4. Setting up Investor Preferences

After you have created an authorized unit holder account for an investor, you can set up any or all of the following investment preferences for the same, as and when requested.

- Setting up of income distribution options for a combination of funds, policy and products the investor has invested in.

- Specifying the applicability of the Letter of Intent facility, at the investor’s behest.

- Setting up a negotiated deal for the investor.

- Specifying non-tax- limits for exemption eligible investors.

You set up these preferences at the investor’s behest, and these will govern the maintenance of the investor’s account and processing aspects of any transactions requested by the investor.

This chapter contains the following sections:

- Section 4.1, "Income Distribution Setup Screen"

- Section 4.2, "Income Distribution Setup Summary Screen"

- Section 4.3, "Unitholder Deal Maintenance Detail Screen"

- Section 4.4, "Unitholder Deal Summary Screen"

- Section 4.5, "LOI Adjust Proc Screen"

- Section 4.6, "Unit Holder LOI Setup Details Screen"

- Section 4.7, "Unit Holder LOI Setup Summary Screen"

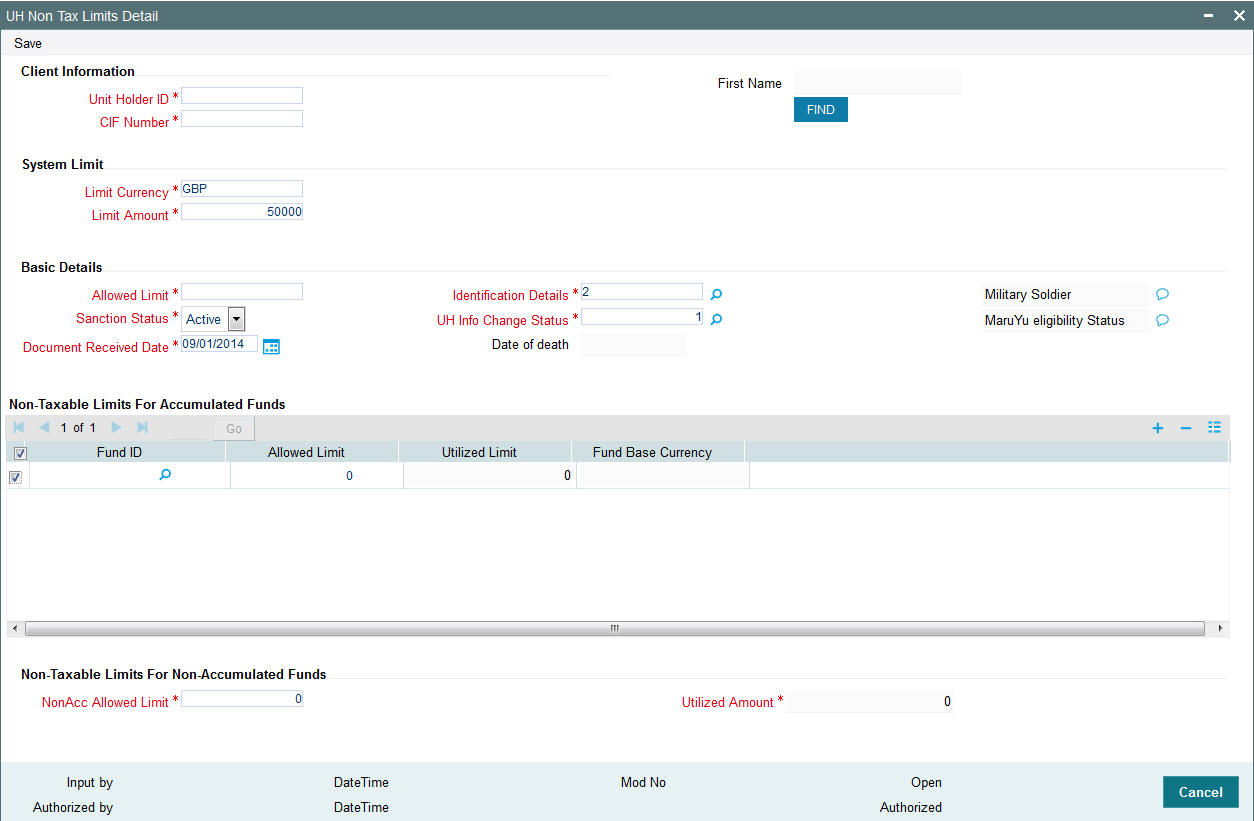

- Section 4.8, "UH Non Tax Limits Detail Screen"

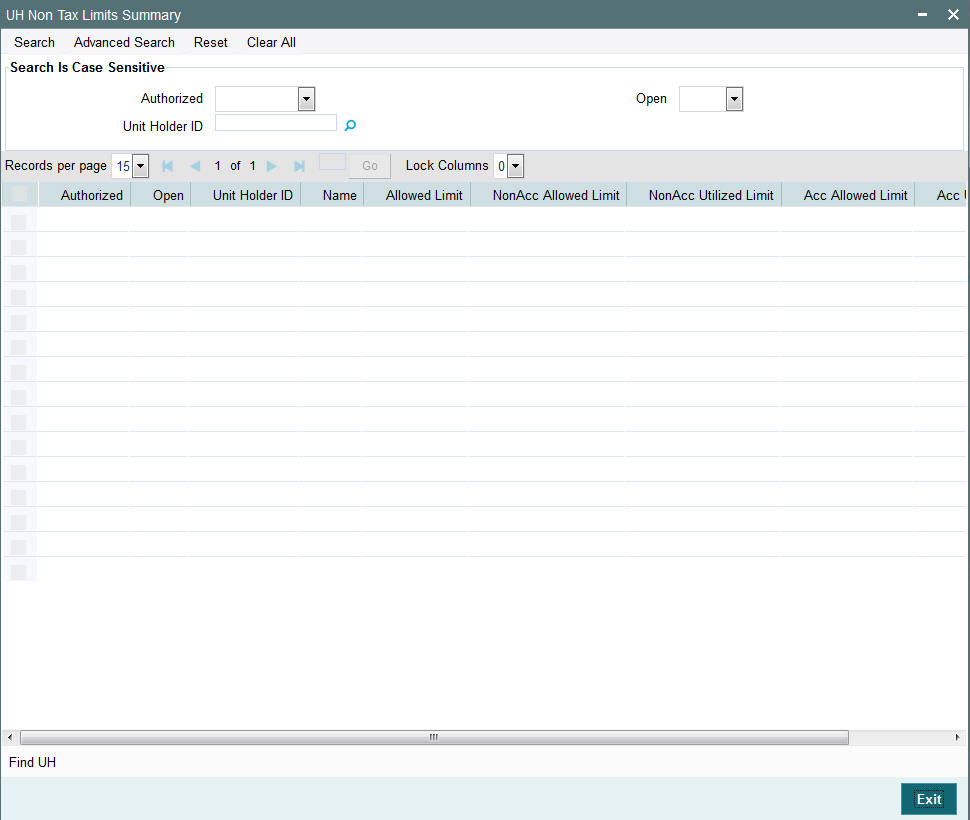

- Section 4.9, "UH Non Tax Limits Summary Screen"

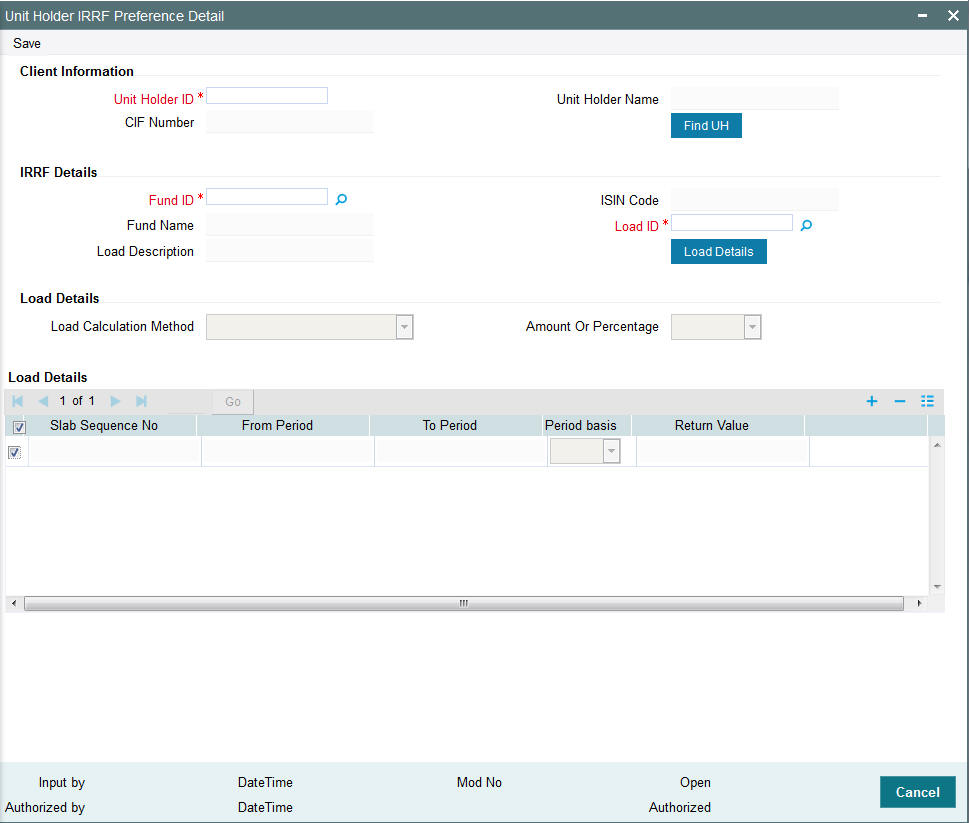

- Section 4.10, "Unit Holder IRRF Preference Detail Screen"

- Section 4.11, "Unit Holder IRRF Preference Summary Screen"

