2. Dividend Maintenance

A fund or an AMC normally shares a portion of its profits with the unit holders by declaring a dividend. By way of receiving a dividend, the unit holders receive their share of the profits, as monetary returns or as increased stock in the funds of the AMC.

Typically, an AMC declares dividends at a regular frequency, depending upon the type of fund and its performance. For money market funds, for instance, there may be daily declaration of dividends. For equity funds, dividends may be declared once a year or every quarter.

Unit holders can receive dividends as payment or choose to reinvest the dividend in the same fund or different funds.

A few important terms must be understood clearly about dividends:

Record Date (Freeze Holdings Date)

When a dividend is declared, a record date is also announced. Any unit holders that hold shares of the company as on this announced record date are eligible to receive dividend.

The holdings balance of the unit holder that is considered for eligibility for dividend on the record date could be the entire holdings including provisional units and blocked units, or it could be only the confirmed balance as on the record date, depending upon the specification made for the fund. The non permissible income (NPI) portion of the earnings is identified if NPI is applicable for the fund.

Book Closing Dates

When a dividend is declared, the company also identifies a period during which no transactions will be accepted and the financial books will be closed. During this period, an inventory of the holdings of the unit holders is taken, and those that are eligible to receive dividend based on their holdings on the record date are identified.

Directors Meeting

In an AMC, the decision to declare dividends is made at a meeting of the board of directors of the AMC. The dividend is also ratified at this meeting.

Cash Dividend

In some funds, unit holders receive their dividends as monetary returns, which can then be reinvested (if desired) in any of the funds of the AMC.

Stock Dividend

In some funds, unit holders receive dividend in the form of a proportionate number of units (holdings), rather than monetary returns. Such dividend always results in an increase in the holdings balance of the investor, and is called a stock dividend. It is exempted from tax. The dividend units are always reinvested into the same fund, for the same unit holder.

The dividend is usually declared as a ratio. For instance, if the declared stock dividend is 2:3, then, for every two units eligible for dividend on the freeze holdings date (from a fund), the unit holder receives 3 units as dividend, which will be reinvested (as subscription transactions in units mode) into the same fund for the unit holder.

Regular Dividend

Dividends are declared by the company / AMC at a frequency that is decided by the directors. Such dividends are called regular dividends.

The board of directors may decide to skip a regular dividend, if deemed necessary, when they feel that the profits gained do not justify a dividend declaration.

Interim Dividend

An AMC / company may decide to declare an ad-hoc dividend independent of the regular frequency, for the purpose of distributing the profits gained during a period in which the fund has done exceptionally well. This is called an interim dividend.

Dividend Declaration Frequency and Dividend Payment Frequency

This is the frequency at which the board of directors decides to declare dividend for a fund. The board may not actually decide to process and pay out dividends when they are declared, but may decide on a different frequency for payment. The frequency at which the board of directors decides to process and pay out dividends that have been declared is known as the Dividend Payment Frequency.

Example

Let us suppose that for the Malcolm Green Income Fund, the board of directors for the fund decides to declare dividend every quarter, and the first declaration is made on 24th January 2002. The board of directors also decides to process and pay out dividend to its shareholders twice each year.

The declaration and payment would occur in the following pattern:

Dividend Declaration Dates |

Dividend Number |

Dividend Payment Dates |

Payment Number |

24th January 2002 |

0 |

|

|

24th April 2002 |

1 |

|

|

24th July 2002 |

2 |

24th July 2002 |

0 |

24th October 2002 |

3 |

|

|

24th January 2003 |

4 |

24th January 2003 |

1 |

This chapter contains the following sections:

- Section 2.1, "Dividend Processing in the System"

- Section 2.2, "Dividend Processing Automation"

- Section 2.3, "Dividend Processing for NPI Funds"

- Section 2.4, "Dividend Processing for Beneficiaries"

- Section 2.5, "Fund Dividend Maintenance"

- Section 2.6, "Fund Dividend Summary Screen"

- Section 2.7, "Dividend Skipping"

- Section 2.8, "Dividend Payments Screen"

- Section 2.9, "Dividend Reinvestments"

- Section 2.10, "Dividends Reversal"

- Section 2.11, "Dividend Reversal / Amendment for Selected Unit Holders"

- Section 2.12, "Mass Reprocessing for Dividends"

- Section 2.13, "Mock Processing for Dividends"

- Section 2.14, "Mock Dividend Summary Screen"

- Section 2.15, "Mock Processing for Accumulation"

- Section 2.16, "Mock Processing for Reversal of Accumulation"

- Section 2.17, "G1-G2 Conversion Details"

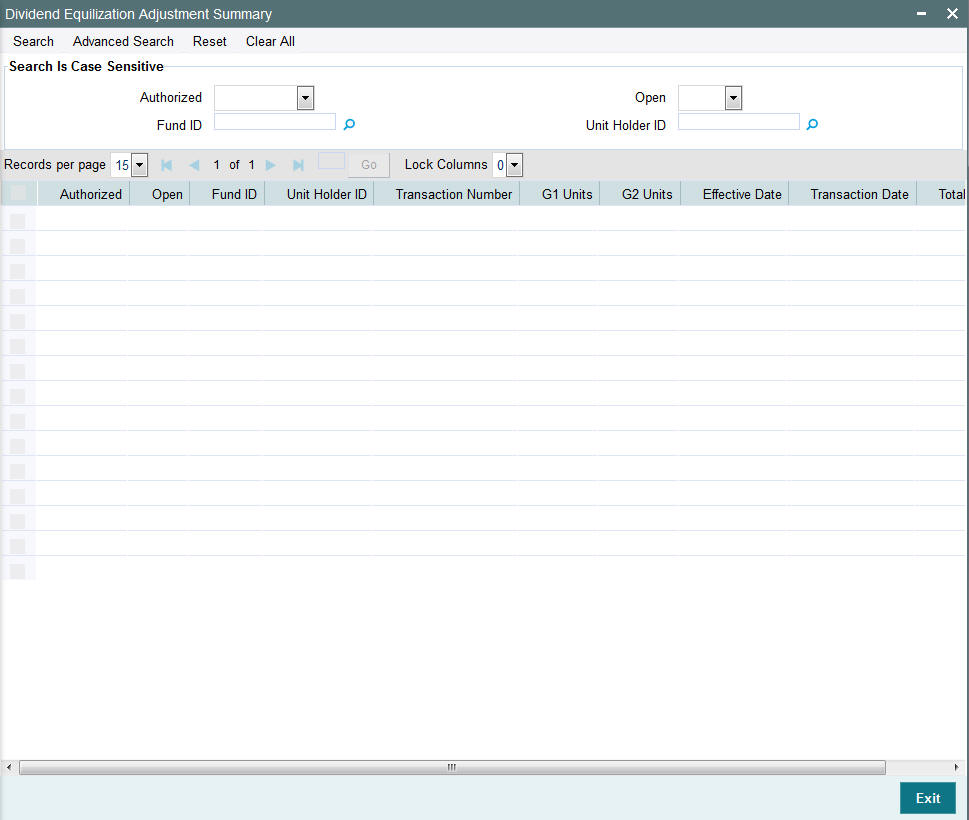

- Section 2.18, "Dividend Equalization Adjustment Summary Screen"

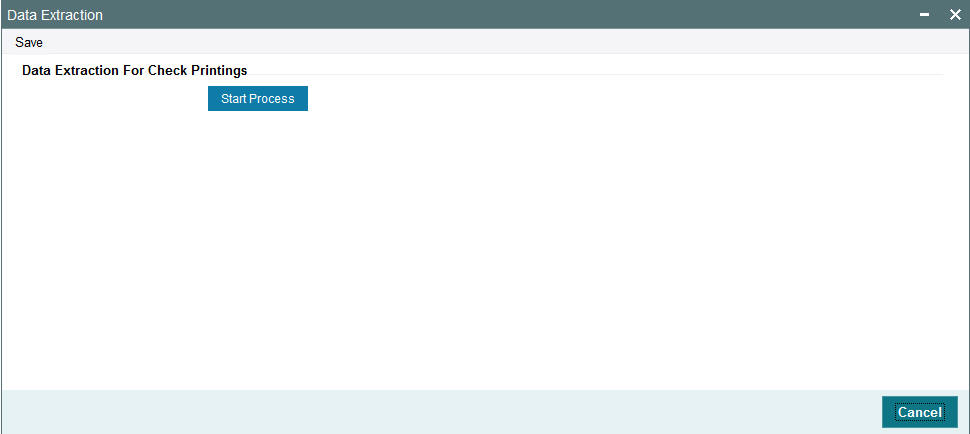

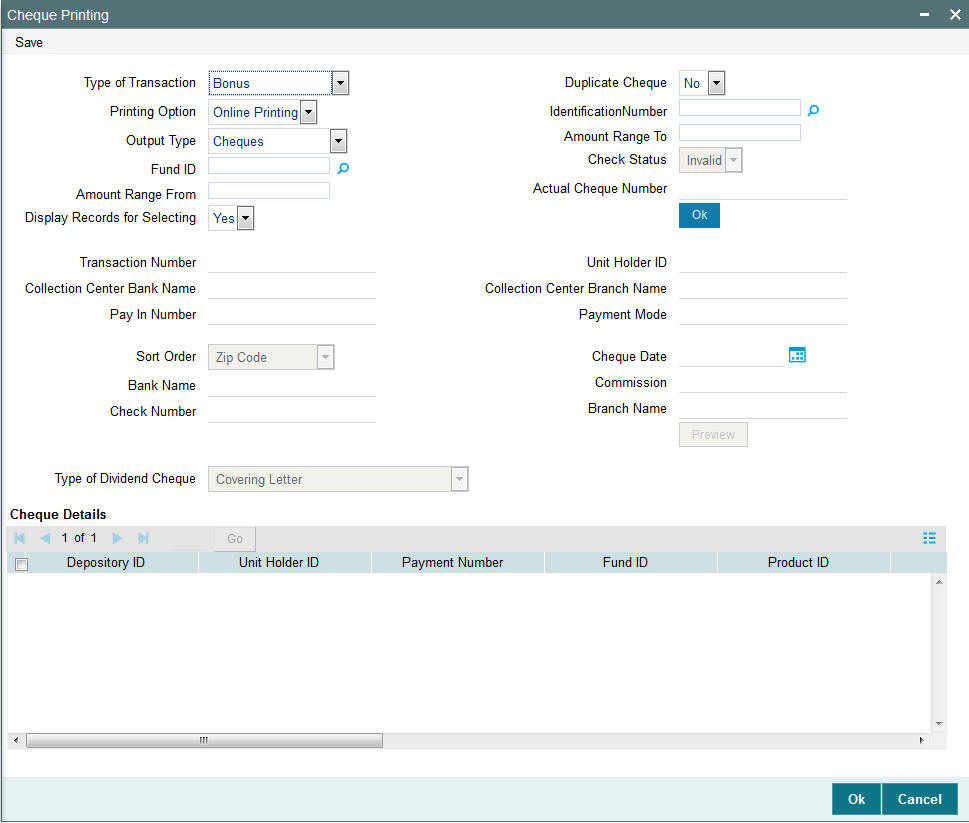

- Section 2.19, "Checks and Pay-in Slips"

