Adjusting Loan Disbursements Manually

This section discusses how to modify disbursements.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

CommonLine Disbursement Maintenance |

LOAN_FUND_MAINT |

|

Adjust disbursements for all CommonLine loans and document the disbursement and return of funds. Suspend or release disbursements. |

|

Comments |

LN_DISBACT_COM_SEC |

Click the Comments link on the CommonLine Disbursement Maintenance page. |

Open a free-form comment page that is associated exclusively with the loan action code entered in the page. |

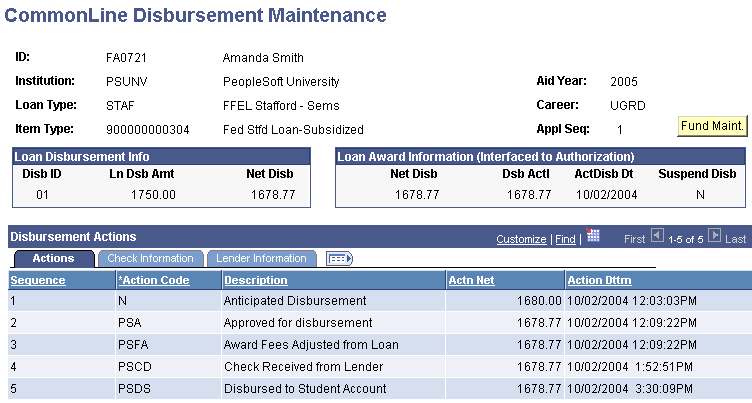

Access the CommonLine Disbursement Maintenance page ().

Image: CommonLine Disbursement Maintenance page: Actions tab

This example illustrates the fields and controls on the CommonLine Disbursement Maintenance page: Actions tab. You can find definitions for the fields and controls later on this page.

Loan Award Information (Interfaced to Authorization)

|

Field or Control |

Definition |

|---|---|

| Net Disb (net disbursement) |

The total EFT or manual check balance for the disbursement ID. This is the maximum amount authorized. This can only be updated by the EFT load and this page. |

| Dsb Actl (disbursement actual) |

Total amount disbursed to the student's account. |

| ActDisb Dt (account disbursement date) |

The last date the student's account was updated for this loan disbursement. |

| Suspend Disb (suspend disbursement) |

A value of Y indicates that the system is suspending disbursement processing for this loan disbursement. Authorization continues to function. N indicates the disbursement is not suspended. This is set in the loan adjustment program when loans are reduced and an EFT has been received. To set this value, enter the appropriate code in the Action Code field to make the field available. |

Actions Tab

|

Field or Control |

Definition |

|---|---|

| Sequence |

The origination action sequence is generated from the loan record activity. |

| Action Cd (action code) |

Enter an action code for the task you want to perform (entering a check, for example). When you enter the code, appropriate fields become available. PSAD: Manual Fund Adjustment. Used to change disbursement amounts. The net disbursement is adjusted with the value of action net. PSCD: Check Received from Lender. Used for manual check entry. Updates Student Financials. Assumes the check has been endorsed by the borrower. The net disbursement is adjusted with the value of action net. PSCR: Funds Returned to Lender. Used when funds have been returned to the disbursing agent or lender. The net disbursement is adjusted with the value of action net. PSCN: Unendorsed Check Received. Used for manual check entry. Updates Student Financials. The check does not disburse to the student's account. The net disbursement is adjusted with the value of action net. The Suspend Disb (suspend disbursement) field is set to Y. PSCE: Check Endorsed. Used to indicate a previously received check has been endorsed by the borrower. The Suspend Disb (suspend disbursement) field is set to N. A previously unendorsed check can now be disbursed to the student's account. PSFH: Suspend Disbursement Processing. The Suspend Disb (suspend disbursement) field is set to Y. This prevents disbursement to the student's account. PSRH: Release Suspended Disbursement. The Suspend Disb (suspend disbursement) field is set to N. This permits disbursement to the student's account. PSPR: Pending Resolution. Informational only. Can be used in conjunction with reports to manage the timely disbursement and return of loan funds. PSFN: Funds Need to be Returned. Informational only. Can be used in conjunction with reports to manage the timely disbursement and return of loan funds. |

| Actn Net (action net) |

Indicates adjustments made to the disbursement. When the loan action code is initiated by the loan origination process or by the loading of an application response file, the value corresponds to the net disbursement. When loan action codes are manually inserted to reflect the receipt or adjustment of actual loan funds—loading of EFT records or manual check entry—the Actn Net value is used to adjust the net disbursement on the page. |

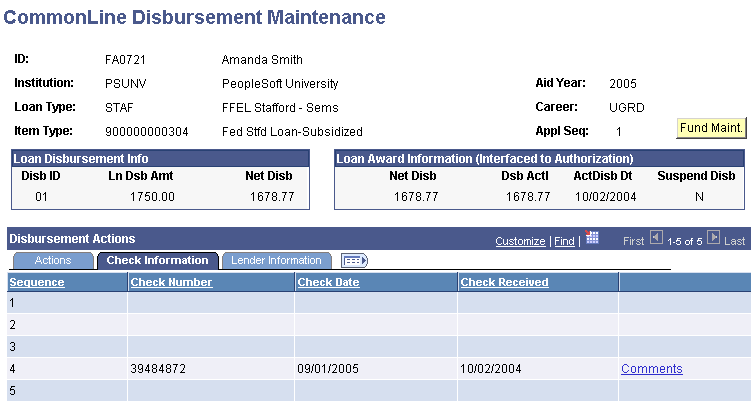

Check Information Tab

Select the Check Information tab on the CommonLine Disbursement Maintenance page.