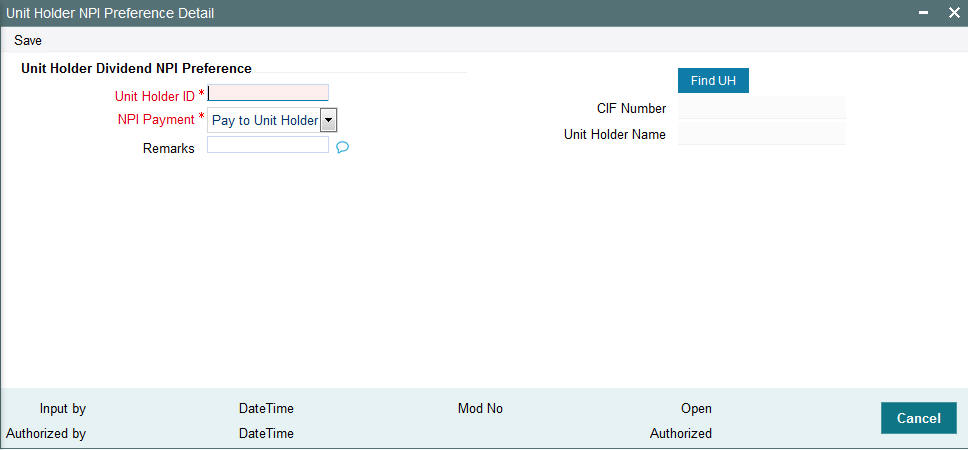

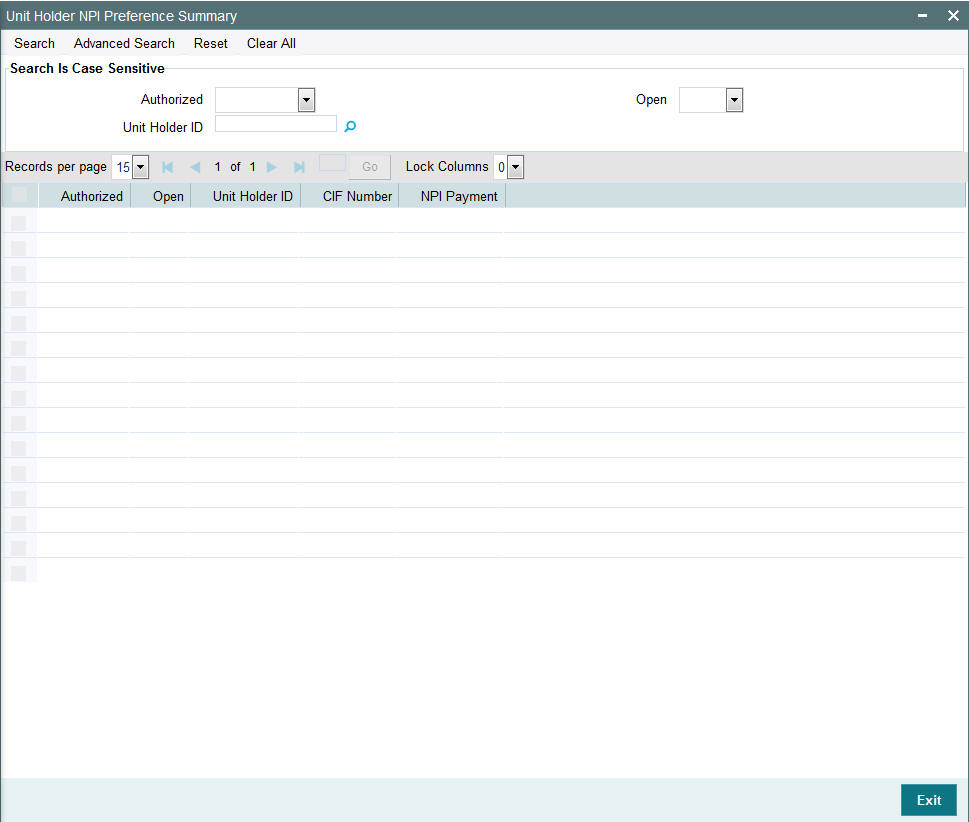

- Section 4.12, "Unit Holder NPI Preference Detail Screen"

- Section 4.13, "Unit Holder NPI Preference Summary Screen"

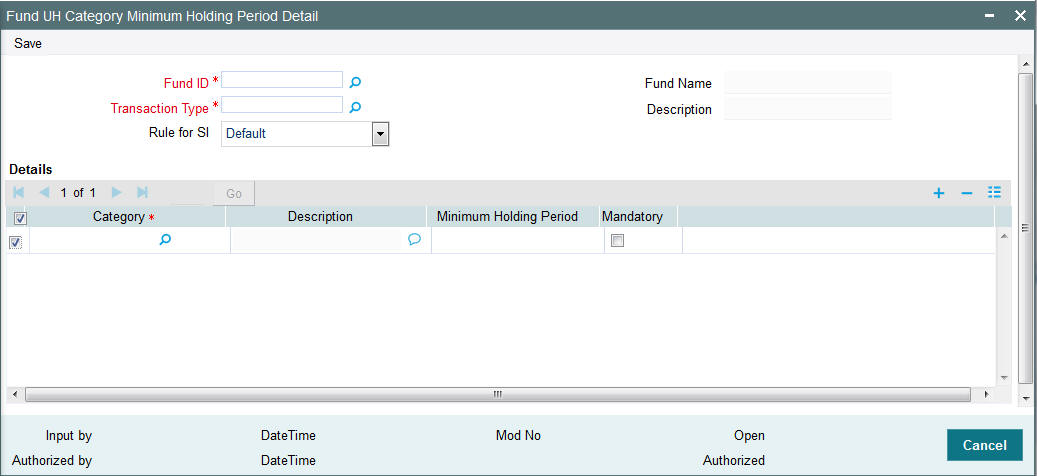

- Section 4.14, "Fund UH Category Minimum Holding Period Details Screen"

- Section 4.15, "Fund UH Category Minimum Holding Period Summary Screen"

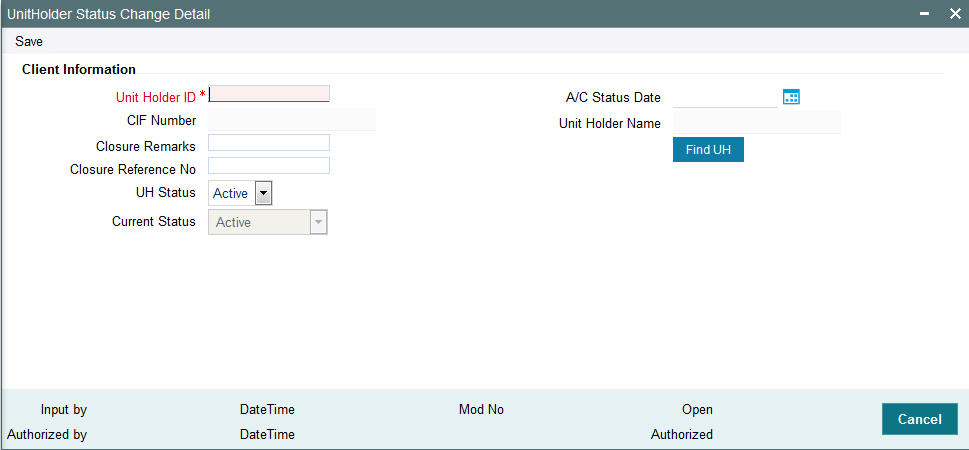

- Section 4.16, "UH Status Change Detail Screen"

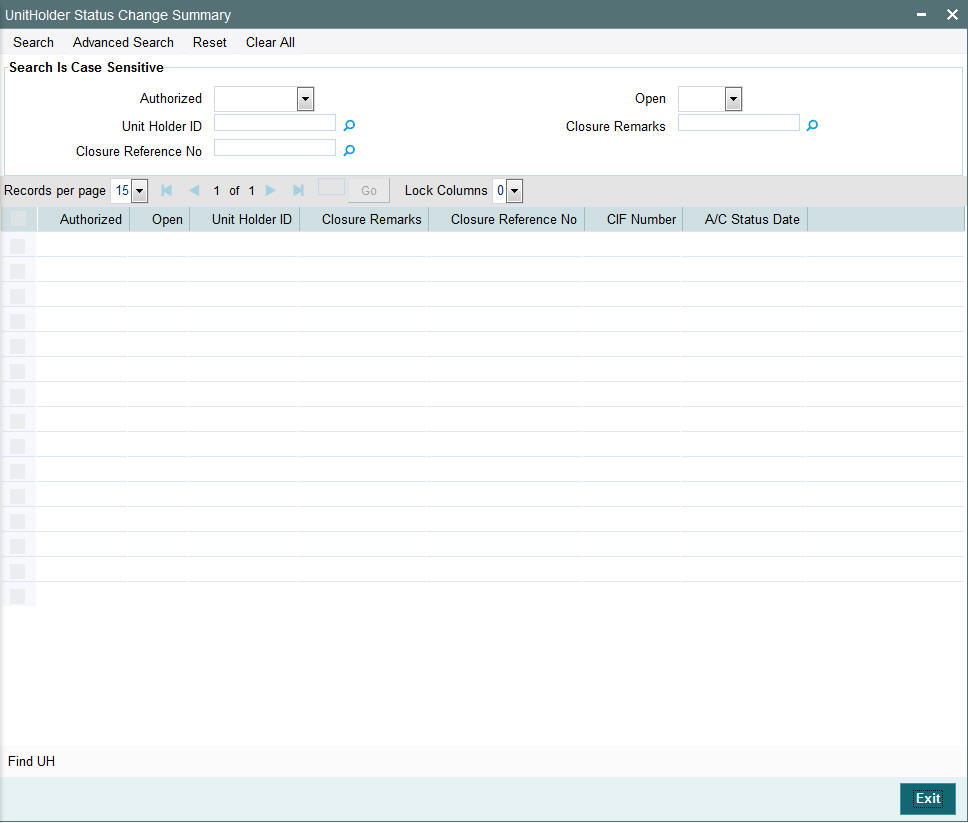

- Section 4.17, "Unit Holder Status Change Summary Screen"

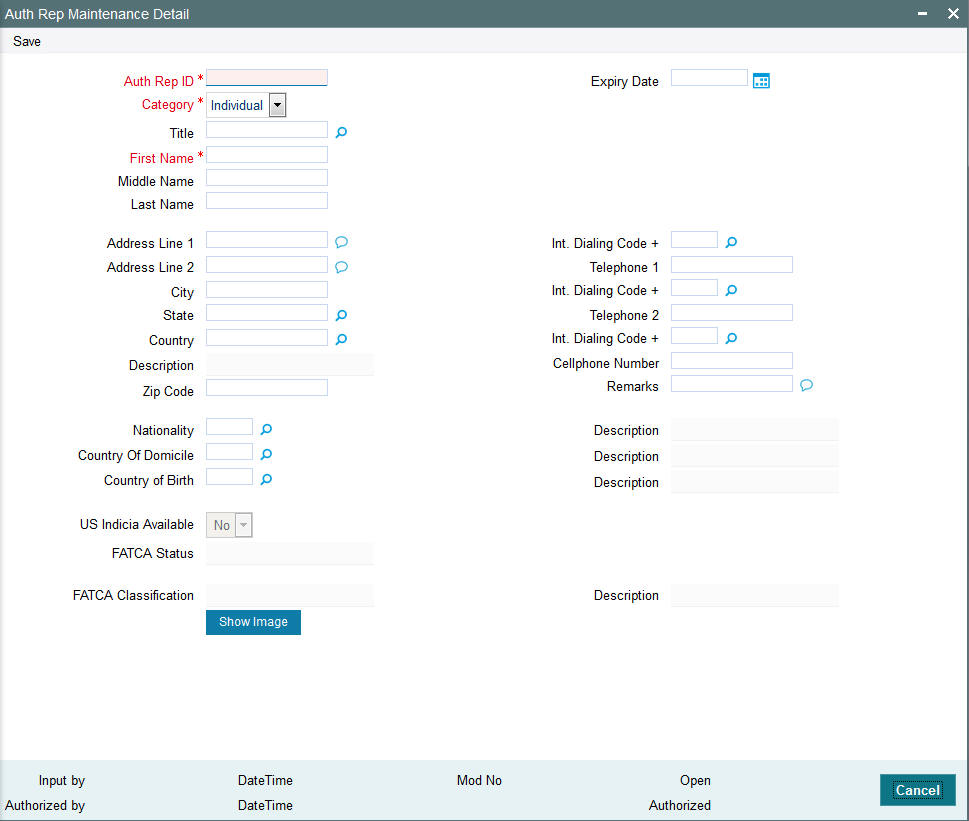

- Section 4.18, "Auth Rep Maintenance Detail Screen"

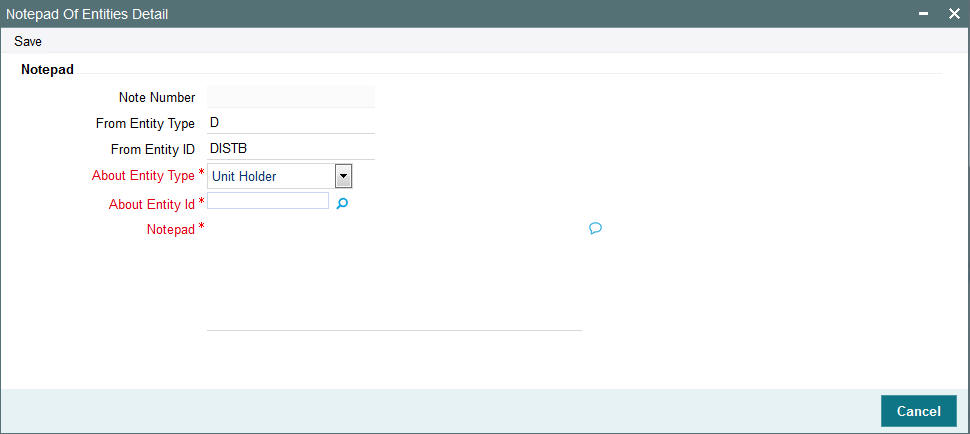

- Section 4.19, "NotePad of Entities Detail Screen"

