3. Setting up Fund Rules

This chapter contains the following sections:

- Section 3.1, "Fund Rule"

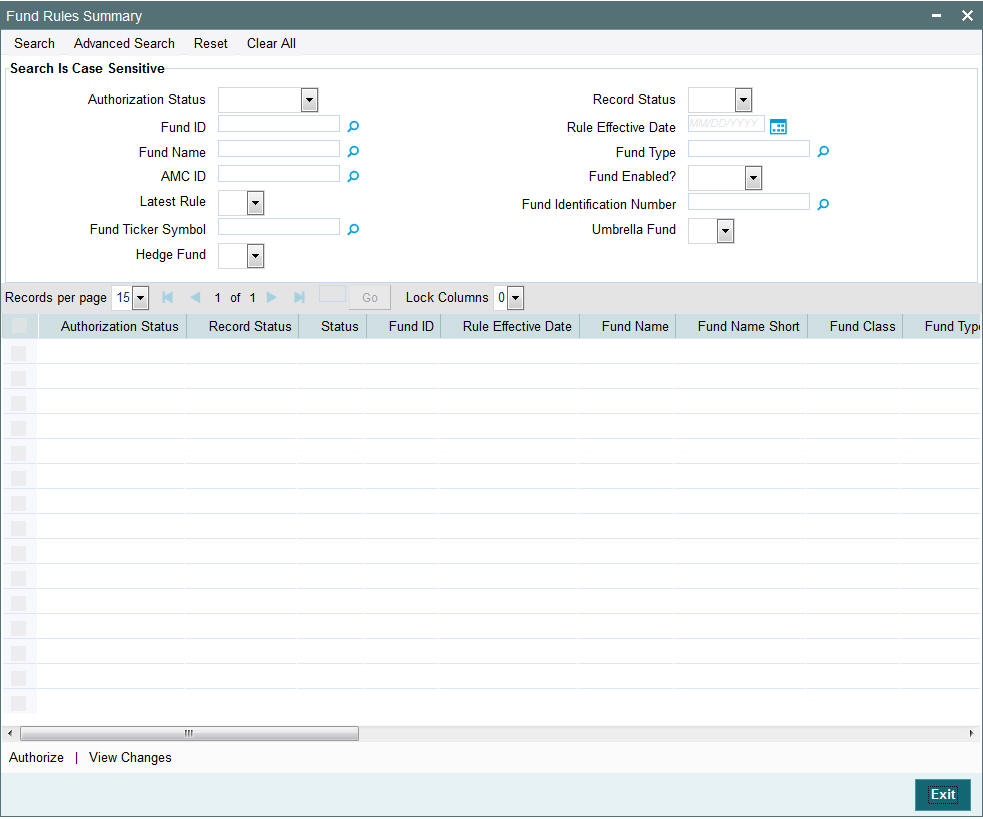

- Section 3.2, "Fund Rules Summary Screen"

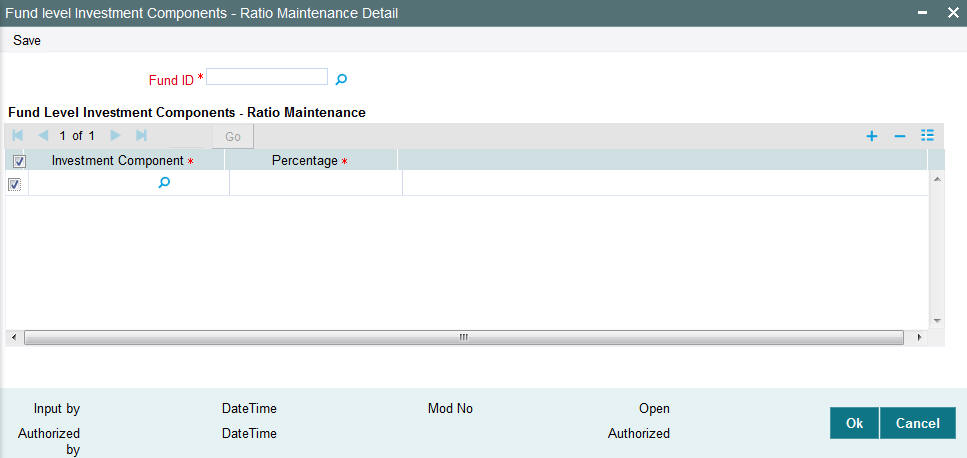

- Section 3.3, "Fund Investment Components"

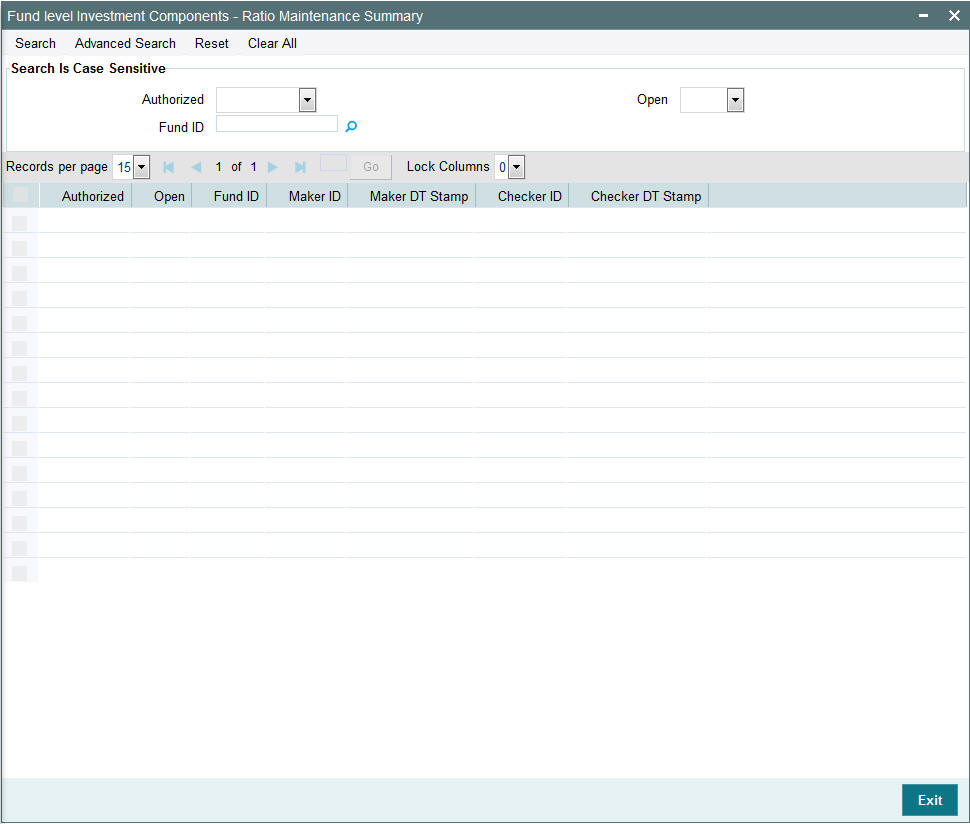

- Section 3.4, "Fund Investment Component Summary Screen"

3.1 Fund Rule

This section contains the following topics:

- Section 3.1.1, "Setting up Fund Rules"

- Section 3.1.2, "Invoking Fund Rule Screen"

- Section 3.1.3, "Maintaining Fund Demographics"

- Section 3.1.4, "Multi Language Details Button"

- Section 3.1.5, "Amount Limits for IRA Transactions Button"

- Section 3.1.6, "Corporate Actions Button"

- Section 3.1.7, "Shares Characteristics Button"

- Section 3.1.8, "General Operating Rules Tab"

- Section 3.1.9, "Hedge Fund Tab"

- Section 3.1.10, "Transaction Processing Rules Button"

- Section 3.1.11, "Fund Load Button "

- Section 3.1.12, "Fund Formula Setup Button"

- Section 3.1.13, "Fund Residency Restrictions Button"

- Section 3.1.14, "Fund Sale Country Restrictions Button"

- Section 3.1.15, "Fund Transaction Currencies Button"

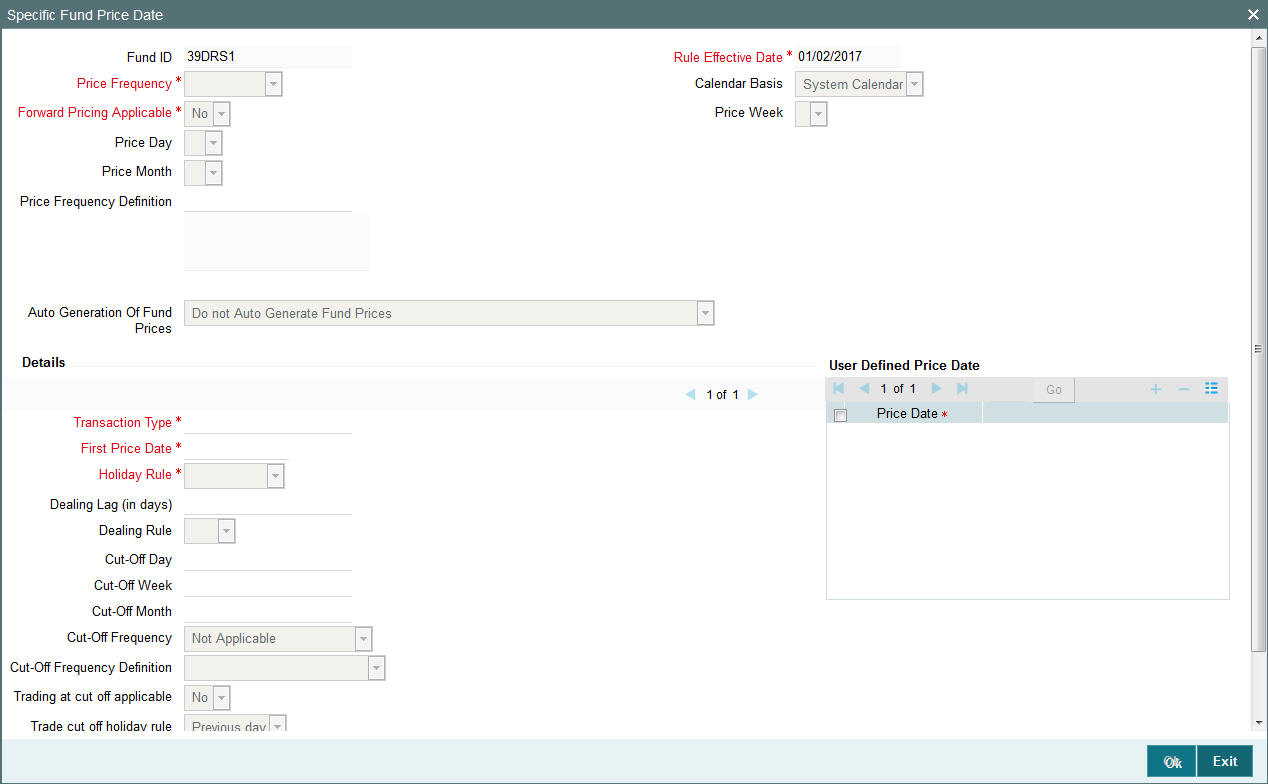

- Section 3.1.16, "Specific Price Dates Button"

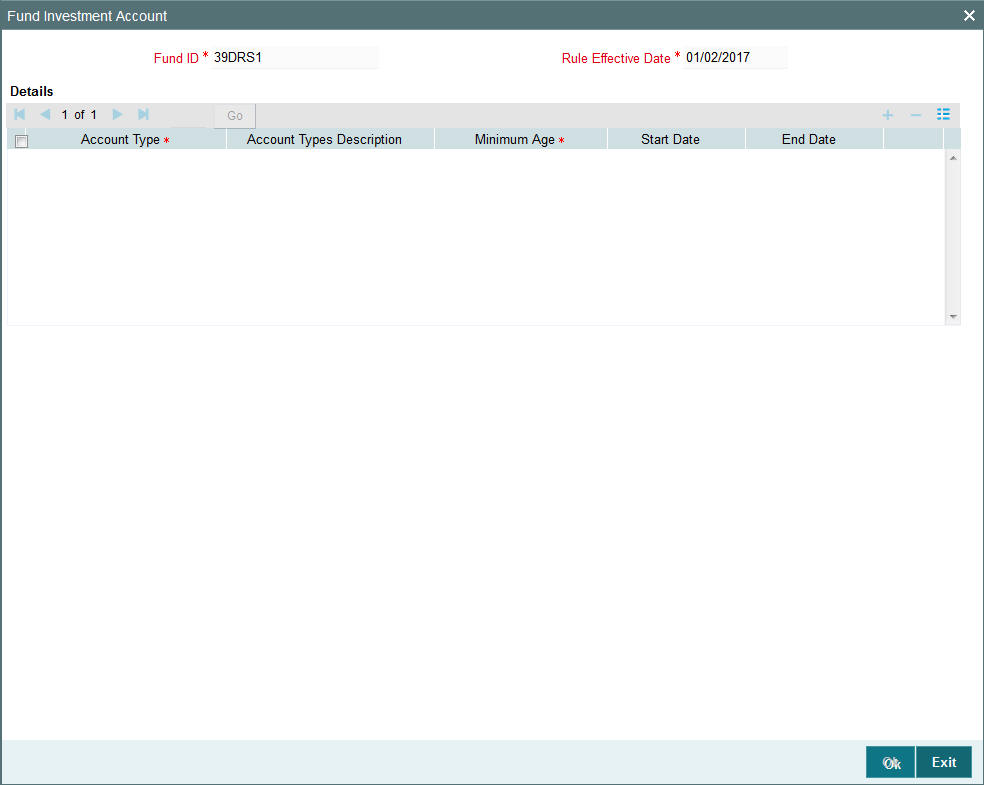

- Section 3.1.17, "Fund Investment Account Button"

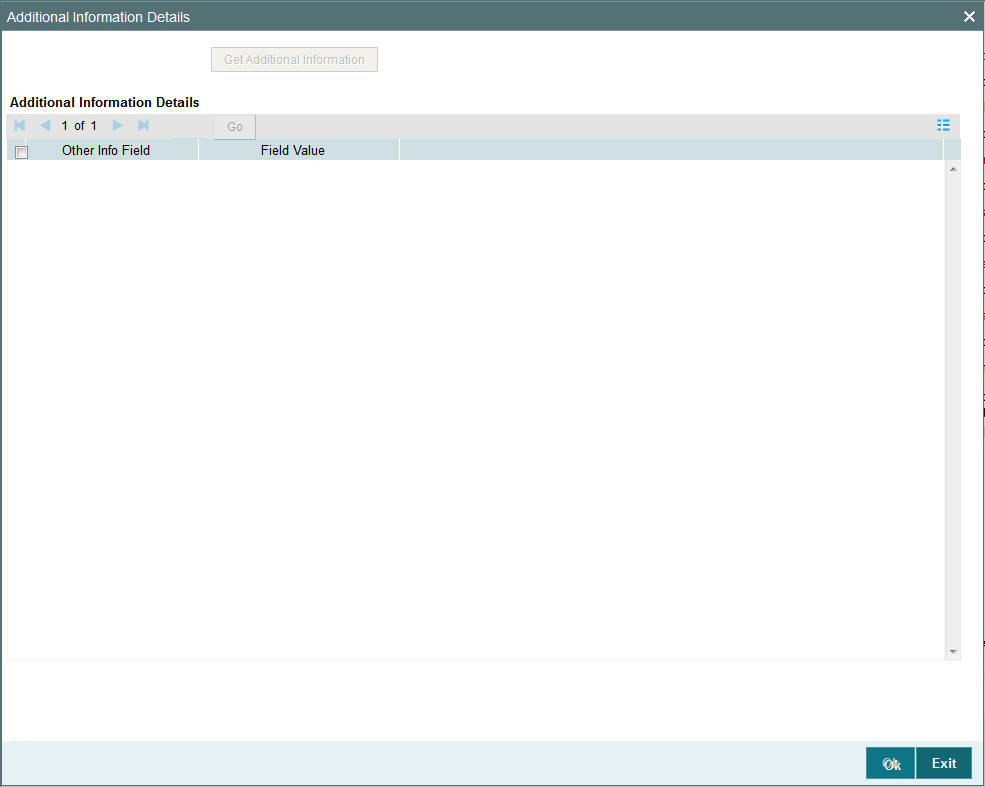

- Section 3.1.18, "Additional Information Button"

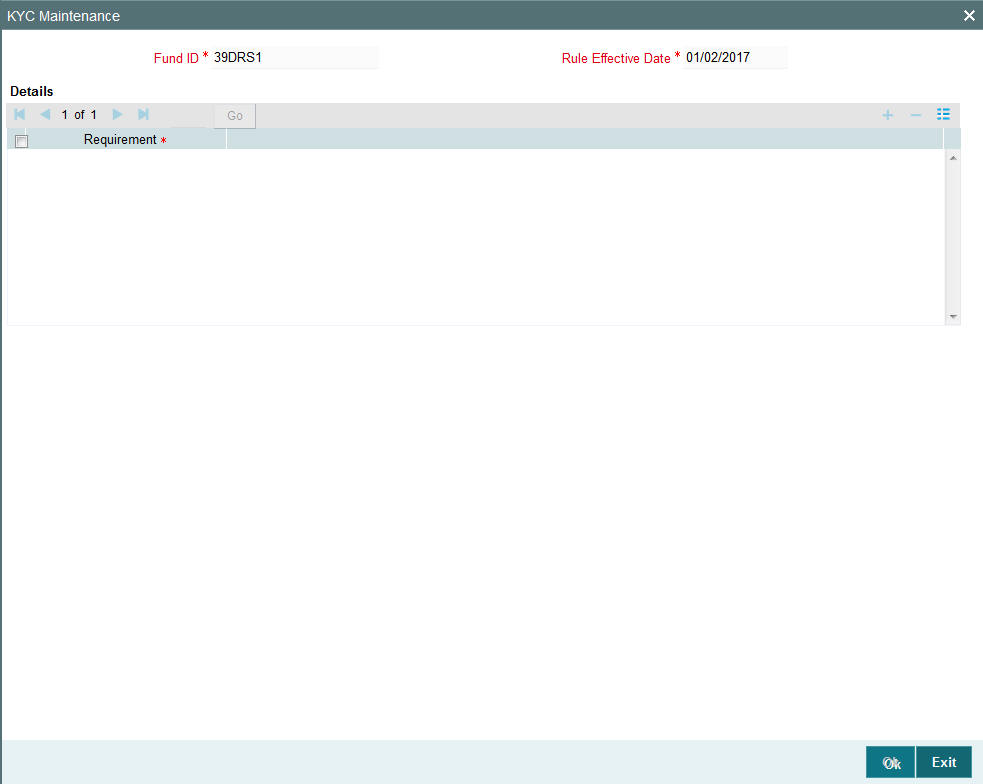

- Section 3.1.19, "KYC Maintenance Button"

3.1.1 Setting up Fund Rules

In Oracle FLEXCUBE Investor Servicing, each fund that the AMC wishes to maintain can be entered into the system database.

Oracle FLEXCUBE Investor Servicing enables you to specify a set of logically grouped guidelines for each fund, which pertain to aspect of the method of operation of the fund. Each of these logically grouped sets of guidelines is distinct and unique, and is called a ‘fund rule’.

For each fund, you can maintain a complete set of such guidelines or ‘fund rules’. The options chosen by the AMC in specifying each of the rules will be directives to the system for the operation of the fund. Therefore, Oracle FLEXCUBE Investor Servicing processes each transaction in a fund according to the fund rules that you maintain for the fund.

Whenever you need to refer to any or all guidelines about the operation of a fund, you can refer to the fund rule records that you have maintained for the fund.

Some fund rules are mandatory and you must set them up before you authorize a fund, while others are optional, and you may be set up as and when required.

There are many different fund rules that may be defined for a fund and these may be enumerated as follows:

Fund Demographics

This is the entry point for setting up a fund in the system. The Fund name, Fund ID, the base currency for the fund, the country that the fund is based in and the effective date for the fund rules may be set here. You can also designate the Type and the Class that the fund comes under. You can specify the AMC that operates the fund.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

Corporate Actions

In this section, you can specify the rules that will govern the pattern of processing corporate actions for the fund. This includes the income distribution by the fund to its unit holders. . These rules include the Dividend Declaration and Payment frequencies, the Default Distribution Mode, Tax Deducted at Source (TDS) details, the lead times for the different dates such as the Book Closing, Freeze Holdings, and Dividend Payment dates.

Setting up this rule is optional, and you can set it up for a fund as and when required. It is recommended that you set it up before you authorize the fund.

For corporate actions such as dividend, you can set up individual, separate rules for processing cash dividend as well as stock dividends for the same fund.

