2. Interface with Depositary Systems

Oracle FLEXCUBE Investor Servicing (FC-IS) provides the facility to interface with external depository systems. A depositary system is an agency that maintains the holdings of investors in an electronic form. An AMC could also function as a depositary. Investors who hold investment units in a depositary system are known as beneficiaries.

Depositary systems may have registrar systems, which maintain records of the balances (known as ‘positions’) held by each beneficiary, and also process and disburse dividend payments for the beneficiaries. In some cases, depositaries could also interface with external systems that will provide registrar services for the depositary.

Another function served by a registrar is the conversion of the physical shares to electronic format, and vice versa. When a physical share is converted to an electronic form, it is said to be ‘dematerialized’. When the reverse occurs, it is said to be ‘rematerialized’.

Oracle FLEXCUBE Investor Servicing provides the facility of functioning as a registrar system to an external depositary. In such a scenario, FC-IS receives details of positions held by beneficiaries in the depositary and updates these positions whenever a dividend is disbursed. FC-IS also processes requests for dematerialization and re-materialization of shares held by the beneficiaries.

To configure the FC-IS system to act as a registrar to an external depositary, you must ensure that the following processes and maintenances are in place:

- Maintaining the depositary as a unit holder in the system

- Associating a fund with the ISIN Code

- Maintaining interfaces for importing beneficiary positions

This chapter contains the following sections:

- Section 2.1, "Depository Maintenance as Unit Holder"

- Section 2.2, "Fund Association with ISIN Code"

- Section 2.3, "Fund ISIN Summary Screen"

- Section 2.4, "Dividend Processing for Beneficiaries"

- Section 2.5, "Requests for De-materialization Processing"

- Section 2.6, "Requests for Re-materialization Processing"

2.1 Depository Maintenance as Unit Holder

Each depositary for which FC-IS provides registrar services must be maintained as a unit holder entity in FC-IS. The total balance held by all beneficiaries in the depositary can then maintained as the depositary unit holder balance in FC-IS.

A unit holder account that is created for a depositary is identified by the dealing type, ‘D’, indicating, ‘depositary’. When the account is created in the system in the Unit Holder New Account screen, you must specify ‘Depositary’ in the Dealing Type field.

Just before a dividend is processed, the external depositary system exports a file (called BENPOS file) containing the positions of all beneficiaries. When this file is uploaded into FC-IS, the system validates that the sum of these positions in the BENPOS file must be equal to the balances in the depositary unit holder account. Based on this information, dividend is processed and disbursed for each beneficiary. The updated positions are maintained in the FC-IS database, and can be exported back to the depositary system when required. Dividend processing, therefore, is done for the beneficiaries and not for the depositary unit holder account.

When dividend is processed, the income distribution option maintained for the fund-ISIN association, for each fund in which the beneficiaries hold balances, is applied. Dividends are apportioned to each beneficiary as applicable, and a report is sent back to the depositary, with the updated positions.

2.2 Fund Association with ISIN Code

This section contains the following topics:

2.2.1 Associating Fund with ISIN Code

Each fund of the AMC which is traded through a depositary must be associated with an identification called the ISIN Code. The ISIN Code will be the common identifier for the fund both in the external depositary and FC-IS, so that the balances of the depositary unit holder in the fund can be maintained and also apportioned to each beneficiary. The income distribution option for each ISIN-fund association can be maintained, and used during dividend processing and distribution, to achieve apportionment to each beneficiary.

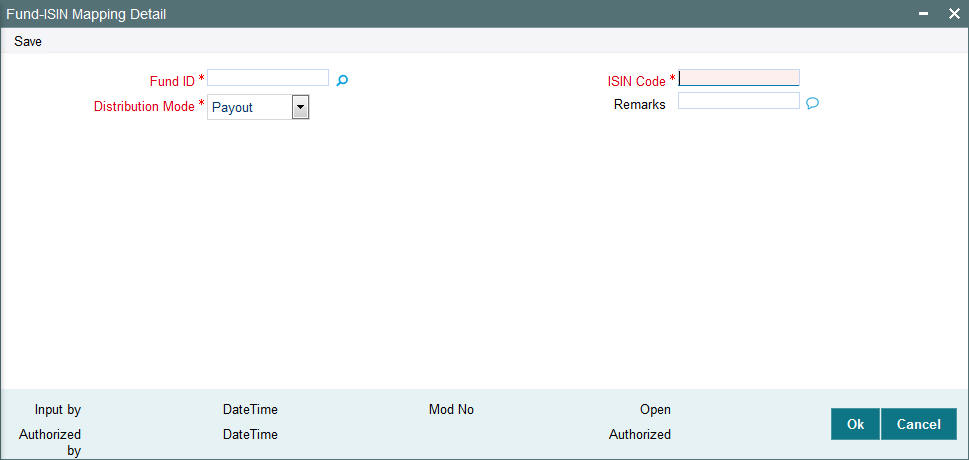

You maintain the association of each fund with the ISIN Code, in the ‘Fund ISIN Mapping Detail’ screen. You can invoke this screen by typing ‘UTDFNDIS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Fund ISIN Mapping.