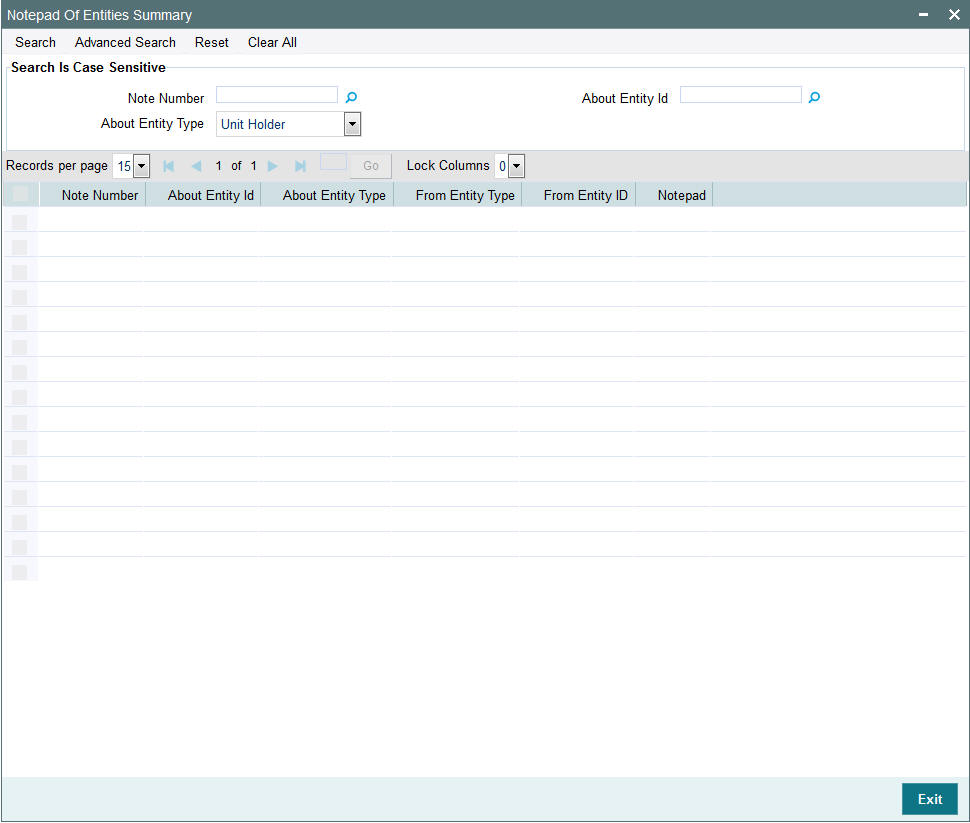

- Section 4.20, "NotePad of Entities Summary Screen"

4.1 Income Distribution Setup Screen

This section contains the following topics:

- Section 4.1.1, "Maintaining Investor Distribution Setup Details"

- Section 4.1.2, "Invoking Income Distribution Setup Screen"

- Section 4.1.3, "Payment Details Tab"

- Section 4.1.4, "Reinvestment Details Tab"

- Section 4.1.5, "Routing Details Tab"

4.1.1 Maintaining Investor Distribution Setup Details

When investors put their capital into any funds of the AMC, they derive earnings out of any dividend declared by the fund at any juncture.

Also, an intermediary (such as a broker) designated for a fund derives commission earnings from the transactions in the fund.

Investors may wish to choose the manner in which they could use the dividend income. Similarly, brokers could wish to choose the manner in which they could use their commission earnings.

They could wish to:

- Receive the entire earnings, dividend or commission, as payment, either entirely through checks or account transfer, or a combination of both.

- Not receive the earnings by way of payment, but invest the earnings back into the funds of the AMC. This is known as reinvestment. The earnings could be reinvested either back into the same fund, or different funds. Also, the reinvestment could be made into any other investor’s account too.

- Receive a portion of the earnings by way of payment, and reinvest the remaining portion.

The option chosen by the investor to use dividend or commission earnings, as the case may be, is known as the Income Distribution Setup option or the IDS option for the investor or broker.

Income distribution options can be set up for both; UT transactions and Policy transactions. You can capture this option for any investor or broker for a combination of fund, policy and product in the Oracle FLEXCUBE Investor Servicing system.

4.1.2 Invoking Income Distribution Setup Screen

You can setup the income distribution setup option for an investor using ‘Income Distribution Setup Detail’ screen. You can invoke the ‘Income Distribution Setup Detail’ screen by typing ‘UTDUHIDS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the Income Distribution Setup screen.

In this screen, you set up the IDS option by:

- Specifying the investor for whom the option is being set up, by indicating the CIF account associated with the unit holder, or the unit holder ID.

Note

Income distribution options are only set up at a unit holder account level, and not at a CIF account level.

- Specifying the fund for which the option is applicable, in the Fund ID field. You can also specify the ISIN Code for the fund. For LEP transactions, you can specify a combination of fund, policy and product, for which the option is applicable. The option you will set up will be applied only for dividend earnings on the fund/combination of fund, product and policy you select here.

- Specifying the mode of distribution, in the Distribution Mode field.

- Specifying the percentages that represent the portions of dividend earnings to be paid and reinvested, as desired by the investor, in the Payment Percentage and Reinvestment Percentage fields.

- Specifying the payment details for the paid portion, in the Payment Details section, and the reinvestment details, for the reinvestment portion, in the Reinvestment Details section.

- Saving your changes.

Client Information Section

In this section, select the ID of the unit holder for whom you are creating an income distribution setup record.

Unit Holder

12 Character Maximum, Alphanumeric, Mandatory

From the list, select the CIF unit holder for whom you are creating an income distribution setup record.

CIF Number

9 Characters Maximum, Alphanumeric, Display for setting up IDS options for a unit holder

under a CIF Account

Select or specify the number of the CIF Account under which the unit holder for whom you are creating an income distribution setup is found.

When you specify the CIF Number, the name of the corresponding CIF Account is retrieved from the database and displayed alongside the field.

All the unit holder accounts under the CIF Account that you have selected are listed in the drop down list in the Unit Holders for CIF field.

CIF Number is displayed when you select/ locate a Unit Holder by clicking ‘Find UH’ button.

CIF Name

Display

CIF name will be displayed for the selected CIF number.

Unitholder Name

12 Character Maximum, Alphanumeric, Mandatory

Specify the ID of the non-CIF unit holder for whom you are creating the income distribution options in this screen. The name of the unit holder that you select is displayed alongside the field.

Details Section

In this section, you can indicate the fund, policy and product, the income earnings from which will be distributed according to the IDS options you are creating for the selected unit holder.

Various combinations at which the Unitholder IDS options can be set up, in order of preference are:

- Product + Policy + Fund level

- Product + Policy level

- Product + Fund level

- Product level

In case of LEP transactions, if the UH IDS is not available, the dividend earnings will be reinvested into the default reinvestment fund maintained for the product in the Product Maintenance Details screen. However, if the reinvestment fund is not defined, then the dividend is reinvested into the source fund itself.

You can also indicate the manner in which the income must be distributed.

Fund ID

6 Character Maximum, Alphanumeric, Mandatory for UT transactions

Select the ID of the fund from which the selected investor derives income, which will be distributed according to the IDS options you are creating in this screen.

If the selected investor receives income from many funds, then you must create the IDS options for the income from each fund in this screen as applicable, if so requested by the investor.

When you specify the ID of the fund, the ISIN Code of the fund is displayed in the ISIN Code field.

ISIN Code

12 Characters Maximum; Alphanumeric; Display

ISIN Code will be displayed for the selected Fund ID.

Distribution Mode

Alphanumeric, Mandatory

From the list, indicate the manner in which the selected investor prefers to avail of income earned in the selected fund. This could be any of the following:

- Full Payment: Choose this option to indicate that the investor prefers to receive the entire income derived from an income distribution cycle in the selected fund as a payment.

Further, the investor can choose to avail of payment either in the form of a check, or an account transfer.

- Full Reinvestment: Choose this option to indicate that the investor prefers to reinvest the entire income derived from an income distribution cycle in the selected fund into another fund.

In such a case, the fund into which the earned income is reinvested must belong to the same fund family as the fund from which the income was earned.

Further, the investor can choose to have the income reinvested either in the investor’s own unit holder account or the account of another investor. In the latter case, the investor in whose account the reinvestment is proposed (i.e., the Reinvestment Unit Holder) must belong to the same AMC as the source investor.

- Both: Choose this option to indicate that the investor prefers to have the income derived from an entire income distribution cycle in the selected fund divided into two portions, receive one portion as payment, and reinvest the remaining portion.

Note

- In some funds in which reinvestment is not allowed, according to the Corporate Action profile for the fund, the investor cannot choose to have income earnings reinvested. In such cases, this field is validated with the “Full Payment” option displayed as a non-editable default option. Also, the Payment Percentage field is locked with a default, non-editable value of one hundred percent displayed, and the Reinvestment Percentage field is locked with a default, non-editable value of zero percent displayed.

- If you have chosen the distribution mode in this field as ‘Full

Reinvestment” or “Both”, and the reinvestment fund

has a restriction on the nationality of the investor as maintained in

the Fund Residency Restriction list, then reinvestment is not allowed

at all.

For some funds, the option of allowing the investor to decide the income distribution mode is restricted. The default distribution mode specified in the fund rules is considered for such funds, and an investor cannot decide the same at account level by making a specification in this field.

Payment Percentage

Alphanumeric, Optional (Mandatory if distribution mode is either Both or Full Payment)

Specify the percentage of income earned that the investor prefers to receive by way of payment.

- If the distribution mode chosen is Both, specify a percentage that is below one hundred percent.

- If the distribution mode chosen is Full Payment, this field contains one hundred percent as a default value. If so, you cannot specify any other value.

- If the distribution mode chosen is Full Reinvestment, and the reinvestment is disallowed for the selected fund, this field contains one hundred percent as a default value. If so, you cannot change it.

Product ID

12 Characters Maximum; Alphanumeric; Optional

Select the ID of product from which the investor derives income, which will be distributed according to the IDS options you are creating in this screen.

This field is not applicable if you are setting up IDS options for UT transactions.

Policy Number

16 Characters Maximum; Alphanumeric; Optional

Select the policy from which the investor derives income, which will be distributed according to the IDS options you are creating in this screen.

This field is not applicable if you are setting up IDS options for UT transactions.

Payment Currency

Alphanumeric, Mandatory

Select the currency in which the unit holder wishes the payment to be made. All currencies maintained in the system are available for selection.

In case Payment mode is transfer then the system looks for a bank account in the opted payment currency for the unit holder. If such an account does not exist, you can choose (in Transfer Details section) any multi-currency account maintained for the unit holder subject to the following conditions:

- The Distribution mode is ‘Full Payment/ Both’

- Mode of Payment is ‘Transfer’

- Payment Type is ‘Self’

Also the fund should have a bank account in this currency. In the event of failure of any one of the two criteria an error will be displayed.

Note

The default value here would be the unit holder base currency.

Reinvestment Percentage

Alphanumeric, Optional (Mandatory if distribution mode is either Both or Full Reinvestment)

Specify the percentage of income earned that the investor prefers to reinvest into another fund.

- If the distribution mode chosen is Both, specify a percentage that is below one hundred percent.

- If the distribution mode chosen is Full Reinvestment, this field contains one hundred percent as a default value. If so, you cannot specify any other value.

- If the distribution mode chosen is Full Reinvestment, and the reinvestment is disallowed for the selected fund, this field contains zero as a default value. If so, you cannot change it.

Exempt UH from Minimum Payment Rule

Optional

Check this option to indicate that the unit holder should be exempt from the ‘Minimum Amount for Payment’ threshold specified (in the Income Distribution rule under Fund Corporate Actions) and be paid the dividend proceeds entirely. This option is enabled only when the ‘Distribution Mode’ specified is either ‘Full Payment’ or ‘Both’.

