Receiving and Processing CL4 Inbound Files

This section discusses how to:

Load CL 4 inbound files to staging tables.

View CL 4 inbound application response details.

View CL 4 inbound EFT details.

Process CL 4 inbound files from staging tables to application tables.

Review CL 4 status and phase codes.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Run Control Parameters |

EC_RUN_INBOUND_01 |

|

Load inbound CommonLine 4 application response or EFT files into staging tables. |

|

CommonLine 4 Import - Header |

CL_IMP_HEAD4 |

|

View the information in the CommonLine application response header record. |

|

Application Detail |

CL_IMP_MAIN4 |

|

View inbound application details. This includes information about each record in the EDI Manager staging tables. |

|

Borrower Perm Address (borrower permanent address) |

SEC_IMP_ADDR |

Click the Address link on the Application Detail page. |

View borrower permanent address information. |

|

EFT Information (electronic funds transfer information) |

CL_EFT4_HEAD |

|

View electronic funds transfer information to verify data loaded into the EDI Manager staging tables. |

|

CommonLine Inbound |

RUNCTL_CLIN |

|

Move selected acknowledgment files from EDI Manager staging tables into the database. |

|

Loan Actions Codes |

LOAN_ACTNCD_TBL |

|

View CommonLine 4 status and phase codes. |

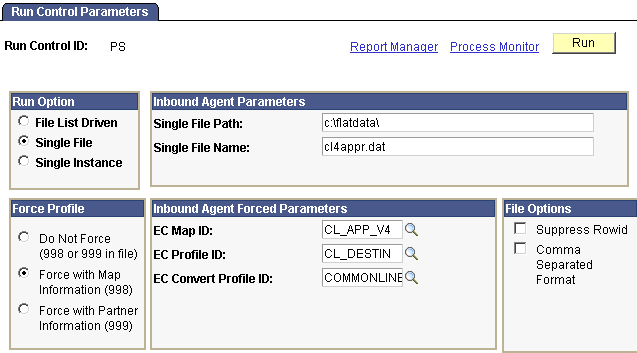

Access the Run Control Parameters page ().

Image: Inbound EC Agent - Run Control Parameters page

This example illustrates the fields and controls on the Inbound EC Agent - Run Control Parameters page. You can find definitions for the fields and controls later on this page.

Use this page to initiate the Inbound EC Agent process (ECIN0001), an SQR report, which loads information from application response or EFT files into staging tables.

Note: Do not make any changes in the File Options group box.

Run Option

|

Field or Control |

Definition |

|---|---|

| Single File |

Select if only one file is to be loaded. |

| File List Driven |

Select if you have created a file list to be loaded. Enter the file list name and location. Refer to the following table for file names to use. |

| Single Instance |

Not used in Financial Aid. |

Inbound Agent Parameters

|

Field or Control |

Definition |

|---|---|

| Single File Path |

Enter the path where the file is located. The syntax varies based on your network environment. |

| Single File Name |

Enter the name of the file in this field. |

Force Profile

|

Field or Control |

Definition |

|---|---|

| Do Not Force ((998 or 999 in file) |

Select to not use inbound agent forced parameters. |

| Force with Map Information (998) |

Select to enter parameters necessary to load the loan files. The parameters include an EC map ID, profile ID, and convert file ID. |

| Force with Partner Information (999) |

Select to enter parameters necessary to load the loan files. The parameters include an external entity code, forced transaction ID, external trading partner ID, internal alias entity code, and an EC alias trading partner ID. |

