Creating Loan Destinations

To set up loan destinations, use the Create Loan Destinations component (LN_DEST_PROFILE).

This section provides an overview and discusses how to:

Define loan destination profiles.

Define CommonLine options.

Define loan destination edits.

Consolidate the loan participants—the lender, guarantor, and servicer—into one entity, the loan destination. The loan destination defines the business characteristics and protocols between a lender, guarantor, and servicer, which enables them to process loans for the school. You must create a loan destination profile for each lender in the FFELP loan program or alternative loan program, and for the direct lending servicer for direct loans.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Dest Profile (loan destination profile) |

LN_DEST_PROFILE |

|

Define participants that your institution uses to exchange loan application data. You can designate multiple destinations for a specific loan program. |

|

CommonLine Options |

LN_DEST_PROFILE2 |

|

Designate CommonLine options for a loan destination. |

|

Loan Dest Edits (loan destination edits) |

LN_DEST_EDITS |

|

Select loan validation edits to be used for the loan destination. |

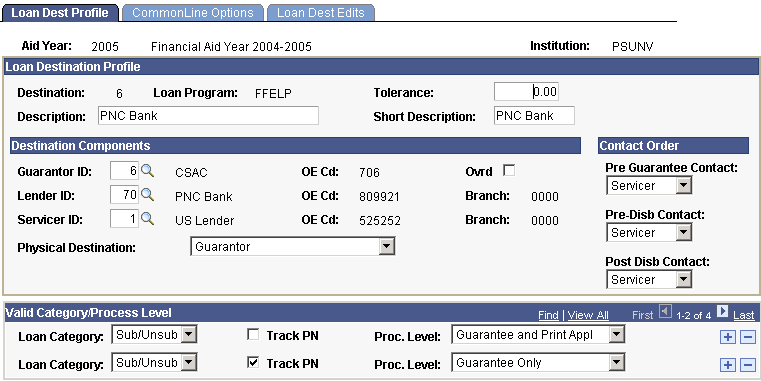

Access the Loan Dest Profile page ().

Image: Loan Dest Profile page

This example illustrates the fields and controls on the Loan Dest Profile page. You can find definitions for the fields and controls later on this page.

Normally, a loan destination includes a lender, a guarantor, and a servicer. CommonLine requires that you define at a minimum a guarantor for the destination.

Loan Destination Profile

|

Field or Control |

Definition |

|---|---|

| Loan Program |

Create a loan destination profile for each participant that receives the physical loan origination files. Select from: Alternative, FFELP, Health, Perkins, State, and University. |

| Tolerance |

Used for CommonLine 96 loans processing. This field is no longer used for current loan processing. |

| Description |

For a FFELP loan, enter a description that best describes the destination. |

Destination Components

|

Field or Control |

Definition |

|---|---|

| Guarantor ID, Lender ID, and Servicer ID |

Select any combination of the guarantor, lender, and servicer, but note that one of them must be the guarantor. This is a CommonLine requirement. Select the Ovrd (override) check box to save the page without designating all three components. After you select an ID and press TAB to move to the next field. The system displays the office of education code and branch. If you are defining a loan destination for the direct lending loan program, you should only select a servicer ID. |

| Ovrd (override) |

Select this check box to be able to save the page without having to designate all three components. |

| Physical Destination |

Select the destination to receive the loan application. Values are: Lender, Servicer, and Guarantor. |

Contact Order

|

Field or Control |

Definition |

|---|---|

| Pre-Guarantee Contact, Pre-Disbursement Contact, and Post Disbursement Contact |

Identifies the loan agency that should be contacted based on the state of the student's loan application. Select a guarantor, lender, or servicer. These fields are for information only and are not used by the loan processes. |

Valid Category Process Level

Assign the process level when you originate a loan.