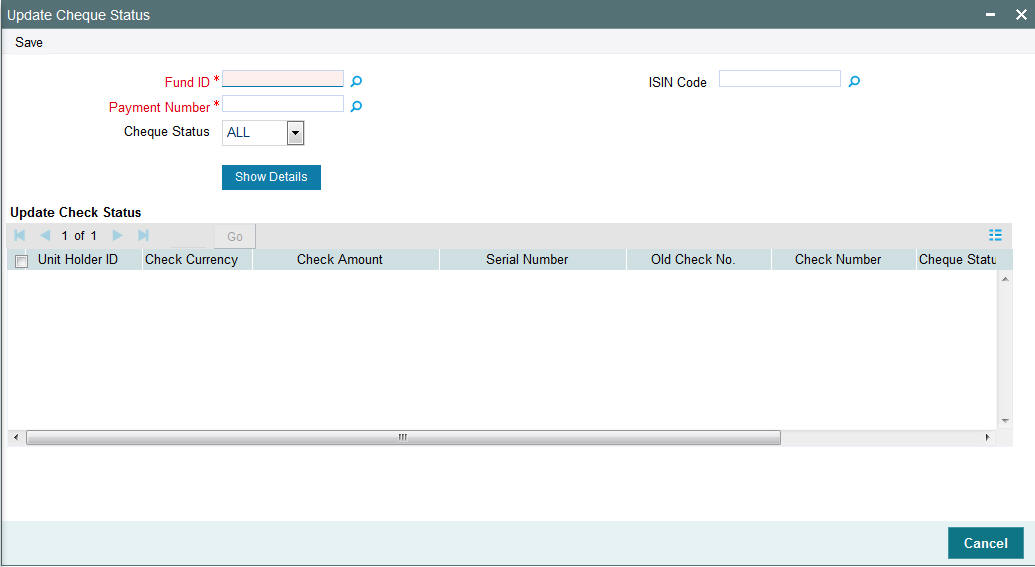

- Section 2.20, "Check Updation"

2.1 Dividend Processing in the System

This section contains the following topics:

- Section 2.1.1, "Maintaining and Processing Dividends"

- Section 2.1.2, "Maintaining Rules for Dividend Processing for Fund"

- Section 2.1.3, "Maintaining Rules for Withholding Tax for Investor Category"

- Section 2.1.4, "Dividend Cycle for Fund"

- Section 2.1.5, "Generation of Dividend Declaration Record"

- Section 2.1.6, "Maintaining Details of Dividend Declaration"

- Section 2.1.7, "Authorizing Dividend Declaration in System"

- Section 2.1.8, "Processing Declared Dividend"

2.1.1 Maintaining and Processing Dividends

Oracle FLEXCUBE Investor Servicing enables the maintenance of dividend for funds, as well as the computation and payment of the same.

The sequence of events that enable the maintenance of dividend is explained below, under the following sequential heads:

- Maintaining the rules for dividend processing for a fund

- Maintaining the rules for withholding tax for an investor category

- Dividend Cycle for a fund

- Generation of the dividend declaration record

- Maintaining details of dividend declaration

- Authorizing the dividend declaration in the system

- Processing the declared dividend

2.1.2 Maintaining Rules for Dividend Processing for Fund

In the Corporate Actions screen, you can define the rules for each type of dividend that must be processed for a fund – cash or stock. If both types need to be processed for a fund, you can maintain two corporate actions profiles for each type.

To understand how you can maintain rules for dividend processing through the Corporate Actions screen, refer the chapter ‘Setting up Funds’ in Volume One of the Fund Setup User Manual.

2.1.3 Maintaining Rules for Withholding Tax for Investor Category

You can maintain the withholding tax parameters applicable for an investor category and country of domicile, in the Withholding Tax Setup screen.

To understand how you can maintain rules for withholding tax processing through the Withholding Tax Setup screen, refer the chapter ‘Maintaining Reference Information’ in the Reference Information User Manual.

2.1.4 Dividend Cycle for Fund

The system reckons the dividend processing cycle for the fund (and dividend type) from the dividend declaration frequency and the dividend payment frequency specified in the Corporate Actions profile.

The system automatically updates the next date upon which a regular dividend is due for a fund. This is based on either of the following bases:

- If the date of the first dividend declared for the fund (First Dividend Declare Date) is specified in the Corporate Actions profile for the dividend type. The system uses the First Dividend Declare Date and the declaration frequency specified for the fund, to update the next dividend declaration date.

- If the First Dividend Declare Date is not specified, the system updates the next dividend declare date based on the Fiscal Year for the fund and the declaration frequency.

2.1.5 Generation of Dividend Declaration Record

The system automatically generates a dividend record for declaration during the Beginning of Day process on the next dividend date, using the dividend cycle for the fund and dividend type. If the fund is a multi distribution fund, then the system generates a dividend record for each distribution type.k

When the dividend record is generated, the system also defaults the following dividend information using the specifications in the Corporate Actions profile for the fund and dividend type:

- The dividend period (the dividend from and to dates). The holiday rule specified for the fund and dividend type in the Corporate Actions profile is used in case of intervening holidays.

- The dividend declare date (this is reckoned to be the dividend to date)

- The freeze holdings date. It is arrived at based on the dividend declare date and the Lead Time for Freeze Holdings (specified in the Corporate Actions profile), as follows:

Freeze Holdings Date = Dividend Declare Date – Freeze Holdings Lead Time

2.1.6 Maintaining Details of Dividend Declaration

On the next date on which the dividend declaration is due, you must specify the following details for the declaration in the Fund Dividend Maintenance screen:

- For cash dividends, the EPU component values, if applicable

- For cash dividends, the NPI value, if the EPU is non components based

- For stock dividends, the stock dividend ratio

- The book closing dates for the dividend

- The board of directors’ meeting date

As explained in the previous section, the system defaults the dividend period, the dividend declare date and the freeze holdings date when it generates the dividend record. This defaulted information is displayed in the Fund Dividend Maintenance screen, but it can be overridden.

For Zero Distribution of funds, you can select the process type as Zero Distribution if the fund is processed for G2-G1 movement. This option is applicable for equalization funds only.

You can access the Fund Dividend by clicking on Detail under the Fund Dividend menu in the Browser.

2.1.7 Authorizing Dividend Declaration in System

After a dividend declaration record has been maintained for the fund in the Fund Dividend Maintenance screen, it must be authorized by another user for it to be effective in the system.

After authorization, the dividend is ready to be processed.

To authorize a declared dividend, use the Fund Dividend Maintenance Summary screen. You can access this screen by clicking Summary under the Fund Dividend menu in the Browser.

2.1.8 Processing Declared Dividend

After the declared dividend is authorized, you can begin the processing for the dividend.

The computation and payment of dividend involves the following processes in the system:

- Identifying the holdings for each unit holder as on the record date, upon which the unit holder is eligible to receive dividend. This process is called the Freeze Holding Process.

- Computing the dividend payable, based on the identified holdings for each unit holder. Withholding tax, wherever applicable, is also computed and deducted. The whole process is first done for non-depositary unit holders (i.e., those unit holders for whom the dealing type is not ‘depositary’. After this, the process is repeated for all depositary unit holders, based on the positions uploaded into the system in the BENPOS file. For details about depositaries, refer the chapter ‘Interfaces with Depositary Systems’ in the Agency Branch user manual.

- Payment of dividend, and the initiation of resulting reinvestment transactions. In the case of depositary unit holders, the income distribution option defined for the fund-ISIN association will be considered. For details, refer the chapter ‘Interfaces with Depositary Systems’ in the Agency Branch user manual.

- You can initiate the dividend processing from the Process Dividend Payment screen. You can access this screen from the Batch menu category of the Browser.

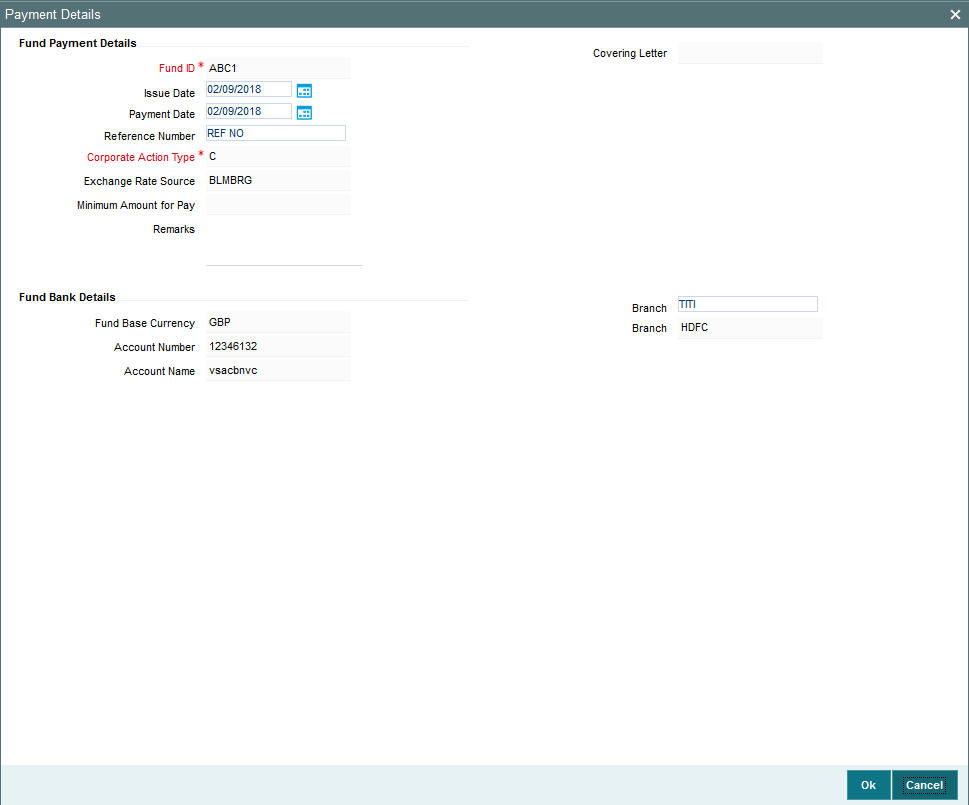

You can the reference number for the dividend payment in the Fund Dividend Payment screen, which you can access from the Process Dividend Payment screen by clicking the ‘Payment Details’ button.

The Dividend Payment Date

In the Fund Dividend Payment screen, the system defaults the payment date as follows:

Dividend Payment Date = Last dividend processed date + Dividend payment frequency + Payment lag, if any.

Here, the holiday rule specified for the fund and dividend type in the Corporate Actions profile is used to arrive at the payment date.

