3. Processing SWIFT Messages

The Oracle FLEXCUBE Investor Servicing (FCIS) system provides the facility of processing incoming and outgoing messages at an AMC / Distributor installation, over the SWIFT (Society for Worldwide Inter bank Financial Telecommunication) network.

This chapter contains the following sections:

- Section 3.1, "Transaction Workflow"

- Section 3.2, "Processing SWIFT Messages"

- Section 3.3, "Swift Message Setup Summary Screen"

- Section 3.4, "Setting Up UDFs for SWIFT Elements"

- Section 3.5, "Manual Generation of Messages"

- Section 3.6, "Subscription Bulk Order"

- Section 3.7, "Subscription Bulk Order Confirmation"

- Section 3.8, "Subscription Bulk Order Cancellation Instruction"

- Section 3.9, "Subscription Multiple Order"

- Section 3.10, "Subscription Multiple Order Confirmation"

- Section 3.11, "Subscription Multiple Order Cancellation Instruction"

- Section 3.12, "Redemption Bulk Order"

- Section 3.13, "Redemption Bulk Order Confirmation"

- Section 3.14, "Redemption Bulk Order Cancellation Instruction"

- Section 3.15, "Redemption Multiple Order"

- Section 3.16, "Redemption Multiple Order Confirmation"

- Section 3.17, "Redemption Multiple Order Cancellation Instruction"

- Section 3.18, "Request for Order Status Report"

- Section 3.19, "Order Instruction Status Report"

- Section 3.20, "Order Cancellation Status Report"

- Section 3.21, "Switch Order"

- Section 3.22, "Switch Order Confirmation"

- Section 3.23, "Switch Order Cancellation Instruction"

- Section 3.24, "Transfer Out Instruction"

- Section 3.25, "Transfer Out Cancellation Request"

- Section 3.26, "Transfer Out Confirmation Request"

- Section 3.27, "Reversal Of Transfer Out Confirmation"

- Section 3.28, "Transfer In Instruction"

- Section 3.29, "Transfer In Cancellation Request"

- Section 3.30, "Transfer In Confirmation"

- Section 3.31, "Reversal Of Transfer In Confirmation"

- Section 3.32, "Request for Transfer Status Report"

- Section 3.33, "Transfer Cancellation Status Report"

- Section 3.34, "Transfer Instruction Status Report"

- Section 3.35, "Price Report"

- Section 3.36, "Price Report Correction"

- Section 3.37, "Price Report Cancellation"

- Section 3.38, "Fund Estimated Cash Forecast Report"

- Section 3.39, "Fund Confirmed Cash Forecast Report"

- Section 3.40, "Fund Confirmed Cash Forecast Report Cancellation"

- Section 3.41, "Fund Detailed Estimated Cash Forecast Report"

- Section 3.42, "Fund Detailed Confirmed Cash Forecast Report"

- Section 3.43, "Fund Detailed Confirmed Cash Forecast Report Cancellation"

- Section 3.44, "Custody Statement of Holdings Report"

- Section 3.45, "Statement of Investment Fund Transactions"

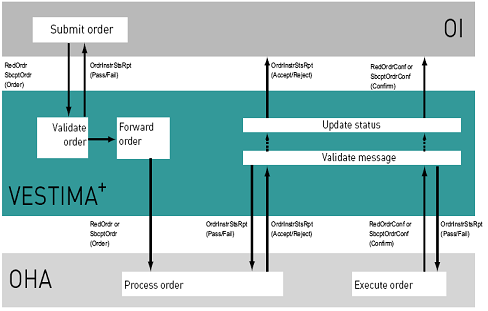

3.1 Transaction Workflow

This section contains the following topics:

- Section 3.1.1, "Incoming SWIFT Bulk/Multiple Orders"

- Section 3.1.2, "Incoming SWIFT Bulk Order Cancellation"

- Section 3.1.3, "Outgoing SWIFT Bulk Order Request"

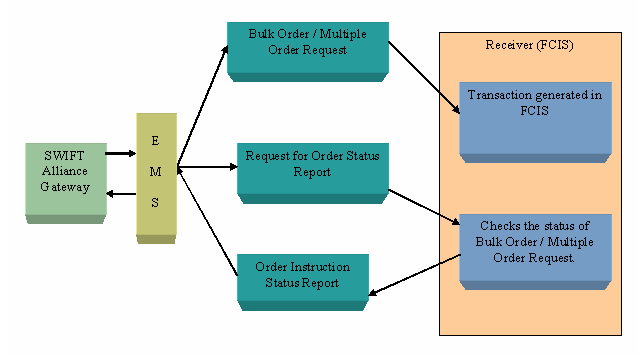

3.1.1 Incoming SWIFT Bulk/Multiple Orders

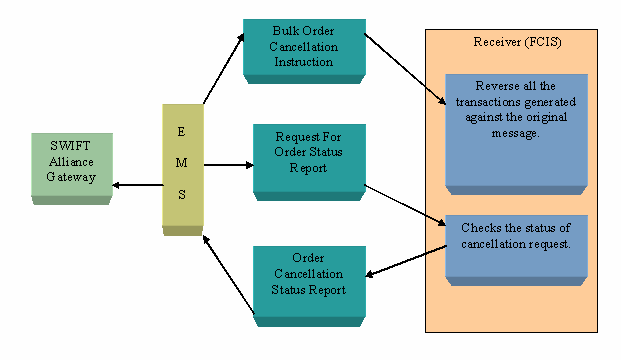

3.1.2 Incoming SWIFT Bulk Order Cancellation

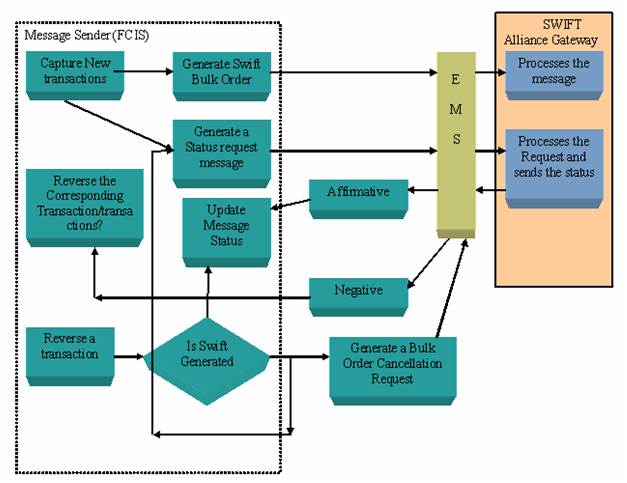

3.1.3 Outgoing SWIFT Bulk Order Request

3.2 Processing SWIFT Messages

This section contains the following topics:

3.2.1 Maintenance for Processing SWIFT Messages

You will need to carry certain maintenances for the generation of SWIFT messages, in the ‘Swift Message Setup Maintenance Detail’ screen. This screen can be used to define parameters applicable for individual messages such as the trigger events, entities involved in the communication etc. You can invoke the ‘Swift Message Setup Maintenance Detail’ screen by typing ‘UTDSWMSG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

The following screen is invoked:

Note

Depending on the Message Type and Message Code that you select, certain fields will be displayed.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Swift message setup maintenance.

Swift Details Section

Swift Details displays the following fields:

Message Reference Code

Mandatory

Enter a unique reference number for the message.

Medium

Mandatory

Select the option ‘In’ to indicate the message will be an incoming message. Select the option ‘Out’ to indicate the message is an outgoing message.

Note

Certain other fields will be displayed in this screen, depending on the option you select against the field Message Type.

Message Code

Mandatory

Select the message code from the drop-down list.

Note

Certain other fields will be displayed in this screen, depending on the option you select against the field Message Code.

Trigger

Mandatory

The trigger for generating the message may be an event, manual or both. Select the appropriate option.

Event Code

Mandatory if the Trigger is ‘Event’ and ‘Both’

Select the event upon which the message should be generated.

Note

This field will be:

- Enabled only if you have selected the option ‘Event’ or ‘Both’ against the field ‘Trigger’.

- Displayed only if the Message Type is ‘OUT’

To Entity Type

Mandatory

Select the Entity Type for which the message will be generated.

Note

For all Message Codes other than ‘Price Report’ messages, the option ‘AMC’ will be displayed in this field. You will not be allowed to change the same.

To Entity ID

Mandatory

Select the entity for which the message is applicable.

Note

This field will be displayed only if the Message Type is ‘OUT’.

Generate Auth Transactions

Optional

Check this box to indicate an incoming transaction request should be created as an authorized transaction.

Note

This check box will be enabled only if the Message Type is ‘IN’ and the Message Code is an Order or Cancellation message.

Confirm Outgoing Messages

Optional

Check this box to indicate the message needs to be manually confirmed. This is applicable only to FCIS initiated messages only and not messages which are in response to SWIFT requests.

Note

This field will be displayed only if the Message Type is ‘OUT’.

Global Order

Optional

Global orders are orders sent from distributors to AMC to subscribe on behalf of the distributor's customers. Check the box Global Order to indicate a global order should be generated.

Note

This check box will be enabled only if the Message Type is ‘OUT’ and the Message Code is a multiple order message.

Ref Types Section

Applicable Ref Types

Mandatory

For FCIS initiated orders, you can specify the Transaction Reference Types applicable to the outgoing message. The ones available for selection will be displayed in the adjoining option list. You can choose the appropriate one.

Reference Type Description

Upon Selection of the applicable reference type, the description of the selected reference type gets displayed.

Account Types Section

Applicable Account Types

Mandatory

For FCIS initiated orders, you can specify the account types which are allowed. The ones available for selection will be displayed in the adjoining option list. You can choose the appropriate one.

Account Type Description

Upon Selection of the applicable account type, the description of the selected account type gets displayed.

