2. Domestic Low Value Payments

This chapter contains the following sections:

- Section 2.1, "Domestic Low Value Payments"

- Section 2.2, "Outgoing Transaction Input Screen"

- Section 2.3, "Authorization of Outgoing Transaction"

- Section 2.4, "ACH Outgoing Payment View"

- Section 2.5, "ACH Incoming Payments"

- Section 2.6, "ACH Incoming Payment View"

- Section 2.7, "ACH Incoming Payments Input"

- Section 2.8, "Return of Incoming Payment"

- Section 2.9, "Payments Recall"

- Section 2.10, "Handling Network Rejects"

2.1 Domestic Low Value Payments

Automated Clearing House Networks facilitate transmission and settlement of electronic payments originated by individuals, businesses, financial institutions and government organizations. Domestic low value payments are local payments or payments limited to a specific region. Depending on the network specifications, messages are processed in batch mode and dispatched at the specified time during the day.

Below listed functionalities for SEPA credit transfer (SCT) are explained in this user manual:

- Outgoing payment processing and message file generation

- Straight through Processing of incoming payment files

For Domestic Low value payments, the payment type is ‘ACH’.

Below transaction types are supported for ACH payments:

- I – Incoming

- O - Outgoing

2.2 Outgoing Transaction Input Screen

This section contains the following topics:

- Section 2.2.1, "Invoking ACH Outgoing Payments Screen"

- Section 2.2.2, "Main Tab"

- Section 2.2.3, "Pricing Tab"

- Section 2.2.4, "Additional Details Button"

- Section 2.2.5, "Saving of Outgoing Transaction"

- Section 2.2.6, "ACH Outgoing SOAP/REST Web services"

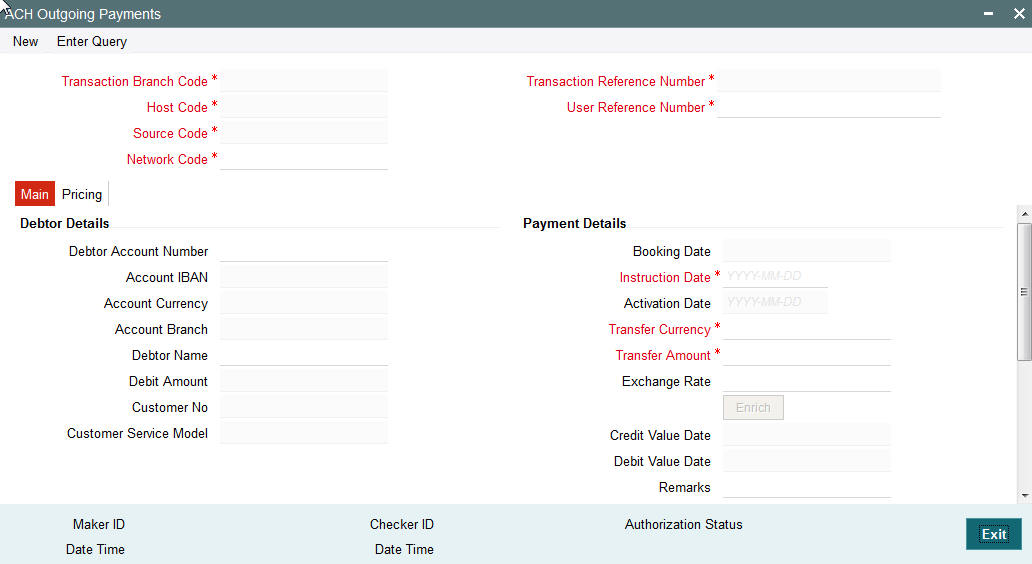

2.2.1 Invoking ACH Outgoing Payments Screen

You can perform ACH outgoing transaction. All transactions that are entered using this screen has payment type as ‘ACH” and transaction type as ‘Outgoing’. You can invoke ‘ACH Outgoing Payment’ screen by typing ‘PADOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Branch code

The system defaults the transaction branch code with the user’s logged in branch code.

Host code

The system defaults the host code of transaction branch.

Source Code

For manual transactions source code is defaulted as MANL. This denotes that the it is a manually input transaction.

Network Code

The system displays the network code if only one Network is maintained with payment type as ACH for the host code. If more than one networks are present, you can select the network code from the available list of values

Transaction Reference number

The system generates the transaction reference number using the following logic:

YYDDDSSSSSsssRRR

YY:Year – 2 digits

DDD: Julian Date – 3 digits

SSSSS: Seconds elapsed since midnight – 5 digits

sss : Milliseconds – 3 digits

RRR : Random number – 3

User Reference Number

The system defaults transaction reference number. However you can modify this.

2.2.2 Main Tab

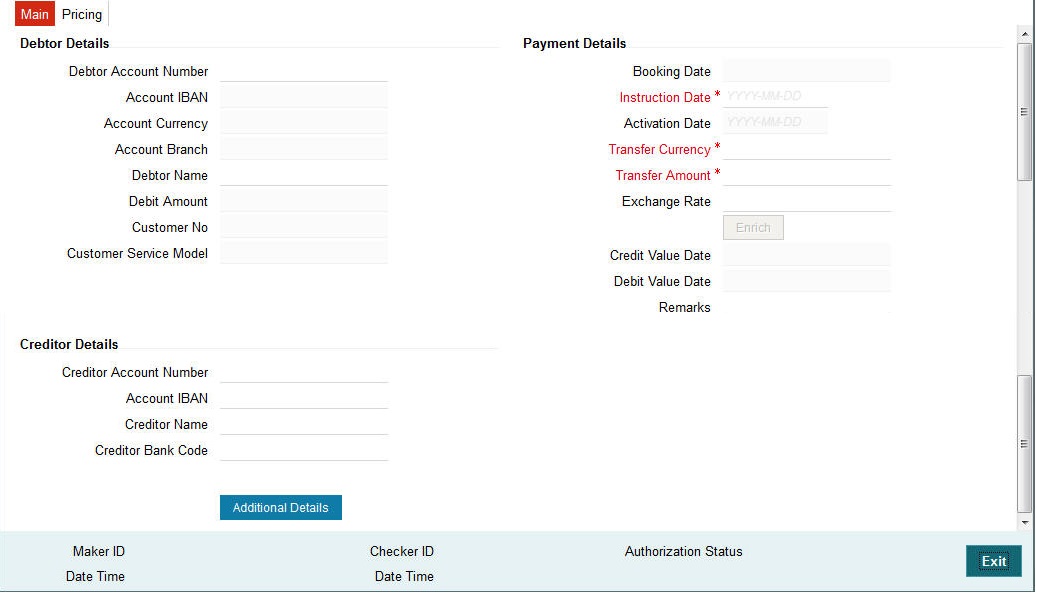

Click ‘Main’ tab to capture the Creditor/ Debtor/ Payments details:

Specify the following details

Debtor Details

Debtor Account Number

Specify the debtor account number. Alternatively, you can select the debtor account number from the option list. The list displays all open and authorized accounts as available in External Account Maintenance.

Account IBAN

The system defaults the account IBAN based on the debtor account number field selected.

Account Currency

The system defaults account currency based on the debtor account number selected.

Account Branch

The system defaults the account branch based on the debtor account number selected.

Debtor Name

The system defaults debtor name based on the debtor account number selected.

Debit Amount

The system populates this field as the transfer amount converted in debtor account currency on enrich.

Customer

This field is defaulted as the customer ID of the Debtor account chosen.

Customer Service Model

Specifies the Customer Service Model. This is displayed if customer is linked to a service model.

Creditor Details

Creditor Account Number

Specify the creditor account number.

Account IBAN

Specify the creditor account IBAN.

Note

If ‘IBAN Check’ is enabled for the network then, you must specify creditor account IBAN and creditor details.

Creditor Name

Specify the creditor name.

Creditor Bank BIC

Specify the creditor bank code. Alternatively, you can select the creditor bank code from the option list. The list displays all open and authorized Bank Codes/BIC codes available in the local bank directory. This is listed based on the ‘Bank Network Identifier’ maintained for Network maintenance (PMDNWMNT).

Payment Details

Booking Date

The system defaults the booking date as application server date.

Instruction Date

This date is populated as Booking date by default. You can specify the requested execution date by the customer in this field.

Activation Date

Activation date is a derived field based on the instruction date provided. Payment is processed on Activation date.

If you specify Instruction date as back-dated, Activation date is moved to current date.

If you input instruction date as a branch holiday, system displays an error message.

Credit Value Date

The system defaults the date based on credit float days mentioned.

Debit Value Date

The system defaults the date based on debit float days mentioned.

Transfer Currency

The system defaults transfer currency if the network allows only single currency as per Network currency preferences (PMDNCMNT).

If multiple currencies are allowed then the system allows you to specify the transaction currency. Alternatively, you can select the transaction currency from the option list. The list displays all valid transaction currencies maintained in the system.

Transfer amount

Specify the transaction amount.

Exchange Rate

Specify the exchange rate if debit account currency and credit account currency is different from the transfer currency. The system retains the input value and validate the same against override and stop variances maintained in the Network preference.

If exchange rate is not specified, then the system populates the exchange rate on enrich or save, if the transfer amount is less than small FX limit maintained.

System populates exchange rate, debit amount and charge/tax amounts when you click on the Enrich Button. If exchange rate pick up or charge pick up fails, then the system throws an error. User can provide the values and proceed with the transaction.

Remarks

Specify the internal remarks, if any.