To facilitate this, it is essential that:

- The ‘Minimum Amount for Payment’ threshold be defined

- The ‘Action on Minimum Amount Validation’ be set to ‘Reinvest’

Usually, when the dividend amount is lower than the threshold maintained, it is automatically re-invested by the system even if the investor has chosen ‘Payout’ as the distribution mode. If the unit holder has opted for a combination of re-investment and payout and the option above has been chosen, the system:

- Pays out the cash portion to the investor even if it is less than the ‘Minimum amount for Payment’ threshold

- Generates a single re-investment transaction for the full dividend income

Note

The dividend amount paid to the investor is in cash and net of tax. If Standing Payment Instructions (SPI) exist for an investor, the system uses the bank details specified here to generate the money transfer. If not, the system issues a cheque

4.1.3 Payment Details Tab

In this section, you can define the option in which the investor can receive income earnings in the form of payment. The investor can receive the payment income either in the form of checks or through account transfers.

If you have chosen either Both or Full Payment as the distribution mode, you must specify all information in this section mandatorily.

Click ‘Payment Details’ tab to enter the details.

Payment Mode

Alphanumeric, Mandatory

From the list, select the mode in which the investor prefers to receive the paid portion of the income earned – either in the form of a check or an account transfer.

Payment Type

Alphanumeric, Mandatory

From the list, indicate whether the check payment instrument must be addressed to the investor (self) or a third party.

You can also indicate that the payment check must be addressed to a broker, by selecting the Entity option. If you choose this option, you must indicate the broker to which the payment must be made.

Third Party Details Section

Note

The payment of income to a third party (i.e. a bank account that is not the investor account or a check that is not in favor of the investor) can be made only if such an installation level option is available.

Third Party Reference

Alphanumeric, Mandatory for ‘Third Party’ payment

Specify the name or reference of the third party for which the check instrument must be made out.

Address

Alphanumeric, Mandatory for ‘Third Party’ payment

Specify the address of the third party for which the check instrument must be made out.

Zip Code

Alphanumeric, Mandatory for ‘Third Party’ payment

Specify the zip code of the city of residence of the third party for which the check instrument must be made out.

City

Alphanumeric, Mandatory for ‘Third Party’ payment

Select the city of residence of the third party for which the check instrument must be made out.

US State/Non-US State

Alphanumeric, Mandatory for ‘Third Party’ payment

Select the state of residence of the third party for which the check instrument must be made out, if the state is a US state.

Entity Details Section

Entity Type

Display

If the payment (check or transfer) is being made to a broker, and you have chosen the Entity option, the Broker entity type is displayed in this field.

Entity ID

Alphanumeric; Mandatory

If you have indicated that the payment (check or transfer) is to be made to a broker, specify the broker in this field. The name of the selected broker is displayed in the Entity Name field.

Entity Name

Display

The entity name will be displayed for the Entity Type selected.

Transfer Details Section

Select Bank Account

Mandatory for Self payment type

Select the bank account to which the transfer payment of the income must be made.

The details of the account you select are displayed in the bank account details fields.

You must select a bank account for which the currency is a valid fund bank account currency so that the income payment transfer can be affected.

Bank

Numeric, Mandatory for Third Party transfer payment

If the payment type is ‘Self’, the bank account associated with the investor is defaulted from the unit holder level.

If you have chosen ‘Third Party’ as the payment type, select the name of the bank in which the transfer account is present, from the drop down list.

Branch

20 Character Maximum, Alphanumeric, Mandatory for Third Party transfer payment

If the payment type is ‘Self’, the branch associated with the investor account is defaulted from the unit holder level.

If you have chosen ‘Third Party’ as the payment type, Specify the branch name of the bank in which the transfer account is present.

A/c No

16 Character Maximum, Alphanumeric, Mandatory for Third Party transfer payment

Specify the number of the transfer account.

A/c Ccy

Alphanumeric, Mandatory for Third Party transfer payment

Specify the currency of the transfer account

The currency specified here must be a valid fund bank account currency.

A/c Type

1 Character Maximum, Alphanumeric, Mandatory for Third Party transfer payment

Select the account type (Fixed, Savings or Current) of the transfer account.

A/ct Holder Name

Alphanumeric, Mandatory for Third Party transfer payment

Specify the name of the holder of the third party account.

IBAN

36 Characters Only; Alphanumeric; Optional

Specify the IBAN (International Bank Account Number) of the account holder.

Payment Type

Alphanumeric, Mandatory

From the list, indicate whether the account transfer payment must be made to one of the investor’s preferred bank accounts (self) or to the bank account of a third party. You can also indicate that the transfer payment must be made to the bank account of a designated broker, by selecting the Entity option in this field

If you select the Self option in this field, all the preferred bank accounts specified for the investor in the unit holder account are listed in the Select Bank Account field. The default designated account is displayed in the bank account fields, and will be reckoned as the account to which the transfer payment must be made. You can choose any of these preferred bank accounts, as requested by the investor.

If you select the Third Party option in this field, then you must specify the bank account details of the third party account to which the transfer must be made, in the bank account fields in this section.

If you select the Entity option, specify the broker into whose bank account the transfer payment must be made, in the Broker field.

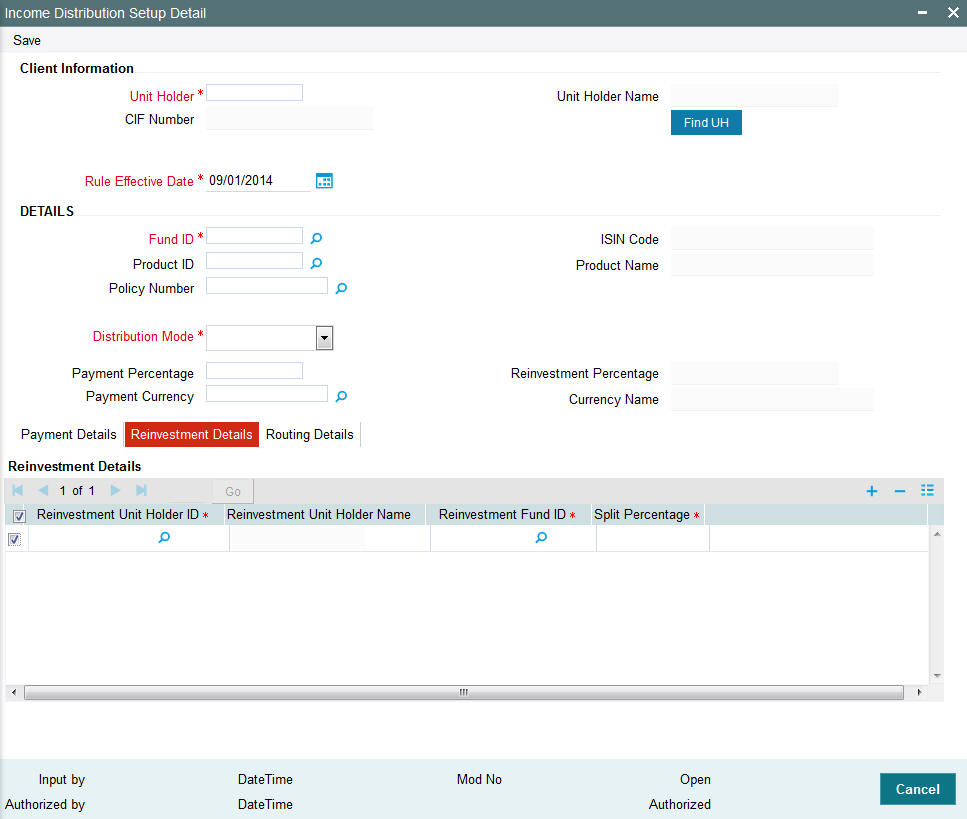

4.1.4 Reinvestment Details Tab

Click ‘Reinvestment Details’ tab to enter the details.

Reinvestment Unit Holder ID and Reinvestment Unitholder Name

12 Character Maximum, Alphanumeric, Mandatory

Specify the ID of the unit holder in whose account the income is to be reinvested. When you select the ID of the reinvestment unit holder, the name of the unit holder is displayed in the Reinvestment Unit Holder Name field.

Reinvestment Unit Holder Name

Display

Reinvestment Fund ID

6 Character Maximum, Alphanumeric, Mandatory

Select the ID of the fund in which the income is to be reinvested. The fund that you select here should be part of the same fund family as the fund from which the income was derived.

Split Percentage

Numeric, Mandatory

Specify the percentage of the derived income that is to be reinvested in the specified reinvestment unit holder's account, in the specified reinvestment fund. You can make any number of such entries, specifying a percentage for each combination. The sum total of all split percentages for all reinvestment unit holder – reinvestment fund ID combinations you have specified must be equal to one hundred percent.

In this section, you can define the option in which the investor can reinvest income earnings from the selected fund. The investor can reinvest earned income in any of the following ways:

- Reinvest either in the investor’s own unit holder account, or another investor’s account. In the latter case, the investor in whose account the reinvestment is proposed (that is, the Reinvestment Unit Holder) must belong to the same AMC as the source investor.

- Reinvest the income in any other fund. If the investor desires to do this, the reinvestment fund must belong to the same fund family as the fund from which the income is derived.

- Reinvest the income in as many target fund/unit holder combinations, subject to the constraints expressed above. This is again subject to the consideration that the sum of the percentages of reinvestment in all these combinations must be equal to 100.

Note

Reinvestment is only allowed into or out of a fund if so designated in the Corporate Actions profile for the fund and corporate action type.

If you have chosen either Both or Full Reinvestment as the distribution mode, you must specify all information in this section mandatory..

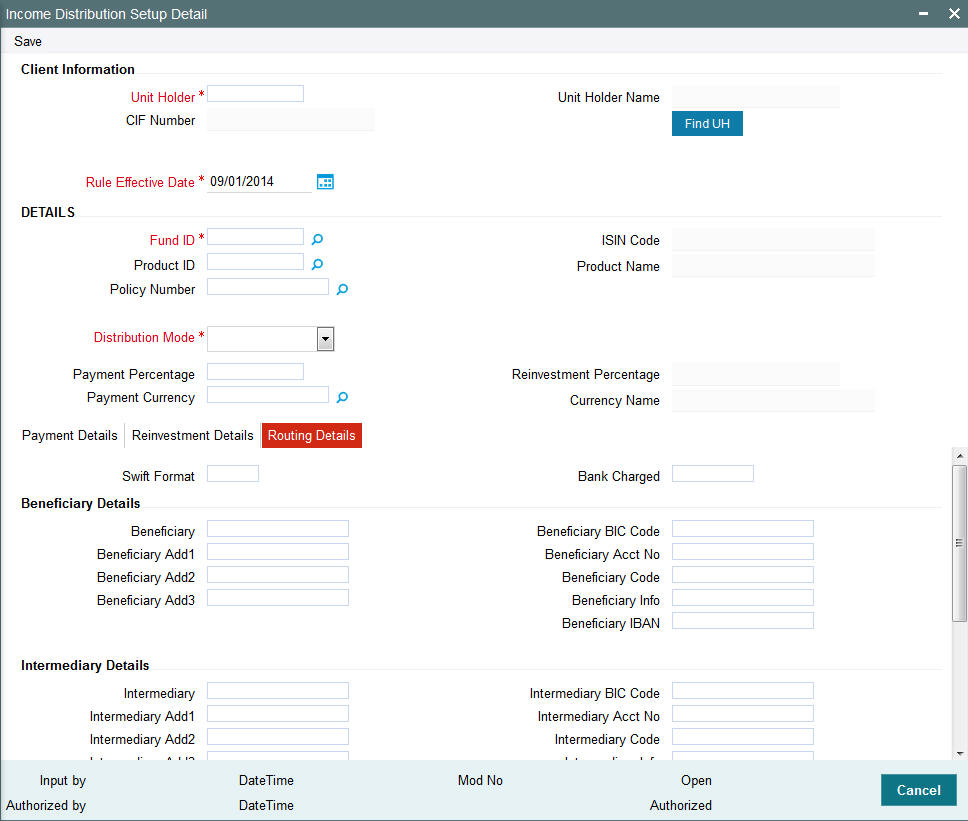

4.1.5 Routing Details Tab

FCIS provides the option to capture the bank routing details. At the time of transaction input, the routing details specified here are picked up for the combination of fund, transaction type and transaction currency. You can specify the routing details by clicking on 'Routing Details'.

