Overriding and Viewing Direct Loan Origination Data and Action Messages

This section discusses how to:

Override direct loan origination data.

View direct loan origination action messages.

Review the loan origination action history.

Review direct loan disbursement actions.

Review loan exception messages.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Direct Loan Override |

LOAN_ORIG_ACK_DL01 |

|

Manually accept a loan origination, manually accept a promissory note, update the disbursement status, put the loan in hold or error status, and remove a hold from the loan. |

|

Direct Loan Orig Actions (direct loan origination actions) |

LN_DL_ORIG_INQ |

|

Review actions and errors pertaining to origination, origination change, and validation. |

|

Direct Loan Disb Actions (direct loan disbursement actions) |

LN_DL_DISB_INQ |

|

View the disbursement actions associated with the loan. |

|

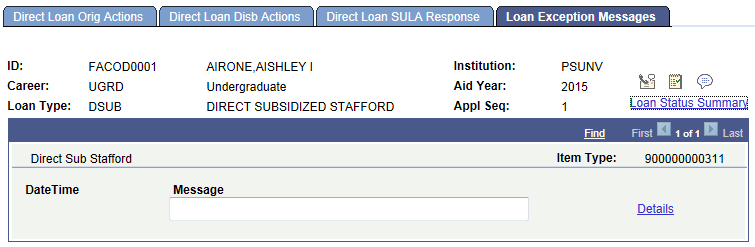

Loan Exception Messages |

LN_MSG_INQ |

|

View messages pertaining to loan processing, such as why a loan is on hold or explanations for manual overrides performed. The information contained in this page is cumulative for the particular loan. |

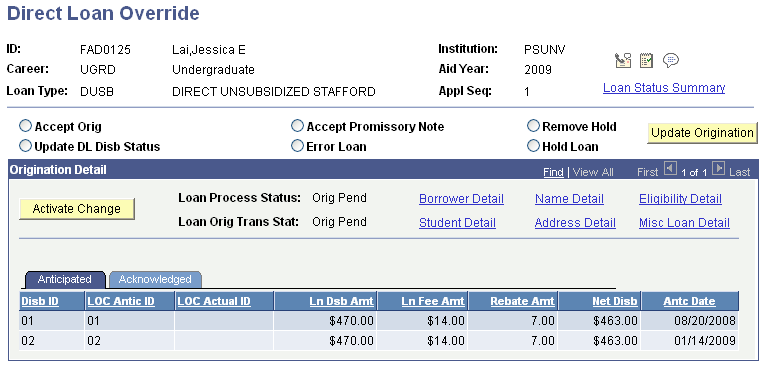

Access the Direct Loan Override page ().

Image: Direct Loan Override page

This example illustrates the fields and controls on the Direct Loan Override page. You can find definitions for the fields and controls later on this page.

Warning! Use extreme caution when updating loan records with this page. Future processing and dollar amounts are based on these loan amounts and loan statuses.

Note: If you override these required fields, your institution must take full responsibility for the data you submit to the COD that may be in conflict with existing institutional records. Access to this page should be limited to key personnel.

With the exception of the fields listed below, the fields on this page are the same as those on the Application Acknowledgement page.

To perform one of the following actions, select the appropriate option and click the Update Origination button.

|

Field or Control |

Definition |

|---|---|

| Accept Orig (accept origination) |

Perform this action only if you do not expect to receive an acknowledgement file from the COD. Selecting this option accepts the current originated loan amounts. The system populates the transmitted fields with the same amount as the originated fields. This is the same as receiving a Loan Origination Acknowledgment file. Selecting this option also manually releases a loan from Error status. |

| Update DL Disb Status (update direct lending disbursement status) |

If you select this option, the system reevaluates the disbursement status for a student. Perform this action when you manually override the credit status for a PLUS loan type or you change the switches on the loan type. |

| Accept Promissory Note |

Select this option to override a promissory note acknowledgement by manually accepting a promissory note. Use this option if you did not or do not expect to receive a promissory note acknowledgement from the COD or if the promissory note was rejected and you want to authorize a disbursement and report and transmit the disbursed award to the COD on behalf of the borrower. When you click the Update Origination button, the system does the following:

|

Important! Use the promissory note acknowledgement override with caution. If the COD rejects a promissory note after you have overridden the promissory note acknowledgement the loan's status is un-booked. To get the loan to a booked status and properly disburse the funds, this situation must be resolved directly with the COD.

