Understanding CommonLine Loan Processing

This section discusses CommonLine loan process flow.

To process Federal Family Education Loan Program (FFELP) and alternative loans, the Campus Solutions system supports both versions of CommonLine, the newer Common Record CommonLine (CRC) and the older CommonLine 4 (CL 4). You use the CommonLine version supported by your lenders, guarantors, and loan servicers; you can process CRC and CL 4 loans separately or simultaneously.

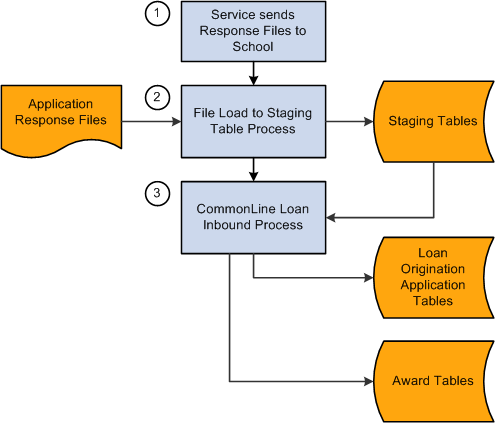

The outbound business processing flow for CommonLine FFELP and alternative loans using either CRC or CL 4 is as follows.

Student accepts the loan offer made on their financial aid package.

The Loan Origination process detects the student's newly accepted loan and calculates application information such as total loan amount, loan period, disbursement amounts and dates, loan servicer, processing type, and whether to process as a CRC or CL 4 loan. The calculated information is stored on the loan origination application tables.

Note: If a Promissory Note is submitted to the school before the loan is originated, the information is used during origination.

After origination is complete, Loan Validation process is run to check the loan application for data discrepancies. Loans failing validation are reprocessed in subsequent runs until validation is reached.

The CommonLine Loan Outbound process moves validated loans into outbound staging tables.

The Application File Creation process creates loan application files from the staging table information. CRC generates files in XML format and CL 4 uses ASCII files.

The system does not provide a method for electronically transmitting CommonLine files to their destinations as each loan servicer might require a specific method to be used, such as FTP or a Web interface.

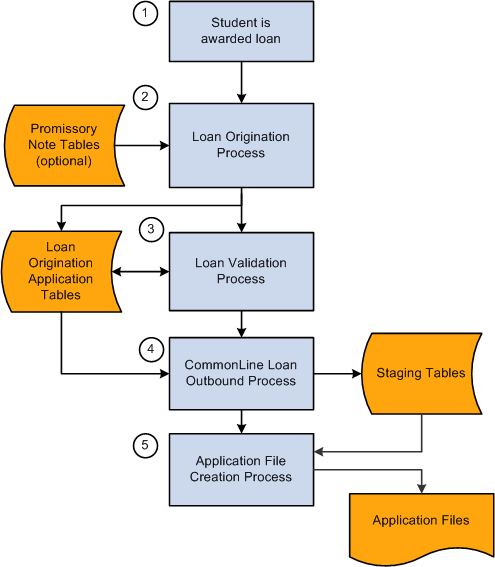

The application files you submit to the loan servicers are processed and you are notified using receipt of response files for each loan processed.

The following illustration shows the flow of CommonLine loan processing:

Image: Loan origination outbound process

Loan origination outbound process

Although the CommonLine Loan Outbound business process flow is the same for CRC and CL 4, several processing steps require a separate programs for CRC and CL4. The following table indicates where the separate processes exist.

|

Business Process |

Common Record CommonLine |

CommonLine 4 |

|---|---|---|

|

Loan validation |

CRC validation (Equation Engine) |

CL 4 validation (Equation Engine) |

|

CommonLine Loan Outbound |

CRC outbound staging (FAPCLOUT) |

CommonLine 4 outbound (FAPLCOD4) |

|

Application File Creation |

CRC XML outbound (SFA_CRC_OUT) |

Outbound EC agent (EDI Manager) |

Inbound file processing:

Image: Inbound Processing

Inbound Processing