You need to maintain the following details:

Swift Format

Optional

At the time of transaction input, the routing details specified here are picked up for the combination of fund, transaction type and transaction currency.

Bank Charged

Optional

Indicate whether the bank charges must be levied upon the beneficiary, the remitter or must be shared between the two.

Beneficiary Details

Beneficiary

Specify the beneficiary name.

Beneficiary Add 1

Specify the beneficiary address. There are three lines available for the same.

Beneficiary BIC Code

Specify the BIC code of the beneficiary.

Beneficiary Acct No

Specify the account number of the beneficiary.

Beneficiary Code

Specify the code of the beneficiary.

Beneficiary Info

Enter more information about the beneficiary.

Intermediary Details

Intermediary

Specify the intermediary detail.

Intermediary Add 1

Specify the intermediary address. There are three lines available for the same

Intermediary BIC Code

Specify the BIC code of the Intermediary.

Intermediary Acct No

Specify the account number of the Intermediary.

Intermediary Code

Specify the code of the Intermediary.

Intermediary Info

Enter more information about the Intermediary.

Save all the details to proceed or click cancel button to cancel the operation.

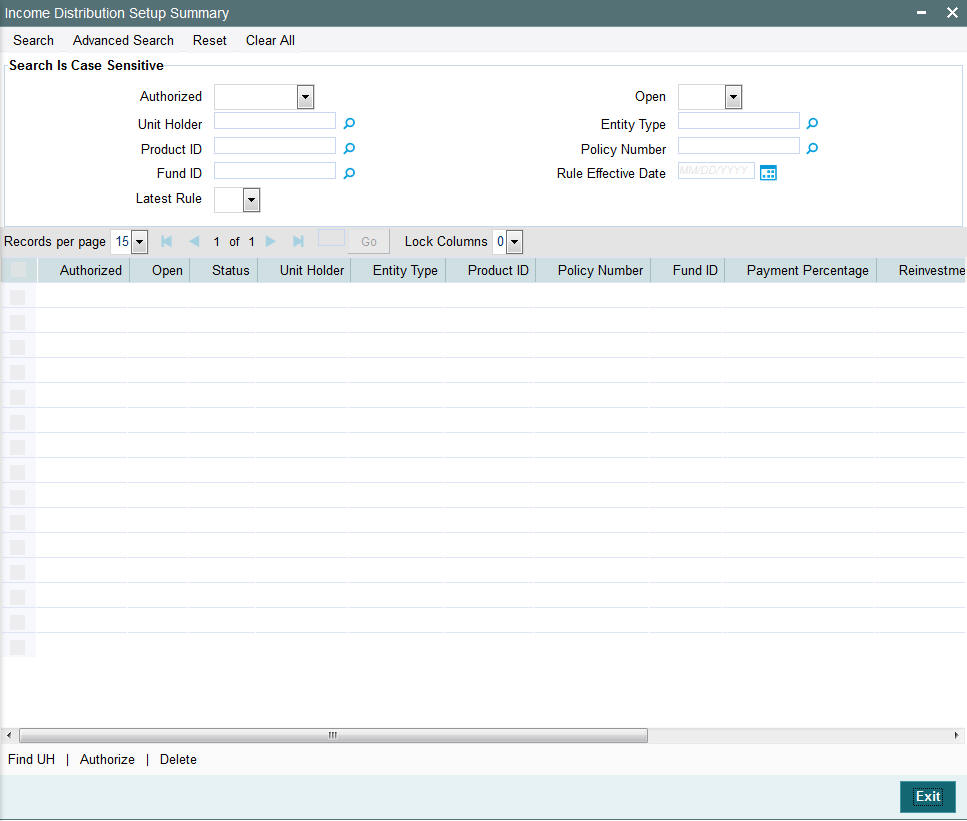

4.2 Income Distribution Setup Summary Screen

This section contains the following topics:

- Section 4.2.1, "Retrieving Income Distribution Setup Record"

- Section 4.2.2, "Editing Income Distribution Setup Record"

- Section 4.2.3, "Viewing Income Distribution Setup Record"

- Section 4.2.4, "Deleting Income Distribution Setup Record"

- Section 4.2.5, "Authorizing Income Distribution Setup"

- Section 4.2.6, "Amending Income Distribution Setup"

- Section 4.2.7, "Authorizing Amended Income Distribution Setup Details"

4.2.1 Retrieving Income Distribution Setup Record

After you set up the IDS options for an investor in the UH IDS Setup Detail screen, you can perform any of the operations before the record is authorized:

- Edit the specified options in the setup. At this stage, you can alter any of the details, other than the fund and the unit holder ID.

- Delete the setup.

To perform either operation, use the ‘Income Distribution Setup Summary’ screen. You can invoke this screen by typing ‘UTSUHIDS’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

You can retrieve a previously entered record in the Income Distribution Setup Summary screen, as follows:

- Specify any or all of the following details in the Income Distribution Setup Summary screen:

- The status of the transaction in the Authorized field. If you choose the “Blank Space” option, then all the transactions that involve the specified unit holder are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the records that involve the specified unit holder are retrieved.

- The Unit Holder

- The Product ID

- The Policy Number

- The Fund ID

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual record detail from the detail screen by doing query in the following manner:

- Press F7

- Input the Product ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for Product ID by using the combination of % and alphanumeric value as follows:

- Search by A%: System will fetch all the records whose Product ID starts from Alphabet ‘A’. For Example: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: System will fetch all the records whose Product ID ends by numeric value’ 7’. For Example: AGC17, GSD267, AGC77 and so forth.

- Search by %17%: System will fetch all the records whose Product ID contains the numeric value 17. For Example: GSD217, GSD172, AGC17 and so forth.

4.2.2 Editing Income Distribution Setup Record

You can modify the details of Income Distribution Setup parameters that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the INCOME DISTRIBUTION SETUP Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed record. The INCOME DISTRIBUTION SETUP Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The INCOME DISTRIBUTION SETUP Detail screen is closed and the changes made are reflected in the INCOME DISTRIBUTIN SETUP Summary screen.

4.2.3 Viewing Income Distribution Setup Record

To view a record that you have previously entered, you must retrieve the same in the INCOME DISTRIBUTION SETUP Summary screen, as follows:

- Invoke the INCOME DISTRIBUTION SETUP Summary Screen from the Browser.

- Select the status of the transaction that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The INCOME DISTRIBUTION SETUP Detail screen is displayed in View mode.

4.2.4 Deleting Income Distribution Setup Record

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the INCOME DISTRIBUTION SETUP Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The INCOME DISTRIBUTION SETUP Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

4.2.5 Authorizing Income Distribution Setup

An unauthorized Income Distribution Setup must be authorized in the system for it to be processed. To authorize a record:

- Invoke the INCOME DISTRIBUTION SETUP Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the Unauthorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The INCOME DISTRIBUTION SETUP Detail screen is displayed. Select Authorize operation from Action.

When the checker authorizes a record, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.2.6 Amending Income Distribution Setup

After an Income Distribution Setup is authorized, it can be modified using the Unlock operation from Action list. To make changes to a transaction after authorization:

- Invoke the INCOME DISTRIBUTION SETUP Summary screen from the Browser.

- Select the status of the transaction that you wish to retrieve for amendment. You can only amend only authorized records.

- Specify any or all of the details of the Income Distribution Setup in the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The INCOME DISTRIBUTION SETUP Detail screen is displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save the changes.

When you retrieve an IDS setup record for the purpose of amendment in this screen, it is displayed in the UH IDS Setup Detail screen, in Amend mode. All the non-editable field values are displayed as labels, while the editable fields are enabled for data entry changes.

Note

When you make changes to any authorized record in the system database through the amendment operation, the record with the amended information is saved as an unauthorized record in the system. For your amendment changes to be effective, the amended record must be subsequently authorized. When it is authorized, it is saved in the system database as an authorized record with the amendment information, and is effective.

4.2.7 Authorizing Amended Income Distribution Setup Details

An amended Income Distribution Setup record must be authorized for the amendment to be made effective in the system. The authorization of amended records can only be done from Agency branch Module.

The process of authorization is subsequently the same as that for normal records.

4.3 Unitholder Deal Maintenance Detail Screen

This section contains the following topics:

- Section 4.3.1, "Setting Up Deal for Investor"

- Section 4.3.2, "Invoking Unitholder Deal Maintenance Detail Screen"

4.3.1 Setting Up Deal for Investor

When you map a charge (or load) to a fund, or a load group, the loads are applied to transactions requested by all investors that transact in the fund or load group subject to the evaluated criteria of the loads matching the unit holder and the transaction.

In some cases, the AMC may wish to offer a special, unique load option to be applied on all transactions involving a specific CIF Account or unit holder. This could also be at the request of the investor. This special load option would override the existing load option mapped to the fund or load group. Such a load option is called a ‘deal’ for an investor.

The deal consists of specifying a new return value for any or all of the loads mapped to the fund or load group. You specify the new return value against an existing return value that is based on a percentage or a fixed amount for the load.

You can set up a deal:

- For a specific unit holder under a CIF customer account.

- For all unit holders under a CIF account.

- For a single, non-CIF unit holder.

- To be applicable to all transactions of the selected unit holder/ CIF unit holder in a specific fund.

- To be applicable to all transactions of the selected unit holder/ CIF unit holder in any or all of the funds under a specific load group.

- To be applicable on a specific load that has been mapped to a fund or load group.

The usage of a negotiated deal is different from an over-the-counter load override. Negotiated deals are generally done for special customers with pre-defined business agreements that are exceptional to the normal business rules.

To set up a deal for an investor, you use the ‘Unitholder Deal Maintenance Detail’ screen. You can invoke this screen by typing ‘UTDUHDEL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the UH Deal Setup Detail screen, set up the deal as follows:

- Select the investor (or CIF Account) for whom the deal is being setup, in the CIF Number or the Unit Holder ID field.

- Select the level at which the deal is to be applied.

- To set a deal as applicable to all unit holders under a CIF, check the Apply at CIF Level check box.

- To set a deal as applicable at either a load level, fund/product level or load group level, choose the desired option in the Apply At field.

- Specify the period, during which the deal is applicable, by indicating the start and end dates, in the Start Date and End Date fields.

- If the deal is applicable for a fund, select the desired fund in the Fund field, and the ISIN Code of the fund, in the ISIN Code field.

- If the deal is applicable for a load group, select the desired load group in the Load Group field.

- If the deal is applicable for a specific load that is mapped to the selected fund or load group, select the desired load in the Load field.

- In the Load Details section, specify the overridden return value that is to be deemed applicable for the required slab, in the Override To field.

- Save your changes.