Inbound Agent Forced Parameters

|

Field or Control |

Definition |

|---|---|

| EC Map ID |

Select an inbound ID file to load. CommonLine choices for particular file names and types. Values are: CL_APP_V4: where file name is R004P and file type is CommonLine 4 application response file. CL_EFT_V4: where file name is E004P and file type is CommonLine 4 EFT roster. |

| EC Profile ID |

Select CL_DESTIN for CommonLine loan files. You can also create your own profile ID with EDI Manager. |

| EC Convert Profile ID |

Select COMMONLINE to load inbound CommonLine files. |

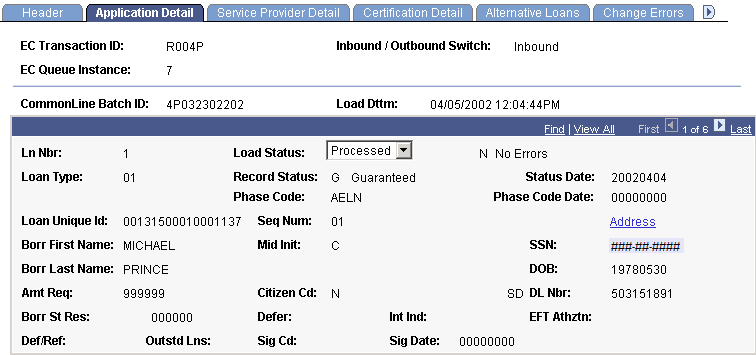

Access the Application Detail page ().

Image: Application Detail page

This example illustrates the fields and controls on the Application Detail page. You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Load Status |

Indicates the load status of the record. Values are: Processed: the record has been used to update the loan application record. Unprocessed: the default status indicating that the record has been loaded into the staging tables, but the CL Inbound process has not been run. Skipped: a value set manually to indicate that the record should not be processed. Error: the CL inbound process could not successfully process the record. View the error reason text that displays next to the field. |

| Record Status |

Displays the status of the loan reported by the loan servicer on the application response record. You can review the record status table for the complete list of valid values. |

| Status Date |

Displays the date the record status occurred. For example, the date when the loan was guaranteed. |

| Phase Code |

Corresponds to field 133 on the application response detail record. This is a more detailed status code communicated between the lending agencies. |

| Phase Code Date |

Displays the date the phase code became active. |

| DL Nbr (driver's license number) |

Displays the borrower's driver's license number. |

| Borr St Res (borrower state residence) |

Displays the date the borrower became a legal resident of the identified state. |

| Defer (deferment) |

Indicates the authorization for the lender to defer repayment periods. The borrower requests to defer principal payments while attending school. |

| Int Ind (interest indicator) |

Indicates whether the borrower intends to pay the interest on the unsubsidized Federal Stafford or Federal PLUS loan while in school and when the loan is in grace or deferment. |

| EFT Athztn (electronic funds transfer authorization) |

Indicates that the borrower has authorized the school to transfer the loan proceeds received by EFT to the appropriate student account. |

| Def/Ref (default/refund) |

Indicates whether the PLUS/alternative student is currently in default on a student loan or owes a refund on a federal grant. |

| Outstd Lns (outstanding loans) |

Indicates whether the borrower has outstanding loans. |

| Sig Date (signature date) |

Indicates the date the valid promissory note was signed. |

| Address |

Click to access the Borrower Perm Address page to view borrower permanent address information. |

Access the EFT Information page ().

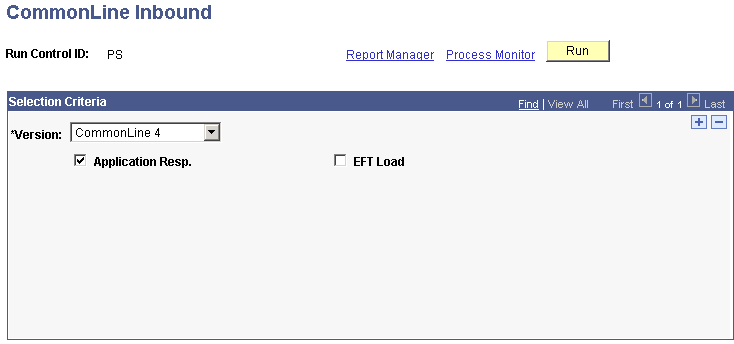

Access the CommonLine Inbound page ().

Image: CommonLine Inbound page

This example illustrates the fields and controls on the CommonLine Inbound page. You can find definitions for the fields and controls later on this page.