Freeze Holdings Process

The freeze holdings process identifies the unit holders that hold units that are eligible for dividend, as on the freeze holdings date.

The manner in which the system identifies the effective freeze holdings date has been explained under the section ‘Generation of dividend declaration record’, earlier on in this chapter.

In case of Uncleared or Blocked transactions, the Uncleared and blocked transactions are tracked separately during dividend processing. The total cleared balance will be the difference between the sum of all blocked units for all block transactions and the total unit balance (excluding provisional units for uncleared transactions).

During the freeze holding process, the identification of holdings for dividend eligibility is done based on the following criteria:

- Whether the installation is a distributor or an AMC installation

- The specification made for the fund and dividend type in the Corporate

Actions profile. Depending upon this specification, either all units

or only confirmed units are considered as eligible for dividend, as follows:

Installation Type

Units to be considered for freeze holdings *

Units considered for dividend eligibility

Distributor

All units

All units (Unit balance = Provisional units + blocked units) as on the effective freeze holdings date

AMC

All units

All units (Unit balance + provisional units + blocked units) as on the effective freeze holdings date

Distributor

Confirmed units

Units confirmed to the AMC as on the effective freeze holdings date

AMC

Confirmed units

All units except provisional units available as on the effective freeze holdings date. (Unit balance + blocked units as on the effective freeze holdings date)

Distributor

Units as of price date

All units (settled + provisional) with price date earlier than or on the freeze holdings date

AMC

Units as of price date

All units (settled + provisional) with price date earlier than or on the freeze holdings date

Distributor

Units as of transaction date

All units (settled + provisional) with transaction date earlier than or on the freeze holdings date

AMC

Units as of transaction date

All units (settled + provisional) with transaction date earlier than or on the freeze holdings date

“*” – as specified in the Corporate Actions profile for the fund and corporate action type.

In a distributor installation, if the units to be considered for dividend are specified as “Confirmed Units” in the Corporate Actions profile, only the units confirmed to the AMC as on the effective freeze holdings date are considered eligible.

This can be understood from the following example:

Let us consider a distributor, Carling Finance. For the fund Banco Italia Income Fund marketed by Carling Finance, only units of unit holders that have been confirmed to the AMC for which Carling Finance is a distributor, as on the freeze holdings date, are to be considered for dividend eligibility.

The confirmation lag that has been specified for the fund is 1 for subscription transactions, and 2 for redemption transactions.

A unit holder, Mr Alfred Werker, has entered into the following transactions in the Banco Italia Income Fund:

Transaction Reference Number |

Transaction Date |

Transaction Type |

Units Allocated and Confirmed |

Confirmation Date |

S1 |

2/1/2001 |

Subscription |

1000 |

3/1/2001 |

S2 |

3/1/2001 |

Subscription |

2000 |

4/1/2001 |

R1 |

4/1/2001 |

Redemption |

1000 |

6/1/2001 |

Therefore, the confirmed units balance for Mr Werker would be as follows:

Unit balance on 2/1/2001 = 0 (assuming there is no brought forward balance from the previous working day)

Unit balance on 3/1/2001 = 1000 units

Unit balance on 4/1/2001 = 1000 + 2000 = 3000 units

Unit balance on 6/1/2001 = 3000 – 1000 = 2000 units

The effective freeze holdings date specified for the Banco Italia is 5th January 2001. The total unit balance on the freeze holdings date = 2000 units. Since only confirmed units are considered for dividend eligibility, the total confirmed units balance on freeze holdings date = 3000 units, since the redemption units have not been confirmed as on 5th January.

Therefore, the total number of confirmed units eligible for dividend as on the freeze holdings date = 3000 units.

Computation of dividend and withholding tax

After the units eligible for dividend have been identified, the system computes the dividend payable. During this process, any applicable withholding tax is also calculated and deducted.

Withholding tax is computed only for cash dividends, according to the rules set up for the investor category and country of domicile, in the Withholding Tax Setup record.

For a fuller understanding of the rules maintained for withholding tax, refer the chapter

Withholding tax is computed in the computation currency specified in the Withholding Tax record. The prevailing exchange rate is used to convert the amount into the tax payment currency, also specified in the Withholding Tax record.

The net dividend amount after deduction of withholding tax is then arrived at by the system.

Payment of cash dividends

The Income Distribution Setup maintained for each unit holder determines the manner in which cash dividends are paid out to the unit holders.

For cash dividends that are to be paid out, you must enter the details of the accounts to which the dividend payments must be made, in the Fund Dividend Payment screen. You can access this screen from the Process Dividend Payment screen itself, by clicking the ‘Payment Details’ button.

In the Fund Dividend Payment screen, the system defaults the payment date as explained earlier.

If there is a lag specified for payment, then it will be deferred accordingly. The lag is interpreted as working days. For instance, if the Dividend Payment Date is 15th January 2002, and the payment is to be lagged by 2 days, then the payment will be made on 17th January, provided the intervening dates are not holidays in the system.

Reinvestment of cash dividends

For cash dividends that are to be reinvested according to the Income Distribution Setup option for the unit holders, subscription transactions by gross amount (the reinvestment amount) are initiated. The transaction date or Value Date for the reinvestment transactions is set by default to be the application date. If there is no lag specified for reinvestments in the Corporate Profile, the date of dividend payment itself will be the Value Date.

You can initiate the reinvestment transactions through the Process Reinvestments screen. You can access this screen from the Batch menu category in the Browser menu.

If a reinvestment lag has been specified for the fund and dividend type in the Corporate Actions profile, the initiation of the reinvestment transactions is deferred accordingly.

The End of Day processes will allocate the reinvestment transactions on the date of entry, using the prevalent price for subscriptions.

Reinvestment of stock dividends

In the case of stock dividends, the unit holder’s Income Distribution Setup options are not considered. The number of units to be reinvested is arrived at using the units eligible for dividend and the stock ratio. This computed number of units is reinvested into the same fund, as subscription transactions in units mode, with the value date being the application date. This will be the same as the dividend payment date, provided there is no reinvestment lag specified for stock dividends in the Corporate Profile.

You can initiate the reinvestment transactions through the Process Reinvestments screen. You can access this screen from the Batch menu category in the Browser menu.

If a reinvestment lag has been specified for the fund and dividend type in the Corporate Actions profile, the initiation of the reinvestment transactions is deferred accordingly.

The reinvestment transactions, in the case of stock dividend, are allocated online, with the price being taken as zero.

2.2 Dividend Processing Automation

If your installation requires it, the whole process of dividend declaration, computation and payment can be automated in the system. In such a case, all data required for the declaration and processing of dividend is defaulted by the system based on the specifications made for the fund and dividend type in the Corporate Actions profile.

The process of defaulting is as explained above, without any user intervention. In such a case, for cash dividends, an interface with an external system must be maintained for the purpose of uploading the EPU component values.

The automation feature is not available unless your installation has requested for it.

2.3 Dividend Processing for NPI Funds

As per Shariah laws, the non permissible portion of the dividend earnings (NPI) can not be reinvested. Even if the customer has opted for reinvestment, the NPI portion will either be paid out to the customer or to a fund trust, whichever is applicable, and only the remaining portion will be reinvested.

If NPI is applicable for a fund, during the Freeze Holding Process, system identifies the cleared and un-cleared balances separately. The un-cleared portion of the dividend will be reinvested.

Tax will be computed on the total balance, if any. If the dividend is not based on components, then apportioned tax for the NPI portion is arrived at as follows:

Tax on NPI = (Total Tax/ Total EPU)* NPI EPU

This amount is deducted from the total NPI amount to arrive at the net NPI amount that is to be paid out to the investor.

While processing reinvestment transactions, system generates separate subscription transactions for cleared and un-cleared portions, if the preference for un-cleared balance is ‘Force Re-investment’. However, if the IDS option is to be considered, then system will not generate separate reinvestment transactions.

After computation of the NPI portion and the un-cleared portion, the Income Distribution options (IDS) specified for the unit holder will be applicable for the remaining dividend amount.

2.4 Dividend Processing for Beneficiaries

Dividends that a unit holder is entitled to, can be distributed among the beneficiaries maintained for the unit holder provided the beneficiaries are existing unit holders and not third party beneficiaries. To facilitate this, you are required to check the ‘Dividend Payout’ option in the ‘Unit Holder Maintenance Detail’ screen and subsequently maintain at least one existing unit holder as a beneficiary along with the percentage of dividend to be awarded.

The following are the salient points for the processing:

- The percentage for the beneficiaries can be modified; the system will pick up the latest rule and pay out the dividend accordingly.

- In case of multiple beneficiaries, if the sum of the percentages awarded to the beneficiaries is not equal to 100%, the system will credit the residual dividend to the primary unit holder.

- The dividend will be net of tax maintained for the beneficiary country and will be paid out in the unit holder preference currency and used for check and transfer payment mode.

- A check for minimum threshold limit for the dividend payment will be done at the primary unit holder level

- The dividend amount available to be distributed to the beneficiaries will depend on the IDS setup for the main unit holder. For instance, if the IDS for the main unit holder has 60% as dividend and 40% as re-investment, only the part pertaining to dividend (60%) will be distributed among the beneficiaries; the rest (40%) will be re-invested in the funds for the main unit holder.

Note

You can also perform Mock Dividend processing, Interim Dividend processing, Dividend Re-processing, Dividend Amendment and Reversal on the dividend paid out.

2.5 Fund Dividend Maintenance

This section contains the following topics:

- Section 2.5.1, "Invoking the Fund Dividend Maintenance Screen"

- Section 2.5.2, "EPU/Lot Component Values"

- Section 2.5.3, "Maintaining Regular Dividends"

- Section 2.5.4, "Maintaining Interim Dividends"

- Section 2.5.5, "Maintaining Cash Dividend for Fund"

- Section 2.5.6, "Maintaining Stock Dividend for Fund"

2.5.1 Invoking the Fund Dividend Maintenance Screen

You can use this screen to maintain the dividend declaration details for a fund, for either a cash dividend or a stock dividend. This maintenance also supports the following:

- Zero distribution of all funds. In Zero Distribution, the Earning per Unit (EPU) will be zero, hence if G2 units are converted into G1 units, the unit holder is not financially benefited. This is applicable for equalization funds only.

- Multiple distribution of a fund on the same day. In this case the system allows to maintain the distribution type.

