Originating CommonLine Loans

This section provides an overview and discusses how to originate CommonLine loans.

Use the loan origination process (FAPLBOG1) to determine student loan eligibility. Eligibility is determined by checking student award information, promissory notes, the student's loan history, and the loan setup parameters used to calculate a new student loan. You can view all originated loans in the Maintain Originated Loans component. During the origination process, key elements are determined to create a complete loan record that can be transmitted to the appropriate lending agency. How these key elements are determined is discussed in this section:

CommonLine version.

Process level.

Serial Loan Code, which supports master promissory note functionality.

Determining the CommonLine Version

The origination process uses loan destination to determine the correct CommonLine version. As described in the Setting Up CommonLine 4 Loans, the origination process determines the assigned lender and guarantor for each loan and then attempts to match the lender or guarantor to an existing CRC loan destination. If found, the system assigns the CL version and destination number to the loan. If not found, then a lender or guarantor match is attempted with the CL 4 loan destinations, and if one is found, the system assigns the CL version and destination number.

Note: If no destination is found for a loan during the Loan Origination process, the program uses the set up on the Loan Destination Default page (Set up SACR, Product Related, Financial Aid, Loans, Define Loan Institutions, Loan Destination Default) to determine the CL version.

If the Use CRC Destination check box is selected on the Loan Destination Default page and the loan destination (CL4 or CRC) cannot be determined when a loan is originated, a CL version of CRC is used.

If the Use CRC Destination check box is cleared on the Loan Destination Default page and the loan destination (CL4 or CRC) cannot be determined when a loan is originated, a CL version of CL4 is used.

The exception to this rule is when the Loan Origination program uses CRC Certification Request data to originate a loan (setup is ignored). If CRC Certification Request data is used and no destination is found, a CL version of CRC is used.

After the CL version is set, if you assign or change the loan destination number online, you can only select loan destinations that support the assigned CL version. If you change the CL version, the available loan destination numbers change accordingly. After the destination is assigned online, the system automatically sets the process level, disbursement hold and release, and serial MPN settings to match the loan destination settings.

Note: For the CL version and loan destination number to be assigned correctly, ensure the setup of the schools' loan destination is complete and accurate before you originate loans for the aid year.

Determining the Process Level

The process level field represents the CommonLine process type code value that is reported to the loan servicer. Each process type and level defines a specific loan business process. The supported CommonLine process types are:

Guarantee Only (GO)

Guarantee and Print (GP)

Print and Guarantee (PG,)

Certification Request (CR)

The process level is based on how the loan promissory note is collected from the borrower. GO implies that the school has collected the promissory note, while GP and PG requests that the note be generated, if necessary, and collected by the loan servicer. The loan origination process automatically determines the process level to use based on the default process levels assigned for each loan destination.

Note: Oracle also provides a process level of Manual (M). Assigning along this process level indicates that the loan is being processed manually and should not be reviewed by any of the automated loan processes or generate an electronic application. This process level is used in cases where the loan servicer does not support electronic loan processing, or you are overriding an existing loan and do not want the loan adjustment or outbound processes to review and possibly manipulate the borrower's loan eligibility.

Determining Serial MPN Eligibility

The serial loan code is set for all originated Stafford and PLUS loans and indicates whether the loan is to be processed as part of a multi-year note (serial processing) or if a new note must be collected for the loan. The system displays these fields on the Loan Origination 3 page in the Maintain Originated Loans component and they are reported using the CommonLine Application Send file.

By default, the system sets the serial loan code based on the loan destination setup unless the process can confirm that the student has a prior loan with the same borrower and the lender confirms possession of the MPN form. The system maintains MPN serial confirmation in the Maintain Student MPN Usage component. Use component. If confirmation is successful, the system sets the serial loan code to S – Serial, Renew existing MPN. The loan origination process attempts to determine serial eligibility by confirming that the originated loan has the same borrower and student maintained in the Maintain Student MPN Usage component.

If the loan origination process is unable to assign the borrower ID or the loan destination, the process might not be able to verify the loan's serial eligibility:

If the origination process cannot assign a borrower ID, then the system sets the serial loan code to N – Use new MPN.