3.3 Swift Message Setup Summary Screen

This section contains the following topics:

- Section 3.3.1, "Invoking Swift Message Setup Summary Screen"

- Section 3.3.2, "Retrieving Record in Swift Message Setup Summary Screens"

- Section 3.3.3, "Editing SWIFT Records"

- Section 3.3.4, "Viewing SWIFT Records"

- Section 3.3.5, "Deleting SWIFT Records"

- Section 3.3.6, "Authorizing SWIFT Records"

- Section 3.3.7, "Amending SWIFT Records"

- Section 3.3.8, "Authorizing Amended Records"

- Section 3.3.9, "Copying Attributes "

3.3.1 Invoking Swift Message Setup Summary Screen

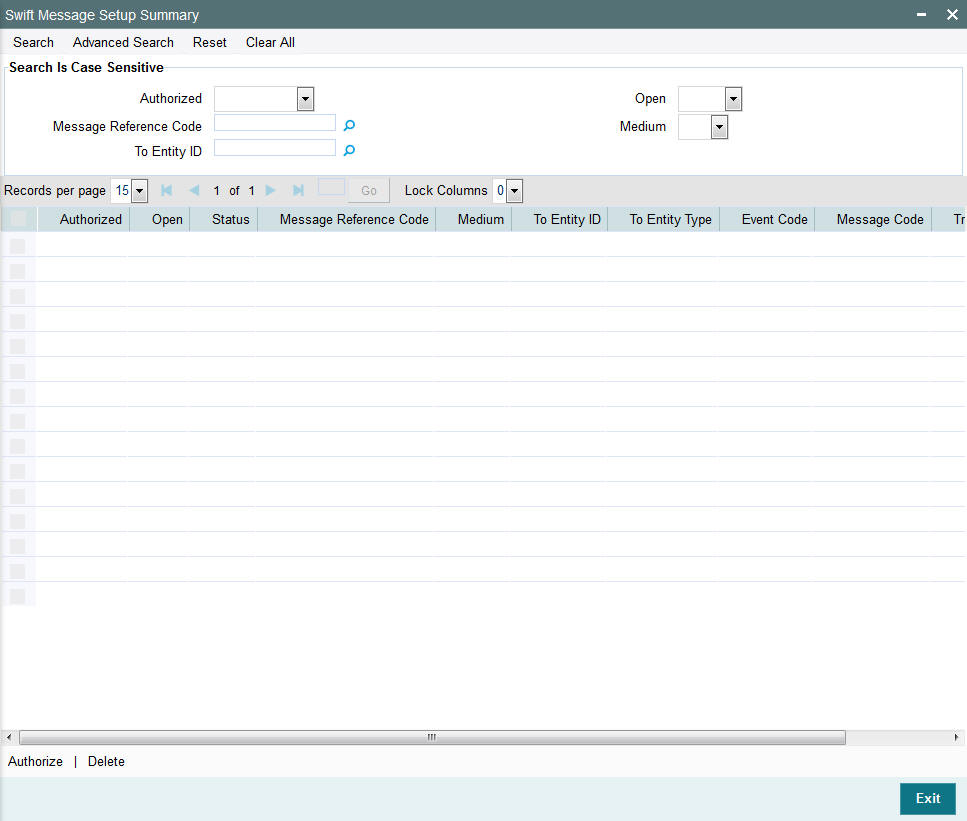

The ‘Swift Message Setup Summary’ screen helps you locate and retrieve the message codes you want to edit, view, delete, authorize or amend, from the database. You can invoke this screen by typing ‘UTSSWMSG’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.3.2 Retrieving Record in Swift Message Setup Summary Screens

You can retrieve a previously entered record in the Swift Message Setup Summary screen, as follows:

Invoke the Swift Message Setup Summary screen and specify any or all of the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the transactions are retrieved.

- The code of message reference, in the Message Reference Code field.

- The medium, in the Medium field.

- The ID of the entity to whom the message is sent, in the To Entity ID field.

After you have specified the required details, click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the detail screen by doing query in the following manner:-

- Press F7.

- Input the Message reference Code

- Press F8.

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example

You can search the record for Message Code by using the combination of % and alphanumeric value as follows:-

- Search by A%: System will fetch all the records whose Message Reference Code starts from Alphabet ‘A’. Ex: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: System will fetch all the records whose Message Reference Code ends by numeric value’ 7’. Ex: AGC17, GSD267, AGC77 and so forth.

- Search by %17%: System will fetch all the records whose Message Reference Code contains the numeric value 17. Ex: GSD217, GSD172, AGC17 and so forth.

3.3.3 Editing SWIFT Records

You can modify the details of a record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the Swift Message Setup Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorized field. You can only modify records of transactions that are unauthorized. Accordingly, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the recording the corresponding fields on the screen to retrieve the record that is to be modified. Click ‘Search’ button. All unauthorized transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed transactions. The Swift Message Setup Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information

- Click Save to save your changes. The Swift Message Setup Detail screen is closed and the changes made are reflected in the Swift Message Setup Summary screen.

3.3.4 Viewing SWIFT Records

To view a record that you have previously entered, you must retrieve the same in the Swift Message Setup Summary screen, as follows:

- Invoke the Swift Message Setup Screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorized field. You can also view all transactions that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed transactions, in the lower portion of the screen. The Swift Message Setup Detail screen is opened in view mode.

3.3.5 Deleting SWIFT Records

You can delete only unauthorized transactions in the system.

To delete a record that you have previously entered, you must retrieve the same in the Swift Message Setup Summary screen, as follows:

- Invoke the Swift Message Setup Summary screen from the browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed transactions, in the lower portion of the screen. The Swift Message Setup Detail screen is opened in view mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion and the record is deleted physically from the system database.

3.3.6 Authorizing SWIFT Records

An unauthorized record must be authorized in the system for it to be processed.

To authorize a transaction, you must first retrieve the same in the Record Summary screen.

- Invoke the Swift Message Setup Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The Swift Message Setup screen is opened in view mode.

- Select Authorize operation from Action list.

When the checker authorizes a record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the record.

3.3.7 Amending SWIFT Records

After a record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the Swift Message Setup Summary screen from the Browser.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records of transactions that are authorized.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All transactions with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The Record screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the transaction.

- Amend the necessary information. Click the Save button to save your changes.

3.3.8 Authorizing Amended Records

An amended record must be authorized for the amendment to be made effective in the system. Authorization of amended transactions can only be done from Fund Manager Module and Agency branch Module.

3.3.9 Copying Attributes

If you want to create a new record having the same attributes of an existing record, you can copy the attributes of the existing record to the new record.

To copy the attributes of an existing record to a new record:

- Retrieve the record whose attributes the new record should inherit. You can retrieve the record through the Swift Message Setup Summary screen or through the F7- F8 operation which are explained in the previous section.

- In the Swift Message Setup Detail screen, click on ‘Copy’ Action.

- Indicate the ID for the new record. You can however change the details of the new record if required.

3.4 Setting Up UDFs for SWIFT Elements

This section contains the following topics:

- Section 3.4.1, "Invoking Swift Element UDF Summary Screen"

- Section 3.4.2, "Retrieving Record in SWIFT ELEMENT UDF Summary Screens"

- Section 3.4.3, "Editing Record"

- Section 3.4.4, "Viewing Record"

- Section 3.4.5, "Deleting Record"

- Section 3.4.6, "Authorizing Record"

- Section 3.4.7, "Amending Record"

- Section 3.4.8, "Authorizing Amended Records"

- Section 3.4.9, "Copying Attributes of Record"

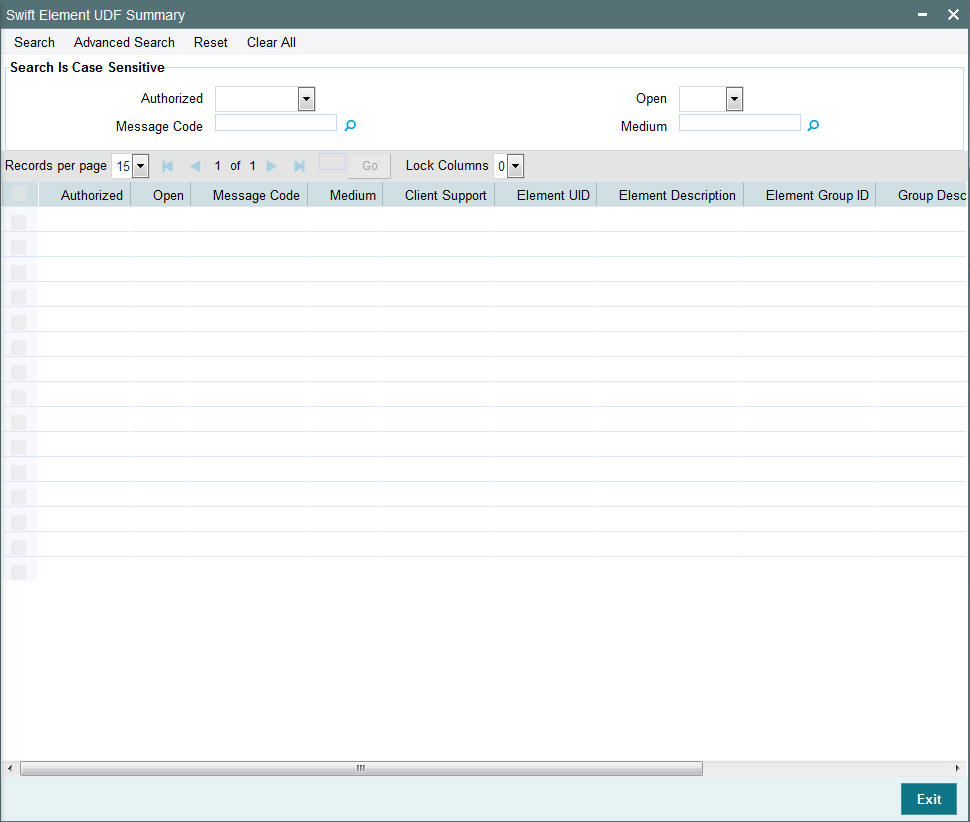

3.4.1 Invoking Swift Element UDF Summary Screen

User elements are pre-shipped. However, you do have the option of changing a few. The ‘Swift Element UDF Summary’ screen allows you to do the same. You can invoke this screen by typing ‘UTSSWUDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

3.4.2 Retrieving Record in SWIFT ELEMENT UDF Summary Screens

You can retrieve a previously entered transaction in the SWIFT ELEMENT UDF screen, as follows:

- Invoke the summary screen and specify any or all of

the following details in the corresponding fields:

- The status of the record in the Authorized field. If you choose the “Blank Space” option, then all the records are retrieved.

- The status of the record in the Open field. If you choose the “Blank Space” option, then all the records are retrieved.

- The code of message for the record, in the Message Code field.

- After you have specified the required details, click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

Note

You can also retrieve the individual record detail from the SWIFT ELEMENT UDF detail screen by doing query in the following manner:-

- Press F7.

- Input the Message Code

- Medium

- Press F8.

You can perform Edit, Delete, Amend, Authorize, Reverse, Confirm operations by selecting from the Action list.

You can also search the record by using combination of % and alphanumeric value.

For example

You can search the record for Message Code by using the combination of % and alphanumeric value as follows:-

- Search by A%: The system will fetch all the records whose Message Code starts from Alphabet ‘A’. Ex: AGC17, AGVO6, AGC74 and so forth.