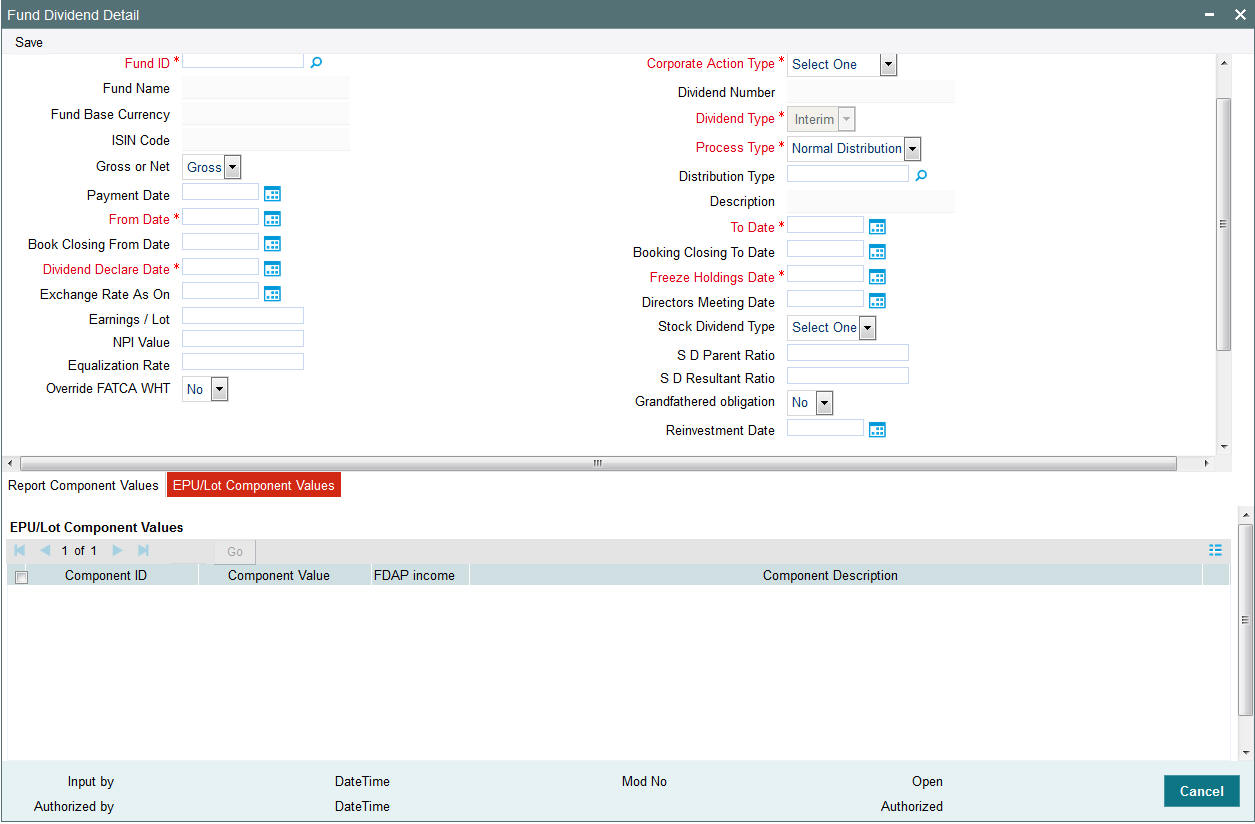

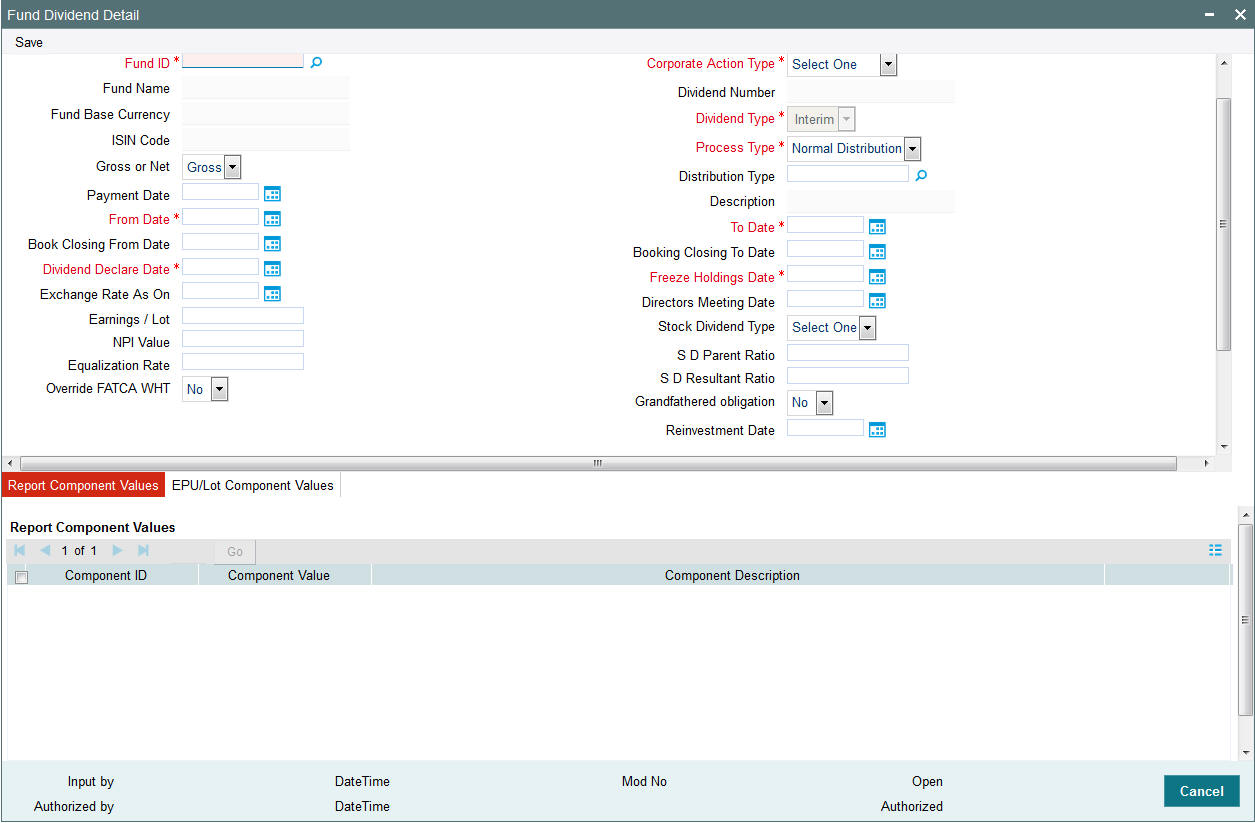

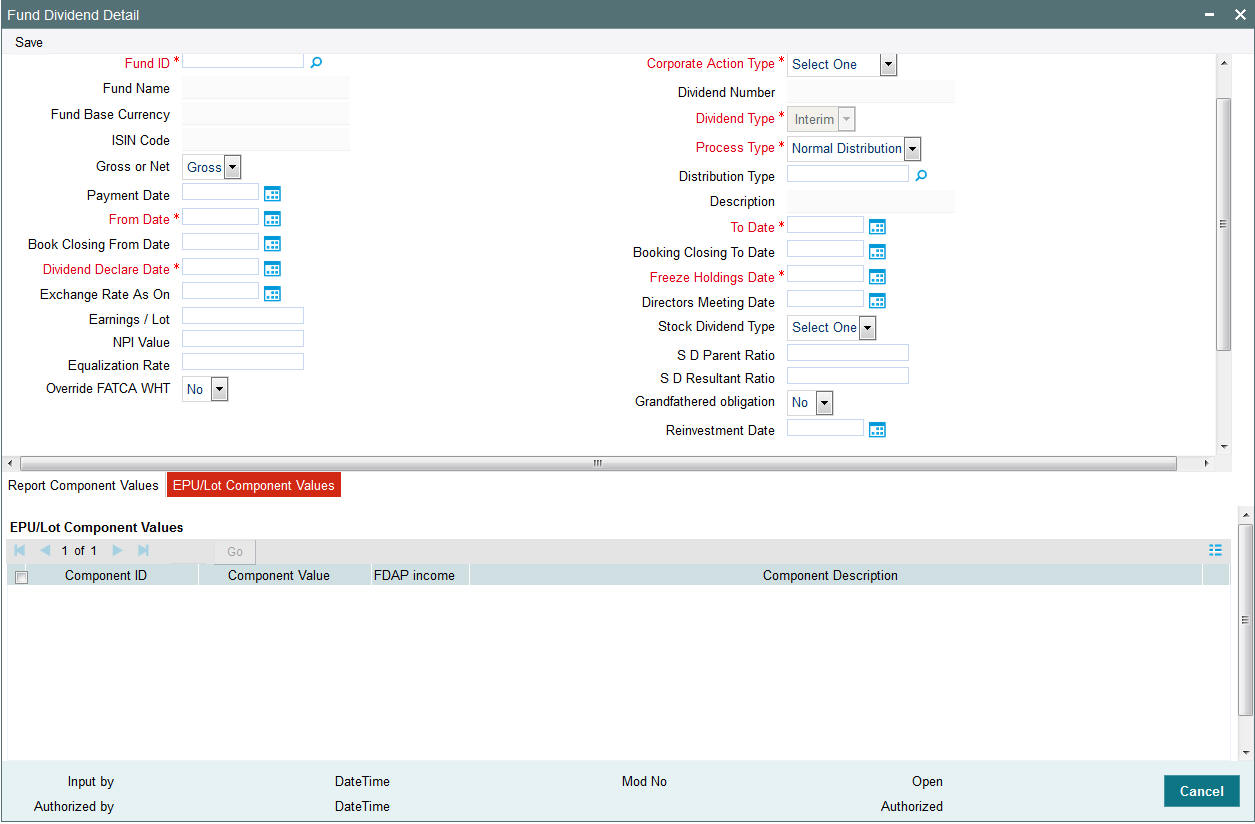

Invoke the ‘Fund Dividend Detail’ screen by typing ‘UTDFUDIV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The Fund Dividend Detail screen is displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the fund dividend.

Fund ID

6 Character Maximum, Alphanumeric, Mandatory

Select the Fund ID, for which the dividend is being set up, from the list provided. The list will display all the funds that have been authorized, along with their latest rule enabled. When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

ISIN Code

12 Characters Maximum; Alphanumeric; Mandatory

Select the ISIN Code of the selected fund. If you specify the ISIN Code of a fund, the ID of the fund is displayed in the Fund field.

Fund Base Currency

Display Only

After you select the Fund ID, the base currency for the selected fund is displayed in this field.

Dividend Status

Display Only

The system displays the status of the dividend, based on the status of the fund. The dividend could be a new one, or the fund could be in its book-closing period, or after the directors meeting. This information is displayed here by the system.

Dividend Number

Numeric, Display

The serial number of the dividend being declared, generated by the system, is displayed. In generating this number, the dividend number of the last, most recent declaration is incremented by 1.

Dividend Type

Display Only

If the dividend being entered is part of the dividend cycle for the selected fund, it is a regular dividend. If it is an ad-hoc declaration, it is an interim dividend.

Process Type

1 Character Maximum, Alphanumeric, Mandatory

The specification in this field indicates whether the dividend being entered has been processed.