Image: CommonLine Disbursement Maintenance page: Check Information tab

This example illustrates the fields and controls on the CommonLine Disbursement Maintenance page: Check Information tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Sequence |

The origination action sequence is generated from the loan record activity. |

| Comments |

Click to open a free-form comment page that is associated exclusively with the loan action code entered in the page. |

| Fund Maint (fund maintenance) |

Click to enter transactions. When entering check transactions, the Check Number, Check Date, and Check Received fields can be updated with the check information. |

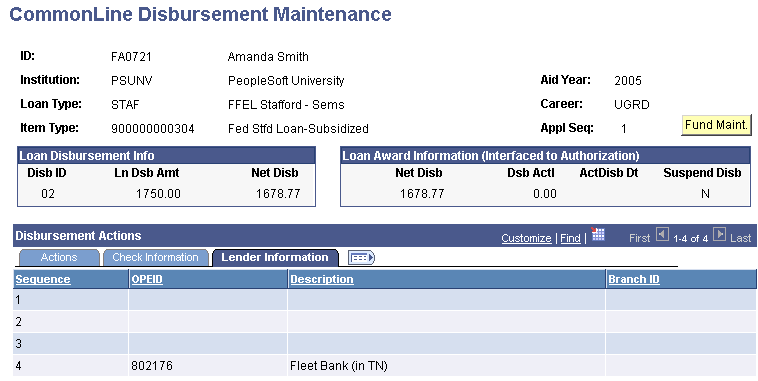

Lender Information Tab

Select the Lender Information tab.

Image: CommonLine Disbursement Maintenance page: Lender Information tab

This example illustrates the fields and controls on the CommonLine Disbursement Maintenance page: Lender Information tab. You can find definitions for the fields and controls later on this page.

The Lender Information tab reflects whether the loan is a CL4 or a CRC processed loan. CL4 Lender Information displays the lender ID in the Loan Check Lender column. CRC Lender Information displays the lender's OPEID and branch ID values.

|

Field or Control |

Definition |

|---|---|

| Loan Check Lender |

For CL4 loans, the Lender ID value of the lender is displayed. The OPEID and Branch ID columns do not display. |

| OPEID |

Displays the ID of the lender who issued the check as entered in the page. When entering check information, the field allows you to select the lender by OPEID. |

| Description |

Displays the name of the lender who issued the check. |

| Branch ID |

Indicates the branch number of the lender OPEID. This field is populated when inserting check information. |

Entering Checks Manually

Enter all checks received on this page.

Use the following action codes:

PSCD (Check Received from Lender) if the check is to be disbursed as soon as possible.

PSCN (Unendorsed Check Received) if unendorsed checks need to be entered, but the funds should not be disbursed to the student's account until the endorsement has been received. After the endorsement is received, a new row must be inserted with the value of PSCE (Check Endorsed) to allow the funds to be disbursed.

Adjusting Amounts After Receipt of Funds

Enter the check for the entire amount for the first loan. Use action code PSCD. Next, enter a new action of PSAD (Manual Fund Adjustment) enter a negative net amount in the value of the first disbursement for the second loan. Enter a comment explaining that reduction.

Next, select the first disbursement of the second loan. Enter action PSCD and enter a net amount for the value of the check reduction. Enter a comment explaining the entry.

Tracking Disbursements Example

Here is an example of using the CommonLine Disbursement Maintenance page to track disbursements.

Loan funds are received using EFT roster. The EFT roster load date is assumed to be the date funds are received by the institution. Authorization and disbursements are run for all students on the roster.

Run the CommonLine reconciliation reports to select all EFT records not disbursed. Review each record not disbursed. Based on the status of each disbursement, you can determine whether:

The disbursement needs to be returned or reissued. Update the loan and award if necessary. Run the loan adjustments process to calculate a return amount or reissue date. Insert an action code of PSFN (Funds Need to be Returned). Use the Actn Net field or the comment page to document the amount to be returned. After the funds have been returned, enter a new action code of PSCR (Funds Returned to Lender), and enter the amount. This reduces the net disbursement amount to zero. If the disbursement is to be reissued later, the new check is processed normally.

The disbursement can be made after an issue is resolved. As an example, the student needs to enroll full time. Insert an action code of PSPR (Pending Resolution). Enter a comment documenting why the disbursement should be held. Continue to run the EFT Reconciliation reports to monitor the status of the disbursement. If, after ten days, you determine that the check must be returned, enter a new action of PSFN. After the funds have been returned, enter a new action code of PSCR and enter the amount.