2. Faster Payments

Faster or Immediate Payments schemes are now being implemented by countries across the globe to enable banks in meeting customer demands for immediate transfer of funds from one account to another across banks, with certainty, convenience and at a low cost. Mexico’s SPEI, United Kingdom’s Faster Payments, India’s IMPS, Singapore’s FAST (G3) payments, Sweden’s Immediate Payments Scheme (BiR), and Australia NPP (New Payments Platform), among others, have led the way in building real time payments schemes and infrastructure.

Faster Payments module is a high performance system that supports stringent SLA of a typical Faster Payments scheme.

It is also highly scalable to increasing transaction volumes and provides very high availability.

High-lights of Faster Payments

- Manual Payment Initiation

- Receipt of individual payment requests from bank channels via ReST services and J-SON over JMS

- Business validation

- External Credit Approval Check for Outward payments

- External Account Validation for Inward payments

- Accounting

- ISO 20022 pacs.008 Message generation

- Processing response of outgoing payment from Clearing infrastructure in ISO20022 pacs.002 message format

- Receiving incoming payment in ISO20022 pacs.008 message format

- Generation of Real-time Response (pacs.002 message) of Incoming payment within stringent SLA

- Notification to Originating Customers within overall processing SLA

- Immediate Notification to Beneficiary Customer on Credit

- Sending payment details to external Sanctions systems

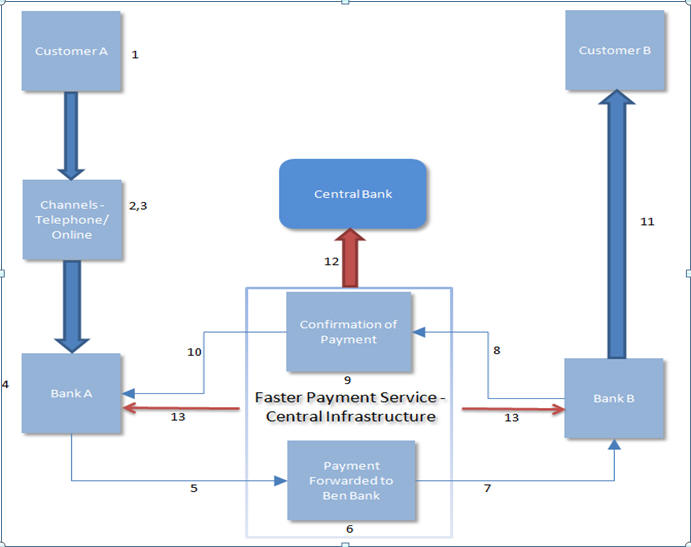

Given below is a end-to-end business process flow for Faster Payments in UK as an example of Faster Payments flow in general. Different countries mentioned above have a variation of the below process flow.

- Customer A having an account with Bank A wants to transfer money to Customer B having account with Bank B

- Customer A instructs his bank, Bank A, through mobile phone, online channel or phone banking to pay £1,000 today to Customer B. In addition to the amount, Customer A also provides Customer B’s bank code and account number in the payment instruction.

- Bank A carries out its normal checks to verify that A is a genuine customer using authentication mechanisms.

- Before Bank A allows the payment to be made, it will check that Customer A’s account has sufficient funds and that the request to make a payment is genuine. In certain cases, the bank may need to hold the payment to undertake further fraud protection checks.

- Bank A submits the transaction through the Faster Payments Service. From this stage onwards, the transaction cannot be cancelled.

- The Faster Payments Service sends the payment instruction to Bank B (Receiving bank) after checking that all the relevant details are included and the instruction is properly formatted, and then debits the sending bank’ shadow account in its system.

- Once Bank B has received the transaction, it checks that the account number is valid (Note: It does not verify that the account name and account number match).

- Bank B then sends a message back to the Faster Payments Service confirming that it has accepted (or rejected) the payment.

