Originating Direct Loans and Viewing Loan Status Summary Information

This section discusses how to:

Originate direct loans.

View loan status summary information.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Origination |

RUNCTL_LNORIG |

|

Originate any Stafford or PLUS loans that have been awarded and have an award status of Accepted. The Stafford or PLUS loans must have the loan program indicated as Direct. |

|

Loan Status Summary Information |

LN_DLSTATSUM_SEC |

Click the Loan Status Summary link on any Direct Lending processing page that has the link available. |

View current loan summary information and quickly check the status of the loan. |

This section discusses how to originate any Stafford or PLUS loans that have been awarded and have an award status of Accepted.

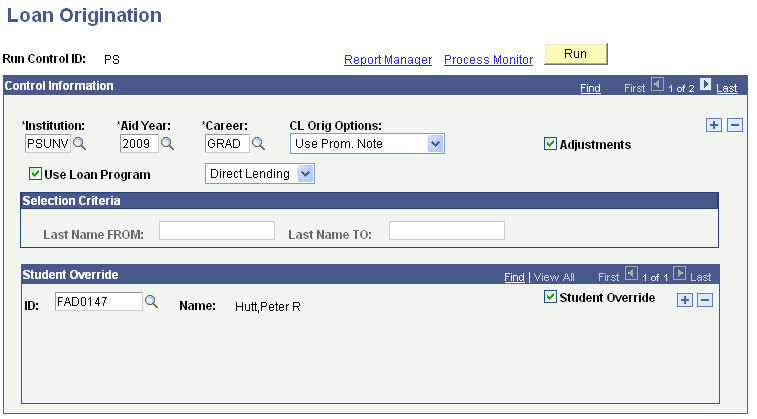

Access the Loan Origination page ().

Image: Loan Origination page

This example illustrates the fields and controls on the Loan Origination page. You can find definitions for the fields and controls later on this page.

Control Information

Use this page to run the Loan Origination process (FAPLBOG1). You can add additional rows to include different institution, aid year, and career combinations for originating loans.

|

Field or Control |

Definition |

|---|---|

| CL Orig Options (CommonLine origination options) |

This field is used for CommonLine loans only. |

|

|

|

| Adjustments |

Select to include origination adjustments when you run the origination process. When this check box is selected, origination adjustments are processed for loans for which the overall award or disbursement amounts have changed and the application has been flagged for Loan Change review based on use of the Activate Change button on the Application Acknowledgement page. Students who have origination adjustments are not included in the values for the ID field in the Student Override group box unless this check box is selected. |

Selection Criteria

Use the fields in the Selection Criteria group box to originate loans for a group of students selected by last name. Only students with the selected Institution, Aid Year, and Career are selected. You can enter names in the Selection Criteria only if the Student Override check box is not selected.

|

Field or Control |

Definition |

|---|---|

| Last Name FROM |

Enter the beginning last name of the group of students to originate. Enter the names in alphabetical order. For example, Last Name FROM Atkins and Last Name TO McMurphy. |

| Last Name TO |

Enter the ending last name of the group of students to originate. Enter the names in alphabetical order. |

Student Override

The Student Override group box is used to originate loans for a single student or a group of specific students within the selected Institution, Aid Year, and Career.

|

Field or Control |

Definition |

|---|---|

| Student Override |

Select this check box to originate specific students. When you select this check box, the ID field becomes available. |

| ID |

Enter the unique ID of the student to originate. Only students with loans that have a loan award in the Accepted status are available. You can insert rows to originate multiple students. |

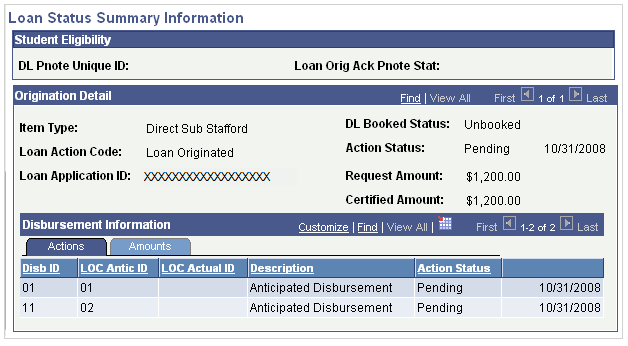

Access the Loan Status Summary Information page (click the Loan Status Summary link on any Direct Loan page with an available link).

Image: Loan Status Summary Information page

This example illustrates the fields and controls on the Loan Status Summary Information page. You can find definitions for the fields and controls later on this page.

