Defining CNAS

This section discusses how to:

Define CNAS rules.

Review CNAS message tables.

Define CNAS Options for Tables 1, 2, and 3.

Define financial parameters for minimum wage.

Define financial parameters for moderate standard of living (MSOL) setup.

Define financial parameters for parent MSOL setup.

Define financial parameters for tuition and fees.

Define financial parameters for parent weekly Canada student loan (CSL) contribution.

Define financial parameters for parent weekly Ontario student loan (OSL) contribution.

Define financial parameters for parent yearly income.

Define financial parameters for program weekly maximum entitlements.

Define financial parameters for prestudy tax deductions setup.

Define financial parameters for study period tax deductions setup.

Define financial parameters for spouse tax deductions.

Define financial parameters for parent federal tax deductions.

Define financial parameters for parent provincial tax deductions.

Define financial parameters for part-time maximum entitlements.

Add a full-time or part-time Canadian application.

Set up cost codes.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

CNAS Rule Setup |

CNAS_SETUP_TBL |

|

Set up options that affect your global and institutional CNAS calculations. The system includes predefined values for CSL and OSL rule sets. You can enter values for additional CNAS rule sets developed by your institution as needed by your business practices. |

|

CNAS Messages |

CNAS_MESSAGES |

|

Define or view the messages used by the CNAS calculation. |

|

CNAS Option Tbl 1 |

CNAS_OPTION_TBL1 |

|

Define or view information about your Financial Aid rule sets. You can add options for other rule sets on these pages. |

|

CNAS Option Tbl 2 |

CNAS_OPTION_TBL2 |

|

Define or view prestudy and study period option information. |

|

CNAS Option Tbl 3 |

CNAS_OPTION_TBL3 |

|

Define or view various full-time student, part-time student, or parent options. |

|

Minimum Wage |

MIN_WAGE_CSL |

|

Define or view the minimum wage and minimum weekly work hour data for each province. |

|

MSOL Setup |

CSL_MSOL_TBL |

|

Define or view the amounts designated as monthly living allowances for each province. |

|

Parent MSOL Setup |

PRT_MSOL_TBL |

|

Define or view the family size and parent MSOL amounts designated as monthly living allowances for parents in each of the provinces. |

|

Tuition and Fees |

BUDGET_CAP_TBL |

|

Define or view the budget cap amounts for non-co-op and co-op programs. |

|

Parent Weekly CSL |

PRT_WKLY_CSL |

|

Define or view information about parent income range, base income, and percent of parent annual discretionary income. |

|

Parent Weekly OSL |

PRT_WKLY_OSL |

|

Define or view information about parent income range, base income, net income percentage, and percent of parent annual discretionary income based on requirements of the OSL. |

|

Parent Yearly Inc (parent yearly income) |

PRT_YEARLY_TBL |

|

Define or view information about family size, contribution limits, and which income formula to use in calculations. |

|

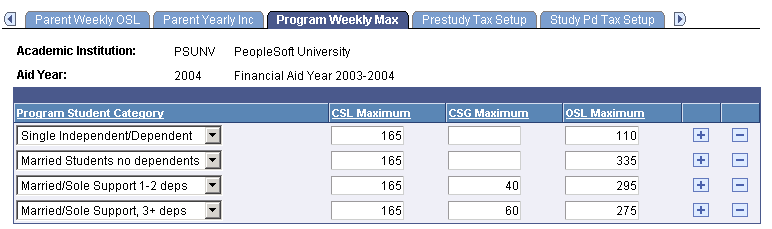

Program Weekly Max (program weekly maximum) |

PGM_WKLY_MAX |

|

Define or view the maximum entitlement for CSL, CSG, and OSL programs based on student status categories. |

|

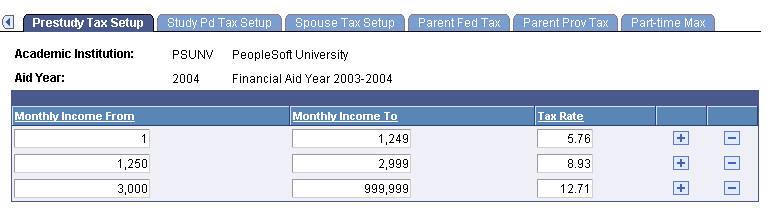

Prestudy Tax Setup |

STDNT_PS_TX_TBL |

|

Define or view information about tax deductions from the student's monthly income during the prestudy period. |