For each association, you can indicate any of the following income distribution modes:

- Payout

- Reinvestment

For instance, for a fund ISIN association, if the distribution mode maintained is ‘Reinvestment’, then during dividend processing, for the depositary unit holders whose beneficiaries have holdings in the fund mapped to the ISIN code, the dividend will be reinvested.

The income distribution option for a fund-ISIN association must be unique, i.e., each fund-ISIN association can only be associated with one income distribution option.

The Fund-ISIN association is an optional attribute for a fund, and can be maintained for any authorized fund as and when necessary.

You can specify the following fields in Fund-ISIN Mapping Screen

Fund ID

6 Characters Maximum, Alphanumeric; Mandatory

Specify the ID of the fund that you are associating with an ISIN code and distribution mode in this screen.

ISIN

Alphanumeric; Mandatory

Specify the ISIN code to be associated with the fund that you have selected, for the selected distribution mode.

Distribution Mode

Alphanumeric; Mandatory

Select the income distribution mode applicable for the selected fund and ISIN code. For a fund-ISIN association, you can only associate one income distribution mode.

Remarks

255 Characters Maximum, Alphanumeric; Optional

Specify any applicable remarks for the fund-ISIN-distribution mode association.

2.3 Fund ISIN Summary Screen

This section contains the following topics:

- Section 2.3.1, "Invoking the Fund ISIN Summary Screen"

- Section 2.3.2, "Retrieving Record in Fund ISIN Summary screen"

- Section 2.3.3, "Editing Fund ISIN Mapping"

- Section 2.3.4, "Viewing Fund ISIN Mapping "

- Section 2.3.5, "Deleting Fund ISIN Mapping "

- Section 2.3.6, "Authorizing Fund ISIN Mapping "

- Section 2.3.7, "Amending Fund ISIN Mapping "

- Section 2.3.8, "Authorizing Amended Fund ISIN Mapping "

- Section 2.3.9, "Maintaining Interfaces for Uploading Beneficiary Positions"

2.3.1 Invoking the Fund ISIN Summary Screen

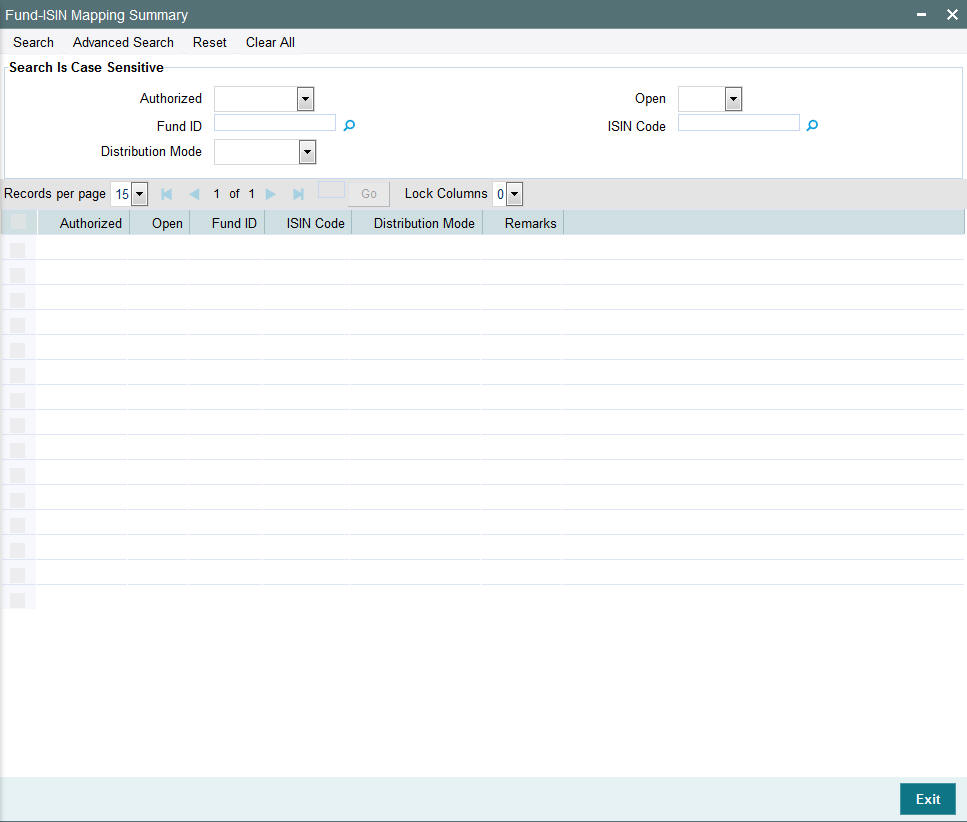

To perform any operation on Fund-ISIN association, you must first retrieve the record from the database in the Summary screen.