By default, the Non Zero Distribution option is selected here, if you are entering a new dividend. If the dividend is to be skipped, select Skip. If Zero Distribution is selected, then the system processes the record with the Earnings per Unit (EPU) as ‘Zero’. Also, the income equalization field will be systemically set to zero. Dividend reversals are also enabled for the zero distribution process. This amendment process supports the following:

- Reversals to the original bucket

- Reprocessing of zero distribution process to non zero distribution process and non zero distribution process to zero distribution process.

Distribution Type

Alphanumeric, Mandatory (if corporate action type is Cash)

The system displays the following options based on the values maintained in the Corporate Action tab of the Fund Rule Maintenance screen:

- Dividend

- Interest

- Property Income Distribution

The system validates whether the distribution type is of Corporate Action type ‘Cash’. The list of values are populated based on the fund maintenance, that is, if the fund has only dividend distribution type or two to three distribution types maintained, then the values are populated accordingly.

Gross/Net Indicator

Display

The system displays the Gross or Net indicator based on the value maintained in the Corporate Action tab of the Fund Rule Maintenance screen.

Dividend From Date

Date Format, Mandatory / Display

The Dividend From Date is the start date of the period for which dividend is being declared. The system defaults this date based on the following criteria:

- For regular dividends, the Dividend Declare Frequency and either the fiscal year for the fund or the First Dividend Declare Date, depending upon the specification made in the Corporate Actions profile for the fund and corporate action type. You can override this defaulted date, if necessary.

- For interim dividends, based on the last dividend payment for the fund. You cannot override this defaulted date.

If overridden, the Dividend From Date should be equal to or later than the Dividend Start Period and equal to or earlier than the Dividend End Period.

Dividend To Date

Date Format, Mandatory

The Dividend To Date is the end date of the period for which dividend is being declared.

- For regular dividends, the system defaults this date to be the next date on which dividend processing is due for the fund, based on the dividend declaration frequency and either the fiscal year for the fund or the First Dividend Declare Date, as specified in the Corporate Actions profile for the fund and corporate action type. You can override the defaulted date, if necessary.

- For interim dividends, this field is enabled for you to enter the To Date for the dividend.

The Dividend To Date should be later than the Dividend Start Period and earlier than the Dividend End Period. It should also be later than the Dividend From Date.

Book Closing From Date

Date Format, Mandatory ONLY if Book Closing To Date is specified.

The Book Closing From Date is the start date of the period during which the books of the fund are closed. Any transactions accepted during this period will be allotted only after the book-closing period is over.

If specified, the Book Closing From Date should be the same as or later than the Dividend To Date. It should also be the same as or later than the System Application Date.

Book Closing To Date

Date Format, Mandatory ONLY if Book Closing From Date is specified.

The Book Closing To Date is the end date of the period during which the books of the fund are closed. If specified, it must be the same as or later than the Dividend To Date, and the Book Closing From Date.

Freeze Holdings Date

Date Format, Mandatory

The system defaults the freeze holdings date, from the specifications made in the Corporate Actions profile for the fund and corporate action type, as follows:

Freeze Holdings Date = Dividend Declare Date – Freeze Holdings Lead Time.

The Dividend Declare Date is also defaulted in this screen, to be the same as the Dividend To Date.

You can override this default date if necessary. When you override the default date, you can specify a past date if necessary. (i.e., earlier than the application date),

Directors Meeting Date

Date Format, Optional

The Directors’ Meeting Date is the day after the Book Closing To Date. It is during the directors’ meeting that the dividend is declared. This date must be earlier than the next date on which a regular dividend is due for processing, for the fund and corporate action type.

The system displays the application date in this field, by default. You can override it, if necessary.

Dividend Declare Date

Date Format, Mandatory

Specify the date on which the dividend is to be declared.

The system defaults this date to be the same as the Dividend To Date. You can override it if necessary.

The Dividend Declare Date should be later than the Directors Meeting Date.

Payment Date

Date Format

The system defaults the payment date in this field based on the first or previous payment date, last day of the month, and frequency values.

Reinvestment Date

Date Format

The system defaults the reinvestment date based on the Reinvestment Lag and Payment Date values.

Exchange Rate as on

Mandatory if Dividend Declare Date is specified.

This field is applicable only if the Exchange Rate Basis specified for the fund is Reference Date. In such a case, the exchange rate to be considered is the rate on the reference date specified here.

Corporate Action Type

Alphanumeric, Mandatory

Select the type of corporate action for which the dividend is being declared – cash dividend or stock dividend.

Earnings Per Unit/LOT

Numeric, Mandatory if Dividend Declare Date and Exchange Rate As On are specified, and only for cash dividends.

Specify the Earnings per Unit per Lot, announced during dividend declaration, in the case of cash dividends.

You must specify this value only if the Earnings per Unit are not to be defined in terms of components, but as a single value. If the EPU is to be defined in terms of components, as specified in the Corporate Actions record for this fund and the System Parameters at the Agency Branch, this field is locked for data entry, and you must specify the EPU in terms of its components. To do so, click the EPU/LOT Component Values link to invoke the Fund Dividend Component screen, where you can specify the values for each component.

S D Parent Ratio

Numeric, Mandatory for stock dividends

For stock dividends, specify the stock dividend ratio that is to be applicable for the dividend declaration.

This field is the parent, which represents the units eligible for dividend in the ratio.

S D Resultant Ratio

Numeric, Mandatory for stock dividends

This field is the resultant, which represents the number of units that is gained by the unit holder as dividend for the specified number of parent units eligible for dividend.

For instance, if you specify 2 in the S D Parent Ratio field and 1 in the S D Resultant Ratio, then, for every two units eligible for dividend, the unit holder receives one unit as dividend.

Equalization Rate

Mandatory for Dividend Equalization Funds

Specify the dividend equalization rate to be applied for the units that have not yet received any benefit (income or dividend) so far. You can input a value only if the fund for which you are maintaining dividend is a ‘Dividend Equalization Fund’. In case of other funds, the system will default null here and will not allow any change in the value.

Stock Dividend Type

Select the type of stock dividend from the drop-down list. Following are the options available in the drop-down list:

- Select One

- Positive

- Negative

This field is mandatory if the dividend type is stock dividend.

Whenever a negative stock dividend is declared a redemption transaction should be passed at current NAV/TXNBP 03 based on maintenance. The number of units that has to be redeemed will depend on the negative stock dividend ratio.

Override FATCA WHT

Optional

Select if FATCA WHT for that particular dividend cycle has to be overwritten or not from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

Grandfathered obligation

Optional

Select to mark the dividend as grandfathered obligation from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

If you select Yes, then the WHT will not be applicable.

FDAP Income

Mandatory

Select to indicate dividend being distributed is FDAP income or not from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

2.5.2 EPU/Lot Component Values

You can use this screen to specify the values for each component in the Earnings per Unit/Lot, which are to be applicable for the cash dividend declaration. You can access it by clicking the ‘EPU/Lot Component Values’ tab in the Fund Dividend Detail screen. This link is only available if the EPU is designated as defined in terms of components, in the Corporate Actions profile defined for the fund and the corporate action type.

Component ID

Display Only

Each row in this field displays the ID of an EPU component as defined in the System Parameters set up for the AMC.

Component Value

Numeric, Mandatory

Specify the portion of the EPU that is made up by earnings from each component. The value indicated here must be a per unit figure.

Once you have entered all the EPU component values in this screen, click ‘Ok’ button. The system performs a sum of all the EPU component values that have been entered. . If the sum is a negative value, an error message is displayed, and you must alter the values till a positive sum is obtained. Once this is done, the Fund Dividend Component Screen is closed, and the sum so obtained is populated in the Earnings Per Unit/LOT field.

Note

The Earnings Per Unit should always be greater than zero. Negative EPU components can be specified only if your installation has specifically requested for this feature. An exhaustive note on negative EPU components is found in the Annexure.

FDAP Income

Mandatory

Select to indicate component being distributed is FDAP income or not at component level from the drop-down list. Following are the options available in the drop-down list:

- Yes

- No

Note

The system will perform EPU upload only if there is no unprocessed dividend data or if there is only one unprocessed dividend.

2.5.3 Maintaining Regular Dividends

In the case of dividends that are declared according the dividend cycle and the declaration frequency, the system generates the dividend record for declaration during the Beginning of Day process on the next dividend date.

To maintain the details for this record, you must:

- Retrieve it through the Fund Dividend Maintenance Summary screen

- Perform an Edit operation through the Fund Dividend Maintenance (Detail) screen, and save your changes.

2.5.4 Maintaining Interim Dividends

In the case of dividends that are declared apart from the normal dividend cycle and declaration frequency, you can maintain the details through the Fund Dividend Maintenance (Detail) screen.

2.5.5 Maintaining Cash Dividend for Fund

Invoke the ‘Fund Dividend Detail’ screen by typing ‘UTDFUDIV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To maintain details of declaration for a cash dividend for a fund in this screen,

- Select the ID of the fund in the Fund ID field. If you are entering

a regular dividend, the following information is displayed by default

in the screen:

- The Fund Base Currency

- The Dividend Status (New, if you are entering a new dividend record)

- The Dividend Number

- The Dividend Type (Regular)

- The Dividend From Date

- The following information is also defaulted by the system using the

specifications made in the Corporate Actions profile for the fund:

- The Freeze Holdings Date

- The Dividend To Date

- The Book Closing From and To Dates

- The Dividend Declare Date

For an interim dividend, only the fund base currency, dividend status, dividend number, dividend type (interim) and the Dividend From Date are defaulted.

- Select the Cash Dividend option in the Corporate Action Type field.

- If necessary, override any of the defaulted information and make your won specifications.

- Specify the exchange rate applicable for the dividend.

- If necessary, specify the Directors’ Meeting Date.

- If applicable, specify the applicable Earnings Per Unit/Lot. If components are applicable for the EPU, click the EPU/LOT Component Values link. The Fund Dividend Components screen is opened. Specify the components as is applicable.

- Back in the Fund Dividend Maintenance screen, you can specify any EPU components that would be used for reporting purposes, by clicking on the Report Component Values link. The Reporting Components screen is displayed. The list of EPU reporting components is pre-shipped for your installation according to your requirements, and you can specify the EPU values for each reporting component.

- If the components are not applicable for EPU and the fund is NPI applicable, then specify the NPI portion of the EPU in the NPI value field.

- Specify the Equalization Rate for Dividend if it is applicable for the fund.

- Click ‘Show Details’ button to default the dividend component details.

For Zero Distribution of Funds, you can select ‘Zero Distribution’ in the Process Type field. Once this value is selected, the system processes the record with EPU as Zero.

For multiple distribution of funds appropriate ‘Distribution Type’ (dividend, interest, property income distribution) values as maintained in the Fund Rule Maintenance screen are defaulted in the Distribution Type field of the Fund Dividend Maintenance screen.

To enable reinvestments on a different date or on the same date as the payment date, the payment date and reinvestment date fields are defaulted by the system. The payment date is derived using the First/Previous date, last day of the month value, and the frequency. The reinvestment date is derived on the basis of the reinvestment lag value (Fund Rule Maintenance) and the payment date.