- The Faster Payments Service credits the Receiving bank’s shadow account with the funds and sends a message to the Sending bank to let them know that the payment has been made successfully.

- Bank A marks the transaction as complete. Each sending bank will decide how this confirmation will be made available to its own customer. In all cases, once the payment has been made, a confirmation message will always be sent between banks. Bank A confirms the fate of the payment to Customer A.

- The Receiving bank will credit Customer B’s account with the £1,000 sent by Customer A. Where Customer B’s account is with a Faster Payment Participant Bank, he should generally be able to see the credit on his account within seconds and also be able to access the funds. If Mike’s account is with a non-participant of the Scheme, then it may take longer for funds to be shown on his account.

- Faster Payment Service sends Net Settlement positions to Bank of England (Central bank) at settlement cut-over time.

- Bank of England sends Settlement reports to the Sending and Receiving Banks.

2.1 Faster Payment Outgoing Payment Transaction Input Screen

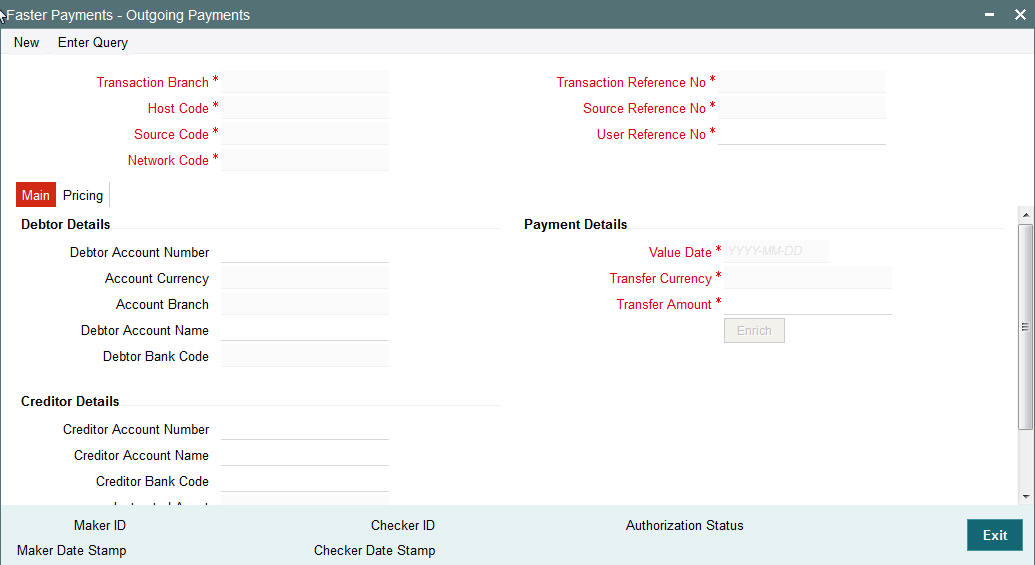

The Transaction Input screen for manual initiation of Faster Payment is used by a branch user to initiate Faster Payment on behalf of a customer who submits a request by walking into the branch or from a customer request received through other offline channels.

2.1.1 Invoking Faster Payment Outgoing Payment Transaction Input Screen

You can invoke ‘Payment Input Instruction’ screen by typing ‘PFDOTONL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Transaction Branch Code

The system indicates the branch from which the customer is logged in.

Host Code

The system indicates the host code that is linked to the transaction branch of the customer

Network Code

Select the Faster Payment scheme. This is a mandatory field.

Source Code

This is defaulted to ‘MANUAL’ and it is non-editable for manually initiated transactions.

Transaction Reference Number

Indicates a unique identifier of the Faster Payment transaction and it is auto-generated. This reference number would be generated on clicking the New button for initiating a new transaction.

- This will be a 26 digit numeric identifier. This number would map to the ‘Instruction Identification’ data element in an ISO20022 message.

