Reviewing and Canceling Self-Service ePayment Transactions

Student Financials enables you to review and cancel submitted payments that are not yet authorized or posted to the student account.

This section discusses how to view self-service credit card transactions.

|

Page Name |

Definition Name |

Navigation |

Usage |

|---|---|---|---|

|

Maintain ePayment Transaction |

SF_PAYMENT_MAINT1 |

|

View and cancel self-service credit card transactions. |

Access the Maintain ePayment Transaction page ().

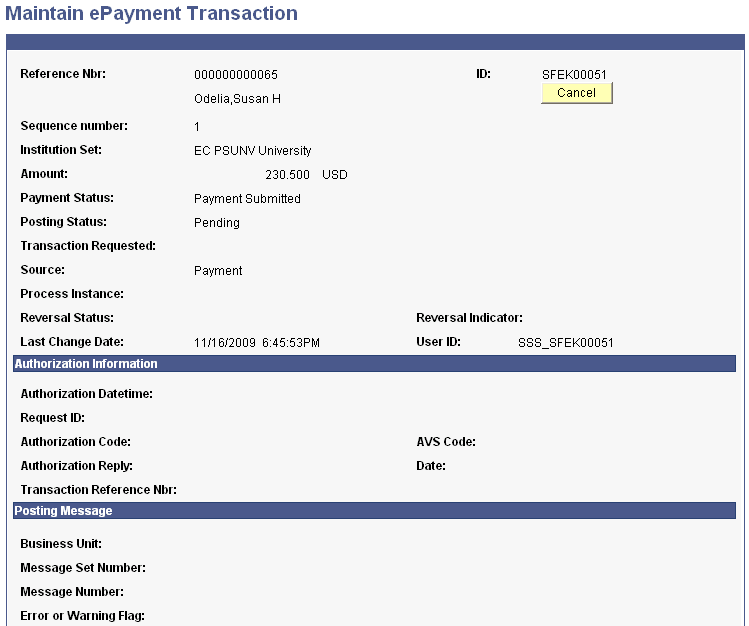

Image: Maintain ePayment Transaction page (1 of 2)

This example illustrates the fields and controls on the Maintain ePayment Transaction page (1 of 2). You can find definitions for the fields and controls later on this page.

Image: Maintain ePayment Transaction page (2 of 2)

This example illustrates the fields and controls on the Maintain ePayment Transaction page (2 of 2). You can find definitions for the fields and controls later on this page.

|

Field or Control |

Definition |

|---|---|

| Reference Nbr (reference number) |

Displays the unique reference number that the system assigns to each credit card transaction. |

| ID |

Displays the ID of the student who made the credit card transaction. |

| Posting Status |

Indicates whether the Student Financials system successfully posted each transaction. Values are: Errors: The transaction encountered errors during posting. Pending: The system has not yet posted the transaction. Successful: The system successfully posted the transaction. |

| Source |

Indicates where the transaction originated. Values are: Application Center: The transaction originated from an admissions office application center. Cashiering: The transaction originated from a cashiering office. Payment: The transaction originated from the self-service Make a Payment page. Refund: The transaction originated from the Student Financials Refund process. Reversal: The transaction originated from the Payment Reversals page. |

| Reversal Status |

If you reversed the transaction, this field Indicates whether the system successfully processed the reversal. Values are: Errors: The system encountered errors during the reversal. Successful: The system successfully reversed the transaction. |

| Cancel |

Click to cancel this transaction. Note: The Cancel button is available only for transactions that are not posted and authorized. |

Authorization Information

Information appears in this group box when a self-service credit card transaction has been authorized.

|

Field or Control |

Definition |

|---|---|

| Credit Card Authorization DTTM (credit card authorization date and time) |

Displays the date and time that the credit card processing vendor authorized the credit card transaction. |

| Credit Card Request ID |

Displays the unique ID that the credit card processing vendor assigns to each transaction. |

| Credit Card Authorization Code |

Displays the unique authorization code sent by the bank to the credit card processing vendor. |

| Date |

Displays the original date of the credit card transaction. |

| Authorization Reply |

Displays the authorization reply code that was received from the credit card processing vendor for each transaction. |

| Credit Card AVS Return Code (credit card address verification system code) |

Displays the address verification code that the credit card processing vendor sends to the Student Financials system. The code indicates whether the address that was sent with the transaction matches the credit card company's records. If you set the system not to perform address verification for a transaction, the AVS Code column is blank for that transaction. Values are: X (Exact): The address and the 9-digit zip code match. Y (Yes): The address and the 5-digit zip code match. A (Address): The address matches, but the 5-digit zip code does not. W (Whole zip): The address does not match, but the 9-digit zip code does. Z (Zip): The address does not match, but the 5-digit zip code does. N (No): Neither the address nor the zip code match. U (Unavailable): Information is unavailable or the card-issuing bank does not support AVS. S (Unsupported): The card-issuing bank does not support AVS. R (Retry): The system of the card-issuing bank is unavailable. E (Edit Error): The transaction is ineligible for AVS or an edit error occurred. |

Posting Message

Information appears in this group box when a self-service credit card transaction has been posted.

|

Field or Control |

Definition |

|---|---|

| Business Unit |

Displays the description of the business unit within which the transactions were processed. |

| Message Set Number and Message Number |

If any errors occurred or warnings were issued during the processing of this transaction, use the message set number and the message number to locate the message explaining what happened. |

| Error or Warning Flag |

Indicates whether the system encountered any errors or generated any warning messages when it posted the transaction. |