- Search by %7: The system will fetch all the records whose Message Code ends by numeric value’ 7’. Ex: AGC17, GSD267, AGC77 and so forth.

- Search by %17%: The system will fetch all the records whose Message Code contains the numeric value 17. Ex: GSD217, GSD172, AGC17 and so forth.

3.4.3 Editing Record

You can modify the details of a record that you have already entered into the system, provided it has not been subsequently authorized. You can perform this operation as follows:

- Invoke the SWIFT ELEMENT UDF Summary screen from the Browser.

- Select the status of the record that you want to retrieve for modification in the Authorization Status field. You can only modify records of records that are unauthorized. Accordingly, choose the Unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen to retrieve the record that is to be modified. All unauthorized records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to modify in the list of displayed records. The SWIFT ELEMENT UDF Detail screen is displayed.

- Select Unlock Operation from Action list to modify the record. Modify the necessary information

- Click Save to save your changes. The SWIFT ELEMENT UDF Detail screen is closed and the changes made are reflected in the SWIFT ELEMENT UDF Summary screen.

3.4.4 Viewing Record

To view a record that you have previously entered, you must retrieve the same in the SWIFT ELEMENT UDF Summary screen, as follows:

- Invoke the SWIFT ELEMENT UDF Summary Screen from the Browser.

- Select the status of the record that you want to retrieve for viewing in the Authorization Status field. You can also view all records that are either unauthorized or authorized only, by choosing the Unauthorized / Authorized option.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to view in the list of displayed records, in the lower portion of the screen. The SWIFT ELEMENT UDF Detail screen is opened in view mode.

3.4.5 Deleting Record

You can delete only unauthorized records in the system.

To delete a record that you have previously entered, you must retrieve the same in the SWIFT ELEMENT UDF Summary screen, as follows:

- Invoke the SWIFT ELEMENT UDF Summary screen from the browser.

- Select the status of the record that you want to retrieve for deletion.

- Specify any or all of the details of the record in the corresponding fields on the screen, and click ‘Search’ button. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to delete in the list of displayed records, in the lower portion of the screen. The SWIFT ELEMENT UDF Detail screen is opened in view mode.

- Select Delete operation from the Action list. The system prompts you to confirm the deletion, and the record is deleted physically from the system database.

3.4.6 Authorizing Record

An unauthorized record must be authorized in the system for it to be processed.

To authorize a record, you must first retrieve the same in the SWIFT ELEMENT UDF Summary screen.

- Invoke the SWIFT ELEMENT UDF Summary screen from the Browser.

- Select the status of the record that you want to retrieve for authorization. Typically, choose the unauthorized option from the drop down list.

- Specify any or all of the details of the record in the corresponding fields on the screen. Click ‘Search’ button. All records with the specified details that are pending authorization are retrieved and displayed in the lower portion of the screen.

- Double click the record that you wish to authorize. The SWIFT ELEMENT UDF screen is opened in view mode.

- Select Authorize operation from Action list.

When the checker authorizes a record, details of validations, if any, that were overridden by the maker of the record during the Save operation, are displayed. If any of these overrides results in an error, the checker must reject the record.

3.4.7 Amending Record

After a record is authorized, it can be modified using the Unlock operation from Action list. To make changes to a record after authorization, you must invoke the Unlock operation which is termed as Amend Operation.

- Invoke the SWIFT ELEMENT UDF Summary screen from the Browser. You can invoke this screen by typing ‘UTDSWUDF’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

- Select the status of the record that you wish to retrieve for amendment. You can only amend records of records that are authorized.

- Specify any or all of the details of the record in the corresponding fields on the screen. All records with the specified details are retrieved and displayed in the lower portion of the screen.

- Double click the record that you want to amend. The ‘Swift Element UDF Detail’ screen will be displayed in Amendment mode. Click the Unlock operation from the Action list to amend the record.

- Amend the necessary information. Click the Save button to save your changes.

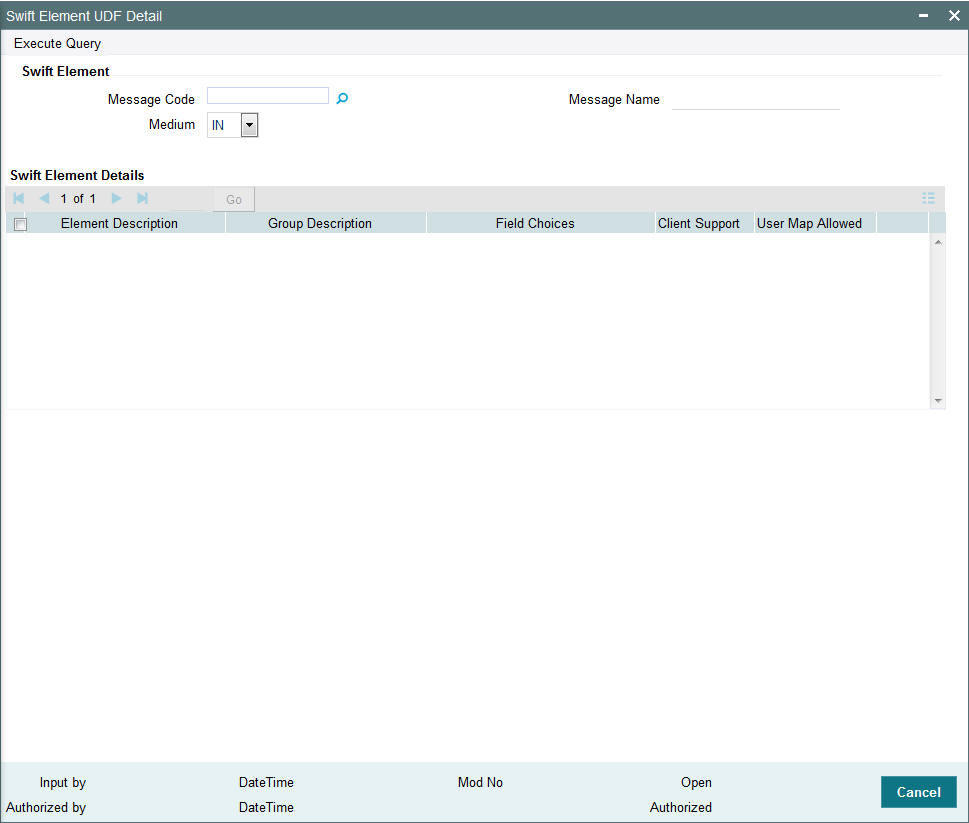

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Swift Element UDF screen.

The following fields will be displayed:

Element Description

Display

The elements of the message code will be displayed here.

Element Group ID

Mandatory

Enter the Element Group ID.

Group Description

Display

The group description for the element will be displayed here.

FCIS Field Map

Mandatory if you have checked the box ‘Client Support’

If you have checked the box ‘Client Support’ for an element, select the FCIS UDF that you want to map to the message element.

User Map Allowed

Display

If this box is checked, it means a user will be allowed to specify the UDF mapping for the elements of a message. If this box is not checked, the user will not be allowed to specify a UDF mapping.

3.4.8 Authorizing Amended Records

An amended record must be authorized for the amendment to be made effective in the system. Authorization of amended records can only be done from Fund Manager Module and Agency branch Module.

3.4.9 Copying Attributes of Record

If you want to create a new record having the same attributes of an existing record, you can copy the attributes of the existing record to the new record.

To copy the attributes of an existing record to a new record:

- Retrieve the record whose attributes the new record should inherit. You can retrieve the record through the SWIFT ELEMENT UDF Summary screen or through the F7 F8 operation which are explained in the previous section.

- In the SWIFT ELEMENT UDF Detail screen, click on ‘Copy’ Action.

- Indicate the ID for the new record. You can however change the details of the new records if required.

3.5 Manual Generation of Messages

This section contains the following topics:

- Section 3.5.1, "Invoking the Manual Message Detail Screen"

- Section 3.5.2, "Validation of SWIFT Messages"

- Section 3.5.3, "Incoming Message Browser Summary Screen"

- Section 3.5.4, "Outgoing Message Browser Summary Screen"

- Section 3.5.5, "Uploading Incoming Messages"

- Section 3.5.6, "Generation of Outgoing Messages"

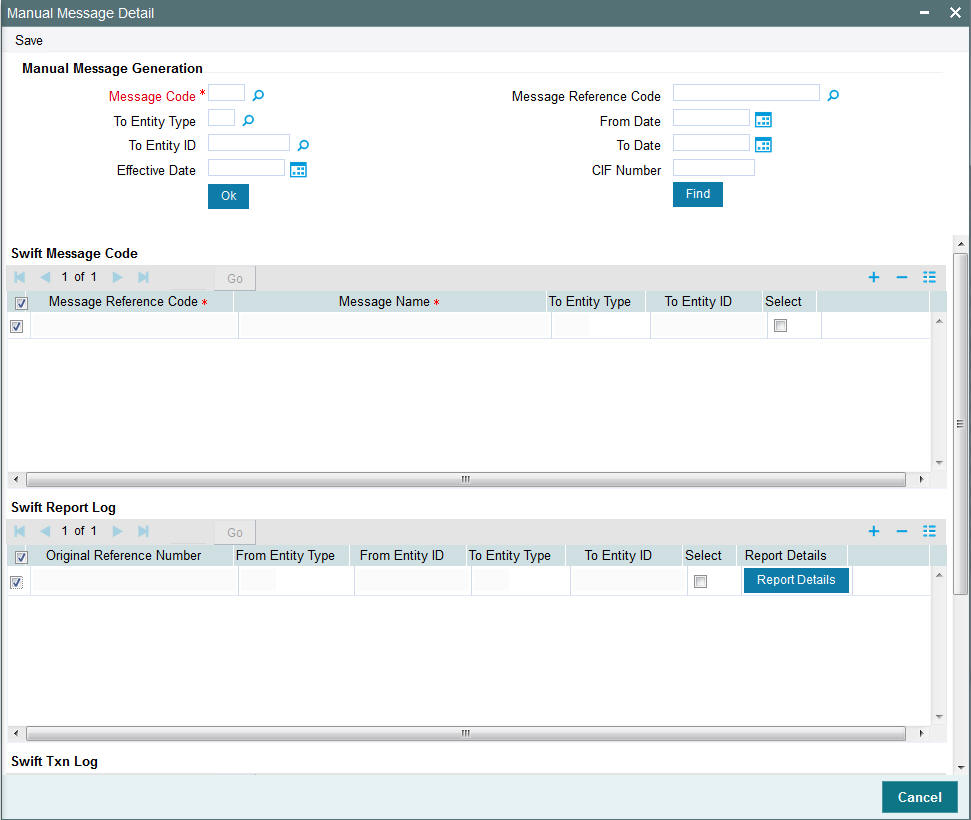

3.5.1 Invoking the Manual Message Detail Screen

The Manual Message Generation screen helps you locate and retrieve the messages you want to manually generate, from the database. Specify any or all of the details corresponding to the message you want to retrieve; the system uses your specifications to as search criteria to query the database and retrieve the record that you are looking for.

