Defining an Organization's Matching Gift Rules

The Matching Rules component enables you to define the matching gift rules for an organization. You can maintain information about minimum match amounts and match ratios, the designations for which gifts can be matched, the annual matching gift budget, required information and contacts, and any matching gift restrictions the organization has.

This section discusses how to set up matching gift rules, restrictions, and required information.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Matching Gift Rules |

AV_MTCH_ORG_RULES |

|

Enter information about an organization's match amount, ratio, and budget rules; eligible and ineligible designation type, gift types, alumni statuses, and employee statuses; and contacts for an organization's matching gift program. |

Access the Matching Gift Rules page ().

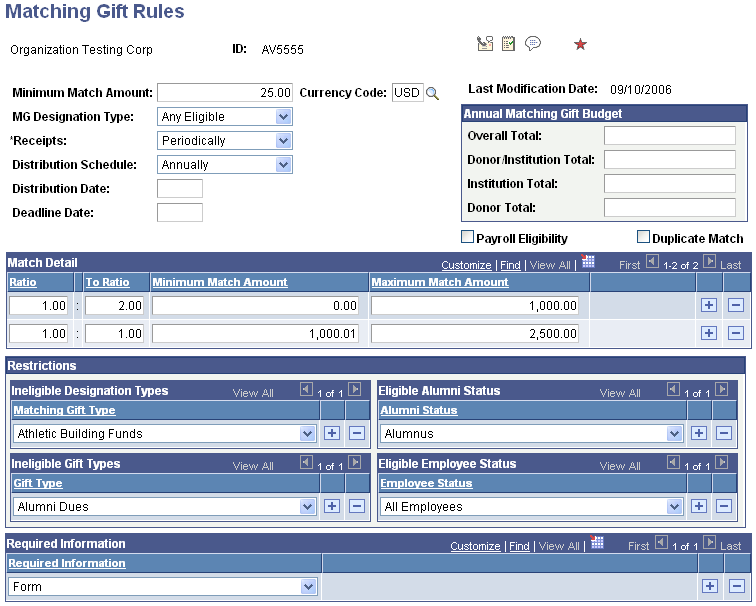

Image: Matching Gift Rules page (1 of 2)

This example illustrates the fields and controls on the Matching Gift Rules page (1 of 2). You can find definitions for the fields and controls later on this page.

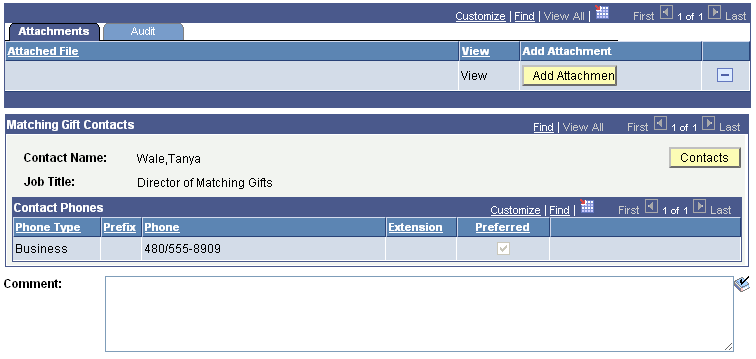

Image: Matching Gift Rules page (2 of 2)

This example illustrates the fields and controls on the Matching Gift Rules page (2 of 2). You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Minimum Match Amount |

Enter a minimum amount for gifts that the organization matches. The organization only matches gifts that are equal to or greater than the amount in this field. If the gift meets this amount, the matching gift program then considers if it is given to an appropriate designation (set up on the Restrictions page). If the gift passes this test, then the matching gift program considers the matching ratios. |

| Currency Code |

Note: The currency you select here applies to all amount fields on this page. |

The following fields are informational only and are not used in the automated matching gift process:

|

Field or Control |

Definition |

|---|---|

| MG Designation Type (matching gift designation type) |

Indicate the designation to which matching gift funds must be applied when they are received. Values for this field include Any Eligible, Donor's Designation, and Gen'l Operating Budget. This field information only field enables you to determine to what designations a matching gift company's payment should be allocated. Values for this field are delivered with the system as translate values. You can modify these translate values. |

| Receipts |

Select the appropriate option for receipts. Periodically means receipts may be combined and sent to the organization periodically. Each Gift means the organization requires a receipt from the institution for each company gift. This field is not included in automated acknowledgement process. Values for this field are delivered with the system as translate values. You can modify these translate values. |

| Distribution Schedule |

Determine the frequency with which organizations make matching gift payments to your institution. Values include: Annually, Continuously, Monthly, Quarterly, and Semiannually. Values for this field are delivered with the system as translate values. You can modify these translate values. |

