Collecting Agent Taxes

Besides the normal tax configurations, retenciónes and percepciónes (collecting agent taxes) are available for use in Latin American countries. (Country mode must be set to a Latin American country to use this feature.)

If your property is a collecting agent, set the Cashiering>Collecting Agent Taxes application function to Y.

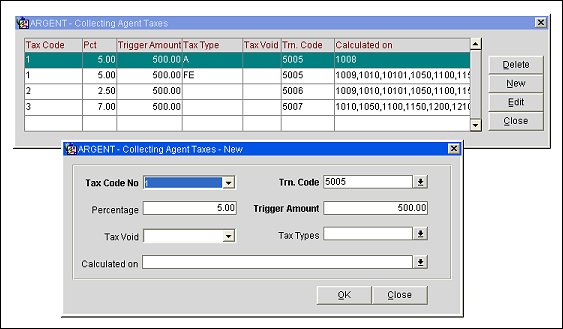

To configure collecting agent taxes, select Configuration>Cashiering>Collecting Agent Taxes. The Collecting Agent Taxes screen appears.

You can configure up to 5 collecting agent taxes per tax type. For each tax to be configured, specify the following:

Tax Code No. Select the down arrow to choose an identifying number for the collecting agent tax.

Trn. Code. Select the down arrow to choose the transaction code to be posted for the tax.

Percentage. Percentage to be charged.

Trigger Amount. Net amount in the Billing screen window that must be reached before the tax is activated.

Tax Void. In some cases, if one collecting agent tax is applied, it will void the possibility of applying one of the others. Select the down arrow to choose the tax to be voided if the tax currently being configured is applied.

Tax Types. Select the down arrow to choose the tax type(s) that will be charged with this collecting agent tax. You may configure multiple collecting agent taxes with the same tax code but with different tax calculations depending on the guest's tax type. The same tax code may not be applied to multiple collecting agent taxes that are configured for the same tax type or combination of tax types.

Calculated On. Select the down arrow to choose all transaction codes or subgroups that will be involved in the calculation of the collecting agent tax.

You must also indicate which tax types will be charged with the collecting agent taxes. To do this, select Configuration>Cashiering>Tax Types. Select the Collecting Agent check box on the Tax Types - New or Tax Types - Edit screen if guests having that tax type are subject to the collecting agent taxes. (See Tax Types for details.)

Since individual guests can be fully or partially exempt from some or all of these taxes, up to 3 Tax Percepción Exemption fields may be screen painted on the Profile screen More Fields tab. Use these fields to specify the guest's percentage of exemption from the collecting agent taxes for the tax type assigned to the profile. For example, if the guest is completely exempt from the tax percepción 1, enter 100 in the TaxPerc1 field. If the guest is exempt from 10 percent of the tax percepción 2, enter 10 in the TaxPerc2 field, and so on. Collecting agent taxes will only be calculated at the time the account is settled.

See Also