2.5.6 Maintaining Stock Dividend for Fund

Invoke the ‘Fund Dividend Detail’ screen by typing ‘UTDFUDIV’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

To maintain details of declaration for a stock dividend for a fund in this screen,

- Select the ID of the fund in the Fund ID field. You can also specify

the ISIN Code of the fund. If you are entering a regular dividend, the

following information is displayed by default in the screen:

- The Fund Base Currency

- The Dividend Status (New, if you are entering a new dividend record)

- The Dividend Number

- The Dividend Type (Regular)

- The Dividend From Date

- The following information is also defaulted by the system using the

specifications made in the Corporate Actions profile for the fund:

- The Freeze Holdings Date

- The Dividend To Date

- The Book Closing From and To Dates

- The Dividend Declare Date

For an interim dividend, only the fund base currency, dividend status, dividend number, dividend type (interim) and the Dividend From Date are defaulted.

- Select the Stock Dividend option in the Corporate Action Type field.

- If necessary, override any of the defaulted information and make your won specifications.

- Specify the exchange rate applicable for the dividend.

- If necessary, specify the Directors’ Meeting Date.

- Specify the dividend ratio applicable for the stock dividend, in the Stock Dividend Ratio field.

- Click ‘Ok’ button to save your changes.

2.6 Fund Dividend Summary Screen

This section contains the following topics:

- Section 2.6.1, "Retrieving Record in Fund Dividend Summary Screen"

- Section 2.6.2, "Editing Fund Dividend Record"

- Section 2.6.3, "Viewing Fund Dividend Record "

- Section 2.6.4, "Deleting Fund Dividend Record"

- Section 2.6.5, "Authorizing Fund Dividend Record "

- Section 2.6.6, "Amending Fund Dividend Record "

- Section 2.6.7, "Authorizing Amended Fund Dividend Record "

- Section 2.6.8, "Copying the Attributes"

2.6.1 Retrieving Record in Fund Dividend Summary Screen

You can retrieve a previously entered record in the Summary Screen, as follows:

- Invoke the ‘Fund Dividend Summary’ screen by typing ‘UTSFUDIV’

in the field at the top right corner of the Application tool bar and

clicking on the adjoining arrow button and specify any or all of the

following details in the corresponding details.

- The status of the record in the Authorization Status field. If you choose the ‘Blank Space’ option, then all the records are retrieved.

- The status of the record in the Record Status field. If you choose the ‘Blank Space’ option, then all records are retrieved

- Fund ID

- Dividend Number

- Dividend Type

- Corporate Action Type

- Dividend Declare Date

- Earning/Lot

- Dividend Status

- Stock Dividend Type

Click ‘Search’ button to view the records. All the records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by querying in the following manner:

- Press F7

- Input the Fund Id

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting the operation from the Action list. You can also search a record by using a combination of % and alphanumeric value.

Example:

You can search the record for Fund ID by using the combination of % and alphanumeric value as follows:-

- Search by A% :- System will fetch all the records whose Fund ID starts from Alphabet ‘A’. For example:- AGC17,AGVO6,AGC74 etc.

- Search by %7 :- System will fetch all the records whose Fund ID ends by numeric value’ 7’ . For example: AGC17, GSD267, AGC77 etc.

- Search by %17%:- System will fetch all the records whose Fund ID

contains the numeric value 17 . For example: GSD217, GSD172, AGC17 etc.

2.6.2 Editing Fund Dividend Record

You can modify the details of Fund Dividend record that you have already entered into the system, provided it has not subsequently authorized. You can perform this operation as follows:

- Invoke the Fund Dividend Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified.

- Click ‘Search’ button. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Fund Dividend Detail screen is displayed.

- Select Unlock Operation from the Action list to modify the record. Modify the necessary information.

Click Save to save your changes. The Fund Dividend Detail screen is closed and the changes made are reflected in the Fund Dividend Summary screen.

2.6.3 Viewing Fund Dividend Record

To view a record that you have previously input, you must retrieve the same in the Fund Dividend Summary screen as follows:

- Invoke the Fund Dividend Summary screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Fund Dividend Detail screen is displayed in View mode.

2.6.4 Deleting Fund Dividend Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Fund Dividend Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified fields are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records. . The Fund Dividend Detail screen is displayed.

- Select Delete Operation from the Action list. The system prompts you to confirm the deletion and the record is physically deleted from the system database.

2.6.5 Authorizing Fund Dividend Record

An unauthorized Fund Dividend record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Fund Dividend Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Fund Dividend Detail screen is displayed. Select Authorize operation from the Action List.

- When a checker authorizes a record, details of validation, if any, that were overridden by the maker of the record during the Save operation are displayed. If any of these overrides results in an error, the checker must reject the record.

2.6.6 Amending Fund Dividend Record

After a Fund Dividend record is authorized, it can be modified using the Unlock operation from the Action List. To make changes to a record after authorization:

- Invoke the Fund Dividend Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. You can only amend authorized records.

- Specify any or all of the details in the corresponding fields on the screen.

- Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to amend. The Fund Dividend Detail screen is displayed in amendment mode. Select Unlock operation from the Action List to amend the record.

- Amend the necessary information and click on Save to save the changes

2.6.7 Authorizing Amended Fund Dividend Record

An amended Fund Dividend record must be authorized for the amendment to be made effective in the system. The authorization of amended records can be done only from Fund Manager Module and Agency Branch module.

The subsequent process of authorization is the same as that for normal transactions.

2.6.8 Copying the Attributes

If you want to create a new Fund Dividend record with the same attributes of an existing maintenance, you can copy the attributes of an existing Fund Dividend record to a new one.

To copy the attributes:

- Retrieve the record whose attributes the new Fund Dividend record should inherit. You can retrieve the record through the Summary screen or through the F7-F8 operation explained in the previous sections of this chapter.

- Click on Copy.

- Indicate the ID for the new Fund Dividend record. You can, however, change the details of the new record.

2.7 Dividend Skipping

A dividend that has been declared can be skipped and not taken up for processing. This is true for cash and stock dividends, as well as for regular or interim dividends. The decision to skip a dividend is typically taken by the board of directors, based on the performance of the fund.

To authorize a fund dividend, use the Fund Dividend Maintenance Summary screen. Access this screen by selecting the Summary option from the Fund Dividend menu in the Maintenance menu category of the Browser menu.

2.8 Dividend Payments Screen

This section contains the following topics:

- Section 2.8.1, "Processing Dividend Payments"

- Section 2.8.2, "Triggering Processing for Cash Dividends involving Payment"

- Section 2.8.3, "Triggering Processing for Dividends involving Reinvestment"

- Section 2.8.4, "Triggering Dividend Processing for All Funds and Corporate Action types"

2.8.1 Processing Dividend Payments

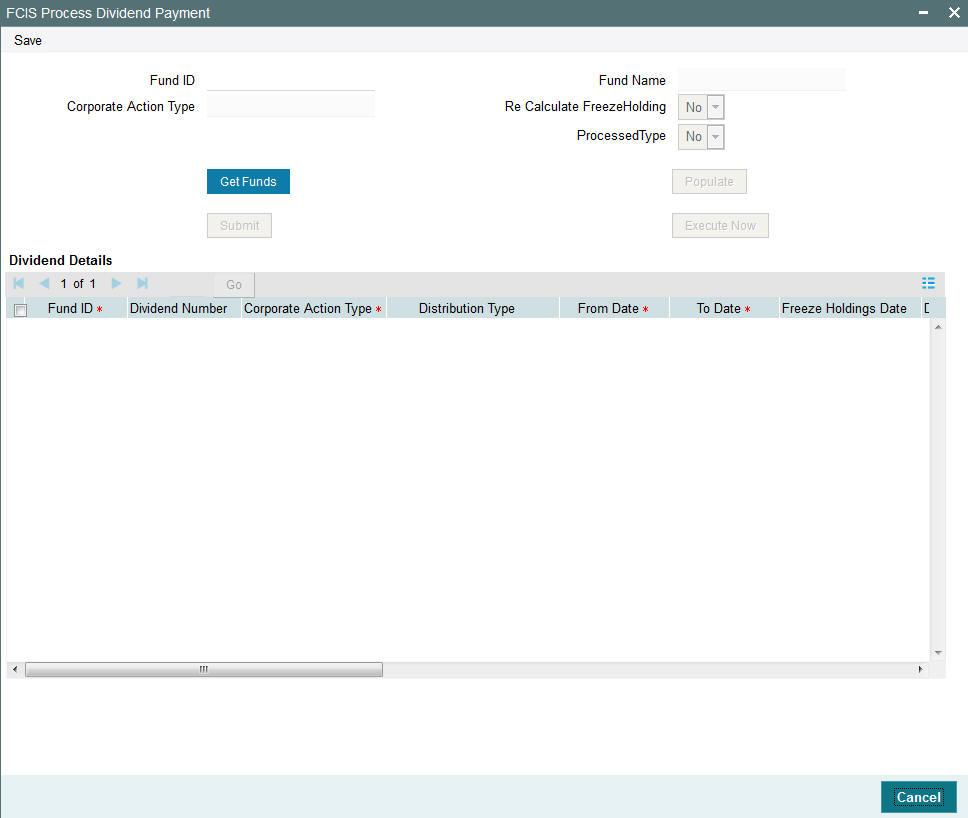

You can use this screen to trigger the processing for a declared dividend, either for a single fund and corporate action type, or a group of funds and corporate action types, as well as for all funds and corporate action types.

Invoke the ‘FCIS Process Dividend Payment’ screen by typing ‘UTDDIPMT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘FCIS Process Dividend Payment’ screen is displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the dividend payment to be processed.

When you open this screen, all funds for which processing of any of the corporate actions are due on the application date are displayed.

The following details are displayed for each fund and corporate action type:

- The From and To dates for the dividend

- The freeze holdings date for the dividend

- The reference date

- The dividend declare date

- The earnings per lot (for cash dividends)

- The stock dividend ratio (for stock dividends)

- Distribution Type for Corporate Action type ‘Cash’.

Fund ID

Display Only

The fund for which the dividend payment details are being specified is displayed here, from the Process Dividend Payment screen.

Corporate Action Type

Display Only

The corporate action type for which the dividend payment details are being specified is displayed here.

Payment Date

Date Format, Mandatory

Enter the Date on which the Dividend Payment is to be done. This must be later than or the same as the application date and must be before the next payment end period.

The system defaults the payment date for the dividend as follows:

Dividend Payment Date = Last dividend processed date + Dividend payment frequency + Payment lag, if any.

You can override the defaulted date. If you do so, the date you specify must not be earlier than the application date.

Issue Date

Date, Mandatory

Enter the Date on which the Dividend Payment is to be issued. This date must be before or the same as the application date.

By default, the application date is displayed here.

Reference Number

20 Character Maximum, Alphanumeric, Mandatory

Enter the Reference Number for the dividend payment.