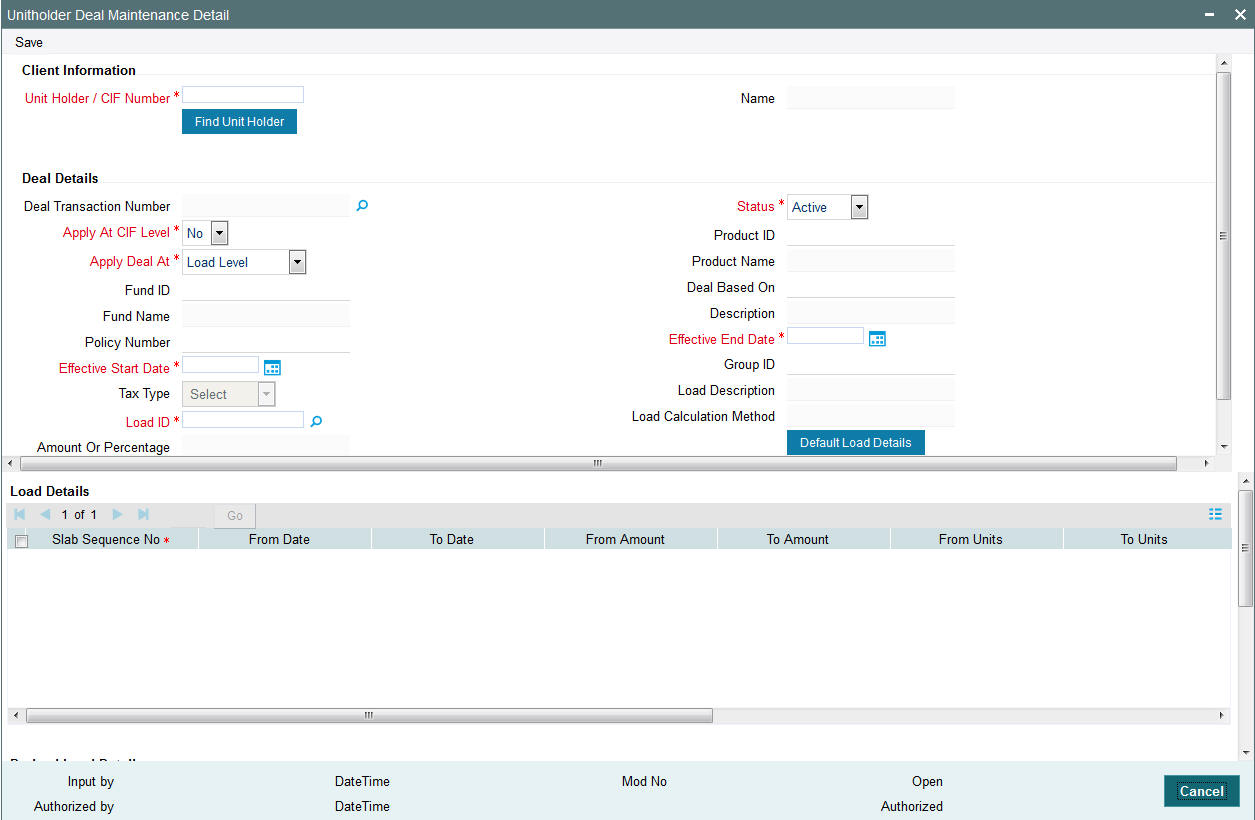

4.3.2 Invoking Unitholder Deal Maintenance Detail Screen

Invoke the ‘Unitholder Deal Maintenance Detail’ screen by typing ‘UTDUHDEL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the ‘Unitholder Deal Maintenance’ screen.

Client Information Section

In this section, select the ID of the unit holder for whom you are specifying deal options.

You can create deals for both authorized and unauthorized unit holders/CIF. If a deal is created for an unauthorized unit holder, the unit holder/CIF record must be authorized before the deal authorization process is put through. Else, the unit holder deal cannot be authorized.

Unit Holder for CIF

12 Character Maximum, Alphanumeric, Mandatory

From the list, select the CIF unit holder for whom you are creating the deal options.

CIF Number

9 Characters Maximum, Alphanumeric, Mandatory for setting up deal options for a unit holder under a CIF Account

Select or specify the number of the CIF Account under which the unit holder for whom you are creating the deal options is found.

When you specify the CIF Number, the name of the corresponding CIF Account is retrieved from the database and displayed alongside the field.

All the unit holder accounts under the CIF Account that you have selected are listed in the drop down list in the Unit Holders for CIF field.

Name

12 Character Maximum, Alphanumeric, Mandatory

Specify the ID of the non-CIF unit holder for whom you are setting up the deal in this screen. The name of the unit holder that you select is displayed alongside the field.

Deal Details Section

In this section, specify the level at which the deal must be applied for the selected unit holder.

Deal Transaction Number

Optional

Specify the transaction number of the deal.

Status

Display Only

By default, the status of all newly created deals in this screen is Active.

Apply at CIF Level

Optional

Check this box to indicate that the deal options you are setting up must be applicable to all unit holder accounts under the selected CIF customer account.

Note

When the deal is applied at CIF level, a similar set up is not possible at unit holder account level for the same fund / group and load, and vice versa.

Apply Deal At

Optional

From the list, select and indicate whether the deal must be applied on a single load (Load Level), a particular load for a fund (Fund Level), all funds in a load group (Load Group Level) or a Product (Product Level).

Note

If you select the option ‘Product Level’ or ‘Fund Level’, the fields ‘Fund’ and ‘ISIN Code’ will be displayed. These two fields are explained below.

Product ID

Specify the Product for which the deal is to be applied.

Fund ID

Optional if ‘Product Level’, Mandatory if ‘Fund Level’

This field will be displayed only if you have selected the option ‘Product Level’ or ‘Fund Level’ against the field ‘Apply At’.

If you have selected the option ‘Product Level’, you can set up a deal for the investor at the Product level. You have the option of specifying a particular fund to which the ‘Load’ that you select applies. If you do not select a fund, the load that you select will be applicable to all funds mapped to the Product.

If you have selected the option ‘Fund Level’, from the list, select the fund for which the deal would apply, for the selected unit holder.

Deal Based On

Mandatory

Select the deal based on from the following options maintained:

- Inclusion Percentage, then the calculation of taxes are as follows:

- Basis Annual Tax = Gross Annualized Amount * Load Return Value

- Annual Tax = Apply the Product With Holding Tax slab basis load on Basis Annual Tax

- Flat Rate Percentage, then the annual tax is calculated as:

- Annual Tax = Policy Annuity Value * Load Return Value

- Flat Rate Amount, then the annual tax is calculated as:

- Basis Amount = Load Return Value * 12 and

- Effective Rate = Basis Amount * 100 / Gross Annualized Amount

- Annual Tax = (Gross Annualized Amount * Effective Rate ) / 100

Note

An option "All" is also available to map a load across all the Products for a Policy Holder. If 'All' is selected then the Funds cannot be selected.

Policy Number

Specify the Policy for which the deal is to be applied.

Tax Type

You will be able to select the tax type only if you have selected ‘Apply At’ as ‘Product Level’.

The investor will be charged for tax and the tax rate will be calculated based on the method of tax calculation you specify. The tax can be either calculated as Tax Directives or Tax Instructions.

Tax Directives: Tax Directives is the tax rate provided by the SARS to the investors. The investors, in turn will instruct the tax that has to be deducted. Accordingly, the system will deduct the tax rate specified by the investor instead of the tax slab that is maintained in the ‘Withholding Tax Setup’ screen.

Refer to the chapter ‘Maintaining Reference Information’ for details on maintaining tax slabs.

Based on the tax directive submitted by the investor at the UH level, the UH deal for the tax load will be maintained.

- Tax Instructions: Tax Instructions is the tax rate suggested by the investors to deduct the tax. However, the system will compare the suggested tax rate with that of the tax slabs maintained. If the value of the suggested tax rate is lower than the maintained tax slab, the system can apply the higher value of the tax rate.

Note

The tax directive or the tax instruction is at the policy level and not at the UH level.

Load Group ID

Alphanumeric, Mandatory if the deal is to be applied for all funds in a load group (Load Group Level)

From the list, select the load group for which the deal would apply, for the selected unit holder. For all transactions for the selected unit holder in any fund belonging to this load group, that occur between the deal start and end dates, the deal will be applied on the selected load.

Load ID

Alphanumeric, Mandatory

From the list, select the load for which you want to specify the new return value as required for the deal. For all transactions for the selected unit holder in the selected fund, that occur between the deal start and end dates, for which the selected load is applicable, the deal will be applied.

Effective Start Date (DD/MM/YYYY)

Date Format, Mandatory

Enter the date from which the deal is to be effective

Specify the date on and following which, the deal options must be applied for transactions for the selected unit holder, in the manner indicated in this record.

Effective End Date (DD/MM/YYYY)

Date Format, Mandatory

Enter the date to which the deal is to be effective.

Specify the last date on which, the deal options must be applied for transactions for the selected unit holder, in the manner indicated in this record.

Load Description

The description of the load selected is defaulted here.

Load Calculation Method

The Load method that is used for calculating the Load is defaulted here when u choose the load ID.

Amount or Percentage

Optional

This field is defaulted depending on whether the Load id selected is an amount based load or a percentage based load.

Specifying Load Details

In this section, you can specify the altered return value for the selected load that is applicable as required for the deal.

The Load details that are maintained gets defaulted in this tab, when the button ‘Default Load Details’ is clicked. For each load that you select in the Load field in the Deal Details section, the following details are displayed in this section, in display mode:

- Slab Sequence No, if any and their applicable boundaries.

- From Date

- To Date

- From Amount

- To Amount

- From Units

- To Units

- From Period

- To Period

- Return Value: The original Return Value for the load.

- Override To

Derived Load Details

- Load Id

- Description

- Load Percentage: Amount or Percentage (this is the basis on which the return value for the selected load is derived)

- Override To

In the Override To field, specify the new return value applicable for the load, as required for the deal, and click ‘Exit’ button.

4.4 Unitholder Deal Summary Screen

This section contains the following topics:

- Section 4.4.1, "Retrieving Deals for Investors"

- Section 4.4.2, "Editing Deals for Investors "

- Section 4.4.3, "Viewing Deals for Investors "

- Section 4.4.4, "Deleting Deals for Investors "

- Section 4.4.5, "Authorizing Deals for Investors"

- Section 4.4.6, "Amending Deals for Investors"

- Section 4.4.7, "Authorizing Amended Deals for Investors"

4.4.1 Retrieving Deals for Investors

After you set up the Deal options for an investor in the UH Deal Setup Detail screen, you can perform any of the following operations before the record is authorized:

- Edit the specified options in the setup. At this stage, you can alter any of the details.

- Delete the setup.

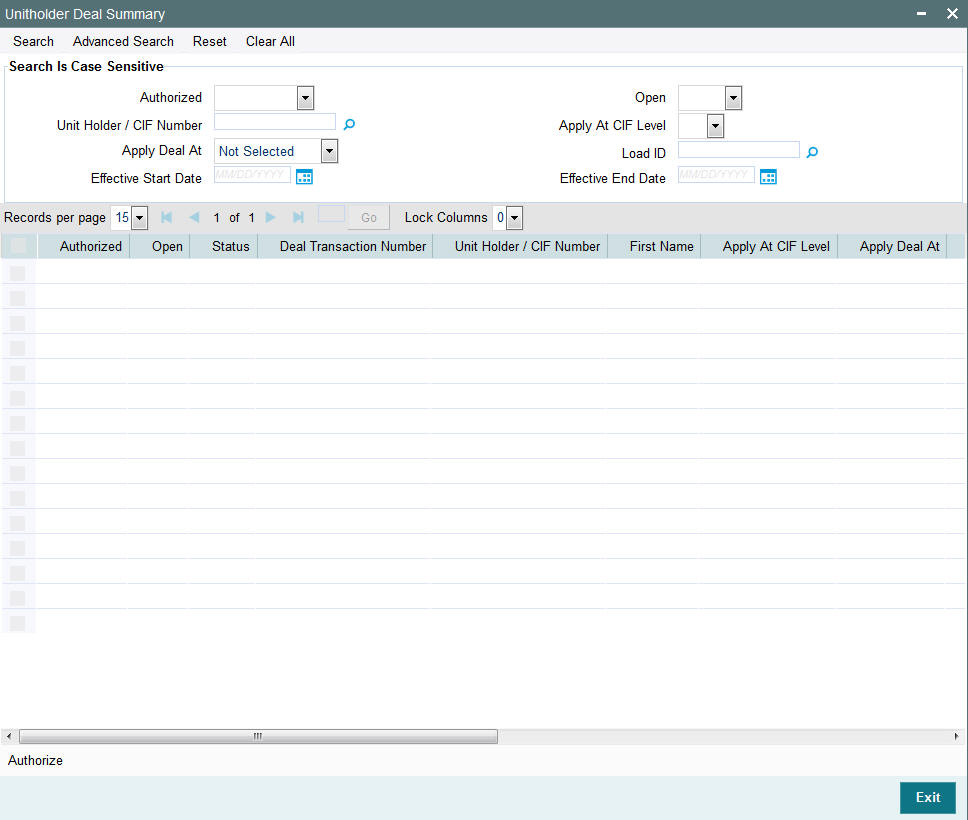

To perform either operation, use the ‘Unitholder Deal Summary’ screen. You can invoke this screen by typing ‘UTSUHDEL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following screen is invoked:

You can retrieve a previously entered record in the Unitholder Deal Summary screen, as follows:

- Specify any or all of the following details in the Unitholder Deal Summary screen:

- The status of the record in the Authorized field. If you choose the “Blank Space” option, then all the records that involve the specified unit holder are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the records that involve the specified unit holder are retrieved.