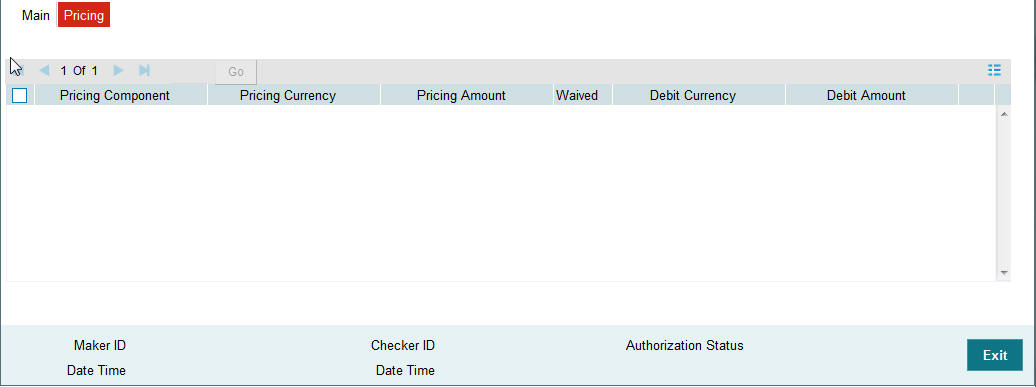

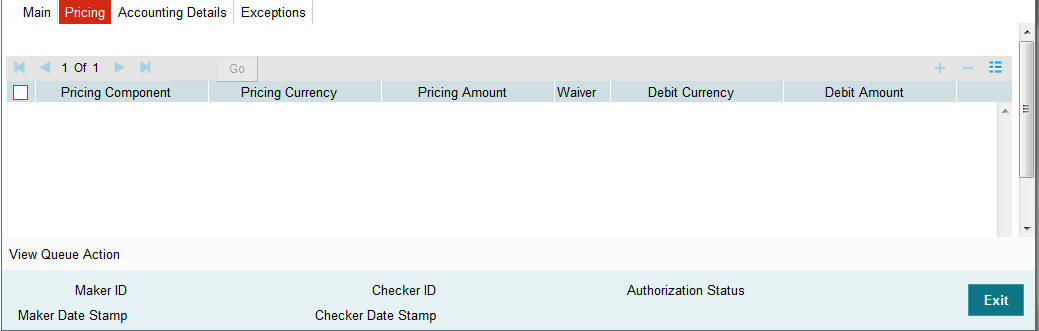

2.2.3 Pricing Tab

You can view the pricing details populated by system in this screen.

The following details are available:

Pricing Component

The system defaults the pricing component based on the Pricing code linked in Network Currency Preferences.

Pricing Currency

The system defaults the pricing currency.

Pricing Amount

The system defaults the pricing amount from Pricing Value Maintenance screen (PPDVLMNT) as applicable for the payment value date, Payment Source code and Debit Customer Service Model. However you can modify this value.

Note

Currency conversions related to charge computation are completed and final amount is populated component wise in the Pricing Tab.

Waived

The system defaults the waiver. However you can modify this value.

Note

If charge/tax is already waived at price value maintenances, then you cannot uncheck the waiver flag.

Debit amount

System defaults the customer debit amount for charge/tax.

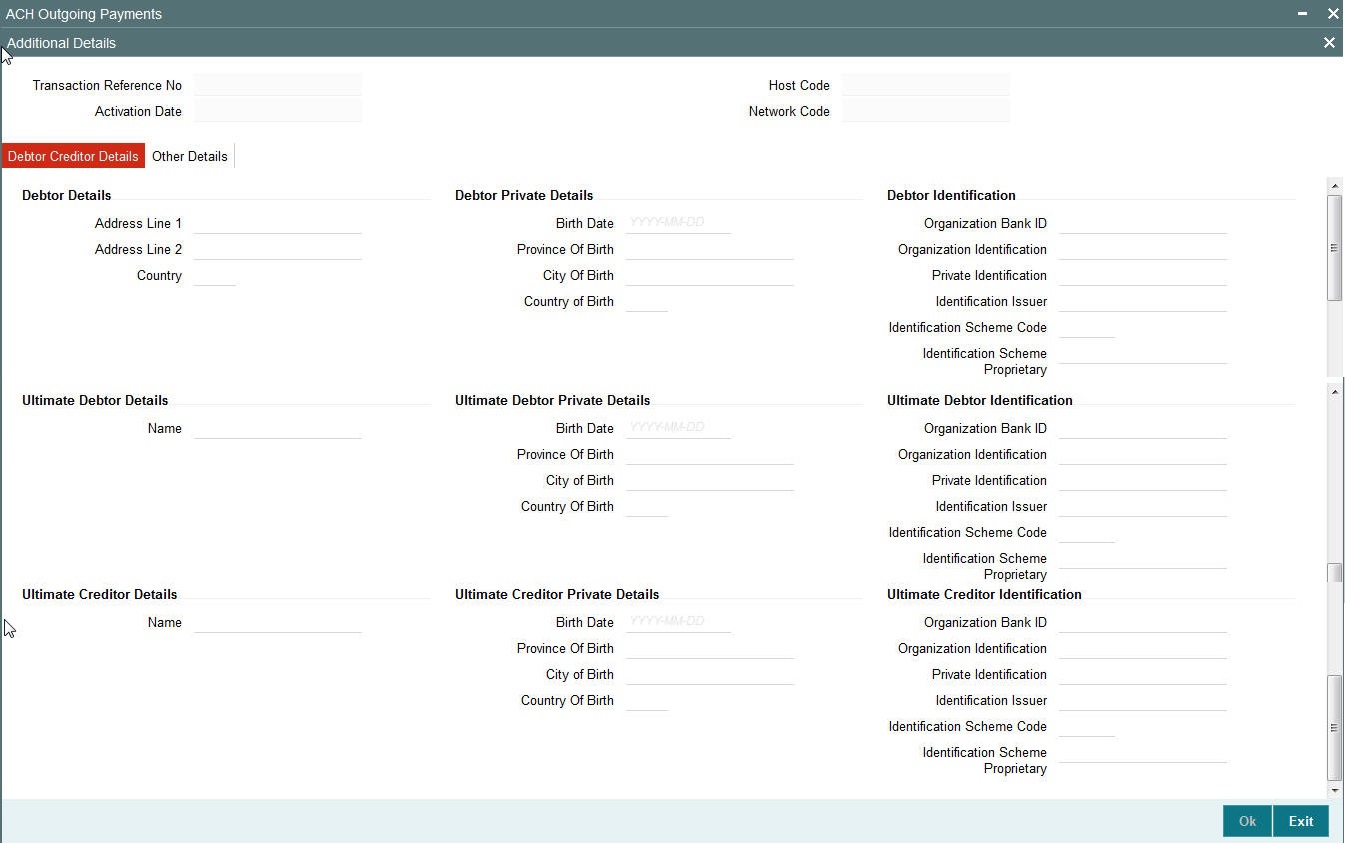

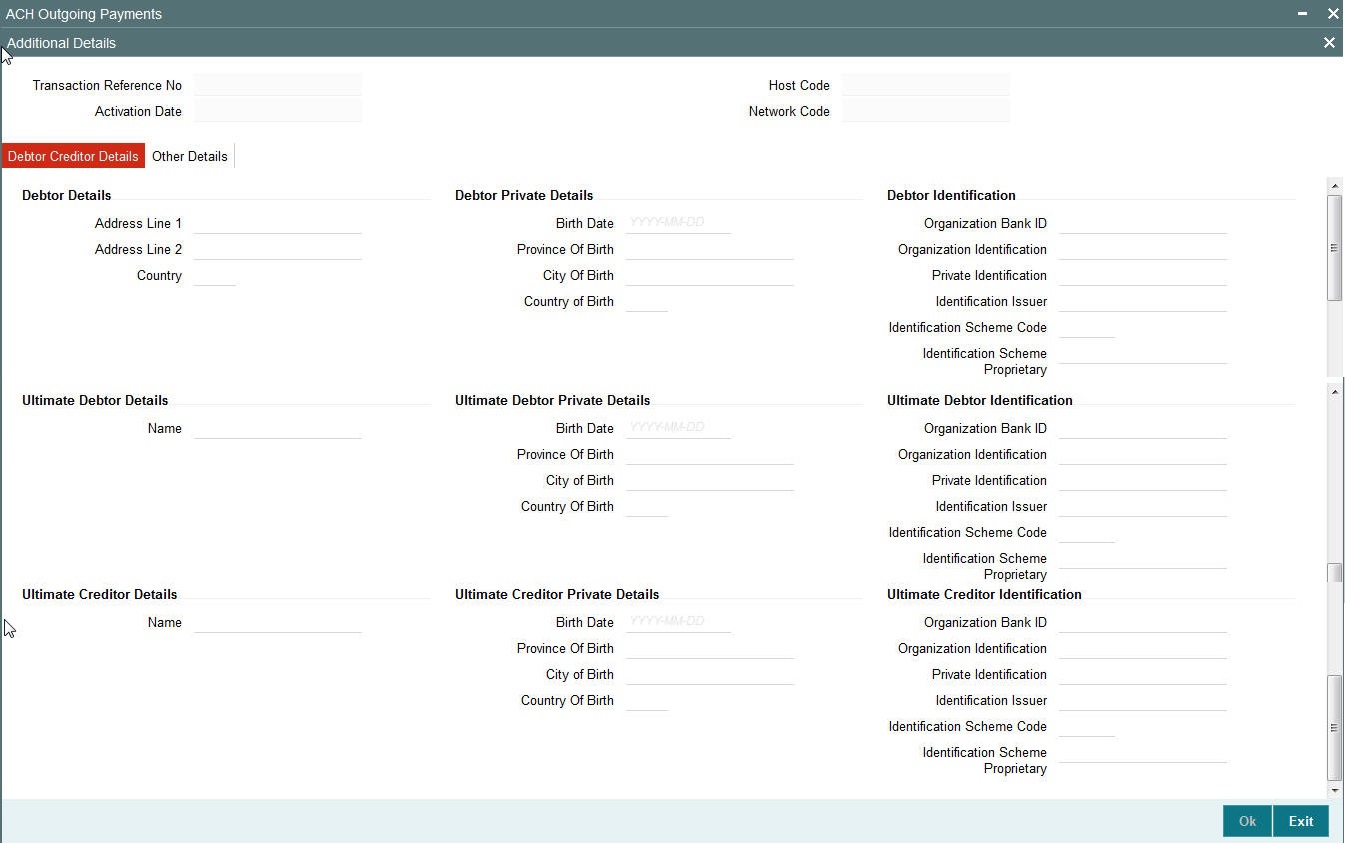

2.2.4 Additional Details Button

Specify the additional details in this screen. Click on the ‘Additional Details Button’ to invoke this screen.

2.2.4.1 Debtor Creditor Details Tab

Specify the debtor and creditor details:

Debtor Details

Address Line 1

Specify the address of the debtor.

Address Line 2

Specify the address of the debtor.

Country

Specify the Country of residence of the debtor. Alternatively, you can select the country from the option list. The list displays all valid country codes maintained in the system.

Debtor Private Details

Birth Date

Select the date of birth of debtor from the adjoining calender.

Province Of Birth

Specify the province of birth of the debtor.

City Of Birth

Specify the city of birth of the debtor.

Country Of Birth

Specify the country of birth of the debtor. Alternatively, you can select the country from the option list. The list displays all valid country codes maintained in the system.

Debtor Identification

Organization Bank ID

Specify the organization bank id of debtor.

Private Identification

Specify the private identification number of debtor.

Identification Issuer

Specify the identification issuer details.

Identification Scheme Code

Specify the identification scheme code.

Identification Scheme Proprietary

Specify the identification scheme proprietary details.

Creditor Details

Address Line 1

Specify the address of the creditor.