General Operating Rules

In this section, you can designate the rules that will govern the operation of the fund. You can specify the frequency at which the fund price is declared. You can also designate a fund to have automatic redemption.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

Shares Characteristics

These rules govern the features of shares that are issued in the fund. You can designate a fund as scrip-less fund or a scrip-based fund that issues certificates. The limits on the number of unit holders that must be allowed to subscribe to the fund and the ceiling on the capital that may be issued by the fund may also be specified in this rule. You can set up the standard lot, the maximum and minimum certificate denominations and the issue number range. You can also set up the limits for Foreign Investors in the fund, either as an amount or as a percentage of the issued share capital.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

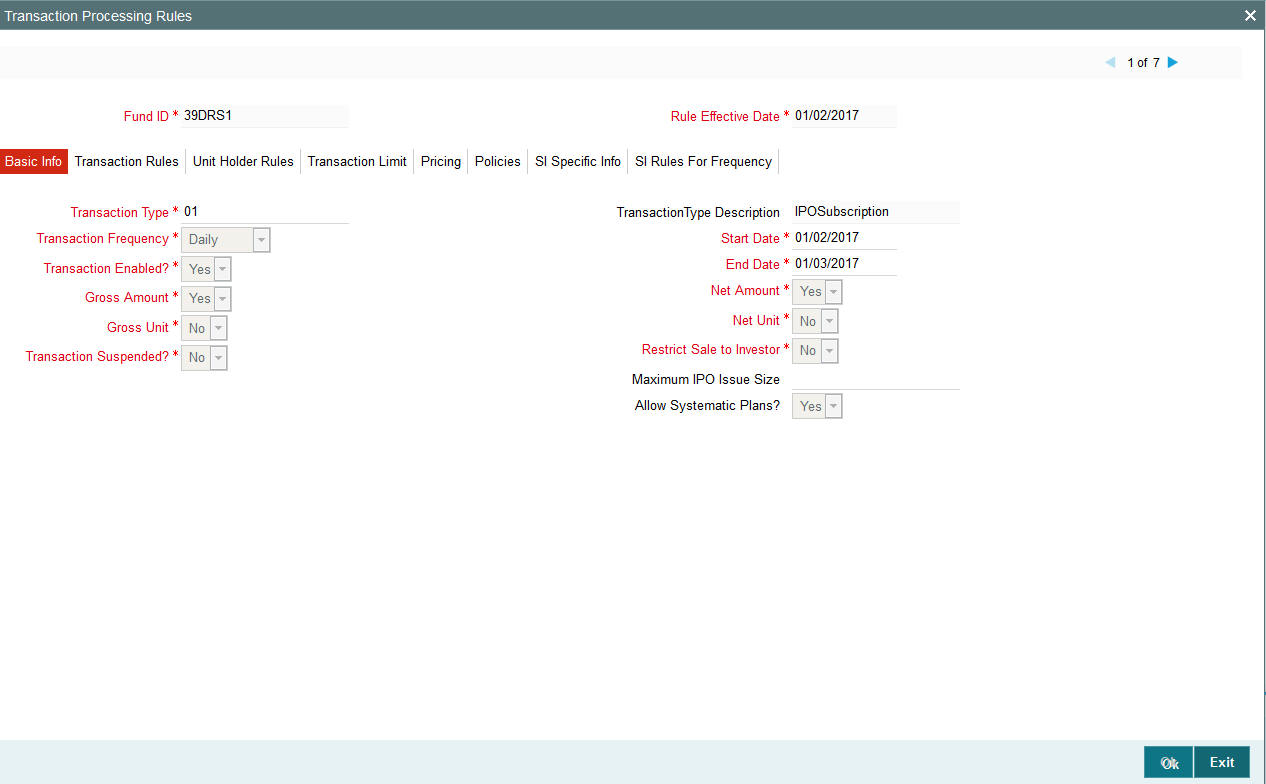

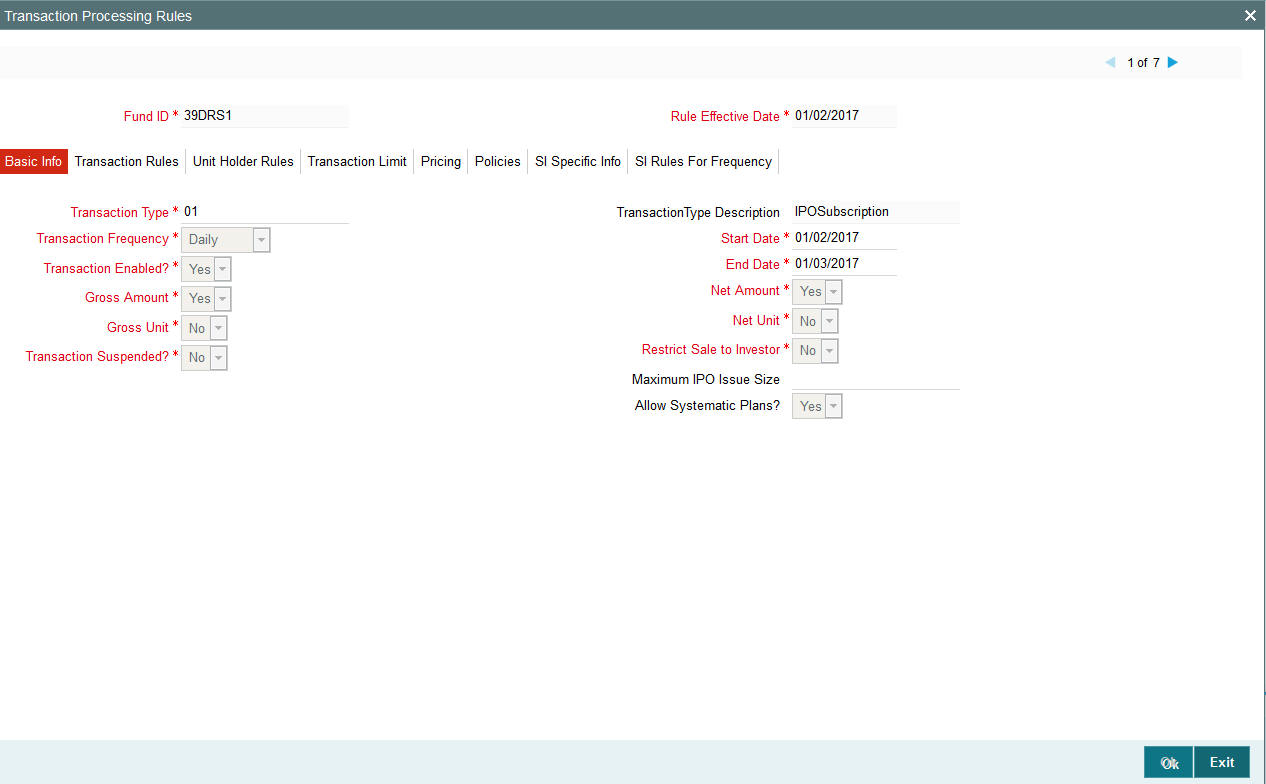

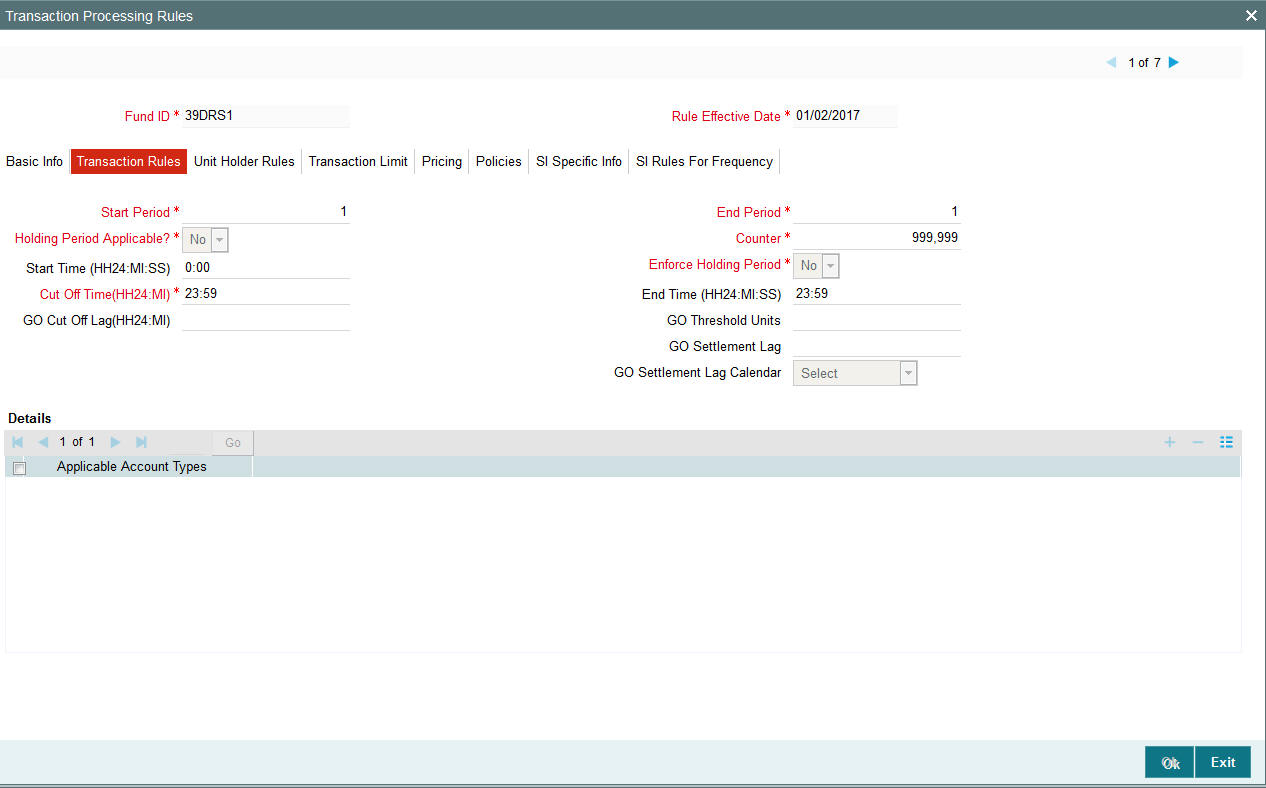

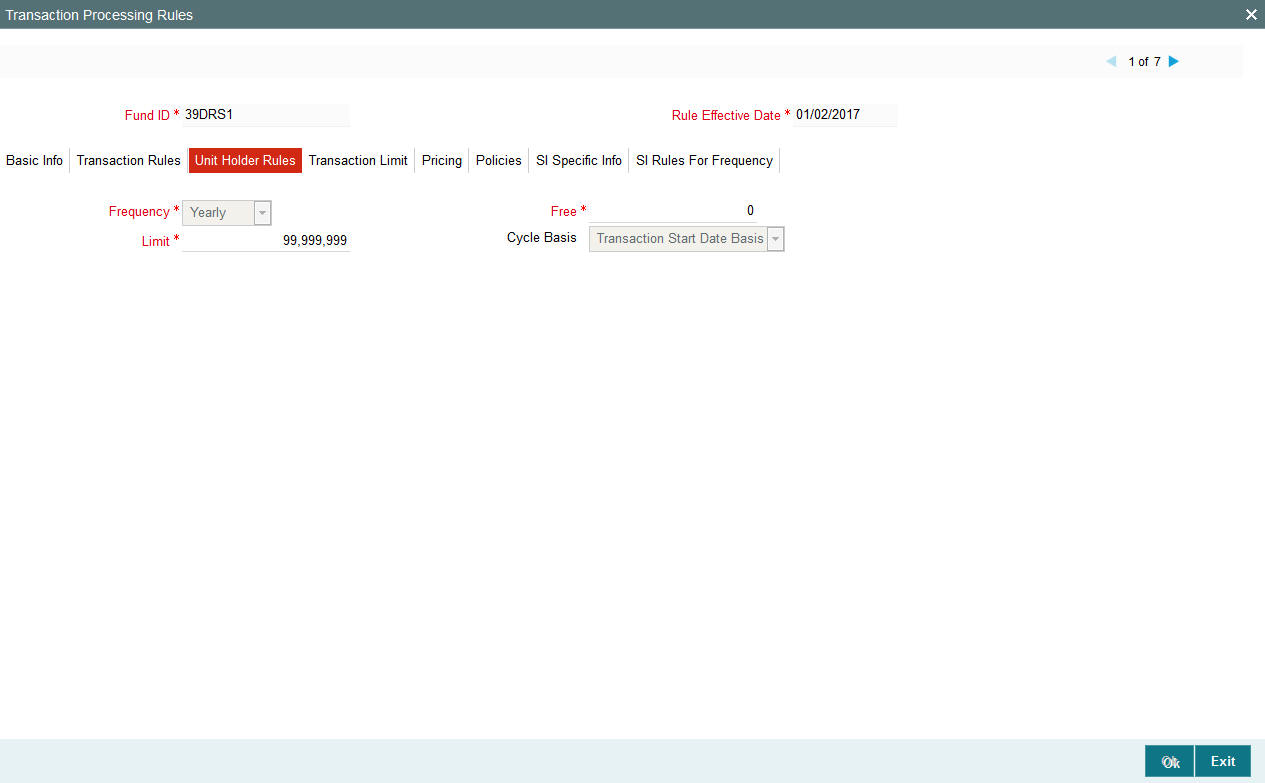

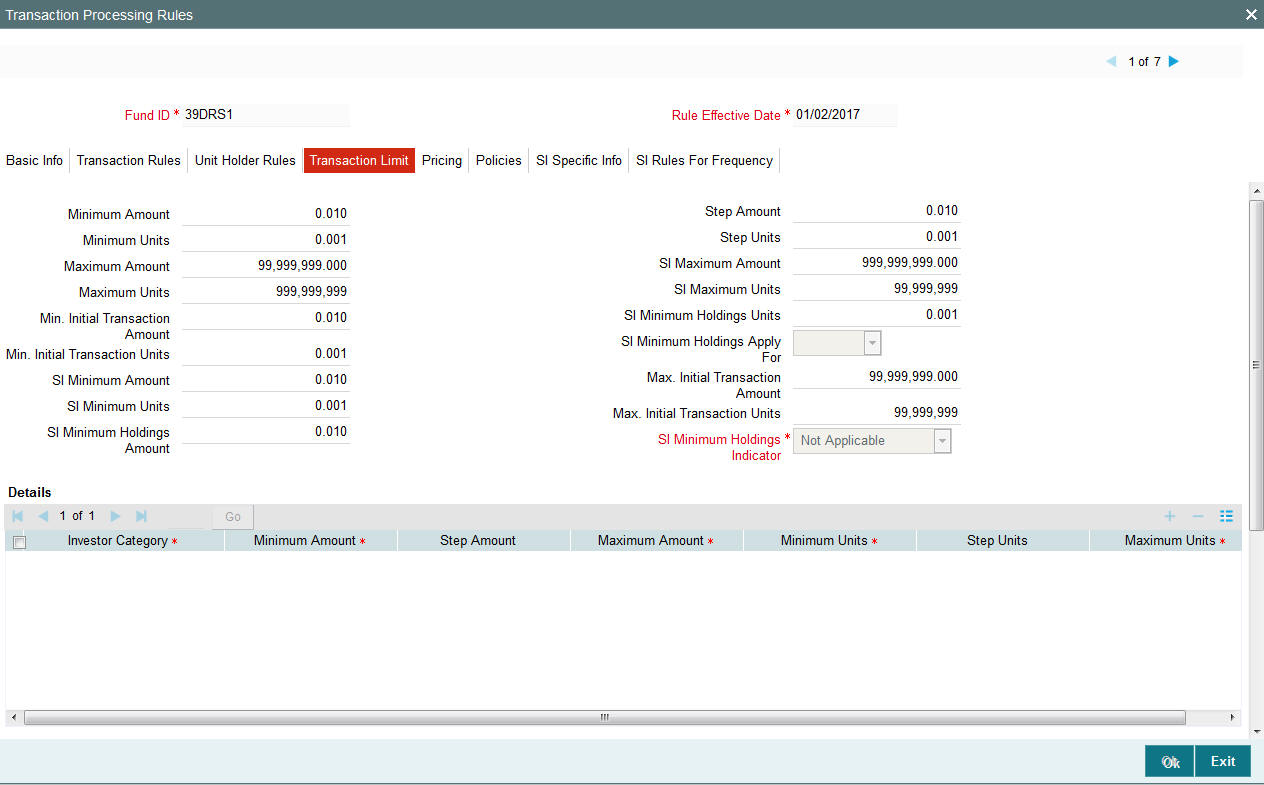

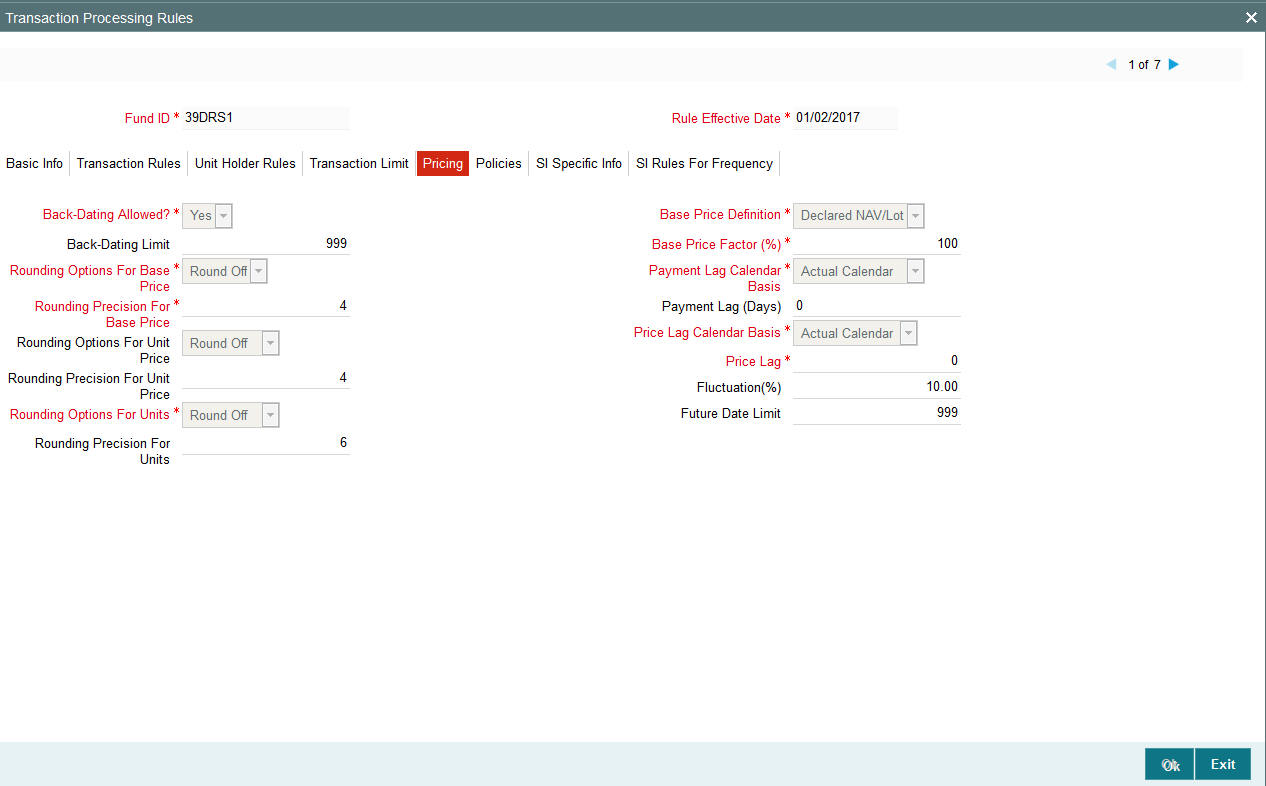

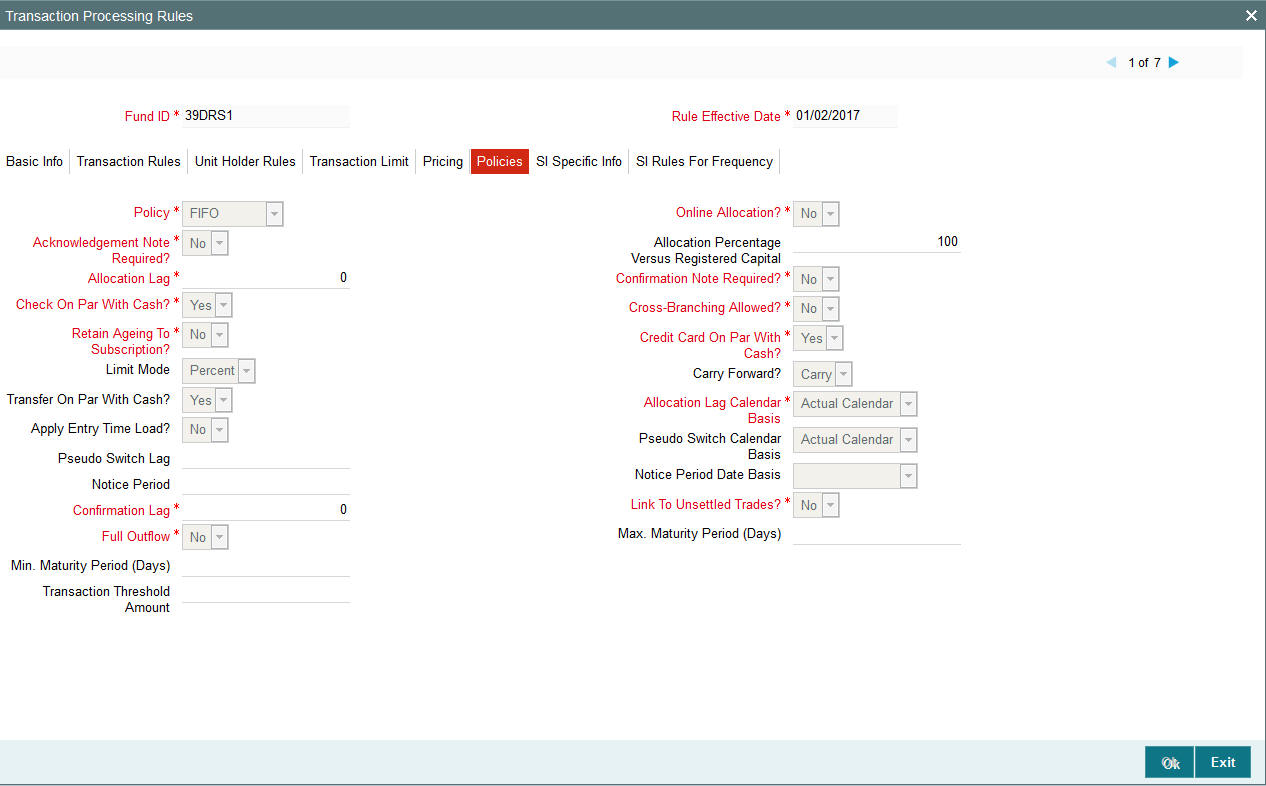

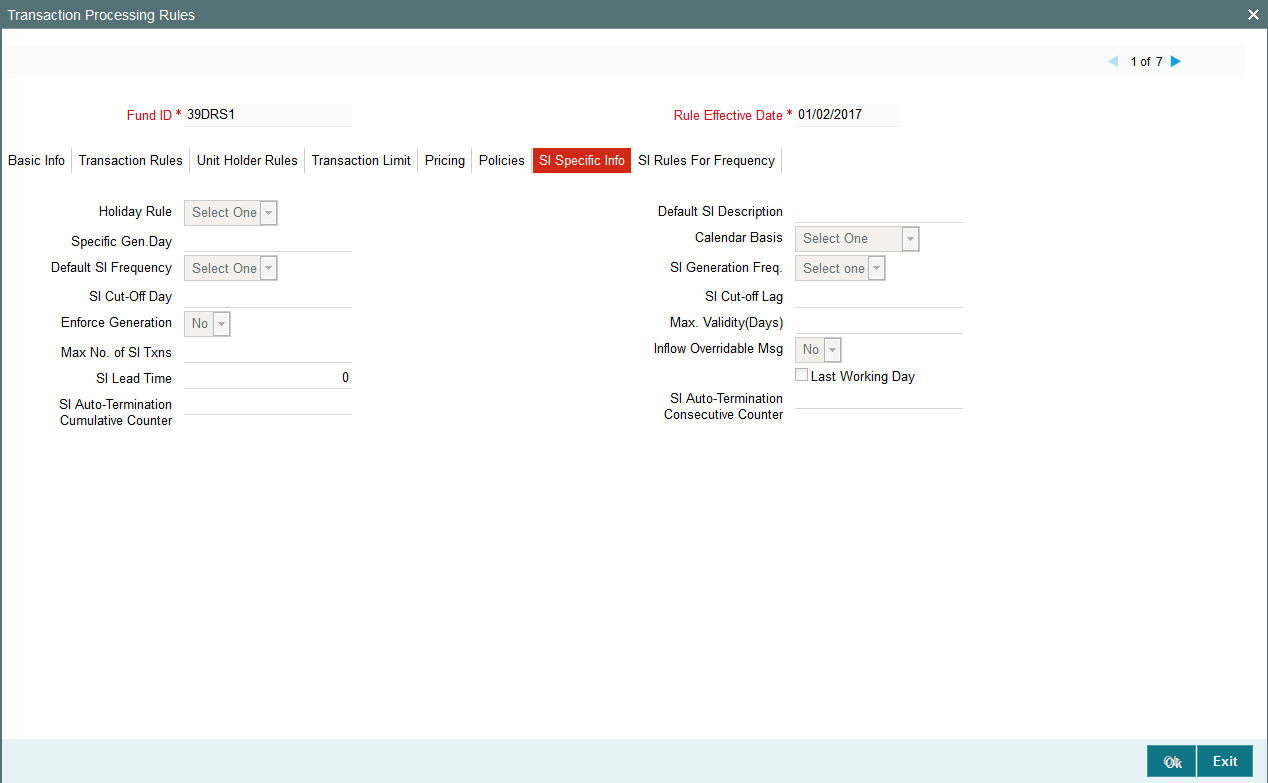

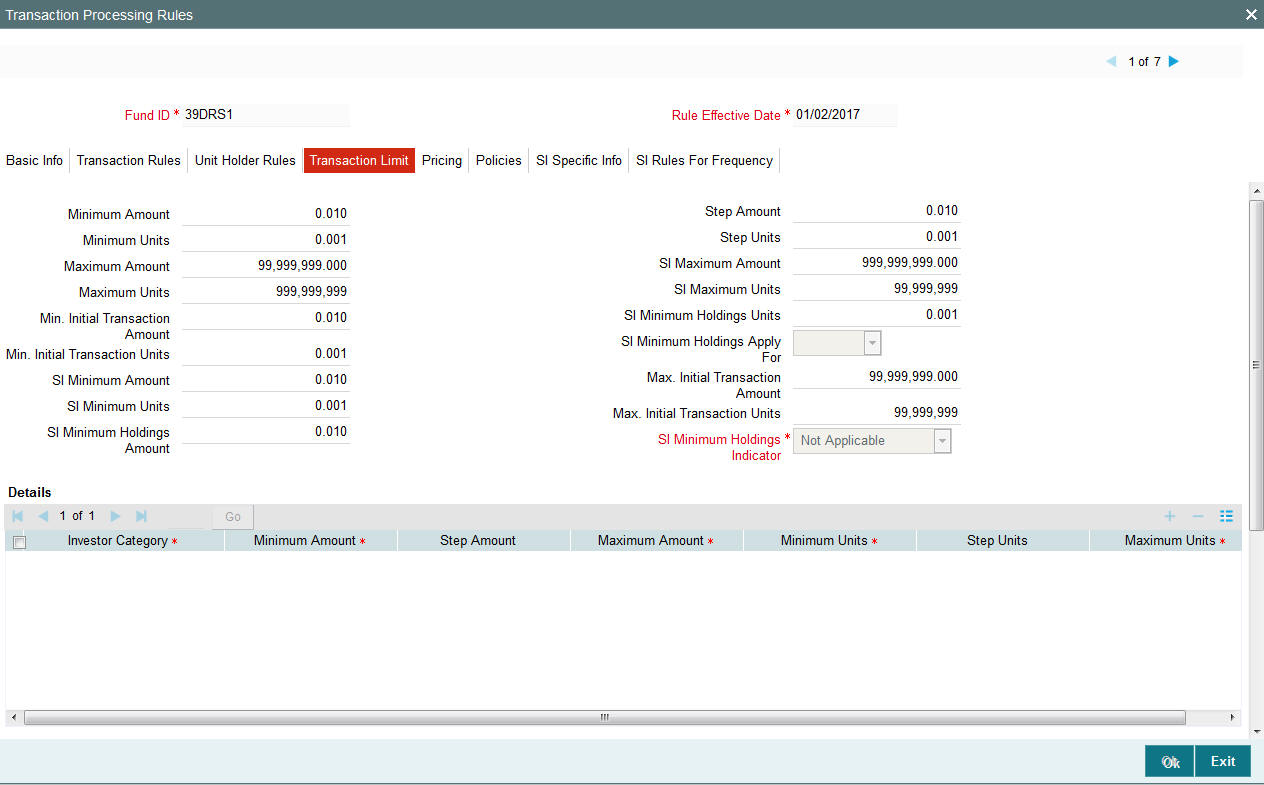

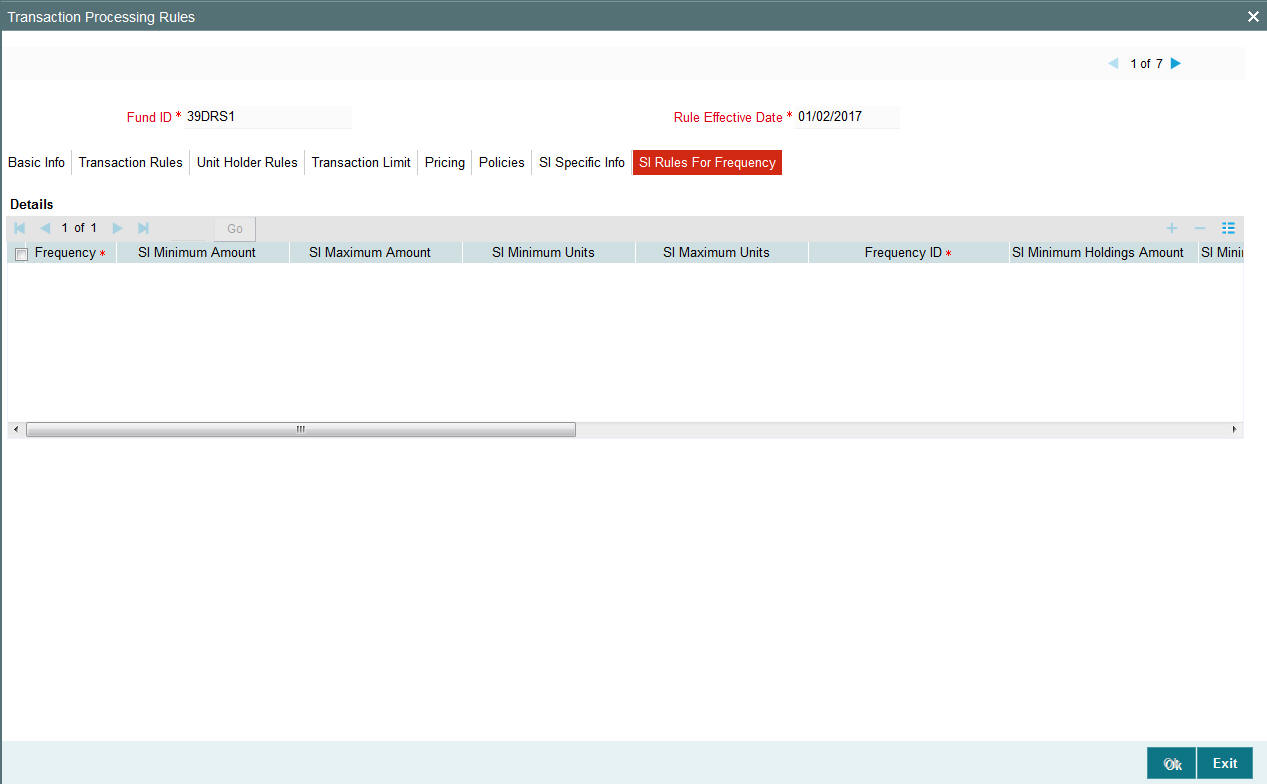

Transaction Processing Rules

These rules govern the parameters by which each transaction is processed in the fund, and these rules may be set up according to each transaction type. These parameters typically include the ranges of volumes allowed for each transaction type, the range of periods and times for the processing of a transaction, the processing policy for each transaction type and the base price definition types and factors. You may enable or disable a transaction type as the requirement may be.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