Invoke the ‘Fund ISIN Mapping Summary’ screen by typing ‘UTSFNDIS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The following screen is displayed:

2.3.2 Retrieving Record in Fund ISIN Summary screen

You can retrieve a previously entered record in the Summary Screen, as follows:

In the Browser, select Fund ISIN menu and click on Summary, specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Record Status field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Fund ID

- ISIN

- Distribution Mode

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the ISIN

- Press F8

You can perform Edit, Delete, Amend, Authorize, operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example:

You can search the record for ISIN by using the combination of % and alphanumeric value as follows:-

- Search by A%:- System will fetch all the records whose ISIN starts from Alphabet ‘A’. For example: AFUND1, AFUND2, AFUND10 etc.

- Search by %7 - System will fetch all the records whose ISIN ends by numeric value’ 7’ .For example: AFUND7, AFUND17 etc.

- Search by %17%:- System will fetch all the records whose ISIN contains the numeric value 17. For example: AFUND17, DUMMY17. etc.

2.3.3 Editing Fund ISIN Mapping

You can modify the details of Fund ISIN Mapping that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Fund ISIN Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund ISIN Mapping Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Fund ISIN Mapping Detail screen is closed and the changes made are reflected in the Fund ISIN Summary screen.

2.3.4 Viewing Fund ISIN Mapping

To view a record that you have previously input, you must retrieve the same in the Fund ISIN Mapping Summary screen as follows:

- Invoke the Fund ISIN Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund ISIN Mapping Detail screen is displayed in View mode.

2.3.5 Deleting Fund ISIN Mapping

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Fund ISIN Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. . The Fund ISIN Mapping Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.3.6 Authorizing Fund ISIN Mapping

An unauthorized Fund ISIN Mapping must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Fund ISIN Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund ISIN Mapping Detail screen is displayed. Select Authorize operation from the Action List.

2.3.7 Amending Fund ISIN Mapping

After a Fund ISIN Mapping is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Fund ISIN Mapping Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details are displayed in the lower portion of the screen.

- Double click the record that you wish to amend. The Fund ISIN Mapping Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes.

2.3.8 Authorizing Amended Fund ISIN Mapping

An amended Fund ISIN Mapping maintenance must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module. The process of subsequent authorization is the same as that for normal transactions.

2.3.9 Maintaining Interfaces for Uploading Beneficiary Positions

Prior to each dividend declaration, the positions for each beneficiary must be obtained from the depositary and stored in the FC-IS database, so that the dividend declared and processed can be apportioned to each beneficiary based on the beneficiary position.

You must maintain an interface through the Interface Definition facility to upload the beneficiary position before each dividend declaration.

The beneficiary positions are exported from the external depositary as a file known as the BENPOS file.

2.4 Dividend Processing for Beneficiaries

When an authorized dividend is processed in FC-IS, the first step is the identification of holdings eligible for dividend, also called the freeze holdings process. This process is first executed for non-depository unit holder accounts. After this, the freeze holdings process is executed for the beneficiaries in each depositary unit holder account, for each fund in which the beneficiaries are eligible for dividend. The positions information contained in the BENPOS file is used for identifying the freeze held units for the beneficiaries.

After the freeze holding units are identified, the dividend is computed and the positions updated accordingly. The income distribution option specified for the fund-ISIN association, for each fund in which the beneficiaries receive dividends, is used to determine whether the dividend is to be paid out or reinvested.

2.5 Requests for De-materialization Processing

FC-IS also processes requests by unit holders for de-materialization of shares i.e., conversion from physical to electronic form, which can be kept in a depositary. A unit holder could therefore be a beneficiary in the depositary.

FC-IS maintains the balances of unit holders in any fund of the AMC. FC-IS also maintains the balances of depositary unit holders. Therefore, when a unit holder who has purchased the shares from the AMC requests for de-materialization, you can enter a transfer transaction for the unit holder, through which the physical holdings (i.e., the shares that need to be converted) can be transferred to the depositary unit holder balance in electronic form. The beneficiary balance of the unit holder, in the depositary unit holder account, will be updated with the transferred shares.

Example

Mr. X, a unit holder of your AMC, holds 100 shares that he has purchased from your AMC, by subscribing to the Carey Bugle Growth Fund. He wishes to convert these shares to electronic form.

Mr. X is also a beneficiary in the NGDL Depositary, which has a depository unit holder account in your AMC.

To process the de-materialization request, you enter a transfer transaction with Mr. X as the transferor, in Units mode, and specify the certificate details of the 100 shares that must be de-materialized. The transferee for this transaction would be the depositary unit holder account held by NGDL, in which Mr. X is a beneficiary. The beneficiary position of Mr. X in the Carey Bugle Fund will be updated with the units transferred due to the de-materialization of the 100 shares.

2.6 Requests for Re-materialization Processing

FCIS provides the facility of processing requests from unit holders for conversion of units in electronic form (which could be with a depositary), to physical shares. This is called re-materialization.