Setting Up Loan Validation Edits

To set up loan validation edits, use the Maintain Loan Edits component (LN_EDITS) and Create Loan Edit Set component (LN_EDIT_DFLTS).

This section provides an overview and discusses how to:

Define validation edit messages.

Create loan validation edit sets.

Loan edits verify that the loan origination data is valid for transmission to the receiving loan agency. All CommonLine 4 loan validation edits must be defined in the Loan Edits/Message Table page. Financial Aid delivers a core set of edits to be used during loan validation. All CommonLine 4 loan edits are equations written using the Equation Engine. You can use the Equation Engine to create or modify equations to support loan agencies that are not defined as a CommonLine standard.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Loan Edits/Messages |

LN_EDIT_TBL |

|

View delivered edits and error messages used in loan validation. You must correct all loan errors before loan data can be selected for outbound processing. You can modify the message text. |

|

Loan Edit Defaults |

LN_EDIT_DFLTS |

|

Create loan validation edit sets that are used when constructing loan destination profile records. Loan edit default sets are logical sets of edits that can be carried out based on aid year, loan program, loan category and process level. After they are added to a loan destination, you can further modify the edit sets to function according to the loan destination's business rules. |

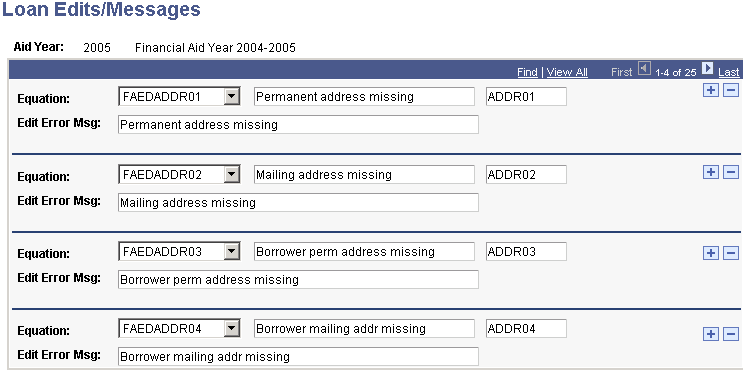

Access the Loan Edits/Messages page ().

Image: Loan Edits/Messages page

This example illustrates the fields and controls on the Loan Edits/Messages page.

This page comes preloaded with updated edit error messages as needed. New loan edits created with the Equation Engine must be added to this page for the loan validation process to use them. Use the Equation field to select an Equation Engine equation.

The Loan Orig Edit Errors (loan origination edit errors) page in the Originate Loan component displays any edit errors encountered during the loan origination process.

This table describes the predefined errors:

|

Equation |

Description |

Cause |

Resolution |

|---|---|---|---|

|

FAEDADDR01 |

Permanent address missing. |

Used for alternative/PLUS loans. A valid permanent address cannot be found for the student. The address type is based on the FA Process Demographic Use page permanent address usage setting. |

Add a valid address that can be used as the permanent address on the Addresses page or modify the permanent address usage setting to select one of the student's existing addresses. |

|

FAEDADDR02 |

Mailing address missing. |

Used for alternative/PLUS loans. A valid mailing address cannot be found for the student. The address type is based on the FA Process Demographic Use page mail address usage setting. |

Add a valid address that can be used as the mailing address on the Addresses page or modify the mailing address usage setting to select one of the student's existing addresses. |

|

FAEDADDR03 |

Borrower perm address missing. |

A valid permanent address cannot be found for the borrower. The address type is based on the FA Process Demographic Use page permanent address usage setting. |

Add a valid address to the borrow ID that can be used as the permanent address on the Addresses page or modify the permanent address usage setting to select one of the student's existing addresses. |

|

FAEDADDR04 |

Borrower mail address missing. |

A valid mailing address cannot be found. The address type is based on the FA Process Demographic Use page mail address usage setting. |

Add a valid address that can be used as the mailing address on the Addresses page or modify the mailing address usage setting to select one of the student's existing addresses. |

|

FAEDBORROW01 |

Loan borrower not defined. |

Used for alternative/PLUS loans. The Borrower ID field in the Maintain Originated Loans component (SFA_CRC_ORIG) is blank. |