Address Line 2

Specify the address of the creditor.

Country

Specify the Country of residence of the creditor. Alternatively, you can select the country from the option list. The list displays all valid country codes maintained in the system.

Creditor Private Details

Birth Date

Select the date of birth of creditor from the adjoining calender.

Province Of Birth

Specify the province of birth.

City Of Birth

Specify the city of birth of the creditor.

Country Of Birth

Specify the country of birth of the creditor. Alternatively, you can select the country from the option list. The list displays all valid country codes maintained in the system.

Creditor Identification

Organization Bank ID

Specify the organization bank id of creditor.

Private Identification

Specify the private identification number of creditor.

Identification Issuer

Specify the identification issuer details.

Identification Scheme Code

Specify the identification scheme code.

Identification Scheme Proprietary

Specify the identification scheme proprietary details

Ultimate Debtor Details

Name

Specify the debtor name.

Ultimate Debtor Private Details

Birth Date

Select the debtor date of birth from the adjoining calender.

Province Of Birth

Specify the debtor province of birth.

City Of Birth

Specify the city of birth of debtor.

Country Of Birth

Specify the country of birth of the debtor. Alternatively you can select the country of birth from the option list. The list displays all valid country codes maintained in the system.

Ultimate Debtor Identification

Organization Bank ID

Specify the organization bank id.

Private Identification

Specify the private identification number.

Identification Issuer

Specify the identification issuer details.

Identification Scheme Code

Specify the identification scheme code.

Identification Scheme Proprietary

Specify the identification scheme proprietary.

Ultimate Creditor Details

Name

specify the creditor name.

Ultimate Creditor Private Details

Birth Date

Select the debtor date of birth from the adjoining calender.

Province Of Birth

Specify the creditor province of birth.

City Of Birth

Specify the city of birth of creditor.

Country Of Birth

Specify the country of birth of the creditor. Alternatively you can select the country of birth from the option list. The list displays all valid country codes maintained in the system.

Ultimate Creditor Identification

Organization Bank ID

Specify the organization bank id.

Private Identification

Specify the private identification number.

Identification Issuer

Specify the identification issuer details.

Identification Scheme Code

Specify the identification scheme code.

Identification Scheme Proprietary

Specify the identification scheme proprietary.

Note

- You can provide only one of the field values for ‘Organization Bank ID’, ‘Organization Identification’ or Private Identification.

- If Identification Issuer or Identification Scheme details are present then either Organization Identification or Private Identification has to be present.

- The above mentioned validations are applicable for:

- Debtor Identification

- Creditor Identification

- Ultimate Debtor Identification

- Ultimate Creditor Identification

- Initiating Party details

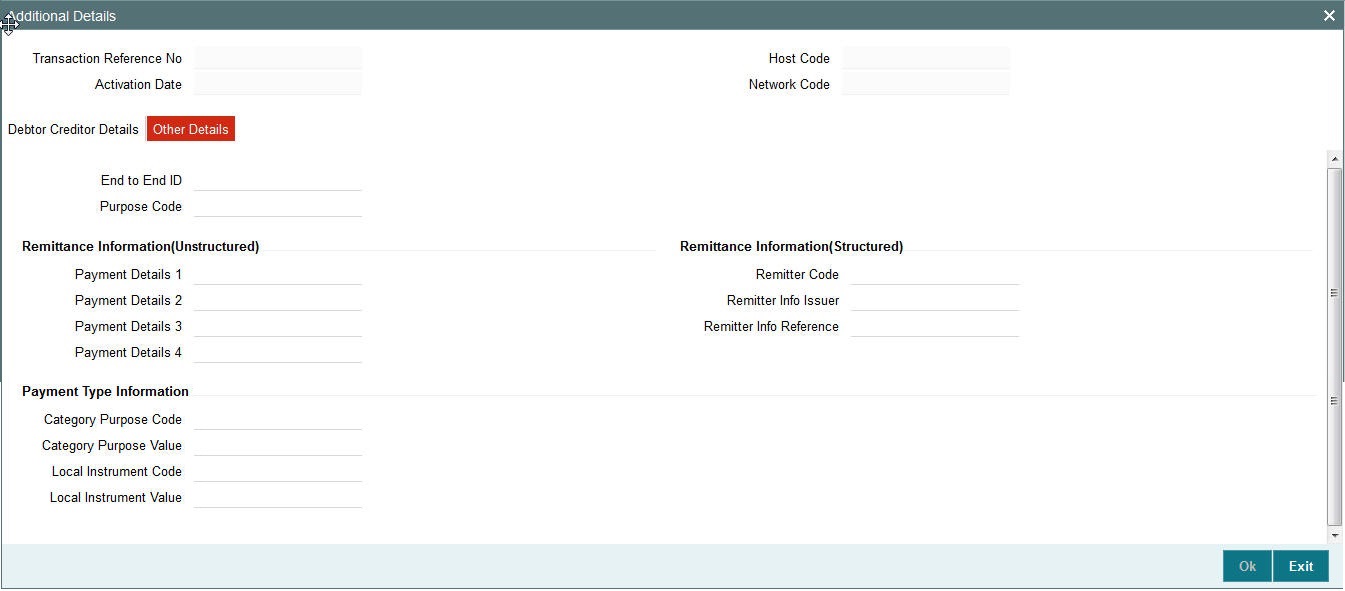

2.2.4.2 Other Details Tab

You can capture the below details in this screen.

Purpose Details

Category Purpose Code

Specify the category purpose code.

Category Purpose Value

Specify the category purpose value.

Purpose Code

Specify the purpose code.

Local Instrument Code

Specify the local instrument code.

Local Instrument Value

Specify the instrument value.

Note

- Only one value (either Code or proprietary value ) may be present under Purpose details for the following pair of fields:

- Category Purpose Code & Category Purpose Value

- Local Instrument Code & Local Instrument Value

Payment Details (Structured)

Remitter Reference

Specify the remitter reference number.

Remitter Code

Specify the remitter code.

Remitter Information Issuer

Specify the remitter information.

Additional Remittance Info

Specify the additional remitter information any.

Payment Details (Unstructured)

Payment Details

Specify the payment details.

Note

Only one of structured Payment Details or Unstructured Payment details may be present

Creditor Reference Information

Payment Details

Specify the payment details.

2.2.5 Saving of Outgoing Transaction

The system performs the following mandatory field checks and the referential checks during the save of ACH outgoing payment transaction. If any of the below validation fails, then the transaction is rejected with an error code.

Following fields are mandatory for requesting ACH outgoing payments:

- Host Code & Transaction Branch Code

- Network Code

- Debtor Account or Debtor IBAN

- Creditor Bank Code

- Creditor Account (or Creditor IBAN, if IBAN is mandatory for the Network)

- Creditor Name

- Transfer Currency

- Transfer Amount

- Value Date

If the source code is not MANL, then it is mandatory to specify the Source reference number.

Customer/Account status validation is done based on the status details available in External Customer maintenance/External Account maintenance.

Holiday check for instruction date is done based on the local branch holidays maintained.

Any validation failure from user interface screen throws error on transaction saving. You can check the error details from the respective error message displayed and can take re medial action before re-submitting.

2.2.6 ACH Outgoing SOAP/REST Web services

FLEXCUBE Payments allows you to process the outgoing ACH payment request received from SOAP or REST web services. All the transactions created based on the requests received from SOAP/REST web services are always auto authorized.

The system picks the booking date of the transaction as the application server date. Based on the debit account number through External Account Maintenance, the system derives at the debit account name, debit currency and debit customer.

The following fields are supported for a payment instruction received through REST services:

- Source Reference Number

- Source Code

- Host Code

- Transaction Branch

- Network Code

- Debtor Account (Debtor IBAN if IBAN is mandatory for the network)

- Creditor Bank Code

- Creditor Account (Creditor IBAN if IBAN is mandatory for the network)

- Creditor Name

- Transfer Currency

- Transfer Amount

- Instruction Date

Initial validations as explained in section 2.2.5 are applicable for payment transactions received from channels as well.

If instruction date is a holiday, activation date is derived as next working day

In case of invalid accounts/bank codes, system does Bank/Account re-direction if any maintenance is available for the invalid codes.

Any validation exception moves the transaction to exception queue. For more details please refer to User Manual on Exception Queues.

2.3 Authorization of Outgoing Transaction

The transaction authorization process involves the following steps for a payment transaction with Activation date as current date:

- Network related validations

- IBAN check

- Duplicate check

- Authorization Limits Check

- Transaction cutoff time check

- Sanction check

- Computation of Charge & Tax

- Exchange rate pickup

- ECA check

- Network cutoff time check

- Debit /Credit Accounting

- Dispatch file generation

- Dispatch Accounting

This section contains the following topics:

- Section 2.3.1, "Network Related Validations"

- Section 2.3.2, "IBAN Check"

- Section 2.3.3, "Duplicate Check"

- Section 2.3.4, "Transaction Cutoff Time Validations"

- Section 2.3.5, "Sanction Check"

- Section 2.3.6, "Computation of Charge and Tax"

- Section 2.3.7, "Small FX Limit Check and Currency Conversion"

- Section 2.3.8, "External Credit Approval Check"

- Section 2.3.9, "Network Cutoff Time Check"

- Section 2.3.10, "Debit/Credit Accounting"

- Section 2.3.11, "Notifications"

- Section 2.3.12, "Future Dated Transactions"

2.3.1 Network Related Validations

The system validates any debtor, creditor, bank, additional details specified for a payment transaction against the valid characters allowed for the network. If any field contains invalid SEPA character, then the transaction is moved to repair queue with error details.

2.3.2 IBAN Check

If 'IBAN Validation Required' flag is checked for the network, then IBAN verification for Debtor IBAN, Creditor IBAN and creditor BIC is done against the IBAN format maintained for the respective country.

Please refer to Payments Core User manual for more details on IBAN check.

2.3.3 Duplicate Check

The duplicate check for a transaction is done during transaction processing if Duplicate check is applicable for the Source. Payment fields marked for duplicate check in Source Maintenance are matched with all the payments booked within the duplicate period. Booking date of the payments is considered for evaluating duplicate period.

Duplicate period is considered based on the number of days maintained for the source. If the maintenance is not available, then the duplicate check is not done.

If there are any matching payments with the fields identical with the payment being processed, then the payment is moved to Business Override Queue for further investigation.

2.3.4 Transaction Cutoff Time Validations

Transaction cut off time validation is based on the Transaction Cut-off Time Maintenance (PMDCTOFF) screen. Transaction cutoff time check is done only for transaction with payment activation date is current date.