|

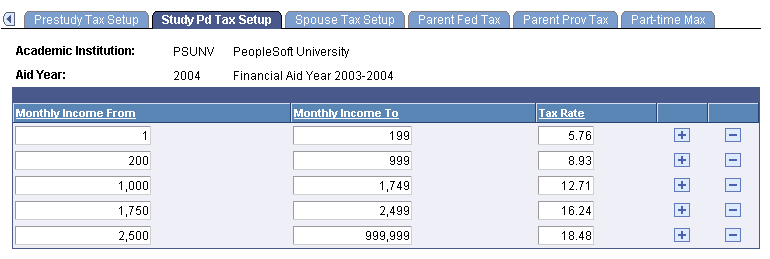

Study Pd Tax Setup (study period tax setup) |

STD_SP_TX_TBL |

|

Define or view information about tax deductions from the student's monthly income during the study period. |

|

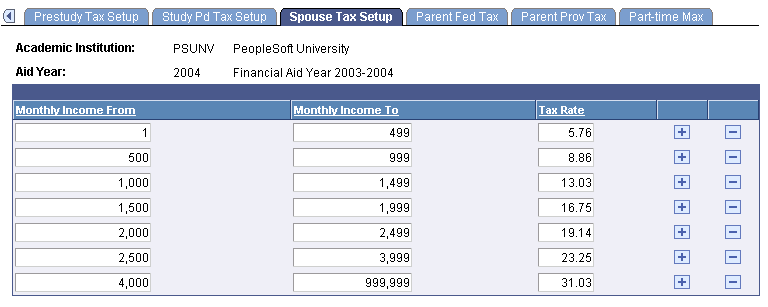

Spouse Tax Setup |

SPS_MTHL_TX_TBL |

|

Define or view information about tax deductions from a student's spousal monthly income during the study period. |

|

Parent Fed Tax |

PRT_FED_TX_TBL |

|

Define or view information about federal tax deductions from the monthly income of the parents of a student during the study period. |

|

Parent Prov Tax (parent provincial tax) |

PRT_PROV_TX_TBL |

|

Define or view information about the provincial tax deductions from the monthly income of the parents of a student during the study period. |

|

Part-time Max (part-time maximum) |

PT_MAX_TBL |

|

Define or view the maximum entitlement of part-time students for special opportunity grant (SOG) and part-time CSL loan programs based on family size. |

|

Add Institutional Application |

INST_ADD_GBL |

|

Define or view the application source code for a full-time or part-time student application. |

|

Cost Code Setup |

CAN_COST_CODE |

|

Define or view the cost codes for your institution. |

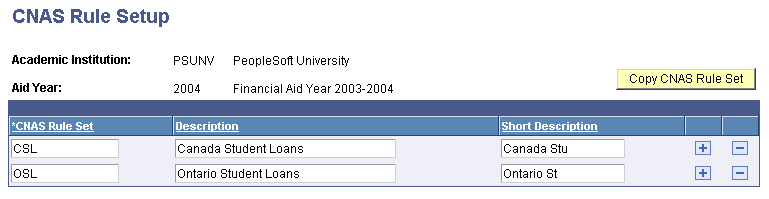

Access the CNAS Rule Setup page ().

Image: CNAS Rule Setup page

This example illustrates the fields and controls on the CNAS Rule Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year. The system also displays the rule set for basic CSL and OSL calculations. To create additional rule sets, insert a new row.

|

Field or Control |

Definition |

|---|---|

| CNAS Rule Set |

Enter a letter code to identify the CNAS rule set that you create. |

| Description |

Enter a description for the CNAS rule set that you create. |

| Short Description |

Enter a corresponding short description for the CNAS rule set that you create. |

Click the CNAS Rule Set button to copy rule set information to another financial aid year and institution. You must enter the new institution and aid year.

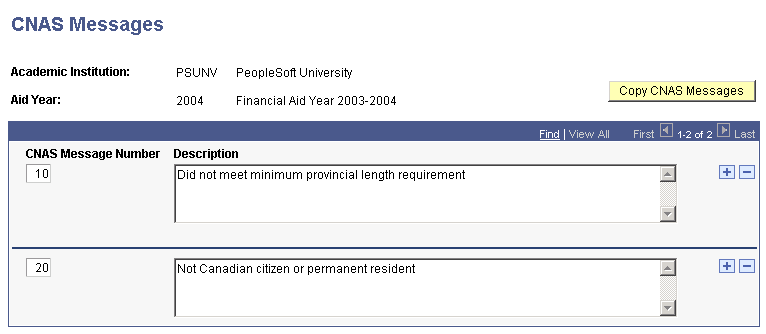

Access the CNAS Messages page ().

Image: CNAS Messages page

This example illustrates the fields and controls on the CNAS Messages page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year, as well as the CNAS message number and the message description. You can edit the message descriptions.