- Transaction Reference number format: YYYYMMDDHHMISSsss2nnnnnnnn

- Transaction Reference number components, in order –

- YYYY - Year

- MM - Month

- DD - Date

- HH - Hour of day in 24 hour format

- MI - Minute

- SS - Second

- sss - Millisecond

- 2 - Indicator for Online processing

- nnnnnnnn - 8digit random serial number

User Reference Number

Specify the payment reference number provided by the debit account owner.

Source Reference Number

Specifies the unique identifier of the Faster Payment transaction specific to a particular source of the payment request.

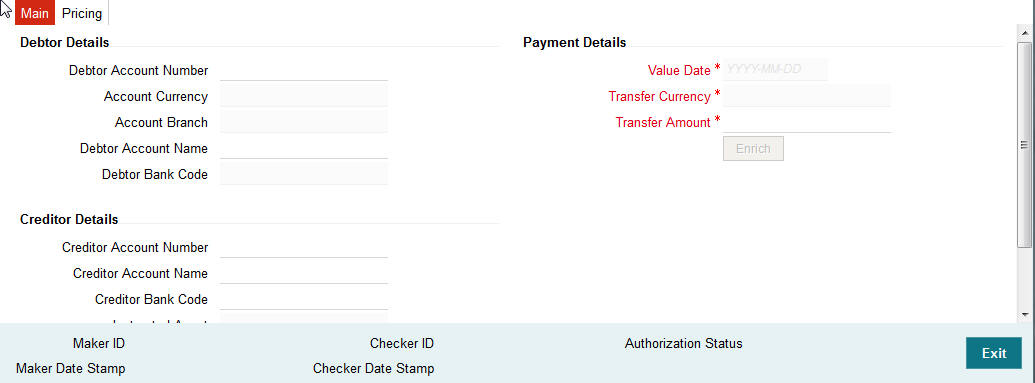

2.1.2 Main Tab

Click Main tab from the Faster Outgoing Payment screen.:

You can specify the following fields:

Debtor Details

Debtor Account Number

Specify the account number of the debtor. Alternatively, you can select the account number from the option list. The list displays all valid account numbers maintained in the system. This is a mandatory field.

Account Currency

Specify the account currency. This is a mandatory field.

Account Branch

Specify the branch of debtor account. This is a mandatory field.

Debtor Account Name

Specify the name of the Debtor Account. This is a mandatory field.

Debtor Bank Code

Specify the bank code of the Debtor Account branch. This is a mandatory field.

Creditor Details

Creditor Account Number

Specify the account number of the beneficiary. This is a mandatory field.

Creditor Account Name

Specify the account name of the creditor. This is a mandatory field.

Creditor Bank Code

Specify the country in which the debtor was born. This is a mandatory field.

Instructed Agent

This field is auto-populated when you specify the Creditor bank code.

Payment Details

Value Date

The system specifies the current application date. This is non-editable. Payment is submitted to the Clearing Infrastructure (CI) on this date and processed by the CI on the same date.

Transfer Currency

This is automatically populated based on the selected Network code and the currency maintained in Network currency preferences (PMDNCMNT) maintenance. For e.g. GBP in case of UK Faster Payments.

Transfer Amount

Specify the payment amount for transfer. This is a mandatory field.

Enrich

Click this button to trigger computation of Charges and populate the Charges in the Pricing tab.