Transaction Cut-off time for the payment network and Transaction Type 'Outgoing' is fetched from the maintenance for the following combination:

- Source - Specific/ALL

- Service Model - Specific/ALL

- Customer - Specific/ALL

Cut off time is derived as follows:

| Sl.No | Network | Transaction Type | Source | CSM | Customer | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Network ID | Outgoing | Specific | Specific | Specific | ||||||

| 2 | Network ID | Outgoing | ALL | Specific | Specific | ||||||

| 3 | Network ID | Outgoing | Specific | Specific | ALL | ||||||

| 4 | Network ID | Outgoing | ALL | Specific | ALL | ||||||

| 5 | Network ID | Outgoing | Specific | ALL | ALL | ||||||

| 6 | Network ID | Outgoing | ALL | ALL | ALL |

If payment processing time is lesser than or equal to the Cut-off date time derived, then the payment is considered as 'Pre Cut-off' payment and proceeds with further processing.

If payment save date time or payment receipt date time exceeds the Cut-off date time derived then the payment is considered as 'Post Cut-off' payment and post cut off status is updated for the transaction.

If the flag 'Move forward to next working day' is checked then Activation date of the transactions which are post cut off is moved to next business day automatically.

User is allowed to force release the transaction with today's value date from post cut off Queue. Payments released from Post Cutoff queue would not undergo transaction cut-off time checks again.

2.3.5 Sanction Check

If sanction screening is required for the Network and the customer, request is sent to External Sanction System.

If the sanction check status of the transaction is 'Approved', then further processing continues. If the contract's sanction check response status is 'Override' or 'Rejected' or 'Timed Out', then transaction is logged in 'Sanction Check Exception Queue’ and the processing of the transaction is stopped at this stage.

2.3.6 Computation of Charge and Tax

Charge and tax for ACH Payment transactions are calculated based on the Pricing Code linked to Network Currency Preferences (PMDNCPRF) screen.

For more details on pricing, please refer Pricing Use Manual.

2.3.7 Small FX Limit Check and Currency Conversion

For a cross currency payment transaction where debit currency and transfer currency are different, exchange rate maintained for the transaction branch in the core system is considered.

If small FX limit is defined in Network Currency Preferences, then the auto rate pick up happens only if the transfer amount is within the small FX limit. If Small FX limit is not maintained auto rate pick up is done for all cross currency payment transactions without any limit check.

For an outgoing transaction limit check is based on the small FX limit specified in Network Preferences for transaction type 'Outgoing’.

Exchange Rate Type is based on Network preferences maintained. Buy/Sell indicator is derived by the system based on the currency pair maintenance available.

If the transfer amount is above the small FX limit specified, system checks whether External Exchange Rate is applicable in Network Preferences.

If external system is available then system interfaces with external system for receiving the exchange rate.

Payment contract is moved to Exchange Rate Queue in the following cases with proper error code details and exchange rate status:

- Exchange Rate derivation based on core system maintenance fails

- Small FX limit is breached and no external exchange rate system maintenance is available

Payment contract is moved to External Exchange Rate queue in the following cases:

- Response from External Exchange Rate system is failure or timed out

It is possible to provide exchange rate manually from Queue screen so that transaction proceeds with further processing.

2.3.8 External Credit Approval Check

Payments send debit accounting entries pertaining to payment amount and charge/tax amounts to external DDA system for credit approval.

External Credit Approval is done for all the external accounts for which ‘External Credit Approval Required’ flag is enabled. ECA system for the credit check is derived based on the External Account maintenance.

If the ECA response status for a payment transaction is 'Approved', then further processing continues. If ECA validation fails i.e. the status is 'Override', 'Rejected', or 'Timed out', then the transaction is logged in ECA Exception queue.

2.3.9 Network Cutoff Time Check

The system checks the network cutoff time based on the cut off time maintained for the network. The system considers the application server time for cut off time check. Transactions which failed cut off time check is moved to Post Network Cutoff Queue.

2.3.10 Debit/Credit Accounting

Debit liquidation accounting entries have both payment entries and charge/tax entries. Accounting details are handed off to accounting system with debit/credit liquidation accounting code linked at Network Currency preferences.

2.3.11 Notifications

Following Notification are available for outgoing ACH payments:

| Notification Code | Tag details | Text | |||

|---|---|---|---|---|---|

PM_ACH_DR_1 -Debit Notification for out going payment individual requests-On Debit Liquidation |

Debit Account, |

Account <Debit Account>is debited for <Debit Currency >,<Debit Amount> on <Debit Liquidation Date> for Payment Reference Number<Transaction Reference Number>. Charge or Tax component amd amount deducted details are <Charge Currency> <Charge Amount> |

|||

Debit currency |

|||||

Debit Amount |

|||||

Debit liquidation date |

|||||

Transaction Reference number |

|||||

Charge/Tax debit amount |

|||||

Charge/Tax debit currency |

|||||

PM_ACH_BK_1 -Notification for for out going payment individual requests received -on transaction booking (This will be applicable for future dated transactions only) |

Transfer Currency |

Payment initiation request received for <Transfer currency> <Transfer Amount> for the credit of <Creditor Account><Creditor Name> with<Creditor Bank Name> on <Booking Date>.Payment reference number is <Transaction reference number> |

|||

Transfer Amount |

|||||

Creditor Account |

|||||

Creditor Name |

|||||

Creditor Bank Name |

|||||

Booking Date |

|||||

Transaction Reference Number |

|||||

PM_ACH_DS_1 -Notification for for out going payment individual requests dispatched |

Transfer Currency |

<Network Description> Payment for <Transfer currency> <Transfer Amount> for the credit of <Creditor Account><Creditor Name> with<Creditor Bank Name> is sent on <Dispatch Date>.Payment reference number is <Transaction reference number> |

|||

Transfer Amount |

|||||

Creditor Account |

|||||

Creditor Name |

|||||

Creditor Bank Name |

|||||

Booking Date |

|||||

Transaction Reference Number |

|||||

Network Description |

|||||

PM_ACH_CL_1 For Debtor on auto/manual cancellation of payment on SC rejection |

Transaction number, transfer currency, transfer amount |

Payment Transaction No.<> for <Transfer currency> <Transfer Amount> is cancelled as sanction check failed |

|||

PM_ACH_CL_2 For Debtor on auto/manual cancellation of payment on ECA rejection |

Transaction number |

Payment Transaction No.<> for <Transfer currency> <Transfer Amount> is cancelled as approval from account system failed |

2.3.12 Future Dated Transactions

Future dated ACH transactions are processed by separate jobs. Processing of transactions will be completed till sanction check on booking date itself. During beginning of day, future dated transaction job picks up transactions with Activation date as current date. Transaction processing starts from initial validations again, on activation date.

Future dated transactions job should be run after rate refresh and this has to be operationally handled.

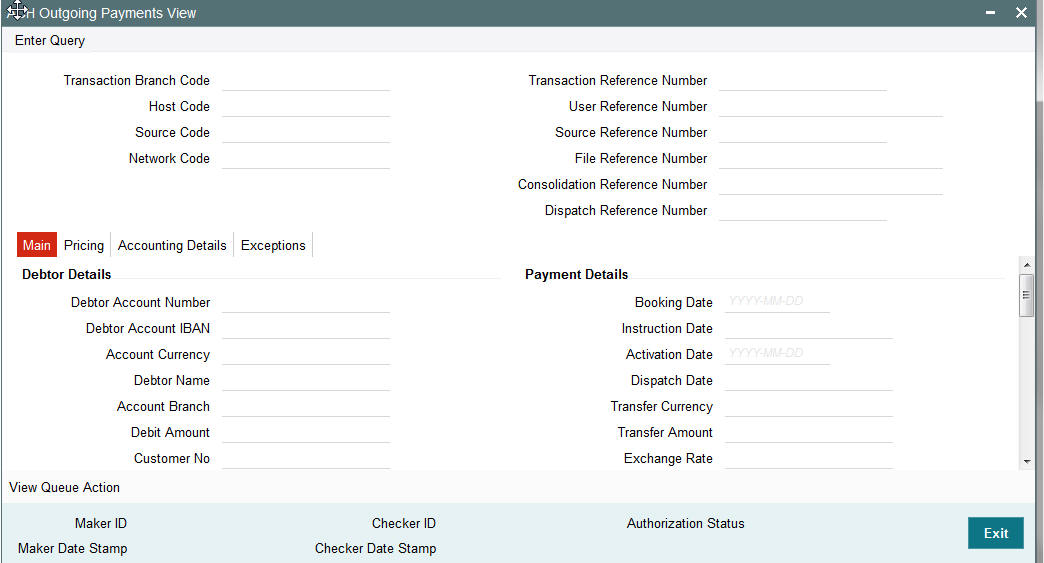

2.4 ACH Outgoing Payment View

This section contains the following topics:

- Section 2.2.1, "Invoking ACH Outgoing Payments Screen"

- Section 2.4.2, "Main Tab"

- Section 2.4.3, "Pricing Tab"

- Section 2.4.4, "Accounting Details Tab"

2.4.1 ACH Outgoing Payments View Screen

You can view the ACH outgoing transaction in this screen.

You can invoke “ACH Outgoing Payments” screen by typing ‘PADOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction reference Number

Specify the transaction reference number. Alternatively, you can select the transaction reference number from the option list. The list displays all valid transaction reference numbers maintained in the system.

The system displays all the fields in the below mentioned tabs based on the transaction reference number selected.

2.4.2 Main Tab

You can view debtor/Creditor details in this screen. Click on the ‘Main’ tab to invoke this screen.

2.4.3 Pricing Tab

You can view pricing details in this screen. Click on the ‘Pricing’ tab to invoke this screen.

2.4.4 Accounting Details Tab

Click on the ‘Accounting Details’ tab to invoke this screen.

You can view the consolidated accounting entries of the transaction.

2.5 ACH Incoming Payments

2.5.1 Incoming File Upload

Background job are available for reading the incoming SCF file from the designated folder and to populate the data into staging table. File reference number is generated. Transaction details received in a single file can be identified by file reference number.

2.5.2 Branch & Host Resolution

Instructed Agent BIC in pacs.008 message is considered as transaction branch BIC. Transaction branch BIC is compared with branch codes available in Core maintenance for branches to ascertain Branch code and related Host code.

2.5.3 Network, Payment Type & Transaction Type Resolution

In File parameters Maintenance, you can specify for File type SCF and for a Host code which Network code is applicable. This Network code will be applicable for all transactions listed in the Incoming file. Payment type linked to the Network is considered as the transaction payment type.

2.5.4 Payment Value Date Resolution

Inter bank settlement date in pacs.008 message is considered as payment debit value date for incoming type of transaction.

