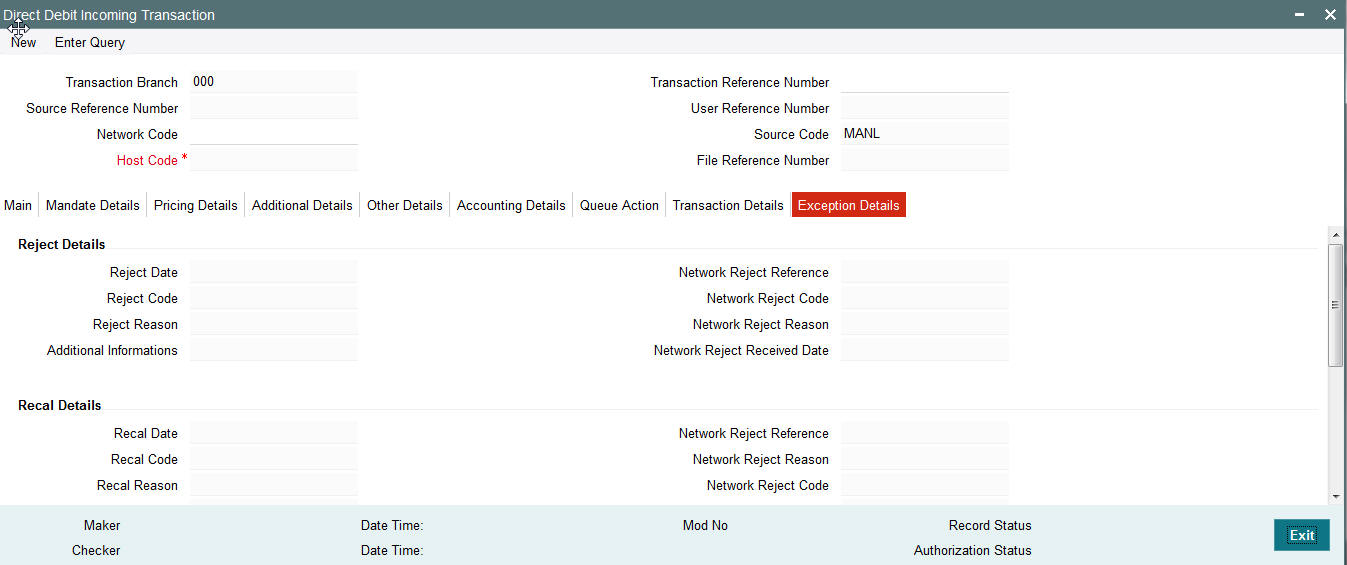

2.2.4.9 Exception Details

Click the Exception Details tab in the Direct Debit Incoming Transaction screen.:

Exception transactions are not currently supported.

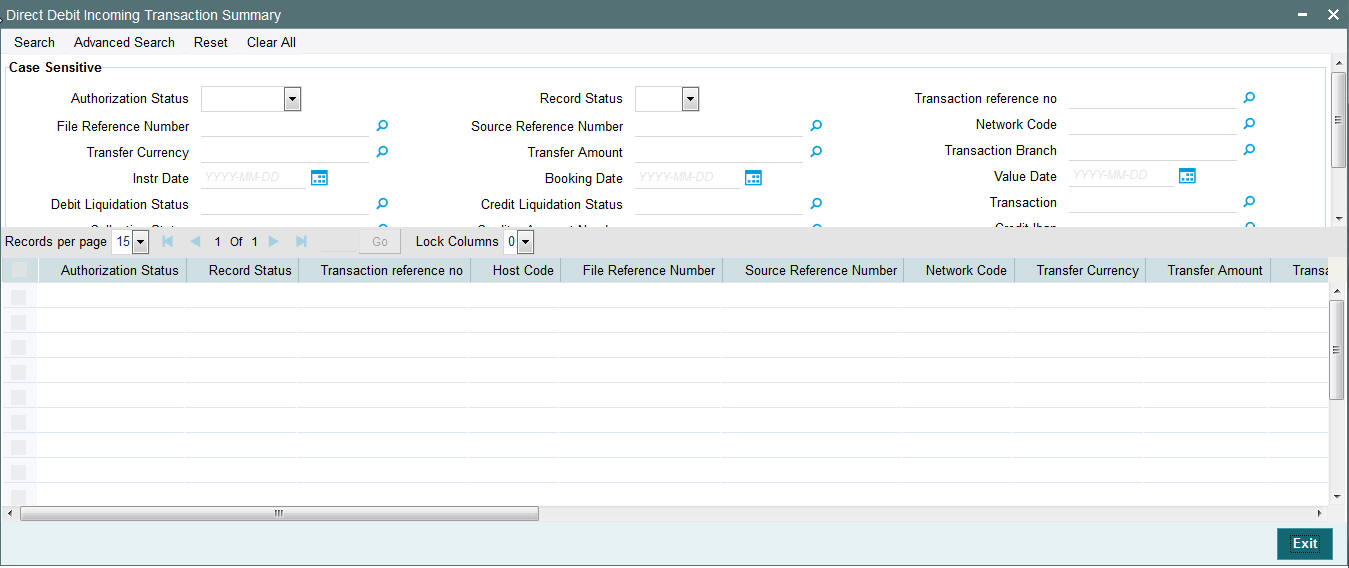

2.2.4.10 Direct Debit Incoming Transaction Summary

You can invoke the ‘Direct Debit Incoming Transaction Summary’ screen by typing ‘PCSAOTXN’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.

You can search using one or more of the following parameters:

- Authorization Status

- Record Status

- Transaction Reference Number

- Host Code

- Transaction

- Collection Status

- Source Code

- Transaction Branch

- Transfer Currency

- Transfer Amount

- Value Date

- Instruction Date

- Booking Date

- Network Code

- File Reference Number

- DRLQ Status

- CRLQ Status

- Debtor Account IBAN

- Creditor Account IBAN

- Debtor Account Number

- Creditor Account Number

- Queue Code

Once you have specified the search parameters, click ‘Execute Query’ button. The system displays the records that match the search criteria.

Double click a record to view the detailed Direct Debit Incoming Transaction screen. You can also export the details of selected records to a file using ‘Export’ button.

2.2.4.11 Incoming Direct Debit Processing

- Incoming direct debit requests are received through CSM or through direct participant of the network.

- DNF files received either from CSM(EBA STEP2) or through direct participant bank code containing pacs.003 messages is read through DD background batch job from the designated folder.

- This batch job performs the de-bulking process and populates the individual transaction details of the message into staging table.

- A set of transactions uploaded from a single file is identified using a unique File reference number.

- Receipt file accounting is triggered on the Interbank settlement date for every DNF file based on the Message ID and File reference no combination using RCLG event code.

- On upload of such pacs.003 messages in staging table, system creates an Incoming DD transaction with Payment type as ‘Direct Debits’ and Transaction type as ‘Incoming’ along with branch and network resolution.

- Transaction booking date is considered as the current application date with value date being future dated for DD transactions as specified in the DD incoming instruction.

- Credit currency is considered as transfer currency for incoming DD transactions.