Creating Loan Destinations for CRC

To set up loan destinations for CRC, use the Create CRC Loan Destinations component (SFA_CRC_DEST_PROF).

This section provides an overview on loan destinations for CRC and discusses how to:

Define loan destination profiles for CRC.

Define loan processing levels for CRC.

Define loan destination validation edits for CRC.

Consolidate the loan participants—the lender, guarantor, and servicer—into one entity, the loan destination. The loan destination defines the business characteristics and protocols between a lender, guarantor, and servicer which enables them to process loans for the school. You must create a loan destination profile for each lender/guarantor/servicer relationship in the FFELP loan program and alternative loan program, and for the Direct Lending servicer for direct loans.

Note: If you continue to process loans under the CommonLine 4 protocol, you should not create active CRC loan destination profiles for the same CommonLine 4 destinations until you are ready to use them.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Dest Profile |

SFA_CRC_DEST_PROF |

|

Define participants that your institution uses to exchange loan application data. |

|

Process Levels |

SFA_CRC_DEST_PROF2 |

|

Define the valid loan processing levels for the loan destination. |

|

Validation Edits |

SFA_CRC_DEST_EDITS |

|

Define the validation edits to be used for loans originated for the loan destination. |

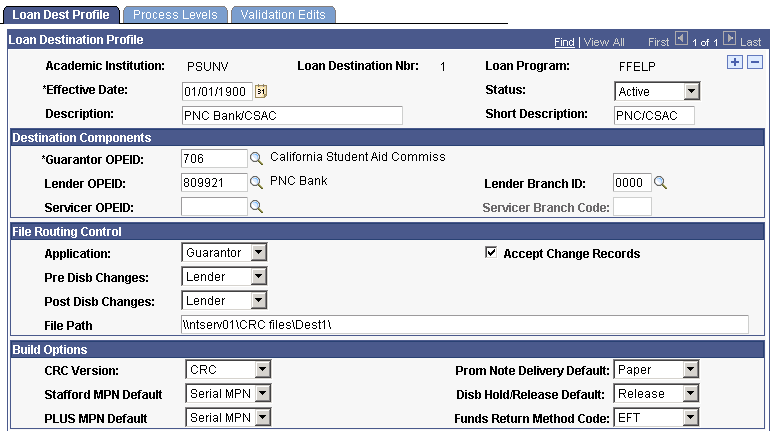

Access the Loan Dest Profile page ().

Image: Loan Dest Profile page

This example illustrates the fields and controls on the Loan Dest Profile page. You can find definitions for the fields and controls later on this page.

Loan Destination Profile

|

Field or Control |

Definition |

|---|---|

| Loan Destination Nbr (loan destination number) |

Indicates the loan destination number. |

| Effective Date |

Enter the date for which this destination is valid and active. |

| Status |

Indicates the effective status. Select Active or Inactive for the effective-dated row set. |

Destination Components

|

Field or Control |

Definition |

|---|---|

| Guarantor OPEID, Lender OPEID, Servicer OPEID (office of postsecondary education identifier) |

Indicates the numeric identifier assigned by the Department of Education. |

| Lender Branch ID |

Indicates the lender branch ID. This field is required if a Lender OPEID value exists. |

| Servicer Branch Code |

Indicates the servicer branch code. This field is required if a Servicer OPEID value exists. |

File Routing Control

|

Field or Control |

Definition |

|---|---|

| Application |

Indicates the recipient of the CRC application file. The system displays the recipient name and OPEID used on the XML document record. |

| Pre Disb Changes (pre disbursement changes) |

Indicates the recipient of the CRC change file. The system displays the recipient name and OPEID used on the XML document record. |

| Post Disb Changes (post disbursement changes) |

Indicates the recipient of the CRC change file. The system displays the recipient name and OPEID used on the XML document record. |

| File Path |

Indicates the physical location in your production environment where the CRC XML files are to be created. Note: The correct syntax of the path statement is dependent on the schools operating systems. The path must end in a closing character (a back slash or forward slash). |

| Accept Change Records |

Select this check box to indicate that the loan destination accepts change records. The Pre Disb Changes and Post Disb Changes fields are not be accessible if the loan destination does not accept changes. |

