Setting Up Verification Options

Verification is the process of checking the accuracy of the information provided by students and their families when applying for financial aid. Institutions are required to perform federal verification on a portion of their aid applicants before awarding Title IV aid. The Campus Solutions application provides options for meeting federal and institutional verification requirements.

This section discusses how to set up fields for compare.

For more information see, the Federal Student Aid Handbook

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Federal Setup |

SFA_VER_FLD_TS_FED |

|

Activate fields for federal verification processing and filter for use by dependency status. |

|

Institutional Setup |

SFA_VER_FLD_TS_INS |

|

Activate fields for institutional verification processing and filter for use by dependency status. |

|

Inst Marital Status Mapping |

SFA_VERIF_MAR_MAPP |

|

Map available parent marital statuses to institutional marital statuses |

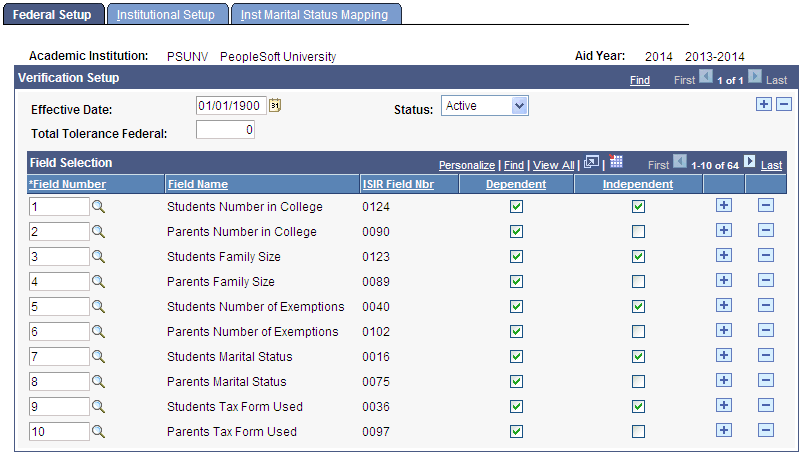

Access the Federal Setup page ().

Image: Federal Setup page

This example illustrates the fields and controls on the Federal Setup page. You can find definitions for the fields and controls later on this page.

Insert rows and select fields to be verified and indicate for which type of student the verification applies; dependent or independent.

|

Field or Control |

Definition |

|---|---|

| Effective Date |

Displays the effective date for these verification tolerance rules. The effective date defines when the status that you select is valid. |

| Status |

Displays the status for the data. Values are Active and Inactive. |

| Total Tolerance Federal |

Enter the amount that the combined total of all selected fields can vary between verified and reported information. This tolerance is the maximum difference that can exist as variance before failing the verification process. |

| Field Number |

Enter the field number for each of the fields to be compared. |

| Field Name |

Displays the corresponding name for each field to verify. |

| Dependent |

Select to compare the field for dependent students. |

| Independent |

Select to compare the field for independent students. |

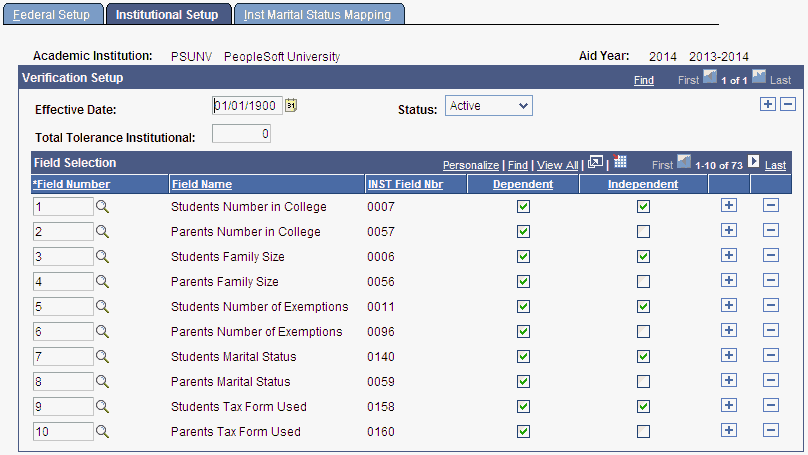

Access the Institutional Setup page ().

Image: Institutional Setup page

This example illustrates the fields and controls on the Institutional Setup page. You can find definitions for the fields and controls later on this page.

Refer to the field descriptions for the Federal Setup page with the following exceptions:

|

Field or Control |

Definition |

|---|---|

| Total Tolerance Institutional |

Enter the amount that the combined total of all selected fields can vary between verified and reported information. This tolerance is the maximum difference that can exist as variance before failing the verification process. |

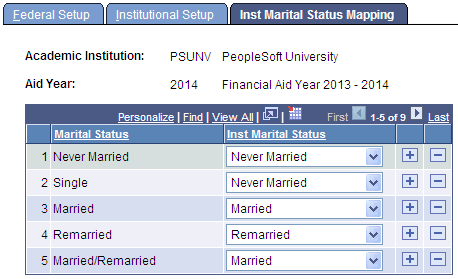

Access the Inst Marital Status Mapping page ().