Setting up the Amount/Units Limits for Investor Categories

The limits in the volume of investment for each category of investors can be setup using this fund rule. This is a sub-rule that you can maintain as part of the Transaction Processing Rules rule.

Setting up the Amount/Units Limits for Communication Modes

The limits in the volume of investment for each communication mode can be set up using this fund rule. This is a sub-rule that you can maintain as part of the Transaction Processing Rules rule.

Setting up the Amount/Units Limits for Investment and Standing Instructions

The limits in the volume of investment for initial investments and standing instructions can be set up using this fund rule. This is a sub-rule that you can maintain as part of the Transaction Processing Rules rule.

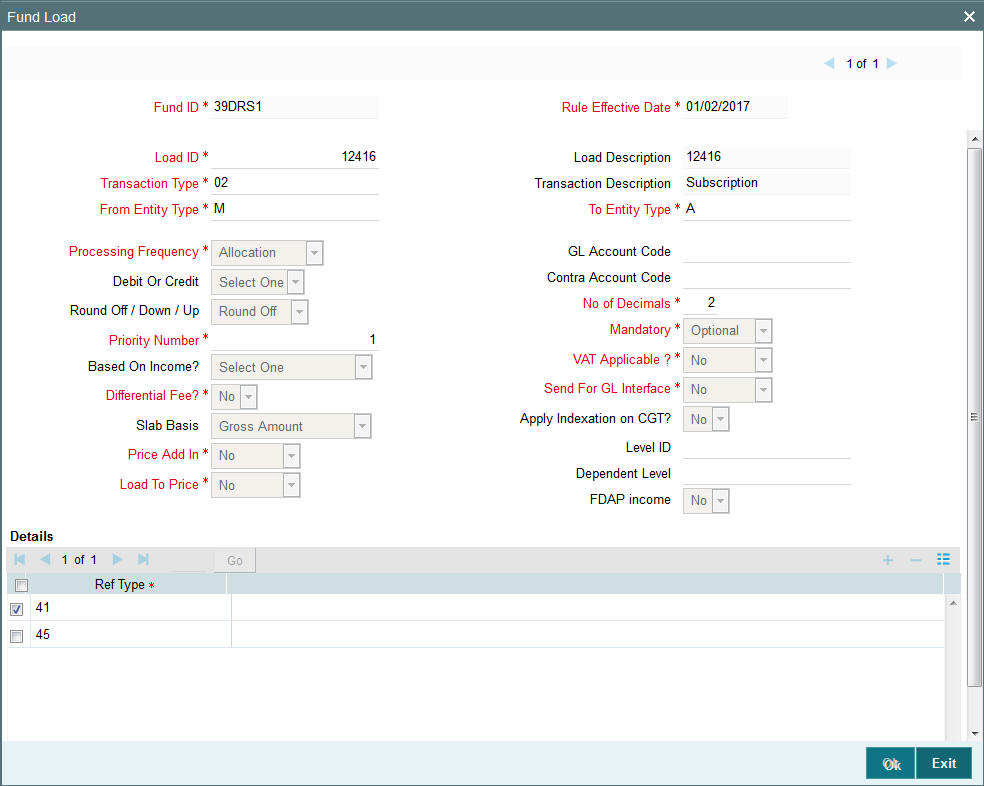

Fund Load Setup

These rules govern the ways in which an applicable fee or incentive will impact the processing of transactions in the fund.

Setting up this rule is optional, and you can set it up for a fund as and when required. It is recommended that you set it up before you authorize the fund.

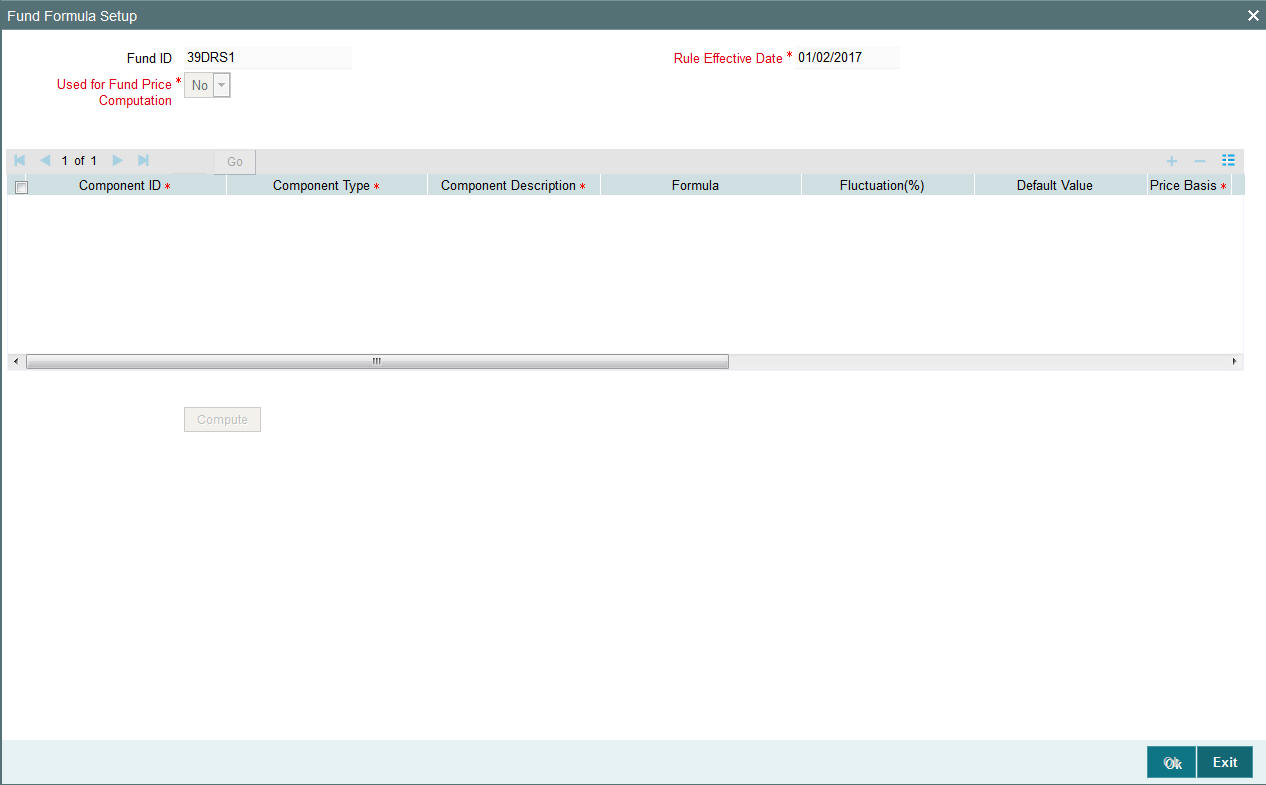

Fund Formula Setup

This fund rule facilitates the specification of any expression that will be used in estimating the base prices or the Net Asset Value for any transaction type.

Setting up this rule is optional, and you can set it up for a fund as and when required. It is recommended that you set it up before you authorize the fund.

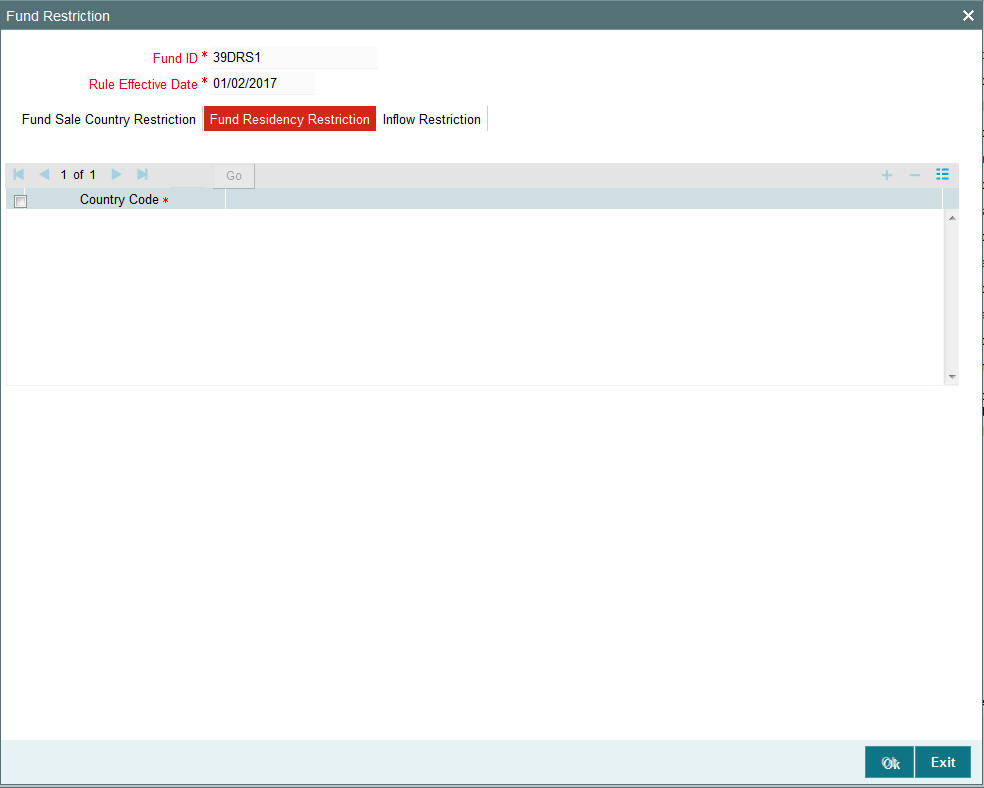

Fund Residency Restriction Setup

This fund rule enables the Fund Manager to make restrictions with respect to the nationality of the unit holders who subscribe to the fund.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