Click the Copy CNAS Messages button to copy message information to another financial aid year. You must click the copy button from an existing aid year, and then enter the academic institution and aid year that you want to create.

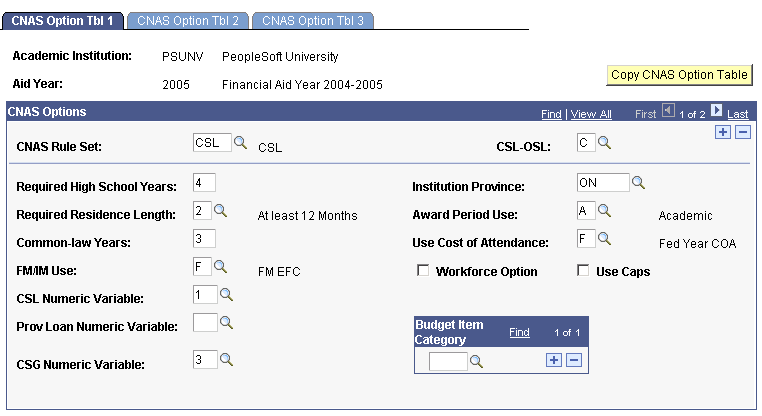

Access the CNAS Option Tbl 1 (CNAS option table 1) page ().

Image: CNAS Option Tbl 1 page

This example illustrates the fields and controls on the CNAS Option Tbl 1 page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| CNAS Rule Set |

The system displays the CNAS rule set used for basic calculations. Select a value to determine the type of calculation to perform. Values are: C − CSL: Select to invoke Canadian rules for contributions and calculations. O — OSL: Select to invoke OSL rules for contributions and calculations. |

| Required High School Years |

Enter the number of years that students are required to be out of high school to be considered independent. |

| Required Residence Length |

Enter translate values that correspond to translate values on the student's application. 1: Less than 12 months 2: At least 12 months |

| Common-law Years |

Enter the number of years of a student's common-law marriage that are required for a student to be considered independent. |

| FM/IM Use |

Select a value. F: Select to update federal need and family contribution (FC) values with calculation results. I: Select to update institutional need and family contribution values with calculation results. B: Select to update both federal and institutional values. |

| CSL Numeric Variable |

Select a numeric packaging variable in which to store the CSL amount. If you leave this field blank, the system does not write the value to packaging variables. |

| Prov Loan Numeric Variable (provincial loan numeric variable) |

Select a numeric packaging variable in which to store the provincial loan amount. If you leave this field blank, the system does not write the value to packaging variables. |

| CSG Numeric Variable |

Select a numeric packaging variable in which to store the CSG amount. If you leave this field blank, the system does not write the value to packaging variables. |

| Institution Province |

Enter the province of your institution. |

| Award Period Use |

Calculation results are populated in the Student Award Period record based on translate values. Select from the following values: A: Academic period. N: Nonstandard period. B: Both academic and nonstandard periods. |

| Use Cost of Attendance |

Select which cost of attendance value is used. Values are: F: Fed Year COA (federal year cost of attendance) I: Inst Year COA (institutional year cost of attendance) |

| Workforce Option |

Select to specify that students in workforce are considered independent. |

| Use Caps |

Select to use budget caps associated with Additional Cost Recovery programs. This is necessary only if the academic program is not set up as deregulated. |

| Budget Item Category |

Select which budget items to use in the budget cap calculation. |

Click the Copy CNAS Option Table button from the CNAS Option Table 1 page to copy CNAS Option Table information to another financial aid year. Click the copy button from an existing aid year and then enter the academic institution and aid year that you want to create.

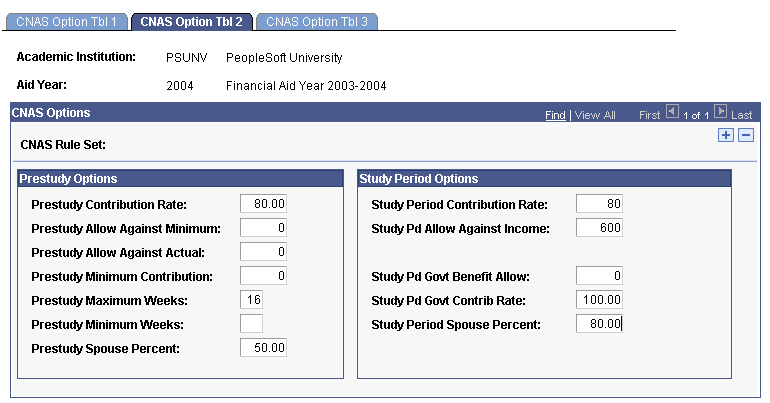

Access the CNAS Option Tbl 2 (CNAS option table 2) page ().