You can generate an outgoing message manually, through the ‘Manual Message Detail’ screen. You can invoke this screen by typing ‘UTDSWIFT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Manual Message screen.

Message Code

Mandatory

Select the message code from the drop-down list.

Message Reference Code

Mandatory

Enter a unique reference number for the message.

Effective Date

Mandatory

Enter the Effective Date for the message.

CIF Number

Enter the CIF number from the LOV.

To Entity Type

Mandatory

Select the Entity Type for which the message will be generated.

To Entity ID

Mandatory

Select the entity for which the message is applicable.From Date

Enter the ‘From date’ that marks the beginning of the period for which the Manual Message generates.

To Date

Mandatory

Enter the ‘To date’ that marks the end of the period for which the Manual Message generates.

It is mandatory that you specify the Message Code as a search criterion. Once you specify the same, you have the option of entering the Message Reference Code of the message you want to manually generate.

Swift Message Code Details

Once you specify the search criteria, click ‘Ok’ button. The records matching your search criteria will be displayed.

Check the option ‘Select’ along a message record to indicate the message should be manually generated.

The following swift message code details will be displayed:

- Message Reference Code

- Message Name

- To Entity Type

- To Entity ID

Swift Report Log

Check the option ‘Select’ along a message record to indicate the message should be manually generated.

The following swift report details will be displayed:

- Original Reference number

- From Entity Type

- From Entity ID

- To Entity Type

- To Entity ID

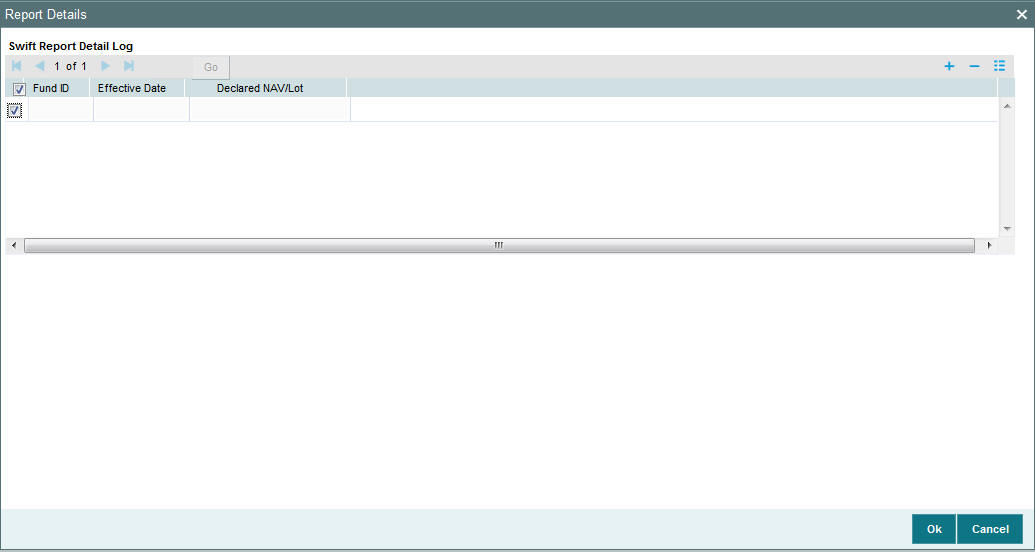

Report Details Button

Click on this button to invoke the Report Details screen:

In the Report Details screen, you can view the following details screen:

- Fund ID

- Effective Date

- Declared NAV/Lot

Swift Txn Log

Check the option ‘Select’ along a message record to indicate the message should be manually generated.

In the Swift Txn Log grid, you can view the following details:

- Original Reference number

- Message Description

- Date Generated

- From Entity Type

- From Entity ID

- To Entity Type

- To Entity ID

- All Txns

Ind Txns Button

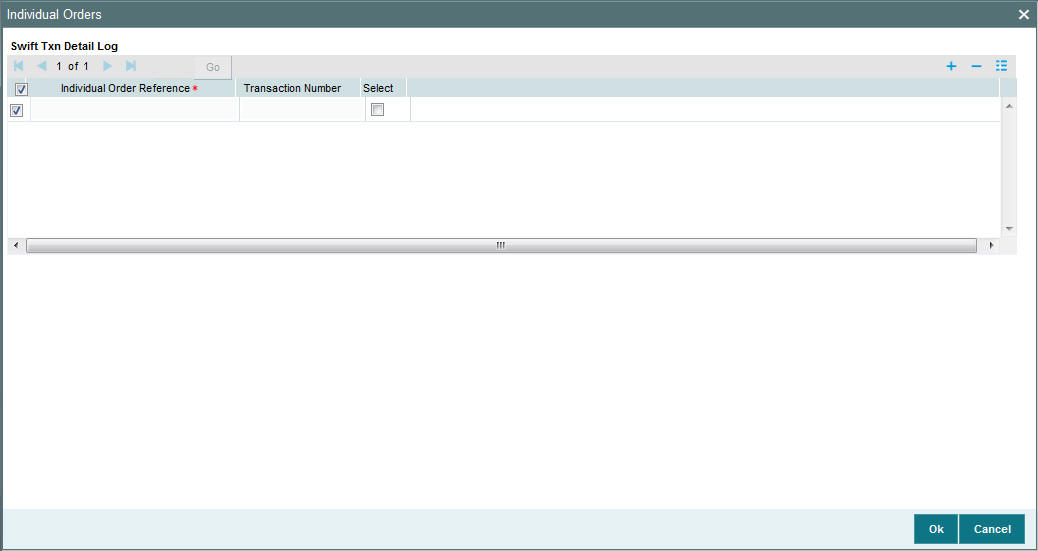

Click on the Ind Txns button to invoke the Individual Orders screen:

Check the option ‘Select’ along a message record to indicate the message should be manually generated.

In the individual Orders screen, you can view the following details:

- Individual Order Reference

- Transaction Number

3.5.2 Validation of SWIFT Messages

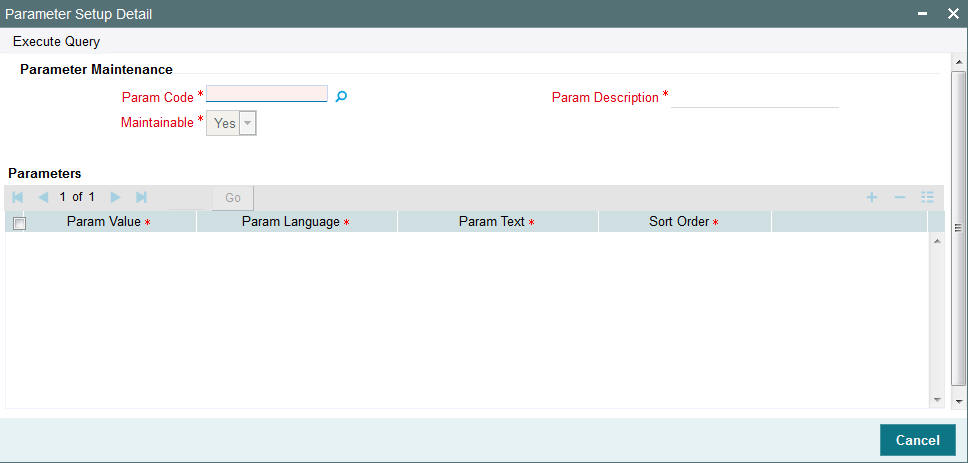

The XML format of SWIFT Messages can be validated. To maintain validation parameters for the XML format, use the ‘Parameter Setup Detail’ screen.

You can invoke this screen by typing ‘UTDPARAM’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

When you open the screen, choose the language for which you want to view the maintained codes, in the Language field.

Then select the Parameter Code ‘SWIFTFORMAT’ and click add icon to add the parameters. The following screen will be displayed:

In this screen:

- Enter the date format for the Param Value SWIFTDATEFORMAT as YYYY-MM-DD

- Enter the value ‘1’ along the Param Value VALIDATE, if validation should happen. Enter the value ‘0’ is validation should not happen.

- If you have entered the value ‘1’ along ‘VALIDATE’, specify the path of the XSD along the Param Value XSDREPOSITORY.

Note

For further information on the System Parameter Codes Maintenance screen, refer to the chapter Maintaining System Parameters in Volume I of the Fund Manager User Manual.

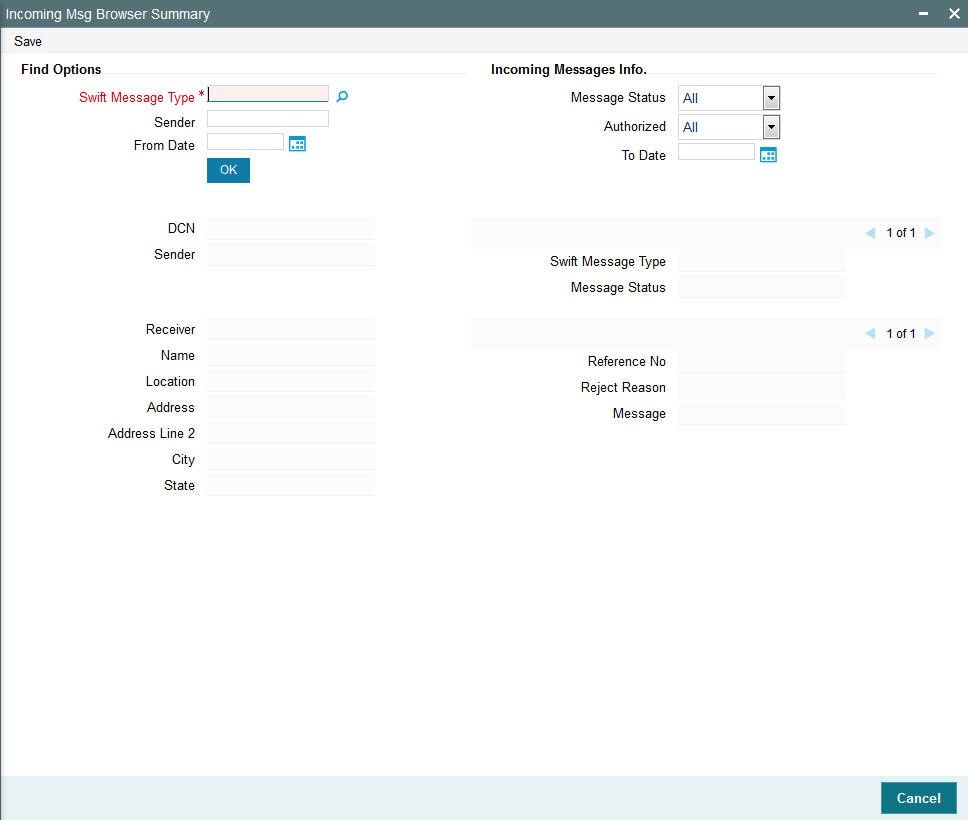

3.5.3 Incoming Message Browser Summary Screen

You can use the incoming message browser to perform the following functions with respect to an incoming SWIFT message:

- Process (that is, upload) an unprocessed message

- Suppress an unprocessed message

- Edit an unprocessed message

- Delete an unprocessed message

- Authorize an edited message

- View all (or selected) unprocessed, processed, suppressed or repaired messages

In order to perform any of these functions, you must first retrieve the ‘In’ message and display it in the ‘Incoming Msg Browser Summary’ screen. You can invoke this screen by typing ‘UTDMSGIN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Incoming Msg Browser.