2.5.5 Debit Account/Credit Account Resolution

Credit settlement account is the credit IBAN received in the message. This has to be a valid IBAN available in External account mapping. System derives the account number based on the IBAN from the same maintenance.

Debit Account is fetched from the accounting code maintained in Network currency preferences for the transaction type Incoming.

2.5.6 Receipt Accounting

For incoming payments file receipt accounting of the consolidated amount of pacs.008 and pacs.004 messages is supported. Receipt accounting code can be maintained in Network Currency preferences for Incoming transaction type.

Transaction account and offset account is maintained as part of accounting code itself. Event for accounting entries is ‘RCLG’.

The resulting accounting entries are as following:

- Debit: CSM Nostro account

- Credit: Clearing GL

Accounting value date is settlement date a received in the file. No External Creit approval is performed for receipt accounting.

There is a provision for handing off accounting entry details to external accounting system.

2.5.7 Processing of Incoming Payments

Incoming payments are processed in PA module in the following steps:

- Initial Validations

- IBAN check for debtor account and debtor Bank BIC

- Duplicate Check

- Sanction Check

- Charge/Tax Computation

- Exchange Rate Pick up

- External Account Check

- Debit & Credit Liquidation

Debit currency is considered as transfer currency for incoming transactions

2.5.8 Incoming Payment Validations

System performs mandatory field checks & referential checks during transaction saving.

Mandatory Fields Check

Below fields are mandatory for booking ACH incoming payment:

- Host Code

- Transaction Branch

- Network Code

- Debtor IBAN

- Debtor Bank Code

- Creditor Account

- Transfer Currency

- Transfer Amount

- Value Date

2.5.9 Referential Check & Initial Validations

Following parameters are validated with the static maintenances available for existence of the values:

- Network code: Validated against the static maintenances (PMDNWMNT) available.

- Currency Codes: Validated against open and authorized currency codes ( CYDCDEFE). In Network Currency preferences, a record should be available for the Network, transaction type ‘Incoming’ and transaction currency.

- Host Code: This field is checked against valid host codes available in Host Code maintenance (STDHSTCD)

- Transaction Branch Code: This has to be a valid branch in core maintenance.

- Credit Customer: This is validated to check whether customer is valid and existing. If Customer status is either closed, whereabouts not known, Deceased or frozen status then the transaction is rejected.

- Customer Account status: The customer accountstatus verification is done based on the status available in External account maintenances.

- Debtor Bank Code: Counterparty Bank is validated based on local clearing bank code maintenance (PMDBKMNT).

- Bank Network Identifier maintained for the network maintenance (PMDNWMNT) is referred by system for this. Based on the option maintained, Counterparty Bank Code is validated against SWIFT address or Local bank code available in PMDBKMNT. Whether the network is allowed for the bank also is validated from the same maintenance.

If any of the above validation fails, transaction is rejected with proper error code. This transaction will be available in Repair queue with error details.

Network Limit Validations

Amount of the transaction should be within the minimum and maximum defined for the Network, Transaction type ‘Incoming’ & transaction currency combination as maintained in Network Currency Preferences (PMDNCPRF).

In case the transaction amount breaches the transaction limit specified for minimum or maximum amount, an override will be logged and this transaction will be moved to the Repair queue

IBAN Check

If ‘IBAN validation required’ flag is checked for the network, then IBAN verification for Debtor IBAN & debtor BIC is done against the IBAN format maintained for the respective country.

Duplicate Check

Identification of duplicate transactions done for a period as maintained in Source Maintenance.

The payment is moved to Business Override Queue for further investigation In case of a duplicate transaction.

Sanction Check

If sanction screening is required for the Network (for incoming transaction type) and the customer, request is sent to External sanction system.

System verifies whether sanction check system is applicable in Network Preferences Maintenance, for ‘Incoming’ transaction type and initiates sanction check validation.

Charges/tax computation

For more information refer ‘Computation of Charge and Tax’ section in this user manual.

Exchange Rate Pick up

Exchange Rate pick up is based on the FX limits maintained in Network preferences for transaction type ‘Incoming’.

External Account Check

- External account validation is done for the credit account in External Account Check (EAC).

- If external account check fails, transaction is available in ECA Queue with error details received.

Debit and Credit Liquidation

For each transaction being processed, debit and credit liquidation are done to the respective settlement accounts. Accounting details are handed off to the accounting system for posting the entries.

2.5.10 Notifications

Following notifications are generated for incoming payments.

| Notification Code | Details | Text | |||||||

|---|---|---|---|---|---|---|---|---|---|

| PM_ACH_CR_1 -Credit | Notification for incoming payment -On Credit Liquidation | Credit Account | Account <Credit Account>is credited for <Credit Currency >,<Credit Amount> on <Credit Liquidation | Date> for Payment Reference Number<Transaction Reference Number>. Charge or Tax component amd amount deducted details are <Charge Currency> <Charge Amount> | |||||

| Credit Account currency | |||||||||

| Credit Amount | |||||||||

| Credit liquidation date | |||||||||

| Transaction Reference number | |||||||||

| Charge/Tax debit amount | |||||||||

| Charge/Tax debit currency |

2.6 ACH Incoming Payment View

This section contains the following topics:

- Section 2.6.1, "Invoking ACH Incoming Payments Screen"

- Section 2.6.2, "Main Tab"

- Section 2.6.3, "Pricing Tab"

- Section 2.6.4, "Accounting Details Tab"

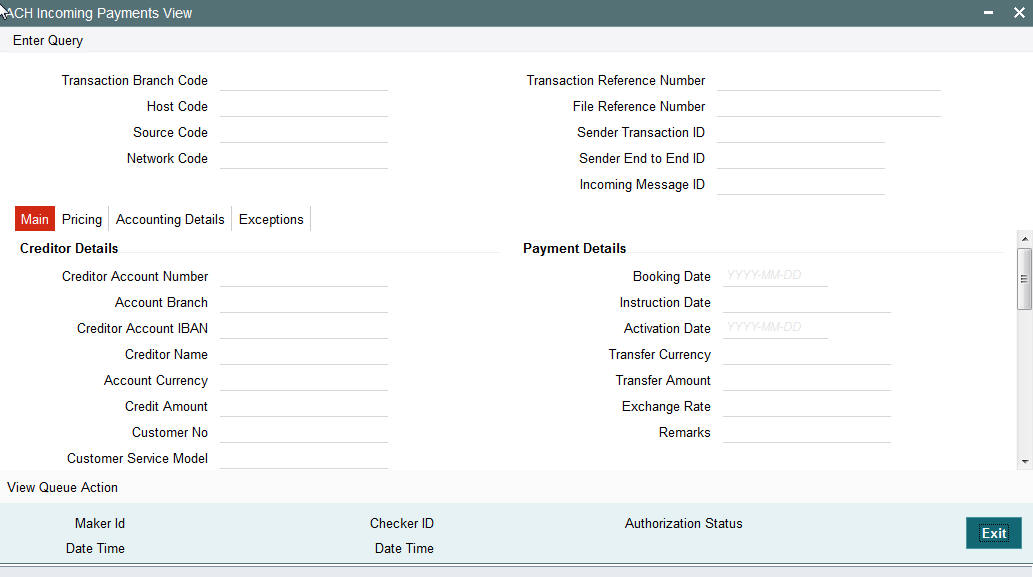

2.6.1 Invoking ACH Incoming Payments Screen

You can view the ACH Incoming transaction in this screen.

You can invoke “ACH Incoming Payments” screen by typing ‘PADIVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Click new button on the Application toolbar..

You can specify the following fields:

Transaction Reference Number

Specify the transaction reference number. Alternatively, you can select the transaction reference number from the option list. The list displays all valid transaction reference numbers maintained in the system.

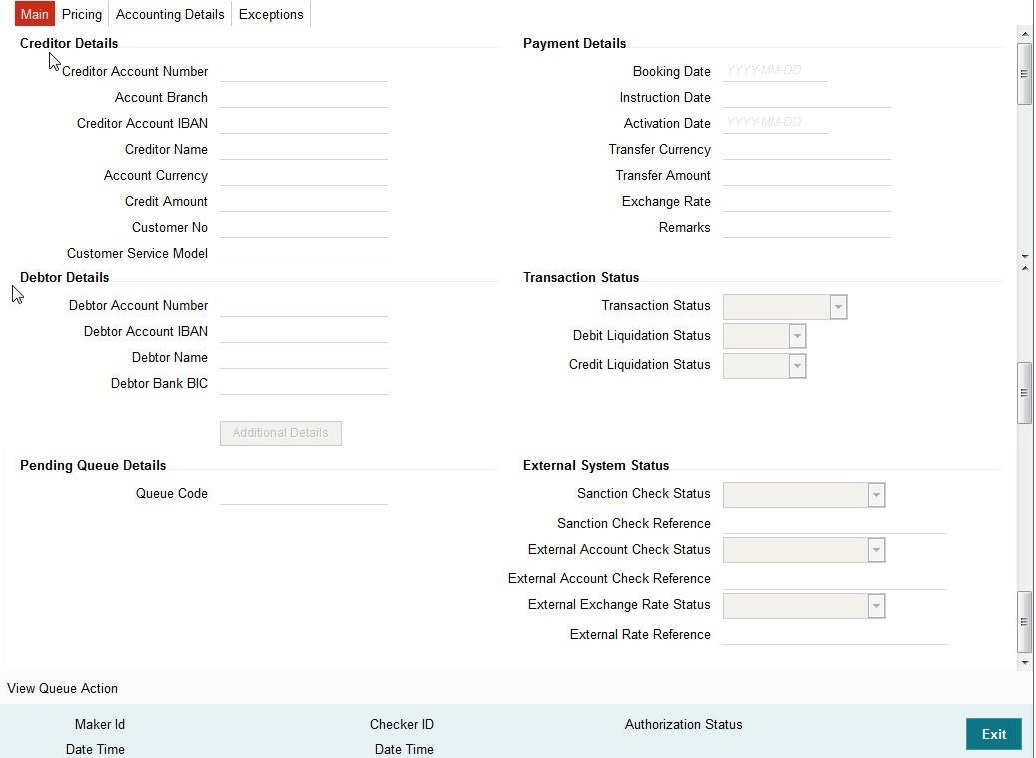

2.6.2 Main Tab

You can view debtor/Creditor details in this screen. Click on the ‘Main’ tab to invoke this screen.