Image: Institutional Marital Status Mapping page

This example illustrates the fields and controls on the Institutional Marital Status Mapping page. You can find definitions for the fields and controls later on this page.

Use this page to map system marital status values to Institutional marital statuses.

|

Field or Control |

Definition |

|---|---|

| Marital Status |

Displays all possible ISIR and Institutional parent marital statuses |

| Inst Marital Status |

Select the Institutional parent marital status you wish to map to each of the possible marital statuses. Note: This setup resolves differences between ISIR (Federal) and PROFILE (Institutional) parent marital statuses when performing Verification without first retrieving application data via 'Get Federal Data' or 'Get Institutional Data'. If you have retrieved application data, the system renders the parent marital statuses based on the application type, Federal or Institutional. However, if application data is not first retrieved, the system cannot determine if the data being verified is Federal or Institutional and renders all possible parent marital statuses. When you consolidate Verification data either online or batch, you are required to select the type of consolidation being performed, Federal or Institutional. Parent marital statuses for consolidation can be mapped without interpretation for Federal Verification. However, Institutional parent marital statuses do not possess the same characteristics and this setup allows you to map the 9 possible parent marital statuses to the 6 actual Institutional parent marital statuses. When consolidation is performed, regardless of what marital status is selected in the Tax Form Data page, the mapped value is used and displayed for consolidation and compare. For example, if you enter a marital status of Married/Remarried and Institutional consolidation is performed, your mapping setup determines if Married or Remarried is used in consolidation. |

The field numbers in this table are from the reference table ISIR_VERIF_XREF. These numbers are current for the 2014 aid year.