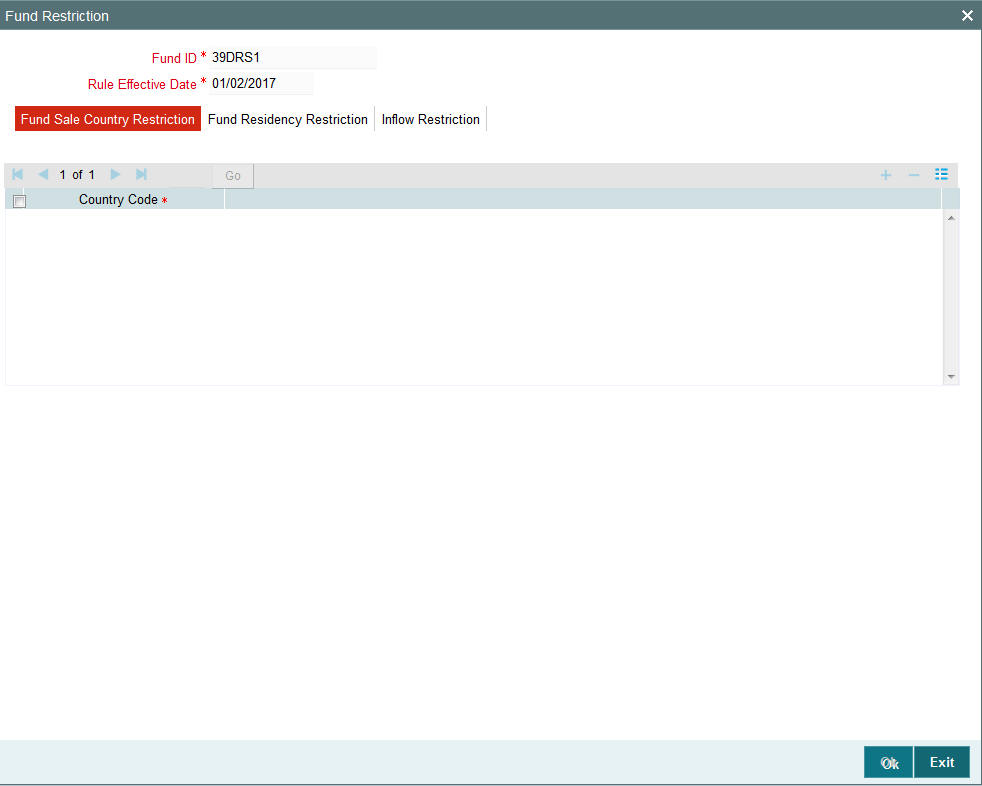

Fund Sale Country Setup

If some funds are not to be opened for investment in specific countries, restrictions can be made in respect of that country, identifying that the fund cannot be sold in that country.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

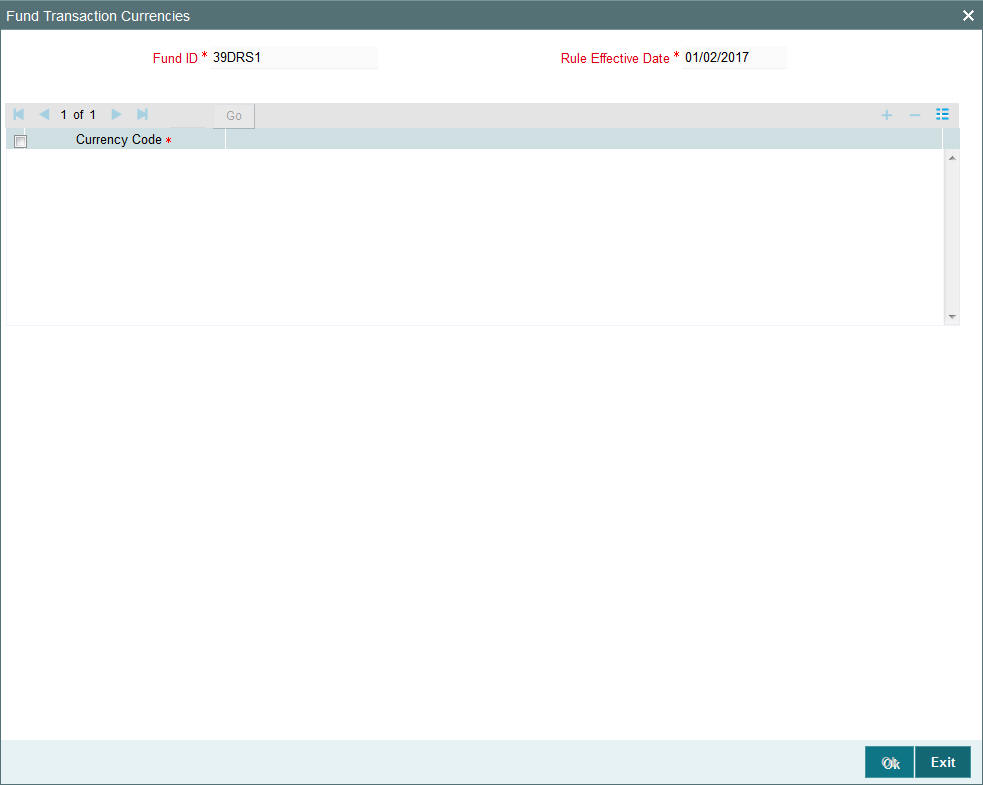

Fund Transaction Currencies Setup

The Fund Manager can also identify the currencies that the fund can transact in, and restrict the use of other currencies for transactions. Therefore, each Fund can have a set of identified currencies that may be used as transaction currencies, and other currencies may be disallowed for transactions.

This is a mandatory fund rule, and you must set it up before you authorize a fund.

Specific Fund Price Date Setup

You can use this fund rule to specify specific price dates to be operable at a specific frequency for certain transaction types, for a fund. Setting up the specific price date is an optional fund rule, and may be edited, authorized or amended just as the other fund rules.

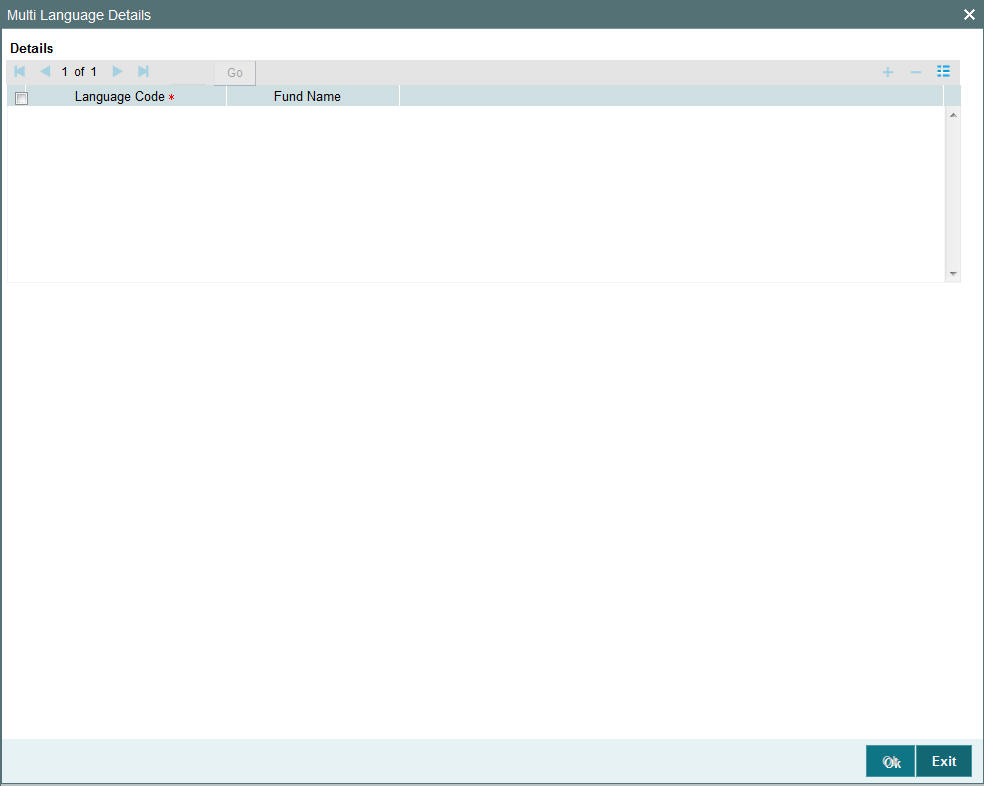

Amount Limits for IRA Transactions

For funds that form part of the investment portfolio of retirement products that you offer to investors, and in which you have opted to allow investment into retirement accounts (IRA), you can define the limits for the different kinds of transactions into such accounts that would apply to the fund.

This is an optional rule, and must be maintained only in the event of IRA investment being allowed for the fund.

Additional Information Setup

You can also maintain additional information for a fund, if additional information heads have been maintained for the AMC, to be applicable for funds.

Though maintenance of additional information is not, strictly speaking, a fund rule, you can only maintain the information through the Fund Demographics screen, when you are setting up a fund, along with all the other fund rules.

3.1.2 Invoking Fund Rule Screen

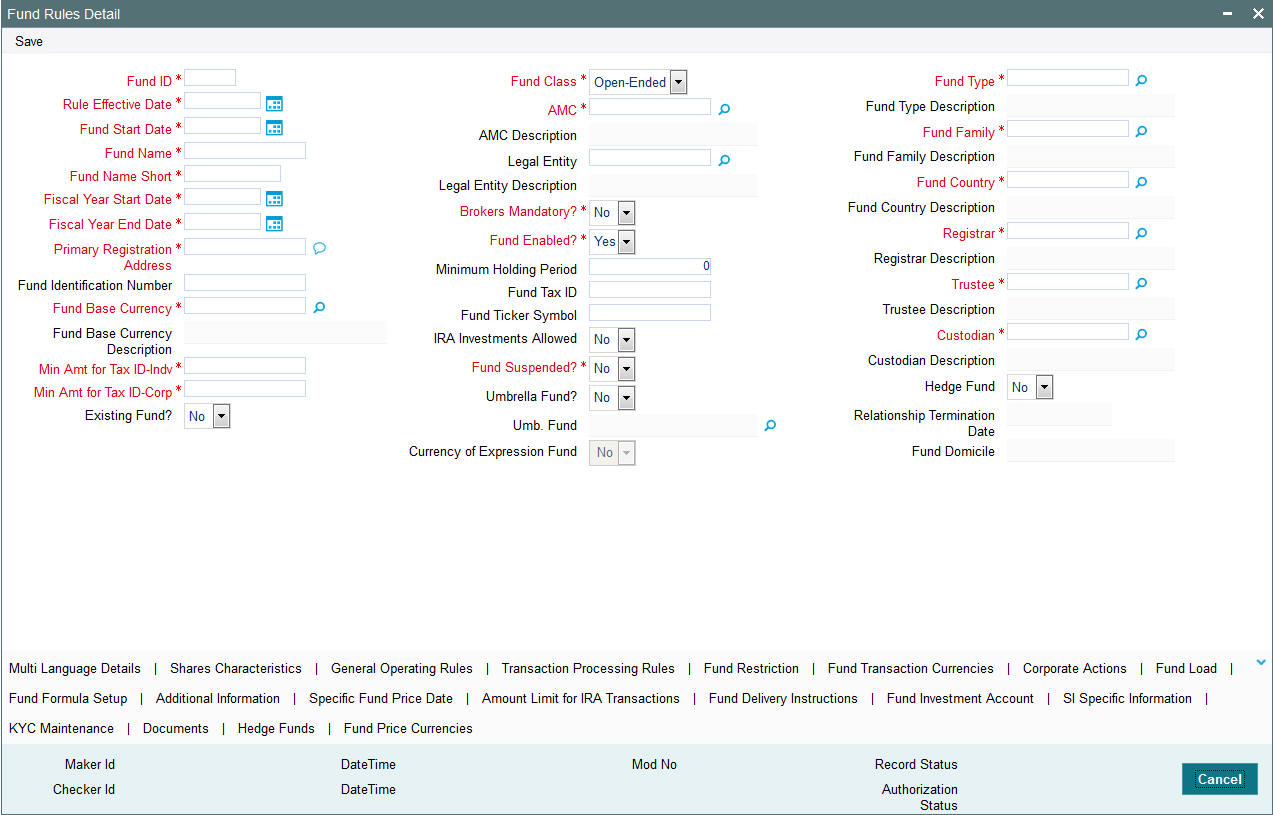

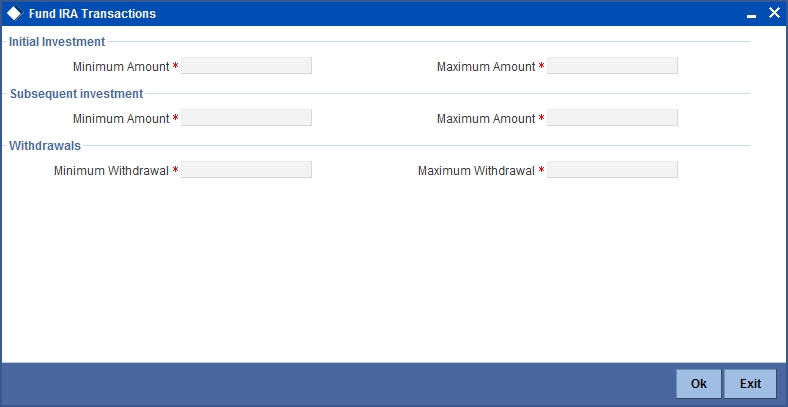

You can set up the fund rules for a fund in the ‘Fund Rules Detail’ screen. You can invoke this screen by typing ‘UTDFNDRL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

In this screen, you must set up the first fund rule, the Fund Demographics rule, before you can set up the other fund rules.

After you have maintained the Fund Demographics rule, click ‘Ok’ button.

Click on any of the links to invoke the corresponding setup screen for any of the other fund rules. For instance, to set up Corporate Actions for the fund, click on the Corporate Actions link. The name, and ID of the fund is defaulted in each of the fund rule setup screen, from the Fund Demographics record.

Choosing an Umbrella Fund

If you are maintaining fund rules for an umbrella fund in the Fund Demographics screen, select Yes in the Umbrella Fund drop-down list and click ‘Umb Fund’ option list which displays the hierarchy structure. The fund you select is displayed in the Umbrella Fund field. The Fund ID of the selected umbrella fund is populated in the Fund ID field of the main fund rule screen. The same steps must be followed in the Summary Fund Rule screen when you are trying to retrieve the record of an umbrella fund.

3.1.3 Maintaining Fund Demographics

This is the entry point for setting up a fund in the system. A rudimentary, demographic profile is captured for the fund that includes the following basic details, and lays down a basis for defining other important rules and details for the fund:

- The Name of the fund and the unique ID that must be used by the system to identify the fund.

- The Start Date and the Rule Effective Date. The Start Date is the date after which the fund is open for transactions. The Rule Effective Date is the date after which the fund rule that is defined is effective. Also, the dates of the Fiscal Year that includes the Rule Effective Date are captured.

- The Type and Class of the fund and the Family of Funds that it must operate under.

- The AMC that floats the fund and other entities that the fund will interact with such as Registrar and Trustee.

- The Country of Domicile of the fund and the base currency that the fund will be denominated in.

- A prospectus for the fund, if any.

- The tax ID for the fund

- Any additional details such as the registration address, ticker symbol in the stock exchange and CUSIP number of the fund.

- The ISIN code for the fund

- Whether IRA transactions are allowed for the fund

- Whether the fund is suspended for transactions of all types. Transactions of all types (both those entered through the Transaction Detail screens as well as system-generated and uploaded transactions) into suspended funds are not allowed.

- Whether the fund is a hedge fund

A fund will not be identified within the system unless it has a Fund Demographics profile record, and all other rules and details for the fund cannot be set up unless the fund has this profile.

To set up the Fund Demographics profile for a fund, use the Fund Demographics screen. You can invoke this screen by typing ‘UTDFNDRL’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Note

Before you set up a Fund Demographics profile record, it is desirable to ensure that the following information is already setup in the system:

- Fund Types must already be defined.

- Fund Families must already be defined.

- Currencies and Countries of Domicile must already be maintained, and the Country-Currency mapping must be defined, so that each Country may be mapped to a default base currency.

- Entities such as AMC’s, Registrars and Trustees must already have a profile in the system.

You can specify the following details in this screen:

Existing Fund?

1 Character Maximum, Optional

Choose ‘Yes’ to indicate that the fund for which the record is being set up here is an existing fund, i.e., the Rule Effective Date is earlier than the Application Date.

Umbrella Fund

1 Character Maximum, Optional

To enter a Fund Demographics Profile for an umbrella fund, choose ‘Yes’. This will enable the Umbrella Fund Details.

Fund ID

6 Character Maximum, Alphanumeric, Mandatory

Fund Short Name

15 Character Maximum, Alphanumeric, Mandatory

Enter the short name of the fund for which the Fund Demographics profile is being set up in this record. If the record of an umbrella fund has been retrieved, the Fund Short Name is defaulted to the Family ID, and cannot be altered. If the record retrieved is that of a share class, then the Fund Short Name is defaulted to the name specified in the Sub-Fund Share Class Mapping.

Fund Name

60 Character Maximum, Alphanumeric, Mandatory

Enter the name of the fund for which the Fund Demographics profile is being set up in this record. If the record of an umbrella fund has been retrieved, the Fund Name is defaulted to the Family Description, and cannot be altered.

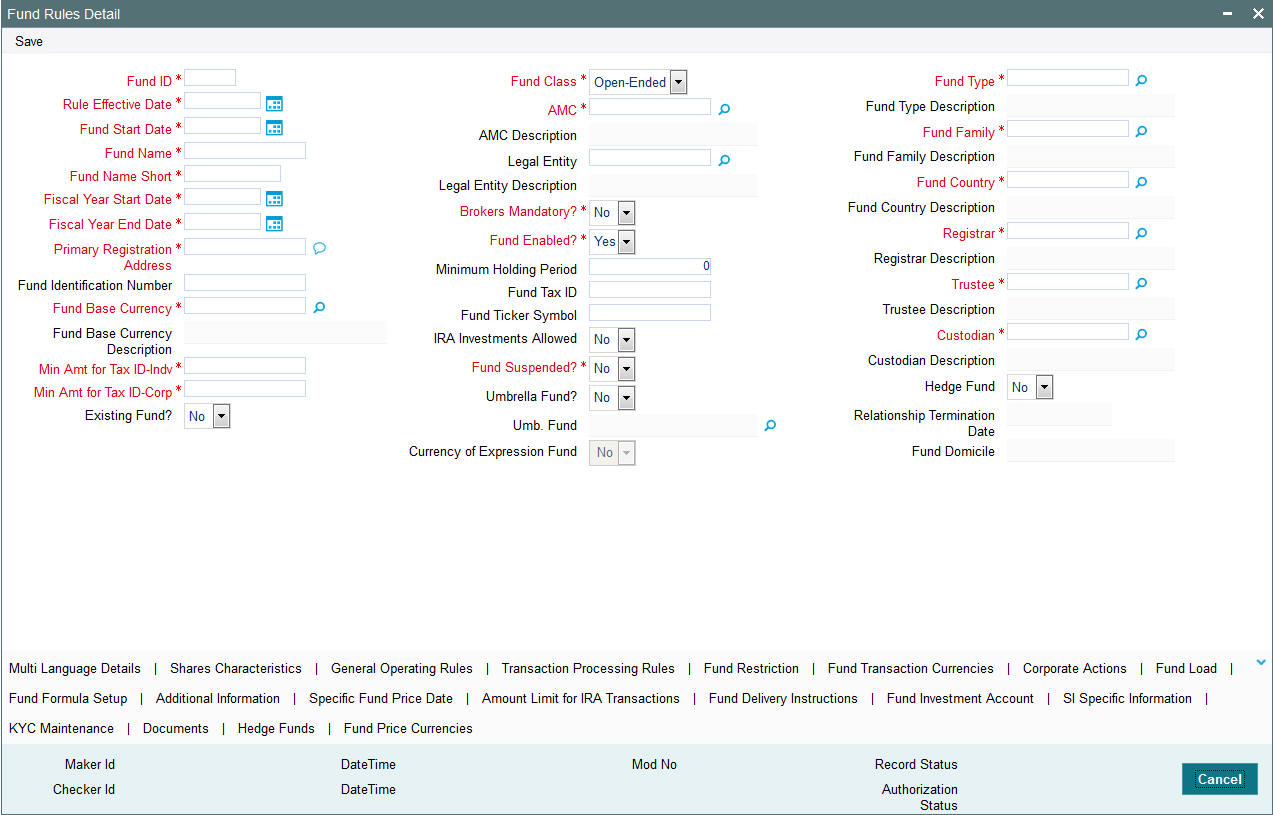

3.1.4 Multi Language Details Button

Click ‘Multi Language Details’ tab to access the Multi Language Details screen. The following screen is invoked:

The Fund Name and the language specified in the Fund Demographics screen are displayed. You can re-enter the fund name in the languages shown in the screen.

Refer the chapter Maintaining Reference Information under Reference Information User Manual for information about Multiple language support.

Fund Start Date

Date, Mandatory

Using the date picker, specify the date upon which the fund is to begin operations (in case of a new Fund).

If the Existing Fund box is checked, the Fund Start Date specified here must be earlier than the Application Date.

For new funds, the Fund Start Date specified here may be the same as the Application Date.

Rule Effective Date

Date, Mandatory

Using the date picker, specify the date from when the Fund Demographics Rule that is currently being set up should become effective.

If the Existing Fund box is checked, the Rule Effective Date specified here must be earlier than the Application Date, and later than the Fund Start Date.

If the fund is not an existing fund, i.e., the Existing Fund box is not checked, and the fund is a new fund, the Fund Start Date and Rule Effective Date must be the same.

The Rule Effective Date should be later than (or same as) the Fund Start Date and it should also be later than (or same as) the current application date of the system.

Fiscal Year Start Date

Date, Mandatory

Enter the date from when the Fiscal Year should start for the fund. This will be the base date for arriving at any frequency defined in the system.

The Fiscal Start Date must be earlier than the application date and the Rule Effective Date of the fund.

Fiscal Year End Date

Date, Mandatory

This is the date on which the Fiscal Year should end for the fund when the Fiscal Start Date is specified; the system displays the Fiscal Year End Date exactly a year later than the Start Date.