If the borrower ID is set, but not the loan destination, the origination process attempts to determine serial loan eligibility by using both the student ID and borrower ID to find MPN information in the Maintain Student MPN Usage component so it can assign a serial loan code value. If a match cannot be made using this criteria, then the system sets the serial loan code to N – Use new MPN.

When a loan is originated with missing borrower or loan destination information, you must complete the loan information before it can be validated and transmitted to the servicer. The system attempts to determine the serial loan code field value when the Borrower ID or Loan Destination Nbr field is modified. For PLUS, if the Borrower ID field is changed, the system checks the CommonLine MPN Use table for a PLUS record that matches the student ID, institution, and borrower ID. If a match occurs, the system sets the serial loan code to comply with the matched record in the Maintain Student MPN Usage component. Renew sets the value to S – Serial, Renew existing MPN. If no match occurs, the serial loan code is set to N – Use new MPN. When the Loan Destination Nbr is changed and if the Borrower ID field is not blank, the same check occurs.

Note: The system intentionally does not confirm that the lender in the loan destination matches the lender in the MPN Use record. If you require a student to use a new MPN for each loan, use the Maintain Student MPN Usage component to enforce this requirement. For serial PLUS loans, a loan validation edit ensures that the lender for the loan matches the lender listed in the MPN Use record.

Understanding the Loan Processing Status and Loan Origination Transmission

From the time a loan is originated until it is processed by the loan servicer, the system uses a loan processing status field and a loan transmission status field to monitor the loan status:

The loan process status field monitors the current internal processing state of the loan. Values are:

Cancelled: A loan cancellation has been initiated.

Hold: The loan is on hold and the system suspends all loan processing until the hold is removed.

Offered and Not Accepted: Used by Direct Loans. Origination Pending: Loan has been originated or reset due to a loan rejection, and waiting loan validation.

In Service: The loan has been transmitted to the appropriate servicer.

Terminated: A pre-guarantee loan cancellation has been initiated.

The loan transmission status field monitors the current transmission state of the loan between the school and the loan servicer. Values are:

Accepted: The servicer has accepted the loan.

Change Pending Transmission: An adjustment generated a change transaction that has not been sent to the servicer.

Error: Not used for CommonLine loans.

Origination Pending Transmission: An Origination that has not been transmitted to the servicer.

Transmitted: An origination or change transaction has been sent to the loan servicer.

The two fields are displayed throughout the loan process with different labels on three pages:

|

Page |

Loan Process Status |

Loan Transmission Status |

|---|---|---|

|

Loan Status Summary Information |

Loan Process Status |

Transmission Status |

|

Loan Orig Status |

Ln Proc Stat |

Orig Trans Stat |

|

CommonLine Loan Origination Transmission |

(Loan Processing Stat |

Orig Trans Stat |

The following table shows how to interpret the loan status based on the field values:

|

Loan Process Status |

Loan Transmission Status |

Explanation |

|---|---|---|

|

Origination Pending |

Origination Pending Transmission |

Set when a loan is originated. The loan is waiting for the validation process to authorize its transmission. |

|

In Service |

Transmitted |

Set by the CommonLine outbound process. The loan application record is in the staging tables and application files can be created by running the EDI Manager (CL 4) or XML creation (CRC) processes. Note: The loan is considered transmitted to the servicer after the data has been sent to the staging tables and not when the school actually transmits the files. |

|

In Service |

Accepted |

Set by the CommonLine inbound process. The loan has been processed successfully by the loan servicer. |

|

In Service |

Change Pending Transmission |

Set by the origination process when a previously approved loan is adjusted. The loan is waiting for the loan validation process to authorize its transmission. |

|

Cancelled |

Change Pending Transmission |

Set by the origination process when a previously approved loan is cancelled. The loan is waiting for the loan validation process to authorize its transmission. |

|

Cancelled |

Transmitted |

Set by the CommonLine outbound process when a loan cancellation record is processed. The loan application record is in the staging tables and application files can be created by running the EDI Manager (CL 4) or XML creation (CRC) processes. |

|

Hold |

Origination Pending Transmission |

Set by the CommonLine Inbound process when a loan has been denied by the loan servicer. If the student is eligible for the loan, the user must perform the corrective action and then remove the hold status. This allows the loan to be reprocessed and retransmitted. |

|

Terminated |

Origination Pending Transmission |

Set by the origination process for a loan that has been cancelled prior to transmission. |