|

Field or Control |

Definition |

|---|---|

| Error Loan |

Perform this action only if you do not expect to receive an acknowledgement file from the COD. Selecting this option changes the Orig Trans Stat (origination transmission status) to Error. This simulates receiving an COD Acknowledgement that rejects the origination or origination change record. This results in loan adjustments reevaluating the loan for changes based on the current acknowledgement values. |

Note: When you perform any of the above actions, the system generates an exception message that you can review on the Loan Exception Messages page. You are encouraged to note exceptions by adding your own detail.

The Direct Loan Actions Inquiry component is view only and is designed to provide status and processing information to staff who may or may not be directly involved with the processing of Direct Lending files, but may need access to direct lending information.

You use the DL Actions Inquiry component to view origination and disbursement action history and loan exception messages.

For SULA processing, Oracle delivers a sample PS Query (QA_CS_FA_SULA_STUDENT) to assist you in evaluating the COD reporting readiness of your students as it relates to their SULA fields. You can run this before attempting to outbound an Origination, Origination Change, or Disbursement transaction. The query includes all of the SULA-related fields that are validated during the Outbound process.

Note: For the SULA sample query, you must update the criteria to reflect the corresponding Aid Year's FA Terms and EMPLID list.

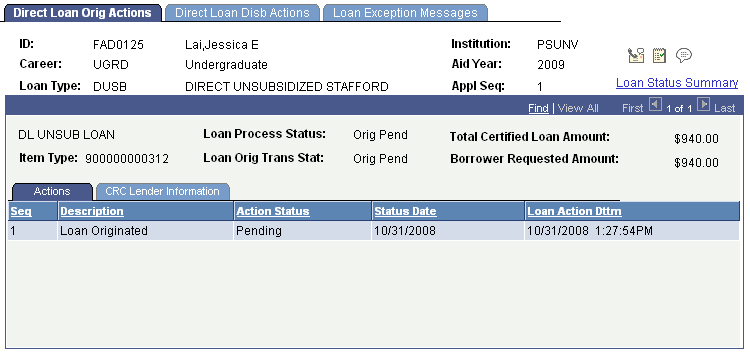

Access the Direct Loan Orig Actions page ().

Image: Direct Loan Orig Actions page

This example illustrates the fields and controls on the Direct Loan Orig Actions page. You can find definitions for the fields and controls later on this page.

The system displays the ID, Career, Loan Type, Institution, Aid Year, and Appl Seq (application sequence) values. The application sequence number increases each time the system creates a new loan origination record for each ID, career, loan type, institution, and aid year combination.

The following fields are derived from the Loan Origination record.

|

Field or Control |

Definition |

|---|---|

| Item Type |

Displays the financial aid item type associated with this loan. |

| Loan Process Status |

Displays the current status of the loan. Values are: Cancelled: Not used for direct lending. Hold: Indicates the COD rejected an activity or a user manually set the loan to hold status. The system suspends all loan processing until the hold is removed. Offered and Not Accepted: Indicates that a loan transmission based on an offer is not be transmitted until the award is accepted. Origination Pending: Indicates a pending origination that has not been transmitted to the COD. In Service: Indicates the loan has been transmitted to the COD. Terminated: Indicates the award is cancelled and the Offer amount is set to zero prior to transmission to the COD. |