Use this page to run the CommonLine 4 Inbound Driver process, a COBOL SQL process.

|

Field or Control |

Definition |

|---|---|

| Application Resp (application response) |

Select to process all CommonLine 4 application response records from the EDI Manager staging table into the application database. |

| EFT Load |

Select to process electronic fund transfer records to the database. After EFT records have been processed, they automatically become eligible for disbursement to the student's account. |

Access the Loan Action Codes page ().

The CommonLine 4 loan inbound process uses the CommonLine 4 ID to match the loan application response record in the staging tables to an originated loan in the application database. When a match is found, the process loads both the record status code field 2 on the application response detail record and the phase code field 133 on the application response detail loan origination action records. The record status code provides a high-level status of the loan, while the phase code provides a detailed status.

Note: You can view the record status codes and application phase codes on the Loan Action Codes page.

In addition to loan origination action codes, the system generates a disbursement action record if a change of status occurs for a specific disbursement. Fields 120, 121, 122, and 123 on the application response detail record indicate changes to the disbursements. If the inbound process cannot load the record, the system generates an error code. Review the load error code table for additional details.

Record Status Codes

The following table lists record status codes that are specific to CommonLine 4 loans.

|

Code |

Description |

Load Action |

|---|---|---|

|

A |

Initial processing successful. Guarantees or obtains guarantee upon receipt of the promissory note. |

A loan origination action message is posted for the loan. |

|

I |

Initial processing successful. Pending further approval. |

A loan origination action message is posted for the loan. |

|

G |

Guaranteed. |

A loan origination action message is posted. The loan approved amounts, disbursement information, MPN, and additional CommonLine 4 information are updated. |

|

B |

Guaranteed. Promissory note received and approved for disbursement. |

Same as G. |

|

P |

Pending processing. (Error resolution underway by sending organization.) |

A loan origination action message is posted. |

|

D |

Denied/rejected/incomplete. No further processing unless school, borrower, or lender provides updated data. |

A loan origination action indicating the reject is posted, along with the error messages. The loan is set to Hold. A second loan origination action is posted to reset the loan to Originated/Pending. |

|

C |

School certification requested for application. |

Load errors. Use report to process manually. |

|

M |

Modification to previously reported guarantee. |

Same as G. |

|

N |

Response to reprint request. |

A loan origination action message is posted. |

|

R |

Response to transactions submitted in change transaction send file. |

A loan origination action message is posted. |

|

T |

Termination record. No action required. |

A loan origination action message is posted. |

Application Loan Phase Codes

The following table lists application loan phase codes.

|

Code |

Description |

Load Action |

|---|---|---|

|

ASCH |

Received transmission from school. |

A loan origination action message is posted. |

|

RECA |

Received application/promissory note. Has yet to be approved for disbursement. |

A loan origination action message is posted. |

|

AWPN |

Received application. Awaiting promissory note. |

A loan origination action message is posted. |

|

AABI |

Awaiting additional borrower information. |

A loan origination action message is posted. |

|

AAIG |

Awaiting additional information from guarantor. |

A loan origination action message is posted. |

|

AAIL |

Awaiting additional information from lender. |

A loan origination action message is posted. |

|

AAIN |

Awaiting additional information. |

A loan origination action message is posted. |

|

AAIS |

Awaiting additional information from school. |

A loan origination action message is posted. |

|

AINP |

Processing for submission to guarantor. |

A loan origination action message is posted. |

|

ASGU |

Submitted to guarantor. |

A loan origination action message is posted. |

|

AWCR |

Awaiting credit approval. |

A loan origination action message is posted. |

|

CRED |

Credit approved. |

A loan origination action message is posted. |

|

AELN |

Approved by guarantor. Not dependent on credit check. |

A loan origination action message is posted. |

|

ADIS |

Awaiting first disbursement. |

A loan origination action message is posted. |

|

PRNT |

Application and promissory note has been printed and mailed. |

A loan origination action message is posted. |

|

DPRT |

Reprint request denied. |

A loan origination action message is posted. |

|

SERV |

Servicing (first disbursement has been made). |

A loan origination action message is posted. |

|

RDCT |

Reduced disbursement amount. |

A loan origination action message is posted. |

|

ALRJ |

Rejected by lender. |

A loan origination action indicating the reject is posted along with the error messages. The loan is set to Hold. A second loan origination action is posted to reset the loan to Originated/Pending. |