Enter the correct borrower ID. |

|

FAEDCHNG01 |

Loan increase with undisbursed check. |

Used for change transactions. A post-disbursement change transaction is generated and an undisbursed check exists for the loan. |

Disburse the funds to the student account or return the funds to the lender. |

|

FAEDCOSIGN01 |

No cosigners - cosigners required. |

Used primarily for alternative loans. If cosigners are required for the loan type, the edit verifies that the required number of cosigners exist in the Relationships page for the student and are assigned to the loan. |

Add the missing cosigners in the Relationships page and Maintain Originated Loans component. |

|

FAEDCOSIGN02 |

Cosigner signature required. |

Used primarily for alternative loans. Co-signer signatures have not been entered in the Promissory Note Alt and Promissory Note Plus tracking pages. |

Revise the data on the Promissory Note Plus page or the Promissory Note Alt page. |

|

FAEDDEBT01 |

Total student loan debt required. |

Used for alternative loans. The total loan debt on the Originate Loan component is zero, and NSLDS loan history exists. |

Update the total loan debt in the Originate Loan component using the Loan Demographic Data page. |

|

FAEDDEPSTAT1 |

Dependency Status missing. |

The student's federal dependency status was missing when the loan was originated. |

Use the Loan Demographic Data page to update the dependency status in the Originate Loan component. |

|

FAEDDEST01 |

Loan destination is zero (missing). |

The loan destination is not assigned after the loan has been originated. This edit is always carried out by the loan validation process and cannot be deactivated. |

Assign a loan destination in the Loan Origination 1 page. |

|

FAEDDISBDT01 |

Disbursement more than 90 days after loan period end. |

A disbursement date is set for greater than 90 days beyond the loan period end date. |

Change the date on the Loan Origination 2 page. |

|

FAEDDISBDT02 |

Disbursement date earlier than 13 days of loan period start. |

The first disbursement precedes the loan period begin date by more than 13 days. This may only be replicated by originating a new loan. An online edit prevents manually creating this situation. |

Revise the disbursement date or loan period start date in the Loan Origination 2 page. |

|

FAEDDISBDT03 |

Disbursement dates must be in chronological order. |

Disbursement dates are not in order. |

Revise disbursement dates in the Loan Origination 2 page. |

|

FAEDDRVLIC01 |

Borr DL Number or state missing. |

The borrower's driver's license information was incomplete when the loan was originated. |

Update the driver's license data in the Driver's License page, and then use the Loan Demographic Data page to update this information in the Originate Loan component. |

|

FAEDGRADDT01 |

Grad date before loan end date. |

The graduation date viewed in the Originate Loan component is before the end of the loan period. |

Update the FA Term graduation date (if required), and then use the Loan Demographic Data page to update this graduation date in the Originate Loan component. |

|

FAEDNAME01 |

Student name missing. |

A valid name type cannot be found. The name type should be based on the FA Process Demographic Use page name usage setting. |

Add a valid name type that can be used as the student's name on the Names page or modify the name usage setting to select one of the student's existing names. |

|

FAEDNAME02 |

Borrower name missing. |

A valid name type cannot be found. The name type should be based on the FA Process Demographic Use page name usage setting. |

Add a valid name type that can be used as the borrower's name on the Names page or modify the name usage setting to select one of the borrower's existing names. |

|

FAEDPER01 |

Loan period greater than 1 year. |

The loan period defined in the Originate Loan 3 page is more than one year. |

Change the loan period dates so that the loan period is less than one year. on the Loan Origination 2 page |

|

FAEDPLUS01 |

PLUS borrower and student SSN are the same. |

A PLUS borrower cannot be the student. |

Correct possible invalid relationship defined for the student. Assign a new borrower for the PLUS loan. |

|

FAEDPLUS02 |

No PLUS for grad students allowed. |

The student has a graduate NSLDS level in the FA Term record when the loan is originated. |