To display the message, you can specify any or all of the following details:

Swift msg type (Subscription Bulk Order etc,)

Specify the Swift Message type to display the message.

For example, Subscription Bulk Order, Redemption Bulk Order etc.

Message Status (unprocessed, processed, repair, suppressed or all)

Specify the status of the message that has to be displayed. The status could be unprocessed, processed, repair, suppressed or all.

Sender

Indicate the sender of the message.

Auth stat

Select the authorization status of the messages that you wish to view.

From Date

Specify the date from which the system has to retrieve the messages.

To Date

Specify the date till which the system has to retrieve the messages.

All messages matching your criteria are displayed in the grid portion of the screen. Click on the message that you wish to operate on, in the DCN field. The Incoming Message Browser screen, with the details of the message displayed.

All messages matching your criteria are displayed in the grid portion of the screen. Click ‘Message Details’ button that you wish to operate on, in the DCN field.

A horizontal array of icons is available for you to perform operations on the message.

You can view the following details:

- DCN

- Reference No

- Message status

- Name

- Address Line1

- Address Line 2

- Address Line 3

- Address Line 4

- Message

- Sender

- Swift Msg Type

- Receiver

- Location

- Reject Reason

3.5.3.1 Performing Operations on Message

View |

Click this button to view the contents of a message. The contents of the message will be displayed the Message section of the screen. |

Delete |

Click this button to delete an unprocessed message. |

Authorize |

Click this button to authorize an unauthorized unprocessed message that has been edited; an unauthorized processed message that has been repaired, or an unauthorized suppressed message |

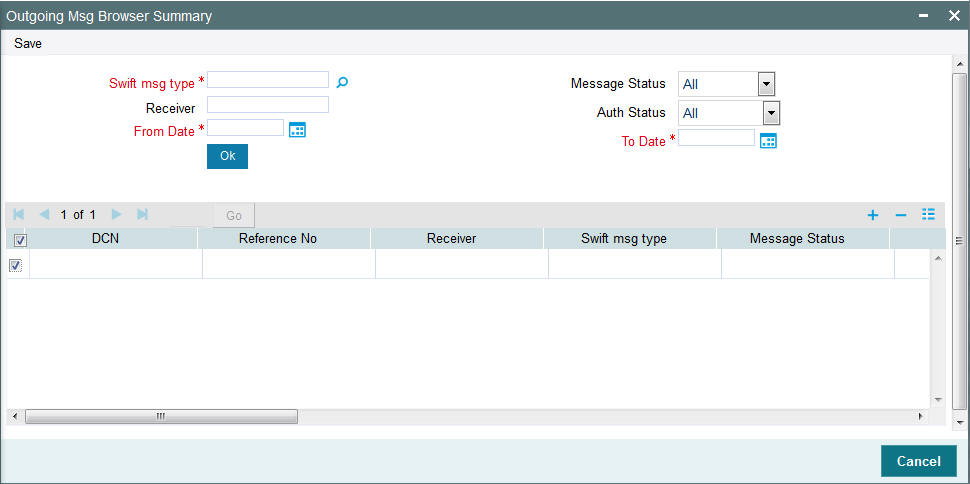

3.5.4 Outgoing Message Browser Summary Screen

You can use the outgoing message browser to perform the following functions with respect to an outgoing SWIFT message:

- Generate the outgoing message in respect of an un generated message

- Edit an ungenerated message

- Authorize a repaired or edited message

- View all (or selected) outgoing ungenerated, generated, handed off, or repaired messages

In order to perform any of these functions, you must first retrieve the message in and display it in the ‘Outgoing Msg Browser Summary’ screen. You can invoke this screen by typing ‘UTDMSGOT’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select ‘New’ from the Actions menu in the Application tool bar or click new icon to enter the details of the Outgoing Msg Browser.

To display the message, you can specify any or all of the following details:

Swift msg type

Mandatory

To display the message, specify the swift message type. Select All for the system to display all the SWIFT message types.

Message Status (ungenerated, generated, edited, handed off, or all)

To display the message, specify the message status (ungenerated, generated, edited, handed off, or all).

Receiver

Specify the receiver of the message to display the message.

Auth Stat

Specify the authorization status of the message which you want to view.

From Date

Specify the date from which the system has to retrieve the outgoing SWIFT message.

To Date

Specify the date till which the system has to retrieve the outgoing SWIFT message.

All messages matching your criteria are displayed in the grid portion of the screen. Click ‘Detail’ button that you wish to operate on, in the DCN field. The Outgoing Message Browser screen, with the details of the message displayed.

A horizontal array of icons is available for you to perform operations on the message.

Outgoing Message Info

All messages matching your criteria are displayed in this portion of the screen. In the outgoing message info grid, you can view the following details:

- DCN

- Reference No

- Receiver

- Swift Msg Type

- Message status

- SI No

- Name

- Address

- Address Line 2

- Address Line 3

- Address Line 4

- Location

- Exception

- Message

Authorize button

Click on the authorize button to authorize the message.

Performing Operations on Message

View |

Click this button to view the contents of a message. The contents of the message will be displayed the Message section of the screen. |

Authorize |

Click this button to authorize an unauthorized ungenerated message that has been edited or an unauthorized generated message that has been repaired. |

Generate |

Click this button to generate the outgoing message in respect of an ungenerated message; or a generated message that has been repaired and then authorized. When you click this button, the status of the message is marked as ‘generated’. If any errors are encountered by the system during outgoing message generation, the message is marked to the ‘repair’ queue and must be repaired before being authorized and uploaded again for outgoing message generation. |

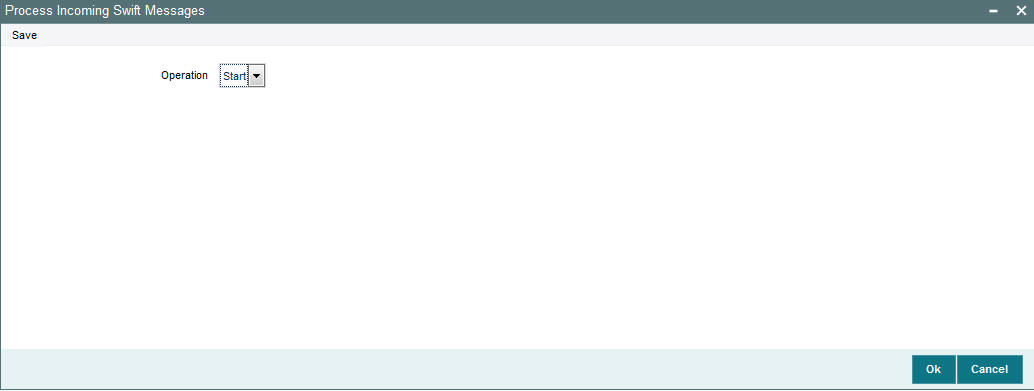

3.5.5 Uploading Incoming Messages

To upload incoming messages, you can use the ‘Process Incoming Swift Messages’ screen. You can invoke this screen by typing ‘UTDPSWIN’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Select the Operation as 'Start' to trigger the upload process.

Triggering the upload process in this screen will move all unprocessed messages collected by the message system from the SWIFT terminal delivery channel, to the ‘processed’ status.

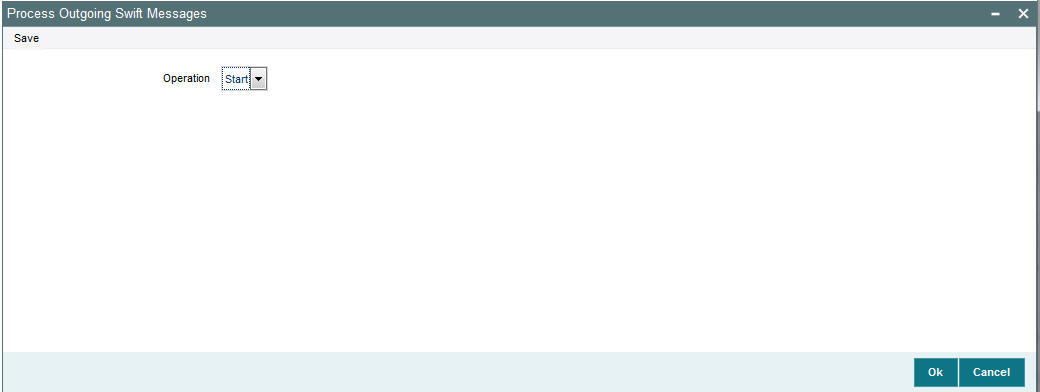

3.5.6 Generation of Outgoing Messages

To generate outgoing messages, use the ‘Process Outgoing Swift Messages’ screen. You can invoke this screen by typing ‘UTDPSWOU’ in the field at the top right corner of the Application tool bar and clicking on the adjoining arrow button.

Click the Start button to trigger the generation process.

Triggering the generation process in this screen will move all ungenerated messages, to the ‘generated’ status; and the outgoing messages are generated and moved to the outgoing queue of the appropriate SWIFT terminal delivery channel.

3.6 Subscription Bulk Order

This section contains the following topics:

3.6.1 Subscription Bulk Order Message

This message is sent by an intermediary to an executing party or to another intermediary party. This message is used to instruct the executing party to subscribe to a specified amount/quantity of a specified financial instrument.

The Subscription Bulk Order message is used to bulk several individual orders into one bulk order. The individual orders come from different instructing parties, but are related to the same financial instrument. The Subscription Bulk Order message can result in one single bulk cash settlement or several individual cash settlements.