| Distribution Date |

Enter a value if the organization only matches gifts once a year on a specific date. Enter the date as mm/dd. |

| Deadline Date |

Enter the date on which a completed matching gift form must be received by the organization in order for it to match the gift. Enter the date as mm/dd. |

| Payroll Eligibility |

Select if the organization offers employees the option of having payroll deduction gifts matched through its matching gift program. |

| Duplicate Match |

Select if the organization matches gifts that are matched by other organizations. For example, if a donor's gift is also matched by his or her spouse's employer, the donor's employer matches the gift as well. |

| Required Information |

Select the items an organization must receive prior to matching a gift. Examples are Matching Gift Form, Original Check to Company, Donor Calls Company, and Receipt. Values for this field are delivered with the system as translate values. You can modify these translate values. |

| Comment |

Enter any additional information about the organization's matching gift program. You can use this field to compile complex facts as appropriate for matching gift organizations so that you have access to specific decision-making information. This is a free-form text field. |

Annual Matching Gift Budget

|

Field or Control |

Definition |

|---|---|

| Overall Total |

Enter the organization's total annual matching gift budget. This amount represents the total amount the organization will donate in matching gift payments to your institution as well as other institutions for the current year. |

| Donor/Institution Total |

Enter the maximum monetary amount the organization will match toward one donor's gifts to your institution this year. |

| Institution Total |

Enter the maximum monetary amount the organization will give to your institution in matching gift payments this year. |

| Donor Total |

Enter the maximum amount the organization will pay in matching gifts for donations made by one donor to your institution as well as other institutions this year. |

Match Detail

The following fields are used in the automated matching gift process.

|

Field or Control |

Definition |

|---|---|

| Ratio and To Ratio |

Enter the formula by which an organization calculates the amount it matches for each regular donor gift to your institution. Ratio ranges can include fractions such as 1.25:1. This field is used in the automatic calculation of the expected matching gift amount. You can enter multiple match ratios as long as the amount ranges associated with each ratio do not overlap. |

| Minimum Match Amount and Maximum Match Amount |

For each ratio, enter a minimum amount and maximum amount. These fields are used in the automatic calculation of the expected matching gift amount. For example, if the matching gift organization matches 100 percent of gifts from 25 to 25,000 USD, then the first minimum amount field on this page should be set to 25 USD and the first Ratio Minimum Amount field should be left blank or set to 0 USD. The maximum amount field should include the cap for the match ratio, or 25,000 USD. The system calculates that all qualified gifts are met at 100 percent up to 25,000 USD. If the organization matches gifts larger than 25,000 USD at a different ratio (perhaps 0.5:1) then the minimum amount for the next ratio would be 25,000.01 with the appropriate cap entered in the maximum amount field. |

Restrictions

|

Field or Control |

Definition |

|---|---|

| Ineligible Designation Types |

Select the designation types that are not eligible for an organization's matching gift program. This field is used in the automatic calculation of the expected matching gift amount. |

| Ineligible Gift Types |

Select the ineligible gift types that your organization does not match, such as dues or deferred gifts. This field is used in the automatic calculation of the expected matching gift amount. |

| Eligible Alumni Status |

Select the appropriate eligible alumni status. Alumni status refers to the status a donor must have as a formal student of your institution in order for the organization to match gifts made to your institution. Values for this field include Alumnus, Attendance Requirement, Child or Spouse Attended, and Graduate. Values for this field are delivered with the system as translate values. You can modify these translate values. |

| Eligible Employee Status |

Select the appropriate eligible employee status. Employee status refers to the status a donor must have as an employee at the organization for it to match gifts. Values for this field include All Employees, All Full-Time Employees, Employees in US or Possessions, Full-Time Salaried Employees, Non-Employee Directors, Period of Service, Permanent Part-Time, Retired Employees, Spouses of Eligible Employees, Spouses of Eligible Retirees, and Widows/Widowers of Eligible Retirees. Values for this field are delivered with the system as translate values. You can modify these translate values. |

Attachments

You can view existing attachments to the organization's matching gift rules record and add new ones. Click the View link to open the attachment in a new window. Click the Add Attachment button to upload a new attachment from within the component.

Matching Gift Contacts

This group box displays the name of each organization contact at the organization with an ORG_CONTACT code of MG or matching gift coordinator, and his or her job title and telephone numbers. The ORG_CONTACT code is a delivered value and should not be deleted.

|

Field or Control |

Definition |

|---|---|

| Contacts |

Click this button to access the page where contact information can be updated. |

| Contact Information |

This area displays phone types and phone numbers for matching gift contacts. |