The Fiscal End Date should be later than (or same as) the current date of the system. It should also be later than (or same as) the Rule Effective Date of the fund that is being set up.

Fund Country

Alphanumeric, Mandatory

Specify the country of domicile of the fund, from the drop down list provided. This information will be used to determine whether a unit holder that subscribes to the fund must be considered a Foreign unit holder or not.

Fund Base Currency

Alphanumeric, Mandatory

Specify the currency in which the fund will be denominated, from the drop down list provided. The NAV and dividend declarations for the fund will be in this base currency.

Fund Class

Alphanumeric, Mandatory

Select the class to which the Fund must belong, from the drop down list. The two classes displayed in the drop down list are Open Ended and Closed-Ended Funds.

Fund Type

Alphanumeric, Mandatory

Select the Fund Type from the options provided in the drop down list. This list is populated with the Fund Types set up in the Fund Type Maintenance.

Fund Family

Alphanumeric, Mandatory

Select the fund family under which the fund must be placed, from the drop down list that is populated with all fund families that are maintained in the system as part of the Fund Family Maintenance. If this record is being set up for an umbrella fund, then the ID of the Immediate Parent Family is displayed here from the Fund Family Maintenance, and this cannot be altered.

AMC

Mandatory

Specify the AMC that this Fund will be operative in. You can make your choice by using the drop down list.

Registrar

6 Characters Maximum, Alphanumeric, Mandatory

Select the Registrar for the fund being set up, from the options provided.

Trustee

6 Characters Maximum, Alphanumeric, Mandatory

Select the Trustee for the fund being set up, from the options provided.

Minimum Holding Period

Numeric, Optional

Enter the lock in period for the investors investing in a Money Market Mutual Fund.

Fund Suspended?

Optional

You can use this field to suspend a fund for transactions of all types. Check this box to indicate that the fund is suspended for transactions. Transactions of all types (both those entered through the Transaction Detail screens as well as system-generated and uploaded transactions) into suspended funds are not allowed.

If a fund is suspended, transactions of all types are not allowed into the fund. If a fund is not suspended, transactions of specific types that have been suspended for the fund in the Transaction Processing Rules (if any) are not allowed.

Brokers Mandatory?

Optional

Select Yes in this field, to indicate that brokers are to be mandatory for the given Fund. If not, select ‘No’ in this field.

Fund Enabled?

Mandatory

This field may be used to enable or disable a fund. By default, when you are setting up a new fund, this field has a ‘Yes’ value, indicating that every new fund is created in the system initially as an enabled fund.

Primary Registration Address

255 Characters Maximum; Alphanumeric; Mandatory

If the registration address for the fund is different from the address of the AMC to which the fund belongs, you may specify the address in this field. By default, the address of the AMC is considered to be the primary registration address for the fund.

This address is necessary for reporting and information purposes only.

Fund Tax ID

25 Characters Maximum; Alphanumeric; Optional

You can use this field to indicate the Tax ID assigned to the fund. It is used for reporting and information purposes. The Tax ID you specify here cannot be specified for any other fund in the system.

Fund Identification Number

12 Characters Maximum; Alphanumeric; Mandatory

Specify the ISIN identification number (ISIN Code) assigned to the fund.

The ISIN Code is a 12-character alphanumeric code, with the first two digits being non-numeric, and the last two, strictly numeric. Along with the Fund ID, It is used for retrieval of the fund details in all search facilities in the system, and is captured during transaction entry as identification for the fund.

Fund Ticker Symbol

25 Characters Maximum; Alphanumeric; Optional

Specify the ticker symbol that identifies the fund in the stock exchange list.

IRA Investments Allowed

Optional

You can use this field to indicate whether investment into the fund is allowed through an Individual Retirement Account (IRA). Check this box to indicate that IRA investments are allowed, into the fund. If so, you must maintain the limits for such investments by in the Fund IRA Transactions section in this screen.

Note

If this option is checked, it implies that the fund is a pension fund.

Custodian

Optional

Enter the custodian details.

Minimum Amount For Tax ID for Individual Customer

Numeric, Optional

Enter the minimum subscription/IPO subscription amount beyond which the system needs to validate the PAN of the unit holder.

While capturing a transaction, the system will check the transaction amount with the amount maintained here for unit holders of the type ‘Individual’. If a transaction exceeds the stated minimum amount, the system will throw up an error and not save the transaction.

Minimum Amount For Tax ID for Corporate Customer

Numeric, Optional

Enter the minimum subscription/IPO subscription amount beyond which the system needs to validate the PAN of the corporate investor.

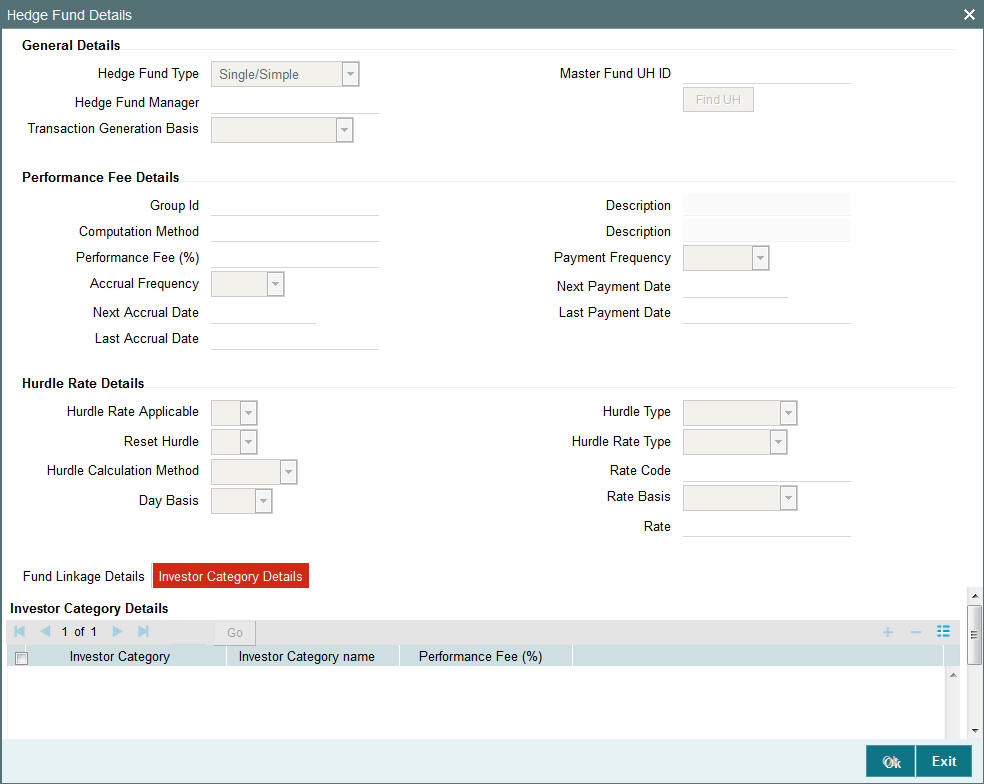

Hedge Fund

Optional

Select ‘Yes’ to indicate that the selected fund is a hedge fund and select ‘No’ to indicate otherwise.

3.1.5 Amount Limits for IRA Transactions Button

For funds in which you have allowed IRA (Individual Retirement Account) investment, you can define the transaction limits. Use the Amount Limit for IRA Transactions section in the Fund Rules Detail screen to specify the limits.

It is mandatory for you to specify the IRA Limits fund rule for funds in which IRA investments are allowed.

The following limits are specified:

- Minimum transaction amount limits for initial, additional investment, and withdrawal transactions

- Maximum transaction amount limits for initial, additional investment and withdrawal transactions.

You can specify the following details in this section:

Minimum Amount (Initial Investment)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the minimum amount that can be contributed in the initial investment into this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

Maximum Amount (Subsequent Investments)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the maximum amount that can be contributed in the initial investment into this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

Minimum Amount (Subsequent Investments)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the minimum amount that can be contributed as an additional investment into this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

Maximum Amount (Additional Investment)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the maximum amount that can be contributed as an additional investment into this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

Minimum Amount (Withdrawal)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the minimum amount that can be withdrawn through a withdrawal transaction out of this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

Maximum Amount (Withdrawal)

Numeric, Mandatory if IRA investment is allowed for the fund

Specify the minimum amount that can be withdrawn through a withdrawal transaction out of this fund, for a plan purchased in a product for which the fund forms part of the portfolio. This limit cannot exceed the corresponding limit set for the product, the portfolio of which the fund is a part.

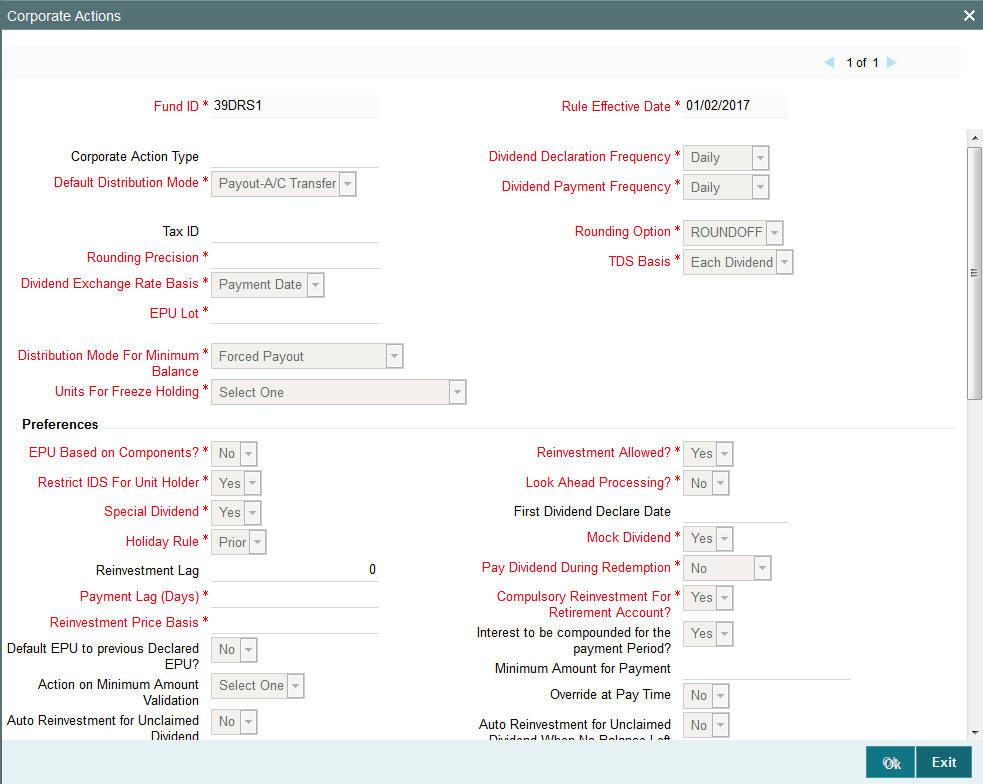

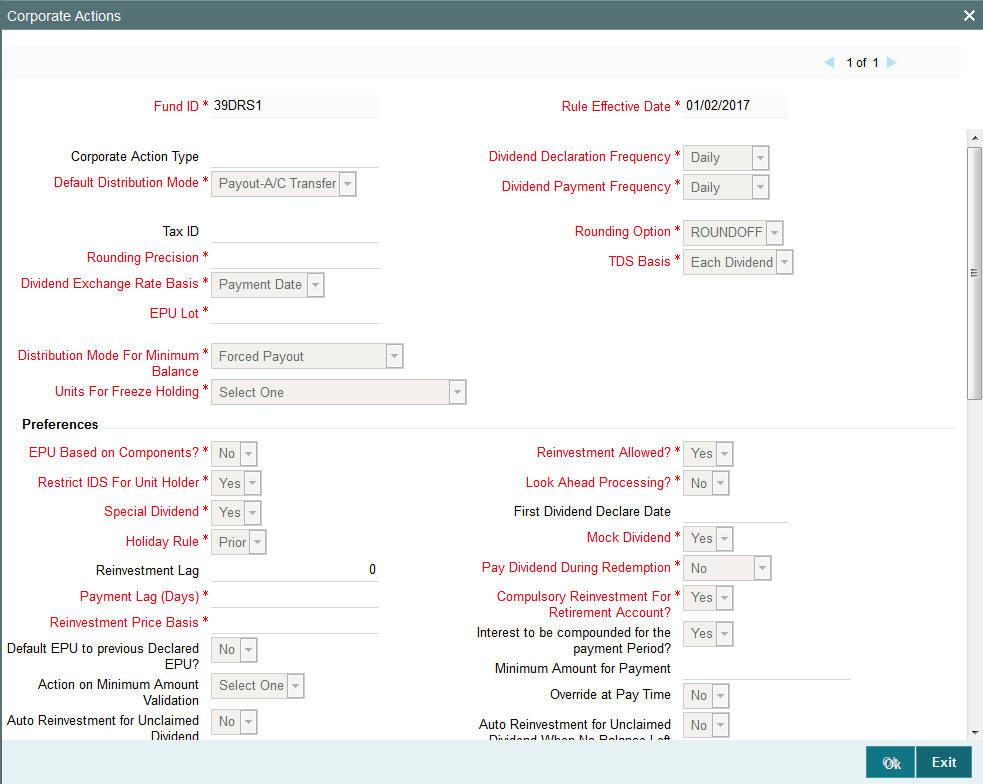

3.1.6 Corporate Actions Button

This fund rule facilitates the definition of the guidelines that will govern the distribution of income derived from the fund by the unit holders that subscribe to the fund. You can define the framework according to which corporate actions such as dividend declaration and processing must be performed for a fund. Through this screen the system can also process multiple distributions of a fund on the same day and process the distribution on the same day.

To set up the Corporate Action rules for a fund, use the Corporate Actions screen. You can invoke this screen by clicking ‘Corporate Actions’ button from the Fund Rules screen.

Note

This screen cannot be used to maintain parameters for corporate actions such as liquidation, split, reverse split and merger. To maintain these, you must use the Corporate Actions Maintenance screen, which you may invoke by clicking on Corporate Actions in the Maintenance menu, and Detail under it.

For more information on these corporate actions and the Corporate Actions Maintenance screen, refer the chapter Other Fund Activities in this user manual.

Before you set up a Corporate Actions profile record for a fund, it is desirable to ensure that the fund already has an existing, unauthorized profile record.

You can specify the following details in this screen:

Fund ID

Display

This field indicates the ID fund for which you are setting up the Corporate Actions profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date

Display

The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Corporate Action Type

Alphanumeric, Mandatory

Select the type of corporate action for which this rule is being set up. It could be either a cash dividend or a stock dividend. It could be either a cash dividend for income, or capital gains earnings.

For stock dividends, the following information is accepted by default:

- The TDS Basis field has a default specification, “Tax-exempt”, and the field is locked for data entry

- The option Restrict IDS for Unit Holder is selected and cannot be changed

- The Default Distribution Mode field has the option “Reinvestment” selected, and is locked for data entry.

Dividend Declaration Frequency

Alphanumeric, Mandatory

Select the frequency with which the dividend is to be declared, from the options provided.

Dividend Payment Frequency

Alphanumeric, Mandatory

Select the frequency with which the declared dividends are to be paid. As the system supports accumulation of dividends, the payment could be for any dividend that has been declared earlier.

The Dividend Payment Frequency must not be less than Dividend Declaration Frequency.

Default Distribution Mode

Mandatory

If the Income Distribution Setup for the unit holder has not yet been specified, the fund level default Unit Holder Distribution Mode to be considered for the unit holder can be specified here. Any one of the options from the drop down list may be chosen. The following values may be entered:

- Full Payout - A/C Transfer

- Full Payout - Check

- Full Reinvestment into Source Unit Holder ID and Source Fund.

If the rules are being setup for a share class fund for which reinvestment is mandatory, then this field is defaulted to Full Reinvestment and locked for data entry.

For stock dividends, the option “Reinvestment” is selected here by default, and cannot be changed.

Click ‘Details’ button to invoke ‘Corporate Actions’ screen.

In this screen, define the following details:

Rounding Precision

1 Character Maximum, Numeric, Mandatory

Indicate the maximum number of decimals that would be reckoned for rounding precision, for the dividend. You cannot indicate a precision higher than 6 decimal places.

Rounding Options

Alphanumeric, Mandatory

Indicate the rounding options for the value of the dividend, designated for the fund.

Choose ‘Round Up’ to indicate rounding the value at the precision decimal place to the next higher numeral.

Choose ‘Round Off’ to indicate normal rounding at the precision decimal.

Choose ‘Round Down’ to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the dividend earned by an investor, Mrs. Laurie Klein, in the ABC Growth Fund is 700.679263 currency units, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 700.680.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 700.679.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 700.679.

Dividend Exchange Rate Basis

Alphanumeric, Mandatory

Specify the basis upon which the exchange rate will be applied for dividend processing. The system provides two options: Reference Date and Payment Date.

Distribution Mode For Minimum Balance

Optional

Indicate how the income derived from the fund is to be distributed, in respect of unit holders whose holdings balance falls below the minimum holdings specified for the fund.

The options are:

- Forced Payout - the income is paid out, regardless of the default distribution mode or any income distribution options (IDS) set for the unit holder

- According to Unit Holder IDS – the income is distributed based on the Income Distribution (IDS) options set for the unit holder

Tax ID

15 Character Maximum, Alphanumeric, Mandatory

Enter the tax ID for the fund that is being set up.

TDS Basis

1 Character Maximum, Alphanumeric, Mandatory

This is to indicate whether slab should be looked for every dividend payment separately or whether consolidated on a fiscal year basis.

For stock dividends, the option “Tax –Exempt” is selected here by default, and cannot be changed.

EPU LOT

Numeric, Mandatory if EPU is applicable

Specify the number of units for which the EPU quote is deemed to be applicable, for the fund.

Setting up EPU components is not applicable for stock dividends

Preferences Section

Restrict IDS for Unit Holder

Mandatory

Select ‘Yes’ in this field to indicate that specific income distribution setups for unit holders may be overridden.

Reinvestment Allowed

Optional

Select ‘Yes’ in this field to indicate that reinvestment is allowed for the fund. If the rules are being setup for a share class fund for which reinvestment is mandatory, then this field has a default ‘Yes’ and locked for data entry.

Reinvestment Lag

Mandatory

Specify the reinvestment lag as the number of days to enable reinvestment on a different date or the same day as the payment date. The default value is 0. If the value is considered as 0, then the reinvestment is made on the same day as the payment date. For a value other than 0, the system calculates the reinvestment date from the payment date. For example: If the number of days entered is 10 and the payment date is 30th June, then the reinvestment date will be 10th July.

Allow EPU Components Setup?

Optional

Select ‘Yes’ in this field to indicate applicability of EPU, (Earnings Per Unit) and that the earnings per unit must be defined in terms of components, or as a single value. By default, this field has a ‘No’ value.

Setting up EPU components is not applicable for stock dividends.

Look Ahead Processing?

Optional

Select ‘Yes’ in this field to indicate that in the event of intervening holidays, the system would obtain the EPU information and process dividends for the holiday period, ahead of the prior business day, for the fund.

Units for Freeze Holding

Alphanumeric, Mandatory

Specify the units to be considered for dividend eligibility on the freeze holdings date. You can specify any of the following options:

- All units (including unconfirmed units) must be considered as on the allocation date

- Only confirmed units are to be considered as on the allocation date

- All units (including unconfirmed units) are to be considered as on the transaction price date

- All units (including unconfirmed units) are to be considered as on the transaction date

- Only confirmed units are to be considered as on the transaction date

- All units (including unconfirmed units) are to be considered as on the dealing date

Note

If the fund is a dividend equalization fund, i.e. if you have checked the ‘Dividend Equalization Applicable’ option in the General Operating Rules for the fund, you can maintain only the following options here:

- All Units as on allocation date

- All units as on confirmed date

- All units as on dealing date

If units for freeze holding is based on transaction/dealing date then all the transactions backdated to the previous dividend cycle would be treated as old units (G1 units). If units for freeze holding is based on allocation date then all the transactions backdated to the previous dividend cycle would be treated as new units (G2 units).

Example:

Consider two dividend cycles - the first from January 01, 2010 to January 31, 2010 and the second from February 01, 2010’ to ‘February 28, 2010. A subscription transaction (S1) is captured on application date, February 15, 2010, with transaction date as January 15, 2010 and allocation date as February 16, 2010. For the second dividend, units allotted in this transaction would be treated as G1 units (if the units for freeze holding is based on transaction/dealing date) or G2 units (if the units for freeze holding is based on allocation date).

First Dividend Declare Date

Date Format, Optional

Specify the first date for dividend declaration, for the fund. The system considers the first dividend date in arriving at the date for dividend processing, as follows:

First dividend processing = First Dividend Declare Date – Dividend Declaration Frequency + Dividend Payment Frequency.

The system also uses the first dividend declare date to arrive at the next dividend declare date, applying the specified declaration frequency.

If you do not specify the first dividend declare date, the fiscal year specified for the fund is used to determine the next dividend declare date.

Holiday Rule

Alphanumeric, Mandatory

Select the rule to be applied if the dividend processing date falls on a holiday. You can select either the PRIOR rule (the previous working day is considered) or the AFTER rule (the next working day is considered), for the dividend type.

The holiday rule you select here will be applicable to all dividend-processing dates that have been arrived at using a frequency. They are not applicable to dates arrived at using lead times or lag periods.