|

AGRJ |

Rejected by guarantor. |

A loan origination action indicating the reject is posted along with the error messages. The loan is set to Hold. A second loan origination action is posted to reset the loan to Originated/Pending. |

|

RJCT |

Rejected due to processing problems. |

A loan origination action indicating the reject is posted along with the error messages. The loan is set to Hold. A second loan origination action is posted to reset the loan to Originated/Pending. |

|

ATEL |

Completing telephone follow-up to resolve problems. |

A loan origination action message is posted. |

|

AXCP |

Performing exception processing. Resolving special problems. |

A loan origination action message is posted. |

|

HOLD |

Holding while resolving outstanding problems. |

A loan origination action message is posted. |

|

AREP |

Reprocessing |

A loan origination action message is posted. |

|

ATRM |

Terminated loans have been withdrawn or cancelled. |

A loan origination action message is posted. |

Inbound File Load Error Codes

The following table describes errors and how they can be resolved. Set error records that do not require resolution to Skipped. This action removes them from the CL 4 App Response Error report. These codes are common to both CL4 and CRC.

|

Code |

Description |

Error Resolution |

|---|---|---|

|

A – Award Discrepancy |

Gross disbursement amounts could not be synchronized. See "Understanding the Inbound File Process." |

Repackage the student so that the gross amounts match. Note: Do not use the CommonLine Loan Orig Trans page to auto-accept the loan instead of repackaging the student. Because the application load process now automatically reconciles differences between the loan and the student awards, PeopleSoft no longer recommends this procedure. |

|

C – Loan certification request |

All loan certification request records produce errors. |

Follow the documented school certification request processing procedures. |

|

D – Loan Destination not found |

The load process was unable to determine the loan destination profile of the guaranteed loan. This occurs when institutions originate loans without a lender specified. |

Create a loan destination using the lender and guarantor information on the Application Response record. |

|

E – Processing Error |

Possible data corruption in the application tables. Refer to your systems administrator for assistance. |

Check for missing PS_LOAN_ORIG_DTL records, missing PS_LOAN_DISB_ACTN rows, or a discrepancy between the number of disbursements in the student's award and. the number of disbursements listed in the application response record. |

|

H – Loan on hold |

The record does not load because the originated loan is in Hold status. |

Resolve the hold condition and remove the Hold status in the Originate Loan component. |

|

L – Loan not found |

The application response record could not be matched to an originated loan using the CommonLine ID values. |

If the origination record exists, either manually change the school's loan application ID to match the CommonLine ID or get the loan agency to change the CommonLine ID to match loan application ID. |

|

N – No Errors |

Assigned when the loan response record is loaded successfully. |

|

|

P – Process Not Supported |

The CRC response file is a type not supported or recognized by the system |

Set to skip. |

|

S – Source Data Corruption |

Loan servicer information is incorrect. One of the following is true:

|

For the first, request a new application response file from your loan servicer where the loan disbursement information is now correct and the gross amount = (loan fees - fees paid) + net amount. For the second, request a new application response file from your loan servicer where the loan disbursement and approved amount information is now correct. For the third, request a new application response file from your loan servicer or manually fix and reprocess the file. |

|

U – Unknown or invalid loan type |

An unknown or invalid CommonLine loan type is defined for the application response record. Only the CommonLine 4 defined loan type codes (field 17) are acceptable. |

Ask the loan servicer to reissue the application response record with a corrected loan type code value. |

|

X – Uninitiated Change |

A response to an uninitiated change response to the student's loan was received. |

Review the changes made to the loan and make the appropriate changes to the loan manually. This may require running loan origination adjustments and then manually accepting the change using the CommonLine Loan Orig Trans page. |

After you resolve any load errors, rerun the CommonLine loan inbound process to reprocess any records set to Error.

Two CL 4 reports can assist you in processing of load errors: the CL 4 App Response Load Error report and the CL School Cert Request report.