This message cannot be used for a single order (a message containing one order for one instrument and for one investment account). The Subscription Multiple Order message, not the Subscription Bulk Order message, must be used for a single order.

3.6.2 Tags in Message

3.6.2.1 Message Identification

Optional

This is a Reference to a set of orders. Even though this block is optional, FCIS will need this to relate to subsequent messages.

Reference

Mandatory

- Incoming: This number is used for storage and reference.

- Outgoing: This will be generated by the system and will be unique for group of transactions in a fund.

3.6.2.2 Pool Reference

Optional

This is a collective reference to identify set of messages.

Reference

Mandatory

- Incoming: This number is used for storage.

- Outgoing: If a set of orders is to be broken, system will assign a common reference number to multiple messages.

3.6.2.3 Bulk Order Details

FinancialInstrumentDetails

Mandatory

This tag provides details to identify a fund.

Identification

Mandatory

The fund can be identified based on the ISIN, Alternate Identification, RIC, Ticker Symbol, Bloomberg, CTA or Common.

- Incoming: FCIS supports identification based on the ISIN or Ticker Symbol. For other options, it will use the UDF mapping relevant for this tag.

- Outgoing: FCIS sends out the fund ISIN.

IndividualOrderDetails

(Mandatory / Repetitive)

OrderReference

Mandatory

This is a unique identifier for an order, as assigned by the instructing party.

- Incoming: This will be stored as part of SWIFT transaction log with corresponding FCIS transaction number.

- Outgoing: This will be the Transaction Number generated by FCIS.

Cash Settlement Date

Optional

Incoming/Outgoing – Both, the Incoming and Outgoing indicators, will be the Transaction Settlement Date.

InvestmentAccountDetails

Account Identification à Proprietary à Identification

Mandatory

This tag is to identify an investor’s account. However, incase of a service provider installation, priority would be given to BeneficiaryDetails tag to get the identification type and identification number.

- Incoming – The system uses the relevant UDF mapping for this tag.

- Outgoing - The system uses the relevant UDF mapping for this tag.

BeneficiaryDetails

Optional

Other Identification à Identification

Mandatory

Incoming – This would map to the Identification Number of the Unit holder.

Other Identification à Identification Type/ExtendedIdentificationType àStructured

Mandatory

This is a choice between Identification Type and Extended Identification Type.

Incoming – FCIS uses data mapping to find the Unit holder account type. Only PASS (passport) and NRIN (the National Registration Number, which is NRIC for Singapore) are supported as Identification Types.

Other Identification à Identification Type à Additional Information

Optional

If structured type is OTHR, the description of identification would be provided. For example, ‘Birth Certificate’.

Choice for Units / NetAmount

Mandatory

- Incoming: The system determines the Transaction Mode and Value depending on the element available. If the field ‘NetAmt’ is provided, the mode of transaction will be ‘Net’. The value here would be in the currency provided as an attribute of the tag. FCIS will give priority to the tag ‘GrossAmount’ while processing the message. If the same is available, the transaction will be considered ‘Gross’.

- Outgoing: Values of the outgoing message will depend on the transaction mode. Net Amount transactions in FCIS, will be reported in the field ‘NetAmt’. The transaction currency will be passed as tag attribute. However, if the transaction is ‘Gross’, the same will be reported under the optional tag ‘GrossAmount’ as well as the tag ‘NetAmt’, as this is mandatory.

GrossAmount

Optional

- Incoming: If a value is provided in this field the transaction will be considered as a gross amount transaction. The transaction currency would be defaulted to the currency code provided in the attribute.

- Outgoing: If the tag ‘GrossOrNet’ carries the value ‘G’, the amount will be passed under this tag. The transaction currency will be passed as a tag attribute.

ForeignExchangeDetails

Optional

This is information related to currency exchange or conversion.

- Incoming: If the Transaction Currency is different from the Fund Base currency, FCIS will use the information provided to override the exchange rate. The Exchange Rate Source will be defaulted from the Bulk Transaction Maintenance for the bulk client ‘SWIFT’.

- Outgoing: If the transaction is a cross currency transaction, the exchange rate details will be provided in the message.

The following sub tags are mandatory:

- Unit Currency: This will be the transaction currency

- Quoted Currency: This will be the fund base currency

- Exchange Rate : This will be the exchange rate for the transactions

PhysicalDeliveryIndicator

Mandatory

This tag indicates whether or not the financial instrument is to be physically delivered.

- Outgoing: This indicator will depend on whether or not fund is scrip based.

CashSettlementDetails

Optional

Payment Instrument

Optional

The payment instruments can be cheque, credit transfer, direct debit, investment account or payment card.

FCIS would not support cheque, payment card as mode of payment in the current release for outgoing orders. However, for incoming orders FCIS would support these payment modes and ignore the fields that are not currently supported.

If payment instrument details are not provided, FCIS would use default bulk transaction setup for “SWIFT”.

PaymentCardDetails

(Mandatory / Choice)

Type

Mandatory

This indicates the type of card.

- CRDT – Credit Card

- DBIT – Debit Card

- Incoming: FCIS will set the Payment Mode to ‘R’ for payments by card, and Sub Payment Mode, depending on the value of the tag ‘Type’. The Sub Payment Mode will be set to ‘R’ for CRDT and ‘DR’ for DBIT.

- Outgoing: The indicator will be either CRDT or DBIT,

based on Payment Mode and Sub Payment mode.

Payment Mode

Sub Payment Mode

Type

R

R

CRDT

R

DR

DBIT

Number

Mandatory

Incoming/Outgoing – This will be the 16-digit Card Number.

Card Issuer Identification

Optional

This is the party that issues the card. FCIS supports identification based on the following tags:

- BICOrBEI

- Proprietary Identification

Incoming: If BIC Or BEI is provided, the system will get the relevant bank information, if available. If Proprietary Identification is provided, the UDF mapping for the field would be used to determine the bank. This will be a set of other information fields applicable for entity type ‘Bank’.

Outgoing: As FCIS is capable of supporting both, the BIC Or BEI and Proprietary Identification, SWIFT UDF mapping will be used to determine the element that client would want to send.

ChequeDetails

(Mandatory / Choice)

Number

Mandatory

Incoming/Outgoing – This will be the Transaction Cheque Number.

Drawee Identification

Optional

This is to identify the bank details.

FCIS supports BIC and Proprietary Identification.

Incoming: If BIC is provided, system the will get the relevant bank information, if available. If Proprietary Identification is provided, the UDF mapping for the field would be used to determine the bank. This would be a set of other information fields applicable for entity type ‘Bank’.

Outgoing: As FCIS is capable of supporting both, the BIC and Proprietary Identification, SWIFT UDF mapping will be used to determine the element that client would want to send.

Credit Transfer Details

(Mandatory / Choice)

Reference

Optional

Incoming/Outgoing: This will be the Transaction Reference Number.

Debtor Details à Identification

Mandatory

FCIS supports Domestic Account based identification.

Incoming: The details available for Domestic Account will be used in conjunction with the element details of the tag First Agent to determine the Unit Holder bank details available in FCIS. FCIS will check if the account number mentioned is valid for the transaction currency. If not, these account details will be considered as third party payment details.

Outgoing: If the transaction payment mode is money transfer, the account details will be provided for the transaction. Money transfer direct debit will not be applicable for this tag.

Debtor Account à Name

Optional

This is the name of the account. It provides additional means of identification.

Outgoing - This will be the Transfer Account Holder Name of the transaction.

Debtor Agent

Mandatory

This is the financial institution that receives the payment transaction from the account owner.

FCIS supports BIC and Proprietary Identification based identification.

Incoming: If BIC is provided, the system will get the relevant bank information, if available. FCIS will use the Bank Code, Account Number and Transaction Currency to get the banking details for the Unit Holder.

If ProprietaryIdentification is provided, the UDF mapping for the field will be used to determine the bank. This will be a set of other information fields applicable for entity type ‘Bank’. If these bank account details do not match with unit holders banking details, the transaction will be captured as the third party payment details, provided the bank entity information is setup in FCIS.

Outgoing: As FCIS is capable of supporting the elements BIC and ProprietaryIdentification, the SWIFT UDF mapping will be used to determine the element that client would want to send.

DirectDebitDetails

(Mandatory / Choice)

These are the details of the bank where the client has given a mandate to debit the account.

DebtorAccount

Mandatory

This tag will be used to identity the bank account of the investor. FCIS supports DomesticAccount based identification.

Incoming: The details available for DomesticAccount will be used in conjunction with the element details of the tag Debtor Agent to determine the Unit Holder bank details available in FCIS. FCIS will check if the account number mentioned is valid for the transaction currency. If not, these account details will be considered as third party payment details.

Outgoing: If the transaction payment mode is money transfer, the account details will be provided for the transaction. Money transfer direct debit will not be applicable for this tag.

Debtor Identification

Mandatory

This tag will be used to identity the bank account of the investor. FCIS supports DomesticAccount based identification.

Debtor Agent

Mandatory

This is used to identify the bank of the investor.

FCIS supports BIC and Proprietary Identification based identification.

Incoming: If BIC is provided, the system will get the relevant bank information, if available. FCIS will use the Bank Code, Account Number and Transaction Currency to get the banking details for the Unit Holder.

If ProprietaryIdentification is provided, the UDF mapping for the field will be used to determine the bank. This will be a set of other information fields applicable for entity type ‘Bank’. If these bank account details do not match with unit holders banking details, the transaction will be captured as the third party payment details, provided the bank entity information is setup in FCIS.

Outgoing: As FCIS is capable of supporting the elements BIC and ProprietaryIdentification, the SWIFT UDF mapping will be used to determine the element that client would want to send.

Cash AccountDetails

(Mandatory / Choice)

AccountIdentification à Proprietary à Identification (Mandatory)

Incoming: This will be the bank account number of the unit holder. This number will be used in conjunction with the element Type à Structured i.e., the bank account type, to get the bank details of unit holder.

Outgoing: If the bank details selected for the transaction is a CPF accounts (CPFOA, CPFSA, ASPFOA, ASPFSA or SRS), the system will provide the structured account type information under this element.

Type à Structured

Mandatory

The following are the SWIFT supported codes for structured types along with the FCIS mapping:

Structured codes |

FCIS Map |

CASH |

No mapping |

CPFO |

CPFOA |

CPFS |

CPFSA |

OTHR |

ASPFOA / ASPFSA |

SRSA |

SRS |

3.7 Subscription Bulk Order Confirmation

This section contains the following topics:

3.7.1 Subscription Bulk Order Confirmation Message

This message is sent by an executing party to an intermediary party. This message is used to confirm the details of the execution of a Subscription Bulk Order message.