Cancel the loan if appropriate, or change the student's grade level to an undergraduate in the correct FA Term record. If you change the student's grade level, then you also need to use the Loan Demographic Data page to update it in the Maintain Originated Loans component. |

|

FAEDPLUSMPN |

Serial PLUS MPN check. |

For PLUS loans. Confirms a prior PLUS loan with the same EmplID, borrower EmplID, and lender in the CommonLine MPN Usage page with the current PLUS loan. |

To process serially, modify the loan record by changing the borrower or loan destination so that the borrower and lender match the information in the CommonLine MPN Use page. If the loan should be processed as a new MPN, set the Serial Loan Code field on the Loan Origination 3 page from S to N. |

|

FAEDREFS01 |

References missing. |

The required number of references have not been defined for the student in the Relationships page and have not been assigned to the loan. |

Add the missing references in the Relationships page and Maintain Originated Loans component. |

|

FAEDSRVCIN01 |

Service indicator exists. |

An active negative service indicator is assigned to the student. |

Remove the service indicator. |

|

FAEDSSN01 |

Borrower SSN is blank (PLUS and Alt Loans only). |

When the loan was originated, either the borrower was not assigned, or the borrower ID did not have a valid Social Security Number (SSN). A valid SSN has the appropriate country code and a NID type of PR. |

Verify that the borrower is assigned in the Originate Loan component. If appropriate, fix the SSN on the Demographic and Address Data component and then import the SSN into the originated loan record using the Loan Demographic Data page. |

|

FAEDSSN02 |

Student SSN is blank. |

When the loan was originated, the student did not have a valid SSN. A valid SSN has the appropriate country code and a NID type of PR. |

Revise the SSN on the Demographic and Address Data component and then import the SSN into the originated loan record using the Loan Demographic Data page. |

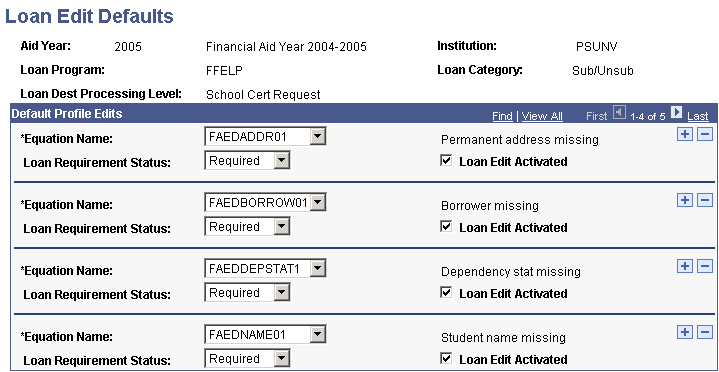

Access the Loan Edit Defaults page ().

Image: Loan Edit Defaults page

This example illustrates the fields and controls on the Loan Edit Defaults page. You can find definitions for the fields and controls later on this page.

The system uses the edit sets defined on this page when you define loan destination profiles.

|

Field or Control |

Definition |

|---|---|

| Loan Program |

Values are: Alternative, Direct Lending, FFELP, Health Professions, State, and University. |

| Loan Category |

Indicates a subsidized, unsubsidized, alternative, or PLUS loan. |

| Loan Dest Processing Level (loan destination processing levels) |

Values are: Direct, Guarantee and Print Appl (application), Print and Guarantee, Guarantee Only, School Certification Request, and Manual. |

Default Profile Edits

Define loan edits to use during validation for the selected loan program, category, and destination processing level. In addition to creating new edit sets, you can also add or delete edits, or activate or deactivate existing edits.

|

Field or Control |

Definition |

|---|---|

| Equation Name |

Select a predefined edit equation. Edit equations are defined in the Equation Engine and are set up on the Loan Edits/Messages page for use by the loan validation process. |

| Loan Requirement Status |

For each section, indicate one of the following: Optional: The selected section is not a requirement for the loan. Recommended: The selected section is not a requirement for the loan. Required: The selected section is a requirement for the loan. Note: The field value does not affect current loan functionality, but is intended to support future business processes. |

| Loan Edit Activated |

Select to activate an edit. |