Image: CNAS Option Tbl 2 page

This example illustrates the fields and controls on the CNAS Option Tbl 2 page. You can find definitions for the fields and controls later on this page.

The student and the student's family are expected to contribute to the costs of post-secondary education. Students from all categories, as well as the spouses of married students, are expected to work during the prestudy period and to contribute to the student's educational costs. Prestudy period income contributions are based on rates and allowances established by Statistics Canada for all of the provinces. The calculation of a student's study period contribution depends on whether the student's program of study is considered deregulated or regulated by the Ministry of Education and Training.

The system displays the academic institution, the aid year, and the CNAS rule set that is selected on the CNAS Option Table 1 page.

Prestudy Options

|

Field or Control |

Definition |

|---|---|

| Prestudy Contribution Rate |

Enter the rate used to calculate the expected prestudy contribution from actual income. |

| Prestudy Allow Against Minimum |

Enter a dollar amount used as an allowance against the minimum student contribution. |

| Prestudy Allow Against Actual |

Enter a CAD amount used as an allowance against the actual student contribution calculated. |

| Prestudy Minimum Contribution |

Enter a minimum prestudy student contribution to be enforced when the actual result of the calculation is below minimum. |

| Prestudy Maximum Weeks |

Enter the number of weeks that are considered as the prestudy work period. |

| Prestudy Minimum Weeks |

Enter the minimum number of prestudy weeks required to charge a minimum student contribution. |

| Prestudy Spouse Percent |

Enter the percent of the student's spousal income that is considered in calculating the contribution. |

Study Period Options (CSL Rule Set)

Different fields appear depending on which rule set is selected. Some fields appear for both CSL and OSL.

|

Field or Control |

Definition |

|---|---|

| Study Period Contribution Rate |

(CSL only) Enter the rate used to calculate the expected study period contribution from actual income. |

| Study Pd Allow Against Income (study period allowed against income) |

(CSL only) Enter an amount used as an allowance against the actual calculated student contribution. |

| Study Pd Govt Benefit Allow (study period government benefits allowance) |

(Both CSL and OSL) Enter an amount used to reduce the living allowance in the assessment of costs for the student. |

| Study Pd Govt Contrib Rate (study period government contribution rate) |

(Both CSL and OSL) Enter the percent of the student's expected income from government benefits, typically 100 percent. |

| Study Period Spouse Percent |

(CSL only) Enter the percent of the student's spousal income that is considered in calculating the contribution. |

Study Period Options (OSL Rule Set)

The following fields appear in the Study Period Options group box when the OSL rule set is selected.

|

Field or Control |

Definition |

|---|---|

| Study Pd Allowance - Merit (study period allowance for merit) |

Enter the weekly study period allowance used to reduce the contribution from income for students who receive merit scholarships. |

| Study Pd Allowance - Non-Merit (study period allowance for non-merit) |

Enter the weekly study period allowance used to reduce the contribution from income for students who do not receive scholarships. |

| Study Pd Spouse Pct 1 in Col (study period percentage spouse 1 in college) |

Enter the percentage of the student's spousal income that is considered in calculating the contribution if only the student is in college. |

| Study Pd Spouse Pct 2 in Col (study period percentage spouse 2 in college) |

Enter the percentage of the student's spousal income that is considered in calculating the contribution if both the student and the spouse are in college. |

For more information, see the Canada Student Loan Manual

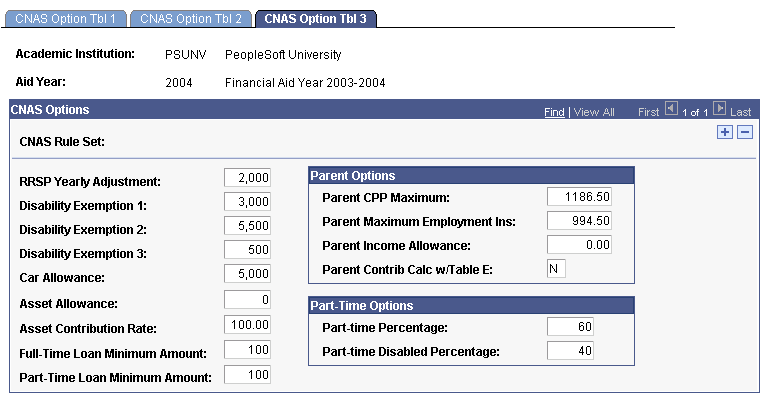

Access the CNAS Options Tbl 3 (CNAS option table 3) page ().