|

Nbr |

Field Name |

Num/Char |

ISIR Nbr |

Profile Nbr |

|---|---|---|---|---|

|

1 |

Students Number in College |

N |

126 |

7 |

|

2 |

Parents Number in College |

N |

91 |

57 |

|

3 |

Students Family Size |

N |

125 |

6 |

|

4 |

Parents Family Size |

N |

90 |

56 |

|

5 |

Students Number of Exemptions |

N |

41 |

11 |

|

6 |

Parents Number of Exemptions |

N |

104 |

96 |

|

7 |

Students Marital Status |

C |

17 |

140 |

|

8 |

Parents Marital Status |

C |

76 |

59 |

|

9 |

Students Tax Form Used |

C |

37 |

158 |

|

10 |

Parents Tax Form Used |

C |

98 |

160 |

|

11 |

Does Student Have Legal Dep |

C |

69 |

5 |

|

12 |

Students AGI |

N |

39 |

12 |

|

13 |

Parents AGI |

N |

102 |

97 |

|

14 |

Students Federal Taxes Paid |

N |

40 |

13 |

|

15 |

Parents Federal Taxes Paid |

N |

103 |

104 |

|

16 |

Students Wage Income |

N |

42 |

15 |

|

17 |

Fathers Wage Income |

N |

105 |

106 |

|

18 |

Students Spouse Wage Income |

N |

43 |

16 |

|

19 |

Mothers Wage Income |

N |

106 |

107 |

|

27 |

Student Eligible for 1040A-EZ |

C |

38 |

0 |

|

28 |

Parent Eligible for 1040A-EZ |

C |

100 |

0 |

|

29 |

Tax Return Filed by Student? |

C |

36 |

161 |

|

30 |

Tax Return Filed by Parent? |

C |

97 |

166 |

|

41 |

Students Untax SS benefits |

N |

0 |

18 |

|

42 |

Parents Untax SS benefits |

N |

0 |

147 |

|

43 |

Students Welfare/TANF |

N |

0 |

19 |

|

44 |

Parents Welfare/TANF |

N |

0 |

109 |

|

45 |

Students Child Supp Received |

N |

55 |

20 |

|

46 |

Parents Child Supp Received |

N |

117 |

110 |

|

47 |

Students Other Untaxed Income |

N |

61 |

21 |

|

48 |

Parents Other Untaxed income |

N |

124 |

113 |

|

49 |

Students EIC |

N |

0 |

22 |

|

50 |

Parents EIC |

N |

0 |

116 |

|

51 |

Parents Adjustment to Income |

N |

0 |

103 |

|

52 |

Students Interest/dividends |

N |

0 |

17 |

|

53 |

Parents Interest Income |

N |

0 |

99 |

|

54 |

Parents Dividend Income |

N |

0 |

100 |

|

55 |

Parents Business/farm Income |

N |

0 |

101 |

|

56 |

Student Child Support Paid |

N |

48 |

40 |

|

57 |

Parent Child Support Paid |

N |

111 |

61 |

|

58 |

Parent IRA/KEOGH/SEP Deduct |

N |

117 |

111 |

|

59 |

Parents Pretax Pension/savings |

N |

116 |

117 |

|

61 |

Parent Military/Clergy Allow |

N |

122 |

0 |

|

62 |

Parent Exempt Interest Income |

N |

119 |

118 |

|

63 |

Parents Foreign Inc Exclusion |

N |

0 |

112 |

|

64 |

Students Itemized Deduction |

N |

0 |

14 |

|

65 |

Parents Itemized Deduction |

N |

0 |

105 |

|

66 |

Parents Other Taxable Income |

N |

0 |

102 |

|

67 |

Parents Wages, Salaries, Tips |

N |

0 |

98 |

|

68 |

Parents Tuition Fees Deduction |

N |

0 |

149 |

|

69 |

Student Education Credit |

N |

47 |

131 |

|

70 |

Parent Education Credit |

N |

110 |

132 |

|

71 |

Student IRA/KEOGH/SEP Deduct |

N |

54 |

0 |

|

72 |

Student Exempt Interest Income |

N |

56 |

0 |

|

73 |

Student Non-Edu Vet Benefit |

N |

60 |

0 |

|

74 |

Parent Non-Edu Vet Benefit |

N |

123 |

231 |

|

75 |

Student Other Unreport Income |

N |

62 |

0 |

|

77 |

Student Pretax Savings |

N |

53 |

0 |

|

78 |

Student Untax IRA |

N |

57 |

0 |

|

79 |

Parent Untax IRA |

N |

120 |

234 |

|

80 |

Student Untax Pension |

N |

58 |

0 |

|

81 |

Parent Untax Pension |

N |

121 |

235 |

|

82 |

Student Military/Clergy Allow |

N |

59 |

0 |

|

83 |

Student Combat Pay |

N |

51 |

182 |

|

84 |

Parent Combat Pay |

N |

114 |

189 |

|

85 |

Student Taxable Work-Study |

N |

49 |

0 |

|

86 |

Parent Taxable Work-Study |

N |

112 |

0 |

|

87 |

Student Grant/Scholarship |

N |

50 |

0 |

|

88 |

Parent Grant/Scholarship |

N |

113 |

0 |

|

89 |

Student Taxed Financial Aid |

N |

0 |

23 |

|

90 |

Student Co-Op Earnings |

N |

52 |

0 |

|

91 |

Parent Co-Op Earnings |

N |

115 |

0 |

|

92 |

Parent Addl Child Tax Credit |

N |

0 |

203 |

|

93 |

Parent Living Allowance |

N |

0 |

114 |

|

94 |

Parent IM Other Untax Income |

N |

0 |

205 |

|

95 |

Parent Family Support Income |

N |

0 |

206 |

|

96 |

Parent Military Allowance |

N |

0 |

204 |

|

97 |

Student SSI Benefits |

C |

127 |

244 |

|

98 |

Parent SSI Benefits |

C |

92 |

171 |

|

99 |

Student SNAP/Food Stamps |

C |

128 |

245 |

|

100 |

Parent SNAP/Food Stamps |

C |

93 |

249 |

|

101 |

Student School Lunch Benefits |

C |

129 |

246 |

|

102 |

Parent School Lunch Benefits |

C |

94 |

250 |

|

103 |

Student TANF Benefits |

C |

130 |

247 |

|

104 |

Parent TANF Benefits |

C |

95 |

170 |

|

105 |

Student WIC Benefits |

C |

131 |

248 |

|

106 |

Parent WIC Benefits |

C |

96 |

251 |

|

107 |

Parent FSA Health Care |

N |

0 |

254 |

|

108 |

Parent FSA Dependent Care |

N |

0 |

252 |

|

109 |

Parent Health Savings Account |

N |

0 |

253 |

|

110 |

Parent Additional Medicare Tax |

N |

0 |

262 |

|

111 |

Parent HSA PreTax Contribution |

N |

0 |

263 |

|

112 |

Student Tax Filing Status |

C |

37 |

264 |

|

113 |

Parent Tax Filing Status |

C |

99 |

265 |

|

114 |

Student Dislocated Worker |

C |

0000 |

0183 |

|

115 |

Parent Dislocated Worker |

C |

0000 |

0188 |

|

116 |

Student Homeless |

C |

0000 |

0184 |

|

117 |

Student Orphan/Foster/Ward |

C |

0000 |

0185 |

|

118 |

Student Upward Bound |

C |

0000 |

0259 |