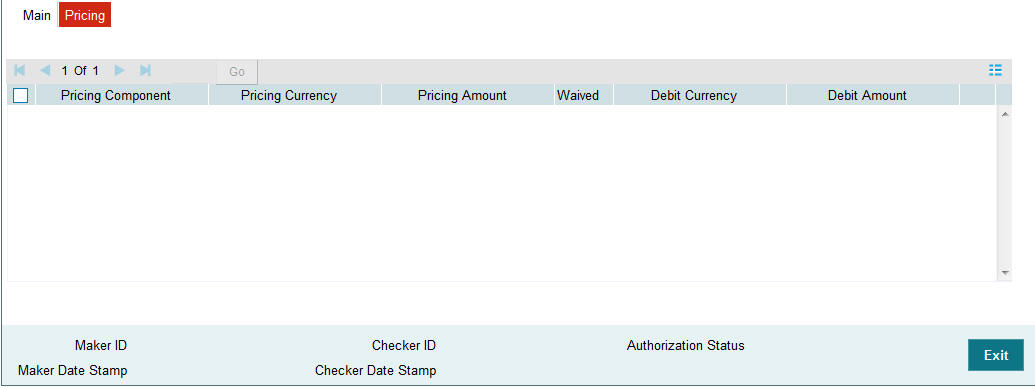

2.1.3 Pricing Tab

Click the Pricing tab from the Faster Payment Outgoing Payment screen.:

Note

- On clicking the Enrich button, system would compute the Charges, and Tax on Charges if applicable, based on the maintenance for Pricing Code specified in Network Currency Preferences (PMDNCPRF).

- There may be one or more applicable Charge and Tax components as defined in the Pricing Code maintenance. For each Charge and/or Tax component, the fixed amount or rate would be fetched from Pricing Value Maintenance screen (PPDVLMNT) as applicable for the Payment Source code & Customer Service model.

You can specify the following fields:

Pricing Component

The system displays the name of the applicable Charge component.

Pricing Currency

The system displays the pricing currency of the component from the Pricing Code Maintenance.

Pricing Amount

The system displays the fixed or calculated charge amount using the Pricing Value Maintenance. You can edit this field to a non-zero value.

Waiver

Check this box to select the charge component to waive the associated charges.

Note

- If a particular Charge component is waived by you, then system would automatically also check the Waiver check box for the associated Tax component (identified from the Pricing code maintenance) if displayed in this grid. You would not be able to clear the Waiver check box for this Tax component unless the associated Charge component waiver flag is unchecked.

- If charge/tax component is already waived in the Pricing Value maintenance, this component would still be displayed with the value and the waiver flag checked. This flag would not be allowed to be unchecked.

Debit Amount

The system displays the amount debited to the selected debit amount.

Note

Debit Currency is the same as Pricing Currency.

2.1.4 Additional Details

Under Main tab, click the Additional Details button in the Faster Payment Outgoing Payment screen.

You can specify the following fields:

Debtor Address

Address 1

Specifies the first line of the debtor’s address.

Address 2

Specify the second line of the debtor’s address.

Country

Specify the country of residence. Alternatively, you can select the country code from the option list. The list displays all valid country codes maintained in the system.

Debtor Identification

Organization Bank Id

Specify the BIC details in case the organization is a Financial Institution. In case of non-financial specify the BIC assigned to the corporate organization.

Private Identification

Specify the Private Identification details that is issued by a government or private organization to an individual person.

Identification Issuer

Specify the Issuer that provided the identification.

Identification Scheme Code

Specify the Identification Scheme Code, if applicable.

Remittance Information

Payment Details 1

Specify the first line of the payment details for the creditor to identify the purpose so that payment can be applied. You can enter a maximum of 35 characters.

Payment Details 2

Specify the second line of the payment details for the creditor to identify the purpose so that payment can be applied. You can enter a maximum of 35 characters.

Payment Details 3

Specify the third line of the payment details for the creditor to identify the purpose so that payment can be applied. You can enter a maximum of 35 characters.

Payment Details 4

Specify the fourth line of the payment details for the creditor to identify the purpose so that payment can be applied. You can enter a maximum of 35 characters.

Creditor Address

Address 1

Specify the first line of the creditor’s address.

Address 2

Specify the second line of the creditor’s address.

Country

Specify the country of residence. Alternatively, you can select the country code from the option list. The list displays all valid country codes maintained in the system.

Creditor Identification

Organization Bank Id

Specify the BIC details in case the organization is a Financial Institution. In case of non-financial specify the BIC assigned to the corporate organization.

Private Identification

Specify the Private Identification details that is issued by a government or private organization to an individual person.