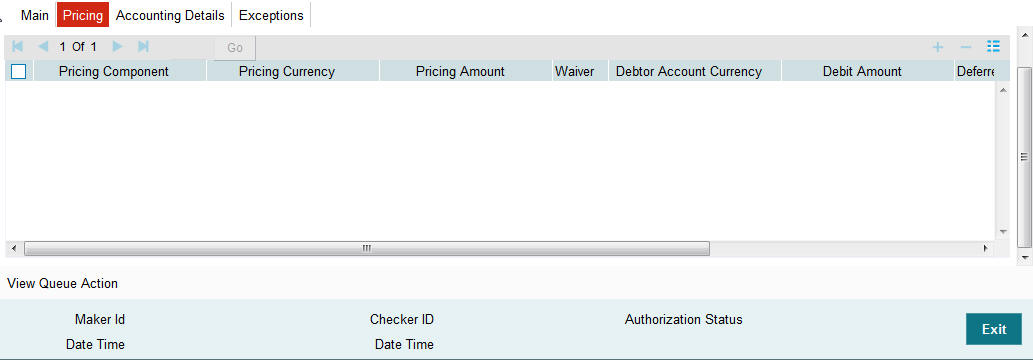

2.6.3 Pricing Tab

You can view pricing details in this screen. Click on the ‘Pricing’ tab to invoke this screen.

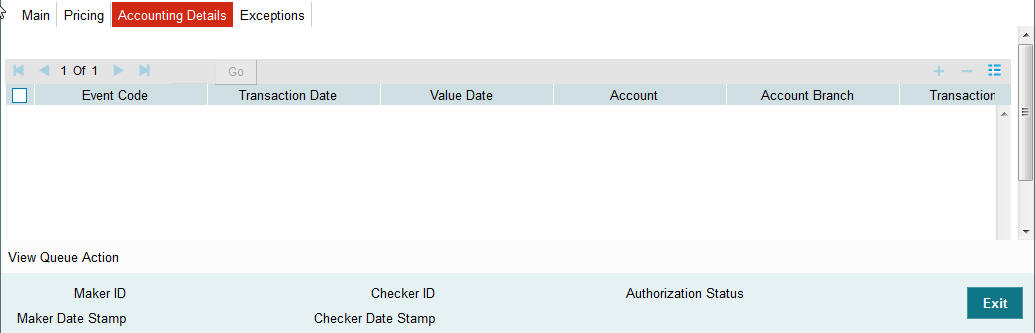

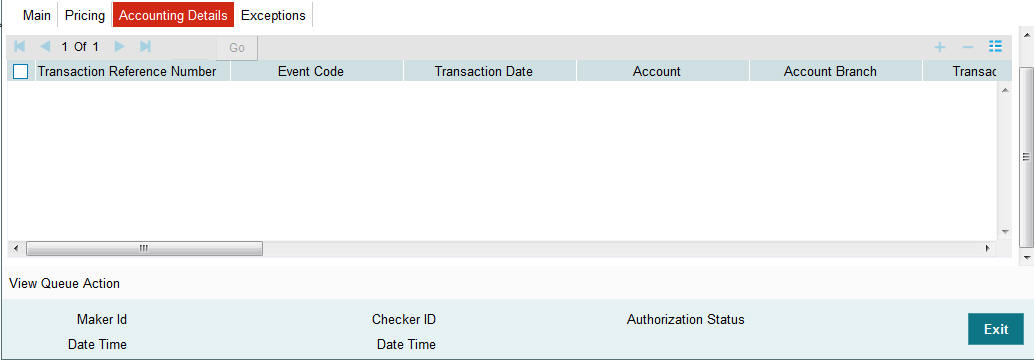

2.6.4 Accounting Details Tab

Click on the ‘Accounting Details’ tab to invoke this screen.

You can view the consolidated accounting entries of the transaction.

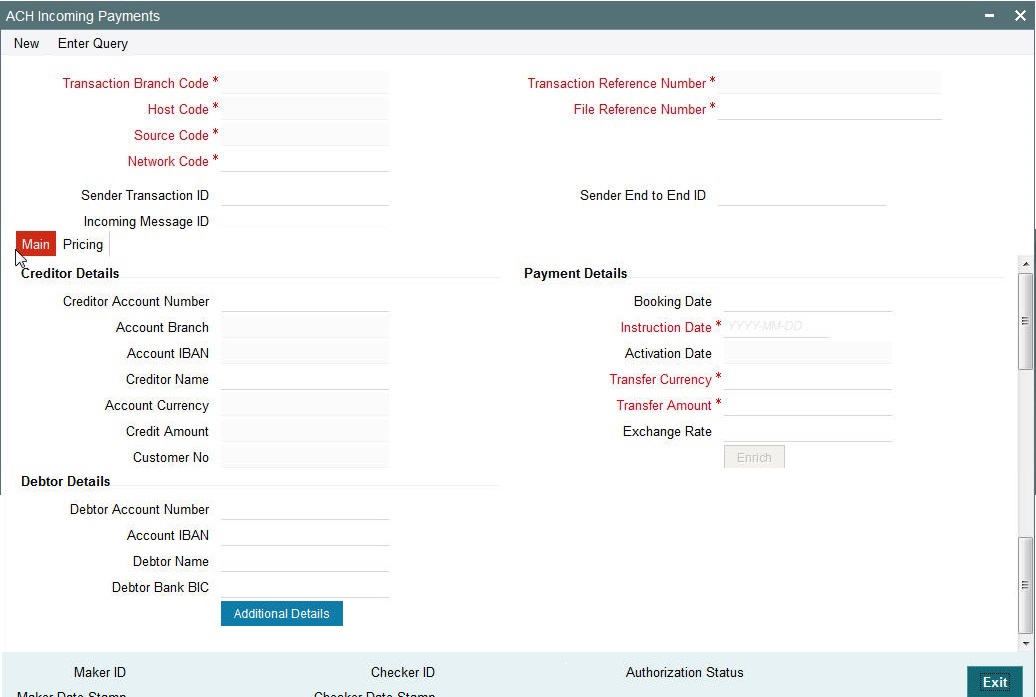

2.7 ACH Incoming Payments Input

It is now possible to manually create an ACH Incoming Payment by providing the details in the Input screen.

You can invoke the “ACH Incoming Payments Input” screen by typing ‘PADITONL‘ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button.

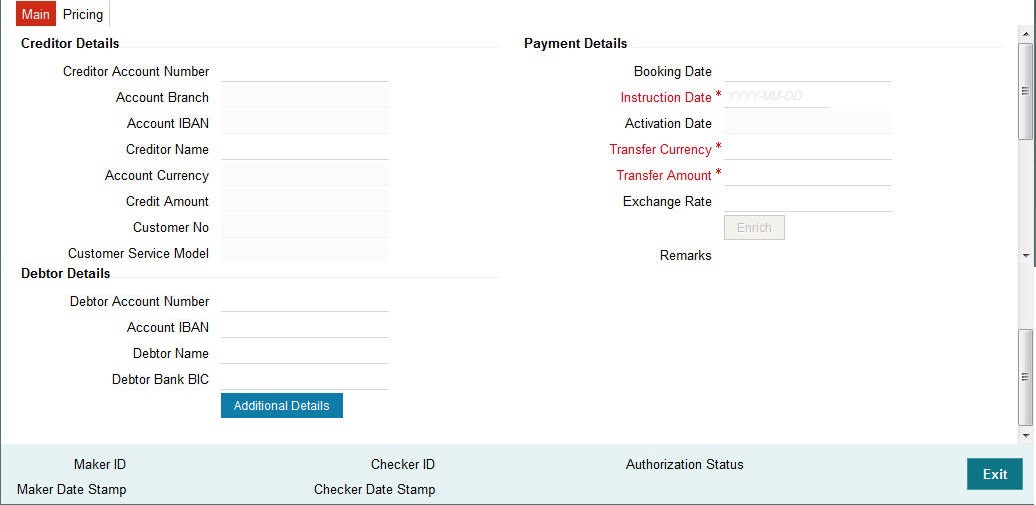

2.7.1 Main Tab

You can view Debtor/Creditor/Payment details in this screen. Click on the ‘Main’ tab to invoke this screen.

You can specify the following fields:

Transaction Branch Code

This field is populated as user’s logged in branch

Host Code

This field is defaulted as logged in Host.

Network Code

If only one Network is maintained for with payment type as ACH for the host code, the same will be defaulted in this field.

In case multiple networks are found for the same combination, all applicable networks will be listed for the field.

Source Code

For manually input transactions, source code is defaulted as MANL.

Creditor Account Number

All open and authorized accounts maintained in External Account maintenance are listed. You can select the creditor account. The list of values search page displays the Account IBAN along with Customer No & Customer Name.

Creditor Details

Creditor Account IBAN

Based on the creditor account number, IBAN appears by default in the IBAN field, if it is available.

Account Currency & Creditor Name

These fields are populated based on creditor account chosen.

Credit Amount

This field as populated as the transfer amount converted in credit account currency. The Exchange rate pick up is based on network preferences.

Debtor Details

Debtor Account Number & Account IBAN

Either debtor account number or account IBAN is mandatory. If the network is ‘IBAN Check’ enabled, it will be mandatory to specify debtor account IBAN

Debtor Name

Specify Debtor Name.

Debtor Bank Code

All open and authorized Bank Codes/BIC codes available in local bank directory are listed in this field. The listing is based on the ‘Bank Network Identifier’ maintained for Network maintenance (PMDNWMNT).

You can choose the appropriate bank code. This is a mandatory field.

Booking Date & Value date

Both booking date & Instruction date are defaulted as current date. Instruction date can be modified as a back date or forward date.

Transfer Currency

If the network allows only single currency as per Network currency preferences screen (PMDNCMNT), this currency will be populated as transfer currency. If multiple currencies are allowed, you can select from the list of allowed currencies.

Transfer Amount

Specifies the amount received in the incoming payment. This is a mandatory field.

Exchange Rate

If transfer currency & creditor account currency are different, then exchange rate can be provided by the user. The system retain the input value and validates the same against override and stop variances maintained in Network Preferences screen.

If exchange rate is not a user input, the system picks up the exchange rate during ‘Enrich’ provided the transfer amount is less than the small FX limit maintained. If the exchange rate is not available, system displays an error message.

If transfer amount is more than the small FX limit and if external exchange rate is applicable, then exchange rate pick up will happen during transaction processing.