Image: CNAS Option Tbl 3 page

This example illustrates the fields and controls on the CNAS Option Tbl 3 page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution, aid year, and CNAS rule set selected on the CNAS Option Tbl 1 page.

|

Field or Control |

Definition |

|---|---|

| RRSP Yearly Adjustment (registered retirement savings plans yearly adjustment) |

Enter the annual amount of retirement accounts registered to students and to student and spouse or common-law partner, if applicable, that are recognized as an allowance. |

| Disability Exemption 1 |

Enter the amount allowed for a student's first disability. |

| Disability Exemption 2 |

Enter the amount allowed for a student's second disability. |

| Disability Exemption 3 |

Enter the amount allowed for a student's third disability. |

| Car Allowance |

Enter the amount allowed for a student-owned vehicle. The Financial Aid Administrator can increase the asset exemption level for vehicles up to 10,000 CAD in specific situations. |

| Asset Allowance |

Enter the exemption amount allowed to reduce asset value. |

| Asset Contribution Rate |

Enter the percentage rate used to assess a contribution based on assets. |

| Full-Time Loan Minimum Amount |

Enter the minimum amount that can be loaned to a full-time student. |

| Part-Time Loan Minimum Amount |

Enter the minimum amount that can be loaned to a part-time student. |

Parent Options

|

Field or Control |

Definition |

|---|---|

| Parent CPP Maximum |

Enter the maximum annual contribution allowance for parents to the Canada Pension Program (CPP) based on income. |

| Parent Maximum Employment Ins (parent maximum employment insurance) |

Enter the maximum annual contribution allowance for parents to the Employment Insurance program. |

| Parent Income Allowance |

Enter the allowance amount that is applied against parents' income. |

| Parent Contrib Calc w/Table E (parent contribution calculation with table E) |

Enter Y (yes) to base the calculation for the parents' contribution on information contained in Table E in the Ontario Student Assistance Program Manual. |

Part-Time Options

|

Field or Control |

Definition |

|---|---|

| Part-time Percentage |

Enter the percentage of a full class load under which a student is considered a part-time student. |

| Part-time Disabled Percentage |

Enter the percentage of a full class load under which a student with a disability is considered a part-time student. |

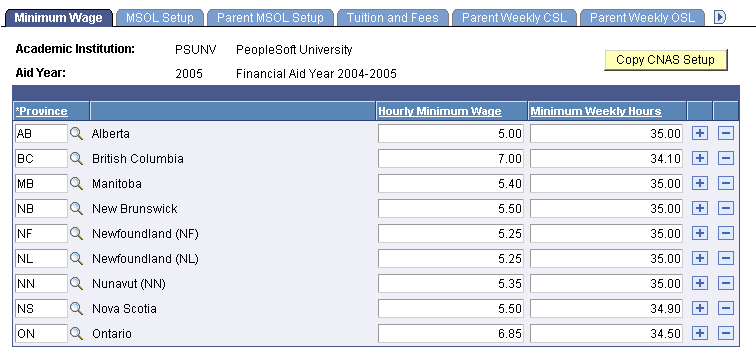

Access the Minimum Wage page ().

Image: Minimum Wage page

This example illustrates the fields and controls on the Minimum Wage page. You can find definitions for the fields and controls later on this page.

The Defining Financial Parameters component, of which this page is a part, stores table data for financial need assessment.

The system displays the academic institution and the aid year.

This page lists each province with its corresponding hourly minimum wage and minimum weekly hours that are considered as full-time work.

To copy a new academic institution or aid year, click the Add a New Value button at the Search level. Enter the academic institution and aid year. The Copy CNAS Setup button appears. Enter the academic institution and aid year information in the Copy From fields.

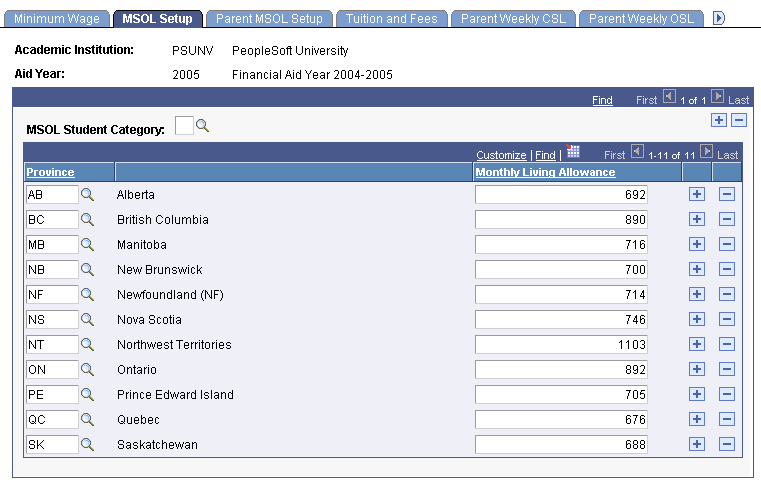

Access the MSOL Setup page ().