| Loan Orig Trans Stat (loan origination transaction status) |

Indicates the current status of the loan origination. Values are: Accepted: Indicates the COD has accepted the loan. Change Pending Transmission: Indicates an adjustment generated a change transaction that has not been sent to the COD. Any further changes entered alter the change record until the transmission occurs. Error: Represents an acknowledgement from the COD indicating a rejection of an origination or origination change record. Origination Pending Transmission: Indicates an Origination that was not transmitted to the COD. Transmitted: Indicates that an acknowledgement from the COD is due regarding an origination or an origination change record. The system suspends all loan change activity until the acknowledgement arrives. |

| Total Certified Loan Amt (total certified loan amount) |

Indicates the amount approved for the loan. This value is derived from the offer amount on the Award. |

| Borrower Requested Amount |

Derived from the Accepted Amount on the Award and represents the Certified Amount to be reported to the COD. |

Actions Tab

|

Field or Control |

Definition |

|---|---|

| Seq (sequence) |

Displays the origination action sequence generated from the loan record activity. When multiple sequences exist for a loan, they display in reverse order; the most recent sequence displays at the top. |

| Description |

Displays the description of the action. Values are: Accepted Orig Rejected Orig Accepted Orig/Credit Chk PLUS only Acpt Orig/Credit Chk Denied PLUS only Loan Originated Lower Endr Orig Change Manually Accepted Manually Rejected Rejected Orig not Proc, Rejected Doc Change not Proc, Rejected Doc Disb not Proc, Rejected Doc Note: Regarding the Orig not Proc, Rejected Doc, Change not Proc, Rejected Doc, and Disb not Proc, Rejected Doc Actions: If the system receives a file whose entire document was rejected, instead of placing all impacted loans contained in the Rejected Document XML on Hold, the system will reset the loan to its previous Loan Processing Status prior to the loan being transmitted to COD (for example, Orig Pending, Change Pending, or Disb Pending). This way, when you are able to identify and resolve the offending students in the Rejected Document, you can run the corresponding Outbound processes for inclusion in the transmission. |

| Action Status |

Displays the current status of the action. Values are: Accepted Ac-NtApld (accepted-not applied) Authorized Failed Invalid Pending Received Rejected Transmitted The action status for an acknowledgement is always Received. If the COD rejects an origination or origination change record, the system creates a new Loan Originated row to track the re-submission of the failed/rejected action. |

| Status Date |

For actions representing received information, the action status date is the COD acknowledgement date. For actions representing transmitted information, this date is the date the action is created. |

| Loan Action Dttm (loan action date/time) |

For actions representing received information, the action date time field displays the date and time the acknowledgement is loaded to the system. For actions representing sent information, this field displays the date and time the transmission was sent. |

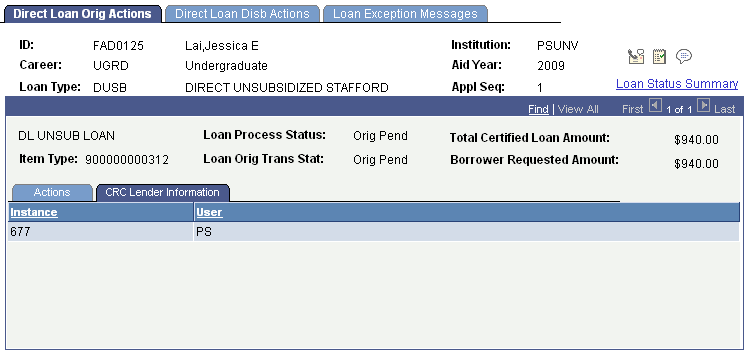

CRC Lender Information Tab

Select the CRC Lender Information tab.