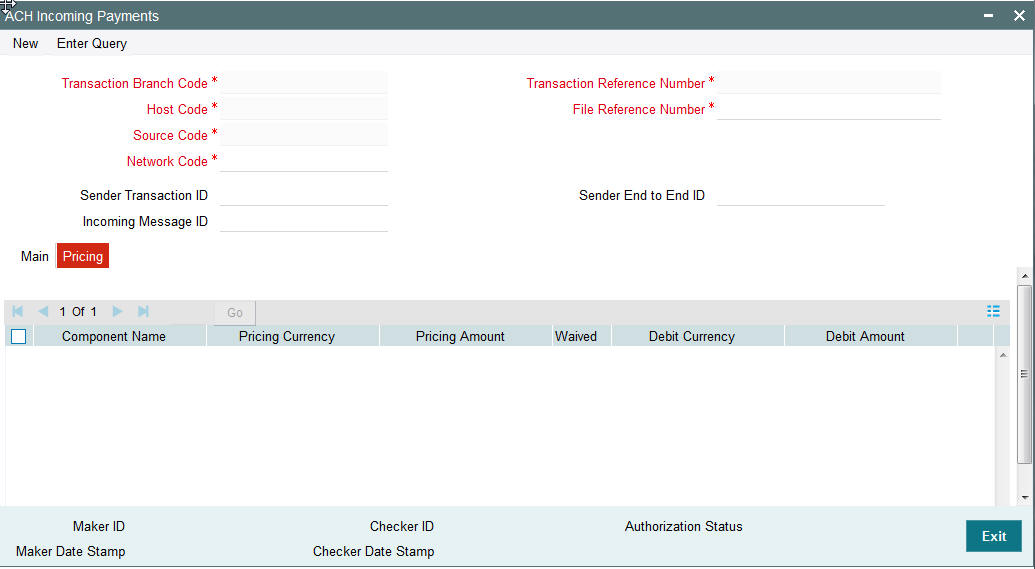

2.7.2 Pricing Tab

You can view pricing details in this screen. Click on the ‘Pricing’ tab to invoke this screen.

2.7.3 Viewing Incoming Payments Summary

You can invoke the ‘Incoming Payments Summary’ screen by typing ‘PASITONL’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

- Transaction Reference Number

- Credit Account Number

- Account Branch

- File Reference Number

- Debtor Account Number

- Customer Number

- Network Code

- Authorization Status

- Customer Service Model

When you click ‘Search’ button the records matching the specified search criteria are displayed.

2.7.4 Future Dated Incoming Payment

- Local Holiday check will be done for the future date and in case of a holiday incoming payment value date will be moved to next working day. This will be applicable for uploaded transactions only. For user input transactions, system will throw error.

- Future dated ACH incoming transactions will be processed by separate jobs.

- Processing of transactions would be completed till sanction check on booking date itself and will be stored in future dated transaction tables.

- During BOD, future dated transaction job picks up transactions with value date as current date and completes steps for processing from initial validations.

Note

Future dated transactions job should be run after rate refresh. This must be handled operationally.

2.8 Return of Incoming Payment

You can invoke the “Return of Incoming Payment” screen by typing ‘PADINRTN‘ in the field at the top right corner of the application tool bar and clicking on the adjoining arrow button. You will be allowed to perform return operations only if the transaction processing status is Completed for incoming transactions.

Return Reference Number

The system displays the Return Reference Number by default.

Return Date

The system displays the Return Date as the current date by default.

Original Transaction Reference

You can select the Original Transaction reference of the incoming payment for which return is to be initiated. Only incoming transactions with payment type as ‘ACH’ and Transaction status ‘Processed’ are listed for this field.

On selecting the Original Transaction Reference ,the information related to the transaction is defaulted in the below listed fields:

- Network Code

- Original Transaction Type

- Original Payment Type

- End to End ID

Original Transaction Details

- Transfer Currency

- Transfer Amount

- Debtor IBAN

- Creditor IBAN

- Creditor Name

- Debtor Bank BIC

- File Reference Number

Return Details

Reject Code

Specify the Reject Code. Alternatively, you can select the Reject Code from the option list. The list displays all valid Reject Codes maintained in the system.

Note

Only the reject codes applicable for the payment network for the operation ‘Payment Re- turn’ are listed.

Reject Reason

The system displays the Reject Reason based on the selected Reject Code.

Originator Name

Specify the name of the Originator.

Originator Bank

Specify the Originator Bank. Alternatively, you can select the Originator Bank from the option list. The list displays all valid Originator Banks maintained in the system.

Note

You must either specify the Originator Name or the Originator Bank.

Network Reject Details

These fields are applicable while querying for a particular Return record which is rejected by the CSM

Reject Reference

The system displays the Reject Reference details.

Reject Received Date

The system displays the date on which the network reject was received.

Reject Code

The system displays the network reject code.

Reject Reason

The system displays the reason for Network Reject.

2.8.1 Return of Incoming Transactions Pending in Queues

- Return operation is provided in Repair queue which is applicable

only for incoming transactions which are pending due to exceptions.

- Incoming ACH payments when cancelled from any exception queue, is moved to Repair Queue.Return of the transaction can be initiated from Repair Queue.

- If payments are returned from the Repair Queue, Incoming payment accounting entries is passed with credit account as Payment Return GL maintained in Payment Currency preferences. Subsequently, payment return is processed and reversal entries are passed.

2.8.2 Processing Auto Returns

- Exceptions encountered during incoming transaction processing are checked with auto reject exception codes that are applicable for the network.

- If exception is to be treated as a auto reject of the incoming transaction, return is processed using Payment Return GL. Both incoming transaction accounting and reverse accounting are posted.

2.9 Payments Recall

A recall happens when an Originator Bank requests to cancel a SEPA Credit Transfer. The recall procedure must be initiated by the Originator Bank within the number of days maintained as Recall days in Network Preferences after the execution date. A recall procedure is initiated for the following reasons:

- Customer Request

- Duplicate payment

- Technical problems

- Fraudulent Credit Transfers

Note

Only outgoing payment transaction in ‘Processed’ and ‘Future Valued’ status will be al- lowed to be selected for recall processing.

2.9.1 Outgoing Recall Input Screen

You can access the Outgoing Recall Input Screen by typing PADOTRCL in the field in the top right corner of the application tool bar and clicking on the adjoining arrow button.

Recall Reference Number

System defaults the recall reference number.

Recall Date

Specifies the date on which the recall was initiated. This date is defaulted as recall booking date.

Customer Initiated

Specify if the customer initiated the recall.

Original Payment Reference

Select the Original Payment Reference. All outgoing payments with payment type as ‘ACH’ and transaction status as ‘Processed’ or ‘Future Valued’ are listed for this field.

On selecting the Original Transaction Reference, the information related to the transaction is defaulted in the below listed fields:

- Network Code

- Original Transaction Type

- Original Payment Type

- End to End ID

Original Transaction Details

- Transfer Currency

- Transfer Amount

- Debtor IBAN

- Debtor Name

- Creditor IBAN

- Creditor Bank BIC

- File Reference Number

Recall Reason

While initiating a Recall request, you can specify the reason for the recall. All valid reject codes applicable for the Network for the operation ‘Payment Recall ‘ are listed for this field.

Reason Description

Based on the Reason code chosen ,reason description is defaulted.

Additional Recall Information

If the reason code entered is ‘FRAD’ then you can provide additional details in this field.

Originator Name

Specifies the name of the Originator.

Originator Bank

Specifies the name of the Originator Bank.

Note

Either Originator name or Originator Bank code can be captured as part of recall request

Response Details

Response details are populated if a positive response is received from Beneficiary bank.

Response Reference

Specifies the reference of the response.

Response Date

Specifies the date on which the response was created.

Reason Code

Specifies the reason code.

Reason Details

Specifies the reason for recall.

Compensation Amount

Specifies the compensation amount.

Network Reject Details

Network reject details are populated if the recall request sent is rejected by the CSM.

Reject Reference

Specifies the reference for rejection.

Reject Received Date

Specifies the date on which the reject was received.

Reject Code

Specifies the reject code.

Reject Reason

Specifies the reason for rejection.

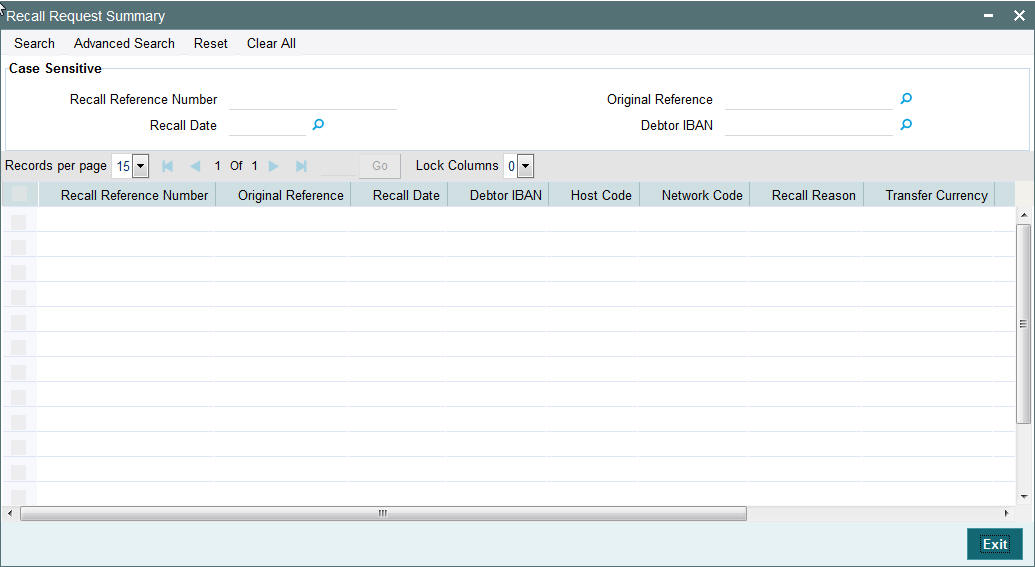

2.9.2 Viewing Recall Request Summary

You can invoke the ‘Recall Request Summary’ screen by typing ‘PASOTRCL’ in the field at the top right corner of the application toolbar and clicking the adjoining arrow button.Click new button on the Application toolbar.

You can click ‘Search’ button to view all the pending functions. However, you can to filter your search based on any of the following criteria:

- Recall Reference Number

- Original Reference

- Recall Date

- Debtor IBAN

When you click ‘Search’ button the records matching the specified search criteria are displayed.

2.9.3 Outgoing Recall Processing

- If you process the recall request before the dispatch of the original transaction message, it is considered as a cancellation of the original payment.

- Original transaction status is also marked as ‘Cancelled’ and payment liquidation entries are reversed. Entries are reversed with negative values.

- If the recall is after the message dispatch, system verifies whether Recall is initiated within the recall days specified in payment preferences. If it exceeds the recall days specified, system displays an override.

- Original transaction is marked as ‘Recall Requested’ and recall record is inserted in message table. camt.056 message is generated for a recall request during dispatch.