Student Eligibility

|

Field or Control |

Definition |

|---|---|

| DL Pnote Unique ID (direct lending promissory note unique ID) |

Displays the promissory note identifier assigned to this loan. |

| Loan Orig Ack Pnote Stat (loan origination acknowledgement promissory note status) |

Displays the current status of the promissory note.

Note: Closed, Endorser, and Inactive MPN values are reported by COD. For disbursement purposes, the system treats Closed, Endorser, and Inactive MPNs as an Accepted MPN. For more information regarding how COD processes MPN's: See the U.S. Department of Education's Common Origination and Disbursement (COD) Technical Reference |

Origination Detail

|

Field or Control |

Definition |

|---|---|

| Item Type |

Displays the financial aid item type associated with this loan. |

| Loan Action Code |

Displays the most recent loan origination action for the loan. For example, Loan Origination, Loan Origination Change, and so on. |

| Loan Application ID |

Displays the unique ID that the Origination process generated for this loan. The loan application ID is comprised of the following elements:

|

| DL Booked Status (direct lending booked status) |

Displays Booked if the origination, first disbursement, and promissory notes are accepted and acknowledged by the COD. Until this occurs, the status is Unbooked. |

| Action Status |

Displays the current status of the action. The values are: Accepted, Ac-NtApld (accepted-not applied), Authorized, Failed, Invalid, Pending, Received, Rejected, and Transmitted. The Action Status for an Acknowledgement is always Received. If an origination or origination change is rejected, the system creates a new loan originated row to track the re-submission of the failed/rejected action. |

| Request Amount |

Displays the amount derived from the accepted amount on the award and is equal to the scheduled disbursement amount. |

| Certified Amount |

Displays the amount approved for the loan. This value is derived from the offer amount on the award. |

Actions Tab

|

Field or Control |

Definition |

|---|---|

| Disb ID (disbursement ID) |

Displays the Disbursement ID defined within the Disbursement Plan and Split Code assigned to the Direct Loan Award from Packaging. |

| LOC Antic ID (loan origination center replaced by common origination and disbursement anticipated [disbursement] ID) |

Displays the sequentially ordered ID for the anticipated disbursement. The system converts the Disbursement ID that comes from the award and the anticipated disbursement date defined in the Disbursement ID setup to assist in defining the disbursement sequencing requirements. The LOC Antic ID represents the Disbursement Number for anticipated disbursements (Disbursement Release Indicator set to 'false). The LOC Antic ID may change if additional disbursements are added. However, once an associated LOC Actual ID has been assigned, the LOC Antic ID does not change. |

| LOC Actual ID |

Displays the numerically ordered disbursement ID, without skipping numbers. The LOC Actual ID represents the Disbursement Number for actual disbursements (Disbursement Release Indicator set to 'true'). |

| Action Code |

Describes the type of disbursement action for that row. |

| Action Status |

Displays the status for this disbursement ID. See the description of the Action Status field above for more details. |

| (unlabeled) |

Indicates the date of the disbursement action. |

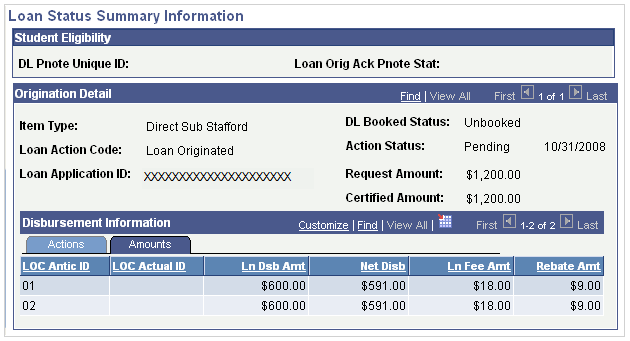

Amounts Tab

Select the Amounts tab.

Image: Loan Status Summary Information page: Amounts tab

This example illustrates the fields and controls on the Loan Status Summary Information page: Amounts tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Ln Dsb Amt (loan disbursement amount) |

Displays the gross scheduled disbursement amount. This value is derived from the accepted balance on the loan award. |

| Net Disb (net disbursement) |

Displays the amount derived from the loan amount minus the loan fee amount plus the rebate amount. |

| Ln Fee Amt (loan fee amount) |

Displays the calculated loan fee for this disbursement. |

| Rebate Amt (rebate amount) |

Displays the calculated rebate amount for this disbursement. |