Image: Direct Loan Orig Actions page: CRC Lender Information tab

This example illustrates the fields and controls on the Direct Loan Orig Actions page: CRC Lender Information tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Instance |

Displays the unique identifier assigned to the particular process that created the action row. |

| User |

Displays the user ID for the individual who processed the action. |

Explaining Direct Loan Origination Status and Action Codes

This section provides an explanation of the Direct Lending Status Codes for origination. This includes the processes run and the actions that generate each status code. The fields referenced in the following table display on the Direct Loan Orig Actions page.

|

Loan Processing Status |

Loan Origination Transmission Status |

Loan Origination Action |

Loan Origination Action Status |

Status/Action Explanation |

|---|---|---|---|---|

|

Orig Pend |

Orig Pend |

Loan Originated |

Pending |

You have not transmitted the loan to the COD. Any changes that you make to the source data are applied to the loan record by the loan adjustments. The system does not create a change transaction. |

|

In Service |

Trans |

Loan Originated |

Transmitted |

You have run the Direct Loan Outbound process and sent the loan origination or loan origination change records to the COD. The system suspends Loan Origination Change Processing until you receive the acknowledgement from the COD. The system updates the action status. |

|

In Service |

Accepted |

Accepted Orig, Accepted Orig/Credit Chk, Acpt Orig/Crdt Chk Denied, or Acpt Orig/Crdt Chk Pending |

Received |

You received an origination acknowledgement and the COD accepted the loan origination. The system inserts a new origination action. If you change the origination data, the system generates an origination change record. |

|

Hold |

Orig Pend |

Rejected Orig |

Received |

You received an origination acknowledgement from the COD and ran COD Inbound. The COD rejected the origination. The system inserts two new actions (Rejected Orig and Loan Originated). |

|

Hold |

Orig Pend |

Loan Originated |

Pending |

As a result of the previous action, the system inserts a new loan origination action to resubmit the origination. |

|

Terminated |

Origination Pending |

The award was cancelled/declined before transmitting the loan origination to the COD. |

Explaining Direct Loan Origination Change Status and Action Codes

This section provides an explanation of the Direct Lending Status Codes for Origination Change. This includes the processes run and the actions that generate each status code. The fields referenced in the following table display on the Direct Loan Orig Actions page.

|

Loan Processing Status |

Loan Origination Transmission Status |

Loan Origination Action |

Loan Origination Action Status |

Status/Action Explanation |

|---|---|---|---|---|

|

In Service |

Change Pend |

Orig Change |

Pending |

You changed origination data after the COD accepted the origination; therefore, the Loan Adjustment process created an origination change record. The Origination program inserts a new origination action. |

|

In Service |

Transmitted |

Orig Change |

Transmitted |

You have transmitted an origination change and the origination program inserts a new origination action. |

|

In Service |

Accepted |

Orig Change |

Accepted |

You received an origination acknowledgment from the COD and the origination change is accepted. The Origination program inserts a new origination action. |

|

In Service |

Accepted |

Orig Change |

Accepted Lower Endr |

Lower Endr – You sent a loan application based on a Credit Override of – Accept Endorser with an Endorser amount lower than the original loan award amount. You received an origination acknowledgement, and COD accepted the updated loan origination. The system inserts this row of data and a Accepted Origination Change row. Therefore, two loan action rows are inserted when a response to Lower Award amount is loaded. This is done to show that the award amount was reduced as a result of lower Endorser amount. |

|

Hold |

Error |

Orig change |

Rejected |

You received an origination change acknowledgement from the COD that rejects the origination change. The Origination program inserts a new origination action. |