- Recall reference, recall date and recall reason is available for original transaction.

- Recall request does not have any accounting impact.

2.9.4 Negative Response for Recall Request

- On receiving a negative response camt.029 for a recall request from beneficiary bank, the system matches the same with the original transaction.

- Parent transaction is matched using the Original Transaction ID field with Transaction reference of outgoing payments in ‘Recall Requested’ status.

- On getting the parent transaction, further matching is done based

on the following fields:

- Transaction currency

- Transaction Amount

- Original debtor IBAN

- Original Creditor IBAN

- Original Creditor BIC

- The original transaction is marked back to ‘Completed’ status. Further operations are possible for this transaction.

- Response details are available as part of original transaction exception details in the view screen.

- There is no accounting impact.

2.9.5 Positive Response for Recall Request

If pacs.004 is received with reject reason ‘FOCR’ – Following Cancellation Request, as response of a recall request, then it is matched with original outgoing transactions with ‘Recall Requested ‘status.

On getting the parent transaction, further matching is done for the following fields:

- Transaction Currency

- Transaction Amount

- Original Debtor IBAN

- Original Creditor IBAN

- Original Creditor BIC

Original transaction is marked as Returned. Return of the outgoing payment transaction is processed.

ECA and accounting related to incoming return is done.

No further action is allowed for a Recall Accepted transaction. Acceptance details are available for viewing.

- Return accounting will be original settlement amount and charges will be debited separately. Customer debit account will be the charge recovery account and charge amount will be the amount mentioned in incoming message. Reversal details will be sent to DDA system for external account check along with charge details. Accounting entries will be handed off to accounting system.

- Accounting code and derived based on the price code linked for third party charges in payment currency preferences for transaction type ‘Outgoing’.

2.9.6 Incoming Recall Upload

- When a incoming camt.056 is received from CSM, matching of the details with original incoming transaction is done.

- Original transaction ID is mapped with Relate Reference field of incoming transactions which are processed in ‘Processed’ status.

- On successful matching with a parent transaction, further matching

will be done with the following fields:

- Transaction Currency

- Transaction Amount

- Original debtor IBAN

- Original Creditor IBAN

- Original Creditor BIC

- Incoming recall request is uploaded on successful matching and will be available in Incoming Recall Screen. You can manually accept or refuse the recall request from this screen.

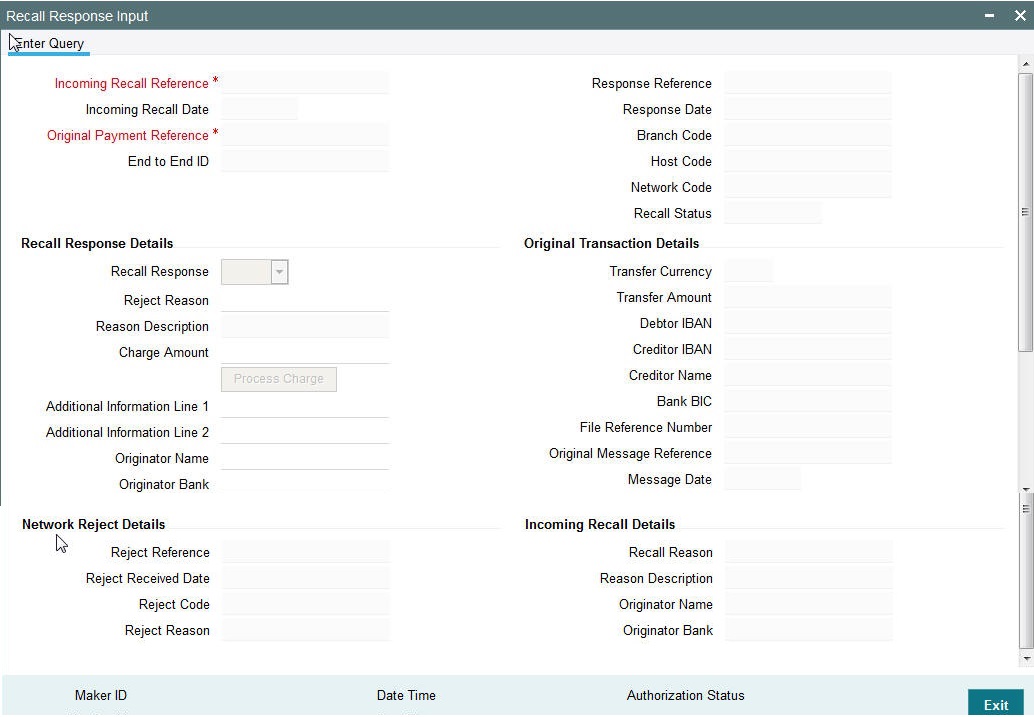

2.9.7 Recall Response Input Screen

You can access the Recall Response Input Screen by typing PADITRCL in the field in the top right corner of the application tool bar and clicking on the adjoining arrow button.

Recall requests received by the Beneficiary Bank are available in this screen.You can query the records and provide positive/negative response to the Originating Bank.

You can query the available records by providing the Incoming Recall reference number.

The following details is defaulted:

- Incoming Recall Date

- Branch Code

- Host Code

- Network Code

- Original Payment Reference

- Original Transaction Details

- Transfer Currency

- Transfer Amount

- Debtor IBAN

- Creditor IBAN

- Creditor Name

- Bank BIC

- File Reference Number

You can unlock the record and provide the recall response details:

Recall Response

You can either accept or reject the recall request received.

Reject Reason

The applicable reject code for the action can be selected

Reason Description

Reason description is populated based on the Reject reason chosen.

Charge Amount

If the recall request is accepted you can mention the charge amount applicable. This amount is reduced from the payment amount while returning the funds.

On clicking Process Charge button, the system defined charge is defaulted. The charge is populated based on the Recall Acceptance Price code maintenance for the transaction type ‘Incoming’ in Network Currency Preferences. You can override the defaulted charge.

2.9.8 Incoming Recall Processing

- While processing a Recall response, it will be validated whether response is being sent within the response days specified in Network preferences.If it exceeds the recall days specified, system displays an override.

- Acceptance of recall triggers return of original incoming and related details gets inserted in message table for sending return message in pacs.004 format.

- Refusal of recall sends out camt.029

2.9.9 Outgoing Positive Response to Recall

- On processing outgoing positive response to recall, system validates whether reject reason input is FOCR when recall response type is ‘Accept’.

- On tabbing out of the reason code field, charge is populated based on the Recall Acceptance Price code maintenance for the transaction type ‘Incoming’ in Payment Currency Preferences.

- You can modify the populated charge amount.

- Return accounting is processed with original settlement amount. Charges are processed separately. GL mentioned in price accounting code is the charge recovery account and charge amount is the amount mentioned in incoming message.

- Reversal details is sent to DDA system for external credit approval. Any failure moves the transaction to ECA queue.

- Accounting entries are handed off to accounting system.

2.10 Handling Network Rejects

Credit Validation File (CVF) is received from CSM for every ICF file to the sending Direct Participant indicating the success or failure of the validation process. A pre-settlement Reject message from CSM can be received in the form of pacs.002S2 report for any message originated by a bank:

- Outgoing Payments – Pacs.008

- Return of Incoming Payments – Pacs.004

- Positive Response to Payment Cancellation Requests – Pacs.004

- Cancellation of Outgoing Payments – Camt.056

- Negative Response to Payment Cancellation Requests – Camt.029

The bulks which are partially accepted or rejected status’PART’ will be processed automatically by system.

2.10.1 Reject of Outgoing Payment

Original transaction has to be in processing ‘Processed’ status with same dispatch details as in incoming reject report .On processing the network reject,

- Transaction status of parent transaction will be marked as ‘Network Rejected’.

- The accounting entries are reversed with negative amounts .Accounting posting will be with event REVR. This action will be auto-authorized.

- No further action is allowed on such transaction.

The Reject Reference Number, Reject date and reject code and reason will be available in Outgoing Transaction View screen.

2.10.2 Reject of Recall Request

In case this is rejected from the network , Original Transaction ID is matched with original recall reference. Original recall has to be in ‘Recall Requested’ status with same dispatch details as in incoming report.

Network Reject Processing

- The reject details will be updated in the Recall Screen. Reject reference, Reject date, Reject code and reason will get updated for the recall request.

- The recall status will be marked as ‘Network Rejected’. No further processing possible on the existing recall request.

- Parent transaction will be moved back to processing ‘Processed’ status.

- A new recall request is possible for parent transaction

Reject reference, Reject date, Reject code and reason can be viewed for original parent transaction. When a new recall is initiated, these details will be nullified.

2.10.3 Reject of Incoming Payment Return

Original Transaction ID is matched with original return reference. Original payment transaction has to be in ‘Returned’ status with return transaction dispatch details as in incoming report.

- The accounting entries posted with RETN event are reversed. Return transaction status is updated to ‘Network Rejected’.

- Parent transaction status is updated back as ‘Processed’ being the status prior to return operation.

- Reject reference, reject date, reject code and reason can be viewed from outgoing transaction view screen.

- Return of the parent transaction can again be initiated. Reject details pertaining to previous return are nullified in the view screen.

2.10.4 Reject of Positive Response to Recall

On receiving a network reject of positive response to Recall,Original Transaction ID is matched with original transaction reference.Original payment transaction has to be in ‘Returned’ status, recall status has to be ‘Approved’ with return transaction dispatch details as in incoming report.

- Return of Incoming Payment will be marked as ‘Network Rejected’. The accounting entries posted with RETN event will be reversed.

- Parent transaction will be marked as processing ‘Recalled’ status as the subsequent return operation is reversed.

- The recall status of the recall request will be updated back to the status prior to the approval action, namely “Recall Requested”, enabling further approval or refusal on the same recall request.

2.10.5 Reject of Negative Response of Recall

Once the Recall request for Incoming Payment is refused, camt.029 will be sent to originating bank.In case, this is rejected from the network , network reject on the negative response of recall request . On receiving the network reject,Original Transaction ID is matched with original transaction reference. Original payment transaction has to be in ‘Processed’ status, recall status has to be ‘Refused’ with return transaction dispatch details as in incoming report

- The recall status of the recall request will be updated back to the status prior to the approval action, namely “Recall Requestedl”, enabling further approval or refusal on the same recall request.

Note

- Bulks with status ’RJCT’ will not be automatically processed by system.This needs to be operationally handled.

- If no original transaction is found for the reject report received,then the system will mark the message as an error and will be moved to the Message Mapping Queue table.

- Suppression of processing at bulk level will not be supported for partially rejected bulks.

- There will not be any file level accounting passed for network rejects. This has to be operationally handled.