- The Unit Holder/ CIF Number

- The Apply At CIF Level

- The Apply Deal At

- The Load ID

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual transaction detail from the detail screen by doing query in the following manner:

- Press F7

- Input the Load ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for Load ID by using the combination of % and alphanumeric value as follows:

- Search by A%: System will fetch all the records whose Load ID starts

from Alphabet ‘A’.

For example: AGC17, AGVO6, AGC74 and so forth. - Search by %7: System will fetch all the records whose Load ID ends

by numeric value’ 7’.

For Example: AGC17, GSD267, AGC77 and so forth. - Search by %17%: System will fetch all the records whose Load ID contains

the numeric value 17.

For Example: GSD217, GSD172, AGC17 and so forth.

4.4.2 Editing Deals for Investors

You can modify the details of Unitholder Deal parameters that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Unitholder Deal Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The Unitholder Deal Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The Unitholder Deal Detail screen is closed and the changes made are reflected in the Unitholder Deal Summary screen.

4.4.3 Viewing Deals for Investors

To view a record that you have previously entered, you must retrieve the same in the Unitholder Deal Summary screen, as follows:

- Invoke the Unitholder Deal Summary Screen from the Browser.

- Select the status of the transaction that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized/ Authorized option.

- Specify any or all of the details of the transaction in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The Unitholder Deal Detail screen is displayed in View mode.

4.4.4 Deleting Deals for Investors

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the Unitholder Deal Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The Unitholder Deal Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

4.4.5 Authorizing Deals for Investors

An unauthorized Unitholder Deal records must be authorized in the system for it to be processed. To authorize a record:

- Invoke the Unitholder Deal Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the Unauthorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The Unitholder Deal Detail screen is displayed. Select Authorize operation from Action.

When the checker authorizes a transaction, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.4.6 Amending Deals for Investors

After an Unitholder Deal record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization:

- Invoke the Unitholder Deal Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend only authorized records.

- Specify any or all of the details of the Unitholder Deal in the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Unitholder Deal Detail screen is displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save the changes.

4.4.7 Authorizing Amended Deals for Investors

An amended Unitholder Deal record must be authorized for the amendment to be made effective in the system. The authorization of amended records can only be done from Fund Manager Module and Agency branch Module.

The process of authorization is subsequently the same as that for normal transactions.

When you retrieve a deal record for the purpose of amendment in this screen, it is displayed in the UH Deal Setup Detail screen, in Amend mode. All the non-editable field values are displayed as labels, while the editable fields are enabled for data entry changes.

Note

When you make changes to any authorized record in the system database through the amendment operation, the record with the amended information is saved as an unauthorized record in the system. For your amendment changes to be effective, the amended record must be subsequently authorized. When it is authorized, it is saved in the system database as an authorized record with the amendment information, and is effective.

You can cancel an existing negotiated deal by changing the status to cancel. When you authorize this change, the deal set up is nullified.

4.5 LOI Adjust Proc Screen

This section contains the following topics:

- Section 4.5.1, "Defining Letters of Intent"

- Section 4.5.2, "Non-fulfilling of Letter of Intent"

- Section 4.5.3, "Setting up Letter of Intent Options for Investor"

- Section 4.5.4, "Invoking LOI Adjust Proc Screen"

4.5.1 Defining Letters of Intent

An investor may promise to invest a certain volume of capital in the funds of the AMC within a certain period. Sometimes, the AMC offers the investor a reduced commission or charge for such investment. Such indemnification from the investor is known as a Letter of Intent.

Any investor that chooses to invest using a Letter of Intent is known as an LOI investor in the system.

Example

An investor, Mrs. Frances Smith, promises to bring in investment worth 500000 USD to the Terry Wynan Growth Fund floated by your AMC, within the space of 3 months dating from 5th May 2003. She indemnifies this through a Letter of Intent. On 5th May 2003, she makes her first investment of 100000 USD.

This means that by the 4th of August, 2003, Mrs. Smith promises to invest the remaining indemnified amount (i.e., 500000 USD – 100000 USD = 400000 USD) in the said fund. She could do so in one transaction worth 400000 USD, or a series of transactions cumulatively worth 400000 USD.

Let us suppose the following charge option for the Terry Wynan Growth Fund, as defined by your AMC for normal investment:

Slab |

From Amount |

To Amount |

Charge percentage per transaction |

1 |

0 |

100000 |

5 |

2 |

100000 |

200000 |

4 |

3 |

200000 |

300000 |

3 |

4 |

300000 |

400000 |

2 |

5 |

400000 |

500000 |

1 |

Let us suppose that Mrs. Smith fulfills her Letter of Intent investment in the pattern specified below after 5th May 2003.

Transaction Reference Number |

Transaction Date |

Transaction Amount |

LOIREF1 |

05-05-2003 |

100000 |

LOIREF2 |

20-05-2003 |

100000 |

LOIREF3 |

05-06-2003 |

100000 |

LOIREF4 |

20-06-2003 |

100000 |

LOIREF5 |

05-07-2003 |

100000 |

For the transaction LOIREF1, the charge percentage actually applied would be as follows:

Slab for LOIREF1, as a normal transaction: Slab 1

Charge Percentage for normal investment transaction, as per charge setup: 5%

LOI Amount: 500000 USD

Slab for LOI Amount: Slab 5.

Charge Percentage actually applied for LOIREF1: 1% of transaction amount = 1% of 100000 USD.

Similarly, the applicable charge percentages for each of the LOI fulfillment transactions are derived, and they are displayed below:

Transaction Reference Number |

Transaction Date |

Transaction Amount |

Charge actually applied |

LOIREF1 |

05-05-2003 |

100000 |

1% |

LOIREF2 |

20-05-2003 |

100000 |

1% |

LOIREF3 |

05-06-2003 |

100000 |

1% |

LOIREF4 |

20-06-2003 |

100000 |

1% |

LOIREF5 |

05-07-2003 |

100000 |

1% |

Each investment made by Mrs. Smith after 5th May 2003 into the fund, will reduce the Letter of Intent amount remaining to be fulfilled. The amount remaining to be fulfilled is known as the ‘used up’ amount.

With the last investment on 5th July 2003, the Letter of Intent amount is fulfilled, or is said to be ‘used up’.

An investor that has opted to invest through a Letter of Intent can reduce the used up Letter of Intent amount within the defined period, by any of the following transactions:

- IPO or subscription transactions

- Standing instructions that result in subscription, switch or redemption transactions.

- Switch transactions

- Redemption transactions

- Transactions resulting from reinvestment of income.

4.5.2 Non-fulfilling of Letter of Intent

If an investor does not bring in the investment amount promised in a letter of intent, before the expiry of the letter of intent, it constitutes non-fulfilment, and the AMC can recover the applicable commission that would have been due without the letter of intent.

The system monitors the fulfilment of letters of intent. The following facilities are available in the system:

Prior Warning Report

On the date that marks the beginning of the start of the lead time period for the load group, a prior warning report is generated by the system during the Beginning of Day (BOD) process. This report contains information about those letters of intent that have not been fulfilled as on that date.

For instance, if the letter of intent expires on 15th June 2002 and the lead-time specified for the load group is 10 days, a BOD process is executed on 5th June 2002 to ascertain whether the investor has satisfied the letter of intent amount agreed upon. This verification is performed for all letters of intent.

The report identifies and displays the following information for each letter of intent for any investor which is unfulfilled as on the date that marks the beginning of the lead time period:

- LOI Number

- LOI start date

- LOI end date (expiry date)

- LOI amount

- Amount fulfilled or used up as on the current date

- Amount remaining unfulfilled as on the current date. This is computed as the difference between the LOI amount and the Amount Used Up as on the current date

- The Load Group to which the fund belongs, for which the LOI has been set up for the investor

- The lead time period specified for the load group

Post-Adjustment Report

In the event of non-fulfilment of a letter of intent, you can obtain a report (known as the post adjustment report) that displays the actual commission that would have been due on any transactions entered into by the investor, had the letter of intent not been applied.

4.5.3 Setting up Letter of Intent Options for Investor

In Oracle FLEXCUBE Investor Servicing, you can set up any or all of the following options for investors who choose to invest through a Letter of Intent, at the investor’s behest:

- The period during which the Letter of Intent will be fulfilled

- The amount indemnified in the Letter of Intent

- The load group in which the investor seeks to invest, through a Letter of Intent.

- The applicability of standing instruction transactions as a means of fulfilling Letters of Intent (i.e., reducing the LOI used up amount).

- The applicability of transactions put through earlier than the Letter of Intent period start date, as a means of reducing the Letter of Intent used up amount. Any period earlier than the start date is known as a prior period.

- The duration of a prior period, if applicable.

- For an LOI investor, you can designate any transaction requested by the investor as an LOI transaction, at the investor’s request. By so doing, the transaction will be taken into account to reduce the used up Letter of Intent amount.

Note

For an investor, you can only set up one Letter of Intent options record for a load group.

To set up the options requested by the investor for a Letter of Intent, use the ‘Unit Holder LOI Setup Detail’ screen. You can invoke this screen by typing ‘UTDUHLOI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In the UH LOI Detail screen, you must specify all the following details to set up the Letter of Intent option for an investor:

- The CIF Number of the CIF Account for whom the Letter of Intent is being set up, or the non-CIF unit holder for whom the options are being set up.

- The applicability of the Letter of Intent setup to all unit holders under a CIF Account. If applicable, indicate this by checking the Apply at CIF Level check box.

- The applicability of a prior period for fulfilling Letters of Intent. If applicable, indicate this by checking the Prior Period Applicable check box.

- Also indicate the duration of the prior period in days, in the Prior Period Duration field.

- The load group in which the investor seeks to invest, through the Letter of Intent, in the Load Group ID field.

- The amount indemnified in the Letter of Intent, in the LOI Amount field.

- The period during which the Letter of Intent will be fulfilled. To specify this, indicate the start and end dates that will define the period, in the Start Date and End Date fields.

- The currency in which the Letter of Intent amount will be deemed, in the LOI Ccy field.

- The applicability of standing instruction transactions as a means of reducing the Letter of Intent used up amount. If applicable, check the Include Standing Instructions check box.

- Any applicable remarks, in the Remarks field.

After making your specifications, save your changes by clicking the Save button. This setup must be authorized for it to be effective.

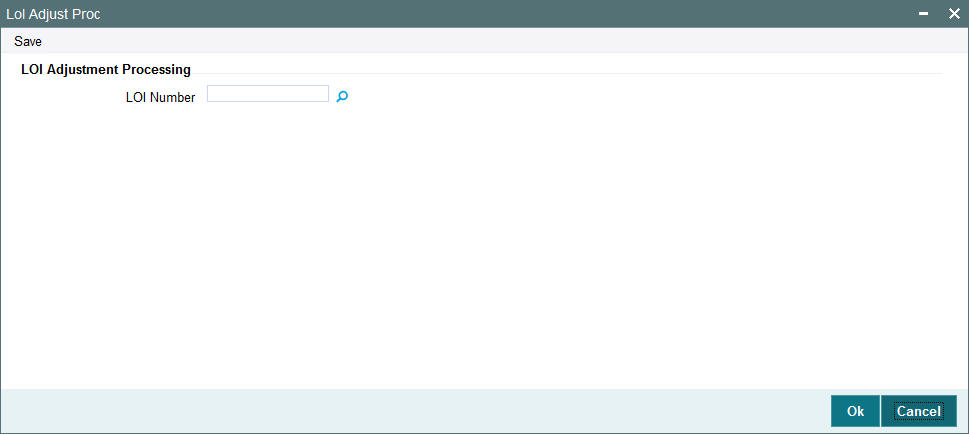

4.5.4 Invoking LOI Adjust Proc Screen

To obtain such a report, you must trigger the computation and storing of the actual commission data, from the system database. You can use the ‘LoI Adjust Proc’ screen for this. You can invoke this screen by typing ‘UTDLOIPR’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button. The ‘LoI Adjust Proc’ screen is displayed.