Image: MSOL Setup page

This example illustrates the fields and controls on the MSOL Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| MSOL Student Category |

Enter a value for the moderate standard of living student category. Values are: 1: Single away from home 2: Single Parent 3: Married 4: Dependent Person 5: Single at Home |

This page lists each province, with the corresponding monthly living allowance amount.

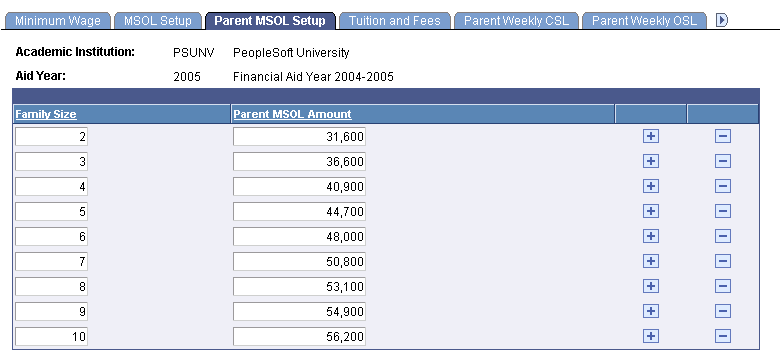

Access the Parent MSOL Setup page ().

Image: Parent MSOL Setup page

This example illustrates the fields and controls on the Parent MSOL Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| Family Size |

Enter the family size. For a dependent student, family size includes the student, parents, and dependent siblings. For an independent student, family size includes the student, the student's spouse, and any dependent children living with the student full-time during the study period. |

| Parent MSOL Amount |

Enter the MSOL amount for each family size. |

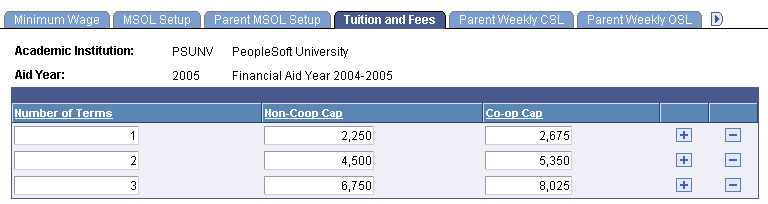

In the OSL assessment, the value of tuition and compulsory fees used may be capped. The tuition, compulsory fees, and number of terms are used in certain need calculations for which fees are capped.

Access the Tuition and Fees page ().

Image: Tuition and Fees page

This example illustrates the fields and controls on the Tuition and Fees page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| Number of Terms |

Enter the number of terms attended by the student. |

| Non-Coop Cap |

Enter the combined cap amounts for tuition and compulsory fees for provincial colleges and universities for noncooperative programs. Tuition and fees are capped based on whether a program is regulated. |

| Co-op Cap |

Enter the combined cap amounts for tuition and compulsory fees for provincial colleges and universities for cooperative programs. Tuition and fees are capped based on whether a program is regulated. |

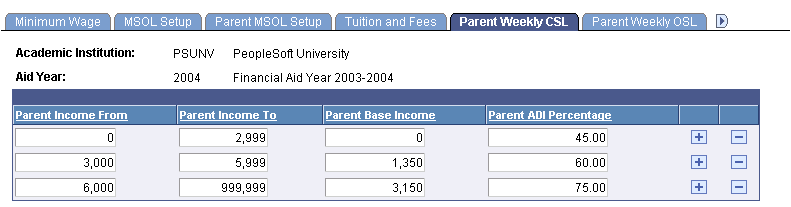

Access the Parent Weekly CSL page ().

Image: Parent Weekly CSL page

This example illustrates the fields and controls on the Parent Weekly CSL page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and aid year.

This page shows the range of parent income, with the corresponding parent base income and the parent ADI (annual discretionary income). The system uses this information to calculate the parents' weekly contribution in the CSL assessment.

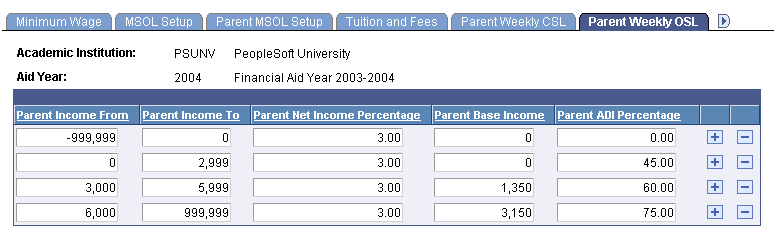

Access the Parent Weekly OSL page ().