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Origination |

RUNCTL_LNORIG |

|

Originate loan item types that have an accepted award status. |

|

Process List |

PMN_PRCSLIST |

Click the Process Monitor link on the Loan Origination page. |

View Process Monitor status and messages generated by the load process. |

|

Process Detail |

PMN_PRCSRQSTDETAIL |

Click the Detail link on the Process List page. |

View information on the run status. |

|

Message Log |

PMN_BAT_MSGLOG |

Click the Message Log link on the Process Detail page. |

View any messages generated by the selected process. |

|

Explain |

PMN_MSG_EXPLAIN |

Click the Explain button on the Message Log page. |

View additional information for the selected Message Log message text entry. |

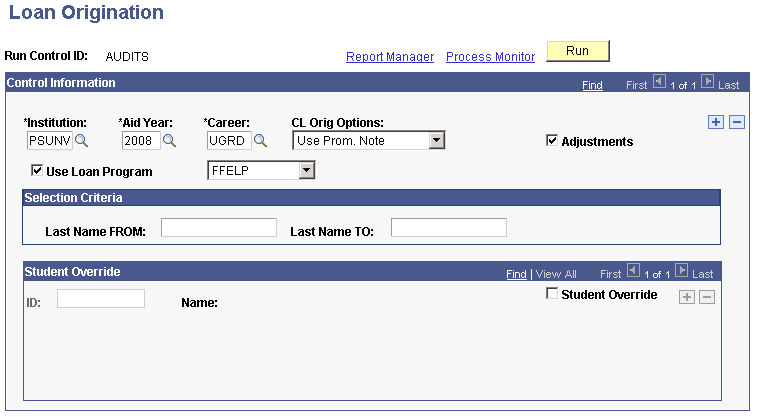

Access the Loan Origination page ().

Image: Loan Origination page

This example illustrates the fields and controls on the Loan Origination page. You can find definitions for the fields and controls later on this page.

Use this page to initiate the Loan Origination process (FAPLBOG1), a COBOL SQL process.

|

Field or Control |

Definition |

|---|---|

| CL Orig Options (CommonLine origination options) |

Select from: Ignore Prom. Notes: The loan origination process originates the loan whether or not a tracked promissory note exists. Require Prom. Notes: The loan is not originated unless a tracked promissory note can be used to originate the loan. Use Prom. Note: The system uses the tracked promissory note, but if one is not available, it still originates the loan. This is the default setting. The loan origination process checks for unused promissory notes in the CommonLine Pnote Stafford, CommonLine Pnote PLUS, and CommonLine Pnote Alt pages. |

| Adjustments |

Select to evaluate and process adjustments to existing loans. The system selects and processes origination adjustments for loans in which information has changed that requires a CommonLine change record to be generated. New loans are also originated when this option is selected. |

| Use Loan Program |

Select the check box to activate the loan program field. Users can restrict the origination process to the selected loan program. |

The information that you enter in the Selection Criteria group box and the Student Override group box is restricted by the institution, aid year, career, and loan program that you selected in the Control Information group box.

|

Field or Control |

Definition |

|---|---|

| Last Name FROM and Last Name TO |

Enter two student last names to originate loans for a range of students. Only students with the selected institution, aid year, career, and loan program (optional) are selected. For example, you could originate loans for students with last names from Atkins to McMurphy. You can enter here only if the Student Override check box is clear. |

| Student Override and ID |

Select Student Override and an individual student ID to originate loans for a single student or a specific group of students in the selected institution, aid year, career, and loan program (optional). Only students with loans that have a loan award in the Accepted status and have remaining loan eligibility are available. |