The Subscription Bulk Order Confirmation message is sent, after the price has been determined, to confirm the execution of all individual orders.

There is usually one bulk confirmation message for one bulk order message.

For all incoming messages, FCIS will set the status of transactions based on individual ‘Order Reference’ number.

For outgoing message, FCIS will generate the confirmation message only after allocation.

FCIS will allow generation of this message in an automated way (based on certain events triggered in the system, which have to be set for the message), or manually.

3.7.2 Tags in Message

3.7.2.1 Message Identification

Mandatory

Incoming: This number is used for storage and reference.

Outgoing: This will be generated by the system and will be unique for group of transactions in a fund.

3.7.2.2 PoolReference

Optional

This is a collective reference to identify set of messages.

Reference

Mandatory

Incoming: This number is used for storage.

Outgoing: If a set of orders is to be broken, system will assign a common reference number to multiple messages.

3.7.2.3 RelatedReference

Mandatory

This is the Reference Number to a linked message that was previously received.

Reference

Mandatory

Incoming: This reference number should be the Message Identification of the original message sent. This would be the link between confirmation message and original bulk order message.

Confirmation messages will be generated against each MessageIdentification/message.

Outgoing : FCIS will send the original ‘Message Identification’ number for the external system to establish the relation between original bulk order message and confirmation message.

3.7.2.4 Bulk Execution Details

Mandatory

This is general information related to the execution of investment orders.

Financial Instrument Details

Mandatory

This tag provides details to identify a fund.

Identification

Mandatory

Outgoing - FCIS sends out the fund ISIN.

Individual Execution Details

(Mandatory / Repetitive)

This is the individual execution of a subscription order.

OrderReference

Mandatory

Incoming: As this would be the Transaction Number handed off in the original message, FCIS will set the Order Status to ‘Confirmed’ depending on the Order Reference number communicated.

Outgoing: This will be mapped to the incoming ‘OrderReference’ corresponding to the transaction number that was allotted successfully by FCIS.

DealReference

Mandatory

This is a unique number assigned by the confirming party.

Incoming: This number is used for storage.

Outgoing: This would map to the Transaction Number generated by the system corresponding to the Order Reference number.

Settlement Amount

Optional

Oracle FLEXCUBE would pass settlement amount of the transaction in this tag.

Investment Account Details

Mandatory

AccountIdentification à Proprietary à Identification

Outgoing - The system uses the relevant UDF mapping for this tag.

Beneficiary Details

Optional

OtherIdentification à Identification

Mandatory

Outgoing: This would map to the Identification Number of the Unit holder.

OtherIdentification à IdentificationType

Mandatory

Outgoing: FCIS supports the Passport Number and NRIC as Identification Types. If the Unit Holder is identified differently, the value ‘OTHR’ would be passed, with the description in the tag AdditionalInformation.

OtherIdentification à ExtendedIdentificationType

Optional

If structured type is OTHR, the description of identification would be provided. For example, ‘Birth Certificate’. Identification other than NRIC and Passport would be passed in extended type with code as Identification Type description

Units Number

Mandatory

Unit

Mandatory

Outgoing: The allocated units for the transaction.

Net Amount

Mandatory

This is the net amount invested in a specific financial instrument by an investor, expressed in the currency requested by the investor.

Outgoing: The system will compute the net amount in transaction currency for transaction getting confirmed.

Gross Amount

Optional

Outgoing: This will be the settlement amount in the transaction currency available in the transaction data store.

Transaction Date Time

Mandatory

This is a choice between Date and DateTime.

Outgoing : Depending on the UDF mapping, the Transaction Date / Transaction Time will be passed.

DealingPriceDetails

Mandatory

This is the price at which order was executed.

ExtendedType

Mandatory

Outgoing : FCIS will support the code ‘OTHR’ only.

Value à Amount

Mandatory

Outgoing:This will be the allocation price for the transaction.

Partially Executed Indicator

Mandatory

This indicates whether the order has been partially executed.

Outgoing: This will be defaulted to ‘NO’.

Cum Dividend Indicator

Mandatory

This indicates whether the dividend (cum dividend) is included in the executed price. When the dividend is not included, the price will be ex-dividend.

Outgoing: This will be defaulted to ‘NO’.

Physical Delivery Indicator

Mandatory

This tag indicates whether or not the financial instrument is to be physically delivered.

Outgoing : This indicator will depend on whether or not fund is script based.

3.8 Subscription Bulk Order Cancellation Instruction

This section contains the following topics:

- Section 3.8.1, "Subscription Bulk Order Cancellation Instruction Message"

- Section 3.8.2, "Tags in Message"

3.8.1 Subscription Bulk Order Cancellation Instruction Message

This message is sent by an intermediary party to an executing party or to another intermediary party. The Subscription Bulk Order Cancellation Instruction message is used to cancel a previously sent Subscription Bulk Order message or a set of individual orders that it contains. There is no amendment, but a cancellation and re-instruct policy.

For all incoming bulk order cancellations, FCIS will process the reversals based on either the Previous Reference or individual Order Reference. For outgoing cancellation messages, FCIS will communicate the details of original transaction and not the newly reversed transaction, provided the original transaction was handed off to SWIFT. If a transaction is reversed before, neither transaction will be included in the SWIFT message.

For outgoing messages, FCIS will always provide the reference of the original message and group cancellations, if multiple transactions of the same batch have been reversed.

FCIS will allow the generation of this message in an automated way (based on a certain event that is triggered in the system, which can be set for the message), or manually.

3.8.2 Tags in Message

3.8.2.1 MessageIdentification

Mandatory

This is a Reference to a set of orders. Even though this block is optional, FCIS will need this to relate to subsequent messages.

Reference

Mandatory

Incoming: This number is used for storage and reference.

Outgoing: This will be generated by the system and will be unique for group of transactions in a fund.

Creation Date Time

Optional

Applicable for incoming and outgoing message. This is the message generation date time.

3.8.2.2 PoolReference

Optional

This is a collective reference to identify set of messages.

Reference

Mandatory

Incoming: This number is used for storage.

Outgoing: If a set of orders is to be broken, system will assign a common reference number to multiple messages.

3.8.2.3 Previous Reference

Optional

This is the reference to a linked message previously sent.

Reference

Mandatory

Incoming: If FCIS is receives this message, this reference number should be the Message Identification of the original message sent. This will be the link between cancellation message and the bulk order message.

If the tag ‘Order To Be Cancelled is not provided in the message, the system will identify the transactions to be reversed based on this link, as FCIS would have logged the bulk orders against the Message Identification.

Outgoing: FCIS will hand off only those reversals for which SWIFT bulk order was sent earlier.

3.8.2.4 Order to be Cancelled

This is common information related to all the orders to be cancelled.

Bulk Order Details

Mandatory

Financial Instrument Details

Mandatory

This tag provides details to identify a fund.

Outgoing : FCIS sends out the fund ISIN.

Individual Order Details

(Mandatory / Repetitive)

OrderReference

Mandatory

Incoming: The system will internally trigger a transaction reversal based on the transaction number logged earlier, corresponding to this order reference.

Outgoing: This will be the Transaction Number of original transaction, corresponding to the newly reversed transaction.

Investment Account Details

Mandatory

AccountIdentification à Proprietary à Identification

Outgoing: The system uses the relevant UDF mapping for this tag.

Beneficiary Details

Optional

Other Identification à Identification

Mandatory

Outgoing: This would map to the Identification Number of the Unit holder.

Other Identification à Identification Type

Mandatory

Outgoing: FCIS supports the Passport Number and NRIC as Identification Types. If the Unit Holder is identified differently, the value ‘OTHR’ would be passed, with the description in the tag Additional Information.

Other Identification à Extended Identification Type

Optional

If structured type is OTHR, the description of identification would be provided. For example, ‘Birth Certificate’.

Choice for Units / NetAmount

Mandatory

Outgoing: Irrespective of the ‘GrossOrNet’ indicator, amount transactions in FCIS, will be reported in the field ‘NetAmt’. However, if the transaction is ‘Gross’, the same will be additionally reported under the tag ‘GrossAmount’.

Unit based transactions will be passed under the tag Units.

Gross Amount

Optional

This is the gross amount invested in the fund.

Outgoing: This will map to transaction gross amount in the fund base currency, if available.

Foreign Exchange Details

Optional

This is information related to currency exchange or conversion.

Outgoing: If the transaction is a cross currency transaction, the exchange rate details will be provided in the message.

The following sub tags are mandatory:

- Unit Currency : This will be the transaction currency

- Quoted Currency :This will be the fund base currency

- Exchange Rate :This will be the exchange rate for the transactions

Physical Delivery Indicator

Mandatory

This tag indicates whether or not the financial instrument is to be physically delivered.

Outgoing - This indicator will depend on whether or not fund is scrip based.

Cash Settlement Date

Optional

Incoming/Outgoing: Both, the Incoming and Outgoing indicators, will be the Transaction Settlement Date.

3.9 Subscription Multiple Order

This section contains the following topics:

3.9.1 Subscription Multiple Order Message

This message is sent by an instructing party to an executing party. There may be one or more intermediary parties between the instructing party and the executing party. The Subscription Multiple Order message is used to subscribe to different financial instruments for the same investment account. It can result in one single bulk cash settlement or several individual cash settlements.

This message can also be used for single orders, i.e., a message containing one order for one financial instrument and related to one investment account.

The Subscription Multiple Order message, and not the Subscription Bulk Order message, must be used for a single order.

FCIS will allow generation of this message in an automated way (based on an event triggered) or manually. The grouping of multiple orders is driven by investment account and not the fund, as in the Subscription Bulk Order message.

3.9.2 Tags in Message

3.9.2.1 Message Identification

Mandatory

This is a Reference to a set of orders. Even though this block is optional, FCIS will need this to relate to subsequent messages.

Reference

Mandatory

Incoming - This number is used for storage and reference.

Outgoing - This will be generated by the system and will be unique for group of transactions in a fund.

3.9.2.2 Pool Reference

Optional

This is a collective reference to identify set of messages.

Reference

Mandatory

Incoming: This number is used for storage.

Outgoing: If a set of orders is to be broken, system will assign a common reference number to multiple messages.

3.9.2.3 Multiple Order Details

Investment Account Details

Mandatory

This is the account impacted by an investment fund order.

Identification à Proprietary à Identification

Mandatory

This tag is to identify an investor’s account. However, incase of a service provider installation, priority would be given to Owner Details tag to get the identification type and identification number.