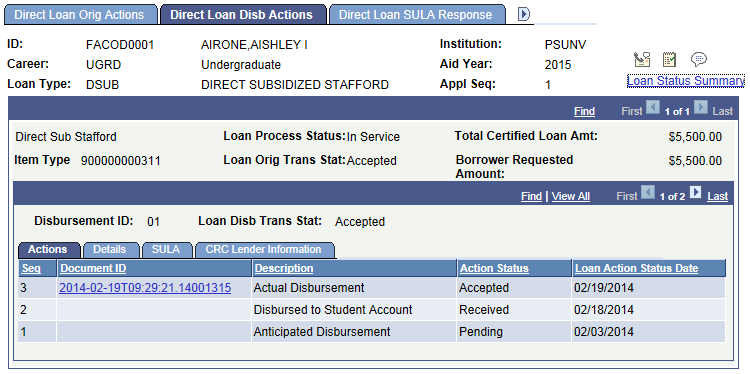

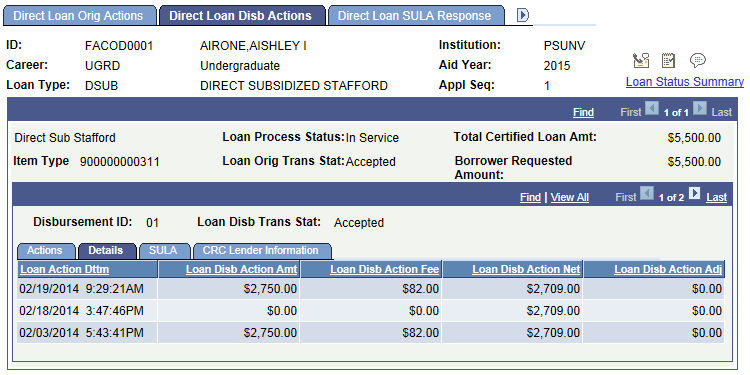

Access the Direct Loan Disb Actions page ().

Image: Direct Loan Disb Actions page

This example illustrates the fields and controls on the Direct Loan Disb Actions page. You can find definitions for the fields and controls later on this page.

The item type, status, and amount fields are the same as those on the Direct Loan Orig Actions page.

|

Field or Control |

Definition |

|---|---|

| Disbursement ID |

Displays the ID number assigned to this particular disbursement. |

| Loan Disb Trans Stat (loan disbursement transaction status) |

Indicates the status for this disbursement. Values are: Accepted Chg Pend (change pending) Actual (actual disbursement) Error Disb Pend (disbursement pending) Trans (transmitted) |

Actions Tab

|

Field or Control |

Definition |

|---|---|

| Seq (sequence) |

Displays the disbursement action sequence generated from the loan record activity. When multiple sequences exist for a loan, the most recent sequence appears at the top. |

| Description |

Displays the description of the disbursement action type. The values are: Adjusted Disbursement Canceled Disbursement Actual Disbursement Booking Disbursement Booking Adjustment Anticipated Disbursement Servicer Refund Disbursed to Student Account |

| Action Status |

Displays the current status of the disbursement action. The values are: Accepted Ac-NtApld (accepted-not applied) Authorized Failed Invalid Pending Received Rejected Transmitted The action status for an Acknowledgement is always Received. |

| Loan Action Status Date |

For actions representing received information, displays the COD acknowledgement date. For actions representing transmitted information, this is the date the action is created. |

Details Tab

Select the Details tab.

Image: Direct Loan Disb Actions page: Details tab

This example illustrates the fields and controls on the Direct Loan Disb Actions page: Details tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Loan Action Dttm (loan action date/time) |

For actions representing received information, the action date time is the date/time the acknowledgement is loaded to the system. For actions representing sent information, this is the date and time the transmission is sent. |

| Loan Disb Action Amt (loan disbursement action amount) |

Displays the gross disbursement amount. |

| Loan Disb Action Fee (loan disbursement action fee) |

Displays the loan fee amount for the disbursement. |

| Loan Disb Action Net (loan disbursement action net) |

Displays the net disbursement amount, minus fees, plus rebate. |

| Loan Disb Action Adj (loan disbursement action adjustment) |

Displays the adjusted disbursement amount reported. |

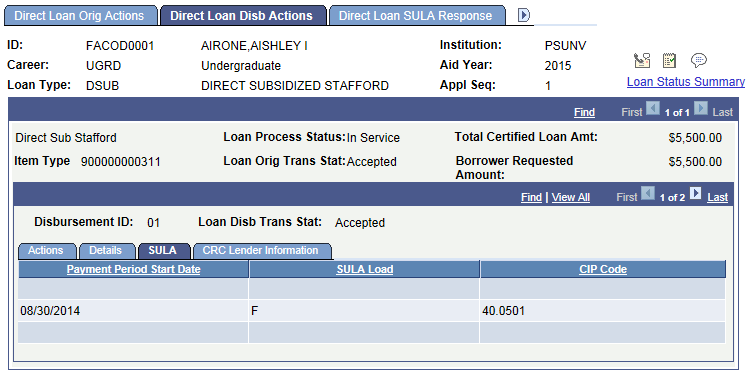

SULA Tab

Select the SULA tab.