Image: Parent Weekly OSL page

This example illustrates the fields and controls on the Parent Weekly OSL page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page shows the parent income range, with the corresponding parent net income percentage, parent base income, and parent ADI. The system uses this information to calculate the parents' weekly contribution in the OSL assessment.

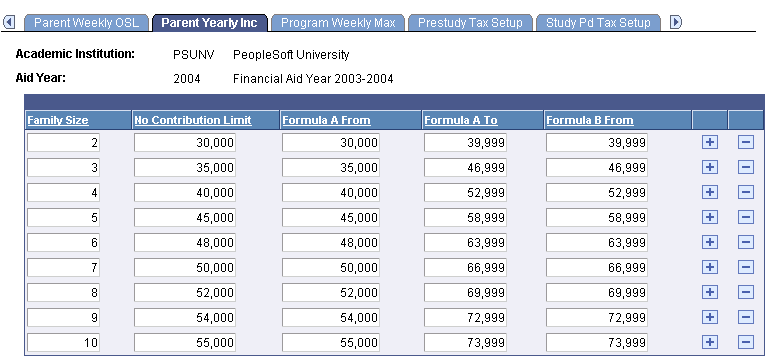

Access the Parent Yearly Inc (parent yearly income) page ().

Image: Parent Yearly Inc page

This example illustrates the fields and controls on the Parent Yearly Inc page. You can find definitions for the fields and controls later on this page.

The system uses two different methods to determine the expected level of parental contribution for OSL, depending on the amount of parental gross income reported on the OSAP application. Check the level of gross parental income for the family size determined in the OSAP Student Eligibility and Financial Need Assessment Manual.

The system displays academic institution and aid year.

You can enter or view information about the Family Size, No Contribution Limit, Formula A From, Formula A To, and Formula B From fields.

For more information, see the Canada Student Loan Manual

Access the Program Weekly Max (program weekly maximum) page ().

Image: Program Weekly Max page

This example illustrates the fields and controls on the Program Weekly Max page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| Program Student Category |

Select the category into which the student belongs for a program. These values are delivered with the system. |

| CSL Maximum |

Enter the CSL maximum for each program student category. |

| CSG Maximum |

Enter the CSG maximum for each program student category. |

| OSL Maximum |

Enter the OSL maximum for each program student category. |

Access the Prestudy Tax Setup page ().

Image: Prestudy Tax Setup page

This example illustrates the fields and controls on the Prestudy Tax Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page lists the monthly income range, with the corresponding tax rate, which is the percentage of income to be deducted from a student's monthly income during the prestudy period.

Access the Study Pd Tax Setup (study period tax setup) page ().

Image: Study Pd Tax Setup page

This example illustrates the fields and controls on the Study Pd Tax Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page lists the monthly income range, with the corresponding tax rate, which is the percentage of income to be deducted from a student's monthly income during the study period.

Access the Spouse Tax Setup page ().

Image: Spouse Tax Setup page

This example illustrates the fields and controls on the Spouse Tax Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page lists the monthly income range, with the corresponding tax rate, which is the percentage of income to be deducted from a student's spousal monthly income during the study period.

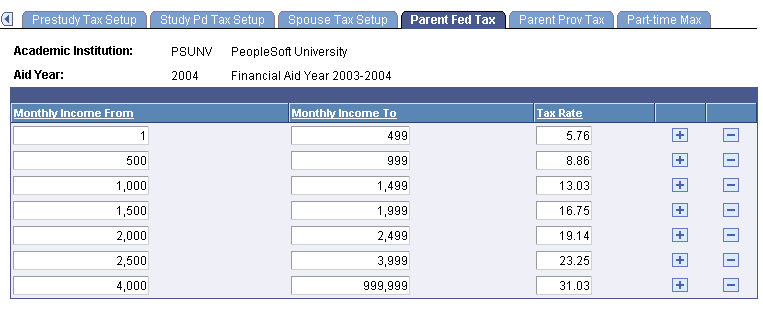

Access the Parent Fed Tax (parent federal tax) page ().

Image: Parent Fed Tax page

This example illustrates the fields and controls on the Parent Fed Tax page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page lists the monthly income range, with the corresponding tax rate, which is the percentage of income to be deducted from a student's parents' monthly federal income during the study period.