Pay Dividends During Redemption?

Optional

Select this option to indicate that dividends may be paid during redemption.

Special Dividend

Optional

Select ‘Yes’ in this field to indicate that special dividends are applicable for the fund. This feature is only available if your installation has requested for it.

Mock Dividend?

Optional

Select ‘Yes’ in this field to indicate the applicability of mock dividends for the fund. This feature is only available if your installation has requested for it.

Payment Lag

1 Character Maximum, Numeric, Optional

Specify a lag period (in days) for the payment of dividend. The lag value is interpreted in calendar days, and is used to arrive at the payment date for the dividend. The payment date is arrived at as follows:

Dividend Payment Date = Dividend Declaration Date + Payment Lag

Compulsory Reinvestment for Retirement Account

Optional

You can use this field to indicate that dividend due from the fund on an IRA account must be compulsorily reinvested. Check this box to indicate compulsory reinvestment.

Default EPU to Previous Declared EPU

Optional

Specify whether the previous day’s Earning Per Unit (EPU) needs to be defaulted during the generation of a dividend record. You can select either ‘Yes’ or ‘No’ from the drop-down list.

If you select the option ‘Yes’, the system will default the previous day’s EPU while generating the dividend record at the Beginning of Day (BOD). This record will be an authorized record. However, you will be able to modify it. If the previous day’s EPU is zero, the system will still default the value and generate an authorized record. You can enter the EPU value for this record.

This field is available only for Money Market funds. Also, if ‘Dividend Declaration Frequency’ and ‘Dividend Payment Frequency’ are the same, this field will be disabled.

Interest to be compounded for the payment period?

Optional

Indicate whether the dividend interest needs to be compounded for the entire payment period or not. You can select either ‘Yes’ or ‘No’ from the drop-down list.

If you select ‘Yes’, the system will calculate the dividend on the amount instead of multiplying the units by the EPU. The EPU value maintained as ‘As amount’ will be directly used in the dividend calculations.

This field is available only for Money Market funds. Also, if ‘Dividend Declaration Frequency’ and ‘Dividend Payment Frequency’ are the same, this field will be disabled.

Example:

Assume that the EPU is 0.001267. This value will be directly used during dividend processing to calculate the payment amount.

Consider the following case listing the transactions from Jan 1, 2005 to Jan 31, 2005:

Open Bal |

InTxns (Bal. sum) |

Freeze holding balance |

Div calc base |

EPU |

Div Units |

NAV |

Div amt |

Div Sum from the 1st till date(Units) |

Div Sum from the 1st of the Month till date (Amount) |

100000 |

0 |

100000 |

100000.0000 |

0.000136986 |

15.07 |

25.00 |

376.71 |

15.07 |

376.71 |

100000 |

0 |

100000 |

100015.0685 |

0.000136986 |

15.07 |

25.00 |

376.75 |

30.14 |

753.46 |

100000 |

0 |

100000 |

100030.1385 |

0.000136986 |

15.07 |

25.00 |

376.75 |

45.21 |

1130.21 |

100000 |

0 |

100000 |

100045.2085 |

0.000136986 |

15.07 |

25.00 |

376.75 |

60.28 |

1506.96 |

100000 |

0 |

100000 |

100060.2785 |

0.000136986 |

15.07 |

25.00 |

376.75 |

75.35 |

1883.71 |

100000 |

0 |

100000 |

100075.3485 |

0.000136986 |

15.07 |

25.00 |

376.75 |

90.42 |

2260.46 |

100000 |

0 |

100000 |

100090.4185 |

0.000136986 |

15.08 |

25.00 |

377.00 |

105.50 |

2637.46 |

100000 |

0 |

100000 |

100105.4985 |

0.000136986 |

15.08 |

25.00 |

377.00 |

120.58 |

3014.46 |

100000 |

0 |

100000 |

100120.5785 |

0.000136986 |

15.08 |

25.00 |

377.00 |

135.66 |

3391.46 |

100000 |

0 |

100000 |

100135.6585 |

0.000136986 |

15.08 |

25.00 |

377.00 |

150.74 |

3768.46 |

100000 |

0 |

100000 |

100150.7385 |

0.000136986 |

15.09 |

25.00 |

377.25 |

165.83 |

4145.71 |

100000 |

0 |

100000 |

100165.8285 |

0.000136986 |

15.09 |

25.00 |

377.25 |

180.92 |

4522.96 |

100000 |

0 |

100000 |

100180.9185 |

0.000136986 |

15.09 |

25.00 |

377.25 |

196.01 |

4900.21 |

100000 |

0 |

100000 |

100196.0085 |

0.000136986 |

15.09 |

25.00 |

377.25 |

211.10 |

5277.46 |

100000 |

5000 |

105000 |

105211.0985 |

0.000136986 |

15.85 |

25.00 |

396.25 |

226.95 |

5673.71 |

105000 |

0 |

105000 |

105226.9485 |

0.000136986 |

15.85 |

25.00 |

396.25 |

242.80 |

6069.96 |

105000 |

0 |

105000 |

105242.7985 |

0.000136986 |

15.85 |

25.00 |

396.25 |

258.65 |

6466.21 |

105000 |

0 |

105000 |

105258.6485 |

0.000136986 |

15.86 |

25.00 |

396.50 |

274.51 |

6862.71 |

105000 |

0 |

105000 |

105274.5085 |

0.000136986 |

15.86 |

25.00 |

396.50 |

290.37 |

7259.21 |

105000 |

0 |

105000 |

105290.3685 |

0.000136986 |

15.86 |

25.00 |

396.50 |

306.23 |

7655.71 |

105000 |

0 |

105000 |

105306.2285 |

0.000136986 |

15.86 |

25.00 |

396.50 |

322.09 |

8052.21 |

105000 |

0 |

105000 |

105322.0885 |

0.000136986 |

15.87 |

25.00 |

396.75 |

337.96 |

8448.96 |

105000 |

0 |

105000 |

105337.9585 |

0.000136986 |

15.87 |

25.00 |

396.75 |

353.83 |

8845.71 |

105000 |

0 |

105000 |

105353.8285 |

0.000136986 |

15.87 |

25.00 |

396.75 |

369.70 |

9242.46 |

105000 |

0 |

105000 |

105385.5685 |

0.000136986 |

15.87 |

25.00 |

396.75 |

385.57 |

9639.21 |

105000 |

0 |

105000 |

105385.5685 |

0.000136986 |

15.88 |

25.00 |

397.00 |

401.45 |

10036.21 |

105000 |

0 |

105000 |

105401.4485 |

0.000136986 |

15.88 |

25.00 |

397.00 |

417.33 |

10433.21 |

105000 |

0 |

105000 |

105417.3285 |

0.000136986 |

15.88 |

25.00 |

397.00 |

433.21 |

10830.21 |

105000 |

0 |

105000 |

105433.2085 |

0.000136986 |

15.88 |

25.00 |

397.00 |

449.09 |

11227.21 |

105000 |

0 |

105000 |

105449.0885 |

0.000136986 |

15.88 |

25.00 |

397.00 |

464.97 |

11624.21 |

105000 |

0 |

105000 |

105464.9685 |

0.000150685 |

15.89 |

25.00 |

397.25 |

480.86 |

12021.46 |

|

|

|

|

Total Dividend |

|

|

12021.46 |

|

|

During payment processing at the end of the month (in case the payment frequency is monthly), the EPU entered at the end of the month will be used for all calculations for the payment period. In case the EPU entered at the end of the month is different, then the new EPU will be used to calculate the dividend amount payable for all days in the payment period.

In case the payment date happens to be a holiday, defined in the system calendar, the system will process the dividend on the day preceding the holiday (if the holiday rule is set to ‘prior’).

Reinvestment Base Price

Alphanumeric; Mandatory only if default distribution mode is ‘Reinvestment’.

Reinvestment transactions into the fund can be put through either at the NAV for the day or the transaction base price. You can use this field to indicate the price that must be used.

Minimum Amount for Payment

Numeric, Optional

Indicate the threshold dividend amount in fund base currency. If Investor has chosen the cash option for dividend payment and the dividend income in the current processing cycle is more than threshold dividend amount, then dividend income can be paid out.

If Unit holder has chosen distribution mode as a combination of cash and reinvestment and the cash portion of dividend amount net of tax is less than Minimum Amount for Payment then system will generate a single reinvestment transaction for the total dividend income.

Action on Minimum Amount Validation

Optional

Select the options from list:

- Reinvest - Reinvest the dividend if it falls below minimum amount for payment.

- Hold - No additional processing is required and Dividend amount is neither be paid out nor reinvested.

Override at Pay Time

Optional

Indicate whether Minimum Amount for Payment can be overridden during dividend payment processing.

Auto Reinvestment for Unclaimed Dividend

Optional

If you select ‘Yes’, system will automatically reinvest when dividend is unclaimed, i.e., dividend check is not encashed within the expiry date.

Note

By default, this option will be ’No’.

Auto Reinvestment for Unclaimed Dividend When No Balance Left

Optional

If you select ‘Yes’, then system will automatically reinvest when dividend is unclaimed, i.e., dividend check is not encashed within the expiry date and when the unit holder does not have sufficient balance in the underlying fund.

Note

By default, this option will be ’No’.

Track Dividend for Uncleared Transactions?

Optional

Indicate whether dividend payment/re-investment should be tracked for an individual un-cleared transaction.

If you select ‘Yes’, dividend will be held back temporarily for subscription transactions whose cheques are not cleared as on the Dividend Declaration Date. Dividend will be released when the payment is cleared.

Note

By default, this option will be ’No’.

Track Dividend for Blocked Transactions?

Optional

Specify whether dividend payment should be tracked for a blocked transaction, where some or all units are blocked at the time of dividend processing.

If you select ‘Yes’,, system will process the dividend as per the action selected in the Block Transaction Screen.

Note

By default, this option will be ’No’.

Pay Ungenerated Reinvestments?

Optional

Select ‘Yes’, to indicate that in case the re investment results in zero units allotment, the amount should be paid out to the investor.

If you select ‘Yes’, then system executes the following steps:

- Converts the amount to be reinvested to the fund base currency

- Divides the amount in fund base currency with the latest NAV for the fund. This will result in the units expected to that could be allotted.

- Applies the rounding rule to the number of units.

If the number of units in the result of step 3 is greater than zero, re-investment transaction will be generated. If the result is zero then the amount should be paid out to the investor in the unitholder preferred currency. In case any specific preference has been set at the unitholder fund level then the respective currency will be used.

TDS Applicable for all UH

Conditional

You can enter a value in this field only if you have selected the ‘Dividend Equalization Applicable’ option in the General Operating Rules for the fund. The default value is ‘No’; if you select ‘Yes’, the system will distribute dividend after deducting the tax applicable for all unit holders who are entitled to dividend. This is applicable even for the equalization amount.

FDAP Income

Optional

Check this box to indicate the dividends distributed in this fund are FDAP income.

Note

- The preference that you have maintained ate the unit holder level (the ‘Tax Deducted At Source’ field in the ‘Unit Holder Maintenance’ screen) will take precedence over the value maintained here. For instance, if you have unchecked the TDS option at the Unit holder level, then all inflows to the unit holder will be done on a gross basis even if you have selected the ‘TDS Applicable for all UH’ field at the fund level.

- You are required to maintain a single WHT setup (with single slab) for the equalization fund. Tax on the gross dividend amount will be deducted based on this setup.

The Lead Times section

Book Closing

3 Characters Maximum, Numeric, Mandatory

Enter a lead-time in days. The Registrar must enter the book closing dates within this lead-time from the time the dividend information is declared.

The Book Closing From and To Dates together signify the period within which no change will be allowed to a unit holder’s balances in a fund. This means that any transaction that has been entered within these dates will not be allocated for the unit holder.

Freeze Holding

3 Characters Maximum, Numeric, Mandatory

Enter a lead-time in days. The Registrar must enter the Freeze Holdings Date within this lead-time from the time the dividend information is declared.

The Freeze Holding Date is the date on which the balances held by all unit holders in the fund will be consolidated.

Board Meeting

3 Characters Maximum, Numeric, Mandatory

Enter a lead-time in days. The Registrar must enter the Board Meeting Date within this lead-time, before the time the dividend information is declared. This is captured for information purposes only.

Dividend Payment

3 Characters Maximum, Numeric, Mandatory

Enter a lead-time in days. The Registrar must enter the Dividend Payment Date within this lead-time, from the time the dividend information is declared.

Each of the lead times must be less than the Dividend Declaration Frequency. For example, if the Dividend Declaration Frequency is WEEKLY, the Board Meeting Lead Time cannot be 8 days.

The NPI Preferences section

NPI Applicable

Mandatory

Select ‘Yes’ in this field to indicate that non permissible income (NPI) component is allowed for this fund.

Default NPI Payment

Mandatory

If NPI is applicable for this fund, then specify the default payment option from the drop-down list provided.

Override Unit holder preference?

Mandatory if NPI is applicable

Select ‘Yes’ in this field if the fund override the NPI payment preferences maintained for the investor at the unit holder level. However, if the NPI payment preferences are not maintained at the unitholder level, then NPI payment will be made as per the fund preferences.

Force Re-investment of Un-cleared units

Mandatory if NPI is applicable

The system does not consider NPI amount while processing reinvestments, even if it is from un-cleared balances. It should either be paid to a trust or to the unit holder.

However, in case of Permissible income, you can opt to reinvest the Un-cleared Unit balances by choosing the ‘Force reinvestment’ option. Else, select ‘No preference’, which overrides the UH IDS setup.

Multiple Distribution

Net/Gross

Optional

Select Net or Gross from the drop-down list. The default value is Gross.

Multiple Distribution

Optional

Select if different types of distributions can be processed on the same day or not from the adjoining drop-down list. Following are the options available:

- Yes

- No

Distribution Type

Alphanumeric, Mandatory (if multiple distribution box is checked.)

This field is enabled if the Multiple Distribution check box is selected. Select the appropriate value from the drop-down list. The options available are INT (Interest), DIV (dividend), and PID (Property Income Distribution). This distribution is applicable for corporate action type ‘Cash’ only.

3.1.6.1 Dividend Processing for Fund

In Oracle FLEXCUBE Investor Servicing, there are two types of dividend that can be processed for a fund:

- Cash Dividend

- Stock Dividend

In the case of cash dividends, the unit holders receive the dividend in monetary form. If an income distribution setup record is defined for an investor, then the dividend received is reinvested according to the framework of the same. Cash dividends could be declared for capital gains or income.

In the case of stock dividends, the unit holders receive dividend in the form of units in addition to their holdings as on the record date, which are reinvested in the same fund.

In Oracle FLEXCUBE Investor Servicing, you can define an individual corporate actions record for each of the dividend types, in the Corporate Actions screen. For a fund, if both cash and stock dividends are declared, a separate Corporate Actions profile must be set up for each of the dividend types.

Refer the chapter Dividend Maintenance in the Fund Manager User Manual for information

about the static maintenance for processing dividends in the system.

Setting up Rules for Cash Dividend for Fund

To set up the guidelines for a cash dividend for a fund in the Corporate Actions screen,

- The ID of the fund and the Rule Effective Date are filled in from the Fund Demographics screen.

- In the Corporate Action type field, select “Cash Dividend”. If you are defining a cash dividend for capital gains, choose Cash Dividend – Capital Gains. For a cash dividend for income, choose Cash Dividend – Income.

- Specify the frequencies for declaration and payment of dividend, in the Dividend Declaration Frequency and Dividend Payment Frequency fields respectively.

- Specify the rounding rules for dividend, in the Rounding Options and Rounding Precision fields.

- Specify the default mode of distribution for the cash dividend – payment by cheque, transfer or reinvestment.

- Specify the basis upon which exchange rate for dividend will be obtained, in the Dividend Exchange Rate Basis field.

- Specify the first dividend declaration date for the fund, in the First Dividend Declare Date field.

- Specify the tax ID for the fund, as well as the basis for tax deduction at source, in the TDS Basis field.

- Specify the units to be considered for the record date (freeze holdings) for dividend eligibility, in the Units for Freeze Holding field.

- If EPU components are applicable for the fund, select the Allow EPU Component Setup option and specify the EPU Lot. The default value for EPU lot will be 1.

- If look-ahead dividend processing for holidays is to be applicable for cash dividends for the fund, select the Look Ahead Processing option.

- Specify a lag period for dividend payment, if necessary, in the Payment Lag field.

- Specify a lag period for reinvestments, if necessary, in the Reinvestment Lag field.

- Specify the holiday rule to be applicable for cash dividends for the fund.

- In the Lead Times section, specify the lead times for freeze holdings, book closing, directors’ meeting and dividend payment, as applicable for cash dividends for the fund.

Setting up Rules for Stock Dividend for Fund

To set up the guidelines for a stock dividend for a fund in the Corporate Actions screen,

- The ID of the fund and the Rule Effective Date are filled in from the Fund Demographics screen.

- In the Corporate Action type field, select “Stock Dividend”. The following information is considered by default for stock dividends:

- Since stock dividends are exempt from tax, the TDS Basis field has a default value, “tax-exempt”, and is locked for data entry.

- Income Distribution Setup options are not applicable for unit holders eligible for stock dividends, and the option Restrict IDS for Unit Holders is selected and cannot be changed. Also, the distribution mode for such dividends is taken by default to be Reinvestment.

- EPU components are not applicable for stock dividends.

- Specify the frequencies for declaration and payment of dividend, in the Dividend Declaration Frequency and Dividend Payment Frequency fields respectively.

- Specify the rounding rules for dividend, in the Rounding Options and Rounding Precision fields.

- Specify the basis upon which exchange rate for dividend will be obtained, in the Dividend Exchange Rate Basis field.

- Specify the first dividend declaration date for the fund, in the First Dividend Declare Date field.

- Specify the units to be considered for the record date (freeze holdings) for dividend eligibility, in the Units for Freeze Holding field.

- If look-ahead dividend processing for holidays is to be applicable for stock dividends for the fund, select the Look Ahead Processing option.

- Specify a lag period for dividend payment, if necessary, in the Payment Lag field.

- Specify a lag period for reinvestments, if necessary, in the Reinvestment Lag field.

- Specify the holiday rule to be applicable for stock dividends for the fund.

- In the Lead Times section, specify the lead times for freeze holdings, book closing, directors’ meeting and dividend payment, as applicable for stock dividends for the fund.

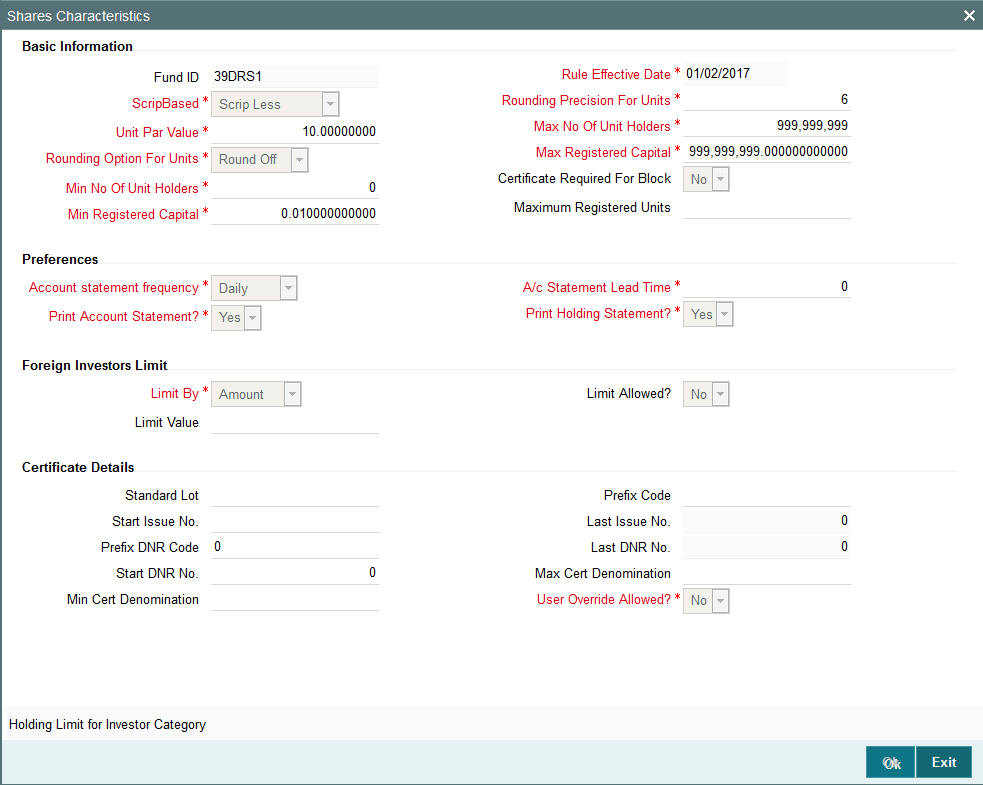

3.1.7 Shares Characteristics Button

The Shares Characteristics fund rule enables you to maintain certificate details for the fund. Further, the fund corpus information, limits on the unit holders and the foreign investors and the account statement information are maintained here.

You can also maintain the rounding precision pattern for allocation of units in this screen.

To set up the Shares Characteristics rule for a fund, use the ‘Shares Characteristics’ screen. You can invoke this screen by clicking ‘Shares Characteristics’ tab from the ‘Fund Rules’ screen.