Image: Direct Loan Disb Actions page: SULA tab

This example illustrates the fields and controls on the Direct Loan Disb Actions page: SULA tab. You can find definitions for the fields and controls later on this page.

Displays the Payment Period Start Date, SULA Load, and CIP Code. These fields are reported on Origination and Disbursement transactions

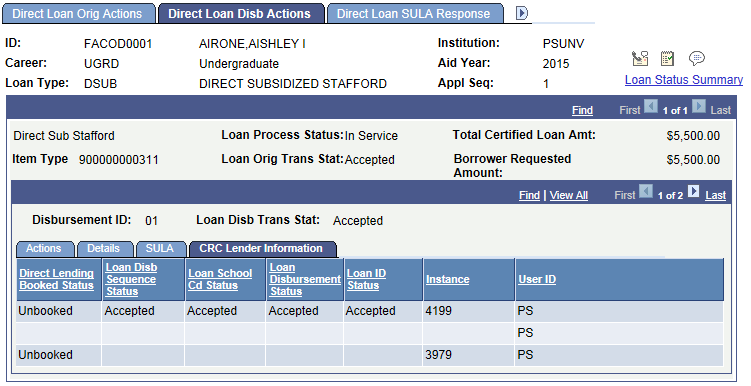

CRC Lender Information Tab

Select the CRC Lender Information tab.

Image: Direct Loan Disb Actions page: CRC Lender Information tab

This example illustrates the fields and controls on the Direct Loan Disb Actions page: CRC Lender Information tab. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Direct Lending Booked Status |

Displays Booked if the COD has accepted and acknowledged the origination, first disbursement, and promissory notes. Until this occurs, the status is Unbooked. |

| Loan Disb Sequence Status (loan disbursement sequence status) |

Displays one of the following values: Accepted Invalid (invalid sequence number) AlrdyRecv (already received) |

| Loan School Cd Status (loan school code status) |

Displays one of the following values: blank if the school code is accepted and I - Invalid if the school code is invalid. |

| Loan Disbursement Status |

Displays one of the following values: Accepted Invalid (invalid disbursement) AlrdyRecv (already received) Reject |

| Loan ID Status |

Displays one of the following values: I - Invalid Loan Identifier N - Loan Identifier Not on File blank - Accepted |

| Instance |

Displays the number used by the system to count the occurrences of the processes you run. Use this on the Messages page to select the particular instance of the process. |

| User ID |

Displays the user ID for the individual who processed the action. |

Explaining Direct Loan Disbursement Status and Action Codes

This section provides an explanation of the Direct Lending Status Codes for disbursements. This includes the processes run and actions that generate each status code. The fields referenced in the following table are located on the Direct Loan Disb Actions page.

The Loan Disbursement Transaction Status field appears opposite the Disbursement ID. The loan disbursement action status refers to the Action Status field on the page.