|

Field or Control |

Definition |

|---|---|

| Loan Category |

Identify the loan category that the loan destination processes. Values are: Alt Loan (alternative loan), PLUS, Subsidized, and Unsub. |

| Track PN (track promissory note) |

Select to indicate how the presence of an application or promissory note determines the process level. The loan origination process checks for an application or promissory note in the Promissory Note Alt, Promissory Note Plus, and CommonLine PNote - Stafford. components. For example, if you are originating a combination Stafford loan (subsidized or unsubsidized) and you have received the promissory note prior to originating the loan, you would select the check box to originate the loan with the process level of Guarantee Only. However, if you are originating without an application or promissory note, you can set Print and Guarantee as your process level. |

| Proc Level (process level) |

Select the loan processing level that the loan destination performs for the corresponding loan category. Select from: Direct: Select for direct loans. Guarantee Only: Select to have the service provider guarantee the loans only. Guarantee and Print Appl: Select to have the service provider guarantee the loan and print and mail a promissory note to the borrower. Manual: Select if the borrower wants to use a lender unable to take electronic applications using CommonLine. Print and Guarantee: Select to have the service provider print and mail a promissory note to the borrower and guarantee the resulting loan after receipt of the promissory note. School Cert request: Select if the loan destination participates in school certification request processing. |

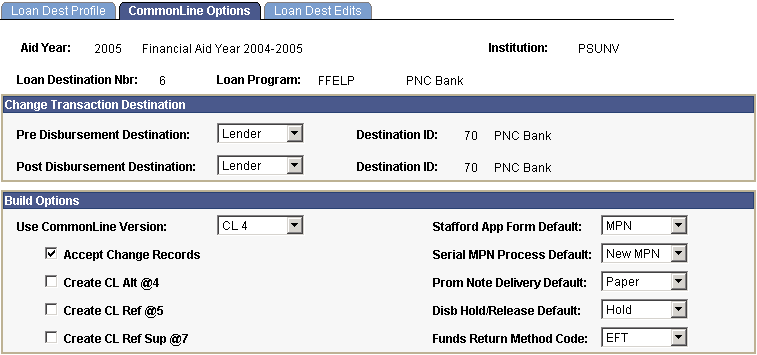

Access the CommonLine Options page ().

Image: CommonLine Options page

This example illustrates the fields and controls on the CommonLine Options page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Pre Disbursement Destination and Post Disbursement Destination |

Designate the loan agency to receive change transaction records when a loan adjustment occurs before or after the receipt of loan funds by the school. |

| Use CommonLine Version |

Select the CommonLine version to indicate the CommonLine application send and change transaction file format to use when creating files for the loan destination. CommonLine version 4 (CL4) is the only valid option for this component. |

| Accept Change Records |

Select to indicate whether the loan destination can receive CommonLine 4 change transaction records. If this check box is clear, the loan origination process adjusts loan eligibility as appropriate, but the system does not generate a CommonLine 4 change transaction record for electronic transmission. Note: Your school must notify the appropriate lending agency of changes in loan eligibility if a change transaction record cannot be sent using CommonLine procedures. |

| Create CL Alt @ 4 (create CommonLine alternative), Create CL Ref @ 5 (create CommonLine reference), and Create CL Ref Sup @ 7 (create CommonLine reference supplemental) |

These check boxes identify optional CommonLine 4 application subrecords. Select to have the CommonLine outbound process build the selected records for all loans of the loan destination. You set up these file build options based on the business processes established between your school and your loan destinations. |

| Stafford App Form Default (Stafford application form default) |

Select the type of Stafford application to use when originating a Stafford loan and when no unused tracked Stafford applications exist. Values are MPN (master promissory note) or Common App (common application). Note that the Stafford MPN is the current acceptable form for Stafford loan processing. |