Before you set up a Shares Characteristics profile record for a fund, it is desirable to ensure that the fund already has an existing, unauthorized Fund Rules profile record.

You can specify the following details in this section:

Basic Information Section

Fund ID

Display

This field indicates the ID fund for which you are setting up the Shares Characteristics profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date

Display

The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Scrip Based

Alphanumeric, Mandatory

In this field, you can designate the applicability of certificate issue for investment in the fund. According to the option you select here, you can:

- Designate that certificate issue for the fund is mandatory. This means that certificates must be issued to unit holders for transactions in the fund. To indicate this, choose the ‘Scrip Based’ option in this field.

- Designate that certificate issue is not mandatory for the fund. This means that certificates are not required to be issued to unit holders for transactions in the fund. To indicate this, choose the ‘Scrip Less’ option in this field. If you do so, the fund is a scrip less fund, and you can designate that certificates must be issued only for block transactions, if so needed, by checking the Certificate Required For Block check box in this screen.

- Designate that certificate issue is to be based on the choice of the investor at the time of transacting. In such a case, certificates will be issued only if the investor specifically requests for certificates at the time of entering into a transaction. To indicate this, select ‘Certificate Option’ in this field. Such funds are known in the system as certificate option funds.

You can specify the details of certificate issue for the fund, in the Certificate Details tab in this screen.

Certificate Required For Block

Optional

For scrip less funds, select ‘Yes’ in this field to indicate that certificates must be issued to investors for block transactions in the fund.

Minimum Registered Capital

Currency, Mandatory

Enter an amount to specify the lower limit of Fund Corpus beyond which the system will disable the fund and await action from the Fund Manager. At any point of time, when the fund is enabled, the fund corpus (registered capital) cannot go below this value.

Maximum Registered Capital

Currency, Mandatory

Enter an amount to specify the Upper limit of Fund Corpus beyond which the system will disable the fund and await action from the Fund Manager. At any point of time, when the Fund is enabled, the fund corpus (registered capital) cannot go above this value.

This upper limit must be below the figure of ten thousand trillion, at any point of time.

Minimum Number of Unit Holders

10 Characters Maximum, Numeric, Mandatory

Enter a value to specify the lower limit (i.e.) Minimum Number of unit holders beyond which the system will disable the fund and await action from the Fund Manager. At any point of time, when the fund is enabled, the number of unit holders cannot fall below this value. This value must not be lower than zero.

Maximum Number of Unit Holders

10 Characters Maximum, Numeric, Mandatory

Enter a value to specify the Upper limit (i.e.) Maximum Number of unit holders beyond which the system will disable the fund and await action from the fund Manager. At any point of time, when the fund is enabled, the number of unit holders cannot go above this value. This value must not be lower than or equal to zero.

Unit Par Value

Currency, Mandatory

Enter the Par Value for the fund. Normally, this will be the base price for Initial Public Offer (IPO) period. However, you can change the base price for IPO.

Rounding Precision for Units

1 Character Maximum, Numeric, Mandatory

Specify the decimal value or negative value for the units and the units would be reckoned for

rounding precision.

Rounding Option for Units

Alphanumeric, Mandatory

Indicate the rounding options for the value of the number of allotted units, designated for the fund.

Choose ‘Round Up’ to indicate rounding the value at the precision decimal place to the next higher numeral.

Choose ‘Round Off’ to indicate normal rounding at the precision decimal.

Choose ‘Round Down’ to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the number of allotted units reckoned for a subscription transaction is 100.36497, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 100.365.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 100.365.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 100.364.

Maximum Registered Units

Numeric, Optional

Enter a value to specify the maximum registered units for the fund. A transaction can be allocated only if it does not breach the maximum registered units specified here or at the investor category level. If breached, system will calculate the balance in the fund at the fund level as well at the investor category level, after considering the effect of the transaction to be allotted. If any of the limits are breached, the transaction will not be allocated and marked as error.

You can specify the limits at the fund-investor category level in the ‘Holding Limit for Investor Category’ screen. This screen is explained in detail further in the chapter.

The Preferences Section

In this section, you can set up your preferences for the Foreign Investors limits and the frequency and lead times for Account Statements.

Account Statement Frequency

Alphanumeric, Mandatory

Select the frequency with which the system should initiate the Account Statement processing, from the options provided. This is applicable only if Account Statement is required.

Account Statement Lead Time

3 Characters Maximum, Numeric, Mandatory

Enter a lead-time in days. This lead-time is to prompt the Registrar that the processing of Account Statement should happen within this lead-time.

Print Account Statement?

Optional

Select ‘Yes’ in this field to indicate that the Account Statement is to be printed for the fund that is being set up.

Print Holdings Statement?

Optional

Select ‘Yes’ in this field to indicate that the Holdings Statement is to be printed for the fund that is being set up.

Foreign Investors Limit Section

Limit Allowed?

Mandatory

Select ‘Yes’ in this field to indicate the fund that is being set up is allows Foreign Investors to invest in the fund.

Limit By

Mandatory

Choose ‘Amount’ if the foreign investors limit is in terms of a flat Amount or choose ‘Percentage’ if the limit is to be defined in terms of percentage of Registered Capital..

Limit Value

Numeric, Optional

Enter a value to specify the percentage of fund corpus that foreigners are allowed to hold. This could be either a percentage of Fund Corpus or a flat Amount. If it is a percentage, then it cannot be greater than 100.

If this is entered as a flat amount, then it should never exceed or be equal to the figure of one hundred trillion.

Certificate Details Section

For funds in which certificate generation is mandatory, or is at the option of the unit holder, you must specify the details of the certificate denominations as mandatory information in this section. Therefore, if you have chosen either the ‘Scrip Based’ option or the ‘Certificate Option’ in the Certificate Options field, then you must specify the certificate details as mandatory information in this tab.

If you have chosen the ‘Scrip Less’ option in the Certificate Options field, and have checked the Certificate Required for Block box, then this section is not applicable.

Standard Lot

Numeric, Mandatory

Enter a value to specify the standard lot for fund. This is also the marketable lot.

Prefix Certificate Code

1 Character Maximum, Alphanumeric, Mandatory

Enter a character for this field. This will be used as prefix to the Certificate Number.

Start Certificate Issue Number

Numeric, Mandatory

Enter a value for this field. This is just for information. For a new Fund, the Certificate Numbers will start from this number.

Last Certificate Issued Number

Numeric, Mandatory

Enter a value for this field. This is to specify that this was the last certificate number that has been issued so far and system needs to start from next number. For new funds, this could be zero. This is also equal to the Start Certificate Issue Number in the case of new Funds

Minimum Certificate Denomination

Numeric, Mandatory

Enter a value to specify the minimum certificate denomination, i.e., the next level of denomination after the standard lot. The system will use this after exhausting the maximum certificate denominations.

Maximum Certificate Denomination

Numeric, Mandatory

Enter a value to specify the maximum certificate denomination. This is the first level of denomination used by the system.

Note

Min. Cert Denomination is 100, Max. Cert Denomination is 1000 and a unit holder purchases 5500 units. The certificates will be issued for 5 of 1000 denomination and 5 of 100 denomination.

Prefix Distinctive Number Record Code

1 Character Maximum, Alphanumeric, Optional

Enter a character for this field. This will be used as prefix to the Distinctive Number Record (DNR) Number.

This information is only applicable if you have specified the number of decimals for units as zero, in the Number of Decimals for Units field in this screen.

User Override Allowed

Mandatory

Select ‘Yes’ in this field to indicate the user on the unit holder’s request can override the default denominations defined above. If this is enabled, system will allow the teller to override the fund default denominations. This is true only for minimum and maximum denominations. The Standard lot cannot be changed. This is applicable only to scrip-based funds.

Start Distinctive Number Record Issued Number

10 Characters Maximum, Numeric, Optional

Enter a value for this field. This is just for information. For new funds, this will be same as last DNR issued number.

This information is only applicable if you have specified the number of decimals for units as zero, in the Number of Decimals for Units field in this screen.

Last Distinctive Number Record Issued Number

6 Character Maximum, Alphanumeric, Optional

Enter a value for this field. This is to specify that this was the last DNR number that has been issued so far and system needs to start from next number. For new funds, this could be zero. This is also equal to the Start Certificate Issue Number in the case of new Funds.

This information is only applicable if you have specified the number of decimals for units as zero, in the Number of Decimals for Units field in this screen.

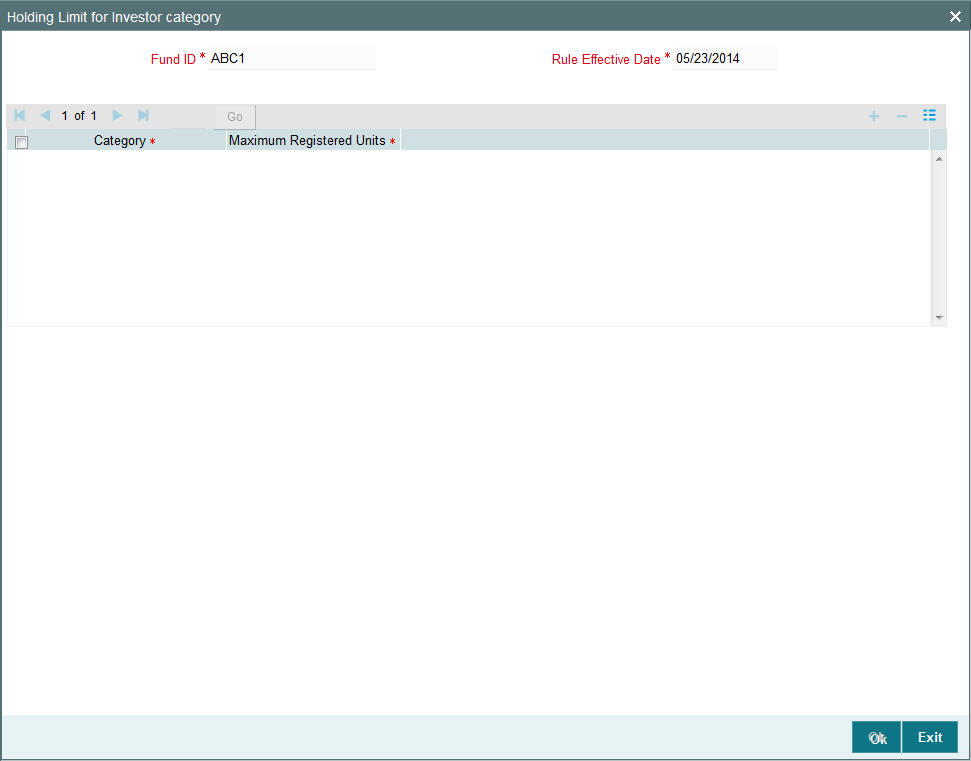

Holding Limit for Investory Category

You can specify the limits in terms of units that can be allowed for any given investor category. You may either skip this maintenance or specify limits for one or more investor categories. Use the Holding Limit for Investory Category screen to specify the limits.

Click ‘Holding Limit for Investor Category’ button from the ‘Share Characteristics’ screen to invoke this screen.

Fund ID

Display

This field indicates the ID fund for which you are setting up the Shares Characteristics profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date

Display

The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Category

Character, optional

Enter one of the valid investor categories. During unitholder amendment the system will validate if the amendment breaches the limit set up at the investor category level. System will not allow the amendment if the limits are breached and displays an appropriate error message.

You can click add icon to add details on Investor Category. Similarly you can click delete icon to delete the details.

The allocation of the following transactions will be impacted:

- IPO Subscription

- Subscription

- Transfer

- Switch In

System will check if any limit has been set for the maximum registered capital at the fund level as well as fund - investor category level. If yes, system will calculate the balance in the fund at the fund level as well as investor category level, after considering the effect of the transaction to be allotted. If any of the limit is breached the transaction will not be allocated and marked as error. This transaction will get picked up in the subsequent EODs and may or may not be allotted based on the holding on that day. The validation for the balances will always be made for the latest fund rule only, regardless of the transaction being backdated or current dated.

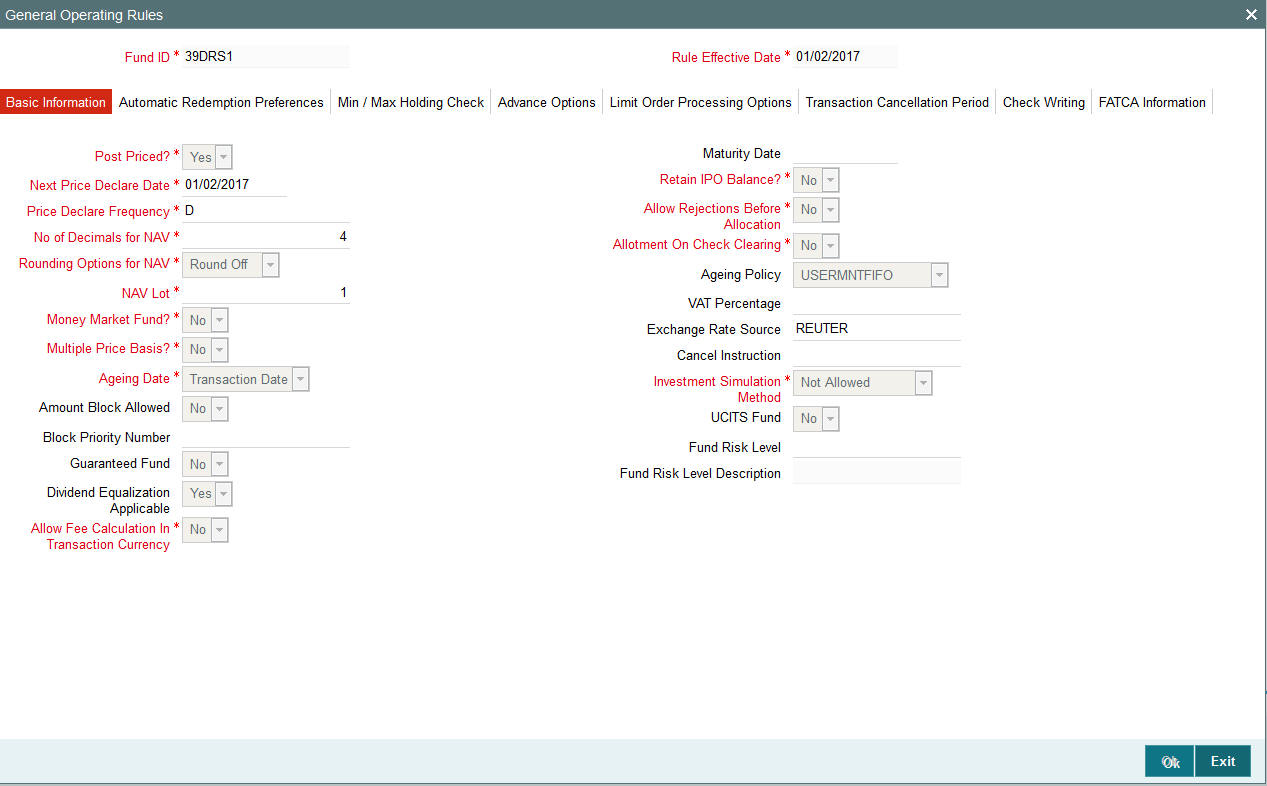

3.1.8 General Operating Rules Tab

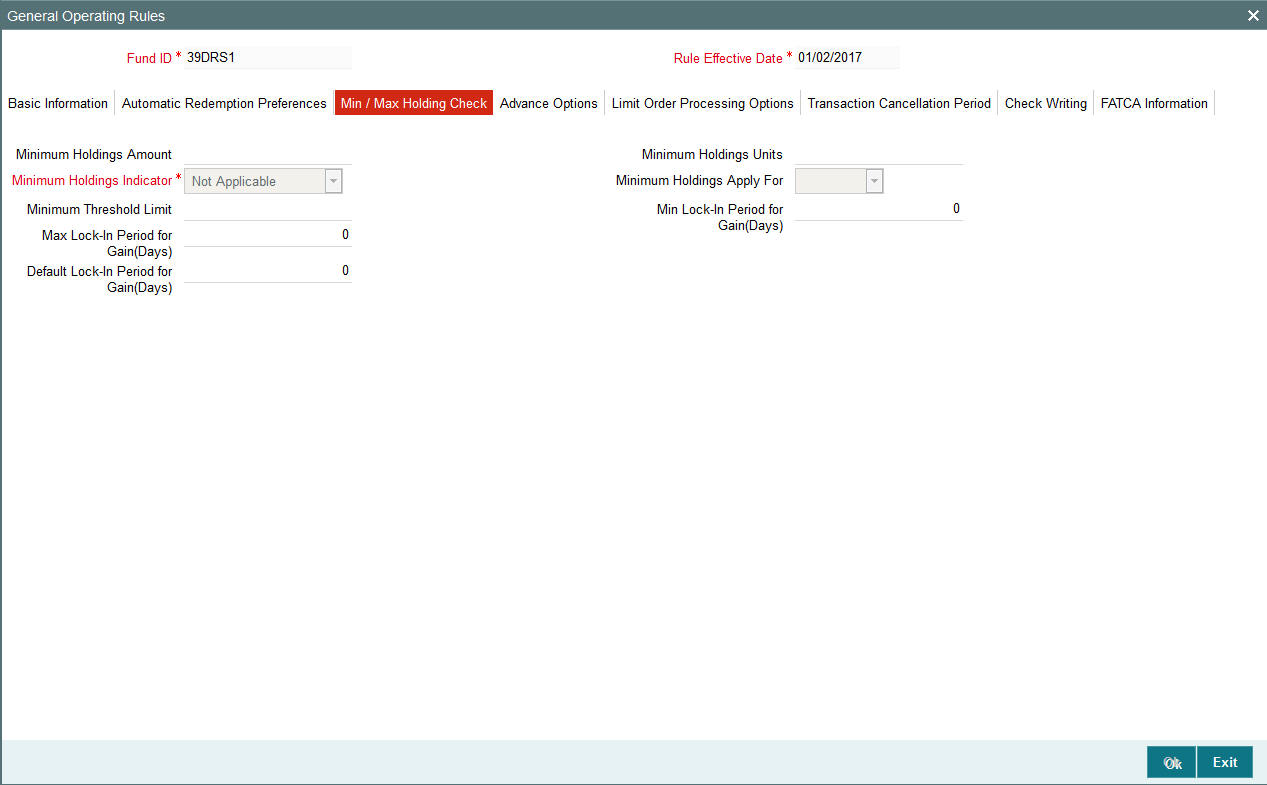

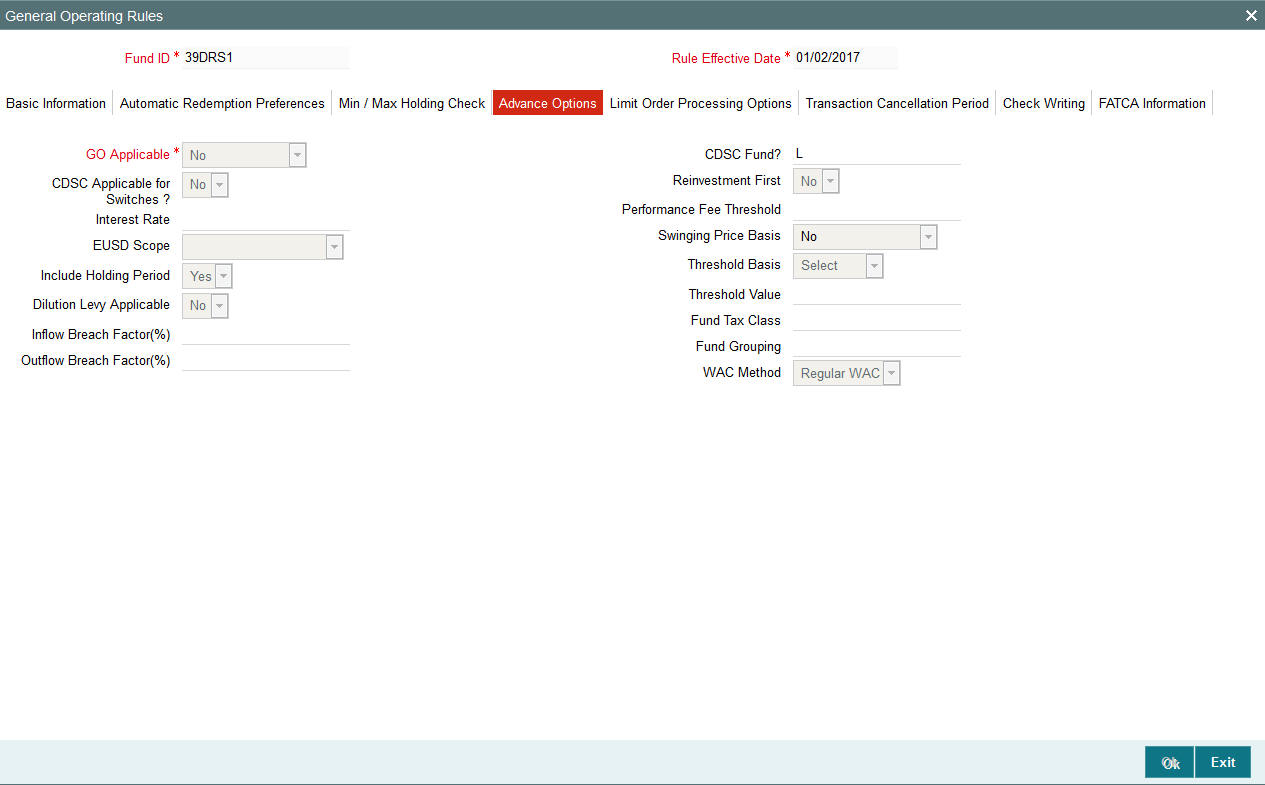

This fund rule facilitates the maintenance of guidelines that will govern the operation of the fund with respect to the following parameters:

- The pricing policy, i.e., whether the fund is to be a pre-priced or a post-priced fund. You can also set up the price declare frequency and the next price declare date. If it is a closed-ended fund, you can also set up the maturity date.