In this screen, you must specify the LOI number of the corresponding letter of intent, on the next business date after the expiry date of the letter of intent. Click on the Process button to trigger the process of computation and storage. Alternatively, if you do not specify the number, you can trigger the computation of commission data for all such letters of intent that are unfulfilled, after the expiry date.

After you have triggered the computation of commission data, in the LOI Adjustment Processing screen, you can use the LOI Non-Fulfilment menu item in the Batch menu to obtain the actual report.

This report contains details of the actual commission due on each of the transactions without considering the letter of intent. This amount must be recovered from the unit holder by the AMC.

The following details are displayed in the report for each letter of intent for any investor which is unfulfilled as on the next business date after the expiry date:

- LOI Number

- Letter of intent amount agreed (LOI amount).

- Letter of intent amount fulfilled (used up amount).

- ID of the load group to which the fund belongs, for which the LOI was set up for the investor.

- The funds in the load group.

- Transaction number, for each transaction designated as an LOI transaction.

- Commission collected for the transaction.

- Actual commission that should have been collected had there been no letter of intent.

- The loss borne by the AMC, which is computed as the difference between the commission collected and commission that should have been collected had there been no LOI.

The commission for each of the LOI transactions entered into during the LOI period is recomputed as if there had been no letter of intent. For each transaction, the actual commission collected and the commission that should have been collected without the LOI is displayed. The sum of the commissions will be subtracted from the actual commission collected and the difference is reported through the report.

LOI investors have the option of designating any single transaction they enter into, as a Letter of Intent transaction. If so designated, the transaction amount in such transactions will reduce the Letter of Intent used up amount.

4.6 Unit Holder LOI Setup Details Screen

This section contains the following topic:

4.6.1 Invoking Unit Holder LOI Detail Screen

Invoke the ‘Unit Holder LOI Setup Detail’ screen by typing ‘UTDUHLOI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select 'New' from the Actions menu in the Application tool bar or click new icon to enter the details of the Unit Holder LOI Setup screen.

UHD/CIFNo

9 Characters Maximum, Alphanumeric, Mandatory for setting up Letter of Intent options for a unit holder under a CIF Account

From the list, select the CIF unit holder for whom you are creating the Letter of Intent options.

When you specify the CIF Number, the name of the corresponding CIF Account is retrieved from the database and displayed alongside the field.

All the unit holder accounts under the CIF Account that you have selected are listed in the drop down list in the Unit Holders for CIF field.

First Name

12 Character Maximum, Alphanumeric, Mandatory

Specify the ID of the non-CIF unit holder for whom you are setting up the Letter of Intent options in this screen. The First Name of the unit holder that you select is displayed alongside the field.

Apply At

Optional

Check this box to indicate that the Letter of Intent options you are setting up must be applicable to all unit holder accounts under the selected CIF customer account.

LOI Number

System Generated

LOI End Date (DD/MM/YYYY)

Date Format, Mandatory

Indicate the latest date by which the investor would fulfill the amount indemnified in the Letter of Intent.

LOI Start Date (DD/MM/YYYY)

Date Format, Mandatory

Indicate the date on which the period of the Letter of Intent commences. Following this date, the investor will have to fulfill the Letter of Intent.

If a prior period is applicable, then the duration of the prior period is reckoned from the date you specify here.

Prior Period Duration

Optional (Mandatory if prior period is applicable)

Specify the duration of the prior period (in days), to be reckoned from the Letter of Intent period start date.

If a prior period is specified, the used up amount on an LOI must be updated during authorization, based on the transactions that have been allocated before the LOI start date, within the prior period.

Prior Period Applicable

Optional

Check this box to indicate that transactions entered into by the investor prior to the commencement of the Letter of Intent period may also be reckoned for reduction of the used up amount.

LOI Amount

Numeric, Mandatory

Specify the amount indemnified by the investor through the letter of intent.

LOI CCY

Alphanumeric, Mandatory

Select the currency in which the Letter of Intent amount will be reckoned.

Include Standing Instructions

Mandatory

If you want to include Standing Instruction, select ‘Yes’. Else, select ‘No’.

Currency Name

Display

The system displays the name of the currency.

Remarks

255 Characters Maximum, Alphanumeric, Optional

You can enter any narrative or descriptive text about the Letter of Intent here.

Group ID

Alphanumeric, Mandatory

Select the load group in which the investor desires to invest, through the Letter of Intent.

Used-up Amount

Display Only

On any given date after the LOI Start Date, the amount displayed in this field reflects the portion of the Letter of Intent amount that the investor has already fulfilled as on that date.

When you are creating the Letter of Intent options for the investor for the first time, this field contains a ‘zero’ value.

You cannot alter the value displayed in this field at any time.

LOI Status

Display Only

At any given date after the LOI Start Date, the displayed value in this field reflects the status of the Letter of Intent option defined for the selected unit holder.

When you are creating the Letter of Intent options for the investor for the first time, the ‘Active’ option is displayed in this field.

If you have cancelled the Letter of Intent through an amendment, the ‘Cancel’ option is displayed in this field. In this state, the Letter of Intent is no longer valid and will not be validated for during any transactions of the investor.

You cannot alter the status displayed in this field at any juncture.

4.7 Unit Holder LOI Setup Summary Screen

This section contains the following topics:

- Section 4.7.1, "Retrieving LOI Setup Options for Investor"

- Section 4.7.2, "Editing LOI Setup Options for Investor"

- Section 4.7.3, "Viewing LOI Setup Options for Investor"

- Section 4.7.4, "Deleting LOI Setup Options for Investor"

- Section 4.7.5, "Authorizing LOI Setup Options for Investor"

- Section 4.7.6, "Amending LOI Setup Options for Investor"

- Section 4.7.7, "Authorizing Amended LOI Setup Options for Investor"

4.7.1 Retrieving LOI Setup Options for Investor

After you set up the Letter of Intent options for an investor in the UH LOI Setup Detail screen, you can perform any of the following operations before the record is authorized:

- Edit the specified options in the setup. At this stage, you can alter any of the details.

- Delete the setup.

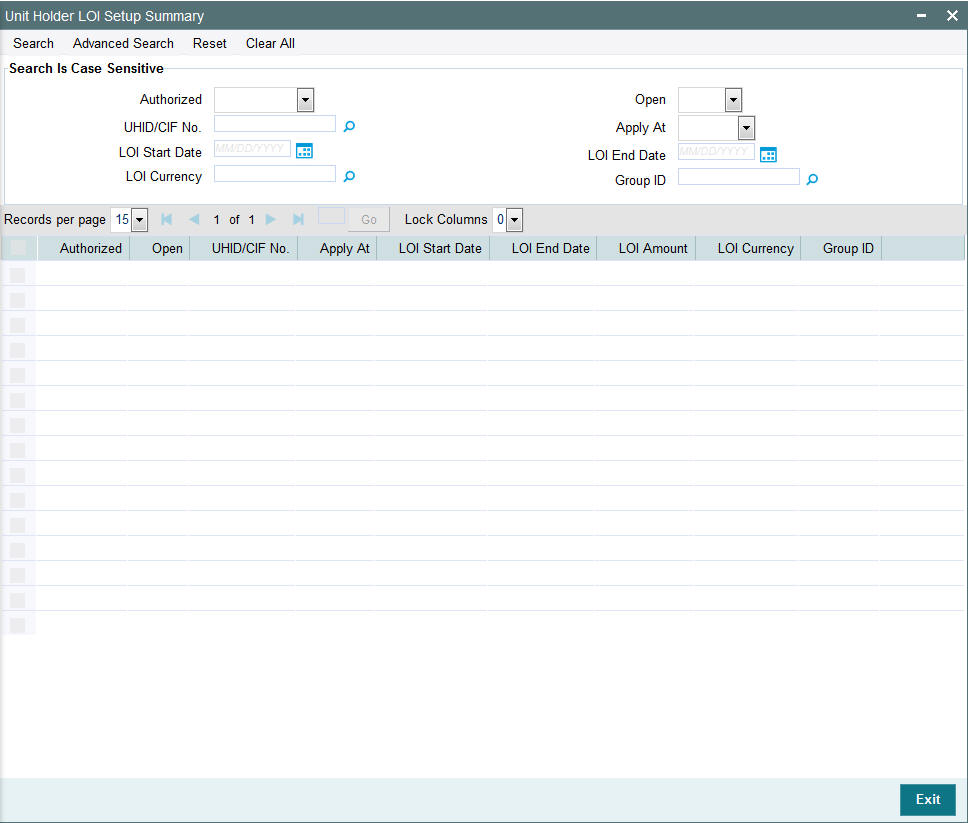

To perform either operation, use the ‘Unit Holder LOI Setup Summary’ screen. You can invoke this screen by typing ‘UTSUHLOI’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following screen is invoked:

You can retrieve a previously entered record in the UH LOI Summary screen, as follows:

- Specify any or all of the following details in the UH LOI Summary screen:

- The status of the transaction in the Authorized field. If you choose the “Blank Space” option, then all the records that involve the specified unit holder are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the records that involve the specified unit holder are retrieved.

- The Unit Holder / CIF Number

- The Apply At

- The LOI Start Date

- The LOI End Date

- LOI Ccy

- The Group ID

Click ‘Search’ button to view the records. All records with the specified details are retrieved and displayed in the lower portion of the screen.

You can also retrieve the individual transaction detail from the detail screen by doing query in the following manner:

- Press F7

- Input the Group ID

- Press F8

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operation by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

Example

You can search the record for Group ID by using the combination of % and alphanumeric value as follows:

- Search by A%: System will fetch all the records whose Group ID starts from Alphabet ‘A’. For example: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: System will fetch all the records whose Group ID ends by numeric value’ 7’. For example: AGC17, GSD267, AGC77 and so forth.

- Search by %17%:- System will fetch all the records whose Group ID contains the numeric value. For example: GSD217, GSD172, AGC17 and so forth.

4.7.2 Editing LOI Setup Options for Investor

You can modify the details of UH LOI parameters that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the UH LOI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records that are unauthorized. Accordingly, choose the Unauthorized option.

- Specify any or all of the details in the corresponding fields to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The UH LOI Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information.

- Click Save to save your changes. The UH LOI Detail screen is closed and the changes made are reflected in the UH LOI Summary screen.

4.7.3 Viewing LOI Setup Options for Investor

To view a record that you have previously entered, you must retrieve the same in the UH LOI Summary screen, as follows:

- Invoke the UH LOI Summary Screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records. The UH LOI Detail screen is displayed in View mode.

4.7.4 Deleting LOI Setup Options for Investor

You can delete only unauthorized records in the system. To delete a record that you have previously entered:

- Invoke the UH LOI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete. The UH LOI Detail screen is displayed.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

4.7.5 Authorizing LOI Setup Options for Investor

An unauthorized UH LOI record must be authorized in the system for it to be processed. To authorize a record:

- Invoke the UH LOI Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the Unauthorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All record with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the transaction that you wish to authorize. The UH LOI Detail screen is displayed. Select Authorize operation from Action.

When the checker authorizes a transaction, details of validations, if any, that were overridden by the maker of the transaction during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the transaction.

4.7.6 Amending LOI Setup Options for Investor

After an UH LOI record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a transaction after authorization:

- Invoke the UH LOI Summary screen from the Browser.

- Select the status of the transaction that you wish to retrieve for amendment. You can only amend only authorized records.

- Specify any or all of the details of the UH LOI in the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The UH LOI Detail screen is displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save the changes.

When you retrieve an LOI record for the purpose of amendment in this screen, it is displayed in the UH LOI Detail screen, in Amend mode. All the non-editable field values are displayed as labels, while the editable fields are enabled for data entry changes.

Note