Remarks

Alphanumeric; Optional

You can specify any narrative for the dividend payment, as free format text, in this field.

Min. Amount for Payment

Numeric; Optional

Specify the minimum amount that can be paid out as dividend, through the dividend payment that you are processing. For a unit holder, if the dividend to be paid falls below this amount, it is distributed according to the Default Distribution Mode defined for the fund and the Income Distribution options (IDS) specified for the unit holder is ignored.

Covering Letter

OLE Object, Optional

To specify the covering letter template word document that is to be completed for the dividend, click the ‘Click here to download covering letter’ link, or click ‘Browse’ to locate the format on the local disk or network.

Bank Details for the Dividend Payment

The bank details are displayed by the system in this section, from the details of the fund account to which the dividend payment was made.

Account Name

Display Only

The name of the account, to which the proceeds due to dividend have been credited, for this fund, is displayed here. This will typically be the fund bank account.

Account Number

Display Only

The account number of the account, to which the proceeds due to dividend have been credited, for this Fund, is displayed here. This will typically be the fund bank account.

Account Currency

Display Only

The currency of the account, to which the proceeds due to dividend have been credited, for this Fund, is displayed here. This, typically, is the fund base currency.

Bank Name

Display Only

The name of the Bank through which the payment is done is displayed here.

2.8.2 Triggering Processing for Cash Dividends involving Payment

To trigger the processing of a cash dividend for which any part of the dividend is being distributed through payment,

- Click the ‘Payment Details’ button to specify the payment

details for the dividend. The Fund Dividend Payments screen is opened.

The payment record for the selected fund dividend is displayed.

- In this screen, the system defaults the payment date for the dividend as follows:

- Dividend Payment Date = Last dividend processed date + Dividend payment frequency + Payment lag, if any.

- You can override the defaulted payment date, if necessary. If you do, the date you specify must not be earlier than the application date.

- The system also defaults the issue date for the dividend as the application date.

- The system assigns, by default, reference number for the dividend payment. You can override it if necessary.

- The accounts to which the payment must be made, are displayed in the list in the bottom half of the screen. The following details are displayed for each account:

- Bank and branch where the account resides

- The number of the account and the name of the account holder

- The account currency

- Any applicable remarks, as free format text, in the Remarks field.

- If a covering letter is required, click the ‘Click here to download covering letter link’, or click ‘Browse’ to locate the format on the local disk or network.

- After you have specified the details, click ‘Ok’ button to save your changes and exit the Fund Dividend Payment screen.

- Back in the main Process Dividend Payment screen, select Yes in the Process field for the fund for which you want to trigger the processing.

- Click ‘Execute Now’ button to trigger the processing. The system displays a completion message when the processing is complete.

2.8.3 Triggering Processing for Dividends involving Reinvestment

- In the row of the dividend record that you want to trigger the processing for, select Yes in the Process field.

- Click ‘Execute Now’ button to trigger the processing. The system displays a completion message when the processing is complete.

After the processing is complete, you must process the reinvestments for the dividend using the Process Reinvestment screen. You can access the Process Reinvestments screen from the Batch menu category of the Browser menu.

2.8.4 Triggering Dividend Processing for All Funds and Corporate Action types

In the Process Dividend Payment screen, you can trigger the dividend processing for all funds and corporate action types together.

- If any of the dividends involve payment, save the payment details through the Fund Dividend Payments screen, as explained above.

- In the main Process Dividend Payment screen, select the Process All link.

- If the volume of records for processing is very high, it is recommended that you click ‘Submit’ button, and then close the screen. The processing is triggered for all the funds, and will go on in the system even after you close the screen. You can query about the progress of the processing through the Asynchronous Processing Details screen.

- If the volume of records is not very high, click ‘Execute Now’ button. The system displays a completion message when the processing is complete.

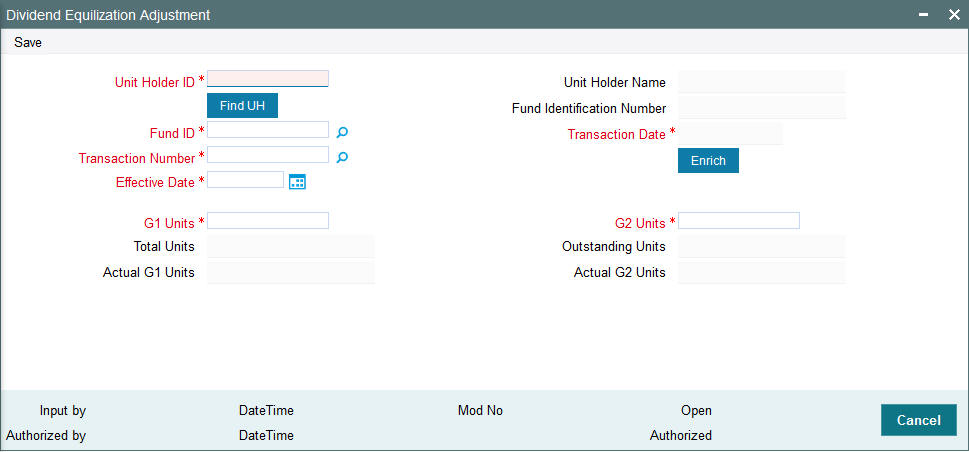

2.9 Dividend Reinvestments

This section contains the following topics:

2.9.1 Processing Dividend Reinvestments

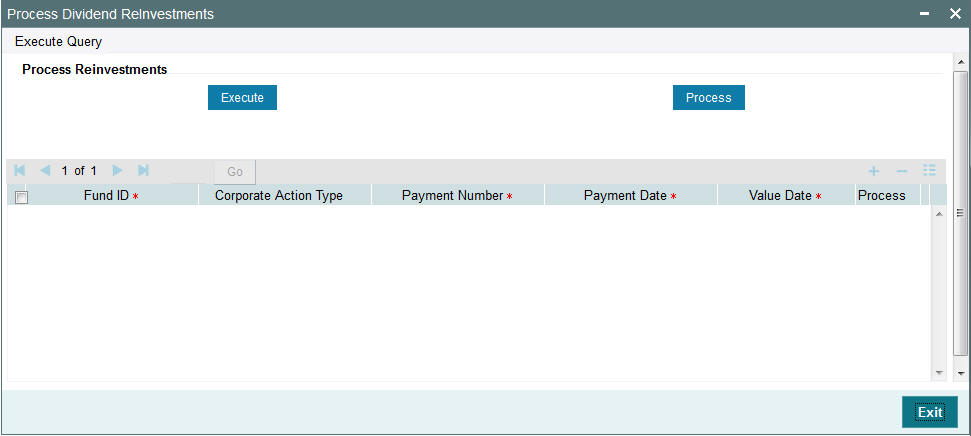

You can use this screen to trigger the processing of any reinvestment transactions resulting out of dividend processing, for both cash and stock dividends.

Invoke the ‘Process Dividend Reinvestments’ screen by typing ‘UTDPRRIN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Process Dividend Reinvestments’ screen is displayed. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the dividend reinvestment to be processed.

When you open this screen, the funds and corporate action types for which reinvestments are due to be processed as on the application date are displayed.

The system defaults the Value Date for the reinvestment transactions as the application date, if there is no lag specified for reinvestments in the Corporate Action profile. If a lag is specified, then the Value Date is defaulted accordingly. You can override the defaulted date, if necessary.

You have the facility to change the reinvestment date to a previous date, called backdating. In the payment date field you have the option to specify the date, here you may enter a previously specified date, in case you receive a delayed instruction from the client on the reinvestment.

For example; A dividend period from 1st July to 31st July has the date of Dividend Payment processing as 15th August. You can change the date to the 1st of August, which is accepted by the system.

The following details are displayed for each reinvestment record:

- The ID of the fund

- The Corporate Action Type

- The Payment Number of the dividend that resulted in the reinvestment transaction

- The Payment Date of the dividend

- The Value Date for the reinvestment transactions

To process the reinvestment,

- In the row of the reinvestment record that you want to trigger the processing for, select Yes in the Process field.

- Click ‘Execute’ button to trigger the processing. The system displays a completion message when the processing is complete.

To process all the records at the same time,

- Select the Process All link. If the volume of records is high, it is recommended that you click ‘Submit’ button and then close the screen. The processing is triggered for all the funds, and will go on in the system even after you close the screen. You can query about the progress of the processing through the Asynchronous Processing screen.

- If the volume of records is not very high, click ‘Execute Now’ button. The system displays a completion message when the processing is complete.

2.10 Dividends Reversal

This section contains the following topics:

- Section 2.10.1, "Invoking the Mass Amendment Detail Screen"

- Section 2.10.2, "Reports for Reprocessing or Reversal of Dividends"

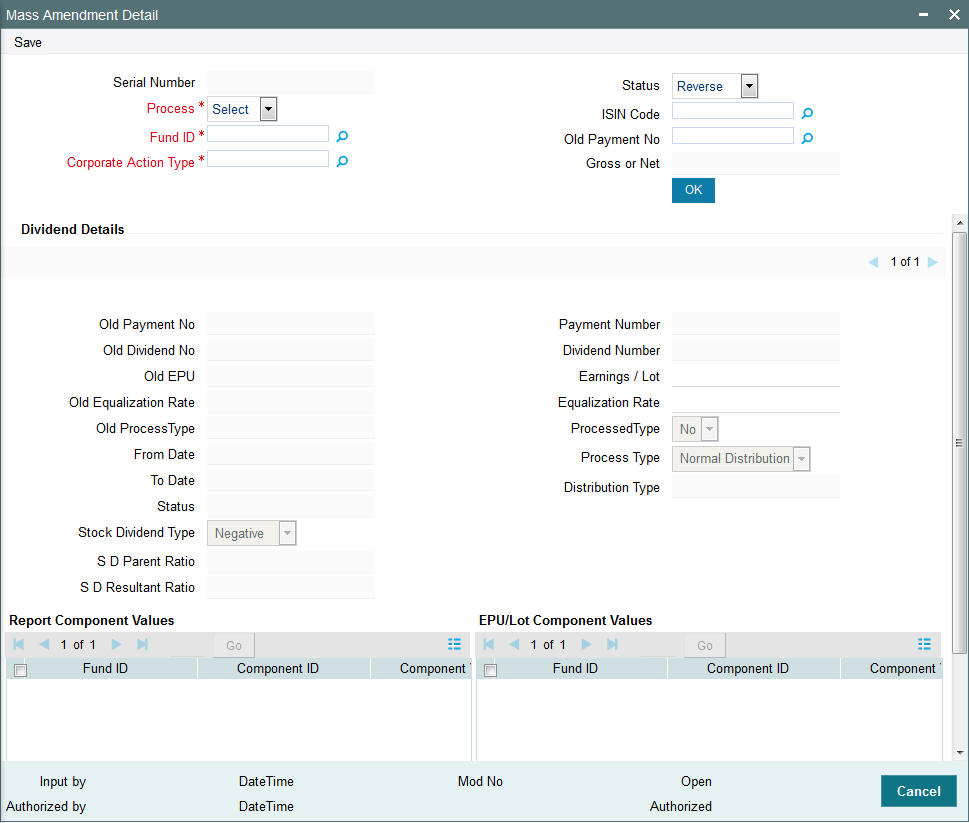

2.10.1 Invoking the Mass Amendment Detail Screen

You may need to reverse a dividend that has been processed. Invoke the ‘Mass Amendment Detail’ screen by typing ‘UTDMASAM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Mass Amendment Detail’ screen is invoked. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the dividend to be amended.