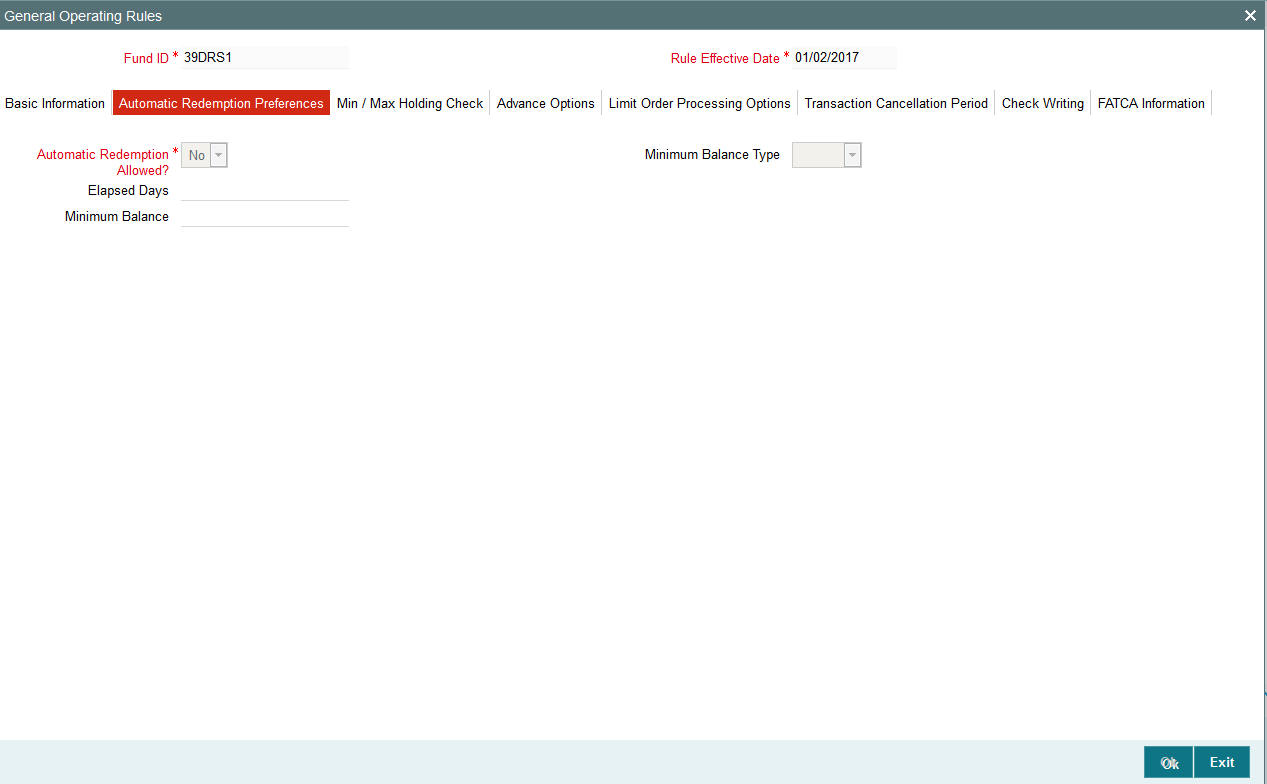

- The automatic redemption details, if the fund is to have automatic redemption of units for a unit holder based on the threshold balance.

- The number of decimals for NAV declaration, as well as the lot for NAV.

- The Ageing Policy of the fund

- The applicability of charges such as Contingent Deferred Sales Charge (CDSC) for redemption or switch transactions in the fund, as well as the processing order.

- Specification of the NAV Lot

- Dividend Equalization

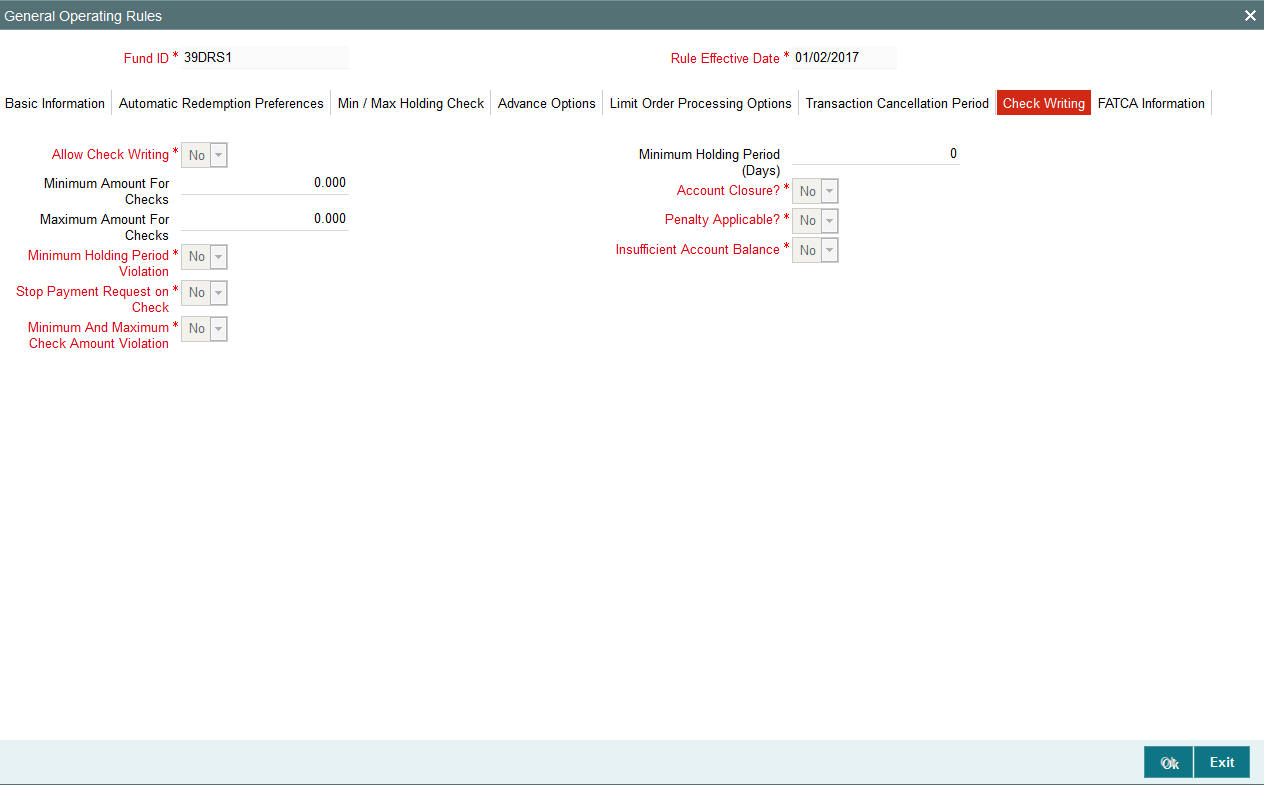

- Rules that govern check writing for the fund, such as:

- The limits on the amount for a check.

- The minimum period for which units must be held in the investor account for the fund, before they are redeemed by a check.

- Whether the unit holder can close the account through a redemption check

- If the fund is a retirement fund, whether check facility can be made available for the fund

- Applicable penalties on check redemption due to contravening any of the limits for check amount, minimum period, or insufficient account balance or stop payment instructions on a check.

- Whether the system should recompute the fund prices and adjust units as per forecast rates, if the fund is a Guaranteed Fund.

To set up the General Operating Rules for a fund, use the General Operating Rules screen. You can invoke this screen by clicking ‘General Operating Rules’ tab from the Fund Rules Detail screen.

Note

Before you set up a General Operating Rules profile record for a fund, it is desirable to ensure that the fund already has an existing, unauthorized profile record.

You can specify the following details in this screen:

3.1.8.1 Basic Information Tab

Fund ID

Display

This field indicates the ID fund for which you are setting up the General Operating Rules profile. This information is defaulted from the Fund Demographics screen.

Rule Effective Date

Display

The Rule Effective Date for the fund, which you specified in the Fund Demographics screen, is displayed here.

Post Priced?

Mandatory

Select ‘Yes’ in this field to indicate that the price for the fund will be announced Post Transactions.

Allotment on Cheque Clearing

Mandatory

Select ‘Yes’ in this field to indicate that allocation must be done on the check clearing date, using the price prevailing on that date, for transactions in which the payment mode is Check.

Price Declare Frequency

1 Character Maximum, Alphanumeric, Mandatory

Select a value to specify the frequency with which the price will be announced, from the options provided.

If you are specifying the General Operating Rules for a Post-priced Fund, you must specify this frequency as Daily

Retain IPO Balance?

Mandatory

Select ‘Yes’ in this field to indicate that the IPO Balance of unit holders must to be stored for later use.

Next Price Declare Date

Date, Mandatory

Specify the next date upon which the fund price is to be declared. This date must be after the Rule Effective Date of the fund, and the current system date.

Allow Rejections before Allocation?

Mandatory

Select ‘Yes’ in this field to indicate that a rejection of a transaction as applicable, for all authorized transactions, prior to allocation. If this is not specified, then all authorized transactions will be taken up for allocation directly.

No of Decimals for NAV

1 Character Maximum, Numeric, Mandatory

Indicate the maximum number of decimals that would be reckoned for rounding precision, for the NAV.

Rounding Options for NAV

Alphanumeric, Mandatory

Indicate the rounding options for the value of the NAV for the selected transaction type, for the fund.

Choose ‘Round Up’ to indicate rounding the value at the precision decimal place to the next higher numeral.

Choose ‘Round Off’ to indicate normal rounding at the precision decimal.

Choose ‘Round Down’ to indicate truncation of the value at the precision decimal place.

Example

Let us suppose that the NAV for the fund on a certain date 02-03-2003 is 10.561234, and that this value must be rounded to the 3rd decimal place.

If you indicate rounding up, then the value reckoned would be 10.562.

If you indicate rounding off, then, applying normal rounding off rules, the value reckoned would be 10.561.

If you indicate rounding down or truncation, then the value would be truncated as it is, in the 3rd decimal place, and it would be reckoned as 10.561.

Ageing Policy

Alphanumeric, Mandatory

By default transactions are ordered in a First In First Out (FIFO) basis. If the unit holder has specified as to how transactions are to be ordered, then click on the drop down menu and select Txn Receipts.

For AMCs, those service distributors, where the distributor books are maintained in the AMC at hierarchical levels mutually decided on through a service level agreement, the option of ageing based on the hierarchy is available.

For funds in which there is a daily declaration of dividend (typically money market funds), and in which redemption transactions would be requested across non-taxable and taxable products, you can select the FIFO Across Products option if required. This feature is available only if your installation has specifically requested for it.

For Funds where IOF and IRRF taxes are applicable on the profits the ageing policy should selected to be ‘IOF/IRRF’ Optimization.

In case of Certificate Option funds, i.e. if certificate issue is to be based on the choice of the investor at the time of transacting, then the ageing policy can be specified as ‘Hierarchy’.

The USERMNTFIFO aging policy will use the Aging sequence maintained in Fund Preference Maintenance (UTDFPMNT) screen during allocation of outflow transaction.

Note

Certificate-option fund with aging logic as USERMNTFIFO will not be supported.

Maturity Date

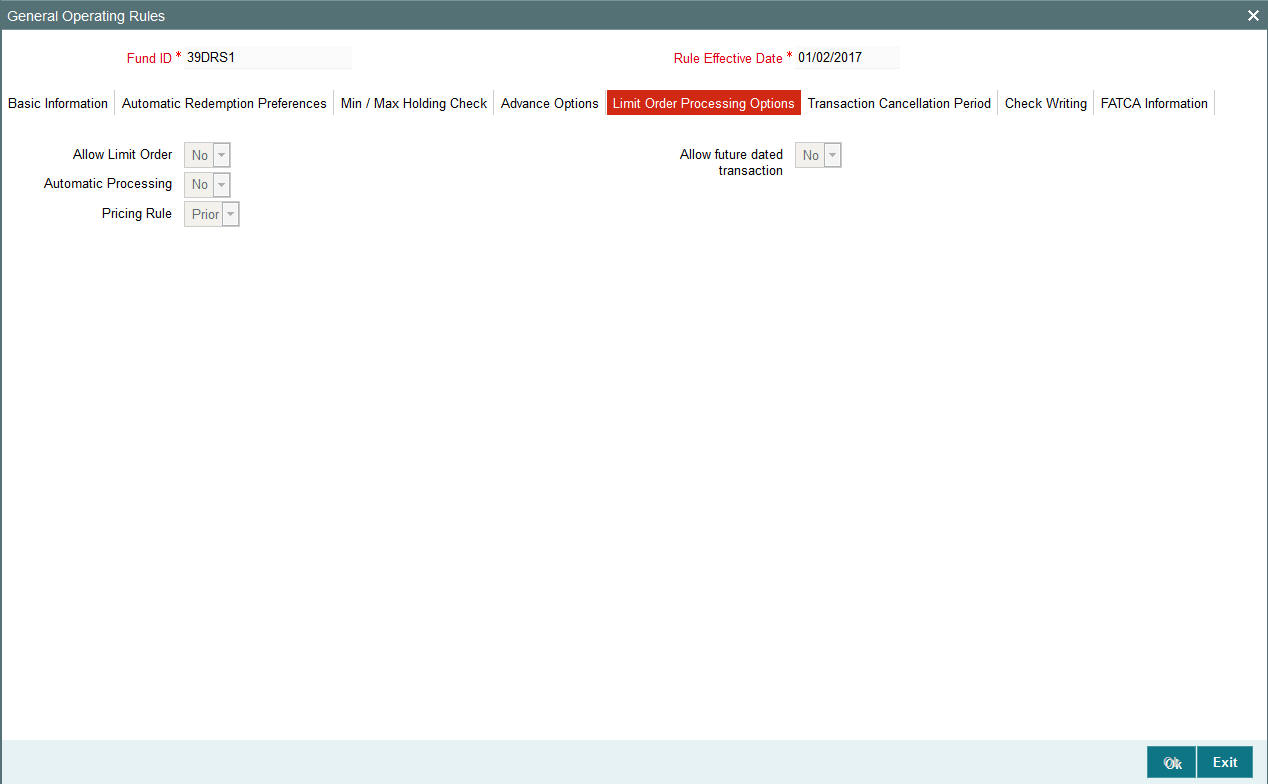

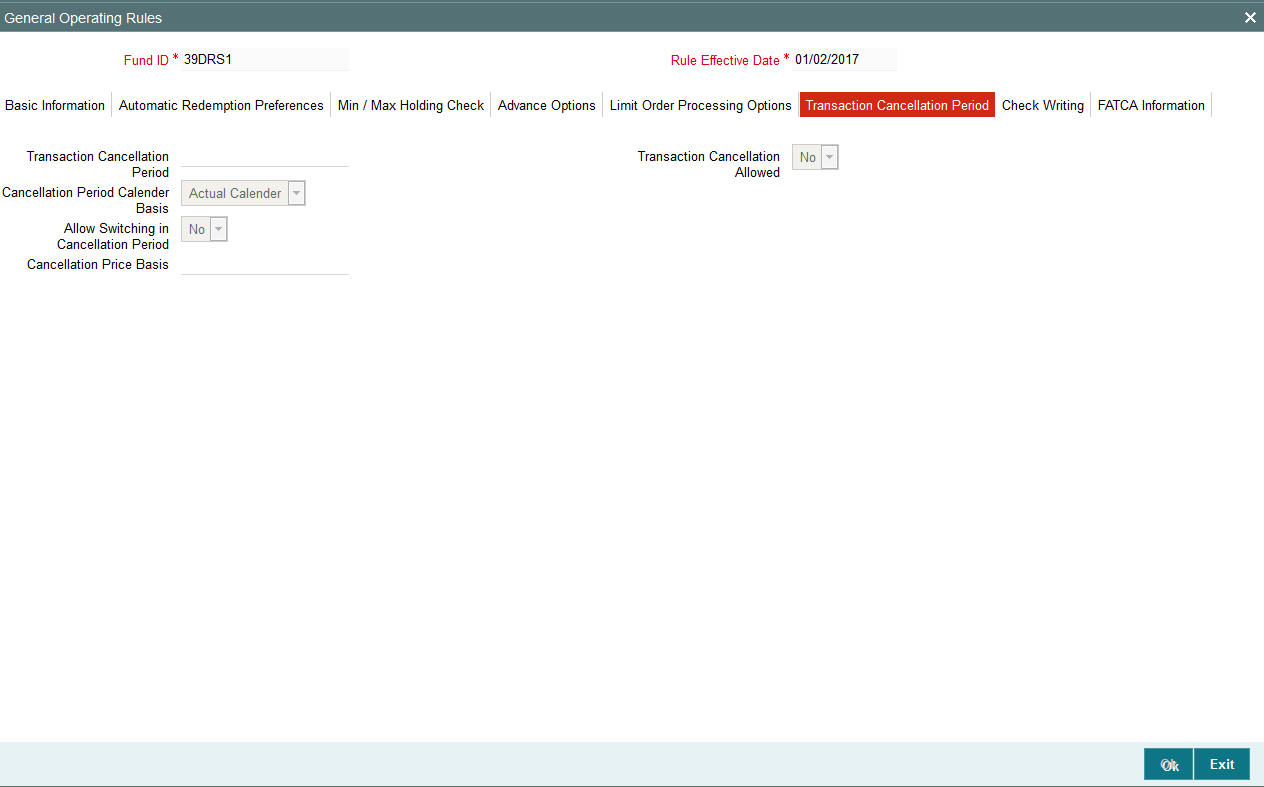

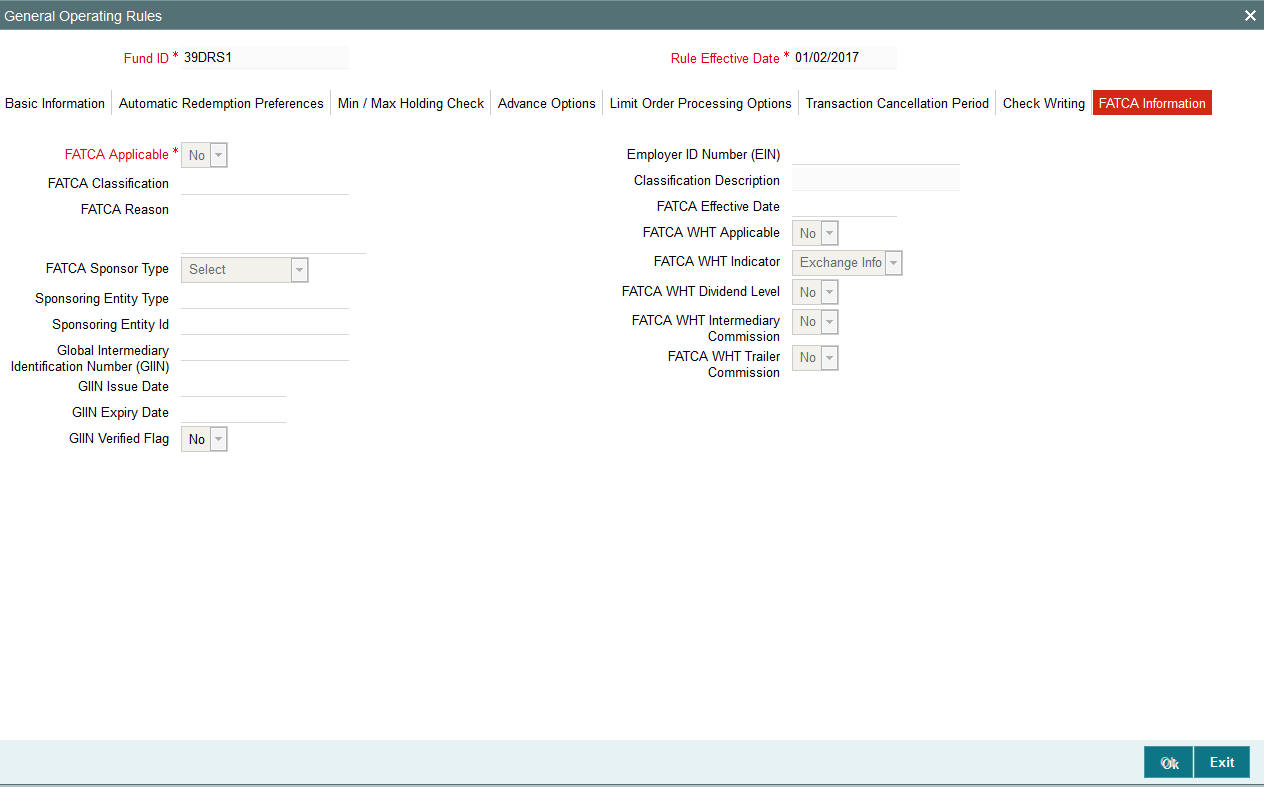

Date, Mandatory