Incoming – The system uses the relevant UDF mapping for this tag.

Outgoing - The system uses the relevant UDF mapping for this tag.

Owner Identification

Optional

- BICOrBEI

- Proprietary Identification

Incoming: If BICOrBEI is provided, the system will get the relevant bank information, if available. If Proprietary Identification is provided, the UDF mapping for the field would be used to determine the bank. This will be a set of other information fields applicable for entity type ‘Bank’.

Outgoing: As FCIS is capable of supporting both, the BICOrBEI and Proprietary Identification, SWIFT UDF mapping will be used to determine the element that client would want to send.

Individual Order Details

OrderReference

Mandatory

This is a unique identifier for an order, as assigned by the instructing party.

Incoming: This will be stored as part of SWIFT transaction log with corresponding FCIS transaction number.

Outgoing: This will be the Transaction Number generated by FCIS.

Financial Instrument Details

This tag provides details to identify a fund.

Identification

Mandatory

The fund can be identified based on the ISIN, Alternate Identification, RIC, Ticker Symbol, Bloomberg, CTA or Common.

Incoming: FCIS supports identification based on the ISIN or Ticker Symbol. For other options, it will use the UDF mapping relevant for this tag.

Outgoing: FCIS sends out the fund ISIN.

Choice for Units Number / Amount

Mandatory

Incoming: The system determines the Transaction Mode and Value depending on the element available. If the field ‘Amt’ is provided, the mode of transaction will be ‘Net’. The value here would be in the currency provided as an attribute of the tag. FCIS will give priority to the tag ‘GrossAmountIndicator’ while processing the message. If the same is available, the transaction will be considered ‘Gross’.

Outgoing: Values of the outgoing message will depend on the transaction mode. Net Amount transactions in FCIS, will be reported in the field ‘Amt’. The transaction currency will be passed as tag attribute. However, if the transaction is ‘Gross’, the same will be reported under the optional tag ‘GrossAmountIndicator’ as well as the tag ‘Amt’, as this is mandatory.

Gross Amount Indicator

Optional

Incoming: If the value in this field is true, the transaction will be considered as a gross amount transaction. The transaction currency would be defaulted to the currency code provided in the attribute.

Outgoing: If the tag ‘GrossOrNet’ carries the value ‘G’, the amount will be passed under this tag. The transaction currency will be passed as a tag attribute.

Commission Details

Optional

This indicates the load corresponding to the commission that is being overridden. The Load in the system can be identified using the Load Id or the Recipient information.

Type à Extended Type

Mandatory

Incoming: This will map to the Load Id. If BIC code, the system will find whether the entity is an agent, AMC, broker or distributor. System will select a load with the corresponding ‘To Entity Type’.

Choice for Amount/Rate

Mandatory

Incoming: If the ‘Amt’ is provided and the Load concerned is amount load, then this indicates the overridden value. However, if the field is ‘Rate’ is provided and the load concerned is percent load then this indicates the overridden value.

Waiving Details

Optional

This tag represents the override percentage that the system will apply. The value provided in this field will be ignored if ‘Amount’ or ‘Rate’ tags are provided since the values provided for those tags represent the final value.

Instruction Basis

Mandatory

This tag can have the value WICA. However the system will not use this value for any processing and hence will be ignored.

Waived Rate

Optional

This field provides the discount percentage. This is applicable only for percentage based loads. The override is by discount.

Physical Delivery Indicator

Mandatory

This tag indicates whether or not the financial instrument is to be physically delivered.

Outgoing - This indicator will depend on whether or not fund is scrip based.

Cash Settlement Date

Optional

Incoming/Outgoing: Both, the Incoming and Outgoing indicators, will be the Transaction Settlement Date.

Payment Instrument Choice

Optional

The payment instruments can be cheque, credit transfer, direct debit, investment account or payment card.

FCIS would not support cheque, payment card as mode of payment in the current release for outgoing orders. However, for incoming orders FCIS would support these payment modes and ignore the fields that are not currently supported.

If payment instrument details are not provided, FCIS would use default bulk transaction setup for “SWIFT”.

Related Party Details

This is information related to an intermediary.

Identification

Mandatory

FCIS supports identification based on the following tags:

- BICOrBEI

- ProprietaryIdentification

If BIC is provided, the system will get either the Broker BIC or the Entity BIC based on the client country parameter ‘TXNBROKERS’. If ProprietaryIdentification is provided, the value provided in this field should be a valid Entity Id or Broker Id in the system based on the client country parameter ‘TXNBROKERS’.

Extended Role

Optional

In case of entity, the values provided in this field can be ‘AGENT’, AGENCY BRANCH’, ‘IFA’ or ‘AO’. If none of the above values are specified, system will throw exception saying ‘Invalid ExtendedRole’.

3.10 Subscription Multiple Order Confirmation

This section contains the following topics:

- Section 3.10.1, "Subscription Multiple Order Confirmation Message"

- Section 3.10.2, "Tags in Message"

3.10.1 Subscription Multiple Order Confirmation Message

This message is sent by an executing party to an instructing party. There may be one or more intermediary parties between the executing party and the instructing party. The Subscription Multiple Order Confirmation message is sent, after the price has been determined, to confirm the execution of the individual orders.

A Subscription Multiple Order can generate more than one Subscription Multiple Order Confirmation message, as the valuation cycle of the financial instruments of each individual order may be different. When the executing party sends several confirmations, there is no specific indication in the message that it is an incomplete confirmation. Reconciliation must be based on the references.

A Subscription Multiple Order must in be answered by the Subscription Multiple Order Confirmation message(s) and in no circumstances by the Subscription Bulk Order Confirmation message(s).

For all incoming messages, FCIS will be able to set the status of transactions based on the individual ‘Order Reference’ number. For outgoing messages, the system will be able to generate the confirmation message only after allocation. Transactions will be grouped based on the original Multiple Order Message.

FCIS will allow generation of this message in an automated way (based on a certain event that is triggered in the system) or manually.

3.10.2 Tags in Message

3.10.2.1 Message Identification

Optional

This is a Reference to a set of orders. Even though this block is optional, FCIS will need this to relate to subsequent messages.

Reference

Mandatory

Incoming: This number is used for storage and reference.

Outgoing: This will be generated by the system and will be unique for group of transactions in a fund.

3.10.2.2 Pool Reference

Optional

This is a collective reference to identify set of messages.

Reference

Mandatory

Incoming: This number is used for storage.

Outgoing: If a set of orders is to be broken, system will assign a common reference number to multiple messages.

3.10.2.3 Related Reference

Mandatory

This is the Reference Number to a linked message that was previously received.

Reference

Mandatory

Incoming: This reference number should be the Message Identification of the original message sent. This would be the link between confirmation message and original bulk order message.

The confirmation messages will be generated against each MessageIdentification/ message.

Outgoing: FCIS will send the original ‘Message Identification’ number for the external system to establish the relation between original bulk order message and confirmation message.

3.10.2.4 Multiple Execution Details

Mandatory

OrderDateTime

Optional

Outgoing: This will be mapped to the transaction save time.

Investment Account Details

Identification à Proprietary à Identification

Outgoing: The system uses the relevant UDF mapping for this tag.

Settlement Amount

Optional

ORACLE FLEXCUBE would pass settlement amount of the transaction in this tag.

Individual Execution Details

This is the individual execution of a subscription order.

OrderReference

Mandatory

Incoming: As this would be the Transaction Number handed off in the original message, FCIS will set the Order Status to ‘Confirmed’ depending on the Order Reference number communicated.

Outgoing: This will be mapped to the incoming ‘OrderReference’ corresponding to the transaction number that was allotted successfully by FCIS.

Deal Reference

Mandatory

This is a unique number assigned by the confirming party.

Incoming: This number is used for storage.

Outgoing: This would map to the Transaction Number generated by the system corresponding to the Order Reference number.

Financial Instrument Details

This tag provides details to identify a fund.

Identification

Mandatory

Outgoing: FCIS sends out the fund ISIN.

Units Number

Mandatory

UnitsNumber

Mandatory

Outgoing: The allocated units for the transaction.

Amount

Mandatory

This is the net amount invested in a specific financial instrument by an investor, expressed in the currency requested by the investor.

Outgoing: The system will compute the net amount in transaction currency for transaction getting confirmed.

Gross Amount Indicator

Optional

Outgoing: This will be the settlement amount in the transaction currency available in the transaction data store.

Transaction Date Time

Mandatory

This tag provides the transaction date

Outgoing: Depending on the UDF mapping, the Transaction Date will be passed.

Price Details

Mandatory

This is the price at which order was executed.

Value à Amount

Mandatory

Outgoing: This will be the allocation price for the transaction.

Partially Executed Indicator

Mandatory

This indicates whether the order has been partially executed.

Outgoing: This will be defaulted to ‘NO’.

Cum Dividend Indicator

Mandatory

This indicates whether the dividend (cum dividend) is included in the executed price. When the dividend is not included, the price will be ex-dividend.

Outgoing: This will be defaulted to ‘NO’.

Foreign Exchange Details

Optional

This is information related to currency exchange or conversion.

Outgoing: If the transaction is a cross currency transaction, the exchange rate details will be provided in the message.

The following sub tags are mandatory:

- Unit Currency: This will be the transaction currency

- Quoted Currency: This will be the fund base currency

- ExchangeRate: This will be the exchange rate for the transactions

Commission General Details

Optional

This indicates the load corresponding to the ‘From Entity Type’ ‘U’ and ‘To Entity Type’ ‘F’.

TotalAmountofCommissions

Optional

Outgoing – FCIS sends out the value of the load where the ‘From Entity Type’ is ‘U’and ‘To Entity Type’ is ‘F’.

CommissionDetails

Type à Extended Type

Mandatory

Outgoing: This would map to the Identification Number of the Load. If BIC is provided, this would map to the corresponding entity’s BIC.

Amount

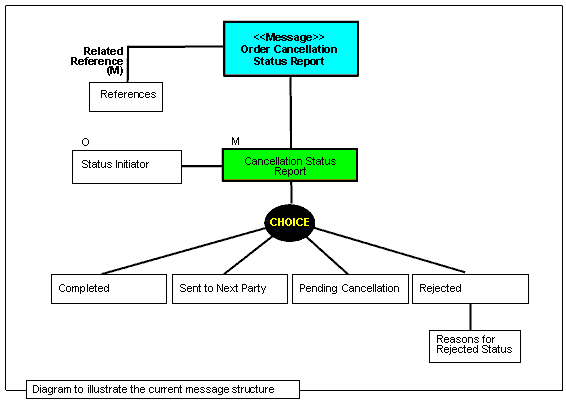

Mandatory