Build Options

|

Field or Control |

Definition |

|---|---|

| CRC Version |

Select CRC to indicate the CommonLine protocol the loan destination supports. |

| Stafford MPN Process Default |

Select New MPN or Serial MPN to indicate the default serial MPN indicator to assign during origination. |

| PLUS MPN Process Default |

Select New MPN or Serial MPN to indicate the default serial MPN indicator to assign during origination. |

| Prom Note Delivery Default (promissory note delivery default) |

Select Email,Paper, or Web to establish the default method for delivering promissory notes to the lender. |

| Disb Hold/Release Default (disbursement hold/release default) |

Select Hold, No Support, or Release to establish the disbursement hold/release status to assign during origination. |

| Funds Return Method Code |

Select Borr Check, EFT, Master Chk,or Netting to establish the method for which funds are returned by the school to the lender or disbursing agent. |

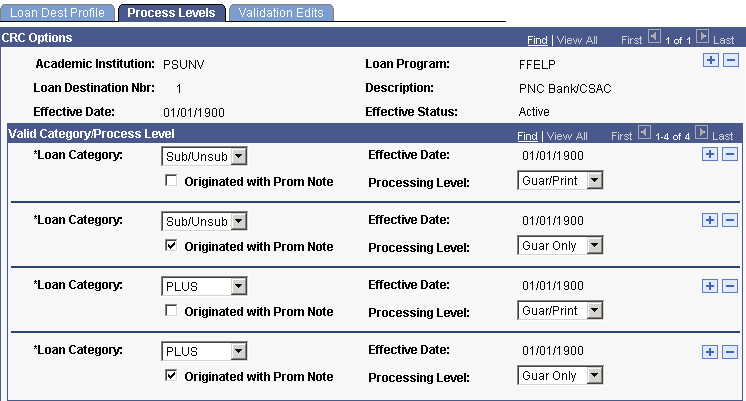

Access the Process Levels page ().

Image: Process Levels page

This example illustrates the fields and controls on the Process Levels page. You can find definitions for the fields and controls later on this page.

Define the valid process levels the loan destination supports. The loan origination process uses these setting to determine the correct process level to assign during the loan origination process.

|

Field or Control |

Definition |

|---|---|

| Loan Category |

Select from: Alt Loan (alternative loan), PLUS, Sub/Unsub (subsidized/unsubsidized), Subsidized, and Unsubsidized. The values to use are dependent on the loan categories used to define the loan types at the school. |

| Originated with Prom Note |

Select the check box to indicate that the corresponding process level be used during origination. The loan origination process determines the process level based on whether a promissory note exists at the school for a student. |

| Processing Level |

Select the loan processing level that the loan destination performs for the corresponding loan category. Select from: Cert Req (certification request), Direct (Direct Lending. This is not a valid selection), Guar Only (guarantee only), Guar/Print (guarantee and print), Manual (loan is not transmitted electronically), and Print/Guar (print and guarantee). |

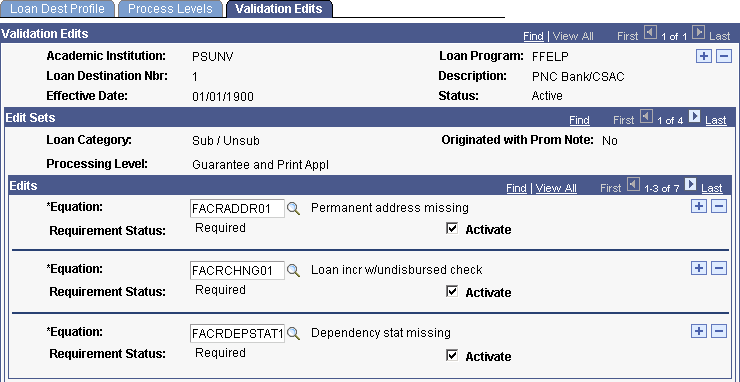

Access the Validation Edits page ().

Image: Validation Edits page

This example illustrates the fields and controls on the Validation Edits page. You can find definitions for the fields and controls later on this page.

This page defines the loan validation edits for the loan destination. The edits are pre-populated from the Loan Edits Defaults page when process level rows are created on the Process Levels page. Insert additional edits or remove invalid edits that are specific to the loan destination.

|

Field or Control |

Definition |

|---|---|

| Equation |

Select a predefined edit statement. |

| Activate |

Select to activate an edit. |