|

Loan Disbursement Transmission Status |

Loan Disbursement Action |

Loan Disbursement Action Status |

Status/Action Explanation |

|---|---|---|---|

|

Disb Pend |

Anticipated Disbursement |

Pending |

You originated the loan. This record represents the anticipated disbursement data at the time of disbursement. The Origination program inserts a new disbursement action row. |

|

Disb Pend |

Disbursed to Student Account |

Received |

You authorized and disbursed funds to the students account. The Disbursement program inserts a new disbursement action row. |

|

Transmitted |

Actual Disbursement |

Transmitted |

You transmitted an actual disbursement record to the COD. The Disbursement Outbound program inserts a new disbursement action. |

|

Accepted |

Actual Disbursement |

Accepted |

You received a disbursement acknowledgement from the COD that indicates the disbursement was accepted. The Disbursement Inbound program updates the disbursement action. |

|

Error |

Actual Disbursement |

Rejected |

You received a disbursement acknowledgement from the COD indicating the disbursement was rejected. The Disbursement program updates the disbursement action. |

|

Transmitted |

Adjusted Disbursement |

Transmitted |

You transmitted an adjusted disbursement record to the COD. The Disbursement Outbound program inserts a new disbursement action. |

|

Accepted |

Adjusted Disbursement |

Accepted |

You received a disbursement acknowledgement from the COD indicating the disbursement adjustment was accepted. The Disbursement Inbound program updates the disbursement action. |

|

Error |

Adjusted Disbursement |

Rejected |

You received a disbursement acknowledgement from the COD indicating the disbursement adjustment was rejected. The disbursement program updates the disbursement action. |

|

Accepted |

Booking Disbursement |

Accepted |

You received a booking notification from the COD. The booking notification indicates that the loan origination, promissory note and the first actual disbursement are accepted. The booking notification includes the Disbursement Activity Type L booking disbursement, the booked date and COD's total net booked amount. |

|

Accepted |

Booking Adjustment |

Accepted |

For each disbursement adjustment acknowledgement you receive from the COD, you also receive a booking notification. The booking notification includes the Disbursement Activity Type M booking adjustment, booked date and COD's total net booked amount. |

|

Accepted |

Servicer Refund |

Accepted |

You received a servicer refund acknowledgement from the COD. |

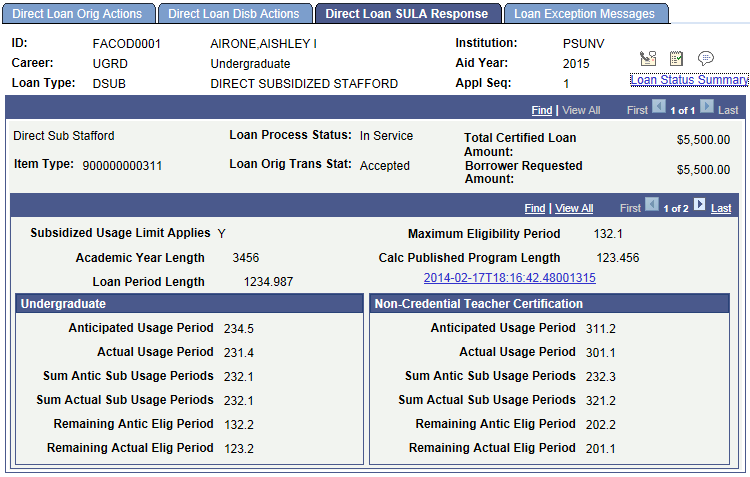

Access the Loan Exception Messages page ().

Image: Direct Loan SULA Response page

This illustrates the Direct Loan SULA Response page.

COD calculates a borrower's Subsidized Usage for two categories of usage: Undergraduate Subsidized Usage and Non-Credential Teacher Certification Usage. Depending upon whether the Special Programs tag equals T (Non-Credential Teacher Certification), one or both of these categories may be populated with duration, consumption, and remaining eligibility values. Also displayed is either anticipated and/or actual values, depending upon whether at least one actual disbursement has taken place (driven by Disbursement Release Indicator equaling true or false).

Access the Loan Exception Messages page ().

Image: Loan Exception Messages page

This example illustrates the fields and controls on the Loan Exception Messages page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| DateTime |

Displays the date and time that the message was created. |

| Message |

Displays the exception message logged for each transaction listed. You can enter further information regarding the exception message using the Loan Message Comment page. |

| Details |

Click this link to view additional message information. |