Identification Issuer

Specify the Issuer that provided the identification.

Identification Scheme Code

Specify the Identification Scheme Code, if applicable.

2.1.5 Actions allowed in the Faster Payment Outgoing Input screen

The following are the operations which will be supported in the Outgoing Payments Input Screen:

- New: This operation is to be used to create a new Payment Transaction.

- Delete: This operation is to be used to delete the new Payment transaction created before Payment Authorization. Only the user who created the Payment transaction can do this Operation.

- Copy: This operation enables the user to create a transaction by copying details from an existing transaction.

- Authorize: This operation is to be used to approve the Payment creation or the last operation on the payment.

- Query: This operation is to retrieve already created payment using the combination of header fields. The search fields should be used in a manner so that it results in a single matching transaction being retrieved as a search result.

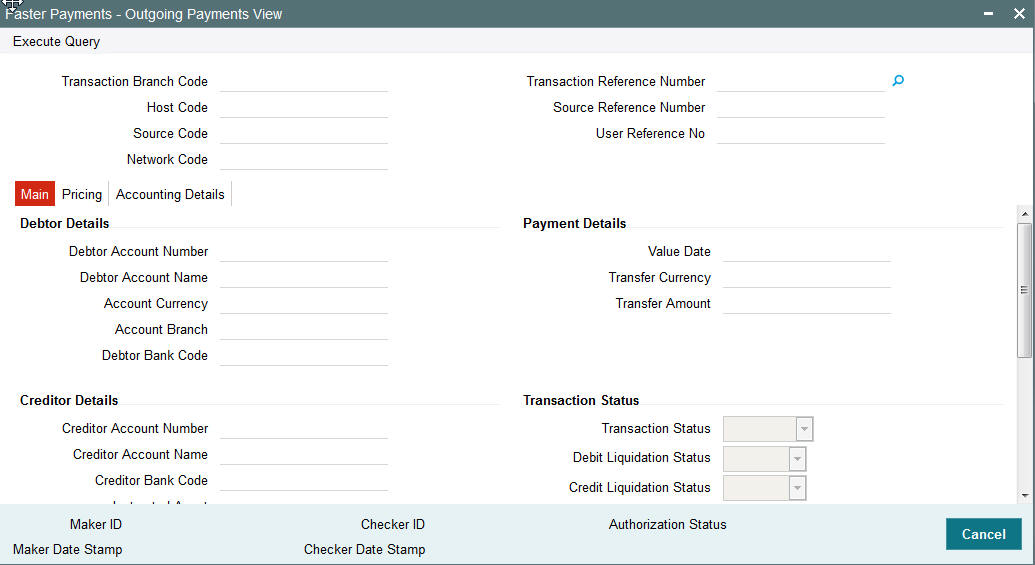

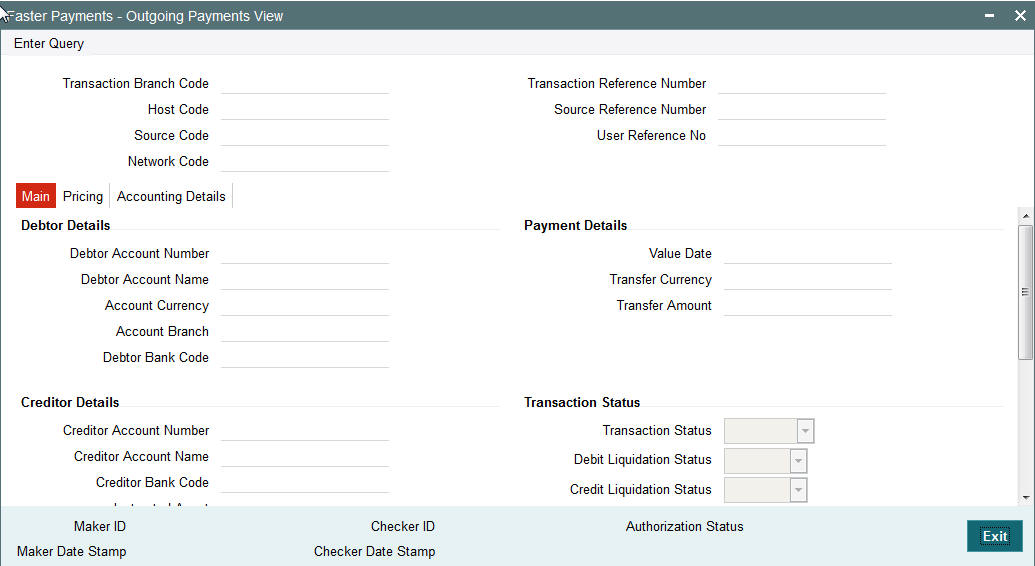

2.2 Faster Payment Outgoing Payment View Screen

The Faster Payment Outgoing Payment View Screen has the following details:

- Main - The Main tab has certain fields that requires user input. Certain fields are disabled.

- Pricing - The Pricing tab of the View Screen is the same as in the Outgoing Payment Transaction Input Screen with all the fields disabled.

- Accounting Details - The Accounting Details tab would be same as that in the ACH Outgoing View Screen.

- Additional Details - The Additional Details popup window would be the same as that in Outgoing Payment Transaction Input Screen.

2.2.1 Invoking Faster Payment Outgoing Payments View Screen

You can invoke ‘Faster Payment Outgoing Payments View’ screen by typing ‘PFDOVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button...

You can specify the following fields:

Transaction Branch Code

The system indicates the branch from where the customer is logged in.

Transaction Reference Number

The system indicates a unique identifier of the Faster Payment transaction and it is auto-generated.

Host Code

The system indicates the host code that is linked to the transaction branch of the customer.

User Reference Number

The system indicates the User Reference Number.

Source Code

This is non-editable for manually initiated transactions.