In this screen, you must specify the following details for the dividend you wish to reverse:

- The ID and ISIN code of the fund in respect of which the dividend was declared

- The dividend type (cash or stock

The system will display the following details:

- The Stock Dividend Type (Negative or Positive)

- The SD Parent Ratio

- The SD Resultant Ratio

- Gross/Net Value for calculation of distribution as maintained in the Corporate Actions tab in the Fund Rule Maintenance screen.

- Distribution Type if cash is the corporate action type.

Select the Reverse option in the Process field in this screen, to signify reversal.

The details of the last processed dividend for the selected fund are displayed in the list portion of the screen. If required, you can change the values for the ‘New EPU’ and the ‘New Equalization’ fields. Click ‘Ok’ button to execute the reversal.

The reversal of the dividend can be authorized by selecting the Authorize option in the Actions list.

After authorization, the reversal is processed by reversing the dividend and reinvestment entries passed, and posting the applicable adjustment entries.

The system will reverse the normal and negative stock dividends.

2.10.2 Reports for Reprocessing or Reversal of Dividends

On the day of execution of reprocessing of dividend, the system prints the Income Advice as part of the End of Day processes, displaying the results of the reprocessing.

The following details are displayed:

- The pre-processing and post-processing values for EPU

- Pre-processing and post-processing payment numbers

- Pre-processing and post-processing payment amounts in fund base currency

- Pre-processing and post-processing tax amounts, in fund base currency

- Pre-processing and post-processing reinvestment amounts in fund base currency

If a reversal has been executed, the Reversal Advice is also printed, containing negative values for all details, to indicate the reversal.

2.11 Dividend Reversal / Amendment for Selected Unit Holders

This section contains the following topics:

- Section 2.11.1, "Invoking the Selected UH Detail Screen"

- Section 2.11.2, "Amendment of Dividend Payments for Specific Unit Holders"

- Section 2.11.3, "Reversal of Dividend Payments for Specific Unit Holders"

- Section 2.11.4, "Authorizing Dividend Reversal / Amendment "

- Section 2.11.5, "Processing of Dividend Reversals/Amendments "

2.11.1 Invoking the Selected UH Detail Screen

When a dividend that has been processed is reversed through the Dividend Reversal/Reprocess screen, it is reversed for all unit holders for whom the dividend was processed.

If you require reversal of processed dividend for specific unit holders, you can perform the reversal through the Selected UH Dividend Reversal/Amendment screen.

Similarly, if amendment of processed dividend is required for specific unit holders, you can perform the amendment through the Selected UH Dividend Reversal/Amendment screen.

Invoke the ‘Selected UH Detail’ screen by typing ‘UTDSELUH’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘Selected UH Detail’ screen is invoked. Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the selected UH for whom the dividend to be amended or reversed.

In this screen, you can:

- Reverse and / or amend a dividend that has been processed

- Select the specific unit holders for whom the reversal or amendment of dividend must be performed.

- For amendment, indicate whether the freeze holdings computation must be processed again with the amendment in effect, as well as whether appropriate reinvestments in respect of the amended dividend must be generated. For reversal, the freeze holdings recalculation is done as a mandatory process.

- Perform operations such as editing, viewing or deleting a reversal or amendment which has not been authorized.

- Have users with requisite rights authorize a reversal or amendment of dividend.

You can specify the following fields in this screen:

Operation

Alphanumeric; Mandatory

Select the operation that you wish to perform. The following operations can be performed through the screen:

- Reverse - Reversal of last processed dividend for selected fund and corporate action, for specific unit holders

- Amend - Amendment of last processed dividend for selected fund and corporate action, for specific unit holders

- View – Viewing reversals or amendments entered through the screen in respect of the selected fund and corporate action

- Edit - Editing reversals or amendments entered through the screen in respect of the selected fund and corporate action, which are yet to be authorized

- Delete - Deleting reversals or amendments entered through the screen in respect of the selected fund and corporate action, which are yet to be authorized

- Authorize – Authorizing reversals or amendments entered through the screen in respect of the selected fund and corporate action, which are yet to be authorized

Fund ID

Alphanumeric; Mandatory if ISIN Code is not entered

Select the ID of the fund for which the last processed dividend is being reversed / amended for the selected corporate action, for the specified unit holders.

To select the fund, you can either indicate the Fund ID or the ISIN Code of the fund. When you select the fund and the corporate action, the Payment Number and Dividend Reference Number of the last processed dividend are also displayed for the combination.

ISIN Code

Alphanumeric; Mandatory if Fund ID is not entered

Select the ISIN Code of the fund for which the last processed dividend is being reversed / amended for the selected corporate action, for the specified unit holders.

To select the fund, you can either indicate the Fund ID or the ISIN Code of the fund. When you select the fund and the corporate action, the Payment Number and Dividend Reference Number of the last processed dividend are also displayed for the combination.

Corporate Action Type

Alphanumeric; Mandatory

Select the corporate action for the selected fund that resulted in the dividend, which is being reversed / amended for the specified unit holders.

When you select the fund and the corporate action, the Payment Number and Dividend Reference Number of the last processed dividend are also displayed for the combination.

Payment Number

Choose the payment number generated by the system from the option list

Dividend Details Section

Fund ID

Select the Fund Id of the fund for which dividend has been processed

Payment Date

The date on which the payment has been processed is displayed.

Status

Choose the status of the dividend from the option list here.

Processed Type

The status of the reversal – whether processed or not – is displayed here.

Recalculate Freeze Holdings

Optional

You can use this field to indicate whether the freeze holdings calculation must be performed again for the amendment to the dividend to come into effect in respect of the selected unit holders. When you enter a reversal in this screen, recalculation of freeze holdings is performed by the system as a mandatory process, when the reversal is processed.

Check the box to indicate recalculation of freeze holdings.

Generate Reinvestments

Optional

You can use this field to indicate whether reinvestments resulting from the dividend amendment are to be generated when the amendment is processed, in respect of the selected unit holders. Check the box to indicate generation of reinvestments.

Reference Number

The reference number is defaulted by the system.

Unit Holder Details

Click the list box to select the specific unit holders for whom the reversal / amendment of dividend is to be applicable. The Unit Holder Selection screen is opened. In this screen, you can either specify the ID of the unit holder, or click on the Find link. After you have specified the unit holder number, click on Add. Each unit holder you select in this fashion is displayed in the text box. Click on Remove to remove a selected unit holder number from the list.

2.11.2 Amendment of Dividend Payments for Specific Unit Holders

In the Selected UH Dividend Reversal/Amendment screen, you can amend a dividend payment for specific unit holders as follows:

- Select ‘Amend’ in the Operation field

- Select the ID or ISIN Code of the fund for which you are amending the last processed dividend.

- Select the corporate action that resulted in the processed dividend that is being amended.When you select the fund and the corporate action, the payment number of the last processed dividend for the selected combination is displayed. The Dividend Reference Number as well as the serial number is also displayed.

- Indicate whether the freeze holdings information in respect of the dividend being amended must be recomputed, so that the amendment would come into effect, for the selected unit holders.

- Indicate whether reinvestments in respect of the amended dividend need to be generated, for the selected unit holders.

- To select the specific unit holders for whom the amendment of the processed dividend must apply, click on the list box in the Unit Holder Details field. The Unit Holder Selection screen is opened, where you can select the specific unit holders.

- After you have made the specifications listed above and selected the specific unit holders, save your changes.

- You can make the necessary amendments in the Fund Dividend Summary screen. The dividend amendments would apply only to those specific unit holders selected in the Selected UH Dividend Reversal / Amendment maintenance.

After an amendment of a processed dividend has been entered as described above, it must be authorized in order to come into effect.

2.11.3 Reversal of Dividend Payments for Specific Unit Holders

In the Selected UH Dividend Reversal/Amendment screen, you can reverse a dividend payment for specific unit holders as follows:

- Select ‘Reverse’ in the Operation field.

- Select the ID or ISIN Code of the fund for which you are reversing the last processed dividend.

- Select the corporate action that resulted in the processed dividend that is being reversed.

- When you select the fund and the corporate action, the payment number of the last processed dividend for the selected combination is displayed. The Dividend Reference Number is also displayed. The freeze holdings information in respect of the dividend being reversed is recomputed for the selected unit holders.

- To select the specific unit holders for whom the reversal of the processed dividend must apply, click on the list box in the Unit Holder Details field. The Unit Holder Selection screen is opened, where you can select the specific unit holders.

- After you have made the specifications listed above and selected the specific unit holders, save your changes.

- You can effect the reversal through the Dividend Reversal/Reprocess screen. The dividend reversal would apply only to those specific unit holders selected in the Selected UH Dividend Reversal / Amendment maintenance.

After a reversal of a processed dividend has been entered as described above, it must be authorized in order to come into effect.

2.11.4 Authorizing Dividend Reversal / Amendment

After a processed dividend has been reversed or amended for specific unit holders, the reversal or amendment must be authorized in order to come into effect. The authorization can be effected through the Selected UH Dividend Reversal/Amendment screen, as follows:

- Select ‘Authorize’ in the Action List.

- Select the ID or ISIN Code of the fund for which the reversal / amendment entered for the last processed dividend, for specific unit holders, is being authorized.

- Select the corporate action that resulted in the processed dividend for which a reversal / amendment is being authorized.

- When you select the fund and the corporate action, the payment number of the last processed dividend for the selected combination is displayed. The Dividend Reference Number is also displayed.

- The details of the amendment / reversal, such as whether recalculation of freeze holdings was opted for, as well as whether generation of reinvestments in respect of the amended / reversed dividend was opted for, are also displayed.

- The specific unit holders for which the reversal / amendment is applicable, can also be viewed through the Unit Holder Selection screen, which you can invoke by clicking on the list box in the Unit Holder Details field.

- To authorize the reversal / amendment, select the Authorize option. Click on ‘Execute Now’ to execute the authorization online, or click on ‘Submit’ to execute the authorization as an asynchronous process.

2.11.5 Processing of Dividend Reversals/Amendments

When a dividend reversal/amendment for specific unit holders is processed, the following operations are performed by the system:

- Freeze holdings calculations are done again, if specified for the amendment. For reversals, recalculation of freeze holdings is performed as a mandatory process.

- The dividend payment and tax amounts are computed for the specific unit holders.