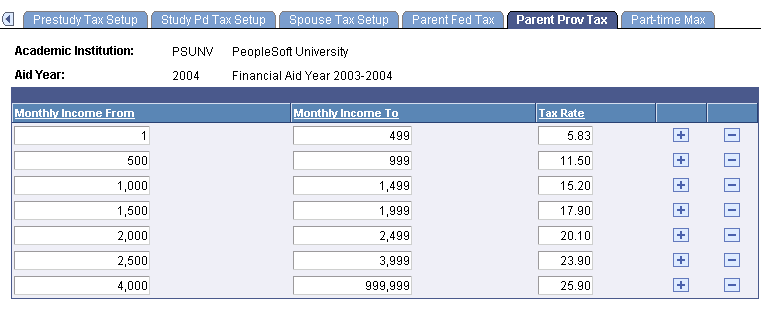

Access the Parent Prov Tax (parent provincial tax) page ().

Image: Parent Prov Tax page

This example illustrates the fields and controls on the Parent Prov Tax page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

This page lists the Monthly Income range, with the corresponding tax rate, which is the percentage of income to be deducted from a student's parents' monthly provincial income during the study period.

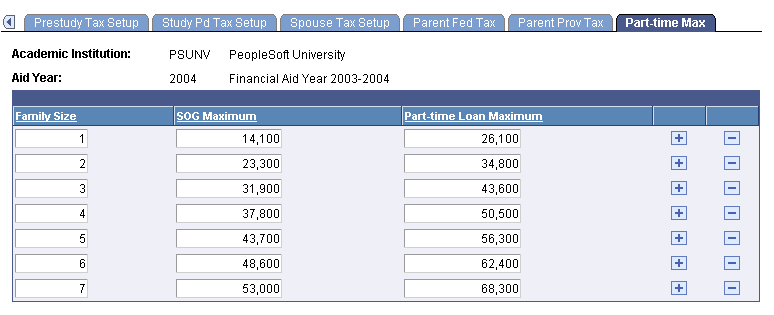

Access the Part-time Max (part-time maximum) page ().

Image: Part-time Max page

This example illustrates the fields and controls on the Part-time Max page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution and the aid year.

|

Field or Control |

Definition |

|---|---|

| Family Size |

Enter the student's family size for each maximum amount. |

| SOG Maximum |

Enter the maximum SOG for each family size. The maximum amounts are based on the maximum total family gross income, assets, and family size. |

| Part-time Loan Maximum |

Enter the maximum for a part-time CSL for each family size. The maximum amounts are based on the maximum total family gross income, assets, and family size. |

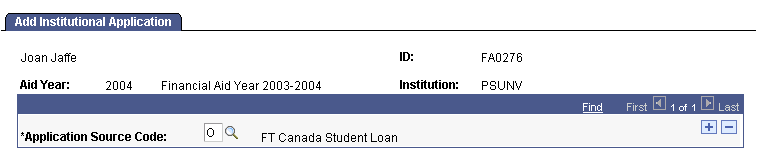

Access the Add Institutional Application page ().

Image: Add Institutional Application page

This example illustrates the fields and controls on the Add Institutional Application page. You can find definitions for the fields and controls later on this page.

The system displays the student name and ID, aid year, and institution.

|

Field or Control |

Definition |

|---|---|

| Application Source Code |

Select an application source code. Values for Canadian institutions are: O: Full-time Canada Student Loan. P: Part-time Canada Student Loan. |

Part-time applications must have a source code of P (part-time) to ensure correct CNAS calculation.

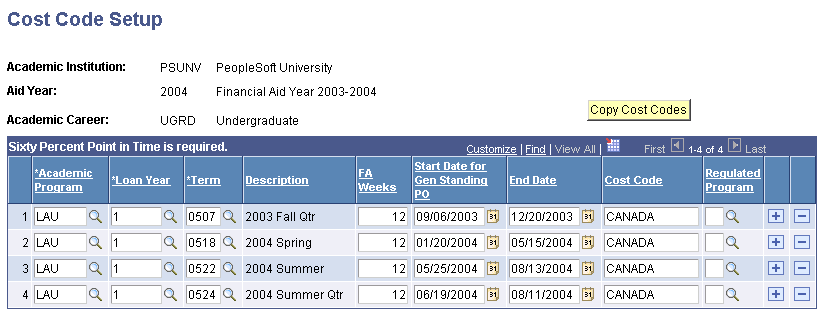

Access the Cost Code Setup page ().

Image: Cost Code Setup page

This example illustrates the fields and controls on the Cost Code Setup page. You can find definitions for the fields and controls later on this page.

The system displays the academic institution, aid year, and academic career.

Enter values for the cost codes for your institution for each of the fields.

To copy a new academic institution, aid year, or academic career, enter the new parameters at the search level. The system displays the Copy Cost Codes button. Click the button and enter the academic institution, aid year, and career information in the Copy From fields. After you enter information in the Copy From fields, the system displays the Academic Program and To Term fields.