Source Reference Number

The system indicates a source reference number of the Faster Payment transaction and it is auto-generated.

Network Code

The system indicates the selected Faster Payment scheme.

2.3 Faster Payment Incoming Payment View Screen

The Faster Payment Incoming Payment View Screen has the following details:

- Main - The Main tab has certain fields that requires user input. Certain fields are disabled.

- Pricing - The Pricing tab of the View Screen is the same as in the Outgoing Payment Transaction Input Screen with all the fields disabled.

- Accounting Details - The Accounting Details tab has details like Event Code, Transaction Date, Transaction Account, Account Branch and so on.

- Additional Details - The Additional Details popup window is the same as that in Outgoing Payment Transaction Input Screen.

2.3.1 Invoking Faster Payment Incoming Payments View Screen

You can invoke ‘Faster Payment Incoming Payments View’ screen by typing ‘PFDIVIEW’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button..

You can specify the following fields:

Transaction Branch Code

The system indicates the branch from where the customer is logged in.

Transaction Reference Number

Specify a unique identifier of the Faster Payment transaction.

Host Code

The system indicates the host code that is linked to the transaction branch of the customer.

User Reference Number

The system indicates the User Reference Number.

Source Code

This is non-editable for manually initiated transactions.

Network Code

The system specifies the selected Faster Payment scheme.

Instruction Id

Indicates the instruction Id of the transaction.

Transaction Id

The system indicates the instruction Id of the sender’s transaction.

2.4 Faster Payment - Maintenances

This section details all the maintenances that are required for processing of outward and inward Faster Payments. Some of these maintenances are New and while others are existing maintenances that are shared with the ACH Payments system.

- Network Maintenance

- Source Maintenance

- Source Network Preferences

- Network Currency Preferences

- Network Preferences - Two parameters are added for Outgoing transaction. They are Time-out period and Number of Re-tries.

Note

The above two parameters are applicable only to Network codes maintained for Payment type as ‘F’.

- Account Redirection

- Bank Redirection.

- External Customer Account Input

- Pricing Code

- Pricing Value