| Serial MPN Process Default (serial master promissory note process default) |

Select the serial default master promissory note process. Use New MPN for a new master promissory note or Serial MPN for serial loan processing. The default value of this field is set in the Financial Aid Installation Defaults page. You can override the value here. When you originate a Stafford loan for this destination, the system uses this default value. You can also override this setting at the loan origination level by updating the record in the Maintain Originated Loans component prior to the transmission of the loan. You can also control whether individual students can qualify for serial loan processing by updating the student's settings in the Maintain Student MPN Usage component. Note: Originating a loan as a serial loan does not result in the loan's rejection if the borrower does not qualify. Refer to the CommonLine 4 version of the NCHER CommonLine Network for FFELP and Alternative Loans Reference Manual for information about the serial loan process. |

| Prom Note Delivery Default (promissory note delivery default) |

Select how you want promissory notes to be delivered to the borrower. Values are: Email, Paper, and Web. Note: The promissory note delivery method is agreed upon between the school and the loan destination. |

| Disb Hold/Release Default (disbursement hold/release default) |

The system sets this field when a loan is originated. Use this field if you participate in disbursement hold and release processing with your loan destination. The default value is No Support, which means that the hold and release process is not supported by the loan destination. Override the default by selecting Hold or Release. A disbursement hold and release status is set for every disbursement of an originated loan. You can automatically place all disbursements on hold or release status when the loan is originated. As you approach the disbursement date, you can request the disbursements on hold to be released to your school for students who are eligible to be paid. Conversely, you can request disbursements set for release to be placed on hold for students who are not eligible to be paid. Do this by updating the student's hold or release status in the Loan Origination component. Changes to disbursement hold and release status are then communicated to the loan agency through the CommonLine V.4 Change Transaction record. |

| Funds Return Method Code |

Select a code to indicate methods for disbursement of funds. Select from: Borr Check (borrower check): Individual borrower checks. EFT (electronic funds transfer): Funds moved electronically from one account to another. Master Chk (master check): A single check to the school containing the sum of funds for all borrowers that are being disbursed to the same institution on the same day. Netting: Funds that have been sent to the school electronically are reallocated for disbursement to another eligible borrower instead of being returned. The disbursing agent then deducts the adjusted amount from the total dollar amount on the next transmission of funds to the school. |

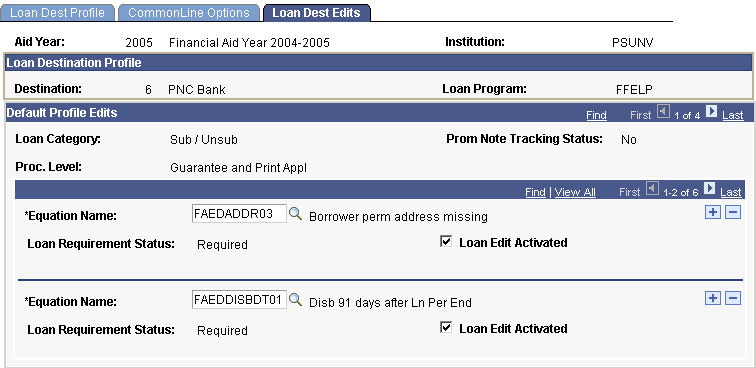

Access the Loan Dest Edits page ().

Image: Loan Dest Edits page

This example illustrates the fields and controls on the Loan Dest Edits page. You can find definitions for the fields and controls later on this page.

When you define a valid loan category and processing level on the Loan Dest Profile page, it matches those parameters to a default edit profile defined in the Loan Edits Default page and automatically attaches them to the loan destination. Use this page to add, delete, or adjust the default values.

The upper portions of this page display profile information from the Loan Dest Profile page.

|

Field or Control |

Definition |

|---|---|

| Equation Name |

Select an equation name for the edit statement. Edit statements are set up on the Loan Edits/Messages page. |

| Loan Requirement Status |

Displays Optional, Recommended, or Required. |

| Loan Edit Activated |

Select to enforce an edit. For example, a loan destination might require a signed promissory note for all loans before the start of the loan period, but might not require one after the loan period begins. If you clear this check box, the system does not look for a signed promissory note in validation. |